Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dubai Strategy

Caricato da

herbakCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dubai Strategy

Caricato da

herbakCopyright:

Formati disponibili

Dubai Strategies for a better way of trading

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

1|Page

Dubai Strategies for a better way of trading

Contents

Risk Disclosure ..............................................................................................................3 Introduction....................................................................................................................4 The Forex Markets.........................................................................................................5 Economic Releases ........................................................................................................6 Section 1.........................................................................................................................8 Introduction to Pip Range Charts...................................................................................8 Installing Pip Range Bar Charts.....................................................................................9 What are we looking at? ..............................................................................................19 How to find trades?......................................................................................................19 What are the stop loss and take profit? ........................................................................26 Any other rules?...........................................................................................................26 Trade Management ......................................................................................................27 Pip Range Bar Checklist ..............................................................................................27 Money Management ....................................................................................................28 Conclusion ...................................................................................................................28 Section 2.......................................................................................................................29 Breakout Strategies ......................................................................................................29 What pair and times are traded?...................................................................................30 Setting up the Breakout................................................................................................30 Installing the Indicators................................................................................................32 Applying Indicator to desired charts............................................................................32 How to trade New York Breakout ...............................................................................41 Expiration.....................................................................................................................50 Check Validation .........................................................................................................50 Slope Indicator .............................................................................................................52 What if?........................................................................................................................53 Trade Management ......................................................................................................56 New York Breakout Trading Checklist .......................................................................57 Money Management ....................................................................................................57 Results:.........................................................................................................................59 New York Results ........................................................................................................59 Trade The Slope...........................................................................................................60 Identifying Trades........................................................................................................62 Stop Loss and Profit Target .........................................................................................73 Money Management ....................................................................................................73 Trading Checklist.........................................................................................................74 Under Development .....................................................................................................74 Trading room and support............................................................................................75 Conclusion ...................................................................................................................76

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

2|Page

Dubai Strategies for a better way of trading

RiskDisclosure

Financial Spread Betting is a leveraged product and therefore may not be suitable for all investors. Financial Spread Bets carry a high degree of risk to your capital and it is possible to lose more than your initial investment or credit allocation as well as any variation margin that you may be required to deposit from time to time. You should only speculate with money that you can afford to lose.

Past performance is no guarantee of future performance and whilst every effort has been made to ensure 100% accuracy no guarantee is made.

John Wheatland does not accept responsibility for any loss incurred whilst trading. This ebook is an educational product and does not constitute as advice or recommendations to trade.

Anyone found to be distributing illegal copies of this work will be prosecuted to the fullest extent of the law!

Copyright John Wheatland 2010

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

3|Page

Dubai Strategies for a better way of trading

Introduction

Welcome to the 2nd edition of Dubai strategies e-book. In this e-book you discover three proven detailed methods and strategies that will enable you to profit from the Forex markets. The e-book is split into two sections; Section 1 is designed for Pip Range Charts and Section 2 covers Breakouts and Slope Trading employing Metatrader 4. I will guide you through each section and explain all the necessary details on how to setup and execute any possible trades. There are several changes from the 1st edition, so if you already have a copy of the original, I suggest glancing through the contents and seeing whats new for 2010.

So why is there an update? The answer is an honest one. The previously successful GBPUSD breakout method has been at breakeven for the whole year and heading to the downside. Its disappointing but I can provide alternatives. Obviously markets adapt and change and I think with the current crisis within Europe and the uncertainty surrounding Americas recovery, the markets are reacting differently.

The original method for the pip range charts was found slightly too user intensive and required constant monitoring. I have taken this onboard and developed what I feel is a much more robust strategy for use with pip range charts.

I like to keep everything in this course straight to the point and concise, nobody is interested in reading hundreds of pages of drivel. Each strategy is simple, logical and easy to follow. As a purchaser of this e-book you are entitled to all of my future strategies, for free. I am always researching and doing my level best to find a better way of making this tough game pay. If you have any questions, feel free to contact me via my blog at

http://dubaitrader.wordpress.com or at johnwheatland@gmail.com .

Once you have finished reading the course, you can setup a demo account and begin practicing the methods detailed to gain confidence and to familiarise yourself with the strategies.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

4|Page

Dubai Strategies for a better way of trading

TheForexMarkets

The definition of the Forex market as described by Wikipedia:

The Forex market is where currency trading takes place. It is where banks and other official institutions facilitate the buying and selling of foreign currencies. FX transactions typically involve one party purchasing a quantity of one currency in exchange for paying a quantity of another.

To take it a little further, the Forex market is unique for several reasons. Firstly there is no central place where currency trading takes place, all transactions are done electronically over the counter (OTC). The market is open 24 hours a day, five days a week, and currencies are traded worldwide in the major financial centres; which are London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney - across almost every time zone. This means that when the trading day draws to a close in one time zone, it begins in another. Prices are constantly moving. The second unique aspect of Forex is the sheer volume traded. There are several reports that show daily turnover to be in the region of $3-4 trillion dollars a day. That is more than all other financial markets combined!!

In this course you will only see reference to GBP/USD (Great British Pound/United States Dollar) and EUR/USD (Euro/United States Dollar). I have targeted these pairs for their volatility and average movement during the course of intraday trading. Understanding and learning each pair is fundamental when becoming a successful trader.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

5|Page

Dubai Strategies for a better way of trading

EconomicReleases

Economic news is the driving force behind the movements in each currency pair. Throughout the day there can be various releases which can dramatically effect the movement of any given pair from the country releasing the news. There are several notable big announcements each month. For the first strategy, it is extremely important to pay attention to when these releases occur. A very useful website for this can be found at forexfactory. Ill go into further detail regarding the news later on.

To get Forexfactory to show in your local time, click on the clock as highlighted and then enter your timezone settings and save.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

6|Page

Dubai Strategies for a better way of trading

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

7|Page

Dubai Strategies for a better way of trading

Section1 IntroductiontoPipRangeCharts

Pip range bar charts are a tool a lot of people overlook. However, I believe they offer several advantages over the traditional candlestick time based format. Depending on which

timeframe you look at, there can be a huge amount of movement within that particular candle or conversely there can be very little movement over the same period of time. We want to take advantage of these movements instead of waiting for a candle to close for confirmation of a valid trade. The beauty of pip range bar charts is that each candle represents a user defined number of pips movement.

I received a lot of emails from clients saying they found the pip range charts interesting but that the original method was tough to follow and unless you could dedicate a lot of time to the screen, the benefits could not be reaped by everyone. I took this on board and began to develop a more user friendly method. It uses the exact same principles as the original but a much better entry and bigger targets for profits.

In the following sections you will find how to download the necessary free software and how to setup the chart for identifying trades.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

8|Page

Dubai Strategies for a better way of trading

InstallingPipRangeBarCharts

Step 1 Download NinjaTrader You can download ninjatrader software at the following address

http://www.ninjatrader.com/webnew/download_trading_software.htm. Fill in your email address and enter any broker of your choice as your broker. This field isnt important, its just required to download the software. You will get the following screen:

Make sure you enter a valid email address as they send you a key that you need to validate the software for use. Also make sure the following boxes are ticked as highlighted by the red box:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

9|Page

Dubai Strategies for a better way of trading

Once you have submitted your data you go to a download section as shown below:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

10 | P a g e

Dubai Strategies for a better way of trading

Click on the download link as highlighted above and follow the on screen instructions. It may take a few minutes to download as it is roughly 32mb in size.

Step 2 Open NinjaTrader Once it is installed onto your computer, open up Ninja trader and you will greeted with the following screen:

Step 3 Setup Data Feed To get the free data feed from Gain, do the following procedure: Select Tools from the toolbar Select Account Connections

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

11 | P a g e

Dubai Strategies for a better way of trading

Click next when prompted by the wizard and enter the following:

Select next and you will taken to the next screen:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

12 | P a g e

Dubai Strategies for a better way of trading

Click next then finish and press ok to the disclaimer and close the set up account connection box. Step 4 Connect To DataFeed Now go to File on the toolbar and select Connect> Gain:

Step 5 Add Currency Now we need to add GBP/USD to the instrument list. Select Tools again and then Instrument manager.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

13 | P a g e

Dubai Strategies for a better way of trading

Select this arrow to add GBPUSD to the default list:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

14 | P a g e

Dubai Strategies for a better way of trading

Step 6 Open New Chart Select ok then go to File> New> Chart

Enter the following parameters to bring up a 15 pip range bar chart:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

15 | P a g e

Dubai Strategies for a better way of trading

YOU WILL NOW HAVE YOUR BASIC 15 PIP RANGE BAR CHART

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

16 | P a g e

Dubai Strategies for a better way of trading

Step 7 Installing Indicators Before we can start looking for trades we need to install the necessary indicators.

Indicator#1 EMA Scroll down to EMA in the indicator list and enter the following:

Indicator#2 EMA Select EMA again and this time enter Period 50, Price type: Low. Select the same colour. You will now see the following:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

17 | P a g e

Dubai Strategies for a better way of trading

Indicator#3 - EMA Go back to indicators and add another EMA this time with Period 15, Price type: Close.

Indicator#4 & 5 There are two final EMAs to attach. These are 5 and 8 EMA applied to Close. I have selected blue for the 5 EMA and red for the 8 EMA.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

18 | P a g e

Dubai Strategies for a better way of trading

NOW WE HAVE OUR CHART FULLY SETUP AND READY TO LOOK FOR TRADES.

Whatarewelookingat?

Good question! Dont be put off by the multiple lines, they will soon become familiar and you will be easily able to identify possible trades. The 50 EMA channel (high and low) is our guide for the overall trend. We will only be trading in the direction of the channel. We will look for longs when candles are above the 50 EMA channel and shorts for when the candles are below the channel. For further confirmation we want the candles on the correct side of the black 15EMA and both the 5 and 8 EMAs.

Howtofindtrades?

The rules are very simple and clear for finding potential trades. We wait for the 5 and 8 EMAs to cross the 15 EMA whilst being on the correct side of the 50 EMA channel. An ideal setup occurs when a trend reversal occurs and a new trend is formed. See the following for an example:

The arrow shows the initial EMA crossing and the candle finishing above the 50 EMA channel.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

19 | P a g e

Dubai Strategies for a better way of trading

Qualifying Trade Examples Example#1

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

20 | P a g e

Dubai Strategies for a better way of trading

This time we have a confirmed short signal. The arrow shows the initial cross and then the candle finishing beneath the 50 EMA channel.

Example#2

Again we see the initial cross but this time in quite so clear fashion. The 8 EMA crosses 1 candle later but this is still acceptable.

Example#3

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

21 | P a g e

Dubai Strategies for a better way of trading

This time the cross occurred quite a bit before a candle finished above the 50 EMA but this represents a strong move in place. Target was easily reached.

Example#4

This is a good example of being patient and waiting. The candles are already beneath the channel but the 5 and 8 EMA had been above the 15 EMA. The 8 EMA finally crossed down and entry was on the close of that candle.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

22 | P a g e

Dubai Strategies for a better way of trading

It is extremely important to make sure all of the criteria are met. Here are a few examples of what are invalid trades

Invalid Trade Examples

Example#1

Here you can see the initial cross but the candle failed to finish above the 50 EMA channel.

Example#2

Here the candle finishes above the 50 EMA channel indicating a long but the 5 and 8 EMA didnt correspond and never finished above the 15 EMA.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

23 | P a g e

Dubai Strategies for a better way of trading

Example#3 Another example of a poor, invalid setup:

This example highlights the importance of waiting for the candle to close beneath the 50 EMA channel. On two occasions the price went beneath the channel but the most important factor was that the candle never managed to close beneath.

This brings me onto my next tip that will quickly enable you to see which candles are lining up with the EMA crosses. Follow the picture below:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

24 | P a g e

Dubai Strategies for a better way of trading

Once selected it allows you to pinpoint exactly where the crossing occurs and it will also show you the price on the right hand side of the chart as well as the time on the horizontal axis:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

25 | P a g e

Dubai Strategies for a better way of trading

Whatarethestoplossandtakeprofit?

This is a rewarding strategy that rewards a winning trade. The target is 50-60 pips and the stop is 25-30 pips. This gives us a simple risk: reward of 1:2. Risk no more than 2% of your account on any trade. I usually position my stop on the opposite side of the 50 EMA channel as any move that went that far would indicate a change in direction.

Anyotherrules?

Yes there are. Be very careful of round numbers such as 1.6500, 1.6600, 1.5000, all 100 pip increments. The most important rule is to avoid HIGH impact news items. As we are trading pip movements and not time based movements, these high impact releases can cause chaos on a pip range chart. Whilst in hindsight a clean, one direction move looks easy to take advantage of, in reality it is extremely difficult. The price will be moving faster than you can place a trade and at any moment the price action can switch and retrace in the opposite direction. The probability of slippage is high and so my best advice would be to just avoid the high impact items. Some strategies are limited by trading hours, not so with this one. This truly is a 24/5 strategy so if you work during the main London session or any global session, do not worry as there are always plenty of opportunities.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

26 | P a g e

Dubai Strategies for a better way of trading

TradeManagement

There will be occasions when you cannot get the price you wish and it is of utmost importance to stay calm and relaxed and simply wait for the next opportunity. A lot of failing traders try and chase the market and end up getting burned and leaving the trade with less money than they had originally. Discipline will be your greatest tool for any trading strategy and it applies to this one. Remember, staying out of a trade is better than being in a losing trade. I cannot emphasise enough how important it is to make sure you follow the rules outlined.

PipRangeBarChecklist

Calculate correct position size for your trading account. Wait for the initial 5 and 8 EMAs crossing over of the 15 EMA Look for the candle to finish above the 50 EMA channel after the initial EMAs crossover in the trend direction given by the 50 EMA channel. Use the crosshairs to make sure everything is lined up for a valid trade.

Warning Signs

Do not trade during high volatility news items. Avoid placing trades when approaching round numbers defined by 100 pip increments. Eg. 1.6500 1.6600.

I would also recommend to stop for the day if you encounter 2 losses in a row. If you encounter 2 losses in a row, it is likely that the market is having difficulty in deciding which direction to take. This can last for hours and chasing the market is a quick way to ruining previous gains. By the same token, I also like to stop after 1 win. Depending on your risk appetite, I feel 2-3% gain in one day is more than adequate and I like to dedicate time to other areas after a win.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

27 | P a g e

Dubai Strategies for a better way of trading

MoneyManagement

As equally as important as trade management, is the use of money management. With the correct money management in place, this strategy will bring in steady growth. As I mentioned earlier, the maximum you should risk per trade is 2% of your trading capital. For beginners, I would even drop that down to 1% until you are comfortable and familiar with how the strategy works. I also strongly recommend running this strategy on a demo account where you can practice your entries and exits without risking your own capital.

When it comes to the time of placing trades on your live account, there are a few simple sums that will enable you to work out your risk. Taking a 1,000 bank as an example with risking 2% per trade will give you an overall risk of 20. Simply multiply your bank by 0.02 and that will give you your overall risk.

The next step is to work out how much to trade per pip. Whether you are with a spreadbetting company or a Forex broker, this applies to everyone. We need to divide our overall risk by our stop loss which for this strategy is 30 pips. Again using the 1,000 bank example; 20/30 pips gives us 0.70 a pip.

I am sure you have seen various systems and robots that claim astronomical pip amounts won over a course of the month. The actual truth is these pip totals mean next to nothing without knowing the risk and position size. As this is a selective strategy, a monthly total is never going to be in the thousands but you can take heart in knowing for each win you are gaining 2% of your account. Percentage gain on your capital is the bottom line with trading; we are looking for the best returns, not the highest pip totals.

Conclusion

Making money from the Forex markets is no easy feat but with the correct strategy, discipline and money management it is possible. I believe the strategy I have outlined is capable of bringing in a steady source of capital growth. You will have good days and bad days but the key thing to remember is to stay focused and disciplined. As soon as you start missing trades due to lack of belief becomes the time to stop trading any strategy altogether. You have to be 100% comfortable with your ability and your strategy before you can make any returns.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

28 | P a g e

Dubai Strategies for a better way of trading

I will be offering live support for anyone who needs it where I will available to answer questions or solve any problems you might have. To gain access to the trading room please contact me and via my blog or email and I will direct you to where you can find the trading room. I am also available by email at johnwheatland@gmail.com

Section2 BreakoutStrategies Introduction

The concept behind breakouts has long been used in every financial market. They are especially effective when applied to the Forex markets. To understand why breakouts work, let me explain the concept briefly. Currencies are constantly moving from economic forces being applied to them, and like any object when applied with force, it has an equal or opposite reaction.

Timing is everything when trading a particular currency pair; not only is liquidity affected but also the pairs trading range. It is important to be trading the correct pairs for the particular global trading session. According to the BIS survey, London has the lions share of FX deals. 30% of all transactions are conducted during the London session, this is due to the majority of large banks being located in London. A breakout occurs when a period of low volatility is followed by high volatility.

The reasons why breakouts are a very good strategy are two fold. The setup and preparation of the breakout is very simple and extremely user friendly, by following my simple rules even a novice can have a clear understanding of what is happening. Secondly, most newcomers to forex get overwhelmed with information and suffer from deciding which strategies to trade.

Discipline is also a major factor for people who fail to profit form financial trading. By having mechanically defined entries, there is little room for error on the users behalf it is simply a case of entering at the defined entry point and setting your stop loss and profit target and walking away from the screen.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

29 | P a g e

Dubai Strategies for a better way of trading

Whatpairandtimesaretraded?

Before moving on to the setting up of the charts and explaining the method I would like to explain which pairs will be monitored and which times to trade. The best breakout I know of and use is the New York breakout. I have been trading this method live for the best part of 9 months and to date have yet to be disappointed by its continuous gains. It has stood the test of time through the European turmoil and still managed to return a gain which is impressive.

SettinguptheBreakout

For this strategy you are going to need a Metatrader 4 account. If you already have a MT4 account, you can skip this step and move to Installing the Indicators. I have no specific preference for a broker but FXDD offer a free demo account for an unlimited period and they seem popular amongst traders.

If you have a preferred broker, by all means download their MT4 software. If you are newcomer, a demo account offers the chance to practice your trading under real conditions without risking real money. It is also beneficial for setting up this strategy. Head over to http://www.fxdd.com, click on free trial for Metatrader 4.

Fill in your details and click on the download link:

Once installed on your computer open up MT 4. There will be several charts open, you just need to click the little x in the top right hand corner of the chart to close them down. Now click on File, open an account.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

30 | P a g e

Dubai Strategies for a better way of trading

Another box will pop up which requires you to fill in your details. Select the currency of your choice and leverage. I have mine set to 100:1. Make sure you select subscribe to newsletters to enable next to be clicked. Select next once again on the highlighted server:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

31 | P a g e

Dubai Strategies for a better way of trading

Next, make note of the account number and passwords and click finish. Your demo MT4 account is now fully setup.

InstallingtheIndicators

With this e-book you see two extra files. Ant-GUBreakout_V.0.4.1.ex4 and slope direction line.ex4. Select one of the files and press ctrl whilst selecting the other file. Then press ctrl+c to copy them. Next double click on My computer on your desktop followed by Local Disk C: Once inside, click on Program files. Look for the folder called FXDD- Metatrader 4 or the name of the broker you are using:

Once inside, you will several folders. Select the folder called Experts. You will then see more folders and the final step is to open the folder called Indicators. You are now ready to paste the two indicators you have copied. Simply press ctrl+v or right click and select paste and the indicators will appear in the list. At this point, if you have MT4 open you will need to close it to compile the indicators just installed.

ApplyingIndicatortodesiredcharts

With MT4 open select File> New chart. Then select EURUSD from the list.

You now have a basic bar chart on a default H1 chart for EURUSD. We are going to change the look of the charts to suit the needs of the breakout. First off we are going to show candlesticks instead of bar charts. To do this, right click anywhere on the chart and select properties. This opens up a new window where you can select the

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

32 | P a g e

Dubai Strategies for a better way of trading colour of the backround and the colours of candles that finish higher and lower. Enter whichever colours suit you best; these are just my personal choice:

The second tab Common is where we can select candlesticks and chart shift is selected:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

33 | P a g e

Dubai Strategies for a better way of trading We now need to switch the timeframe down to 30 minutes from H1. This is done by selecting M30 along the periodicity tool bar. This is found along the top:

We also need to zoom in to get a better view of the candles. Use the magnifying glass with the + sign in as highlighted above.

Your chart should now look like this with your own colour scheme in place:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

34 | P a g e

Dubai Strategies for a better way of trading

We are now ready to insert the indicator on to the M30 chart. Within MT4 you should see a side menu called Navigator, it is located to the left of the charts. If this isnt showing press ctrl+n to bring it up:

Click on the tab Inputs:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

35 | P a g e

Dubai Strategies for a better way of trading

Depending on your broker time we need to adjust the GMT shift parameter. To find out your brokers time look at the clock on the market watch menu. This is located next to the navigator menu. If you cannot see it press ctrl+m to bring it up.

If

you

do

not

know

if

your

broker

is

ahead

or

behind

GMT,

head

to

http://forex.timezoneconverter.com/

which shows all of the major time zones. If your

brokers time is ahead then you are looking at a broker who is + GMT. If the brokers time is behind GMT then the broker is GMT. FXDD is GMT +2.

IMPORTANT NOTE: During BST (British Summer Time) the box will begin at 1300 GMT and finish at 1500 GMT. If your broker allows for daylight saving, no adjustments need to be made. Fxpro, FXDD, Alpari are three that I know automatically adjust their server clocks.

The basis of this box is defined by a period of time. As we are dealing with a New York breakout, we want to take any advantage of early moves in the session. The box starts forming at 0700 EST and finishes at 0900 EST or 1200-1400 GMT. This encapsulates 1 hr before NY opens and the hr after it opens which means the market should have settled down after any early spikes.

These are the values you need to enter once you have clicked on the inputs tab. Remember, I have set GMT shift to 2 as this is what FXDD is, enter the correct value for your broker.

Scroll down on the sidebar to see further options:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

36 | P a g e

Dubai Strategies for a better way of trading

Day_number refers to how many previous boxes you want to show on your chart. I set mine to 100 so if I ever want to scroll back in time I can quickly see how the boxes have looked. You can choose to have less or more, its entirely up to you.

Offset is an important parameter and needs to be correct. Depending on whether you are using a 4 or 5 digit broker will make a big difference. If you are unsure, check how many digits are in place after the decimal point on the price. FXDD is a 4 digit broker but most others are 5 these days. If using a 5 digit broker, enter 100, if using a 4 digit broker enter 10.

You can now click ok, and youll see a boxes on your chart now:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

37 | P a g e

Dubai Strategies for a better way of trading

The lighter shade of blue represents the offset of 10 pips. This helps us avoid some false breakouts, which Ill highlight a little later. You can also see the indicator shows the high of the box and the low as well as the range in terms of pips.

The next step is to install the final indicator on to a different chart. For this you need a H1 EURUSD chart. To add a new chart all you need to do is simply follow the same steps previously used. Setup the chart as you wish:

The final indicator is called the slope indicator. This is also located within the navigation menu. Simply drag and drop on to the chart and a new menu will appear.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

38 | P a g e

Dubai Strategies for a better way of trading

The first step is to change one of the parameters. Double click on period value and enter 50 then click OK:

The final step is to add the slope indicator again to the chart. We are using 2 slope indicators on this chart so drag and drop another slope direction line from the navigator menu and enter these settings:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

39 | P a g e

Dubai Strategies for a better way of trading

Click on colours and enter the following:

This will help distinguish between the two slope lines. Click OK and you now have the complete setup for New York Breakout.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

40 | P a g e

Dubai Strategies for a better way of trading

HowtotradeNewYorkBreakout

Now we have everything fully setup with our charts, we are now ready to look for potential trades. There is one golden rule with the New York breakout strategy; trade only with the overall trend. The old saying of the trend really is your friend rings very true here. You will see in the following pages how important that rule is. You do not need to be sat at the computer whilst the box forms; you only need to monitor the box and the H1 chart from 14:00-14:30 GMT.

There are three possible variations for the slopes;: both slopes are showing blue, both slopes are showing red one slope is showing up/down whilst the other is showing the opposite.

THE TREND CHECK If the two slopes are conflicting then at that stage there is no valid trade regardless if the price breaks out. If the slopes are showing short which is indicated by two red lines then we are going to place an order short at the price indicated by the box.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

41 | P a g e

Dubai Strategies for a better way of trading

If the slopes are showing long which is indicated by two blue lines then we are going to place an order long at the price indicated by the box.

Whilst the last candle is forming on the M30 chart check the H1 chart for the trend direction. Blue means the trend is up and red means the trend is down. When the last candle has finished forming you will know if you are placing a long trade, short trade or sitting the day out.

A very useful feature of MT4 is the crosshairs, this feature allows for easy alignment and to check if certain parameters are met.

We already know that the box will form from 12:00 GMT and finish forming at 14:00 GMT but as we are using a M30 chart, the actual last candle will not finish forming until 14:30 GMT. The first priority is to check the position of the two slopes at 1400 GMT on the H1 chart as seen below: (Dont be confused by 16:00 showing, remember the broker is ahead of GMT.)

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

42 | P a g e

Dubai Strategies for a better way of trading

You can see they are both red so the trend direction is down and now we find out our entry price. Switch back to the M30 chart:

You can see the box high was 1.3150 and the low was 1.3093. You can also use the crosshairs to find the high and low by simply placing the crosshair on box. This is where the offset comes into play. The offset adds an extra 10 pips to either side of the box and can sometimes avoid some nasty false breakouts as seen below:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

43 | P a g e

Dubai Strategies for a better way of trading

The price dipped beneath the actual low of the box but didnt manage to break the 10 pip offset which saved us a losing trade had we not used an offset.

Back to the above example where the box high was 1.3150 and the low was 1.3093. With the offset of 10 pips, our short entry will actually be 1.3083 (1.3093 -10 pips) and if we were going long, the entry would be 1.3160 (1.3150+10 pips).

Here are a few examples of valid trades:

Example#1 Long slopes:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

44 | P a g e

Dubai Strategies for a better way of trading

Entry at 1.3286: Box high was 1.3276 and add the offset of 10 pips to enter at 1.3286.

Example#2 Short slopes:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

45 | P a g e

Dubai Strategies for a better way of trading

Entry at 1.3994: Box low was 1.4005 and with the offset of 10 pips making entry 1.3994.

Here you can see the low of the box was 1.4005 but the text box is showing 1.3994. When this happens simply look at the price on the right hand side of the chart for verification:

Example#3 Short slopes:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

46 | P a g e

Dubai Strategies for a better way of trading

Both slopes are showing red so we place our order short at the level designated by the box:

Low of the box was 1.20179 (5 digits) and with the offset, entry becomes 1.2007.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

47 | P a g e

Dubai Strategies for a better way of trading

Now that you have seen a few examples of valid trades let me show you some invalid setups:

Example#1

The slopes are showing short, meaning we are only placing a short position. However the price broke the high of the box causing a false breakout:

Here you can see the slopes were in agreement showing short but the price action broke to the long side and lost. However, we avoided this trade due to trade being against the trend.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

48 | P a g e

Dubai Strategies for a better way of trading

Example#2

Here the slopes are showing long, however the price broke the low of the box causing a fake breakout:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

49 | P a g e

Dubai Strategies for a better way of trading

Expiration

There is time decay on the New York breakout. If price action has not triggered the trade in the correct direction by 17:30 GMT then the pending trade is to be cancelled. This means the last candle that can qualify for a valid trade begins forming at 17:00 GMT and finishes at 17:30 GMT, exactly three hrs from the end of the box formation.

CheckValidation

Due to prices constantly changing, the slope direction can change over the course of an hour. It is important to make sure that the trade is still valid throughout the three hour qualifying window. If the trade has not been triggered by 15:00 GMT, check the slopes again for verification. If they are still showing the same direction as 14:00 GMT then keep the order in place. Follow the same procedure for 16:00 GMT and finally 17:00 GMT.

Here is the initial direction at 14:00 GMT (16:00 GMT+2):

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

50 | P a g e

Dubai Strategies for a better way of trading

The price did not trigger the trade until 16:30 GMT :

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

51 | P a g e

Dubai Strategies for a better way of trading

As the trade hadnt triggered by 15:00 GMT or 16:00 GMT we check the slope to make sure it is still showing long:

It was so we kept our trade in place. However, if one of the slopes had changed and now conflicted the original entry, we cancel the trade.

SlopeIndicator

The slope lines can change during the course of a candle. If at 14:00 GMT when you are checking the slopes for direction and you see one of the slopes changing, you have to wait until 15:00 GMT for confirmation of that change.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

52 | P a g e

Dubai Strategies for a better way of trading

Here you can see one of the slopes turning from blue (long) to red (short). This will not be confirmed until the CLOSE of the candle. It is very important to remember; wait for the close of the candle before confirming the trend.

Whatif?

There will be occasions when one of the slopes is beginning to change direction to agree with the other slope. If the box high or low has been pierced and you are waiting for confirmation, do not enter the trade until the original entry is available.

Here is a classic example of how one of the slopes changed direction from the initial 14:00 GMT check. By 15:00 the slope began to change direction and was validated by the close of the candle. Below is how it would have played out.

At 14:00 GMT when checking for the slope direction, we see a conflict between the two meaning we are not trading in any direction:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

53 | P a g e

Dubai Strategies for a better way of trading

Here is the box setup:

You can see that the price broke the high of the box at 16:00 GMT (18:00 chart time). At our second check of the slopes at 15:00 GMT we see that the slope is beginning to turn from red to blue, remember it takes a full hour before confirmation of the change. So by 16:00 GMT the trend is confirmed by both slopes.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

54 | P a g e

Dubai Strategies for a better way of trading

I have zoomed in again to show it more clearly above. The text box shows the candle started forming at 15:00 GMT (1700 chart time). By the close it had confirmed the slopes were in agreement for a trade going long. So we now have the green light to trade. We now wait for our entry to be hit:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

55 | P a g e

Dubai Strategies for a better way of trading

The trade was triggered between 16:00-16:30 GMT. The first horizontal green dashed line is our stop loss and the second green dashed line is our entry at 1.4252. The third dashed line is our profit target which was hit at 07:30 GMT the next morning.

TradeManagement

Now you are aware of how to find valid and invalid setups, it is time to learn the stop loss and profit target; 30 stop loss and 50 pip profit target. If you are actively watching your trade, you can move your stop loss to breakeven once the trade has reached +45 pips. This avoids a few painful reversals that sometimes can occur.

Some trades can be open for a period of 24 hours, just sit back and let the trade run its course. Taking all valid setups is more beneficial than avoiding high impact news items. So whenever there is a valid setup, I would take it. However if the trade is running at a reasonable profit pre news at say 25 pips, I would move my stop to breakeven so the worst case scenario would be 0 pips and the best case would be a full win.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

56 | P a g e

Dubai Strategies for a better way of trading

Note: I trade regardless if there is a Public Holiday in the U.K or U.S. My results have found them to be a profitable situation.

NewYorkBreakoutTradingChecklist

Whilst the last candle is forming on the M30 chart between 14:00 and 14:30 GMT check the slopes for trend direction. If both slopes are in agreement set your order once the fifth and last candle has finished forming. Use the crosshairs or the high/low of the box +/-10 pips for the buffer. If a pending trade has not been filled by 17:30 GMT cancel the trade order. Use a 30 pip stop loss and 50 pip profit target.

Warning Signs

Ignore any breakout in the opposite direction to the slopes. If by 15:00 GMT the trade has not been triggered, check H1 chart again for confirmation of the trend. Repeat at 16:00 GMT if not triggered during 15:00-16:00 GMT. Repeat finally at 17:00 GMT if not triggered during 16:00-17:00 GMT. If slopes are conflicting for the three hour qualifying window, do not trade. If either slope starts to change colour to agree with the other, wait until the CLOSE of the candle for confirmation. This will occur only at the end of the hour. Wait for entry price to become available, if it never becomes available, do not chase the price and enter above the entry point. If the trade has not yet been triggered and either slope starts to change colour to disagree with the other, wait until the CLOSE of the candle for confirmation. If confirmed cancel any pending trade

MoneyManagement

I am sure you eager to see what the results have been like when everything is combined together! But first of all I want to address the issue of money management as I feel it is probably the most important tool a trader can learn. Without correct management any winning strategy can quickly turn into a losing one.

Whenever you see a trading system or strategy you always see the total number of pips quoted. I have done so myself in this e-book. However, pip totals without further information are incredibly miss-leading. By the desire to have the most success, we are instinctively

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

57 | P a g e

Dubai Strategies for a better way of trading

drawn to systems claiming huge pip totals. I mean who would take 200 pips a month over a system that can produce 2,000 pips, a whole 10x more! But what if I told you the 200 pip system produces a higher percentage return a month? Dont believe me? Read on...

For the purpose of this illustration I will use hypothetical results but the same principle applies when looking at any system or strategy.

System A produces 200 pips a month with the trader risking 5% per trade as he feels the success rate is worthy of 5% risk, his stop loss for this system is 20 pips. The next simple calculation is used to find out what is called position sizing. You take the 5% risk and divide it by the stop loss, so in this case 5/20. This gives each pip a % value of 0.25%. So for every pip win or lost, the trader is gaining/losing 0.25% of their account. As he won 200 pips over the course of the month we can work out what his overall percentage gain on his capital would have been. Simple multiply the pip percentage value by the total pips won. 0.25*200=50%.

System B produces 2,000 pips a month with the trader risking 3% per trade with a stop loss of 150 pips. His position sizing therefore would be 3/150=0.02% per pip won or lost. The system gained 2,000 pips over the course of the month so his overall percentage gain on his capital would have been 0.02*2,000=40%. So now we can see who actually gained the most on their bank. Due to system A operating at a much higher pip percentage value the total number of pips neednt be as high as system B which used a much bigger stop loss. Of course these are arbitrary values but in the following pages you see how this approach is applied to the best effect using the outlined strategies.

I would advise risking no more than 3% per trade for the New York breakout and I would strongly advise newcomers to reduce the risk to 1% per trade. I would also advise practicing these methods on a demo account to become familiar with this method and to become confident with the strategy.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

58 | P a g e

Dubai Strategies for a better way of trading

Results:

Below you will find month by month results for the New York breakout. As you can see, each month has consistently produced gains. This is a very efficient strategy that can be introduced into anyones portfolio.

NewYorkResults:

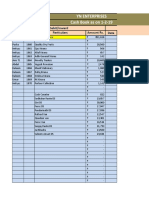

January February March April May June July August September October November December January 2010 February March April May Pips gained 40 280 -200 230 110 230 180 170 310 180 153 80 250 170* 30 130 Percentage success 42% 67% 23% 64% 57% 70% 60% 54% 73% 60% 57% 50% 65% 80% 43% 56% Percentage gain 4% 28% -20% 23% 11% 23% 18% 17% 31% 18% 15% 8% 25% 17%* 3% 13%

Note: * represents only up until 14th March. As I have recently moved from Dubai to Australia, I am without access to my results spreadsheets and whilst downloading history in MT4, for some reason there is half of March data missing. I tried several brokers but all history is downloaded from metaquotes software corp. I will fix March results as soon as I have access to the full month of data or I get my computer from Dubai.

I have not recorded results for August as I take the month off. Many professionals take their summer vacation and if we want to replicate professionals results, we should act accordingly. It is also nice to take some time away from the computer and enjoy the benefits that have been gained during the year.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

59 | P a g e

Dubai Strategies for a better way of trading

TradeTheSlope

Firstly, I cannot take any credit for this strategy, it was introduced to me by a friend and all I have done is researched it and tracked its performance. If you are able to watch your charts during a set period of time each day, this is an excellent strategy. This is a strategy that I find very easy to operate and relies on an indicator youll now be familiar with from using it New York Breakout. By using multiple timeframes for guidance and trend, the chances of success are nicely stacked in our favour. To get started, you first need to put the slope indicator onto a 30 minuteGBPUSD chart. Set the chart properties to whatever you feel comfortable with. The settings for the slope indicator are standard, so once dragged onto the chart, its all done. Below is my chart.

Then with the slope attached:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

60 | P a g e

Dubai Strategies for a better way of trading

That is all we need for this particular strategy. By using a few basic tools within MT4, we can determine and identify potential trades. I have found this strategy to work best on GBPUSD but I am sure it is capable of working on other pairs, I am investigating USDJPY and EURJPY.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

61 | P a g e

Dubai Strategies for a better way of trading

IdentifyingTrades

The first step is to decide on when you want to trade. I am most comfortable with the London session and feel that this strategy is suited perfectly to this time period. I look for trades from 7AM London time to 3PM London time. As my broker is 2 hrs ahead of London, you will notice all times are ahead of London. To begin with, I use the vertical line within MT4 and mark 7AM London time which is 9AM broker time.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

62 | P a g e

Dubai Strategies for a better way of trading

You can see that the slope line is blue, indicating the trend is up. Make a note of this on a piece of paper to begin with. The next step is drop down a timeframe. All you need to do is to click on M15 on the periodicity toolbar. The vertical line will stay in place.

This is a particularly interesting one. As this is a post graph its difficult to tell what colour the slope is showing. If looking at this live, it would have been showing red. One important note I want to make before going any further is the structure of how the vertical line works. As its placed at 7AM, this means it will dissect the candle which began at this time. Whilst that might seem trivial information, it is very important for this method. The slope can change colour during a candle and you MUST wait for the close of the candle for confirmation. In the case of a 15 minute chart, this means 9:15 AM (broker time). As its showing red, this is obviously in conflict with the 30 minute chart which was showing blue. Make a note of this on the piece of paper, and then drop down to a 5 minute chart. This is the lowest timeframe we will be using. It clearly shows blue at 9:00AM so make a note of that also.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

63 | P a g e

Dubai Strategies for a better way of trading

The number one rule of this strategy is to wait for all 3 timeframes to align with the same colour. In this example only the 5 and 30 minute timeframe align. This means we need to wait for the 15 minute timeframe to align before entering a trade. As the 15 minute timeframe is out of sync, we need to switch back to it to monitor its progress. The candle that began at 9:15AM (broker time) turns the slope to blue. Remember, we have to wait until the close of the candle before knowing if it will confirm the change of colour.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

64 | P a g e

Dubai Strategies for a better way of trading

Now we have a valid setup. All 3 timeframes align in the same direction. Be sure to check the other two timeframes to double check that they still show blue. In this case they do. The entry is on the candle that began at 09:30AM.

I will visit the trade parameters a little later but first I want to continue with identifying trades. NOTE: A good tip is note that the 5 minute timeframe will change direction the most as this timeframe obviously has more noise than a 15 or 30 minute timeframe. If all 3 timeframes are aligned at the start of trading I will switch to a 5 minute timeframe and wait for it to go out of sync with the higher timeframes and then wait for it to realign. If it looks like the trend is moving in the direction of the 5 minute slope, Ill switch up to the 15 timeframe and wait for that to change also and the same again with the 30 minute timeframe.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

65 | P a g e

Dubai Strategies for a better way of trading

Remember, we are only looking a trade when all timeframes are in sync. Here are some examples to make it easier to understand: 30 min timeframe:

15 min timeframe:

So we can see the 15 min timeframe is still showing blue but the 30m and 5 min are showing red:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

66 | P a g e

Dubai Strategies for a better way of trading

So switch to the 15 minute timeframe and wait for it to turn red and then enter a trade. A couple more:

7AM London time 30 min and 15 min are showing red:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

67 | P a g e

Dubai Strategies for a better way of trading

However when switching to the 5 min chart, you can see its showing blue. So that means we wait until the 5 min chart turns red and confirms and then enter:

It confirms red at the close of the 10.30 AM candle (chart time):

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

68 | P a g e

Dubai Strategies for a better way of trading

Entry is on the candle shown by the green arrow. The yellow dashed line shows the confirmation candle which you wait for to close and then enter. Remember: only enter on confirmation of candle.

Another example: 30 minute at 0700 London time:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

69 | P a g e

Dubai Strategies for a better way of trading

15 min:

5 min:

As you can see, the 30 min and 5 min charts are showing red but the 15 min chart is showing blue. Usually Id switch to the 15 min chart to wait for it to turn red but in this instance Id

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

70 | P a g e

Dubai Strategies for a better way of trading

switch to the 30 min chart as there is a good indication the slope will change as the candles are well above the red slope line. You could watch the 15 min chart but after 30 minutes its clear the trend is going up so you wait for the 30 min chart to switch.

The yellow dashed line represents the candle that began to turn the slope from red to blue. When watching live, confirmation would only be given at the CLOSE of this candle which would be 11:00 AM chart time.

Whilst this candle is forming, you should check the other two charts to confirm an entry is coming up. The 15 min is still showing blue from earlier:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

71 | P a g e

Dubai Strategies for a better way of trading

And the 5 minute chart is also showing blue:

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

72 | P a g e

Dubai Strategies for a better way of trading

We now have a potential entry at the close of the 10:30 candle on the 30 min chart. Our entry is shown below:

As soon as the 11:00 AM candle opens, that is the entry.

StopLossandProfitTarget

I have found the best results come from a 25 SL and 25 TP. This ensures only a 50% strike rate is needed to break-even. I have witnessed a run of 9 consecutive winners and strike rate is certainly above 50%.

MoneyManagement

As with the other two strategies within this e-book, I would set maximum risk to 3% and whilst learning the nature of the strategy, limit yourself to absolute minimum risk. This is a strategy that does require some patience and there will be days where no trade eventuates. Trust is also a major factor in the success of this strategy. At times you will see an entry that you think just cant win. A massive 50-60 pip could just have finished and its turned the slopes to an entry and you think this cant keep going! Well, Ive found it can! It is much better money management practice to take all trades than to cherry pick.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

73 | P a g e

Dubai Strategies for a better way of trading

TradingChecklist

Identify 0700 London time within your chart using the horizontal line on the M30 chart. Switch down to the 15 minute and then 5 minute chart and note the slopes colour. If all three timeframes are aligned, wait for a break of alignment and then a realignment before entering. Only ever enter on the close of the confirmation candle. 25 stop loss and 25 take profit. Exercise good money management.

UnderDevelopment

One area I feel that is vital to anyones trading is learning to understand pure, naked price action. You will have noticed I have only used 1 indicator within this e-book, which is because I am generally not a fan of indicators as they are bound to lag pure price action. Some of the more popular indicators have been around since the 1970s and the markets are so different from those days, I question how useful they can be.

In my next update I will examine how a trader can use support and resistance as a foundation for trading and learn to understand why and how the market reacts the way it does. Im sure youve all seen a nice trending chart when it suddenly stops dead and engages maximum reverse thrust. Until then, I hope you enjoy the strategies outlined within this e-book.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

74 | P a g e

Dubai Strategies for a better way of trading

Tradingroomandsupport:

One of the real advantages of purchasing this e-book is the ability to join a live trading room and community. Trading is an extremely lonely and sometimes boring job and being able to share and discuss ideas is a real benefit. Each day all valid trades for the above strategies will be called out by me so you can check along with your charts to see if they match. If youre having a problem, itll be a good opportunity to solve it.

If you want to take advantage of the trading room please email me your details and I will give you all the necessary details of how to access the room. So come on in and join the fun!

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

75 | P a g e

Dubai Strategies for a better way of trading

Conclusion:

Thank you for taking the time to read this e-book. I sincerely hope you have learnt something from it. I believe I have outlined several strategies that will enable you, as a trader, to become a more successful and profitable individual. Trading Forex can be extremely daunting and at times stressful so its important to remember that in the long term, these strategies are profitable; learn to take the rough with the smooth and you will see the rewards. If you have any queries or questions, please dont hesitate to contact me. I am available by email everyday; johnwheatland@gmail.com

Regards,

John Wheatland.

Copyright John Wheatland 2010 Not to be shared, distributed or discussed without formal consent

76 | P a g e

Potrebbero piacerti anche

- Pip By Pip: Forex Trading Strategies for the Winning Trader: Day Trading Strategies for the Smart Forex TraderDa EverandPip By Pip: Forex Trading Strategies for the Winning Trader: Day Trading Strategies for the Smart Forex TraderValutazione: 2.5 su 5 stelle2.5/5 (5)

- Fx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerDa EverandFx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerNessuna valutazione finora

- The Easy Forex Breakout Trend Trading Simple System Basic Manual VersionDocumento30 pagineThe Easy Forex Breakout Trend Trading Simple System Basic Manual VersionChakrey LeaderNessuna valutazione finora

- Abonacci Trading v11-11Documento12 pagineAbonacci Trading v11-11ghcardenas100% (1)

- Fundamental News PredictionDocumento6 pagineFundamental News PredictionSimamkele NtwanambiNessuna valutazione finora

- How The Banks Trade Forex - Article Contest - Dukascopy CommunityDocumento5 pagineHow The Banks Trade Forex - Article Contest - Dukascopy Communitywan1984Nessuna valutazione finora

- Forex 4 UDocumento25 pagineForex 4 US N Gautam100% (2)

- Correlation ShortDocumento9 pagineCorrelation Shortcan canNessuna valutazione finora

- Forex Virtuoso PDFDocumento19 pagineForex Virtuoso PDFHARISH_IJTNessuna valutazione finora

- Forex Pair Performance Strength ScoreDocumento10 pagineForex Pair Performance Strength ScoreTradingSystem100% (1)

- DDFX FOREX TRADING SYSTEM v4 PDFDocumento15 pagineDDFX FOREX TRADING SYSTEM v4 PDFstrettt100% (1)

- Serial ScalperDocumento17 pagineSerial ScalperfxquickNessuna valutazione finora

- Pip Revelation ManualDocumento18 paginePip Revelation ManualCapitanu IulianNessuna valutazione finora

- Double Profit LevelsDocumento14 pagineDouble Profit LevelsScooterKatNessuna valutazione finora

- ScalpingDocumento6 pagineScalpingzooor100% (1)

- CCT Ebook How To Time Forex Trades V4 Aka James EdwardDocumento27 pagineCCT Ebook How To Time Forex Trades V4 Aka James EdwardEdward Xu100% (1)

- The Forex System: by John AnthonyDocumento34 pagineThe Forex System: by John AnthonyZehra Da TaaoNessuna valutazione finora

- 10 Golden Rules of Forex TradingDocumento15 pagine10 Golden Rules of Forex TradingDenis KoriNessuna valutazione finora

- Forex M SystemDocumento16 pagineForex M SystemBảo KhánhNessuna valutazione finora

- Big Secret of Intermarket TradingDocumento7 pagineBig Secret of Intermarket TradingadolfinoNessuna valutazione finora

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocumento10 pagineForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNessuna valutazione finora

- Lesson 1 - Inside Bar Forex Trading StrategyDocumento7 pagineLesson 1 - Inside Bar Forex Trading StrategyFitz100% (1)

- (Ebook) Guide To Profitable Forex Day TradingDocumento42 pagine(Ebook) Guide To Profitable Forex Day TradingThie Chen100% (1)

- Double in A Day Forex TechniqueDocumento11 pagineDouble in A Day Forex Techniqueabdulrazakyunus75% (4)

- QuickTrader+G P@FBDocumento9 pagineQuickTrader+G P@FBPranshu guptaNessuna valutazione finora

- BigE Full PDFDocumento113 pagineBigE Full PDFlucnes100% (2)

- Hasim AliuDocumento138 pagineHasim Aliuhasim_a100% (1)

- Vol-1-Introduction To The Basics-Of Forex PDFDocumento21 pagineVol-1-Introduction To The Basics-Of Forex PDFkenneth sherwin ChuNessuna valutazione finora

- ForexCobraSystem PDFDocumento49 pagineForexCobraSystem PDFMarcos100% (1)

- Forex Trading To RichesDocumento56 pagineForex Trading To Richesmyisis2uNessuna valutazione finora

- For Ex Morning Trade ManualDocumento40 pagineFor Ex Morning Trade Manualpaul888869100% (1)

- OptionsUniversity TriadCheatSheetsDocumento17 pagineOptionsUniversity TriadCheatSheetsDan TranNessuna valutazione finora

- G7 Forex SystemDocumento49 pagineG7 Forex SystemSun Karno100% (1)

- Ebook Setup EA Padu Viral V.100Documento50 pagineEbook Setup EA Padu Viral V.100raszcor lolitaq100% (1)

- Summary Cheat Sheet: Top Forex Reversal Patterns That Every Trader Should KnowDocumento2 pagineSummary Cheat Sheet: Top Forex Reversal Patterns That Every Trader Should Knowsselvaraj109613Nessuna valutazione finora

- Price Trapping StrategyDocumento5 paginePrice Trapping StrategyscriberoneNessuna valutazione finora

- AMG RobotDocumento33 pagineAMG RobotShanNessuna valutazione finora

- How To Use Forex Volume IndicatorsDocumento7 pagineHow To Use Forex Volume IndicatorsIFCMarketsNessuna valutazione finora

- 4 5778654187806000905 PDFDocumento38 pagine4 5778654187806000905 PDFDa VidNessuna valutazione finora

- For Ex Box ProfitDocumento29 pagineFor Ex Box Profitnhar15Nessuna valutazione finora

- Forex & IntuitionDocumento0 pagineForex & Intuitionagus purnomoNessuna valutazione finora

- Forex VSD Powerful VSD 15min-1h Trading System With 90%+ AccuracyDocumento4 pagineForex VSD Powerful VSD 15min-1h Trading System With 90%+ Accuracymangelbel6749Nessuna valutazione finora

- Toshimoku's Trading Tips & Tricks - #SatoshiMoku - CarpeNoctom - Medium PDFDocumento54 pagineToshimoku's Trading Tips & Tricks - #SatoshiMoku - CarpeNoctom - Medium PDFSyed Asad TirmazieNessuna valutazione finora

- Introducing The No Risk Binary Options StratergyDocumento18 pagineIntroducing The No Risk Binary Options StratergyrogerquintonNessuna valutazione finora

- 4 5864058452845790959 PDFDocumento4 pagine4 5864058452845790959 PDFSidibe MoctarNessuna valutazione finora

- Forex Opening Range Breakout StrategyDocumento4 pagineForex Opening Range Breakout StrategySIightly100% (1)

- Moda Trendus ManualDocumento9 pagineModa Trendus ManualCapitanu IulianNessuna valutazione finora

- The Forex Lifestyle Forex Made Simple PDFDocumento73 pagineThe Forex Lifestyle Forex Made Simple PDFRavindra Erabatti100% (1)

- Analysis of Forex MarketDocumento78 pagineAnalysis of Forex MarketAmit MishraNessuna valutazione finora

- MMM (Order Block)Documento5 pagineMMM (Order Block)Ronald DubeNessuna valutazione finora

- Technical Analysis in Forex TradingDocumento7 pagineTechnical Analysis in Forex TradingIFCMarketsNessuna valutazione finora

- Detection of Repetitive Forex Chart PatternsDocumento8 pagineDetection of Repetitive Forex Chart PatternsDwight ThothNessuna valutazione finora

- Super BUY SELL Profit - Bes..Documento17 pagineSuper BUY SELL Profit - Bes..Muhammad Muntasir AlwyNessuna valutazione finora

- .Forex Success Formula 2 of 3 (Forex Success System)Documento43 pagine.Forex Success Formula 2 of 3 (Forex Success System)Scottie EricksonNessuna valutazione finora

- Scientific Forex PDFDocumento34 pagineScientific Forex PDFAlain Castillo0% (1)

- NASDAQDocumento10 pagineNASDAQVìkhíl VíçkyNessuna valutazione finora

- 4x4 Forex Trading StrategyDocumento4 pagine4x4 Forex Trading StrategySubbuPadalaNessuna valutazione finora

- Paya TruDocumento9 paginePaya TruprospectingrightsNessuna valutazione finora

- Classic Forex Trader Learning ForexDocumento5 pagineClassic Forex Trader Learning ForexGlen Makgetlaneng0% (1)

- Genesa IstruzioniDocumento1 paginaGenesa IstruzioniherbakNessuna valutazione finora

- 2652 Theory of Day TradingDocumento5 pagine2652 Theory of Day Tradingherbak100% (1)

- Trading Pivot PointsDocumento5 pagineTrading Pivot Pointsherbak100% (1)

- AquaProfiler M ProDocumento4 pagineAquaProfiler M Proherbak100% (1)

- User ManualDocumento7 pagineUser ManualherbakNessuna valutazione finora

- Virtual Radionic Instrument HandbookDocumento32 pagineVirtual Radionic Instrument Handbookherbak100% (1)

- (Trading) Carolyn Boroden - How I Identify Powerful Setups Using Symmetry (FibonacciDocumento7 pagine(Trading) Carolyn Boroden - How I Identify Powerful Setups Using Symmetry (FibonacciMakiyama Mariko100% (1)

- Auto Trend ForecasterDocumento15 pagineAuto Trend ForecasterherbakNessuna valutazione finora

- Dowsing Chart EnglishDocumento1 paginaDowsing Chart EnglishherbakNessuna valutazione finora

- Fibonacci Time Zone Drawing InstructionsDocumento1 paginaFibonacci Time Zone Drawing InstructionsherbakNessuna valutazione finora

- Forex Time Trading Machine EntriesDocumento2 pagineForex Time Trading Machine EntriesherbakNessuna valutazione finora

- Essential User GuideIIDocumento9 pagineEssential User GuideIIherbakNessuna valutazione finora

- Thomas Demark'S Pivot Points Interpretation: Eur/Usd Gbp/Usd Usd/Jpy Usd/Chf High Low Close Low HighDocumento2 pagineThomas Demark'S Pivot Points Interpretation: Eur/Usd Gbp/Usd Usd/Jpy Usd/Chf High Low Close Low Highherbak100% (1)

- FxgenDocumento68 pagineFxgennegocio2hNessuna valutazione finora

- Optimus ChannelDocumento18 pagineOptimus ChannelherbakNessuna valutazione finora

- Money Services Business Act 2011: Laws of MalaysiaDocumento68 pagineMoney Services Business Act 2011: Laws of MalaysiaAminudin Baki Bin MahmudNessuna valutazione finora

- TB ListDocumento46 pagineTB ListWee Tan33% (3)

- Financial Markets and Their Role in EconomyDocumento6 pagineFinancial Markets and Their Role in EconomyMuzammil ShahzadNessuna valutazione finora

- Foreign Exchange Management Act, 1999 (FemaDocumento52 pagineForeign Exchange Management Act, 1999 (FemaDhronacharya100% (1)

- Payment Details: Telegraphic Transfer Instruction 电汇指示Documento2 paginePayment Details: Telegraphic Transfer Instruction 电汇指示Benedict Wong Cheng WaiNessuna valutazione finora

- Account Statement 08 2023Documento1 paginaAccount Statement 08 2023viany leproNessuna valutazione finora

- Potential Risks in ConstructionDocumento4 paginePotential Risks in ConstructionAbdelmuneimNessuna valutazione finora

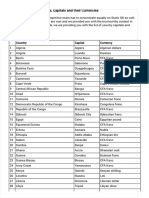

- Important List of Countries, Capitals and Their CurrenciesDocumento7 pagineImportant List of Countries, Capitals and Their CurrenciesShiva KumarNessuna valutazione finora

- TelnetDocumento4 pagineTelnetsadeqNessuna valutazione finora

- Technical Indicators For Trading ForexDocumento6 pagineTechnical Indicators For Trading ForexMayo Ade OyeNessuna valutazione finora

- W14494 PDF EngDocumento6 pagineW14494 PDF EngJason RoyNessuna valutazione finora

- K.U.K-M.B.A-3rd Sem SyllabusDocumento16 pagineK.U.K-M.B.A-3rd Sem SyllabusvivekatriNessuna valutazione finora

- Answer: Q - 1 (RTP N - S 2020, N S)Documento15 pagineAnswer: Q - 1 (RTP N - S 2020, N S)sandesh SandeshNessuna valutazione finora

- ACB System Installation ManualDocumento12 pagineACB System Installation ManualAngNessuna valutazione finora

- Getting To Know Northern Trust: Northern Operating Services PVT LTDDocumento15 pagineGetting To Know Northern Trust: Northern Operating Services PVT LTDejashrwnNessuna valutazione finora

- Cash Book Feb 2019Documento275 pagineCash Book Feb 2019ABDUL FAHEEMNessuna valutazione finora

- OVER-RSI Strategy by Herman NtladiDocumento13 pagineOVER-RSI Strategy by Herman NtladiHerman Seema Ntladi67% (6)

- Screenshot 2022-07-09 at 4.18.36 PMDocumento24 pagineScreenshot 2022-07-09 at 4.18.36 PMOgunjobi OmobolajiNessuna valutazione finora

- Harmonic Pattern Trading Strategy PDFDocumento10 pagineHarmonic Pattern Trading Strategy PDFyul khaidir malik100% (1)

- High Probability Trading Setups For The Currency Market PDFDocumento100 pagineHigh Probability Trading Setups For The Currency Market PDFDavid VenancioNessuna valutazione finora

- CACIB - FAST FX Model 20230206Documento7 pagineCACIB - FAST FX Model 20230206G.Trading.FxNessuna valutazione finora

- S4H - 007 Embedded Analytics - SAP S4HANA Cloud EXDocumento26 pagineS4H - 007 Embedded Analytics - SAP S4HANA Cloud EXEnrique MarquezNessuna valutazione finora

- Candle Stick Art by Unclejoe FXDocumento8 pagineCandle Stick Art by Unclejoe FXZulkifle Md YunusNessuna valutazione finora