Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Employ Operations Manuel 2 Final

Caricato da

mosonicDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Employ Operations Manuel 2 Final

Caricato da

mosonicCopyright:

Formati disponibili

EMPOWERING MANY OF LOW AND ORDINARY

YIELDING

Loan Policy and Procedure Manual

1. Background and Vision of EMPLOY Program

Empowerment Program for Local and Ordinary Yielding (EMPLOY) is in the process of

engaging in micro-loan programs with the goal of providing savings and loans to the

vulnerable poor in Liberia. The idea of establishing this program came about through Jill

McClure, an American who visited Liberia in January 2008 after distributing money,

medication, relief items to orphans at the God’s Children Orphanage home and the

visitation of several communities in the Jamaica Road area on Bushrod Island .With so

much passion to make a difference in Liberia and her contribution to the economic

recovery program and poverty reduction initiated by other partners of Liberia, through

Moses S. Forkpah, Jr. ( LIBERIAN) has developed this program to promote grassroots

economic development in Liberia by providing loans to local entrepreneurs to rebuild or

develop local business enterprises. Due to high interest rates and restrictions on loan

recipients, the formal banks in Liberia are not able to offer the poor traditional banking

services. These micro-entrepreneurs will be trained to have the necessary skills,

experience and initiative to manage their own businesses. EMPLOY aims at

enabling/empowering the vulnerable to improve the quality of life of families within

Liberia through credit and saving.

2. General Policy Statement

The purpose of this document is to establish concise guidelines and procedures by which

EMPLOY shall disperse loans. EMPLOY’s Senior Staff will review this policy each calendar year

to provide guidance and recommend and/or approve any changes to this policy.

EMPLOY has a specific mandate in the area of lending to the community which it serves.

EMPLOY staff has the responsibility to serve those not able to access formalized financial

services. At the same time, our responsibilities to these very same clients require us to be

prudent and ensure that EMPLOY is financially sound and stable.

This policy document is designed to provide flexibility as it becomes necessary to modify our

lending strategies in response to an ever-changing economic environment and to the needs of

the clients that we are here to serve. However, EMPLOY will carefully comply with any rules,

laws, or regulations provided by the local government to ensure sound financial practices and the

fair extension of credit.

LEAP Operations Manual- 1

3. Actors in Promoting, Tracking and Supervising EMPLOY’s Loans

3.1 General Policy Statements

The following employees play important roles in promoting, tracking, and supervising loans. The

job descriptions described below are by no means comprehensive of all tasks required of the staff

but represent tasks that have direct bearing on functions outlined in this manual.

For ease of operation and financial accountability, at this stage the corporation activities will be

handled / divided into two separate departments: Credit/Finance department and Management

Information Systems (MIS). The Credit/Finance Department disburses loans to Clients and is also

responsible for receiving their repayments. The MIS Officer/ Director of operations records all the

disbursements and repayments and provide information regarding the loan portfolio status.

.

3.2 Finance Department

3.2.1 Director of Finance

The Director of Finance should oversee all of EMPLOY’s financial activities. The following points

outline the primary job responsibilities of the Director of Finance:

• Manages the over-all financial aspect of the institution

• Oversees the importation of all transactions into QuickBooks

• Prepares annual budgets for all activities in conjunction with the Director of Operations

• Informs the Management of any financial change that would affect EMPLOY’s business

activities

• Provides Management with timely, accurate and up-to-date financial reports (monthly,

quarterly, and annually)

• Interprets financial performance of the Institution by submitting accomplished financial

performance indicators and ratio analysis quarterly and as require

• Perform other tasks as may be required by the Executive Director

Provides daily updates to the Director of Finance on the financial status of EMPLOY

• Provide oversee Board with monthly, quarterly, and yearly quantitative data

• Performs other tasks and functions as assigned by the board.

• Receives cash from Clients/solidarity groups on a daily basis with daily spot checks for

accuracy

• Deposit Client repayments (principle, interest, and savings) and withdraw disbursement

Receive repayments (principle, interest, and savings) directly from Clients

• Verify Solidarity Group repayments with daily repayment schedule

• Maintain a record of cash transferred to the Bank

3.2.3 Director of Operations/MIS Officer

The Director of Operations should oversee all of EMPLOY’s credit activities- from the

monitoring of the activities of the various solidarity groups through the loan tracking

system. The following points outline the primary job responsibilities of the Director of

Operations:

• Ensure timely disbursement and repayment of loans.

• Oversees EMPLOY’s portfolio

• Monitors the day to day functions of the MIS system

• From time to time makes necessary revisions in the configurations of EMPLOY’s loan

tracking system

LEAP Operations Manual- 2

• Monitors the flow of information from all solidarity groups.

• Provides oversight to each client.

• Prepares annual budgets for operations and other costs in conjunction with the Director

of Finance

• Prepares and submits monthly and end of period Credit Operation report.

• Prepare long term viability plans (in coordination with the Director of Finance, and

solidarity groups).

• Perform other tasks as may be required by the Director of Finance.

• Assist in the training of new Clients

• Conduct impromptu visits and area surveys in the field

• Spot-check records on Solidarity Groups to ensure accuracy

• Approve Loan applications

• Monitor daily repayments through the MIS reports

• Perform other tasks as may be required

• Organize approved Solidarity Groups into Centers

• Exhibit ethical values that heal relationships or ethnic differences, encouraging a concern

for justice of the oppressed

• Facilitate personal transformation of Clients, Solidarity Groups, and their respective

families and neighborhoods

• Facilitate conflict resolution within Solidarity Groups and/or Centers

• Review weekly/daily collection update in order to detect delinquencies promptly

• Ensure consistency between EMPLOY and Solidarity Group records

• Assist in planning program activities

• Work toward a 100% repayment rate and be responsible to follow-up on every delinquent

loan

4.0 Raising Understanding within the Community about EMPLOY

EMPLOY staff seeks to make many sound and beneficial loans as the Institution’s resources can

handle. They will facilitate informational meetings for communities with a large enough clientele to

support at least solidarity group.

Some advertising may be necessary for these meetings. The staff will make neighborhoods

aware of the meeting and notify those who are eligible to apply.

It is absolutely necessary, that targeted Beneficiary should be in close proximity to the home or

the solidarity group leader. EMPLOY’s lending model necessitates frequent visits to Clients.

These visits help solidarity group leader assess Potential Clients’ needs, track the success of

Clients’ businesses, and bring in missed payments from the field. Close proximity to the home of

the solidarity group leader will save time and money to meet clients on a regular basis.

The leader may suggest that Potential Clients desiring to form a Solidarity Group attend the

meeting together.

4.1 Structuring the Informational Meeting

Solidarity group leader should be present in an advisory role for all such meetings. The primary

responsibility of administrating such meetings should be done by the Director of operations

LEAP Operations Manual- 3

although the Director of Finance should ensure that information is communicated in a clear and

accurate manner.

Note: The initial meeting is held at the EMPLOY’S office.

After arriving to the meeting the Potential Clients should receive a brochure outlining the loan

methodology and terms and conditions EMPLOY.

Throughout the meeting the following topics should be addressed:

• What is the role of the Solidarity Group in EMPLOY’s lending methodology?

• What is the role of the Center in EMPLOY’s new lending methodology?

• What is a “Poverty Assessment” and how will it be conducted?

• What are EMPLOY’s loan terms?

• Since loans don’t require collateral, what guarantees does EMPLOY have?

• How are repayments made?

• What happens at a monthly mandatory meeting?

• What happens if a Solidarity Group member defaults?

• How do Clients apply for a second loan?

These questions are expected to be a starting point for the understanding of EMPLOY’s Loan

Methodology.

Potential Clients should have plenty of opportunity to ask questions. The Director of operation

and the Director of finance may answer these questions.

At the end of the meeting the Director of operations will offer interested individuals an application.

The forms will supply EMPLOY with basic information on Potential Clients, and allow the

applicants request a loan amount and to submit a brief business plan. The application will have

spaces for signatures of the other four (4) members of the Solidarity Group.

4.2 Formation of Solidarity Groups and Loan Application

Those who wish to participate with EMPLOY must form Solidarity Group of five (5) members. By

having members self-select, EMPLOY is able to create a group formed on existing network of

peer trust and friendship.

After the informational meeting, Potential Clients are encouraged to form into Solidarity Groups.

Applicants should be encouraged to join with members who are committed to guaranteeing each

other’s loans.

Individuals should carefully fill out the applications and business plan. Each Solidarity Group

member must request the amount for their initial loan, although loans cannot be less than 30 USD

or larger than 70 USD as a start up.

Each group member must submit the EMPLOY simple business plan form, outlining the

business’s projected growth path based on the requested loan amount. All business plans are to

be completed on a form provided to the Solidarity Group by the Director of Operations .

Individuals who require assistance in filling out the application form may ask for assistance from

the rest of the group.

Although the application form and business plan are for individuals, it is important that each

Solidarity Groups member understands how the loans amounts that (s)he is guaranteeing.

Completed applications will have spaces for the signatures for the other four (4) members of the

Solidarity Group. Group members who are unable to sign their name are permitted to use their

LEAP Operations Manual- 4

thumb print in place of a signature. Client should understand that by signing application forms

they are entering into a contract with the Solidarity Group and with EMPLOY.

To ensure that the group meets EMPLOY’s poverty criteria, the director of Operations will conduct

a poverty assessment questionnaire with each individual client. The questionnaire will assist

EMPLOY in evaluating the depth of impact in alleviating poverty in Liberia. Visits to the client’s

home and/or business may be necessary to verify information. Although Client visits are time

consuming EMPLOY considers it a necessary expense in the loan application process.

Note: All applications and poverty assessment questionnaires should be completed no more than

three (3) weeks from the time of the initial meeting.

4.3 Loan Approval

After the poverty assessment and business plans are completed the Director of Finance meets

with the Field Agent to assess the viability of each Solidarity Group. Groups should be appraised

on need and the viability of their business plans. Groups that are approved now are eligible to

proceed to the next step in the formation process.

Note: Loan sizes may be adjusted at this time. The Potential Client’s application must be revised

if the loan amount is changed. Group members must re-sign the loan application.

If a Potential Client fails to meet the client criteria set by EMPLOY then the other Solidarity Group

members must find a suitable process. Because the loans are guaranteed by the group, no

member will move forward in this process until all members are approved.

Once the whole Solidarity Group is approved, the Director of Operations will sign the application

and give it to the Director of Finance for review. The Director of Finance must check to confirm

that the EMPLOY has adequate funding for each loan.

4.4 Training of Centers

After clients are approved by EMPLOY, group members begin 7 hours process of training on

savings and loan model in business management.

The main focus of the training meetings should be a comprehensive explanation of the terms and

conditions associated with the savings and loan products. Clients should also have time to ask

questions regarding the repayment process. Repetition may be important aspect of this process.

Two main areas must be discussed in detail:

4.5 Weekly Repayments/compulsory savings at EMPLOY”s Office

During the first training session, each Solidarity Group will democratically elect a Solidarity Group

leader. Leader will make repayments on behalf of the other Solidarity Group members each

week at the EMPLOY Office. The Leader should have a flexible enough business to make all

repayments in a timely manner. Because the leader will be handling repayments on behalf of

other Clients, members should choose leader who is able to handle the responsibility.

. .

4.6 Monthly Meetings

The monthly meeting allows groups to receive specialized training while still employing group

pressure. Client attendance at monthly meetings is absolutely necessary. Monthly meetings are

scheduled to last for one and a half hours.

Training sessions will vary from loan cycle to loan cycle and may include presentations from

external organizations. Training may cover the following but is not limited to the areas of Biblical

values in the marketplace, business development skills, savings and risk management, and

preventative health care.

LEAP Operations Manual- 5

While loans are guaranteed at the Solidarity Group level, EMPLOY can still provide an important

group pressure on members. Because the banks are formed from business owners within small

community, members should know which members are making regular repayments and which

members have missed payments. At the monthly meeting the Director of operations will read out

a list of defaulters to the Center. He will keep track of all defaulted loans in his/her loan ledger

book. Employ will decide if it wishes to charge fees, such as a late fees or attendance fees. The

payment of all fines must be managed by the solidarity group leader and not EMPLOY.

Monthly meetings can also provide a time for networking for the office. Clients should be

encouraged to exchange business ideas with other members. Members within solidarity groups

who sell similar products or who use the same raw materials may wish to purchase goods in bulk.

LEAP Operations Manual- 6

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Thieves' World Murder at The Vulgar Unicorn (d20)Documento81 pagineThieves' World Murder at The Vulgar Unicorn (d20)Red Stone100% (4)

- Harvey Vs Defensor Santiago DigestDocumento5 pagineHarvey Vs Defensor Santiago DigestLeo Cag0% (1)

- Structuring Business LettersDocumento7 pagineStructuring Business LettersAvinab DasNessuna valutazione finora

- MedMen HochulDocumento67 pagineMedMen HochulChris Bragg100% (1)

- 2006 IBC Short ChecklistDocumento1 pagina2006 IBC Short ChecklistBrandon VieceliNessuna valutazione finora

- Account Statement 010721 210122Documento30 pagineAccount Statement 010721 210122PhanindraNessuna valutazione finora

- California Code of Civil Procedure Section 170.4 Striking 170.3Documento1 paginaCalifornia Code of Civil Procedure Section 170.4 Striking 170.3JudgebustersNessuna valutazione finora

- Final Managerial AccountingDocumento8 pagineFinal Managerial Accountingdangthaibinh0312Nessuna valutazione finora

- Commercial Bill: Atlas Honda LimitedDocumento1 paginaCommercial Bill: Atlas Honda LimitedmeheroNessuna valutazione finora

- Rosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrDocumento5 pagineRosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrEliza Den DevilleresNessuna valutazione finora

- Advantage: A Health Cover For at The Cost of Your Monthly Internet BillDocumento4 pagineAdvantage: A Health Cover For at The Cost of Your Monthly Internet BillAmitabh WaghmareNessuna valutazione finora

- Vice President Security Lending in NYC NY NJ Resume Fernando RiveraDocumento3 pagineVice President Security Lending in NYC NY NJ Resume Fernando Riverafernandorivera1Nessuna valutazione finora

- KK PROFILING - MEMORANDUM CIRCULAR Guidelines - KK Profiling - June 08 1Documento4 pagineKK PROFILING - MEMORANDUM CIRCULAR Guidelines - KK Profiling - June 08 1Cherie LerioNessuna valutazione finora

- Licensing Notes For Oracle'S Peopletools 8.52Documento19 pagineLicensing Notes For Oracle'S Peopletools 8.52Juan Pablo GasparriniNessuna valutazione finora

- Clado-Reyes V LimpeDocumento2 pagineClado-Reyes V LimpeJL A H-DimaculanganNessuna valutazione finora

- Legal OpinionDocumento8 pagineLegal OpinionFrancis OcadoNessuna valutazione finora

- Form No. 1: The Partnership Act, 1932Documento3 pagineForm No. 1: The Partnership Act, 1932MUHAMMAD -Nessuna valutazione finora

- In The Industrial Court of Swaziland: Held at Mbabane CASE NO. 280/2001Documento10 pagineIn The Industrial Court of Swaziland: Held at Mbabane CASE NO. 280/2001Xolani MpilaNessuna valutazione finora

- ARTADocumento1 paginaARTAAron Paul Morandarte RulogNessuna valutazione finora

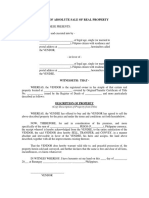

- Deed of Absolute Sale of Real Property in A More Elaborate Form PDFDocumento2 pagineDeed of Absolute Sale of Real Property in A More Elaborate Form PDFAnonymous FExJPnC100% (2)

- Chapter 1: Introduction: 1. Distribution of Powers To Local Government As Limitation To Political AuthorityDocumento33 pagineChapter 1: Introduction: 1. Distribution of Powers To Local Government As Limitation To Political AuthorityJoseph GabutinaNessuna valutazione finora

- Guide To Confession: The Catholic Diocese of PeoriaDocumento2 pagineGuide To Confession: The Catholic Diocese of PeoriaJOSE ANTONYNessuna valutazione finora

- Federalisms of US and IndiaDocumento3 pagineFederalisms of US and IndiaTanya TandonNessuna valutazione finora

- Deutsche Bank, Insider Trading Watermark)Documento80 pagineDeutsche Bank, Insider Trading Watermark)info707100% (1)

- IMO Online. AdvtDocumento4 pagineIMO Online. AdvtIndiaresultNessuna valutazione finora

- Sop EnglishDocumento42 pagineSop Englishapi-236690310Nessuna valutazione finora

- ChrisDocumento5 pagineChrisDpNessuna valutazione finora

- 0452 s03 Ms 2Documento6 pagine0452 s03 Ms 2lie chingNessuna valutazione finora

- (Azizi Ali) Lesson Learnt From Tun Daim E-BookDocumento26 pagine(Azizi Ali) Lesson Learnt From Tun Daim E-BookgabanheroNessuna valutazione finora

- 08 Albay Electric Cooperative Inc Vs MartinezDocumento6 pagine08 Albay Electric Cooperative Inc Vs MartinezEYNessuna valutazione finora