Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 7 Final

Caricato da

Michael HuDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 7 Final

Caricato da

Michael HuCopyright:

Formati disponibili

Chapter 7

Multiple-Choice Questions

1. Easy c Auditors must make decisions regarding what evidence to gather and how much to accumulate. Which of the following is a decision that must be made by auditors related to evidence? Sample size Yes No Yes No Timing of audit procedures Yes No No Yes

a. b. c. d. 2. Easy a

Audit procedures may be performed: Prior to the fiscal year-end of the client Yes No Yes No Subsequent to the fiscal year-end of the client Yes No No Yes

a. b. c. d. 3. easy b

Which of the following forms of evidence is most reliable? a. General ledger account balances. b. Confirmation of accounts receivable balance received from a customer. c. Internal memo explaining the issuance of a credit memo. d. Copy of month-end adjusting entries. Which of the following is not a characteristic of the reliability of evidence? a. Effectiveness of client internal controls. b. Education of auditor. c. Independence of information provider. d. Timeliness. Which of the following is not a characteristic of the reliability of evidence? a. Qualification of individual providing information. b. Auditors direct knowledge. c. Degree of subjectivity. d. Degree of objectivity. Calculating the gross margin as a percent of sales and comparing it with previous periods is what type of evidence? a. Physical examination. b. Analytical procedures. c. Observation. d. Inquiry Audit evidence obtained directly by the auditor will not be reliable if: a. the auditor lacks the qualifications to evaluate the evidence. b. it is provided by the clients attorney. c. the client denies its veracity. d. it is impossible for the auditor to obtain additional corroboratory evidence. Appropriateness of evidence is a measure of the: a. quantity of evidence.

4. easy b

5. easy c

6. easy b

7. easy a

8. easy

Arens/Elder/Beasley

b. c. d.

quality of evidence. sufficiency of evidence. meaning of evidence.

9. easy a

Which of the following statements regarding the relevance of evidence is correct? a. To be relevant, evidence must pertain to the audit objective of the evidence. b. To be relevant, evidence must be persuasive. c. To be relevant, evidence must relate to multiple audit objectives. d. To be relevant, evidence must be derived from a system including effective internal controls. Two determinants of the persuasiveness of evidence are: a. competence and sufficiency. b. relevance and reliability. c. appropriateness and sufficiency. d. independence and effectiveness. Three common types of confirmations used by auditors are (1) negative confirmations, (2) blank form positive confirmations, and (3) positive confirmations with information included. Place the confirmations in order of reliability from highest to lowest. a. 1, 2, 3. b. 3, 2, 1. c. 2, 3, 1. d. 3, 1, 2. When auditors use documents to support recorded transactions, the process is often called: a. inquiry. b. confirmation. c. vouching. d. physical examination. An example of an external document is: a. employees time reports. b. bank statements. c. purchase order for company purchases. d. carbon copies of checks. An example of a document the auditor receives from the client, but which was prepared by someone outside the clients organization, is a(n): a. confirmation. b. sales invoice. c. vendor invoice. d. bank reconciliation. Evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data involving comparisons of recorded amounts to expectations developed by the auditor is a definition of: a. analytical procedures. b. tests of transactions. c. tests of balances. d. auditing. Often, auditor procedures result in significant differences being discovered by the auditor. The auditor should investigate further if: Significant differences are not Significant differences are expected but

10. easy c

11. easy c

12. easy c

13. easy b

14. easy c

15. easy a

16. Easy a

Arens/Elder/Beasley

a. b. c. d. 17. easy c

expected but do exist Yes No Yes No

do not exist Yes No No Yes

Which of the following is not a purpose of analytical procedures? a. Understand the clients industry. b. Assess the clients ability to continue as a going concern. c. Evaluate internal controls. d. Reduce detailed audit tests. Which of the following forms of evidence would be least persuasive in forming the auditors opinion? a. Responses to auditors questions by the president and controller regarding the investments account. b. Correspondence with a stockbroker regarding the quantity of clients investments held in street name by the broker. c. Minutes of the board of directors authorizing the purchase of stock as an investment. d. The auditors count of marketable securities. Which of the following statements is not true? The evidence-gathering technique of inquiry: a. cannot be regarded as conclusive. b. requires the gathering of corroborative evidence. c. is the auditors principal method of evaluating the clients internal control. d. does not provide evidence from an independent source. Sarbanes-Oxley requires auditors of public companies to maintain audit documentation for what period of time? a. Not less than 3 years. b. Not less than 5 years. c. Not less than 7 years. d. Through the issuance of the financial statements. Analytical procedures must be used during which phase(s) of the audit? Test of Controls Yes No Yes No Planning Yes Yes No No Completion Yes Yes No No

18. medium a

19. medium c

20. (SOX) medium c

21. medium b

a. b. c. d.

22. medium b

Which of the following statements is not correct? a. It is possible to vary the sample size from one unit to 100% of the items in the population. b. The decision of how many items to test should not be influenced by the increased costs of performing the additional tests. c. The decision of how many items to test must be made by the auditor for each audit procedure. d. The sample size for any given procedure is likely to vary from audit to audit. Auditors will replace tests of details with analytical procedures when possible because the: a. analytical procedures are more reliable. b. tests of details are more expensive. c. analytical procedures are more persuasive. d. tests of details are more difficult to interpret.

23. medium b

Arens/Elder/Beasley

24. medium c

Which of the following statements is not correct? a. Persuasiveness of evidence is partially determined by the reliability of evidence. b. The quantity of evidence obtained determines its sufficiency. c. The auditor need not consider the independence of an information source when obtaining evidence. d. Evidence obtained directly by the auditor is ordinarily more reliable than evidence obtained from other sources. Which one of the following is not one of the primary purposes of audit documentation? a. A basis for planning the audit. b. A record of the evidence accumulated and the results of the tests. c. A basis for review by supervisors and partners. d. A basis for determining work deficiencies by peer review teams. Which of the following is the most objective type of evidence? a. A letter written by the clients attorney discussing the likely outcome of outstanding lawsuits. b. The physical count of securities and cash. c. Inquiries of the credit manager about the collectibility of noncurrent accounts receivable. d. Observation of cobwebs on some inventory bins. Which of the following statements regarding documentation is not correct? a. Documentation includes examining client records such as general ledgers and supporting journals. b. Internal documents are documents that are generated within the company and used to communicate with external parties. c. External documents are documents that are generated outside of the company and are used to communicate the results of a transaction. d. External documents are considered more reliable than internal documents. When making decisions about evidence for a given audit, the auditors goal is to obtain a sufficient amount of timely, reliable evidence that is relevant to the information being verified, and to do so: a. no matter the cost involved in obtaining such evidence. b. at any cost because the costs are billed to the client. c. at the lowest possible total cost. d. at the cost suggested in the engagement letter. Physical examination is the inspection or count by the auditor of items such as: a. cash, inventory, and payroll timecards. b. cash, inventory, canceled checks, and sales documents. c. cash, inventory, canceled checks, and tangible fixed assets. d. cash, inventory, securities, notes receivable, and tangible fixed assets. Which items affect the sufficiency of evidence when choosing a sample? Selecting items with a high likelihood of misstatement Yes No Yes No The randomness of the items selected Yes No No Yes

25. medium d

26. medium b

27. medium b

28. medium c

29. medium d

30. medium c

a. b. c. d. 31. medium a

Which of the following is an example of vouching? a. Trace inventory purchases from the acquisitions journal to supporting invoices. b. Trace selected sales invoices to the sales journal.

Arens/Elder/Beasley

c. d. 32. medium b

Trace details of employee paychecks to the payroll journal. All of the above are examples of vouching.

Which of the following statements about confirmations is true? a. Confirmations are expensive and so are often not used. b. Confirmations may inconvenience those asked to supply them, but they are widely used. c. Confirmations are sometimes not reliable and so auditors use them only as necessary. d. Confirmations are required for several balance sheet accounts but no income statement accounts. Traditionally, confirmations are used to verify: a. individual transactions between organizations, such as sales transactions. b. bank balances and accounts receivable. c. fixed asset additions. d. payroll expenses. To be considered reliable evidence, confirmations must be controlled by: a. a client employee responsible for accounts receivable. b. a financial statement auditor. c. a clients internal audit department. d. a clients controller or CFO. Indicate whether confirmation of accounts receivable and accounts payable is required or optional:

33. medium b

34. medium b

35. medium b

a. b. c. d. 36. medium b

Accounts Receivable Required Required Optional Optional

Accounts Payable Required Optional Required Optional

The Auditing Standards Board has concluded that analytical procedures are so important that they are required during: a. planning and test of control phases. b. planning and completion phases. c. test of control and completion phases. d. planning, test of control, and completion phases. Which of the following statements regarding analytical procedures is not correct? a. Analytical tests emphasize a comparison of client internal controls to GAAP. b. Analytical procedures are required on all audits. c. Analytical procedures can be used as substantive tests. d. For certain accounts with small balances, analytical procedures alone may be sufficient evidence. A benefit obtained from comparing the clients data with industry averages is that it provides a(n): a. indication of the likelihood of financial problems. b. indication where errors exist in the statements. c. benchmark to be used in evaluating a clients budgets. d. comparison of what is with what should be. The primary purpose of performing analytical procedures in the planning phase of an audit is to: a. help the auditor obtain an understanding of the clients industry and business. b. assess the going concern assumption.

37. medium a

38. medium a

39. medium a

Arens/Elder/Beasley

c. d. 40. medium d

indicate possible misstatements. reduce detailed tests.

Which of the following is not a correct combination of terms and related type of audit evidence? a. Foot reperformance. b. Compare documentation. c. Vouch documentation. d. Trace analytical procedures. Which of the following is not a correct combination of terms and related type of audit evidence? a. Inquire inquiries of client. b. Count physical examination. c. Recompute documentation. d. Read documentation. Which of the following is not one of the major types of analytical procedures? a. Compare client with industry averages. b. Compare client with prior year. c. Compare client with budget. d. Compare client with SEC averages. What is the overall objective of audit documentation? a. Defend against claims of a deficient audit. b. Provide a basis for reviewing the work of subordinates. c. Provide reasonable assurance that the audit was conducted in accordance with standards. d. Provide additional support of recorded amounts to the client. An important benefit of industry comparisons is as: a. an aid to understanding the clients business. b. an indicator of errors. c. an indicator of fraud. d. a least-cost indicator for audit procedures. The permanent files included as part of audit documentation do not normally include: a. a copy of the current and prior years audit programs. b. copies of articles of incorporation, bylaws and contracts. c. information related to the understanding of internal control. d. results of analytical procedures from prior years. Those procedures specifically outlined in an audit program are primarily designed to a. prevent litigation. b. detect errors or irregularities. c. test internal systems. d. gather evidence. Evidence is generally considered appropriate when: a. it has been obtained by random selection. b. there is enough of it to afford a reasonable basis for an opinion on financial statements. c. it has the qualities of being relevant, objective, and free from known bias. d. it consists of written statements made by managers of the enterprise under audit. Given the economic constraints in which auditors collect evidence, the auditor normally gathers evidence that is: a. irrefutable. b. conclusive. c. persuasive.

41. medium c

42. medium d

43. medium c

44. medium a

45. medium a

46. medium d

47. medium c

48. challenging c

Arens/Elder/Beasley

d. 49. challenging b

completely convincing.

The auditor is concerned that a client is failing to bill customers for shipments. An audit procedure that would gather relevant evidence would be to: a. select a sample of duplicate sales invoices and trace each to related shipping documents. b. trace a sample of shipping documents to related duplicate sales invoices. c. trace a sample of Sales Journal entries to the Accounts Receivable subsidiary ledger. d. compare the total of the Schedule of Accounts Receivable with the balance of the Accounts Receivable account in the general ledger. Relevance can be considered only in terms of: a. general audit objectives. b. specific audit objectives. c. transaction audit objectives. d. balance audit objectives. Audit documentation should possess certain characteristics. Which of the following is one of the characteristics? Audit documentation should be indexed and cross-referenced Yes No Yes No Audit documentation should be organized to benefit the clients staff Yes No No Yes

50. challenging b

51. challenging c

a. b. c. d. 52. medium b

Which of the following statements is not a correct use of the terminology? a. Evidence obtained from an independent source outside the client organization is more reliable than that obtained from within. b. Documentary evidence is more reliable when it is received by the auditor indirectly rather than directly. c. Documents that originate outside the company are considered more reliable than those that originate within the clients organization. d. External evidence, such as communications from banks, is generally regarded as more reliable than answers obtained from inquiries of the client. Evidence is usually more persuasive for balance sheet accounts when it is obtained: a. as close to the balance sheet date as possible. b. only from transactions occurring on the balance sheet date. c. from various times throughout the clients year. d. from the time period when transactions in that account were most numerous during the fiscal period. Audit documentation should provide support for: The audit report Yes No Yes No The financial statements Yes No No Yes

53. challenging a

54. medium c

a. b. c. d.

Arens/Elder/Beasley

55. challenging a

Which of the following statements is not correct concerning audit documentation? a. Audit documentation is acquired to defend against claims that the auditor performed a deficient audit. b. The only time anyone has a legal right to examine audit documentation is when the documentation is subpoenaed by a court as legal evidence. c. Audit documentation is the primary frame of reference used by supervisory personnel to evaluate the sufficiency of evidence. d. The auditor may deny requests by the client to review audit evidence. Which of the following statements is not true? a. A large sample of highly competent evidence is not persuasive unless it is relevant to the objective being tested. b. A large sample of evidence that is neither competent nor timely is not persuasive. c. A small sample of only one or two pieces of relevant, competent, and timely evidence lacks persuasiveness. d. The persuasiveness of evidence can be evaluated after considering its competence and its sufficiency. Which of the following statements is not correct? a. Analytical procedures are used to isolate accounts or transactions that should be investigated more extensively. b. For certain immaterial accounts, analytical procedures may be the only evidence needed. c. In some instances, other types of evidence may be reduced when analytical procedures indicate that an account balance appears reasonable. d. Analytical procedures use supporting documentation to determine which account balances need additional detailed procedures. Which of the following statements is not correct? a. The effectiveness of the clients internal control has little effect on the reliability of most types of evidence. b. Analytical procedures may be reliable even if tests of internal controls indicate control weaknesses. c. Both physical examination and mechanical accuracy are likely to be highly reliable if the internal control is effective. d. A specific type of evidence is rarely sufficient by itself to provide reliable evidence to satisfy any audit objective. Audit evidence supporting the financial statements consists of the underlying accounting data and all corroborating information available to the auditor. Which of the following is an example of corroborating information? a. Minutes of meetings. b. General and subsidiary ledgers. c. Accounting manuals. d. Worksheets supporting cost allocations. Which of the following discoveries through the use of analytical procedures would indicate a relatively high risk of financial failure? a. A decline in gross margin percentages. b. An increase in the balance in fixed assets. c. An increase in the ratio of allowance for uncollectible accounts to gross accounts receivable, while at the same time accounts receivable turnover also decreased. d. A higher than normal ratio of long-term debt to net worth as well as a lower than average ratio of profits to total assets. Which of the following statements is correct regarding the costs involved in obtaining

56. challenging d

57. challenging d

58. challenging a

59. challenging a

60. challenging d

61.

Arens/Elder/Beasley

evidence? challenging d Physical examination is usually the least expensive type of audit evidence a. Yes b. No c. Yes d. No

Cost of obtaining evidence may be a factor in deciding whether to obtain that evidence Yes No No Yes

62. challenging c

A common comparison occurs when the auditor calculates the expected balance and compares it with the actual balance. The auditors expected account balance may be determined by: a. using industry standards. b. using Dun and Bradstreet reports. c. relating it to some other balance sheet or income statement account or accounts. d. inquiry of the client. Two analytical procedures available to the auditor are: Compare current years balances with the preceding year. Compare details of a particular accounts balance with the preceding year. Shortcomings of these two procedures are that: a. the first ignores effects of tests of controls and the second fails to consider possible changes in client personnel. b. the first fails to consider growth or decline in business activity and the second ignores relationships of data to other data. c. both fail to consider growth or decline in business activity and ignore relationships of data. d. it is difficult, time consuming, and, therefore, costly to perform these procedures. Which of the following statements relating to the competence of evidential matter is always true? a. Evidence from outside an enterprise is always reliable. b. Accounting data developed under satisfactory conditions of internal control are more relevant than data developed under unsatisfactory internal control conditions. c. Oral representations made by management are not reliable evidence. d. Evidence must be both reliable and relevant to be considered appropriate.

63. medium b

64. challenging d

Essay Questions

65. easy One purpose of performing analytical procedures in the planning phase of an audit is to assess the clients financial condition. Explain how the assessment of a clients financial condition can affect the auditors decisions concerning evidence accumulation in later phases of the audit. Answer: All things being equal, the weaker the clients financial condition, the more assurance the auditor will require that the financial statements are free of material misstatements. As the auditor requires greater assurance, he or she can (1) perform detailed testing closer to the balance sheet date, (2) increase the extent of detailed testing, or (3) perform more reliable procedures. In extreme cases, however, if the auditor believes the entity is not a going concern, he or she may withdraw from the engagement and perform no additional tests.

66. medium

Distinguish between internal documentation and external documentation as types of audit evidence. Give two examples of each. Which type is considered more reliable?

Arens/Elder/Beasley

Answer: Internal documentation involves the auditors examination of documents that have been prepared and used within the clients organization and are retained without ever going to an outside party. Examples would include duplicate sales invoices, employees time reports, and inventory receiving reports. External documentation involves the auditors examination of documents that have been in the hands of someone outside the clients organization. Examples include vendors invoices, cancelled checks, cancelled notes payable, and insurance policies. External documents are regarded as more reliable evidence than internal documents.

67. medium

Identify the three common types of confirmations used by auditors. Indicate which type is most reliable and explain your answer. In addition, indicate which type is least reliable and explain your answer. Answer: In order of reliability, the three common types of confirmations used by auditors are: positive confirmation with a request for information to be supplied by the recipient. positive confirmation with the information to be confirmed included on the form. negative confirmation. The positive confirmation with a request for information to be supplied by the recipient is the most reliable because the recipient must supply the information from his or her records. If this information agrees with the information in the clients records, the likelihood that the information is correct is high. The positive confirmation with the information to be confirmed included on the form is not as reliable as the first type because the recipient may sign and return the confirmation without carefully examining the information. The negative confirmation is the least reliable because a nonresponse could be due to either the recipient agreeing with the information or the recipient ignoring the confirmation request.

Arens/Elder/Beasley

68. medium

There are four important purposes of analytical procedures. Identify each of these four purposes and, for each purpose, give a specific example of an analytical procedure that an auditor might perform. Answer: Four important purposes of analytical procedures are: To help the auditor understand the clients industry and business, the auditor might analyze recent trends in the clients gross margin percentages to assess the effects of competition in the industry. To aid in the assessment of the clients ability to continue as a going concern, the auditor might analyze several of the clients key ratios including the ratio of long -term debt to net worth, the ratio of profits to total assets, and the current ratio. To indicate the presence of possible misstatements in the financial statements, the auditor might compare the current years unaudited account balances with the previous years audited balances. To reduce the extent of detailed tests, the auditor might perform a simple analytical procedure such as multiplying the clients monthly rent times 12 as a test of the clients rent expense account. If the product agrees with the balance in rent expense, no additional testing of the account may be necessary.

69. medium

Discuss how each of the following influences the persuasiveness of evidence. 1. Relevance 2. Independence of provider 3. Effectiveness of clients internal controls 4. Auditors direct knowledge 5. Degree of objectivity Answer: 1. Relevance Evidence must pertain to the audit objective if it is to be persuasive. Relevance must be considered in terms of specific audit objectives as evidence may be relevant to one objective and not another. 2. Independence of provider Evidence obtained from a source outside the entity is more reliable and persuasive than that obtained from within. 3. Effectiveness of clients internal controls When a clients internal controls are effective, evidence obtained is more reliable than when they are weak. 4. Auditors direct knowledge Evidence obtained directly by the auditor through physical examination, observation, computation and inspection is more competent than information obtained indirectly. 5. Degree of objectivity Objective evidence is more reliable than evidence that requires considerable judgment to determine whether it is correct.

Arens/Elder/Beasley

70. medium

Give two examples of relatively reliable documentation and two examples of less reliable documentation. What characteristics distinguish the two? Answer: Examples of relatively reliable documents include vendors statements, cancelled notes payable, insurance policies, and bank statements. Examples of less reliable documents include duplicate sales invoices, employees time reports, inventory receiving repo rts, and internal memoranda. The primary characteristic that distinguishes the two is whether the document is an external document (the document has been in the hands of someone outside the clients organization who is a party to the transaction), or an internal document. External documents are considered to be more reliable than internal documents. Discuss the auditors use of documentation as evidence. Answer: Documentation is the auditors examination of the clients documents and r ecords to substantiate the information that either is included or should be included in the financial statements. Documents that the auditor examines may either be classified as external documents or internal documents. External documents are those that have been in the hands of someone outside of the clients organization who is a party to the transaction being documented. Internal documents are those that have been prepared and used within the clients organization without ever being in the custody of an external party. The primary determinant of the auditors willingness to accept a document as reliable evidence is whether it is internal or external, and, when internal, whether it was created and processed under conditions of effective internal control. The auditors decisions regarding evidence accumulation can be broken into four subdecisions. One decision relates to determining the nature of the audit procedure to be used to collect the evidence; i.e., which audit procedures to use. Identify and discuss the remaining three audit evidence decisions that the auditor makes. Answer: The remaining three audit evidence decisions are: What sample size to select for a given procedure. This decision relates to the extent of testing to be performed. Once the auditor has identified which procedure to perform, he or she needs to decide the appropriate number of items in the population to test ranging from one to all items in the population. Which items to select from the population . Once the auditor has decided the appropriate number of items to test, he or she needs to decide which particular items in the population to examine. When to perform the procedures. This decision relates to the timing of the testing to be performed. Audit procedures related to balance sheet accounts which are performed close to the balance sheet date are generally considered more reliable than procedures performed during the interim period.

71. medium

72. challenging

Arens/Elder/Beasley

73. challenging

The reliability of evidence refers to the degree to which evidence is considered believable or trustworthy. There are five factors that affect the reliability of audit evidence. One factor is the independence of the provider; i.e., evidence obtained from a source outside the client company is more reliable than that obtained within. Identify and discuss the remaining four factors that affect the reliability of evidence. Answer: The remaining four factors that affect the reliability of evidence are: Effectiveness of clients internal control. When a clients internal controls are effective, evidence obtained from the client is more reliable than when controls are weak. Auditors direct knowledge. Evidence obtained directly by the auditor is more reliable than information obtained indirectly. Qualifications of individuals providing the information. Information obtained from persons not familiar with the business world would generally not be considered as reliable as information from an expert in a business-related field. Degree of objectivity. Objective evidence is more reliable than evidence that requires considerable judgment to determine whether it is correct.

74. challenging

Define the following terms commonly used in audit procedures: 1. Examine 2. Scan 3. Compute 4. Foot 5. Compare 6. Count 7. Vouch Answer: 1. Examine A reasonably detailed study of a specific document or record to determine specific facts about it. 2. Scan A less detailed examination of a document or record to determine whether there is something unusual warranting further investigation. 3. Compute A calculation done by the auditor independent of the client. 4. Foot Addition of a column of numbers to determine whether the total is the same as the clients. 5. Compare A comparison of information in two different locations. 6. Count A determination of assets on hand at a given time. This is associated with evidence defined as physical examination. 7. Vouch The use of documents to verify recorded transactions or amounts.

Arens/Elder/Beasley

Other Objective Answer Format Questions

75. medium Below are 12 audit procedures. Classify each procedure according to the following types of audit evidence: (1) physical examination, (2) confirmation, (3) documentation, (4) observation, (5) inquiry of the client, (6) reperformance, and (7) analytical procedure. Audit Procedures 1. 2. 3. 4. 5. 6. 7. 8. 9. Watch client employees count inventory to determine whether company procedures are being followed. Count inventory items and record the amount in the audit files. Trace postings from the sales journal to the general ledger accounts. Calculate the ratio of cost of goods sold to sales as a test of overall reasonableness of gross margin relative to the preceding year. Obtain information about the clients internal controls by asking questions of client personnel. Trace column totals from the cash disbursements journal to the general ledger. Examine a piece of equipment to make sure a recent purchase of equipment was actually received and is in operation. Review the total of repairs and maintenance for each month to determine whether any months total was unusually large. Compare vendor names and amounts on purchases invoices with entries in the purchases journal.

Type of Evidence

10. Foot entries in the sales journal to determine whether they were correctly totaled by the client. 11. Make a surprise count of petty cash to verify that the amount of the petty cash fund is intact. 12. Obtain a written statement from the clients bank stating the clients year -end balance on deposit. Answer: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Observation Physical examination Reperformance Analytical procedure Inquiry of the client Reperformance Physical examination Analytical procedure Documentation Reperformance Physical examination Confirmation

Arens/Elder/Beasley

76. medium

Match nine of the terms (a-k) with the definitions provided below (1-9): a. b. c. d. e. f. g. h. i. j. k. Foot Compute Scan Inquire Count Trace Recompute Read Examine Observe Compare 1. 2. A calculation done by the auditor independent of the client. Addition of a column of numbers to determine if the total is the same as the clients. A comparison of information in two different locations. A use of the senses to assess certain activities. Following details of transactions from original documents to journals. A less detailed examination of a document or record to determine if there is something unusual warranting further investigation. Obtaining information from the client in response to specific questions. A determination of assets on hand at a given time. An examination of written information to determine facts pertinent to the audit.

b a

k j f c

3. 4. 5. 6.

d e h

7. 8. 9.

Arens/Elder/Beasley

77. medium

Match five of the terms (a-h) with the definitions provided below (1-5): a. b. c. d. e. f. g. h. Audit documentation Audit procedures Audit objectives Analytical procedures Budgets Reliability of evidence Sufficiency of evidence Persuasiveness of evidence 1. Use of comparisons and relationships to assess the reasonableness of account balances. Detailed instructions for the collection of a type of audit evidence. The degree to which evidence can be considered believable or trustworthy. Contains all the information that the auditor considers necessary to conduct an adequate audit and to provide support for the audit report. This is determined by the amount of evidence obtained.

b f a

2. 3. 4.

5.

78. medium Type of Document

Below are 10 documents typically examined during an audit. Classify each document as either internal or external. Documents 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Canceled checks for payments of accounts payable. Payroll time cards. Duplicate sales invoices. Vendors invoices. Bank statements. Minutes of the board of directors meetings. Signed lease agreements. Notes receivable. Subsidiary accounts receivable records. Remittance advices. 1. 2. 3. 4. 5. External Internal Internal External External 6. 7. 8. 9. 10. Internal External External Internal External

Answer:

Arens/Elder/Beasley

79. easy b 80. easy a 81. easy b 82. easy b

Cost should never be a consideration when making decisions about evidence for a given audit. a. True b. False Confirmations are among the most expensive type of evidence to obtain. a. True b. False Observation is normally more reliable than physical examination. a. True b. False Inquiries of the client are usually sufficient to provide appropriate evidence to satisfy an audit objective. a. True b. False A canceled check written by the client, made payable to a local supplier and drawn on the clients bank account is one type of internal document. a. True b. False Whenever practical and reasonable, the confirmation of accounts receivable is required of CPAs. a. True b. False Inquiries of clients and reperformance normally have a low cost associated with them. a. True b. False When analytical procedures reveal unusual fluctuations in an account balance, the auditor will probably perform fewer tests of details for that account and increase the tests of controls related to the account. a. True b. False The type of audit evidence known as inquiry requires the auditor to obtain oral information from the client in response to questions. a. True b. False One of the primary determinants of the reliability of audit evidence is the quantity of evidence. a. True b. False Audit documentation is the joint property of the auditor and the audit client. a. True b. False

83. easy b

84. easy a

85. easy a 86. easy b

87. easy a

88. medium b 89. medium b

Arens/Elder/Beasley

90. medium a 91. medium a

Objective evidence is more reliable, and hence more persuasive, than subjective evidence. a. True b. False Ordinarily, audit documentation can be provided to someone else only with the express permission of the client. a. True b. False Analytical procedures must be used in the planning and completion phases of the audit. a. True b. False Confirmations are ordinarily used to verify account balances, but may be used to verify transactions. a. True b. False Of the three common types of confirmations used by auditors, the least reliable type is the negative confirmation. a. True b. False Accounts receivable confirmations must be controlled by the client from the time they are prepared until the time they are returned to the auditor. a. True b. False Cost is never an adequate justification for omitting a necessary procedure or not gathering an adequate sample size. a. True b. False Analytical procedures can be used to provide reliable substantive evidence for all balancerelated audit objectives. a. True b. False One advantage of using statistical techniques when performing analytical procedures is that they eliminate the need for auditor judgment. a. True b. False Relevance of evidence can only be considered in terms of specific audit objectives. a. True b. False

92. medium a 93. medium a

94. medium a

95. medium b

96. medium a

97. medium b

98. medium b

99. medium a

Arens/Elder/Beasley

Potrebbero piacerti anche

- Chapter 16 FinalDocumento15 pagineChapter 16 FinalMichael Hu100% (1)

- AUDITINGDocumento11 pagineAUDITINGMaud Julie May FagyanNessuna valutazione finora

- Psa 315Documento18 paginePsa 315Joanna Caballero100% (1)

- Prelim and Midterm CompilationDocumento61 paginePrelim and Midterm CompilationJOLLYBEL ROBLESNessuna valutazione finora

- Chapter 9 FinalDocumento17 pagineChapter 9 FinalMichael Hu33% (3)

- Auditing Theory Answer Key 1Documento197 pagineAuditing Theory Answer Key 1AngelUmayam100% (2)

- Chapter 13Documento25 pagineChapter 13Clarize R. Mabiog50% (2)

- Group 3 PSA 240 SummaryDocumento10 pagineGroup 3 PSA 240 SummaryAra Jane T. Pinili100% (1)

- Audit CH 6 and 7Documento30 pagineAudit CH 6 and 7Nanon WiwatwongthornNessuna valutazione finora

- Chapter 4 SalosagcolDocumento3 pagineChapter 4 SalosagcolElvie Abulencia-BagsicNessuna valutazione finora

- Ac10 Chap 56Documento30 pagineAc10 Chap 56SVPSNessuna valutazione finora

- Psa 315 (Part 1)Documento47 paginePsa 315 (Part 1)LisaNessuna valutazione finora

- Chapter 12 FinalDocumento19 pagineChapter 12 FinalMichael Hu100% (1)

- Review of Auditing and Assurance PrinciplesDocumento23 pagineReview of Auditing and Assurance PrinciplesJoseph BarreraNessuna valutazione finora

- Management of Public Accounting PracticeDocumento32 pagineManagement of Public Accounting PracticeClar Aaron Bautista100% (3)

- Audit Evidence Consists of Underlying Accounting Data and Corroborating InformationDocumento4 pagineAudit Evidence Consists of Underlying Accounting Data and Corroborating InformationJudy100% (1)

- Acctg 14 - MidtermDocumento5 pagineAcctg 14 - MidtermRannah Raymundo100% (1)

- Department of Accountancy: Page - 1Documento19 pagineDepartment of Accountancy: Page - 1NoroNessuna valutazione finora

- IR Quiz 3 Final Answer KeyDocumento5 pagineIR Quiz 3 Final Answer KeyAna LengNessuna valutazione finora

- Auditing Test Bank Ch1Documento34 pagineAuditing Test Bank Ch1Rosvel Esquillo95% (21)

- Completion of Audit Quiz ANSWERDocumento9 pagineCompletion of Audit Quiz ANSWERJenn DajaoNessuna valutazione finora

- ASSERTIONS, AUDIT PROCEDURES AND AUDIT EVIDENCE Red Sirug Lecture NotesDocumento11 pagineASSERTIONS, AUDIT PROCEDURES AND AUDIT EVIDENCE Red Sirug Lecture NotesMikaNessuna valutazione finora

- Chapter 11 FinalDocumento13 pagineChapter 11 FinalMichael Hu100% (4)

- 24 - Completing The AuditDocumento46 pagine24 - Completing The Auditdelrisco8100% (5)

- Review Questions: Click On The Questions To See AnswersDocumento10 pagineReview Questions: Click On The Questions To See AnswersJinjer Ann LanticanNessuna valutazione finora

- Multiple Choice Questions: Review of Financial StatementsDocumento8 pagineMultiple Choice Questions: Review of Financial StatementsMarnelli CatalanNessuna valutazione finora

- Chapter 16 Solution ManualDocumento22 pagineChapter 16 Solution ManualTri MahathirNessuna valutazione finora

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)Documento10 pagineFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)marygraceomacNessuna valutazione finora

- Module 1 Auditing ConceptsDocumento21 pagineModule 1 Auditing ConceptsDura LexNessuna valutazione finora

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Documento4 pagineAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- Auditing Theory - Q1 GAASDocumento7 pagineAuditing Theory - Q1 GAASKevin James Sedurifa Oledan100% (1)

- Audtheo Midterm ExamDocumento4 pagineAudtheo Midterm Examejay niel100% (1)

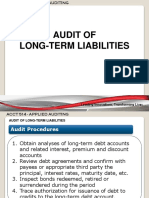

- Audit of Long-Term LiabilitiesDocumento43 pagineAudit of Long-Term LiabilitiesEva Dagus0% (1)

- Answer KeyDocumento6 pagineAnswer KeyClaide John OngNessuna valutazione finora

- Attestation Services 2Documento8 pagineAttestation Services 2sana olNessuna valutazione finora

- Problems On Audit of Shareholders EquityDocumento26 pagineProblems On Audit of Shareholders EquityNhel AlvaroNessuna valutazione finora

- Chapter 1 - Test Bank Auditing UICDocumento15 pagineChapter 1 - Test Bank Auditing UICLana Bustami100% (4)

- PSA 700, 705, 706, 710, 720 ExercisesDocumento11 paginePSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNessuna valutazione finora

- Audit Chapter 7 MCDocumento11 pagineAudit Chapter 7 MCNanon WiwatwongthornNessuna valutazione finora

- Chapter 8 Data Structures and CAATs For Data ExtractionDocumento4 pagineChapter 8 Data Structures and CAATs For Data ExtractionCamille Saranghae100% (1)

- Chapter 13 Audit of Long LiDocumento37 pagineChapter 13 Audit of Long LiKaren Balibalos100% (1)

- Unit Xii Copleting The Audit Audit Reports Other ServicesDocumento66 pagineUnit Xii Copleting The Audit Audit Reports Other ServicesDieter LudwigNessuna valutazione finora

- Auditing Quiz BeeDocumento9 pagineAuditing Quiz BeeWilsonNessuna valutazione finora

- AUDIT MCQs-Arens, Elder, Beasley - FinalDocumento13 pagineAUDIT MCQs-Arens, Elder, Beasley - FinalLeigh PilapilNessuna valutazione finora

- Auditing Theory Audit of The Inventory and Warehousing CycleDocumento15 pagineAuditing Theory Audit of The Inventory and Warehousing CycleMark Anthony Tibule100% (2)

- Department of Accountancy: Page - 1Documento14 pagineDepartment of Accountancy: Page - 1NoroNessuna valutazione finora

- The Accountancy Profession QuizDocumento4 pagineThe Accountancy Profession Quizsharon5lotinoNessuna valutazione finora

- Quiz For 3rd ExamDocumento2 pagineQuiz For 3rd ExamSantiago BuladacoNessuna valutazione finora

- Define Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudDocumento3 pagineDefine Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudSomething ChicNessuna valutazione finora

- Chapter 7 FinalDocumento11 pagineChapter 7 FinalMuhammad M BhattiNessuna valutazione finora

- Chapter 7Documento18 pagineChapter 7Rafael GarciaNessuna valutazione finora

- AT Quizzer 10 - Audit Evidence S2AY2122Documento7 pagineAT Quizzer 10 - Audit Evidence S2AY2122Ferdinand MangaoangNessuna valutazione finora

- At.03 Audit EvidenceDocumento3 pagineAt.03 Audit EvidenceAngelica Sanchez de VeraNessuna valutazione finora

- 46 Which of The Following Statements Is Not Correct o A 38118255Documento15 pagine46 Which of The Following Statements Is Not Correct o A 38118255frl antNessuna valutazione finora

- Audit Evidenc1Documento5 pagineAudit Evidenc1samuel debebeNessuna valutazione finora

- CHP 7 Auditing Flashcards QuizletDocumento1 paginaCHP 7 Auditing Flashcards QuizletCamilla TalagtagNessuna valutazione finora

- Q19 - Audit Procedures, Evidence and DocumentationDocumento7 pagineQ19 - Audit Procedures, Evidence and Documentationace zero0% (1)

- Which of The Following Statements Concerning Evidential Matter Is True?Documento10 pagineWhich of The Following Statements Concerning Evidential Matter Is True?JehannahBaratNessuna valutazione finora

- Aud Theo Quiz 2 Finals 2018 PrintDocumento6 pagineAud Theo Quiz 2 Finals 2018 Printneo14Nessuna valutazione finora

- Chapter-7 AuditingDocumento22 pagineChapter-7 AuditingAhmed SuleymanNessuna valutazione finora

- Chapter 26 FinalDocumento11 pagineChapter 26 FinalLenlen VersozaNessuna valutazione finora

- Chapter 23 FinalDocumento15 pagineChapter 23 FinalMichael Hu0% (1)

- Chapter 21 FinalDocumento16 pagineChapter 21 FinalMichael HuNessuna valutazione finora

- Chapter 24 FinalDocumento21 pagineChapter 24 FinalJessica GarciaNessuna valutazione finora

- Chapter 19Documento14 pagineChapter 19lopoNessuna valutazione finora

- Chapter 22 FinalDocumento15 pagineChapter 22 FinalMichael HuNessuna valutazione finora

- Acquisition and Payment CycleDocumento19 pagineAcquisition and Payment CycleE-kel Anico Jaurigue67% (3)

- Chapter 14 FinalDocumento17 pagineChapter 14 FinalMichael HuNessuna valutazione finora

- Chapter 12 FinalDocumento19 pagineChapter 12 FinalMichael Hu100% (1)

- Chapter 15 FinalDocumento20 pagineChapter 15 FinalMichael Hu100% (1)

- Chapter 11 FinalDocumento13 pagineChapter 11 FinalMichael Hu100% (4)

- Chapter 10 FinalDocumento19 pagineChapter 10 FinalMichael Hu0% (1)

- Chapter 4Documento23 pagineChapter 4Yenny TorroNessuna valutazione finora

- Chapter 8 FinalDocumento17 pagineChapter 8 FinalMichael Hu67% (9)

- Rules of SyllogismDocumento6 pagineRules of Syllogismassume5Nessuna valutazione finora

- Chapter 2 - Professinal Ethics Legal LiabilityDocumento29 pagineChapter 2 - Professinal Ethics Legal LiabilityThị Hải Yến TrầnNessuna valutazione finora

- I. Title: "REPAINTING: Streetlight Caution Signs"Documento5 pagineI. Title: "REPAINTING: Streetlight Caution Signs"Ziegfred AlmonteNessuna valutazione finora

- SOCI 223 Traditional Ghanaian Social Institutions: Session 1 - Overview of The CourseDocumento11 pagineSOCI 223 Traditional Ghanaian Social Institutions: Session 1 - Overview of The CourseMonicaNessuna valutazione finora

- Lesson Plan1 Business EthicsDocumento4 pagineLesson Plan1 Business EthicsMonina Villa100% (1)

- Factual DescriptionDocumento14 pagineFactual Descriptionaleena'Nessuna valutazione finora

- LRL Rudy Acuna On Neftali DeLeon - I Am Proud To Be The Grandson Son and Husband of Immigrants.Documento9 pagineLRL Rudy Acuna On Neftali DeLeon - I Am Proud To Be The Grandson Son and Husband of Immigrants.EditorNessuna valutazione finora

- Part 4 Basic ConsolidationDocumento3 paginePart 4 Basic Consolidationtαtmαn dє grєαtNessuna valutazione finora

- Schedule Risk AnalysisDocumento14 pagineSchedule Risk AnalysisPatricio Alejandro Vargas FuenzalidaNessuna valutazione finora

- Coaching Skills For Optimal PerformanceDocumento58 pagineCoaching Skills For Optimal PerformanceYodhia Antariksa100% (3)

- Review of Related LiteratureDocumento5 pagineReview of Related LiteratureRJ PareniaNessuna valutazione finora

- Final Draft Investment Proposal For ReviewDocumento7 pagineFinal Draft Investment Proposal For ReviewMerwinNessuna valutazione finora

- A Palace in TimeDocumento6 pagineA Palace in TimeSonkheNessuna valutazione finora

- Keir 1-2Documento3 pagineKeir 1-2Keir Joey Taleon CravajalNessuna valutazione finora

- Lara CroftDocumento58 pagineLara CroftMarinko Tikvicki67% (3)

- Assignment 1 TVM, Bonds StockDocumento2 pagineAssignment 1 TVM, Bonds StockMuhammad Ali SamarNessuna valutazione finora

- t10 2010 Jun QDocumento10 paginet10 2010 Jun QAjay TakiarNessuna valutazione finora

- Guoyin Shen, Ho-Kwang Mao and Russell J. Hemley - Laser-Heated Diamond Anvil Cell Technique: Double-Sided Heating With Multimode Nd:YAG LaserDocumento5 pagineGuoyin Shen, Ho-Kwang Mao and Russell J. Hemley - Laser-Heated Diamond Anvil Cell Technique: Double-Sided Heating With Multimode Nd:YAG LaserDeez34PNessuna valutazione finora

- Happiness Portrayal and Level of Self-Efficacy Among Public Elementary School Heads in A DivisionDocumento13 pagineHappiness Portrayal and Level of Self-Efficacy Among Public Elementary School Heads in A DivisionPsychology and Education: A Multidisciplinary JournalNessuna valutazione finora

- Corporation Essay ChecklistDocumento5 pagineCorporation Essay ChecklistCamille2221Nessuna valutazione finora

- Dwnload Full Western Civilization Beyond Boundaries 7th Edition Noble Solutions Manual PDFDocumento36 pagineDwnload Full Western Civilization Beyond Boundaries 7th Edition Noble Solutions Manual PDFgramendezwv100% (8)

- Cayman Islands National Youth Policy September 2000Documento111 pagineCayman Islands National Youth Policy September 2000Kyler GreenwayNessuna valutazione finora

- QUARTER 3, WEEK 9 ENGLISH Inkay - PeraltaDocumento43 pagineQUARTER 3, WEEK 9 ENGLISH Inkay - PeraltaPatrick EdrosoloNessuna valutazione finora

- 4 Transistor Miniature FM TransmitterDocumento2 pagine4 Transistor Miniature FM Transmitterrik206Nessuna valutazione finora

- Modern State and Contemporaray Global GovernanceDocumento34 pagineModern State and Contemporaray Global GovernancePhoebe BuffayNessuna valutazione finora

- Soal Ujian Tengah Semester Genap Sma Islam Diponegoro Surakarta TAHUN PELAJARAN 2020/2021Documento5 pagineSoal Ujian Tengah Semester Genap Sma Islam Diponegoro Surakarta TAHUN PELAJARAN 2020/2021Dian OctavianiNessuna valutazione finora

- Investigative Project Group 8Documento7 pagineInvestigative Project Group 8Riordan MoraldeNessuna valutazione finora

- House of Wisdom - Bayt Al Hikma (For Recording) - ArDocumento83 pagineHouse of Wisdom - Bayt Al Hikma (For Recording) - ArMaeda KNessuna valutazione finora

- Internship Report-2020Documento77 pagineInternship Report-2020Hossen ImamNessuna valutazione finora

- AUTONICSDocumento344 pagineAUTONICSjunaedi franceNessuna valutazione finora