Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bhadravathi

Caricato da

Bharath RajathTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bhadravathi

Caricato da

Bharath RajathCopyright:

Formati disponibili

CHAPTER 5 MARKETING MIX STRATEGIES ADOPTED BY HOSIERY PRODUCTS MANUFACTURERS

234

CHAPTER 5: MARKETING MIX STRATEGIES ADOPTED BY HOSIERY PRODUCTS MANUFACTURERS

5.0

MARKETING MIX

Marketing mix consist of four dimensions of marketing i.e. product, price, promotion and place/distribution. It is hall mark of marketing activities. Marketing mix is a deliberated effort on part of any firm or company to decide on their offerings and these offerings decide the fate of the firm in market place. The marketing mix has to be inline with the time, competition and up to the expectations of the customer. In this chapter we have tried to analyse the segmentation and marketing mix strategies of hosiery manufacturers. Question No. 15 to 23 will help us understand marketing mix strategies of hosiery manufacturing companies.

Question No. 15: Market segment chosen by hosiery manufacturers

Table 5.1 enlists the responses on the market segment chosen by hosiery manufacturers. 20% respondents make as per the specifications of the buyer and do not categorize themselves concentrating on any specific segment. These respondents make hosiery garments according to specific requirements of customers. 15% respondents categorize themselves gents wear clothing. 16% categorize themselves as teenage boys wear clothing company. 17% respondents make women wear clothing, 14% make teenage girls wear clothing, and 13% make kids wear clothing. About 4% dont fall into any of the

235

above category. These are one make special and fashion wear products like swimwear, lingerie etc.

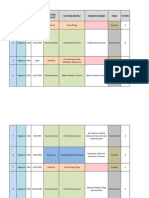

Table 5.1: Market segment being catered by hosiery manufacturers Frequency Percent As per customer specifications only 23 19.7 Gents wear clothing 18 15.4 Teenage boys wear clothing 19 16.2 Women wear clothing 20 17.1 Teenage girls wear clothing 17 14.5 Kids wear clothing 15 12.8 Any other 5 4.3 Total 117 100.0 Source: Authors own

Question No. 16: Sales channel as adopted by hosiery manufacturers.

Different sales channel used by hosiery manufacturers are listed in table 5.2. Some of the surprising facts came into picture when asked respondents to indicate their most widely used sales channel. 43% respondents use agents or buying agencies/houses or both to sell their products in the overseas market. The benefit of using these channels is the reduction in sales cost. These buying houses are professional organizations in tie up with overseas retailer or buyer to source the clothing for them. Bases on the design, quantity and other parameters, they chose the right vendor and negotiate on various terms and conditions like price, delivery etc. The reason for increasing role of buying agencies it to reduce the procurement cost. These buying agencies are professional and engaged only in single activity of procuring clothing for various overseas brands and keep close eye on . 236

production activities going on in a vendors factory. They have to ensure the timely shipment of goods. Therefore overseas buyers would be willing to outsource these professional services that would reduce their follow up cost, timely shipment and far better price.

Only 20% directly deal with buyers to sell their products. Dealing directly with the overseas buyer is costly affair. It is helpful if the hosiery manufacturing company is very innovative and keeps on producing new designs very frequently. Overseas buyers ask for variety and samples to display on their shelf to check the response. Most of these activities do not generate any revenue for hosiery manufacturers till the product get acceptance in the market. That is reason why many prefer to deal through buying agencies.

About 33% adopt both channels of sales i.e. directly deal with overseas buyer and through buying agencies and around 3% are which use more than two channels of sales.

Table 5.2: Most widely used sales channel by hosiery manufacturers Frequency Percent Directly to overseas buyer 24 20.5 Through agent/s, buying agencies 50 42.7 Combination of direct sale and through agent 39 33.3 Combination of two or more channels 4 3.4 Total 117 100.0 Source: Authors own

237

Question No. 17: Product promotion through branding

When asked respondent on the product branding, the responses are given in table 5.3. Only 2 respondents out of 117 which is merely 2% of respondent size confirmed that they sell their products as branded one in the overseas market, while all others sell it as commodity one and only producer factory.

On further discussion it was realized that most of the hosiery units have brands some of them are even registered brands, but for domestic market. In overseas market these are not sold as their brands and they work for overseas brands and put label supplied by overseas buyer for particular garment, on the garment.

Table 5.3: Companies producing branded products Frequency Percent No 115 98.3 Yes 2 1.7 Total 117 100.0 Source: Authors own

Question No. 18: Pricing policy/ies adopted.

When asked respondents on the basis of their pricing policy, the responses are listed in table 5.4. 20% respondents feel that the prices they get from overseas buyers are more or less as prevailing in the international markets i.e. the price of garment quoted would be somewhere close to the price as quoted by Chinese or Bangladeshi hosiery manufacturer.

238

These respondents would be dealing with international buyers sourcing their requirements from various international markets and they are in capacity to negotiate the price as prevailing in other countries. Or these products could be commodity items which are sold in large quantities and small price change may lead to change in source.

22% respondents negotiate the prices whenever they finalize a new order. These hosiery manufacturers prefer to incorporate the changes in price of raw material in price offered. The margin in such cases is very less and there is no scope of profit if there is any increase in price of raw material. Further discussion with hosiery manufacturers can be elaborated with small example a hosiery manufacturer working on 5% profit over and above Direct and Variable (DnV) cost of product plus the benefit of duty Draw Back. In case the price of cotton, yarn or dyes goes up, the input cost goes up by 3%, the manufacturer will incorporate the necessary change in the price to get the margin of 5% over and above the DnV cost as earlier plus duty draw back as earlier. This type of pricing is popular in mid segment products where competition is very fierce and margins are bare minimum.

9% prefer to enter long term price agreement for complete season or even multiple seasons. These are one who mainly deals with big brands and products are also hi-value addition. Mostly international brands ask for price of a particular design of garment along with tentative quantity which is normally very huge. The suppliers do thorough analysis of product, its cost, economy of scale, quality parameters, testing cost etc and quote the price for multiple or single season. Also, it is inevitable to mention here

239

that large brands normally and ideally deal with few but a large producer, therefore competition is also not very high and price undercutting is comparatively less.

Approximately 5% respondents keep transparency on prices with buyers. This is possible in two cases: a) when the association with buyer is very old, b) when the overseas buyer is very large brand. When the association is very old, there is sense of understanding and buyer is willing to provide reasonable margins. In such case, the price is quoted with details of other input cost like fabric cost, cost of TRIMS and accessories. If the buyer is convinced with the cost breakup, he would agree the price. In case of large buyers, this is one of their corporate policies to avoid undercutting the prices and they encourage healthy competition. They do not want their suppliers to bear losses on product sale and then squeeze the salaries or other hygiene standards of workplace to cut the expenses. They ask for price in RMC (Raw Material Cost) sheet which include the cost of fabric. Trims, labor and other input cost etc and then profit the supplier is charging over and above it. They make sure that no one is in loss. This is a good practice to increase the healthy competition instead of cutting prices.

Around 23% are opportunist which means based on the order booking condition they quote the prices. If their capacities are booked and orders in hand are enough to run the factory for next few months, they ask for higher price and in case they need orders to fill capacities, they reduce the price and fill the capacity first. This is one of the very common practices.

240

20% respondents indicate that they use multiple tactics on pricing. It depends upon buyer to buyer when it comes to pricing tactics. Dealing with buying agencies is different from dealing directly with buyer and also the type of test parameters buyer is asking for in a particular garment also affect the pricing technique. Therefore they use multiple tactics.

Further discussion on pricing concludes that pricing is not a static phenomenon and almost all respondents use multiple tactics. The responses given in table 5.4 are most commonly in use with their present set of customers, while all other options are always open to them. They pricing tactics is based on various elements like status of buyer, type of product, skills, capacity, order booking condition, raw material pricing etc.

Table 5.4: Pricing practices prevailing among the hosiery producers Frequency Percent More or less international market price driven 23 19.7 Negotiation with buyer every time new order is booked 26 22.2 Price fixation on long term basis eg. for one or more seasons 11 9.4 Transparency on cost and margin with buyer 6 5.1 Opportunist 27 23.1 Any other or combination of above 24 20.5 Total 117 100.0 Source: Authors own

241

Question No. 19: Channels of promotion

When asked respondents on the channel of promotion they most commonly use to promote their product in the international markets, the responses are listed in table 5.5. The question is in the form of binary questions having answer in yes or no against each channel of promotion.

As discussed in Chapter 1, Apparel Export Promotion Council used to be nodal agency for quota allocation and administration for exports of hosiery products from India. It promotes Indian hosiery export through various ways. AEPC organizes two trade fairs in India every year called India International Garment Fair. Buyers and suppliers from around the world participate in these trade fairs. Most of the participants from India and they are exposed to international buyers. The cost of participating in Indian international trade fairs is comparatively less and also carriage cost of samples is comparatively less when compared to international fairs and custom clearing cost is nil. So it is far easier for Indian exporters to participate in Indian international fairs than overseas fairs. Other schemes to promote Indian hosiery products in overseas markets are Marketing Development Assistance (MDA) and Market International Assistance (MAI) schemes. These schemes are discussed in chapter 1 in detail.

56% respondents participate in the various schemes of AEPC. Further discussions elaborate that MDA scheme used to be very useful earlier but due to procedural hassles it is not very popular. Now MIA scheme is introduced which is modified form of MDA and

242

it is getting very popular these days. Also, if any new buyer approaches AEPC office or website with any query, they forward it their regional offices which in turn float it to various suppliers to respond. This practice is not very popular these days.

79% respondents participate in international trade fairs regularly with or without the any assistance from AEPC. Every year few large International trade fairs are organized around the world like in Paris and Hong Kong. Buyers and sellers from around the world participate and come in contact with each others.

89% respondents promote their products through one to one meeting with overseas buyers and exhibit product samples from their latest developments and most successful designs. The display is carried out with detailed presentation which exhibits their capabilities, capacities and skill level company acquires.

86% keep sending their catalogues to various buyers and buying agencies updating their capacities and skill levels. 86% respondents approach buying agencies and agents to promote their products in the international markets.

There are no respondents exposed to channels of mass communications like TV commercials, news papers, outdoor advertisements at international airports and sponsoring international events. Exceptionally there is one respondent opting for advertisements in international news paper.

243

Table 5.5: Promotional channel being used by hosiery manufacturers Promotion Channel Yes No Export Promotion cells/councils 66 51 (56.4%) (43.6%) International Trade fairs 92 25 (78.6%) (21.4%) One to One meeting with overseas customers 104 13 (88.9%) (11.1%) Catalogues 101 16 (86.3%) (13.7%) Through Agents/buying houses 99 18 (84.62%) (15.4%) TV commercials in foreign medias 117 0 (100%) International News papers/Magazines etc 1 116 (1%) (99%) Outdoor Ads like at International Airports etc. 117 0 (100%) Sponsoring International Events/games 117 0 (100%) Source: Authors own

Question No. 20: Annual advertising budget allocated for product promotion

When asked respondents on their annual advertising budget, the responses are listed in table 5.6. While collecting data, responses were noted in the form of approximate promotion budget and then converted into continuous scale.

41% respondents have marginal promotional budget which is below 1.5 lacs. 26% respondents have promotion budget of below 3 lacs but more than 1.5 lacs. Similarly with increasing budget the responses are decreasing and at the top more than 6 lacs annual budget, only 4 respondents are there. It is evident that more of respondents are towards lower side of budget.

244

Table 5.6: Advertising budget of hosiery manufacturers Frequency Percent <1.5 lacs 48 41.0 >1.5 but < 3 lacs 31 26.5 > 3 but < 4.5 lacs 20 17.1 > 4.5 but < 6 lacs 14 12.0 > 6 lacs but < 7.5 lacs 4 3.4 Total 117 100.0 Source: Authors own

Question No. 21: Product promotion through personal visits to buyers market

Personal contacts and visits is one of the most effective modes of promotion in international business. When asked respondents on frequency of their foreign visits to meet overseas buyers, the responses are listed in table 5.7. 26% respondents do not visit abroad to meet their buyers. These are one who are not having large capacities and would prefer to work only on contractual basis.

48% respondents visit abroad once a year and 16% visit twice a year to meet their customers. However 9% visit more than twice a year to meet their overseas customers.

When we tried to establish the correlation between promotion budget and abroad visits, the correlation was 0.682, which is significant. It is obvious that a significant portion of promotion budget is spent on overseas visit rather than on other promotional activities.

245

Table 5.7: frequency of visit to overseas markets to meet the customers Frequency Percent Don't visit 31 26.5 Once a year 56 47.9 twice a year 19 16.2 More than twice a year 11 9.4 Total 117 100.0 Source: Authors own

Question No. 22: International certification on health and safety standards

Question on compliance on international and safety standard is in line with agreement in WTO called agreement on Sanitation and Photosanitation. When asked respondents on compliance with any international certification; the responses are as indicated in table 5.8. Obtaining international certification is very important these days especially if one has to export its textile products to Europe. European has sacrificed their textile industry because it is very labor intensive and second is creates pollution. In Europe and US, pollution norms are very stringent and also labor cost is very high. So they have sacrificed their textile and clothing industry but created such tough standards that prevent the use of harmful chemicals like formaldehyde etc which is harmful to skin, child labor etc. This way they have been able bring down the cost of garments being sold in their country and also can maintain the minimum hygiene standard as specified in their country. There are various other certificates like blue flower etc which are not very popular at the moment. But the most popular are discussed here.

246

It was one the most surprising fact realized in Ludhiana hosiery industry that the compliance with international certification is almost absent. Most commonly used four international certifications are listed below. Fair trade is one the most common used in international textile market especially where cotton plays important role. No hosiery manufacture has availed this certification. ISO 14000 is not new and very common in use especially wherever there is pollution. Even here no hosiery producer is having this certification. REACH is getting popularity these days. This is European standard where in supplier needs to comply with quality products without the use of any has prohibited chemicals. Only the international certification that is getting acceptance among Ludhiana hosiery producers is Social Audit (SA8000). 15% respondents are either having it or in process of having it. This certification ensures the compliance with minimum social norms for workers.

Table 5.8: International certification being obtained by hosiery producers International certification Number of respondents Number of respondents having it not having it Fair trade 0 117 (0%) (100%) ISO 14000 0 117 (0%) (100%) REACH 0 117 (0%) (100%) Social Audit 18 99 (15.40%) (84.6%) Source: Authors own

Under the agreement of Sanitation and Photosanitation in WTO, the member countries need to set health and safety standards on various products on international trade. Developed nations have all these standards at the place, but in India we do not have

247

such standards in parallel to their standards. So we have to follow their standards which are not easy to implement and maintain.

Question No. 23: Future expectations on the prices in international market in near future.

Respondents view on international price of hosiery products in next 2-3 years are listed in table 5.9. 48% respondents feel that in next 2-3 years time the prices of hosiery items will increase in international market. The reason as explained by them is that the margins are all time low at this time. Cotton prices are high but the garment prices have not increased yet causing drastic shrink in their profitability. Below this profitability level no one would like to work, rather they would either churn their product portfolio or switch over to high value products or would prefer to sell in domestic market instead of exports. According to them, the cost of production has also increased in China and other garment producing Asian nations, which is likely to pushup the price in near future. The present scenario is due to global melt down causing shrink in demand from US and EU markers which is on the path of recovery now.

21% respondents feel that the prices would further slide down causing. The reason as explained by them is the increasing competition from domestic and international market. Also, the bargain power of buyers plays an important role. The volumes are sometimes so high that no one would like to leave it and in anticipation of profits in future orders they accept it.

248

31% respondents are of opinion that the average prices are likely to remain same. The prices are already low and further reduction in prices may not be acceptable. In few of the items which are high value addition items, price reduction is possible to some extent but they have to look for new products which are high value and high margins so that they could maintain their profitability level and average price realization could be maintained.

Table 5.9: Expectation of hosiery products prices in 2-3 years from now Frequency Percent Higher 56 47.9 Lower 25 21.4 Same as today 36 30.8 Total 117 100.0 Source: Authors own

5.1

CONCLUSION

Most of the hosiery manufacturing units have adopted particular product lines and try to specialize in few product ranges so that they could develop competitiveness in those product lines. Buying houses and agents are the main channel of sales rather than direct selling. Branding is virtually absent. Multiple pricing policies are used. Promotional strategies are age old and main promotional channel is through buying agencies. There is no effort to promote the company as a reliable supplier. This is not a healthy practice in long run this is not taking industry anywhere. There is no standardization or certification parallel to international certification in health and safety standards. This is why overseas buyers are imposing their own standards and Indian hosiery units are finding it hard to implement.

249

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Simple and Scalable Response Prediction For Display AdvertisingDocumento34 pagineSimple and Scalable Response Prediction For Display AdvertisingCorey SteinNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Brand Management Group 10 Dell ReportDocumento24 pagineBrand Management Group 10 Dell Reportkartikay GulaniNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Mary Meeker's 2017 Internet Trends ReportDocumento355 pagineMary Meeker's 2017 Internet Trends ReportJosh Constine99% (76)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Promotional StrategiesDocumento1 paginaPromotional StrategieskinikinayyNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Marketing PlanDocumento11 pagineMarketing PlanYanie Taha50% (2)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Marketing PlanDocumento15 pagineMarketing PlanSOMBILON JOMARNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Raftaar Bikes Integrated Marketing Comm. Plan: Presented By:-Amit AryaDocumento23 pagineRaftaar Bikes Integrated Marketing Comm. Plan: Presented By:-Amit AryaAmit AryaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Shampoo Market ImcDocumento37 pagineThe Shampoo Market Imcjeetan198467% (3)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Class Notes Book and MagazineDocumento13 pagineClass Notes Book and MagazineMeghana JoshiNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- JHGUGJUGDocumento36 pagineJHGUGJUGRishikesanNessuna valutazione finora

- Report On UfoneDocumento24 pagineReport On UfoneJalal Ud Din95% (22)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- FLATPEBBLEDocumento9 pagineFLATPEBBLERasika Dhiman100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Google Ads Display Certification Exam AnswersDocumento44 pagineGoogle Ads Display Certification Exam AnswersE KaynaklarNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Ultimate Guide To Rental Property MarketingDocumento1 paginaThe Ultimate Guide To Rental Property MarketingColinNessuna valutazione finora

- HE Byssey: Defending The BankDocumento8 pagineHE Byssey: Defending The BankPaul BucciNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Study of Marketing of The Dairy Products at Mother Dairy (Firoz)Documento92 pagineStudy of Marketing of The Dairy Products at Mother Dairy (Firoz)Nilabjo Kanti PaulNessuna valutazione finora

- Humaniora: A Cultural Dimension of American-Indonesian "Fast Food Diplomacy"Documento9 pagineHumaniora: A Cultural Dimension of American-Indonesian "Fast Food Diplomacy"Vale Espinel BurgosNessuna valutazione finora

- Binangonan Catholic College Binangonan, Rizal SY 2020-2022 Senior High School Department ABM-RDL2Documento8 pagineBinangonan Catholic College Binangonan, Rizal SY 2020-2022 Senior High School Department ABM-RDL2Rowee CerdaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- SWOT Matrix of DoveDocumento4 pagineSWOT Matrix of DoveJoey WongNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Cadbury ArticleDocumento30 pagineCadbury ArticleBoaz EapenNessuna valutazione finora

- Arjun Cement-Bba-Mba Project ReportDocumento48 pagineArjun Cement-Bba-Mba Project ReportpRiNcE DuDhAtRaNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Haldemann-Julius - The First Hundred MillionDocumento347 pagineHaldemann-Julius - The First Hundred Millionblackharmonica100% (5)

- Wall Street TranscriptDocumento11 pagineWall Street Transcriptlirin00Nessuna valutazione finora

- RiddeelllllDocumento18 pagineRiddeelllllapi-352141939Nessuna valutazione finora

- 1 DecemberDocumento3 pagine1 DecemberAMH_DocsNessuna valutazione finora

- Role of Advertising in Marketing Strategy ofDocumento19 pagineRole of Advertising in Marketing Strategy ofmegh9Nessuna valutazione finora

- Impact BBDO Creative BriefDocumento4 pagineImpact BBDO Creative BriefaejhaeyNessuna valutazione finora

- Brand Wars Consumer Brand Engagement Beyond Client Agency Fights - CleanDocumento15 pagineBrand Wars Consumer Brand Engagement Beyond Client Agency Fights - Cleanyang yangNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- AG Multistate Lawsuit and Settlement Dataset (Updated To 2013)Documento1.330 pagineAG Multistate Lawsuit and Settlement Dataset (Updated To 2013)HoyapaulNessuna valutazione finora

- Marketing Mix Magazine Nov Dec 2007Documento60 pagineMarketing Mix Magazine Nov Dec 2007marketing mix magazineNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)