Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

What Will A Trustee's Deed Tell?

Caricato da

Mortgage Compliance InvestigatorsTitolo originale

Copyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

What Will A Trustee's Deed Tell?

Caricato da

Mortgage Compliance InvestigatorsCopyright:

WHAT WILL A TRUSTEES DEED TELL?

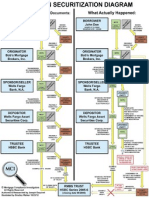

Most public records keep the chain of index in order of Grantor to Grantee as to the property affected. When the tangible obligation and the intangible obligation are mixed, confusion is imminent. In fact, there are mixed tangibles and intangibles, where the words sound and are spelt the same, but require a different application as to law. Most individuals see the financial crisis as being an issue between homeowners and banks. This is far from the truth. Even individuals that rent with investments placed in intangible trust pools stand to lose a mediocre amount or all of their retirement investment. Such loss is not limited to just renters, but also any person, place, or thing that involves investing in the intangible market. Yes, this includes lawmakers, public officials, police and firemen retirement funds, etc. Back to Grantor Grantee Indexing In this writing the tangible obligor, maker of the promissory note, issuer of the promissory note, and Grantor of an interest in real property identified in a security instrument, Deed of Trust, Mortgage, etc will be a homeowner for lay person comprehension. The homeowner issues a promissory note as being the maker to an identified payee, the mortgage brokers lender. For the lender to be better protected that funds will be repaid, the mortgage broker lender required the homeowner to sign a security instrument as an alternate means to collect a debt, by granting the mortgage broker lender an interest in real property. To comply with most states laws regarding contracts involving interest in land the security instrument was recorded in local county records. Similarly, any assignment of an interest in land made by the mortgage brokers lender would also need to be in writing and filed of record in the county where the property resides. So far we have the homeowner signing a promissory note, but for this promissory note to be a Negotiable Instrument the promissory note has to be in compliance with Uniform Commercial Code Article 3 or each states adopted equivalence. The homeowner has also sign as Grantor a security interest in the real property to mortgage brokers lender being the Grantee. In the old days where the promissory note and the security instrument were written within one document, the required filing of the security instrument resulted in the promissory note also being file. This writer is unaware of any legal requirement that a promissory note needs to be filed record. However, any conveyance or assignment of an interest in real property is to be filed in the county where the real property resides. Additionally, any conveyance or assignment of an interest in personal property that requires a UCC filing statement to perfect interests is to be filed with the appropriate state agency. Filing for perfection and the filing for perfection position are not one in the same and there are consequences for not filing. To explain part of the deception, we will use filings from Williamson County in Texas, although there are likely to be similar instances in each county in the country. We will start by looking at the Williamson County instrument #200000775, Substitute Trustees Deed. The face of this instrument reveals a claim that Atlantic Mortgage & Investment Corporation purchased the real property. The instrument also notes that Atlantic Mortgage &

Investment Corporation was the beneficiary by assignment of the Deed of Trust that began with Charter Mortgage Company. In this Deed of Trust identified as instrument #9548934 we find written in Covenant #20 that the Note or a partial interest in the Note (together with this Security Instrument) maybe sold one or more times. Where a case law as far back as in the United States Supreme Courts opinion of Carpenter versus Longam, Charter Mortgage Company could sell the Note and the Security Instrument would have traveled with the Note instilling that the Note was a secured instrument. However, where state laws do not apply to the Note there is application to the Security Instrument as to require recordation in regards for the Security Instrument to remain perfected to the Note, unlike the Note the Security Instrument in non-compliance with law would become a nullity. Upon such nullity, in the case of Vacek, the subsequent beneficiary of the Note would have been limited to actions dependent upon the Note being unsecured by a Security Instrument. Wherein if an interest in the Note was sold, value would exist in the intangible world and intangible laws would apply. Here enters a point of serious word crafting confusion. Not only are the county land records being deprived of fees required, the states offices for filing of UCC financing statements are being deprived of fees due if an intangible instrument is to be perfected. Uniform Commercial Code prescribes the method and means for assigning perfected rights to a subsequent purchaser of an intangible obligation but such rights first must be perfected which all states require a fee for filing. Not only will the banks bleed all the tangible value from a homeowner, the banks will bleed all tangible value from each and every state, county investor, or retiree and the United States government appears to be aiding and abetting this theft process by funneling tangible taxpayer funds to the banks for protecting intangible wealth which is 100 fold in value greater than tangible value. Addressing Atlantic Mortgage & Investment Company we find a New York Times article, noting that Atlantic Mortgage & Investment Corporation was a servicing company purchased by ABN AMRO. Now, back to the Williamson County documents filed of record. Here we must caution the use of an abstract offered up with an attempt to introduce as evidence should be deemed inadmissible as being hearsay under Federal Rules of Evidence 802/803. However, there is nothing wrong with obtaining an abstract to guide for the purchase of Certified Copies from public records, which is admissible as evidence. What appears to be missing in the Vacek case is there was a negotiation of the tangible obligation is a chain of assignments assigning the Security Instrument to each subsequent purchaser of the tangible Note. When we look at the filings for Vacek in Williamson County public land records, we notice that the intangible obligation was negotiated and thus filing in Williamson County of these instruments was not required. Could this be the banks mentality for stating that tangible assignments may be filed? In accordance to law, the filing of notice in the wrong record office is equal to that of no notice being recorded. Back to Grantor, in the tangible world there is only one Grantor to a Security Instrument, in the intangible world there is also only one Grantor of the intangible security (the payment stream). As the law is written, to best serve the lack of proper indexing, the Assignors of an intangible obligation routinely file of county land records they are the Grantor of an interest in real property. As partially noted above, filing by an intangible assignor in public land records is not the proper

place for filing a UCC financing statement, therefore such filing in accordance to law should be that of a nullity. Lets look back to instrument #2000004103, appointment of Substitute Trustee in Williamson County public land records. The signatory, Jim M. Satterwhite Assistant Vice President, would come into question as to what the Substitute Trustee was to sell. The Substitute Trustee could not sell the real property of Vaceks, for there is a lack of continuous granting of real property rights filed with Williamson County public land records for this property. By elimination, the only thing that the signatory could proffer up is an assignment of intangible rights to sell the security, securing the intangible obligation, but this cannot be done because there was a failure to perfect the state record. However, a tangible security instrument is entirely different breed from that of an intangible security interest. As public records reveal, this financial fiasco is not a recent event of haphazard movements but of a very well-planned strategy. 2013 Mortgage Compliance Investigators Authored by Joseph Esquivel and Damion Emholtz

Potrebbero piacerti anche

- Poverty: Its Illegal Causes and Legal Cure: Lysander SpoonerDa EverandPoverty: Its Illegal Causes and Legal Cure: Lysander SpoonerNessuna valutazione finora

- Stop! Illegal Predatory Lending: A Self-Help GuideDa EverandStop! Illegal Predatory Lending: A Self-Help GuideNessuna valutazione finora

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.Da EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.Nessuna valutazione finora

- The Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5Da EverandThe Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5Nessuna valutazione finora

- Code Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphDa EverandCode Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphValutazione: 3.5 su 5 stelle3.5/5 (2)

- Explanation of Securitization By: Joe Esquivel (MCI)Documento3 pagineExplanation of Securitization By: Joe Esquivel (MCI)Billy Bowles0% (1)

- Beware Note Article by - Bill-ButlerDocumento7 pagineBeware Note Article by - Bill-ButlerWonderland ExplorerNessuna valutazione finora

- MSFraud Forum PageDocumento23 pagineMSFraud Forum PageJohn Reed100% (1)

- Get Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionDa EverandGet Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionValutazione: 5 su 5 stelle5/5 (1)

- Securities and Exchange Commission (SEC) - Sec1661Documento4 pagineSecurities and Exchange Commission (SEC) - Sec1661highfinanceNessuna valutazione finora

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)Da EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)Nessuna valutazione finora

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsDa EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNessuna valutazione finora

- Lawfully Yours: The Realm of Business, Government and LawDa EverandLawfully Yours: The Realm of Business, Government and LawNessuna valutazione finora

- Traffic Tickets. Don't Get Mad. Get Them Dismissed. Stories From The Streets.Da EverandTraffic Tickets. Don't Get Mad. Get Them Dismissed. Stories From The Streets.Valutazione: 4 su 5 stelle4/5 (1)

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActDa EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActNessuna valutazione finora

- Custom and PracticeDocumento5 pagineCustom and PracticeRichard Franklin KesslerNessuna valutazione finora

- The Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeDa EverandThe Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeValutazione: 4.5 su 5 stelle4.5/5 (9)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionDa EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNessuna valutazione finora

- Notice of Default Must Have Signature Of.....Documento3 pagineNotice of Default Must Have Signature Of.....83jjmackNessuna valutazione finora

- An Inexplicable Deception: A State Corruption of JusticeDa EverandAn Inexplicable Deception: A State Corruption of JusticeNessuna valutazione finora

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetDa EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNessuna valutazione finora

- FORECLOSE ON THE FRAUDSTERS - PUT BANK OF AMERICA IN RECEIVERSHIP - White Collar Expert Calls For FDIC To Take Control of BofADocumento8 pagineFORECLOSE ON THE FRAUDSTERS - PUT BANK OF AMERICA IN RECEIVERSHIP - White Collar Expert Calls For FDIC To Take Control of BofA83jjmack100% (2)

- Mortgage Fraud PresentationDocumento5 pagineMortgage Fraud Presentation92589258Nessuna valutazione finora

- Constitution of the State of Minnesota — 1876 VersionDa EverandConstitution of the State of Minnesota — 1876 VersionNessuna valutazione finora

- Petition for Certiorari Denied Without Opinion: Patent Case 96-1178Da EverandPetition for Certiorari Denied Without Opinion: Patent Case 96-1178Nessuna valutazione finora

- I. Amendment Modification Waiver: Unsecured Promissory Note (Installment Payments)Documento3 pagineI. Amendment Modification Waiver: Unsecured Promissory Note (Installment Payments)Emman Dumayas100% (1)

- Courts and Procedure in England and in New JerseyDa EverandCourts and Procedure in England and in New JerseyNessuna valutazione finora

- The Declaration of Independence: A Play for Many ReadersDa EverandThe Declaration of Independence: A Play for Many ReadersNessuna valutazione finora

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151Da EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151Nessuna valutazione finora

- The Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationDa EverandThe Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationValutazione: 5 su 5 stelle5/5 (1)

- Business Was Established After The Disaster: Pdcrecons@sba - GovDocumento2 pagineBusiness Was Established After The Disaster: Pdcrecons@sba - GovVince KimmetNessuna valutazione finora

- What Everyone Ought to Know About: Debt Relief Today! Some Plain Talk About Today's Economy That no one Talks About!Da EverandWhat Everyone Ought to Know About: Debt Relief Today! Some Plain Talk About Today's Economy That no one Talks About!Nessuna valutazione finora

- That Man from Nebraska - Confronting the ConstitutionDa EverandThat Man from Nebraska - Confronting the ConstitutionNessuna valutazione finora

- The administration and you – A handbook: Principles of administrative law concerning relations between individuals and public authoritiesDa EverandThe administration and you – A handbook: Principles of administrative law concerning relations between individuals and public authoritiesNessuna valutazione finora

- Milstead No AuthorityDocumento5 pagineMilstead No AuthorityArgusJHultNessuna valutazione finora

- FRAUDULENT Foreclosure Action BY F.D.I.C. SEIZED BANKUNITED, FSBDocumento11 pagineFRAUDULENT Foreclosure Action BY F.D.I.C. SEIZED BANKUNITED, FSBAlbertelli_Law100% (1)

- Chas Beaman v. Mountain America Federal Credit UnionDocumento16 pagineChas Beaman v. Mountain America Federal Credit UnionAnonymous WCaY6r100% (1)

- Commentary On The Security AgreementDocumento1 paginaCommentary On The Security AgreementJason HenryNessuna valutazione finora

- Mortgage Compliance Investigators - Mortgage Fraud InvestigationDocumento16 pagineMortgage Compliance Investigators - Mortgage Fraud InvestigationBilly Bowles100% (3)

- Attorneys' "Unbundled Service Pre - Litigation Package"Documento3 pagineAttorneys' "Unbundled Service Pre - Litigation Package"Damion EmholtzNessuna valutazione finora

- Mortgage Compliance Investigators - Chain of Title AnalysisDocumento31 pagineMortgage Compliance Investigators - Chain of Title AnalysisBilly BowlesNessuna valutazione finora

- Alvie's "Pig in A Poke"Documento9 pagineAlvie's "Pig in A Poke"Billy BowlesNessuna valutazione finora

- Explanation of Securitization By: Joe Esquivel (MCI)Documento3 pagineExplanation of Securitization By: Joe Esquivel (MCI)Billy Bowles0% (1)

- Mortgage Compliance Investigators - Loan Disposition Analysis (LDA)Documento15 pagineMortgage Compliance Investigators - Loan Disposition Analysis (LDA)Billy BowlesNessuna valutazione finora

- Mortgage Compliance Investigators - Level 3 Securitization AuditDocumento35 pagineMortgage Compliance Investigators - Level 3 Securitization AuditBilly Bowles100% (1)

- RMBS Loan Securitization Flow ChartDocumento1 paginaRMBS Loan Securitization Flow ChartBilly BowlesNessuna valutazione finora

- FANNIE MAE/FREDDIE MAC Loan Securitization Flow ChartDocumento1 paginaFANNIE MAE/FREDDIE MAC Loan Securitization Flow ChartBilly Bowles100% (1)