Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SFM Topics Module 5

Caricato da

Soeb ShekhCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SFM Topics Module 5

Caricato da

Soeb ShekhCopyright:

Formati disponibili

SFM Topics for VIVA - FIN-A - Batch 2011-13 Name of The Topic Finance and Related Disciplines (like

Economics, Accounting)- Interdependence Scope of Financial Management Agency Problem Organisation of Finance funtion Business Set Up EPS v/s Wealth Maximization Budget - Definitoin and Purpose Matster Budget Static v/s Flexible Budget Capital Budgeting - Definition and Importance for Business Importance of Relevant Cash Flows Components of Irrelevant Cash Flows Impotance of NPV as Evaluation Criteria IRR as evaluation criteria Profitability Index (PI) as evaluation criteria for Capital Budgeting Payback method - Advantages and Disadvantages Accounting / Average rate of Return as evaluation criteria for Capital Budgeting Size Disparity issue in Capital Budgeting Time Disparity Problem in Capital Budgeting Unequal Project Lives - Problem with NPV and IRR Evaluation and it's Solution Inflation and Capital budgeting Description and Measurement of Risk Risk Adjusted Discout Rate (RAD) approach in Risk Analysis Decision Tree Analysis Use of Simulation Analysis (Monte Carlo Simulation) in Risk Assesment of Project Operating Leverage - Meaning and Importance Financial Leverage - Meaning and Importance Combined Leverage Capital Structure Theory - Net income Approach Capital Structure Theory - Net Operating Income approach Modigliani-Miller (MM) Approach Profitability and Liquidity aspect while desiging Capital Structure

Group No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

38 76

SFM Topics for VIVA - FIN-B - Batch 2011-13 Name of the Topic Control aspect consideration while deciding Capital Structure Leverage ratio of Other firms and Nature of Industry - Imporatnce for Capital Structure Consultation with Investment Bankers and Lenders and Timing of Issue - Effect on Capital Structure Tax planning effect of Capital Structure Capital Structure Practices in India Capital Budgeting practices in India Risk Analysis Practices in Corporate India Lease Financing Irrelevance of Dividends regarding Valuation of Company Relevance of Dividends regarding Valuation of Company Impact of Investor expectation on Dividend Policy of a Corporate Utilization of Stock Splits and Bonus issue in lieu of Dividends Comparison of Constant Dividend per Share (DPS) v/s Constant Dividend Payout Ratio Impact of Capital Market consideration and Inflation on Dividend Policy Owner's Consideration while deciding dividend policy Dividend Policy being follwed by Indian Corporates in Practice Book Value based approach for Valuation Asset Based Approach to Valuation Market Based Approach to valuation Earnings based approach to valuation Market Value added approach to Valuation (applicable only to Listed Companies) Economic Value Added Fair Value method for Valuation of Business Terminal value method for Capital budgeting Modified IRR method for Capital Budgeting Exhchange ratio calculation in Mergers based on EPS and Market Price Major Tax aspects related Amalgamation / Mergers Major Tax aspects related to Demerger Legal aspects regarding declaration of Dividends Case of Merger of Reliance Petrochemicals with Reliance Industries Ltd. Industrial Sickness - Meaning, causes and suggested remedies Hybrid Financing - Convertible Debentures, Preference Share Capital Securitization - Meaning and advantages Methods of Hedging the Foreign exchange exposure by corporates Forms of External Commercial Borrowings (ECB's) and it's utilization by Indian corporates Venture Capital Financing in India Factors considered by Lending institution for granting Debt Finance in India Major requirements (stipulated by SEBI) for a Corporate raising money from Public Issue

Group No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38

Potrebbero piacerti anche

- Why Should I Take This Certification?: How Will I Benefit From Corporate Finance Certification?Documento9 pagineWhy Should I Take This Certification?: How Will I Benefit From Corporate Finance Certification?Heeral TNessuna valutazione finora

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Da EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Nessuna valutazione finora

- The Portable MBA in Finance and AccountingDa EverandThe Portable MBA in Finance and AccountingValutazione: 4 su 5 stelle4/5 (19)

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesDa EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNessuna valutazione finora

- Financial Modelling Corporate PDFDocumento64 pagineFinancial Modelling Corporate PDFLinus Vallman Johansson100% (3)

- 1ratio Analysis of Automobile Sector For InvestmentDocumento29 pagine1ratio Analysis of Automobile Sector For Investmentpranab_nandaNessuna valutazione finora

- Financial Statement Analysis: Business Strategy & Competitive AdvantageDa EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageValutazione: 5 su 5 stelle5/5 (1)

- SSRN Id1716209 PDFDocumento36 pagineSSRN Id1716209 PDFZul LapuduNessuna valutazione finora

- HDFC ValuationDocumento23 pagineHDFC ValuationUdit UpretiNessuna valutazione finora

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Finance Cheat Sheet - Formulas and Concepts - RM NISPEROSDocumento27 pagineFinance Cheat Sheet - Formulas and Concepts - RM NISPEROSCHANDAN C KAMATHNessuna valutazione finora

- Finance Projects, Thesis, Dissertation, Financial Management Topics or IdeasDocumento4 pagineFinance Projects, Thesis, Dissertation, Financial Management Topics or IdeasArcot Ellender Santhoshi Priya75% (4)

- Sekai 05Documento2 pagineSekai 05Micaela EncinasNessuna valutazione finora

- Conceptual Framework of Financial Statements: Financial Accounting For ManagementDocumento16 pagineConceptual Framework of Financial Statements: Financial Accounting For ManagementArja DebNessuna valutazione finora

- Valuation Matters The Complete Guide to Company Valuation TechniquesDa EverandValuation Matters The Complete Guide to Company Valuation TechniquesNessuna valutazione finora

- Credit Ratings: Amity Business SchoolDocumento22 pagineCredit Ratings: Amity Business SchoolRicky BhatiaNessuna valutazione finora

- List of ProjectsDocumento3 pagineList of ProjectsNaveen KumarNessuna valutazione finora

- SIP Topics For ReferenceDocumento44 pagineSIP Topics For ReferenceMahesh KhadeNessuna valutazione finora

- Instant Download Ebook PDF Engineering Economic Analysis 14th Edition PDF ScribdDocumento51 pagineInstant Download Ebook PDF Engineering Economic Analysis 14th Edition PDF Scribdnathan.prokop31698% (44)

- MCom Finance-Specialization 1-Financial Analysis PDFDocumento5 pagineMCom Finance-Specialization 1-Financial Analysis PDFjamalzareenNessuna valutazione finora

- Engineering Economics & Accountancy :Managerial EconomicsDa EverandEngineering Economics & Accountancy :Managerial EconomicsNessuna valutazione finora

- Corporate Finance ManagementDocumento9 pagineCorporate Finance Managementtrustmakamba23Nessuna valutazione finora

- FNCE 100 Syllabus Spring 2016Documento12 pagineFNCE 100 Syllabus Spring 2016kahwahcheongNessuna valutazione finora

- Study The Relationship Between Financial Ratios and Profitability To Market Value of Companies Listed On The Stock Exchange of Thailand. Resource Industry Group Energy and Utilities CategoryDocumento12 pagineStudy The Relationship Between Financial Ratios and Profitability To Market Value of Companies Listed On The Stock Exchange of Thailand. Resource Industry Group Energy and Utilities CategoryInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Credit Risk Irb ModelDocumento66 pagineCredit Risk Irb ModelKrishnan Chari100% (1)

- Analysis of Financial Statements - Ratio Analysis: Learning ObjectivesDocumento56 pagineAnalysis of Financial Statements - Ratio Analysis: Learning ObjectivesAnkit GargNessuna valutazione finora

- MBA Final Semester Finance Project TopicsDocumento2 pagineMBA Final Semester Finance Project TopicsRiyas ParakkattilNessuna valutazione finora

- Financial Modeling & Valuation Workshop - WallStreetMojoDocumento14 pagineFinancial Modeling & Valuation Workshop - WallStreetMojoPavithra GowthamNessuna valutazione finora

- TATA MOTORS RATIO ANALYSIS (1) (4) Final Report LajdlfjhdgskDocumento30 pagineTATA MOTORS RATIO ANALYSIS (1) (4) Final Report LajdlfjhdgskVishal SajgureNessuna valutazione finora

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersDa EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNessuna valutazione finora

- Performance Evaluation PDFDocumento10 paginePerformance Evaluation PDFsiddhartha karNessuna valutazione finora

- Financial Management Dissertation ExamplesDocumento4 pagineFinancial Management Dissertation ExamplesBuyCollegePaperOnlineAtlanta100% (1)

- Financial Performance Measures and Value Creation: the State of the ArtDa EverandFinancial Performance Measures and Value Creation: the State of the ArtNessuna valutazione finora

- Accounting and Finance for Business Strategic PlanningDa EverandAccounting and Finance for Business Strategic PlanningNessuna valutazione finora

- Financial Modeling and ForecastingDocumento59 pagineFinancial Modeling and ForecastingYamini Divya KavetiNessuna valutazione finora

- A Study On Capital Structure Analysis of Tata Motors LimitedDocumento5 pagineA Study On Capital Structure Analysis of Tata Motors LimitedAntora HoqueNessuna valutazione finora

- MBA Finance Thesis Topics List PDF: Equity Analysis of BanksDocumento4 pagineMBA Finance Thesis Topics List PDF: Equity Analysis of BanksbagyaNessuna valutazione finora

- Ratios & Trend Analysis: Week 7Documento65 pagineRatios & Trend Analysis: Week 7Zuhaib AhmedNessuna valutazione finora

- Coverage Cpale 2020Documento7 pagineCoverage Cpale 2020Rommel CruzNessuna valutazione finora

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationDa EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNessuna valutazione finora

- Chapter 1Documento23 pagineChapter 1SayeedMdAzaharulIslamNessuna valutazione finora

- Eirc - Icai: KolkataDocumento69 pagineEirc - Icai: Kolkatalakshmipriya_mcNessuna valutazione finora

- Measuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachDa EverandMeasuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachNessuna valutazione finora

- Chapter 10 - Financial Performance and Investment AppraisalDocumento10 pagineChapter 10 - Financial Performance and Investment AppraisalSteffany RoqueNessuna valutazione finora

- SyllabusDocumento3 pagineSyllabusArsalan LobaniyaNessuna valutazione finora

- Cae07 All Chapter PDFDocumento108 pagineCae07 All Chapter PDFJocelyn Sta AnaNessuna valutazione finora

- Research Paper On Ratio Analysis in IndiaDocumento6 pagineResearch Paper On Ratio Analysis in Indiafzqs7g1d100% (1)

- Financial Management: Partner in Driving Performance and ValueDa EverandFinancial Management: Partner in Driving Performance and ValueNessuna valutazione finora

- Chapter 15 Company AnalysisDocumento52 pagineChapter 15 Company AnalysisSamantha WrightNessuna valutazione finora

- Assignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Documento7 pagineAssignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Md Ohidur RahmanNessuna valutazione finora

- Group 2Documento97 pagineGroup 2SXCEcon PostGrad 2021-23100% (1)

- Benefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideDa EverandBenefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideNessuna valutazione finora

- Finance Project Report TopicsDocumento4 pagineFinance Project Report TopicsLufang FengNessuna valutazione finora

- Assignment: On Financial Statement Analysis and ValuationDocumento4 pagineAssignment: On Financial Statement Analysis and ValuationMd Ohidur RahmanNessuna valutazione finora

- Project ReportDocumento9 pagineProject ReportYod8 TdpNessuna valutazione finora

- Seminarski Rad 2014-15 FPSP ModelDocumento7 pagineSeminarski Rad 2014-15 FPSP ModelAleksandar TomićNessuna valutazione finora

- BBF612S - Understanding Financial PerfomanceDocumento5 pagineBBF612S - Understanding Financial PerfomanceReana GeminaNessuna valutazione finora

- OpportunitiesSWOT ANALYSISDocumento6 pagineOpportunitiesSWOT ANALYSISTuico Panlilio Wilbert ImbeNessuna valutazione finora

- Terminal One Group Association Issues Request For Qualifications Targeting Potential MWBE Investors For JFK Airport Terminal ProjectDocumento3 pagineTerminal One Group Association Issues Request For Qualifications Targeting Potential MWBE Investors For JFK Airport Terminal ProjectTerminal OneNessuna valutazione finora

- Balance SheetDocumento4 pagineBalance SheetPFENessuna valutazione finora

- CSC Vol I Study NotesDocumento16 pagineCSC Vol I Study NotesJeff Tr100% (1)

- Dominos+Pizza+Financial+Model+v1 TemplateDocumento5 pagineDominos+Pizza+Financial+Model+v1 TemplateEmperor OverwatchNessuna valutazione finora

- Live Mint 19 Aug 2020 PDFDocumento16 pagineLive Mint 19 Aug 2020 PDFAyush BhardwajNessuna valutazione finora

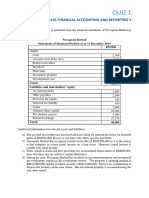

- QUIZ 1 Deferred Taxes SolutionDocumento3 pagineQUIZ 1 Deferred Taxes SolutionMohd NuuranNessuna valutazione finora

- What Is Finance?: Key TakeawaysDocumento3 pagineWhat Is Finance?: Key TakeawaysAnubhavNessuna valutazione finora

- EXcoin中国北京私享会圆满成功 (英文)Documento7 pagineEXcoin中国北京私享会圆满成功 (英文)Anonymous nsecedNessuna valutazione finora

- Sweet Poison DayamaniDocumento20 pagineSweet Poison DayamaniwillyindiaNessuna valutazione finora

- "Hamburg Summit: China Meets Europe" - Documentation 2010Documento21 pagine"Hamburg Summit: China Meets Europe" - Documentation 2010Handelskammer HamburgNessuna valutazione finora

- VipDocumento6 pagineVipVipin KushwahaNessuna valutazione finora

- Amco Republic of Resubmitted Decision: Indonesia: Case On JurisdictionDocumento13 pagineAmco Republic of Resubmitted Decision: Indonesia: Case On JurisdictionKylie Kaur Manalon DadoNessuna valutazione finora

- Ketan Parekh Held in Rs 120 CR Stock Scam CaseDocumento3 pagineKetan Parekh Held in Rs 120 CR Stock Scam CaseNishad JoshiNessuna valutazione finora

- Porfolio Management GuidelinesDocumento82 paginePorfolio Management Guidelinespachino007Nessuna valutazione finora

- Economic Effects of An AppreciationDocumento11 pagineEconomic Effects of An AppreciationIndeevari SenanayakeNessuna valutazione finora

- Narrative For Ship ValuationDocumento2 pagineNarrative For Ship ValuationSaw WinNessuna valutazione finora

- A Study On Financial Performance Analysis of ACCDocumento5 pagineA Study On Financial Performance Analysis of ACCpramodNessuna valutazione finora

- International Flow of FundsDocumento6 pagineInternational Flow of FundsSazedul EkabNessuna valutazione finora

- Moony: Betting Model ResultsDocumento3 pagineMoony: Betting Model ResultsNikola KarnasNessuna valutazione finora

- SaharaRefundFormEnglish PDFDocumento2 pagineSaharaRefundFormEnglish PDFPrashantUpadhyayNessuna valutazione finora

- Restaurant Valuation - A Side Peace of The Hustle: AmityDocumento5 pagineRestaurant Valuation - A Side Peace of The Hustle: AmityGHOST LifeNessuna valutazione finora

- Holdings Ltd-2013Documento101 pagineHoldings Ltd-2013AliNessuna valutazione finora

- DYNAcerts Hydrogen Generator For TrucksDocumento25 pagineDYNAcerts Hydrogen Generator For TrucksHabiburRahmanNessuna valutazione finora

- The Insites: Vishnu Prayag Hydro Power Project (400Mw)Documento12 pagineThe Insites: Vishnu Prayag Hydro Power Project (400Mw)kittieyNessuna valutazione finora

- Draft Circular Resolution of Board of Directors For Tack On Notes - 08112011Documento3 pagineDraft Circular Resolution of Board of Directors For Tack On Notes - 08112011Andry Wisnu UditNessuna valutazione finora

- Corporate Finance Chapter10Documento55 pagineCorporate Finance Chapter10James ManningNessuna valutazione finora