Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1samsung Construction Co

Caricato da

tere_aquinoluna828Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1samsung Construction Co

Caricato da

tere_aquinoluna828Copyright:

Formati disponibili

1

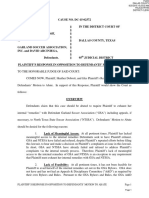

SAMSUNG CONSTRUCTION CO. vs FAREAST BANK AND TRUST CO., CA Gr no. 129015, August 13, 2004 Tinga,J.

FACTS: Petitioner Samsung Construction Company, Philippines (Samsung Construction), is a Korean company that while based in Bian, Laguna maintained a current account with private respondent Fareast Bank and Trust Company (FEBTC) at its Bel-Air Makati Branch. Jong Kyu Lee (Jong), its project manager, is the sole signatory to Samsung Construction while the checks remained in the custody of the companys accountant, Kyu Yong Lee (Kyu). On March 19, 1992, a certain Roberto Gonzaga presented for payment FEBTC Check No. 432100 to the FEBTC Makati Branch, payable to cash and drawn against Samsung Construction in the amount of P999,500.00. Three bank officers compared the signature of the drawer on the check with the banks specimen signature of drawer, Jong. The last of the three officers, upon seeing Jose Sempio III, who is the assistant accountant of Samsung Construction and is regularly negotiating with the bank in behalf of Samsung Construction, showed him the check for further verification and the latter confirmed the identity of bearer Gonzaga and vouched for the genuineness of Jongs signature on the check. According to him the check was for the purchase of equipment for Samsung Construction. Hence, the bank authorized the encashment of said check to Gonzaga but which was vehemently denied by Samsung Construction the very following day when Jong, the companys signatory proceeded to the bank to notify the latter of their discovery of the unauthorized encashment. ISSUE: 1. Whether or not the check was forged. 2. Whether or not petitioner is precluded from setting up forgery in its claim. 3. Whether or not private respondent FEBTC must reimburse petitioner Samsung Construction of the amount debited from its account. HELD: 1. Yes. According to the SC upon examination of the record, and based on the applicable laws and jurisprudence the case at bar is one of forgery made possible through the acts of one Jose Sempio III. Section 23 of the Negotiable Instruments Law states: When a signature is forged or made without the authority of the person whose signature it purports to be, it is wholly inoperative, and no right to retain the instrument, or to give a discharge therefor, or to enforce payment thereof against any party thereto, can be acquired through or under such signature, unless the party against whom it is sought to enforce such right is precluded from setting up the forgery or want of authority. The crucial fact in question is whether or not the check was forged, not whether the bank could have detected the forgery. The latter issue becomes relevant only if there is need to weigh the comparative negligence between the bank and the party whose signature was forged. 2. No. The Court albeit affirming Section 23 of the Negotiable Instruments Law which states that a party is barred from setting up the defense of forgery if it is guilty of negligence. The CA failed to explain precisely how petitioner was negligent or how more and prudence on its part would have prevented the forgery. By applying PCI Bank vs. CA applies in this case: The mere fact that forgery was committed by a drawer-payors confidential employee or agent, who by virtue of his position had unusual facilities for perpetrating the fraud and imposing the forged paper upon the bank, does not entitle the bank to shift the loss to the drawer-payor, in the absence of some circumstance raising estoppel against the drawer. 3. Yes. The Court upheld the general rule of imputing liability on a drawee who paid out on a forgery. Private respondent FEBTC is liable for reimbursement. Sec. 23 of the Negotiable Instrument Law states that a forged signature makes the instrument wholly inoperative. If payment is made by the drawee (FEBTC), it cannot charge it to the drawers account (Samsung Construction). The fact

that the forgery is clever is immaterial. The forged signature may so closely resemble the genuine as to defy detection by the depositor himself. And yet, if the bank pays the check, it is paying out with its own money and not of the depositors. This rule of liability can be stated briefly in these words: A bank is bound to know its depositors signature. The accusation of negligence on the part of Samsung was not clearly proven. Absence of proof to the contrary, the presumption is that the ordinary course of business was followed.

2 FACTS:

TRADERS ROYAL BANK vs RADIO PHILIPPINES NETWORK G.R. No. 138510, Oct. 10, 2002 Corona, J.

On April 15, 1985, the Bureau of Internal Revenue (BIR) assessed plaintiffs RPN, IBC, and BBC of their tax obligations for the taxable years 1978-1983. Plaintiffs comptroller sent a letter to the BIR requesting settlement of plaintiffs tax obligations which the BIR granted said request. Accordingly, on June 26, 1986, plaintiffs purchased from defendant Traders Royal Bank (TRB), three managers checks amounting to 9,790,716.87 to be used as payment for their tax liabilities to BIR. Sometime in 1988, BIR again assessed plaintiffs for their tax liabilities. It was only then they discovered that the three managers checks intended as payment for the taxes were actually never delivered nor paid to the BIR by plaintiffs comptroller. Instead, the checks were presented for payment by unknown persons to defendant Security Bank and Trust Company (SBTC). Thereafter, plaintiffs, constrained to enter into a compromise, paid the BIR in settlement of their unpaid deficiency taxes, sent letters to both defendants, demanding that the amounts covered by the checks be reimbursed or credited to their account which the defendants refused, hence, the instant suit. ISSUE: Whether or not TRB should be held solely liable for the three managers checks in question. HELD: Yes. The SC affirmed CAs decision in absolving appellant and private respondent SBTC. Sec.17 of the Bank Guarantee, Phil Clearing Housing Corp rules: xxx not one of the disputed checks bears the requisite indorsement of appellant and private respondent SBTC what appeared to be a guarantee stamped at the back of the checks is that of another bank PNB, thereby indicating that it was the latter bank which received the same. Sec.19 of the Rules of PCHC on Regular Item Procedure: xxx In the case at bar, the add-list submitted by appellant SBTC together with the checks it presented for clearing on does not show any of the three checks. Circumstances taken altogether created serious doubt on whether the disputed checks passed through the hands of appellant and private respondent SBTC. Petitioner TRB was the one remiss in its duty and obligation, and must therefore suffer the consequences of its own negligence and disregard of established banking rules and procedures.

Wherefore, the appealed decision is modified by deleting the award of exemplary damages and respondent networks are granted the P100,000.00 as attorneys fees. In all respects the CAs decision is affirmed.

3 Facts:

PNB vs CA

GR No 107612

January 31, 1996

Romero, J.

Faustino Pangilinan, cashier of the Concepcion Emergency Hospital, forged the signature of Dr. Adena Canlas who was the Chief of the said hospital and endorsed 30 checks amounting to P203,300 to himself. The money was drawn from the account of the Province of Tarlac with PNB. Pangilinan deposited the checks to his personal savings account with Associated Bank which was cleared and paid for by PNB. The checks have a stamp of Associated Bank which reads All prior endorsements guaranteed by Associated Bank. The Province of Tarlac, through the Provincial Treasurer, wrote PNB to restore the various amounts debited from the current account of the Province. PNB on its part demanded reimbursement from Associated Bank. Both banks resisted payment which led to the Province of Tarlac suing PNB. PNB in turn impleaded Associated Bank in the suit as a third-party defendant while Associated Bank impleaded Canlas and Pangilinan as fourth-party defendants. The trial court ruled that 1) PNB should pay the Province of Tarlac the P203,300 with legal interests, 2) Associated Bank should be pay the same amount to PNB and 3) dismissed the complaints against Canlas and Pangilinan due to lack of jurisdiction on the person of the latter. On appeal, the CA affirmed the ruling of the trial court. Issue: Who should bear the loss arising from the forgery, the Province of Tarlac, PNB, Associated Bank or Pangilinan? Held: The SC held that the Province of Tarlac and Associated Bank should bear losses in the proportion of 50-50. The Province can only recover 50% of the P203,300 from PNB because of the negligence they exhibited in releasing the checks to the then already retired Pangilinan who is an unauthorized person to handle the said checks. On the other hand, Associated Bank is liable to PNB only to 50% of the same amount because of its liability as indorser of the checks that were deposited by Pangilinan, and guaranteed the genuineness of the said checks. They failed to exercise due diligence in checking the veracity of indorsements.

4 FACTS:

ILUSORIO vs CA [G.R. No. 139130. November 27, 2002]

Quisumbing, J.

Ilusorio was a prominent business man and a creditor in good standing of Manila Banking Corporation. Due to his numerous business dealings and frequent travels he left the management of

his account to his secretary Katherine Eugenio. From September 1980 to January 1981, Eugenio was able to encash and deposit 17 checks to her account drawn against that of Ilusorio. When a business partner informed him of Eugenios activities he fired her and instituted criminal action for estafa through falsification. At the same time, private respondent Manila Bank also instituted criminal action against Eugenio for estafa through falsification of commercial documents. Petitioner requested the bank to restore to his account the value of the checks but respondent refused. Hence, this instance case. ISSUE: 1) W/n petitioner has a cause of action against Manila Bank 2) W/n Manila Bank is barred from raising defense that the fact of forgery was not established by filing an estafa case against Eugenio. RULING: 1) No. The Court finds that petitioner has no cause of action against Manila Bank. Petitioner has the burden of proving negligence on the part of the bank for failure to detect the discrepancy in the signature. The forgery was not proven because of the petitioners own inaction, by not providing further specimen signatures. He is precluded therefore from setting up forgery. Sec. 23 of the N.I.L provides for the exception that unless the party against whom it is sought to enforce such right is precluded from setting up forgery or want of authority. On the second issue, the fact that Manila Bank filed a cased against Eugenio would not estop it from asserting the fact that forgery has not been clearly established. 2) No. Based on Sec 2 Rule 110 of the Rules of Court, the party to the complaint is the People of the Philippines. Petitioner therefore cannot hold Manila Bank in estoppel for it is not the actual party to the criminal action.

5 FACTS:

GEMPESAW vs CA GR 92244 9 February 1993

Campos Jr. (J)

Gempesaw filed for recovery of the money value of 82 checks charged against her account due to forgery of indorsements made by Alicia Galang, her trusted bookkeeper. In the normal course of her grocery business, it would be Galang who would write the amounts in the check and Gempesaw would only sign the checks without ascertaining its contents. The checks were deposited in the accounts of Romero and Lam, with the aggregate total amounting to 1.2 million pesos. Gempesaw filed a case with the RTC which held that Gempesaw was negligent in handling her affairs by not ascertaining the values of the payments and if indeed the payments reached the payees making forgery not a defense for her to recover. The CA affirmed. ISSUE: W/N the forgery entitles Gempesaw to reimbursement? HELD: Partly yes and partly no. The SC found that Gempesaw is indeed negligent which precludes her from raising the defense of forgery under the provision of Section 23 of the Negotiable Instruments Law. However, the SC, using Article 1170 of the Civil Code, said that the bank becomes also liable for damages for accepting the check with a second indorsement. It should be noted that in the current banking system, checks with second indorsements are not generally accepted and given this fact, the Bank should also shoulder liability. Gempesaw and the bank are liable 50-50 for the loss.

Facts: Natividad Gempesaw issued checks, prepared by her bookkeeper, a total of 82 checks in favor of several supplies. Most of the checks for amounts in excess of actual obligations as shown in their corresponding invoices. It was only after the lapse of more than 2 years did she discovered the fraudulent manipulations of her bookkeeper. It was also learned that the indorsements of the payee were forged, and the checks were brought to the chief accountant of Philippine Bank of Commerce (the Drawee Bank, Buendia Branch) who deposited them in the accounts of Alfredo Romero and Benito Lam. Gempesaw made demand upon the bank to credit the amount charged due the checks. The bank refused. Hence, the present action. Issue: Who shall bear the loss resulting from the forged indorsements. Held: As a rule, a drawee bank who has paid a check on which an indorsement has been forged cannot charge the drawers account for the amount of said check. An exception to the rule is where the drawer is guilty of such negligence which causes the bank to honor such checks. Gempesaw did not exercise prudence in taking steps that a careful and prudent businessman would take in circumstances to discover discrepancies in her account. Her negligence was the proximate cause of her loss, and under Section 23 of the Negotiable Instruments Law, is precluded from using forgery as a defense. On the other hand, the banking rule banning acceptance of checks for deposit or cash payment with more than one indorsement unless cleared by some bank officials does not invalidate the instrument; neither does it invalidate the negotiation or transfer of said checks. The only kind of indorsement which stops the further negotiation of an instrument is a restrictive indorsement which prohibits the further negotiation thereof, pursuant to Section 36 of the Negotiable Instruments Law. In light of any case not provided for in the Act that is to be governed by the provisions of existing legislation, pursuant to Section 196 of the Negotiable Instruments Law, the bank may be held liable for damages in accordance with Article 1170 of the Civil Code. The drawee bank, in its failure to discover the fraud committed by its employee and in contravention banking rules in allowing a chief accountant to deposit the checks bearing second indorsements, was adjudged liable to share the loss with Gempesaw on a 50:50 ratio. 6 ASSOCIATED BANK vs CA 252 SCRA 620 G.R. No. 89802 May 7, 1992 Cruz, J. FACTS: Merle Reyes is engaged in the business of RTW garments under the name Melissas RTW. She deals with several stores; among them are Robinsons Department Store, Payless Department Store and Corona Bazaar. These stores issued in payment of their respective accounts crossed checks (6 TOTAL) payable to Melissa RTW. However, Reyes never acquired the checks. It was discovered that the checks were deposited in the Associated Bank under the account of Rafael Sayson, who was not authorized by Reyes. Reyes then sued the Associated Bank for the recovery of the amount. Associated Bank challenged the suit, arguing that Reyes has no cause of action against them. They contest that Reyes should have instituted the case against the stores /drawers. RTC ruled in favor of Reyes, saying that she has a cause of action against the bank. CA affirmed the decision. Hence this case.

ISSUE: W/N Reyes has a cause of action against Associated Bank. RULING: YES. The 6 checks that were issued by the stores were crosschecks, having 2 parallel lines diagonally on left top with words for payees account only. Sec 72 of the NIL states that presentment for payment must be made by the holder or by some person authorized to receive payment. In this case, only Reyes could deposit the check, as she did not authorize anyone else. Nevertheless, the checks were accepted for deposit by the Bank in the account of Sayson. In addition, it stamped thereon that it guaranteed all prior endorsements and/or lack of endorsements. By this positive and deliberate act of the bank, it assumed the warranty of the indorser. The position of the bank taking the check on the forged / unauthorized indorsement is the same as it had taken the check and collected without indorsement at all. The act of the bank amounts to conversion of the check. Thus, when the bank paid the checks, it did so at peril and became liable to the payee for the value of the check. The bank should have exercised due diligence and verified if Sayson was authorized by the payee. However, it did not and outright accepted the check. The bank interposed a defense, alleging that it was the husband of Reyes that endorsed the check to Sayson. However, this is immaterial because Merle Reyes did not authorize anyone else to accept and deposit the check, not even his husband. Having no proof that Reyes received the checks, she has a cause of action against the drawer stores, which in turn could sue their respective drawee banks, which in turn could use the collecting bank. To simplify proceedings, the payee is allowed direct recourse against the collecting bank.

7 FACTS:

PNB vs QUIMPO 158 SCRA 582

G.R. No. L-53194

1988 March 14

Gancayco, J

Gozon went to PNB with his friend, Santos and left the latter in his car along with his checkbook. Santos took one check, wrote 5000 pesos as its value, forged the signature of Gozon and encashed it. The so-called friend was later caught by the authorities and also admitted to his crime. Gozon wanted to recover the value the check encashed by Santos but PNB refused, using as its defense the negligence of Gozon for leaving the checkbook in his car. ISSUE: Whether or not PNB is liable to recredit Gozons account? HELD: YES. The bank should be familiar with the signatures of its depositors and based on the facts, there were clear discrepancies between the signature of Gozon and the forgery of Santos. PNB was found to be negligent in ascertaining the genuineness of the signature in the check. Also, it was only appropriate for Gozon to trust his long time friend Santos that the latter wouldnt do anything to compromise such relationship.

MWSS vs CA G.R. No. L-62943

July 14, 1986

Gutierrez, Jr., J.

Negotiable Instruments Law Liabilities of Parties 143 SCRA 20 Forgery Negligence of Drawer

FACTS: Metropolitan Waterworks and Sewerage System (MWSS) had an account with PNB. When it was still called NAWASA, MWSS made a special arrangement with PNB so that it may have personalized checks to be printed by Mesina Enterprises. These personalized checks are the ones being used by MWSS in its business transactions. From March to May 1969, MWSS issued 23 checks to various payees in the aggregate amount of P320,636.26. During the same months, another set of 23 checks containing the same check numbers earlier issued were forged. The aggregate amount of the forged checks amounted to P3,457,903.00. This amount was distributed to the bank accounts of three persons: Arturo Sison, Antonio Mendoza, and Raul Dizon who were later found out to be fictitious persons. MWSS then demanded PNB to restore the amount of P3,457,903.00. PNB refused. The trial court ruled in favor of MWSS but the Court of Appeals reversed the trial courts decision. ISSUE: Whether or not PNB should restore the said amount. HELD: No. MWSS is precluded from setting up the defense of forgery. It has been proven that MWSS has been negligent in supervising the printing of its personalized checks. It failed to provide security measures and coordinate the same with PNB. Further, the signatures in the forged checks appear to be genuine as reported by the National Bureau of Investigation so much so that the MWSS itself cannot tell the difference between the forged signature and the genuine one. The records likewise show that MWSS failed to provide appropriate security measures over its own records thereby laying confidential records open to unauthorized persons. Even if the twenty-three (23) checks in question are considered forgeries, considering the MWSSs gross negligence, it is barred from setting up the defense of forgery under Section 23 of the Negotiable Instruments Law. The Supreme Court further emphasized that forgery cannot be presumed. It must be established by clear, positive, and convincing evidence. This was not done in the present case.

9 Facts:

San Carlos Milling vs. BPI GR 37467, 11 December 1933

Hull (J)

59 PHIL 57

Joseph Wilson, the principal employee of San Carlos Milling Co. Ltd. in the Manila Office, conspired with one Alfredo Dolores, a messenger-clerk in the same office, in sending a cablegram in code to the company in Honolulu requesting a telegraphic transfer of $100,000 to China Bank of Manila. Upon receipt of the money, China Bank sent an exchange contract to San Carlos Milling offering the sum of P201,000, which was then the current rate of exchange. On this contract was forged the name of Newland Baldwin. A managers check on China Bank payable to San Carlos Milling or order was receipt for by Dolores. The check was deposited with BPI indorsed by a spurious signature of Baldwin. After clearing, BPI received a letter, purportedly signed by Baldwin, directing the shipment and delivery of P201,000. Dolores witnessed the packing of the money and returned with the check for P201,000 purportedly signed by Baldwin. Dolores turned the money over to Wilson and received as his share P10,000. When the crime was discovered, BPI refused to credit San Carlos Millings account with the amount withdrawn by the forged checks. Issue: Who shall be liable for the value of the forged check. Held: A bank that cashes a check must know to whom it pays. It is an elementary principle both in banking and of the Negotiable Instruments Law that a bank is bound to know the signatures of its customers; and if it pays a forged check, it must be considered as making the payment out of its own funds, and cannot ordinarily charge the amount so paid to the account of the depositor whose name was forged. As the proximate cause of loss was due to the negligence of BPI in honoring and cashing the forged checks, it is liable for the amount of P201,000 with legal interest thereon from 23 December 1928, until payment.

Potrebbero piacerti anche

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsDa EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsValutazione: 5 su 5 stelle5/5 (1)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintDa EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintValutazione: 4 su 5 stelle4/5 (1)

- Negotiable Instrument Law CasesDocumento7 pagineNegotiable Instrument Law CasesAngelo Raphael B. DelmundoNessuna valutazione finora

- Facts:: Allied Banking Corporation, Petitioner Versus Lim Sio Wan, Metropolitan Bank and Trust Co., RespondentsDocumento7 pagineFacts:: Allied Banking Corporation, Petitioner Versus Lim Sio Wan, Metropolitan Bank and Trust Co., RespondentsNadzlah BandilaNessuna valutazione finora

- 20 Traders Royal Bank Vs Radio Philippines NetworkDocumento6 pagine20 Traders Royal Bank Vs Radio Philippines NetworktheresagriggsNessuna valutazione finora

- 50 - Traders Royal Bank v. Radio Philippines NetworkDocumento8 pagine50 - Traders Royal Bank v. Radio Philippines NetworkCheska VergaraNessuna valutazione finora

- Petitioner VS: SynopsisDocumento15 paginePetitioner VS: SynopsisJobelle VillanuevaNessuna valutazione finora

- Negotiable Instrument CasesDocumento14 pagineNegotiable Instrument CasesDianne D.Nessuna valutazione finora

- Security Bank v. Rizal Commercial (2009)Documento9 pagineSecurity Bank v. Rizal Commercial (2009)Angela ConejeroNessuna valutazione finora

- Case #8, Batch 2 Bank of The Philippine Islands V. Casa Montessori Internationale G.R. No. 149454 May 28, 2004Documento8 pagineCase #8, Batch 2 Bank of The Philippine Islands V. Casa Montessori Internationale G.R. No. 149454 May 28, 2004Benz Clyde Bordeos TolosaNessuna valutazione finora

- Mitra V PeopleDocumento2 pagineMitra V PeopleCourt NanquilNessuna valutazione finora

- CASE #2 Mitra Vs PeopleDocumento1 paginaCASE #2 Mitra Vs PeoplepistekayawaNessuna valutazione finora

- Samsung Construction Co. Phil. v. Far East Bank and Trust CompanyDocumento16 pagineSamsung Construction Co. Phil. v. Far East Bank and Trust CompanyAmmie AsturiasNessuna valutazione finora

- Case Digests - Nego - FinalsDocumento25 pagineCase Digests - Nego - FinalsSteve Rojano ArcillaNessuna valutazione finora

- Nego Material Alteration CasesDocumento38 pagineNego Material Alteration CasesCielo Revilla SantosNessuna valutazione finora

- Case Digest NIL - Without Rigor YetDocumento3 pagineCase Digest NIL - Without Rigor YetKik EtcNessuna valutazione finora

- Banking Lapulapu B1Documento8 pagineBanking Lapulapu B1Jennica Gyrl DelfinNessuna valutazione finora

- Development Bank of Rizal Vs Sima Wei PDFDocumento3 pagineDevelopment Bank of Rizal Vs Sima Wei PDFkaren mae bollerNessuna valutazione finora

- NIL Digest For May 6Documento94 pagineNIL Digest For May 6Crystene R. SarandinNessuna valutazione finora

- Credit Transactions DigestsDocumento8 pagineCredit Transactions DigestsMary Grace Dionisio-RodriguezNessuna valutazione finora

- Petitioner Vs Vs Respondents: Second DivisionDocumento14 paginePetitioner Vs Vs Respondents: Second DivisionAira PatricioNessuna valutazione finora

- 121110-2004-Samsung Construction Co. Phil. v. Far East20180413-1159-1qg1diuDocumento14 pagine121110-2004-Samsung Construction Co. Phil. v. Far East20180413-1159-1qg1diuKristinaCuetoNessuna valutazione finora

- G.R. No. L-29432: Jai-Alai Corporation of The Philippines, Petitioner, V. Bank of The Philippine ISLAND, RespondentDocumento5 pagineG.R. No. L-29432: Jai-Alai Corporation of The Philippines, Petitioner, V. Bank of The Philippine ISLAND, RespondentJessie AncogNessuna valutazione finora

- Case Digests Nego Part 1Documento6 pagineCase Digests Nego Part 1adonis.orillaNessuna valutazione finora

- Central Bank of The Phils. Vs - Citytrust BankDocumento3 pagineCentral Bank of The Phils. Vs - Citytrust Bankazzy_km67% (3)

- Case Digest On NegoDocumento9 pagineCase Digest On NegoCayen Cervancia CabiguenNessuna valutazione finora

- Forgery Case DigestsDocumento4 pagineForgery Case DigestsKim Arizala100% (1)

- 2aa - Credit 6-10Documento13 pagine2aa - Credit 6-10yukibambam_28Nessuna valutazione finora

- NIL 77-109jhjDocumento39 pagineNIL 77-109jhjBenedict AlvarezNessuna valutazione finora

- NEGOTIABLE INSTRUMENT-Written Compliance - 20170201215-GACUTANDocumento27 pagineNEGOTIABLE INSTRUMENT-Written Compliance - 20170201215-GACUTANAnneNessuna valutazione finora

- Allied Banking Corp. Vs Lim Sio WanDocumento2 pagineAllied Banking Corp. Vs Lim Sio WanColeenNessuna valutazione finora

- Development Bank of Rizal vs. Sima Wei G.R. No. 85419Documento3 pagineDevelopment Bank of Rizal vs. Sima Wei G.R. No. 85419Gendale Am-isNessuna valutazione finora

- Development Bank of Rizal v. Sima Wei and or Lee Kian HuatDocumento2 pagineDevelopment Bank of Rizal v. Sima Wei and or Lee Kian HuatbearzhugNessuna valutazione finora

- UntitledDocumento3 pagineUntitledJunaid DadayanNessuna valutazione finora

- Central Bank v. CitytrustDocumento2 pagineCentral Bank v. CitytrustAnjNessuna valutazione finora

- 02 - CBP Vs CTBCDocumento4 pagine02 - CBP Vs CTBCAlvinReloxNessuna valutazione finora

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawDocumento28 pagineSuggested Answers To Bar Exam Questions 2008 On Mercantile LawRJay JacabanNessuna valutazione finora

- Ilusurio v. Ca - DigestDocumento1 paginaIlusurio v. Ca - DigestMirabel VidalNessuna valutazione finora

- Development Bank of Rizal Vs Sima WeiDocumento2 pagineDevelopment Bank of Rizal Vs Sima WeiSharon Padaoan RuedasNessuna valutazione finora

- Dev Bank of Rizal - V - Sima WeiDocumento4 pagineDev Bank of Rizal - V - Sima WeiStefanie RochaNessuna valutazione finora

- 3 Complete But UndeliveredDocumento2 pagine3 Complete But UndeliveredSteven Ortiz100% (1)

- Philippine Commercial International Bank v. Court of Appeals, G.R. Nos. 121413, 121479 and 128604, January 29, 2001Documento23 paginePhilippine Commercial International Bank v. Court of Appeals, G.R. Nos. 121413, 121479 and 128604, January 29, 2001liz kawiNessuna valutazione finora

- Philippine Education CoDocumento11 paginePhilippine Education CoMark Hiro NakagawaNessuna valutazione finora

- DBP Vs Sima WeiDocumento5 pagineDBP Vs Sima WeiKrister VallenteNessuna valutazione finora

- Development Bank of Rizal vs. Sima Wei, 217 SCRA 743, March 9, 1993Documento3 pagineDevelopment Bank of Rizal vs. Sima Wei, 217 SCRA 743, March 9, 1993XuagramellebasiNessuna valutazione finora

- In Case There Is A Collecting BankDocumento9 pagineIn Case There Is A Collecting BankMikkboy RosetNessuna valutazione finora

- Great Eastern Life Ins. Co. V. Hongkong Shanghai Bank (1922)Documento11 pagineGreat Eastern Life Ins. Co. V. Hongkong Shanghai Bank (1922)Vitas VitalyNessuna valutazione finora

- Digested Finals CasesDocumento6 pagineDigested Finals CasesGladden MacedaNessuna valutazione finora

- TRB V RPNDocumento1 paginaTRB V RPNeieipayadNessuna valutazione finora

- Negotiable Instruments Law (Peca's Digest)Documento19 pagineNegotiable Instruments Law (Peca's Digest)Chiska Payopanin50% (10)

- Jai-Alai Corporation of The Philippines, Petitioner, V. Bank of The Philippine Island, RespondentDocumento67 pagineJai-Alai Corporation of The Philippines, Petitioner, V. Bank of The Philippine Island, RespondentPatricia RodriguezNessuna valutazione finora

- OBLI DIGEST EXtinguishmentDocumento9 pagineOBLI DIGEST EXtinguishmentRozelle B. SalvosaNessuna valutazione finora

- Crisologo vs. People G.R. No. 199481 December 3, 2012Documento3 pagineCrisologo vs. People G.R. No. 199481 December 3, 2012NxxxNessuna valutazione finora

- 01 July AM Remedial LawDocumento2 pagine01 July AM Remedial LawGNessuna valutazione finora

- Mercantile Law ReviewerDocumento13 pagineMercantile Law ReviewerMarjorie Ramirez100% (1)

- BPI v. CADocumento23 pagineBPI v. CApistekayawaNessuna valutazione finora

- Union Bank vs. CADocumento4 pagineUnion Bank vs. CALili MoreNessuna valutazione finora

- Introduction to Negotiable Instruments: As per Indian LawsDa EverandIntroduction to Negotiable Instruments: As per Indian LawsValutazione: 5 su 5 stelle5/5 (1)

- DEPARTMENT ADMINISTRATIVE ORDER (Dao - 2002-36)Documento2 pagineDEPARTMENT ADMINISTRATIVE ORDER (Dao - 2002-36)tere_aquinoluna828100% (1)

- ACT NO. 1508-Chattel Mortgage LawDocumento2 pagineACT NO. 1508-Chattel Mortgage LawDex MohammadNessuna valutazione finora

- Notice of Appeal CRIMDocumento31 pagineNotice of Appeal CRIMtere_aquinoluna828Nessuna valutazione finora

- Trust Fund DoctrineDocumento1 paginaTrust Fund Doctrinetere_aquinoluna8280% (2)

- Lathe Holding DeviceDocumento28 pagineLathe Holding Devicetere_aquinoluna828Nessuna valutazione finora

- Philippine Mechanical CodeDocumento9 paginePhilippine Mechanical Codetere_aquinoluna82875% (4)

- How To Appeal Decisions of ProsecutorDocumento5 pagineHow To Appeal Decisions of Prosecutortere_aquinoluna828Nessuna valutazione finora

- Atty Padua Labor Reln CasesDocumento134 pagineAtty Padua Labor Reln Casestere_aquinoluna828Nessuna valutazione finora

- Proprietary LimitedPty LTDDocumento2 pagineProprietary LimitedPty LTDtere_aquinoluna828Nessuna valutazione finora

- Democrat Vs Republican PhilosophyDocumento7 pagineDemocrat Vs Republican Philosophytere_aquinoluna828100% (1)

- Kinds of Taxes: Indirect Taxes Are Taxes That Are Levied Upon Commodities Before They Reach The Consumer Who UltimatelyDocumento3 pagineKinds of Taxes: Indirect Taxes Are Taxes That Are Levied Upon Commodities Before They Reach The Consumer Who Ultimatelytere_aquinoluna828Nessuna valutazione finora

- Specro Case DigestsDocumento102 pagineSpecro Case DigestsLea Andrelei0% (1)

- United States v. Darrell P. Laflam, Also Known As Darrell Charbonneau, 369 F.3d 153, 2d Cir. (2004)Documento6 pagineUnited States v. Darrell P. Laflam, Also Known As Darrell Charbonneau, 369 F.3d 153, 2d Cir. (2004)Scribd Government DocsNessuna valutazione finora

- Atienza ForeclosureDocumento4 pagineAtienza ForeclosureIco AtienzaNessuna valutazione finora

- Domingo Vs Sheer - Strong Family Ties JurisDocumento25 pagineDomingo Vs Sheer - Strong Family Ties JurisGerald MesinaNessuna valutazione finora

- CognizanceDocumento12 pagineCognizanceBONGNessuna valutazione finora

- Plaintiff's Response in Opposition To Defendants' Motion To AbateDocumento62 paginePlaintiff's Response in Opposition To Defendants' Motion To AbateHeather DobrottNessuna valutazione finora

- Malayan Insurance Co., Inc. V. Arnaldo (1987) G.R. No. L-67835Documento4 pagineMalayan Insurance Co., Inc. V. Arnaldo (1987) G.R. No. L-67835PJr MilleteNessuna valutazione finora

- R. S. Nayak Vs A. R. Antulay On 16 February, 1984Documento48 pagineR. S. Nayak Vs A. R. Antulay On 16 February, 1984Skk IrisNessuna valutazione finora

- Farolan V CTADocumento2 pagineFarolan V CTAMijo SolisNessuna valutazione finora

- Court Room Exercise 2020: Before The District Court Complex, Leh, LadakhDocumento28 pagineCourt Room Exercise 2020: Before The District Court Complex, Leh, LadakhDeepesh KatariyaNessuna valutazione finora

- Maria Perez-Cabrera, A072 365 767 (BIA Mar. 15, 2012)Documento3 pagineMaria Perez-Cabrera, A072 365 767 (BIA Mar. 15, 2012)Immigrant & Refugee Appellate Center, LLCNessuna valutazione finora

- Popular Law Library - Equity - Jurisprudence - PutneyDocumento360 paginePopular Law Library - Equity - Jurisprudence - PutneyJacqueline Clarissa100% (4)

- Judicial Selection For The 21st CenturyDocumento36 pagineJudicial Selection For The 21st CenturyThe Brennan Center for Justice100% (1)

- Wix License NoteDocumento2 pagineWix License NoteRodrigo CruzNessuna valutazione finora

- Certificate of TitleDocumento17 pagineCertificate of TitleJarvin David ResusNessuna valutazione finora

- McCullough v. BergerDocumento12 pagineMcCullough v. Bergerviva_33Nessuna valutazione finora

- Draft Service Level AgreementDocumento39 pagineDraft Service Level AgreementLutfhi ArdiansyahNessuna valutazione finora

- CONTENTS INDEX - Certificate Course in Introduction To Legal DraftingDocumento4 pagineCONTENTS INDEX - Certificate Course in Introduction To Legal DraftingManan Mehra100% (1)

- Chapter 7Documento6 pagineChapter 7Matata PhilipNessuna valutazione finora

- Republic Vs PLDTDocumento2 pagineRepublic Vs PLDTBreth1979100% (5)

- DTC Agreement Between Nigeria and United KingdomDocumento35 pagineDTC Agreement Between Nigeria and United KingdomOECD: Organisation for Economic Co-operation and DevelopmentNessuna valutazione finora

- Habeas DataDocumento4 pagineHabeas DataNella Faye RicoNessuna valutazione finora

- Reviwer Notes ObliconDocumento2 pagineReviwer Notes ObliconCarol JacintoNessuna valutazione finora

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 529Documento18 pagineDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 529Justia.comNessuna valutazione finora

- Tamil Nadu Local Authorities Finance Act, 1961Documento36 pagineTamil Nadu Local Authorities Finance Act, 1961Latest Laws TeamNessuna valutazione finora

- Flow Chart Civil Case PDFDocumento1 paginaFlow Chart Civil Case PDFAshley Candice33% (3)

- All Subscribed Australian Cases Sources2012-10!26!11-49Documento108 pagineAll Subscribed Australian Cases Sources2012-10!26!11-49buddyhello1Nessuna valutazione finora

- Ramos V PallugnaDocumento4 pagineRamos V Pallugnagel94Nessuna valutazione finora

- Custom Biogenics MotionDocumento26 pagineCustom Biogenics MotionWews WebStaffNessuna valutazione finora

- IPR QuizDocumento5 pagineIPR QuizConstantin CalimanNessuna valutazione finora