Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MCI Introduces: Unbundled Services - Pre Litigation Package!

Caricato da

Billy BowlesCopyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

MCI Introduces: Unbundled Services - Pre Litigation Package!

Caricato da

Billy BowlesCopyright:

Phone: 888-491-3741 Fax: 877-606-2746 info@mortgagecomplianceinvestigators.com www.mortgagecomplianceinvestigators.

com

MCI INTRODUCES UNBUNDLED SERVICE PRE-LITIGATION PACKAGE

Mortgage Compliance Investigators pre-litigation package addresses the primary issues surrounding the chain of title of a securitized mortgage and the subsequent foreclosure of the home due to the borrowers inability to pay the loan per the original terms of the contract. The pre -litigation package exposes potential violations to the borrower or subsequent title holder to either defend against foreclosure or to secure settlement to the property through judicial means.

STEP ONE: LOAN DISPOSITION ANALYSIS The Loan Disposition Analysis (LDA) Report is a tool that will allow you or your client to know definitively what the homeowner qualifies for as a foreclosure alternative. Remember, there are other modification types besides the Home Affordable Modification Program (HAMP). The LDA Report will inform you of those options, plus you will know why you DO or DO NOT qualify, in terms that will hold up under any level of scrutiny all the way up to the court level. The report includes an NPV (net present value) Pass/Fail, as well as multiple separate AVMs (automated valuation model) reflecting a TRUE current property valuation. The LDA Report is a 20-to-40-page report that is generated using specific information about the Homeowner, the property, and the mortgage. It runs proprietary algorithms and NPV analytics to determine whether it is in the best financial interest of the investor to modify the loan. Sample: http://www.scribd.com/doc/130226394/MCI-Loan-Disposition-Analysis-Sample

MCI Pre-Litigation Package Page 1 of 3

STEP TWO: CHAIN OF TITLE ANALYSIS We will complete a comprehensive, state-specific analysis to address issues regarding securitization and lack of proper implementation of rules and procedures that govern the SPV. Each title holder is linked to the previous title holder and to any subsequent title holders through transfers and endorsements, forming a chain of title as disclosed through various public and private entities. This is equivalent to a chain of custody. These preliminary findings will show that by operation of law, the Intangible Debt Obligation and Security Instrument have become bifurcated; thus, any entity claiming ownership of the tangible promissory note and purported rights to enforce the security instrument lacks standing to foreclose, based on what has been filed into public record and according to the local laws of jurisdiction. State statutes, relevant Supreme Court rulings, and UCC codes will all be used in support of our arguments. Our Analysis is comprehensive in nature and enables our clients to formulate and articulate the arguments pursuant to the local laws of jurisdiction where the real property resides, and can be used within the four corners of pleadings without having to do further research. Affidavits come notarized, and blue-ink originals are mailed to whichever address the law office has provided, ready to be placed into court as exhibits. If requested for trial appearance, expert witness testimony from a licensed private investigator is available. Sample: http://www.scribd.com/doc/130218545/MCI-Chain-of-Title-Analysis-Sample

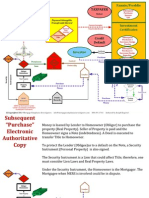

CUSTOM FLOWCHART for Chain of Title Analysis Visually documents the chain of title and illustrates complicated concepts like intangibles-vstangibles. Helps homeowners, attorneys and judges understand the complex arguments in the Analysis a picture is worth a thousand words Created specifically for each persons loan, almost no two flowcharts are the same. The Analysis references the chart, and the chart explains the Analysis, so they mutually strengthen each other. A flowchart must be ordered with pre litigation package; one will not be provided separately. Sample: http://www.scribd.com/doc/113401110/MCI-RMBS-Do-Did-Flowchart

MCI Pre-Litigation Package Page 2 of 3

STEP THREE: MORTGAGE FRAUD INVESTIGATION A Licensed Private Investigator will conduct an investigation of all the foreclosure documents executed and recorded by the trustee, mortgage servicer, lender, or lenders agents, for verification of compliance pursuant to Civil Code and State Penal Codes. A Licensed Private Investigator will analyze the clients recorded documents and look for fraud upon the court, signatory fraud, backdating, assignments in blank, robo-signers, notary fraud, and similar fraudulent and criminal activity. Full background checks will be conducted on the individuals who signed those documents to ascertain the validity of the individuals themselves and the capacity in which they have purported to sign (all recorded documents and background checks are provided as exhibits). This innovative new product is designed to help address the elements of fraud that attorneys need in order to be specific about damages if fraud is being alleged. The report will also come with a notarized affidavit and will include the state-specific statutory requirements for foreclosure.

STEP FOUR: DEMAND LETTER & SETTLEMENT REQUEST Available only upon acquisition, no sample available MCIs pre-litigation package is a much-needed component to support law offices legal conclusion on whether there is a valid basis for proceeding with a foreclosure defense action. MCIs demand letter will provide legal notice to all parties of any and all findings regarding violations or non-compliance to federal statutes and state-specific civil code. MCIs demand letter will request a rescission of recorded foreclosure documents including, but not limited to, the Notice of Default, Notice of Trustee Sale, Lis Pendens, Summons & Complaint. It will also demand cancellation/postponement of any sale date scheduled.

Keywords: Prima Fascia Evidence, Counter Claims, Treble Damages, Right To Show Cause, TRO (Temporary Restraining Order), Injunctive Relief, Declaratory Relief, Judicial Review, Exparte, Ex parte, Summary Judgment, Discovery, Civil Rico, Title 42, Adverse Claims, Bankruptcy, Unsecured Intangible Obligation, Nullity, Security Instrument, Mortgage, Note

MCI Pre-Litigation Package Page 3 of 3

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Damion Emholtz Curriculum VitaeDocumento2 pagineDamion Emholtz Curriculum VitaeDamion Emholtz100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Mortgage Securitization Auditor - CertificationDocumento1 paginaMortgage Securitization Auditor - CertificationDamion EmholtzNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Damion Emholtz Curriculum VitaeDocumento2 pagineDamion Emholtz Curriculum VitaeDamion Emholtz100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Legal Update: California Supreme Court Opens Door To Promissory Fraud Claims by Borrowers That Directly Contradict Terms of An Integrated Written Workout Agreement.Documento5 pagineLegal Update: California Supreme Court Opens Door To Promissory Fraud Claims by Borrowers That Directly Contradict Terms of An Integrated Written Workout Agreement.Damion EmholtzNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Subsequent Purchaser Electronic Copy MCIDocumento8 pagineSubsequent Purchaser Electronic Copy MCIDamion Emholtz100% (1)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- What Will A Trustee's Deed Tell?Documento3 pagineWhat Will A Trustee's Deed Tell?Billy BowlesNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Pig in A Poke - English Translation of Tangible IntangibleDocumento13 paginePig in A Poke - English Translation of Tangible IntangibleA. CampbellNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Explanation of Securitization By: Joe Esquivel (MCI)Documento3 pagineExplanation of Securitization By: Joe Esquivel (MCI)Billy Bowles0% (1)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- MCI Credit Card Authorization FormDocumento1 paginaMCI Credit Card Authorization FormDamion EmholtzNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- MCI Client Intake SheetDocumento3 pagineMCI Client Intake SheetDamion EmholtzNessuna valutazione finora

- Mortgage Compliance Investigators - Loan Disposition Analysis (LDA)Documento15 pagineMortgage Compliance Investigators - Loan Disposition Analysis (LDA)Billy BowlesNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Mortgage Compliance Investigators - Chain of Title AnalysisDocumento31 pagineMortgage Compliance Investigators - Chain of Title AnalysisBilly BowlesNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)