Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Steel Industry Update #282

Caricato da

Michael LockerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Steel Industry Update #282

Caricato da

Michael LockerCopyright:

Formati disponibili

Steel Industry Update/282

February 2013

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

Click on link below to go to table

Table 1: Selected U.S. Steel Industry Data, 2009-2012

Table 2: U.S. Spot Prices for Selected Products, February & Year-to-Date, 2013

Table 3: World Crude Steel Production, January & Year-to-Date, 2013

Table 4: Global Crude Steel Production, by Year, 2000-2012e

Table 5: U.S. Steel Exports, by Country, October 2012 & Year-to-Date

Table 6: Global Iron Ore Mine Production and Reserves, 2011-2012

Table 7: Global DRI Production, 2012

Table 8: Turkeys Top 10 Rebar Export Destinations, 2012

Table 9: Chinas Top 10 Steel Mills, by Output, 2012

Table 10: Japanese Steel Exports, by Product, 2012

Table 11: NLMK Steel Mill Production, 2012

Table 12: Severstal Production & Sales Volume, 2012

Table 13: Tenaris SA Financial Results, 3rd Quarter 2012

Table 14: Vale Output of Steel Mill Products October 2012 & Year-to-Date

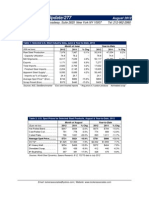

Table 1: Selected U.S. Steel Industry Data, 2009 - 2012

2009

2010

2011

2012

% Chg

Raw Steel Production (mt).

58.2

80.5

86.4

88.6

2.5%

Mill Shipments (mt).

54.8

75.8

83.5

87.2

4.4%

Exports (mt)...

8.5

11.0

12.2

12.5

2.2%

Total Imports (mt).

14.7

21.7

25.9

30.4

17.4%

Average Spot Price* ($/ton)..

$553

$680

$867

$754

-13.0%

Average Scrap Price# ($/ton)..

$236

$348

$437

$398

-9.8%

(000 net tons)

Sources: AISI, World Steel Dynamics, US ITA, *composite of 3 carbon products; #shredded bundles

Table 2: U.S. Spot Prices for Selected Products, February & Year-to-Date, 2013

($ per net ton)

Hot Rolled Band....

Cold Rolled Coil........

Coiled Plate..................

Month of February

2013

2012

% Chg

631

735

-14.1%

727

830

-12.4%

722

934

-22.7%

2013

628

725

729

Year-to-Date

2012

732

830

942

% Chg

-14.2%

-12.7%

-22.7%

Average Spot Price....

$693

$833

-16.8%

$694

$835

-16.9%

OCTG*

1,878

2,014

-6.8%

1,878

2,014

-6.8%

#1 Heavy Melt...

Shredded Scrap...

#1 Busheling.

332

366

370

393

435

470

-15.5%

-15.9%

-21.3%

339

373

378

407

451

487

-16.6%

-17.3%

-22.5%

Iron Ore ($/dmtu)...

Pig Iron ($/tonne)...

150

385

140

450

7.1%

-14.4%

150

446

140

494

7.1%

-9.7%

Sources: World Steel Dynamics, Spears Research; SteelontheNet.com; IndexMundi.com; *OCTG and

iron ore data is January, 2013; pig iron data is December, 2012, $/dmtu: US$/dry metric tonne unit

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Steel Industry Update/282

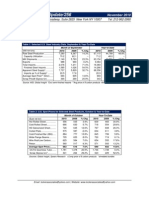

Table 3: World Crude Steel Production, January & Year-to-Date, 2013

Month of January

Year-to-Date

(000 metric tons)

2013

2012

% Chg

2013

2012

Region

% Chg

European Union.

Other Europe.

13,452

3,015

14,157

3,334

-5.0%

-9.6%

13,452

3,015

14,157

3,334

-5.0%

-9.6%

C.I.S.

8,913

9,503

-6.2%

8,913

9,503

-6.2%

North America

10,139

10,451

-3.0%

10,139

10,451

-3.0%

South America...

3,611

3,731

-3.2%

3,611

3,731

-3.2%

Africa/Middle East.....

2,854

2,929

-2.6%

2,854

2,929

-2.6%

Asia..

82,325

79,174

4.0%

82,325

79,174

4.0%

Oceania......

491

490

0.3%

491

490

0.3%

Total

124,799

123,768

0.8%

124,799

123,768

0.8%

China.......

Japan...

59,339

8,865

56,733

8,630

4.6%

2.7%

59,339

8,865

56,733

8,630

4.6%

2.7%

United States..

7,260

7,707

-5.8%

7,260

7,707

-5.8%

India(e).

6,600

6,357

3.8%

6,600

6,357

3.8%

Russia..

5,751

5,775

-0.4%

5,751

5,775

-0.4%

South Korea.......

5,705

6,049

-5.7%

5,705

6,049

-5.7%

Germany...

3,550

3,367

5.4%

3,550

3,367

5.4%

Turkey..

2,859

3,135

-8.8%

2,859

3,135

-8.8%

Ukraine...

2,748

2,873

-4.4%

2,748

2,873

-4.4%

Country

Brazil

2,620

2,791

-6.1%

2,620

2,791

-6.1%

All Others....

19,502

20,351

-4.2%

19,502

20,351

-4.2%

Source: World Steel Association, 2/13; e=estimate

Graph 1: World Crude Steel Production, January 2013

Source: World Steel Association, 2/13; in million metric tons

-2-

Steel Industry Update/282

Graph 2: World Steel Capacity Utilization, January 2013

Source: World Steel Association, 2/13

Graph 3: World Crude Steel Output, 2005-2012e

Source: World Steel Association, 2/13

-3-

Steel Industry Update/282

Table 4: Global Crude Steel Production, by Year, 2000-2012e

Year

2000

Output (mil tonnes)

847.6

Yr-Yr % Chg

--

2001

850.3

0.3%

2002

904.0

6.3%

2003

969.9

7.3%

2004

1,069.1

10.2%

2005

1,146.7

7.3%

2006

1,251.2

9.1%

2007

1,351.3

8.0%

2008

1,307.3

-3.3%

2009

1,211.5

-7.3%

2010

1,413.6

16.7%

2011

1,490.0

5.3%

2012(e)

1,510.0

1.3%

Source: Worldsteel.org, 1/8/13

Table 5: U.S. Steel Exports, by Country, October 2012 & Year-to-Date

Country

Canada

Oct12

574,922

Sep12

534,016

% Chg

7.7%

YTD12

5,758,658

YTD11

5,574,166

% Chg

3.3%

Mexico

393,691

319,206

23.3%

3,582,069

2,814,065

27.3%

41,153

37,339

10.2%

514,841

459,316

12.1%

543

1,087

-50.0%

6,212

7,324

-15.2%

Turkey

1,293

1,160

11.5%

18,097

29,615

-38.9%

Brazil

13,827

9,125

51.5%

179,914

117,850

52.7%

7,312

4,062

80.0%

104,570

56,457

85.2%

549

430

27.7%

10,862

38,671

-71.9%

-52.2%

EU

Russia

Venezuela

Ecuador

Argentina

284

980

-71.0%

6,109

12,792

Colombia

6,170

7,510

-17.8%

107,572

93,976

14.5%

Trinidad & Tobago

2,500

340

635.3%

13,201

16,543

-20.2%

Peru

6,172

13,922

-55.7%

165,052

104,885

57.4%

Chile

3,864

3,447

12.1%

22,593

26,452

-14.6%

17,648

28,312

-37.7%

186,243

187,905

-0.9%

7,604

1,088

598.9%

57,522

101,510

-43.3%

Other W. Hemis

10,216

22,178

-53.9%

193,613

236,670

-18.2%

Africa

10,157

11,295

-10.1%

124,228

220,678

-43.7%

Dominican Rep

Panama

Australia

4,320

3,008

43.6%

32,958

30,181

9.2%

China

9,828

11,234

-12.5%

103,753

127,992

-18.9%

Other Asia

44,134

12,709

247.3%

245,678

222,095

10.6%

Others

29,627

35,353

-16.2

343,797

543,839

36.8

1,185,814

1,057,801

12.1%

11,777,542

11,022,982

6.8%

Total

Source: AIIS, 12/17/12

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2013 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-4-

Steel Industry Update/282

Table 6: Global Iron Ore Mine Production and Reserves, 2012e

Country

China

Australia

2012e

1,300

525

2011

1,330

488

Reserves

23,000

35,000

Brazil

375

373

29,000

India

245

240

7,000

Russia

100

100

25,000

Ukraine

81

81

76,500

South Africa

61

60

1,000

Other countries

61

59

12,000

United States

53

55

6,900

Canada

40

34

6,300

Iran

28

28

2,500

Kazakhstan

25

25

2,500

Sweden

25

25

3,500

Venezuela

20

17

4,000

Mexico

13

15

700

Mauritania

12

12

1,100

3,000

2,940

170,000

2012e

19,739

11,395

2011

27,560

10,150

% Chg

-28.4%

12.3%

Mexico

5,510

5,945

-7.3%

Saudi Arabia

5,160

5,153

0.1%

Egypt

4,540

2,933

54.8%

Venezuela

4,510

4,470

0.9%

Trinidad & Tobago

1,693

1,915

-11.6%

Argentina

1,586

1,650

-3.9%

South Africa

1,410

1,400

0.7%

World total

Source: Payvand, 2/6/13; in million tonnes

Table 7: Global DRI Production, 2012

Country

India

Iran

Canada

824

702

17.4%

Peru

95

95

0.0%

Total

56,462

63,474

-11.0%

Source: Worldsteel.org, 1/2/13; in 000 tonnes

-5-

Steel Industry Update/282

Table 8: Turkeys Top 10 Rebar Export Destinations, 2012

Year 2012

1,246,723

Year 2011

858,793

Dec 12

104,838

Dec11

91,973

UAE

979,657

1,220,078

114,615

92,987

Saudi Arabia

677,341

231,053

74,556

30,291

US

597,375

372,518

121,978

146,092

Yemen

487,422

238,422

50,604

53,924

Egypt

455,548

390,945

4,972

70,975

Israel

439,271

406,435

26,472

33,089

Libya

361,646

60,081

64,518

8,250

Lebanon

315,880

222,613

35,165

14,160

Ethiopia

287,511

174,943

11,251

19,871

Country

Iraq

Source: Steelorbis.com, 2/5/13; in tonnes

Table 9: Chinas Top 10 Steel Mills, by Output, 2012

Company

Hebei Iron & Steel Group

2012

69.2

Share

9.7%

Anshen Iron & Steel Group

45.3

6.3%

Baosteel Group

42.7

6.0%

Wuhan Iron & Steel Group

36.4

5.1%

Shagang Group

32.3

4.5%

Shougang Group

31.4

4.4%

Shandong Iron & Steel Group

23.0

3.2%

Magang Group

17.3

2.4%

Tangshan Bohai Steel Group

17.3

2.4%

Hunan Valin Iron & Steel Group

Total of Top 10 Steelmakers

14.1

329.0

2.0%

45.9%

Other Steelmakers

Total of All Steelmakers

388.0

717.0

54.1%

100.00%

Source: Reuters, 2/3/13; in million tonnes

Table 10: Japanese Steel Exports, by Product, 2012

Product

Pig iron

2012

402,584

2011

52,885

Ferroalloy

230,394

132,879

73%

6,071

51,004

-88%

5,512,929

5,111,373

8%

Total ordinary steel products

27,678,225

27,372,448

1%

Total specialty steel products

Total secondary steel products

7,852,004

675,682

7,709,654

671,595

2%

1%

Total iron and steel products

42,494,856

41,234,288

3%

Ingots

Semi-finished products

Source: SteelGuru, 2/2/13; in tonnes

-6-

% Chg

661%

Steel Industry Update/282

Table 11: NLMK Steel Mill Production, 2012

Product

Pig iron

Crude steel

2012

2.88

3.67

2011

2.96

3.77

% Chg

-2.7%

-2.6%

Salable pig iron

0.04

0.11

-60.8%

Salable slabs

1.04

1.05

-1.4%

Flat products

2.08

2.16

-3.8%

Long products

0.35

0.38

-6.3%

Metalware

0.07

0.08

-15.1%

Total steel

3.58

3.78

-5.2%

Source: SteelGuru, 2/2/13; in million tonnes

Table 12: Severstal Production & Sales Volume, 2012

Production

Russian Steel

Severstal NA

2012

10,553,560

4,586,626

2011

11,354,746

3,938,661

% Chg

-7%

16%

Hot metal (total

10,256,881

10,543,687

-3%

Russian Steel

8,407,000

8,815,059

-5%

North America

1,849,881

1,728,628

7%

Crude steel total

15,140,185

15,293,407

-1%

Sales Volume

Coking coal concentrate

Iron ore pellets

2012

7,513,436

10,439,413

2011

7,591,670

10,051,406

% Chg

-1%

4%

Iron ore concentrate

4,759,702

4,763,870

0%

Total steel products

14,605,102

14,824,074

-1%

Total steel products (Russian)

10,295,098

11,027,695

-7%

4,464,137

3,808,552

17%

Total steel products (SNA)

Source: SteelGuru, 1/30/13; in tonnes

Table 13: Tenaris SA Financial Results, 3rd Quarter 2012

Item

Q3 '12

2,657.1

Q2 '12

2,801.5

% Chg

-5%

Q3 '11

2,494.80

Operating income

583.6

620.9

-6%

468.6

Net income

437.5

460.2

-5%

365.5

Shareholders' net income

436.4

461.1

-5%

325

Earnings per ADS

0.74

0.78

-5%

0.55

Earnings per share

0.37

0.39

-5%

0.28

EBITDA

679

758.6

-10%

603.6

26%

27%

Net sales

EBITDA margin (% of net sales)

Source: SteelGuru, 11/9/12; in US$ millions

-7-

24%

Steel Industry Update/282

Table 14: Vale Output of Steel Mill Products October 2012 & Year-to-Date

Product

Iron Ore

Q4'12

85,498

Q4'11

82,944

% Chg

3.1%

2012

319,690

2011

322,632

% Chg

-0.9%

Pallets

12,090

12,344

-2.1%

55,067

53,817

2.3%

Manganese

Coal

Nickel

668

757

-11.8%

2,365

2,556

-7.5%

1,951

1,608

21.3%

7,082

3,707

91.0%

64

69

-7.2%

237

242

-2.1%

Copper

81

85

-4.7%

292

302

-3.3%

Potash

161

180

-10.6%

549

625

-12.2%

2,060

1,833

12.4%

7,982

7,359

8.5%

Phosphate Rock

Source: SteelGuru, 2/12/13; in 000 tonnes

-8-

Steel Industry Update/282

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government clients.

By combining expert business and financial analysis with a sensitivity to labor issues, the firm is

uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labor-management

effort. Locker Associates also produces a widely read monthly newsletter, Steel Industry Update

that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Metallic Lathers and Reinforcing Ironworkers (2010-Present): strategic industry research and

ongoing advisement on major industry trends and companies to help enhance the competitive

position of the unionized NYC construction industry

Building & Construction Trades Council of Greater NY (BCTC) (2011-present): analysis and

advisement regarding major trends in the New York City construction industry, including capital

market developments which affect BCTC members

Communication Workers of America (CWA) (2011-present): research and analysis to prepare

CWA for nationwide contract negotiations with AT&T

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Metallurgical Coal Producer (2011): prepared a detailed study on the major trends in the world

metallurgical coal market for a large metallurgical coal producer

-9-

Potrebbero piacerti anche

- Steel Industry Update 283Documento9 pagineSteel Industry Update 283Michael LockerNessuna valutazione finora

- Steel Industry Update #276Documento7 pagineSteel Industry Update #276Michael LockerNessuna valutazione finora

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 pagineCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNessuna valutazione finora

- Steel Industry Update #281Documento6 pagineSteel Industry Update #281Michael LockerNessuna valutazione finora

- Steel Industry Update #278Documento9 pagineSteel Industry Update #278Michael LockerNessuna valutazione finora

- Steel Industry Update #273Documento8 pagineSteel Industry Update #273Michael LockerNessuna valutazione finora

- Steel Industry Update #279Documento8 pagineSteel Industry Update #279Michael LockerNessuna valutazione finora

- Steel Industry Update #275Documento9 pagineSteel Industry Update #275Michael LockerNessuna valutazione finora

- Steel Industry Update #280Documento10 pagineSteel Industry Update #280Michael LockerNessuna valutazione finora

- Steel Industry Update #270Documento9 pagineSteel Industry Update #270Michael LockerNessuna valutazione finora

- Steel Industry Update #277Documento9 pagineSteel Industry Update #277Michael LockerNessuna valutazione finora

- Steel Industry Update #274Documento8 pagineSteel Industry Update #274Michael LockerNessuna valutazione finora

- Steel Industry Update #264Documento10 pagineSteel Industry Update #264Michael LockerNessuna valutazione finora

- Steel Industry Update #271Documento9 pagineSteel Industry Update #271Michael LockerNessuna valutazione finora

- Steel Industry Update #269Documento8 pagineSteel Industry Update #269Michael LockerNessuna valutazione finora

- Steel Industry Update #265Documento7 pagineSteel Industry Update #265Michael LockerNessuna valutazione finora

- Steel Industry Update #272Documento7 pagineSteel Industry Update #272Michael LockerNessuna valutazione finora

- Steel Industry Update #266Documento8 pagineSteel Industry Update #266Michael LockerNessuna valutazione finora

- Steel Industry Update #268Documento13 pagineSteel Industry Update #268Michael LockerNessuna valutazione finora

- Steel Industry Update #267Documento9 pagineSteel Industry Update #267Michael LockerNessuna valutazione finora

- Locker RPA Transcript 6-9-11Documento2 pagineLocker RPA Transcript 6-9-11Michael LockerNessuna valutazione finora

- Steel Industry Update #263Documento10 pagineSteel Industry Update #263Michael LockerNessuna valutazione finora

- Steel Industry Update #260Documento6 pagineSteel Industry Update #260Michael LockerNessuna valutazione finora

- Steel Industry Update #261Documento8 pagineSteel Industry Update #261Michael LockerNessuna valutazione finora

- Steel Industry Update #262Documento7 pagineSteel Industry Update #262Michael LockerNessuna valutazione finora

- Steel Industry Update #258Documento8 pagineSteel Industry Update #258Michael LockerNessuna valutazione finora

- Steel Industry Update #257Documento8 pagineSteel Industry Update #257Michael LockerNessuna valutazione finora

- Steel Industry Update #259Documento10 pagineSteel Industry Update #259Michael LockerNessuna valutazione finora

- Steel Industry Update #256Documento11 pagineSteel Industry Update #256Michael LockerNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 3M Respirator Fit Tesing Guide - One PageDocumento1 pagina3M Respirator Fit Tesing Guide - One PageAhmad Aliff AkmalNessuna valutazione finora

- Philippine Corporate Law SyllabusDocumento102 paginePhilippine Corporate Law SyllabusRoa Emetrio NicoNessuna valutazione finora

- Boris v. Thomson Healthcare Inc. - Document No. 5Documento4 pagineBoris v. Thomson Healthcare Inc. - Document No. 5Justia.comNessuna valutazione finora

- As 1770-2003 Steel - Hardenability Test by End Quench (Jominy Test)Documento8 pagineAs 1770-2003 Steel - Hardenability Test by End Quench (Jominy Test)SAI Global - APACNessuna valutazione finora

- Speech About AbortionDocumento2 pagineSpeech About AbortionJody CangrejoNessuna valutazione finora

- Trade Union Act 1926Documento14 pagineTrade Union Act 1926Jyoti DaveNessuna valutazione finora

- Notes On Letter of CreditDocumento6 pagineNotes On Letter of Creditsandeepgawade100% (1)

- TIP Letter To ParentsDocumento3 pagineTIP Letter To ParentsncossNessuna valutazione finora

- Presentation On Wild ChildDocumento30 paginePresentation On Wild ChildjosieameliaNessuna valutazione finora

- Disaster Preparation and ManagementDocumento45 pagineDisaster Preparation and ManagementJan Paul Salud LugtuNessuna valutazione finora

- Presentation II Hacking and Cracking Wireless LANDocumento32 paginePresentation II Hacking and Cracking Wireless LANMuhammad TaufikNessuna valutazione finora

- Arguments over caring and authenticity erupt at gatheringDocumento4 pagineArguments over caring and authenticity erupt at gatheringAngieNessuna valutazione finora

- Data PimpinanDocumento66 pagineData PimpinanEuis JuwitaNessuna valutazione finora

- Disciplinary Board Reso BaldemoraDocumento2 pagineDisciplinary Board Reso BaldemoraBjmp Los Banos MJ100% (1)

- Bloom. Coleridge - The Anxiety of InfluenceDocumento7 pagineBloom. Coleridge - The Anxiety of InfluencemercedesNessuna valutazione finora

- Delos Reyes vs. AznarDocumento7 pagineDelos Reyes vs. AznarDennis VelasquezNessuna valutazione finora

- WTP WI Stick Diagram R4Documento3 pagineWTP WI Stick Diagram R4setyaNessuna valutazione finora

- Bennun v. Carrie Lynn Madej, Complaint & Jury Demand, Filed 2/27/23, TN Ninth Judicial District Circuit CourtDocumento26 pagineBennun v. Carrie Lynn Madej, Complaint & Jury Demand, Filed 2/27/23, TN Ninth Judicial District Circuit CourtPeter M. HeimlichNessuna valutazione finora

- Un Plan D'urgence en Cas de Marée Noire À Maurice Élaboré Depuis Plus de 30 AnsDocumento99 pagineUn Plan D'urgence en Cas de Marée Noire À Maurice Élaboré Depuis Plus de 30 AnsDefimedia100% (1)

- SRP Project 2020Documento67 pagineSRP Project 2020Monika ShindeyNessuna valutazione finora

- Minoan Foreign TradeDocumento28 pagineMinoan Foreign Tradeehayter7100% (1)

- AlterEgo Sample 2 - OCRDocumento23 pagineAlterEgo Sample 2 - OCRBob BenjyNessuna valutazione finora

- Metallicus ComplaintDocumento51 pagineMetallicus ComplaintfleckaleckaNessuna valutazione finora

- Coimbatore To Bengaluru, Road MapDocumento3 pagineCoimbatore To Bengaluru, Road MapRatna Giridhar KavaliNessuna valutazione finora

- Basic Beliefs of IslamDocumento4 pagineBasic Beliefs of IslamsirjsslutNessuna valutazione finora

- Nephrotic Syndrome Nutrition Therapy: Recommended FoodsDocumento8 pagineNephrotic Syndrome Nutrition Therapy: Recommended FoodssivasankarisukumarNessuna valutazione finora

- Emilio Gentile. Political Religion - A Concept and Its Critics - A Critical SurveyDocumento15 pagineEmilio Gentile. Political Religion - A Concept and Its Critics - A Critical SurveyDeznan Bogdan100% (1)

- EVNAnnual Report 2018Documento46 pagineEVNAnnual Report 2018Dương NguyễnNessuna valutazione finora

- Voter RegistrationDocumento3 pagineVoter Registrationapi-460427284Nessuna valutazione finora

- Mock Test 7 Suggested SolutionDocumento10 pagineMock Test 7 Suggested SolutionHung SarahNessuna valutazione finora