Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reserve Bank of India

Caricato da

tejaskamble45Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Reserve Bank of India

Caricato da

tejaskamble45Copyright:

Formati disponibili

RESERVE BANK OF INDIA ADDRESS Reserve Bank of India, Central Office, Shaheed Bhagat Singh Road, Mumbai - 400

001.

July 31, 2007 12:31 IST

RBI Governor Dr Y Venugopal Reddy presented the First Quarter Review of Annual Statement on

Monetary Policy for the Year 2007-08 on Tuesday

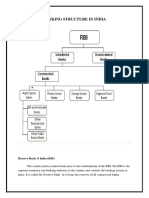

The central bank of the country is the Reserve Bank of India (RBI). It was established in April 1935 with a share capital of Rs. 5 crores on the basis of the recommendations of the Hilton Young Commission. The share capital was divided into shares of Rs. 100 each fully paid which was entirely owned by private shareholders in the begining. The Government held shares of nominal value of Rs. 2,20,000. Reserve Bank of India was nationalised in the year 1949. The general superintendence and direction of the Bank is entrusted to Central Board of Directors of 20 members, the Governor and four Deputy Governors, one Government official from the Ministry of Finance, ten nominated Directors by the Government to give representation to important elements in the economic life of the country, and four nominated Directors by the Central Government to represent the four local Boards with the headquarters at Mumbai, Kolkata, Chennai and New Delhi. Local Boards consist of five members each Central Government appointed for a term of four years to represent territorial and economic interests and the interests of co-operative and indigenous banks. The Reserve Bank of India Act, 1934 was commenced on April 1, 1935. The Act, 1934 (II of 1934) provides the statutory basis of the functioning of the Bank. The Bank was constituted for the need of following: To regulate the issue of banknotes To maintain reserves with a view to securing monetary stability and To operate the credit and currency system of the country to its advantage.

and Repo Rate under LAF kept unchanged. Withdrawal of the ceiling of Rs. 3,000 crore on daily reverse repo under the LAF with effect from Monday, August 6, 2007. The Reserve Bank, however, retains the discretion to re-impose a ceiling as appropriate. The second LAF, conducted between 3.00 p.m. and 3.45 p.m. on a daily basis, is withdrawn with effect from Monday, August 6, 2007. Cash Reserve Ratio to be increased by 50 basis points to 7.0 per cent with effect from the fortnight beginning August 4, 2007. GDP growth projection for 2007-08 retained at around 8.5 per cent, barring domestic or external shocks. Holding inflation within 5.0 per cent in 2007-08 assumes priority in the policy hierarchy, while reinforcing the medium-term objective to condition policy and perceptions to reduce inflation to 4.04.5 per cent on a sustained basis.

The Reserve Bank of India has the following Functions of Reserve Bank of India India Act of 1934 entrust all the important functions of a central bank the Reserve Bank of India. Bank of Issue Under Section 22 of the Reserve Bank of India Act, the Bank has the sole right to issue bank notes of all denominations. The distribution of one rupee notes and coins and small coins all over the country is undertaken by the Reserve Bank as agent of the Government. The Reserve Bank has a separate Issue Department which is entrusted with the issue of currency notes. The assets and liabilities of the Issue Department are kept separate from those of the Banking Department. Originally, the assets of the Issue Department were to consist of not less than two-fifths of gold coin, gold bullion or sterling securities provided the amount of gold was not less than Rs. 40 crores in value. The remaining three-fifths of the assets might be held in rupee coins, Government of India rupee securities, eligible bills of exchange and promissory notes payable in India. Due to the exigencies of the Second World War and the post-was period, these provisions were considerably modified. Since 1957, the Reserve Bank of India is required to maintain gold and foreign exchange reserves of Ra. 200 crores, of which at least Rs. 115 crores should be in gold. The system as it exists today is known as the minimum reserve system. Banker to Government The second important function of the Reserve Bank of India is to act as Government banker, agent and adviser. The Reserve Bank is agent of Central Government and of all State Governments in India excepting that of Jammu and Kashmir. The Reserve Bank has the obligation to transact Government business, via. to keep the cash balances as deposits free of interest, to receive and to make payments on behalf of the Government and to carry out their exchange remittances and other banking operations. The Reserve Bank of India helps the Government - both the Union and the States to float new loans and to manage public debt. The Bank makes ways and means advances to the Governments for 90 days. It makes loans and advances to the States and local authorities. It acts as adviser to the Government on all monetary and banking matters. Bankers' Bank and Lender of the Last Resort the Reserve Bank of India acts as the bankers' bank. According to the provisions of the Banking Companies Act of 1949, every scheduled bank was required to maintain with the Reserve Bank a cash balance equivalent to 5% of its demand liabilites and 2 per cent of its time liabilities in India. By an amendment of 1962, the distinction between demand and time liabilities was abolished and banks have been asked to keep cash reserves equal to 3 per cent of their aggregate deposit liabilities. The minimum cash requirements can be changed by the Reserve Bank of India. The scheduled banks can borrow from the Reserve Bank of India on the basis of eligible securities or get financial accommodation in times of need or stringency by rediscounting bills of exchange. Since commercial banks can always expect the Reserve Bank of India to come to their help in times of banking crisis the Reserve Bank becomes not only the banker's bank but also the lender of the last resort.

Controller of Credit The Reserve Bank of India is the controller of credit i.e. it has the power to influence the volume of credit created by banks in India. It can do so through changing the Bank rate or through open market operations. According to the Banking Regulation Act of 1949, the Reserve Bank of India can ask any particular bank or the whole banking system not to lend to particular groups or persons on the basis of certain types of securities. Since 1956, selective controls of credit are increasingly being used by the Reserve Bank. The Reserve Bank of India is armed with many more powers to control the Indian money market. Every bank has to get a licence from the Reserve Bank of India to do banking business within India, the licence can be cancelled by the Reserve Bank of certain stipulated conditions are not fulfilled. Every bank will have to get the permission of the Reserve Bank before it can open a new branch. Each scheduled bank must send a weekly return to the Reserve Bank showing, in detail, its assets and liabilities. This power of the Bank to call for information is also intended to give it . The Reserve Bank has also the power to inspect the accounts of any commercial bank. As supereme banking authority in the country, the Reserve Bank of India, therefore, has the following powers: (a) It holds the cash reserves of all the scheduled banks. (b) It controls the credit operations of banks through responsibility to maintain the official rate of exchange. According to the Reserve Bank of India Act of 1934, the Bank was required to buy and sell at fixed rates any amount of sterling in lots of not less than Rs. 10,000. The rate of exchange fixed was Re. 1 = sh. 6d. Since 1935 the Bank was able to maintain the exchange rate fixed at lsh.6d. though there were periods of extreme pressure in favour of or against the rupee. After India became a member of the International Monetary Fund in 1946, the Reserve Bank has the responsibility of maintaining fixed exchange rates with all other member countries of the I.M.F. Besides maintaining the rate of exchange of the rupee, the Reserve Bank has to act as the custodian of India's reserve of international currencies. The vast sterling balances were acquired and managed by the Bank. Further, the RBI has the responsibility of administering the exchange controls of the country.

Supervisory functions In addition to its traditional central banking functions, the Reserve bank has certain non-monetary functions of the nature of supervision of banks and promotion of sound banking in India. The Reserve Bank Act, 1934, and the Banking Regulation Act, 1949 have given the RBI wide powers of supervision and control over commercial and co-operative banks, relating to licensing and establishments, branch expansion, liquidity of their assets, management and methods of working, amalgamation, reconstruction, and liquidation. The RBI is authorised to carry out periodical inspections of the banks and to call for returns and necessary information from them. The nationalisation of 14 major Indian scheduled banks in July 1969 has imposed new responsibilities on the RBI for directing the growth of banking and credit policies towards more rapid development of the economy and realisation of certain desired social objectives. The supervisory functions of the RBI have helped a great deal in improving the standard of banking in India to develop on sound lines and to improve the methods of their operation. Bank's functions has steadily widened. The Bank now performs a varietyof developmental and promotional functions, which, at one time, were regarded as outside the normal scope of central banking. The Reserve Bank was asked to promote banking habit, extend banking facilities to rural

Promotional functions With economic growth assuming a new urgency since Independence, the range of the Reserve Bank's functions has steadily widened. The Bank now performs a varietyof developmental and promotional functions, which, at one time, were regarded as outside the normal scope of central banking. The Reserve Bank was asked to promote banking habit, extend banking facilities to rural and semi-urban areas, and establish and promote new specialised financing agencies. Accordingly, the Reserve Bank has helped in the setting up of the IFCI and the SFC; it set up the Deposit Insurance Corporation in 1962, the Unit Trust of India in 1964, the Industrial Development Bank of India also in 1964, the Agricultural Refinance Corporation of India in 1963 and the Industrial Reconstruction Corporation of India in 1972. These institutions were set up directly or indirectly by the Reserve Bank to promote saving habit and to mobilise savings, and to provide industrial finance as well as agricultural finance. As far back as 1935, the Reserve Bank of India set up the Agricultural Credit Department to provide agricultural credit. But only since 1951 the Bank's role in this field has become extremely important. The Bank has developed the co-operative credit movement to encourage saving, to eliminate moneylenders from the villages and to route its short term credit to agriculture. The RBI has set up the Agricultural Refinance and Development Corporation to provide long-term finance to farmers.

To respond swiftly with all possible measures as appropriate to the evolving global and domestic situation impinging on inflation expectations, financial stability and the growth Reddy also presented the First Quarter Review of Annual Statement on Monetary Policy for the Year 2007-08. The Review consists of three sections: I. Assessment of Macroeconomic and Monetary Developments; II. Stance of Monetary Policy; and III. Monetary Measures. Domestic Developments

Real GDP growth during the quarter January-March 2007 is placed at 9.1 per cent as against 10.0 per cent in the corresponding quarter a year ago and real GDP growth for the year 2006-07 is revised upwards from 9.2 per cent to 9.4 per cent. Inflation, measured by variations in the wholesale price index (WPI) on a year-on-year basis, declined from 5.9 per cent at end-March 2007 to 4.4 per cent as on July 14, 2007. The average international price of the Indian crude oil basket increased from US $ 56.2 per barrel in January-March 2007 to US $ 66.2 per barrel in April-June 2007 and to around US $ 73.5 per barrel on July 27, 2007. Growth in money supply (M3) at 21.6 per cent on a year-on-year basis on July 6, 2007 was above the projected trajectory of 17.0-17.5 per cent indicated in the Annual Policy Statement for 2007-08 and higher than 19.0 per cent a year ago. The year-on-year increase in aggregate deposits of scheduled commercial banks (SCBs) at 24.4 per cent (Rs.5,31,881 crore) up to July 6, 2007 was higher than 20.9 per cent (Rs.3,77, 392 crore) a year ago. momentum. The year-on-year non-food credit growth of SCBs at 24.4 per cent (Rs.3,67,258 crore) on July 6, 2007 was lower than 32.8 per cent (Rs.3,70,899 crore) a year ago. The total overhang of liquidity under the LAF, the MSS and cash balances of the Central Government taken together declined from an average of Rs.97,449 crore in March 2007 to Rs.72,823 crore on July 27, 2007. An assessment of the total liquidity overhang, however, should also reflect the transfer of Rs.35,351 crore from the Central Government to the Reserve Bank during this period on account of transfer of shares from the Reserve Bank to the Central Government. During the first quarter of 2007-08, financial markets experienced sizeable fluctuations in liquidity and attendant episodes of volatility in the money market with overnight rates in the call, market repo and collateralised borrowing and lending obligations (CBLO) segments displaying close comovement. Banks had generally increased their deposit rates by about 25-50 basis points across various maturities between March 2007 and June 2007, but reduced them during July 2007, especially in the shorter maturities. The majority of public sector banks (PSBs) adjusted their deposit rates upwards by10-25 basis points on maturities above one year, particularly at the longer end. By the beginning of the current financial year, several banks had drawn down holdings of statutory liquidity ratio (SLR)-eligible securities close to the statutory floor. Exclusive of liquidity adjustment facility (LAF) operations, however, banks' investments in Government and other approved securities increased by Rs.27,331 crore during the current year so far (up to July 6,2007) as compared with an increase of Rs.751 crore in the corresponding period of the previous year. Gross market borrowings (dated securities and 364-day Treasury Bills) of the Central Government during 2007-08 at Rs.85,628 crore up to July 27, 2007 (Rs.70,813 crore a year ago) constituted 45.4 per cent of the budget estimates while net market borrowings at Rs.46,047 crore (Rs.34,822 crore) constituted 2.0 per cent of the budget estimates.

External Developments

During the first two months of 2007-08, export growth rose to 20.2 per cent from 19.2 per cent in the corresponding period of the previous year. Imports also posted a sharp rise of 33.0 per cent as compared with 16.9 per cent in the corresponding period of the previous year. Non-POL imports rose by 47.3 per cent whereas oil imports remained broadly stable at the level recorded a year ago. As a result, the merchandise trade deficit widened to US $ 13.3 billion during April-May 2007 from US $ 8.2 billion in April-May 2006. As on July 20, 2007 India's foreign exchange reserves increased by US $ 22.9 billion over their end-March 2007 level to US $ 222.0 billion. During April-June 2007, the rupee appreciated by 6.63 per cent against the US dollar, by 5.19 per cent against the euro, by 4.41 per cent against the pound sterling and by 10.44 per cent against the Japanese yen.

Global Developments

According to the World Economic Outlook (WEO) of the International Monetary Fund (IMF) released in April 2007, global real GDP growth was expected to decline from 5.4 per cent in 2006 to 4.9 per cent in 2007 and 2008. The update of the WEO released in July 2007 has revised this estimate upwards to 5.5 per cent for 2006 and its forecast for 2007 and 2008 to 5.2 per cent. Globally, headline inflation has picked up in the wake of increase in commodity prices and core inflation has also generally remained firm. The inflation outlook remains a matter of concern on account of energy and other commodity prices, increased capacity utilisation rates in developed and major emerging economies and the impact of rising wages on inflation in advanced industrial economies. Perceptions of inflation pressures ahead have prompted monetary authorities generally to persevere in withdrawing monetary accommodation. The central banks that have tightened their policy rates include the ECB; the Bank of England; the Bank of Japan; the Bank of Canada; the Reserve Bank of Australia; the Reserve Bank of New Zealand; the People's Bank of China; the Bank of Korea; the Banco de Mexico; and the Banco Central de Chile. Some central banks, such as China and Korea, have used supplementary measures for tightening, besides increasing the key policy rates such as increases in reserve requirements. In the first half of 2007, emerging markets outperformed stocks in developed markets. Foreign investor demand for emerging market assets was reflected in a broad-based rise in inflows into dedicated bond and equity markets of the EMEs. Emerging market corporate bond issuance in international bond markets rose to a record level in 2006. The exposure of emerging markets to risky financial assets of the mature markets has increased, and therefore, the overall global financial risks have increased.

Overall Assessment

Domestic economic activity has continued to expand at a strong pace and there are indications that the impulses of growth are getting broad-based. The recent gains in bringing down inflation and in stabilising inflation expectations should support the current expansionary phase of the growth cycle. It is, however, necessary to note that demand pressures and cyclical effects persist, mirrored in investment and consumer demand, monetary and banking aggregates, capacity constraints and a widening trade deficit. Financial markets are reflecting the interplay of these factors, although increases in capital inflows and large changes in liquidity conditions are obscuring an accurate assessment of risks, with attendant uncertainty. While there is an abatement of inflation in the recent period, upward pressures persist. In this regard, it is essential to carefully monitor developments relating to aggregate supply conditions and the supply response to the impulses of demand in the short-term, while stepping up efforts to expand production capabilities over the medium-term. It is also necessary to continuously assess the risks to the inflation outlook emanating from high and volatile international crude prices, the continuing firmness in key food prices and the uncertainties surrounding the evolution of demand-supply gaps, both globally as well as in India. Risks from global developments continue to persist, especially in the form of inflationary pressures, re-pricing of risks by financial markets and danger of downturn in some asset classes, with implications for EMEs in general. International food and energy prices are likely to settle at higher levels than before with indications that the sharp acceleration recorded in 2006 will not reverse. In addition, there are risks emanating from the developments in global financial markets.

Stance of Monetary Policy for the Remaining Period of 2007-08

The projection of real GDP growth in 2007-08 at around 8.5 per cent, as set out in the Annual Policy Statement of April 2007, is retained, barring domestic or external shocks. The outlook for inflation in 2007-08 remains unchanged. Accordingly, holding headline inflation within 5.0 per cent in 2007-08 assumes priority in the policy hierarchy; while reinforcing the medium-term objective to condition policy and perceptions to reduce inflation to 4.0-4.5 per cent on a sustained basis. For the purpose of monetary policy formulation, the Annual Policy Statement of April 2007 projected growth of money supply (M3) at around 17.0-17.5 per cent for 2007-08 in consonance with the outlook on growth and inflation. Consistent with the projections of money supply, the growth in aggregate deposits in 2007-08 was placed at around Rs.4,90,000 crore while non-food credit including investments in bonds/debentures/shares of public sector undertakings and private corporate sector and commercial paper (CP) was projected to decelerate to 24.0-25.0 per cent in 2007-08 from the average of 29.8 per cent over 2004-07. While non-food credit growth has decelerated, the acceleration in money supply and reserve money warrants an appropriate response. The global outlook is positive with continuing prospects for strong and stable growth but there are concerns about inflationary pressures worldwide. Monetary authorities are inclined to regard the current levels of real interest rates as warranting further withdrawal of monetary accommodation and are indicating a preparedness to respond to the manner in which the inflation scenario evolves. Financial markets have been aggressively re-pricing risks; however, the wide diffusion of risks and the abundance of liquidity have imparted considerable uncertainty. These developments are necessitating intensified policy monitoring with a policy preference for insulating domestic real activity from these shocks. Monetary policy in India would continue to be vigilant and pro-active in the context of any accentuation of global uncertainties that pose threats to growth and stability in the domestic

economy. The domestic outlook continues to be favourable and would dominate the dynamic setting of monetary policy in the period ahead. It is important to design monetary policy such that it protects growth by contributing to the maintenance of stability. Accordingly, while the stance of monetary policy would continue to reinforce the emphasis on price stability and well-anchored inflation expectations and thereby sustain the growth momentum, contextually, financial stability may assume greater importance in the months to come. Recent developments in financial markets in India and potential uncertainties in global markets warrant a higher priority for managing appropriate liquidity conditions in the policy hierarchy at the current juncture. The Reserve Bank will continue with its policy of active demand management of liquidity through appropriate use of the CRR stipulations and open market operations (OMO) including the MSS and LAF, using all the policy instruments at its disposal flexibly, as and when the situation warrants. Barring the emergence of any adverse and unexpected developments in various sectors of the economy and keeping in view the current assessment of the economy including the outlook for inflation, the overall stance of monetary policy in the period ahead will broadly continue to be:

1) To reinforce the emphasis on price stability and well-anchored inflation expectations while ensuring a monetary and interest rate environment that supports export and investment demand in the economy so as to enable continuation of the growth momentum. 2) To re-emphasise credit quality and orderly conditions in financial markets for securing macroeconomic and, in particular, financial stability while simultaneously pursuing greater credit penetration and financial inclusion. 3) To respond swiftly with all possible measures as appropriate to the evolving global and domestic situation impinging on inflation expectations, financial stability and the growth momentum. Monetary Measures

Bank Rate kept unchanged at 6.0 per cent. Reverse Repo Rate and Repo Rate under LAF kept unchanged at 6.00 per cent and 7.75 per cent, respectively. In view of the current macroeconomic and overall monetary and liquidity conditions, it has been decided to withdraw the ceiling of Rs. 3,000 crore on daily reverse repo under the LAF with effect from Monday, August 6, 2007. The Reserve Bank, however, retains the discretion to re-impose a ceiling as appropriate and has the flexibility to conduct repo/reverse repo auctions at a fixed rate or at variable rates as circumstances warrant. The Reserve Bank retains the option to conduct overnight or longer term repo/reverse repo under the LAF depending on market conditions and other relevant factors. The Reserve Bank will continue to use this flexibility including the right to accept or reject tender(s) under the LAF, wholly or partially, if deemed fit, so as to make efficient use of the LAF in daily liquidity management. The second LAF, which was introduced from November 28, 2005 and is conducted between 3.00 p.m. and 3.45 p.m. on a daily basis, is withdrawn with effect from Monday, August 6, 2007. On a review of the current liquidity situation, it is considered desirable to increase the CRR by 50 basis points to 7.0 per cent with effect from the fortnight beginning August 4, 2007.

The Mid-Term Review of the Annual Policy Statement for the year 2007-08 will be undertaken on October 30, 2007.

The Reserve Bank of India (RBI) does not bring any changes in its key signaling rates in its annual policy statement for 2007-08. The apex bank seems to pave the way for more foreign exchange outflows and restricts the inflow to cut inflation. It has set a challenging inflation target of 5 per cent for the current year and expects to woo further monetary tightening with the continuing breach. The RBI has also increased the amount of cash banks are

Check out Inflation Control Measures by RBI

Tuesday , April 03, 2007

Print This Page Email to Friend

The Reserve Bank of India (RBI) does not bring any changes in its key signaling rates in its annual policy statement for 2007-08. The apex bank seems to pave the way for more foreign exchange outflows and restricts the inflow to cut inflation. It has set a challenging inflation target of 5 per cent for the current year and expects to woo further monetary tightening with the continuing breach. The RBI has also increased the amount of cash banks are required to keep with it by 150 basis point to 6.75 per cent of deposits. Also, it has given a push to repo rate as well which is now 7.75 per cent. There will be no further tightening, says the RBI. The RBI has taken two broad measures to keep a close scrutiny on net foreign exchange inflows. First, it is making hard efforts to discourage foreign currency inflows by tightening the norms for Non Resident Indians (NRIs) investments. Second, it has encouraged greater outflows by companies and individuals. Putting the same efforts to control inflation, the RBI has reduced the interest rates that banks can pay on NRI deposits by 50 basis points. The ceiling on overseas investments by companies has been increased to 200 per cent of their net worth from 200 per cent and by mutual funds to $4 billion from $3 billion. The RBI has also reduced its medium-term inflation goal to 4.0-4.5 per cent from 5 per cent. The inflation is believed to be ruling above 6 per cent since December 2006, which has actually persuaded the central bank to ponder over tightening the monetary measures during the period. As such, the finance ministry has all praises for the RBI for taking significant steps and right decisions to control inflation without hurting economic growth rate.

10

Potrebbero piacerti anche

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Reserve Bank of IndiaDocumento21 pagineReserve Bank of IndiaAcchu BajajNessuna valutazione finora

- Role of RBI in Indian EconomyDocumento17 pagineRole of RBI in Indian Economychaudhary9259% (22)

- RESERVE BANK OF INDIA (Shivam)Documento6 pagineRESERVE BANK OF INDIA (Shivam)nishantarya283Nessuna valutazione finora

- Indian Banking SystemDocumento36 pagineIndian Banking SystemRohit Sharma100% (1)

- University of Mumbai: "75 Years of Reserve Bank of India"Documento109 pagineUniversity of Mumbai: "75 Years of Reserve Bank of India"Harshal Chavan100% (1)

- Reserve Bank of IndiaDocumento10 pagineReserve Bank of Indiadev sharmaNessuna valutazione finora

- Role of Banks in Indian Economy ReportDocumento28 pagineRole of Banks in Indian Economy Reportsouravsaha8694% (34)

- Banking Sector ReformsDocumento16 pagineBanking Sector ReformsbabuNessuna valutazione finora

- Bhavin kkkkkkkkk38Documento87 pagineBhavin kkkkkkkkk38Sandip ChovatiyaNessuna valutazione finora

- Introduction of RbiDocumento63 pagineIntroduction of RbiAshley BakerNessuna valutazione finora

- Banking Structure in IndiaDocumento49 pagineBanking Structure in IndiaAjay RapelliNessuna valutazione finora

- Bank of Maharashtra PDFDocumento76 pagineBank of Maharashtra PDFPRATIK BhosaleNessuna valutazione finora

- Nakil Investment Banking FinalDocumento52 pagineNakil Investment Banking Finalnakil_parkar7880100% (1)

- Role of Rbi in Indian Banking System 2022Documento22 pagineRole of Rbi in Indian Banking System 2022ayushNessuna valutazione finora

- Uday BlackbookDocumento61 pagineUday BlackbookRavi VishwakarmaNessuna valutazione finora

- Challenges For Public Sector Banks in IndiaDocumento63 pagineChallenges For Public Sector Banks in IndiaKahkashan Anjum100% (8)

- Reserve Bank of IndiaDocumento84 pagineReserve Bank of IndiaSunil ColacoNessuna valutazione finora

- State Bank of IndiaDocumento12 pagineState Bank of IndiapreetighNessuna valutazione finora

- Evolution of Reserve Bank of IndiaDocumento6 pagineEvolution of Reserve Bank of IndiamotherfuckermonsterNessuna valutazione finora

- Functions of RBIDocumento4 pagineFunctions of RBIaditi aditiNessuna valutazione finora

- Impact of Npa On Bank ProfitabilityDocumento61 pagineImpact of Npa On Bank ProfitabilityVardhaman BhandankarNessuna valutazione finora

- Introduction and Functions of Nationalized BankDocumento10 pagineIntroduction and Functions of Nationalized BankPrashant MunnolliNessuna valutazione finora

- State Bank of IndiaDocumento7 pagineState Bank of Indiajay_kanjariaNessuna valutazione finora

- Financial Statement Analysis of Apex BankDocumento61 pagineFinancial Statement Analysis of Apex BankMohd Shahid75% (4)

- A Complete Project On RBI PDFDocumento109 pagineA Complete Project On RBI PDFNiharNessuna valutazione finora

- Role of RBI in Indian Financial MarketsDocumento5 pagineRole of RBI in Indian Financial MarketsBiswajit Paul100% (2)

- BankingDocumento49 pagineBankingRitu BhatiyaNessuna valutazione finora

- Role of RBI in Indian EconomyDocumento4 pagineRole of RBI in Indian EconomySubhashit SinghNessuna valutazione finora

- Performance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalDocumento72 paginePerformance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalSatish P.Goyal71% (17)

- Tushar Tybbi Project Sem 5Documento73 pagineTushar Tybbi Project Sem 5Omkar ChavanNessuna valutazione finora

- Rbi ThesisDocumento51 pagineRbi ThesisAnil Anayath100% (8)

- Project Report On Ratio Analysis of HDFC BankDocumento15 pagineProject Report On Ratio Analysis of HDFC BankRajat GuptaNessuna valutazione finora

- Banking Sector in IndiaDocumento29 pagineBanking Sector in Indiahahire0% (1)

- Dena Bank Working Capital and Ratio Analysis VinayDocumento106 pagineDena Bank Working Capital and Ratio Analysis Vinayविनय गुप्ता75% (4)

- Merchant Banking Meaning - Functions of Merchant Banking PDFDocumento3 pagineMerchant Banking Meaning - Functions of Merchant Banking PDFkadalarasane83% (6)

- Types of Banks: BankingDocumento11 pagineTypes of Banks: BankingKaviya KaviNessuna valutazione finora

- Co Operative BankDocumento52 pagineCo Operative BankDevendra SawantNessuna valutazione finora

- SBI (State Bank of India)Documento2 pagineSBI (State Bank of India)dashgreevlankeshNessuna valutazione finora

- Consortium BankingDocumento4 pagineConsortium BankingSnigdha DasNessuna valutazione finora

- Growth in Banking SectorDocumento30 pagineGrowth in Banking SectorHarish Rawal Harish RawalNessuna valutazione finora

- Changing Scenario of Indian Banking SectorDocumento14 pagineChanging Scenario of Indian Banking Sectorrupeshdahake8586100% (2)

- Indian Banking: Paradigm ShiftDocumento80 pagineIndian Banking: Paradigm ShiftJayesh Gawade100% (1)

- ProjectDocumento70 pagineProjectnramkumar00775% (4)

- Management of NPA in BankingDocumento29 pagineManagement of NPA in BankingNagireddy KalluriNessuna valutazione finora

- Financial Analysis PNBDocumento32 pagineFinancial Analysis PNBTarandeepNessuna valutazione finora

- Organisational Setup and Management of The State Bank of IndiaDocumento6 pagineOrganisational Setup and Management of The State Bank of IndiapandisivaNessuna valutazione finora

- Universal Banking Project 2Documento128 pagineUniversal Banking Project 2Vishagrah Tyagi33% (6)

- A Research Project On Credit Risk and Liquidity RiskDocumento86 pagineA Research Project On Credit Risk and Liquidity RiskEkam JotNessuna valutazione finora

- Blackbook Project On Modernization in Banking System in India 163418955 Compress (1) Converted by AbcdpdfDocumento80 pagineBlackbook Project On Modernization in Banking System in India 163418955 Compress (1) Converted by AbcdpdfVikas Yadav0% (1)

- Project Report On Financial SevicesDocumento102 pagineProject Report On Financial SevicesVaishnavi khotNessuna valutazione finora

- LIC Swot AnalysisDocumento3 pagineLIC Swot AnalysisGOVIND JANGIDNessuna valutazione finora

- RBI Governor Announces Mid-Term Review of Annual Policy For 2006-07Documento16 pagineRBI Governor Announces Mid-Term Review of Annual Policy For 2006-07vitika1Nessuna valutazione finora

- Reserve Bank of IndiaDocumento4 pagineReserve Bank of IndiaShilpa AgarwalNessuna valutazione finora

- 1 Raja BSEDocumento7 pagine1 Raja BSEsanraja2011Nessuna valutazione finora

- Reserve Bank of India Act 1934 FinalDocumento19 pagineReserve Bank of India Act 1934 FinalBijal GohilNessuna valutazione finora

- Dr. Ram Manohar Lohiya National Law University, LucknowDocumento10 pagineDr. Ram Manohar Lohiya National Law University, LucknowSubit ChakrabartiNessuna valutazione finora

- Roles and Function of RbiDocumento15 pagineRoles and Function of RbiCharu LataNessuna valutazione finora

- Economics: Functions of Reserve Bank of IndiaDocumento2 pagineEconomics: Functions of Reserve Bank of IndiaNirmit MehtaNessuna valutazione finora

- SWOT Analysis SBI BankDocumento8 pagineSWOT Analysis SBI Banktejaskamble45Nessuna valutazione finora

- Pestel Analysis of Coca ColaDocumento4 paginePestel Analysis of Coca Colatejaskamble450% (1)

- Banana TCDocumento16 pagineBanana TCtejaskamble45Nessuna valutazione finora

- Lifeinsurance Awareness in IndiaDocumento17 pagineLifeinsurance Awareness in Indiatejaskamble45Nessuna valutazione finora

- Insurance Awareness in India MainDocumento39 pagineInsurance Awareness in India Maintejaskamble4575% (4)

- Lifeinsurance Awareness in IndiaDocumento17 pagineLifeinsurance Awareness in Indiatejaskamble45Nessuna valutazione finora

- University of Mumbai Investment Banking: Project Report by Tejas.S.Kamble ROLLNO:18 T.Y.Bcom - Banking & InsuranceDocumento54 pagineUniversity of Mumbai Investment Banking: Project Report by Tejas.S.Kamble ROLLNO:18 T.Y.Bcom - Banking & Insurancetejaskamble45Nessuna valutazione finora

- Insurance Awareness in India MainDocumento34 pagineInsurance Awareness in India Maintejaskamble45Nessuna valutazione finora

- Banana TCDocumento16 pagineBanana TCtejaskamble45Nessuna valutazione finora

- Investment Banking F2Documento44 pagineInvestment Banking F2tejaskamble45Nessuna valutazione finora

- Insurance OmbudsmanDocumento60 pagineInsurance OmbudsmanTejashree WazeNessuna valutazione finora

- Reserve BankDocumento49 pagineReserve Banktejaskamble45Nessuna valutazione finora

- Insurance OmbudsmanDocumento60 pagineInsurance OmbudsmanTejashree WazeNessuna valutazione finora

- Frauds, Scams and Financial Euphoria: Jack LangDocumento27 pagineFrauds, Scams and Financial Euphoria: Jack Langtejaskamble45Nessuna valutazione finora

- Frauds, Scams and Financial Euphoria: Jack LangDocumento27 pagineFrauds, Scams and Financial Euphoria: Jack Langtejaskamble45Nessuna valutazione finora

- Frauds, Scams and Financial Euphoria: Jack LangDocumento27 pagineFrauds, Scams and Financial Euphoria: Jack Langtejaskamble45Nessuna valutazione finora

- TapaswiniDocumento87 pagineTapaswinirinkuchoudhuryNessuna valutazione finora

- Occupy Scenes From Occupied America PDFDocumento2 pagineOccupy Scenes From Occupied America PDFMichelleNessuna valutazione finora

- National Agriculture PolicyDocumento3 pagineNational Agriculture PolicyImran AfizalNessuna valutazione finora

- No-BS Trading SystemDocumento6 pagineNo-BS Trading SystemIvan Sanader100% (1)

- EconomicsDocumento322 pagineEconomicsMark John BernaldezNessuna valutazione finora

- AwbDocumento1 paginaAwbAnonymous RCM8aHgrPNessuna valutazione finora

- LC DraftDocumento3 pagineLC DraftNRVision Exim100% (3)

- Metro CashDocumento19 pagineMetro CashArslan BhattiNessuna valutazione finora

- Economic Impacts of Covid 19Documento19 pagineEconomic Impacts of Covid 19Soorya ShrinivasNessuna valutazione finora

- One Region: Promoting Prosperity Across RaceDocumento70 pagineOne Region: Promoting Prosperity Across RaceCenter for Social InclusionNessuna valutazione finora

- Industry Analysis of InsuranceDocumento48 pagineIndustry Analysis of InsuranceDebojyotiSahoo100% (1)

- Cases Title IX Partnership General Provisions (1) Art. 1767 1.1 Partnership Defined Evangelista, Et Al vs. CIR Decided 15 October 1957Documento9 pagineCases Title IX Partnership General Provisions (1) Art. 1767 1.1 Partnership Defined Evangelista, Et Al vs. CIR Decided 15 October 1957Edward Kenneth Kung100% (1)

- Christmas Tree LCA - EllipsosDocumento91 pagineChristmas Tree LCA - EllipsoscprofitaNessuna valutazione finora

- MULTIPLE CHOICE: Choose The Best AnswerDocumento3 pagineMULTIPLE CHOICE: Choose The Best AnswerEppie SeverinoNessuna valutazione finora

- BillDocumento1 paginaBillAskari NaqviNessuna valutazione finora

- Security Seal 4-MALAYSIADocumento124 pagineSecurity Seal 4-MALAYSIAEkin Elias100% (1)

- Securitization of Trade ReceivablesDocumento2 pagineSecuritization of Trade ReceivablesBhavin PatelNessuna valutazione finora

- Prof. Labitag (Property)Documento49 pagineProf. Labitag (Property)Chad Osorio50% (2)

- Policy On Intellectual Property in KenyaDocumento50 paginePolicy On Intellectual Property in KenyaE Kay Mutemi100% (1)

- Latin America Confronts The Great Depression: Brazil and ArgentinaDocumento24 pagineLatin America Confronts The Great Depression: Brazil and ArgentinaEnriqueNessuna valutazione finora

- Failure and Resurgence of The Barbie DollDocumento23 pagineFailure and Resurgence of The Barbie DollrknanduriNessuna valutazione finora

- Town of Rosthern Coucil Minutes October 2008Documento4 pagineTown of Rosthern Coucil Minutes October 2008LGRNessuna valutazione finora

- App ADocumento37 pagineApp AadeepcdmaNessuna valutazione finora

- Economic RRL Version 2.1Documento8 pagineEconomic RRL Version 2.1Adrian Kenneth G. NervidaNessuna valutazione finora

- Philippine Bank vs. NLRC Case DigestDocumento1 paginaPhilippine Bank vs. NLRC Case Digestunbeatable38Nessuna valutazione finora

- Category Management GTDocumento2 pagineCategory Management GTArun MaithaniNessuna valutazione finora

- Este Documento Es Aceptado Tributariamente Por SunatDocumento2 pagineEste Documento Es Aceptado Tributariamente Por SunatMelissa CongonaNessuna valutazione finora

- UNIT 1 - Grammar Choices For Graduate StudentsDocumento21 pagineUNIT 1 - Grammar Choices For Graduate StudentsDragana BorenovicNessuna valutazione finora

- Types of SlabsDocumento5 pagineTypes of SlabsOlga KosuoweiNessuna valutazione finora

- Taxation Quiz - ADocumento2 pagineTaxation Quiz - AKenneth Bryan Tegerero TegioNessuna valutazione finora

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetDa EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetValutazione: 5 su 5 stelle5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsDa EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsValutazione: 5 su 5 stelle5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDa EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistValutazione: 4 su 5 stelle4/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)