Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Daily Metals and Energy Report, March 5

Caricato da

Angel BrokingCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Daily Metals and Energy Report, March 5

Caricato da

Angel BrokingCopyright:

Formati disponibili

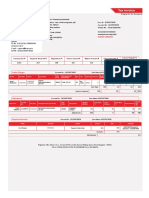

Commodities Daily Report

Tuesday| March 5, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn :6130 Saif Mukadam Research Analyst saif.mukadam@angelbroking.com (022) 2921 2000 Extn :6136 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 5, 2013

International Commodities

Overview

Spanish Unemployment Change to 59,400 in the last month. UKs Construction PMI declined by to 46.8-mark in February. European Sentix Investor Confidence was at -10.6-mark in March. UKs BRC Retail Sales Monitor rose by 2.7 percent in February. Japans Average Cash Earnings increased by 0.7 percent in January. Asian markets are trading higher today on the back of expectations that US Federal Reserve will continue with its stimulus measures program to boost the economic growth in the worlds largest economy. US Dollar Index (DX) depreciated marginally by 0.1 percent in yesterdays trading session on the back of rise in risk appetite in the global market sentiments in the later part of the trade which led to fall in demand for the low yielding currency. Additionally, expectations that US Federal Reserve will continue with its stimulus measures program also exerted downside pressure on the currency. In addition, US equities also traded on a positive note in yesterdays trade which also acted as an unfavorable factor for the DX. The currency touched an intra-day low of 82.23 and closed at 82.26 on Monday. The Indian Rupee depreciated by 0.1 percent in yesterdays trading session. The currency depreciated on the back of weak global and domestic market sentiments coupled with strength in the DX in the early part of the trade. Further, disappointment over the budget announcement in the last week along with record high current account deficit also added downside pressure on the currency. Further, sharp downside in the currency was cushioned as a result of selling of dollars from exporters and corporates in the last hour of the trading session. The Indian Rupee touched an intra-day low of 55.13 and closed at 54.95 against dollar on Monday. For the month of March 2013, FII outflows totaled at Rs.359.20 crores th ($69.03 million) as on 4 March 2013. Year to date basis, net capital th inflows stood at Rs.46,139.0 crores ($8,565.60 million) till 4 March 2013. UKs Construction Purchasing Managers' Index (PMI) declined by 1.9 points to 46.8-mark in the month of February as compared to rise of 48.7-level in January. British Retail Consortium (BRC) Retail Sales Monitor rose by 2.7 percent in February from earlier rise of 1.9 percent in January. Japans Average Cash Earnings increased by 0.7 percent in January as against a decline of 1.7 percent a month ago.

Market Highlights (% change)

Last INR/$ (Spot) 54.95 Prev day -0.1

as on 4 March, 2013 w-o-w -1.8 m-o-m -3.1 y-o-y -9.9

$/Euro (Spot)

1.3025

0.0

-0.3

-3.6

-1.3

Dollar Index NIFTY

82.26

-0.1

0.6

3.4

3.5

5698.5

-0.4

-2.7

-4.8

6.3

SENSEX

18878.0

-0.2

-2.3

-4.4

3.2

DJIA

14127.8

0.3

2.5

1.8

8.9

S&P

1525.2

0.5

2.5

2.0

11.4

Source: Reuters

The Euro appreciated marginally by 0.01 percent in yesterdays trade on the back of positive economic data from Spain, mixed global market sentiments along with weakness in the DX. However, as the uncertainty in the Italy persists further appreciation in the currency was capped. Spanish Unemployment Change declined by 72,700 to 59,400 in February as against a rise of 1,32,100 in January. European Sentix Investor Confidence was at -10.6-mark in March from earlier fall of 3.9-level in February. European Producer Price Index (PPI) rose by 0.6 percent in February as compared to decline of 0.2 percent a month ago.

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 5, 2013

International Commodities

Bullion Gold

Market Highlights - Gold (% change) Spot gold prices fell around 0.1 percent in the in yesterdays trading session on the back of mixed global market sentiments. However, expectation among the market participants that major central banks will maintain the stimulus measures to spur growth coupled with weakness in dollar cushioned the downfall in prices. The yellow metal touched an intra-day low of $1569.1/oz and closed at $1573.3/oz on Mondays trading session. In the Indian markets, prices declined by 0.2 percent yesterday and closed at Rs.29668/10 gms after touching an intra-day low of Rs. 29606/10 gms on Monday. Depreciation in the Indian Rupee cushioned sharp fall in the prices. .

Gold Gold (Spot) Gold (Spot Mumbai) Gold (LBMA-PM Fix) Comex Gold (April13) MCX Gold (April13) Unit $/oz Rs/10 gms $/oz Last 1573.3 29500.0 Prev. day -0.1 0.4 as on 4 March, 2013 WoW -1.3 0.7 MoM -6.0 -1.9 YoY -8.1 6.2

1574.3

-0.5

-0.8

-5.5

-7.8

$/oz

1572.1

-0.4

-0.9

-6.2

-8.7

Rs /10 gms

29668.0

-0.2

0.2

-2.1

Source: Reuters

Silver

Taking cues from fall in gold prices coupled with mixed trading in the base metals pack, Spot silver prices ended flat on Monday. Expectation among the market participants that major central banks will maintain the stimulus measures to spur growth, positive economic data from Spain and UK cushioned the downside pressure. Further, weakness in dollar also prevented downfall in prices. The white metal prices touched an intra-day low of $28.4/oz and closed at $28.6/oz in yesterdays trade. On the domestic front, prices gained by 0.2 percent as a result of depreciation in the Indian Rupee and closed at Rs. 53801/kg on Monday after touching an intra-day low of Rs. 53587/kg on Monday.

Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (May13) MCX Silver (May13) Unit $/oz Rs/1 kg Last 28.6 55600.0 Prev day 0.0 2.2

as on 4 March, 2013 WoW -1.6 0.4 MoM -10.0 -5.4 YoY -17.8 -6.0

$/oz $/ oz

2869.0 2845.7

2.4 0.0

-1.6 -2.7

-8.9 -10.7

-18.5 -15.4

Rs / kg

53801.0

0.2

-0.3

-7.9

Source: Reuters

Technical Chart Spot Gold

Outlook

In the intraday, we expect precious metals to trade on a positive note on the back of optimistic global market sentiments coupled with weakness in the DX. In the Indian markets, appreciation in the Indian Rupee will cap sharp rises in the prices on the MCX. Technical Outlook

Unit Spot Gold MCX Gold Apr13 Spot Silver MCX Silver May13 $/oz Rs/10 gms $/oz Rs/kg valid for March 05, 2013 Support 1573/1568 29590/29500 28.50/28.30 54500/54200 Resistance 1581/1587 29750/29850 28.80/29.0 55100/55400

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 5, 2013

International Commodities

Energy

Market Highlights - Crude Oil (% change)

as on 4 March, 2013 WoW -2.8 -4.0 -3.2 MoM -6.3 -5.2 -6.3 YoY -15.5 -12.9 -15.5

Crude Oil

Crude Oil Unit $/bbl $/bbl $/bbl Last 90.1 111.1 90.1

Nymex crude oil prices declined around 0.6 percent yesterday taking cues from decline in Chinas non-manufacturing data which led to expectations of slow demand growth in worlds second largest consumer for crude oil. However, sharp downside in the prices was cushioned on the back of weakness in the DX. Crude oil prices touched an intra-day low of $89.33/bbl and closed at $90.12/bbl in yesterdays trading session. On the domestic bourses, prices declined by 1.2 percent and closed at Rs.4,951/bbl after touching an intra-day low of Rs.4,943/bbl on Monday. Depreciation in the Indian Rupee prevented sharp fall in the prices on the MCX. API Inventories Forecast The American Petroleum Institute (API) is scheduled to release its weekly inventories today and US crude oil inventories are expected to rise by 0.7 million barrels for the week ending on 1st March 2013. Gasoline stocks are expected to decline by 1.3 million barrels and distillate inventories are expected to fall by 0.9 million barrels for the same week. Outlook In todays session, we expect crude oil prices to trade with positive bias due to upbeat global market sentiments along with weakness in the DX. However, sharp upside in the prices will be capped on the back of expectations of rise in US crude oil inventories from API. In the Indian markets, appreciation in the Rupee will prevent sharp gains in the prices on the MCX. Technical Outlook

Unit valid for March 05, 2013

WTI (Spot) Brent (Spot) Nymex Crude (April 13) ICE Brent Crude (March13) MCX Crude (Mar 13)

Prev. day -0.6 -0.2 -0.6

$/bbl

110.1

-0.3

-3.8

-4.8

-11.0

Rs/bbl

4951.0

-1.2

-2.0

-3.7

Source: Reuters

Market Highlights - Natural Gas (% change)

Natural Gas (NG) Nymex NG MCX NG (Mar 13) Unit $/mmbtu Rs/ mmbtu Last 3.535 195.6 Prev. day 2.26 1.77

as on 4 March, 2013

WoW 1.84 9.33

MoM 6.19 9.33

YoY 43.35 57.23

Source: Reuters

Technical Chart NYMEX Crude Oil

SSource: Telequote

Technical Chart NYMEX Natural Gas

Support

Resistance

NYMEX Crude Oil MCX Crude March 13

$/bbl

89.80/89.20

91.10/91.90

Rs/bbl

4920/4890

4990/5035

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 5, 2013

International Commodities

Base Metals

The base metals pack traded on a mixed note in yesterdays trading session on the back of decline in Chinas non-manufacturing PMI. Additionally, mixed LME inventories also added downside pressure on the prices. However, sharp downside in the prices was prevented as a result of upbeat global market sentiments along with weakness in the DX. In the Indian markets, depreciation in the Rupee cushioned sharp fall in the prices. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (April13) LME Aluminum (3 month) MCX Aluminum (Mar13) Rs /kg 107.8 0.1 0.1 -3.8 $/tonne 1976.0 0.1 -2.9 -6.6 -14.9 Rs/kg 430.3 0.0 1.9 -3.3 $/tonne Last 7740.3 Prev. day 0.3 as on 4 March, 2013 WoW -1.1 MoM -1.4 YoY -9.8

Copper

Copper, the leader of the base metal pack increased by 0.3 percent yesterday on account of upbeat global market sentiments coupled with weakness in the DX. However, sharp upside in the prices was capped as a result of rise in LME Copper inventories by 0.8 percent which stood at 462,400 tonnes. Further, decline in Chinas non-manufacturing PMI also restricted sharp gains in the prices. The red metal touched an intra-day high of $7,770/tonne and closed at $7,740.30/tonne in yesterdays trading session. On the domestic front, prices traded on a flat note and declined marginally by 0.01 percent after touching an intra-day low of Rs.427.30/kg and closed at Rs.430.30/kg on Monday. Depreciation in the Indian Rupee cushioned sharp fall in the prices on the MCX. Outlook In the intra-day, we expect base metals prices to trade on the positive side on account of expectation among the market participants that major central banks will maintain the stimulus measures to spur growth and optimistic global market sentiments. However, expectation of negative Services PMI from Spain, Italy and UK coupled with expectations of negative ISM-Non Manufacturing PMI from US may cap the sharp rally in the prices. Appreciation in the Indian Rupee will cap sharp gains in prices on the MCX. Technical Outlook

MCX Copper April13 MCX Zinc Mar 13 MCX Lead Mar 13 MCX Aluminum Mar13 MCX Nickel Mar 13 Unit Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for March 05, 2013 Support 428/425 109.3/108.5 121.5/120.5 107/106.3 905/898 Resistance 432/434 110.8/111.5 123/124.8 108.5/109.5 921/931

LME Nickel (3 month) MCX Nickel (Mar13) LME Lead (3 month) MCX Lead (Mar13) LME Zinc (3 month) MCX Zinc (Mar13)

$/tonne

16543.0

-0.6

-1.0

-11.3

-15.6

Rs /kg

913.3

-0.8

1.6

-8.0

$/tonne

2219.0

-1.7

-3.3

-9.5

1.3

Rs /kg

122.2

-1.7

-1.3

-6.5

$/tonne

2007.0

-1.0

-3.8

-7.9

-5.2

Rs /kg

110.0

-1.3

-2.1

-4.9

Source: Reuters

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 4th March 462,400 5,162,875 160,656 1,198,300 287,175 1st March 458,775 5,172,550 159,552 1,200,050 287,225 Actual Change 3,625 -9,675 1,104 -1,750 -50 (%) Change 0.8 -0.2 0.7 -0.1 0.0

Source: Reuters

Technical Chart LME Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 5, 2013

International Commodities

Important Events for Today

Indicator BRC Retail Sales Monitor y/y Average Cash Earnings y/y Halifax HPI m/m Spanish Services PMI Italian Services PMI ECOFIN Meetings Services PMI Retail Sales m/m ISM Non-Manufacturing PMI Country UK Japan UK Europe Europe Europe UK Europe US Time (IST) 5:31am 7:00am 5th-7th 1:45pm 2:15pm All Day 3:00pm 3:30pm 8:30pm Actual 2.7% 0.7% Forecast -0.3% 0.4% 47.8 43.6 51.5 0.3% 55.0 Previous 1.9% -1.7% -0.2% 47.0 43.9 51.5 -0.8% 55.2 Impact Medium Medium Medium Medium Medium Medium High Medium High

www.angelcommodities.com

Potrebbero piacerti anche

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 12 2013Documento6 pagineDaily Metals and Energy Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 13 2013Documento4 pagineCurrency Daily Report September 13 2013Angel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 12Documento2 pagineMetal and Energy Tech Report Sept 12Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 12 2013Documento2 pagineDaily Agri Tech Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 12 2013Documento4 pagineCurrency Daily Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Quiz Chapter 1 - AnswersDocumento21 pagineQuiz Chapter 1 - Answersbobbybobsmith12345Nessuna valutazione finora

- Digitalize Indonesia 2019 1 Siemens Smart InfrastructureDocumento7 pagineDigitalize Indonesia 2019 1 Siemens Smart InfrastructureronisusantoNessuna valutazione finora

- Mas Test Bank QuestionDocumento3 pagineMas Test Bank QuestionEricka CalaNessuna valutazione finora

- Final Internship ReportDocumento46 pagineFinal Internship ReportwaseemNessuna valutazione finora

- Topic 5 Seminar Management AccountingDocumento84 pagineTopic 5 Seminar Management Accountinglim qsNessuna valutazione finora

- W-W New Hire (MaAurelia Aguirre)Documento14 pagineW-W New Hire (MaAurelia Aguirre)beth aguirreNessuna valutazione finora

- IIMB Alumni Magzin Final - 16!05!2011Documento48 pagineIIMB Alumni Magzin Final - 16!05!2011Sridhar DPNessuna valutazione finora

- Urban Development Policies in Developing Countries: Bertrand RenaudDocumento13 pagineUrban Development Policies in Developing Countries: Bertrand RenaudShahin Kauser ZiaudeenNessuna valutazione finora

- Rural Marketing FMCG Product Hindustan Unilever Limited: Master of Business Administration (MBA) Session 2019-20Documento6 pagineRural Marketing FMCG Product Hindustan Unilever Limited: Master of Business Administration (MBA) Session 2019-20Amit SinghNessuna valutazione finora

- PGPEM Brochure 2017 v12Documento18 paginePGPEM Brochure 2017 v12srikar_scribdNessuna valutazione finora

- Chp12 MCDocumento10 pagineChp12 MCReddy FreddyNessuna valutazione finora

- Ed Ebreo - High Performance Team Leadership WorkshopDocumento5 pagineEd Ebreo - High Performance Team Leadership WorkshopEdwin EbreoNessuna valutazione finora

- Epzs, Eous, Tps and SezsDocumento23 pagineEpzs, Eous, Tps and Sezssachin patel100% (1)

- The Effect of Direct Marketing On The Consumers of Maharashtra A Consumer Survey of Metros in Maharashtra With Reference To Household Products Zeenat F.M.Khan - PDFDocumento340 pagineThe Effect of Direct Marketing On The Consumers of Maharashtra A Consumer Survey of Metros in Maharashtra With Reference To Household Products Zeenat F.M.Khan - PDFAbhishek jhaNessuna valutazione finora

- 2022 KOICA SP Fellows GuidebookDocumento34 pagine2022 KOICA SP Fellows Guidebookhamzah0303Nessuna valutazione finora

- TQM and QFDDocumento19 pagineTQM and QFDtashapa100% (1)

- Writing Business Proposals, Business Plan and Case ReportsDocumento47 pagineWriting Business Proposals, Business Plan and Case ReportsAbhishek Agarwal100% (2)

- Lesson 3:: Total Quality Management PrincipleDocumento17 pagineLesson 3:: Total Quality Management PrincipleJolina CabardoNessuna valutazione finora

- 1Documento2 pagine1Ana AnaNessuna valutazione finora

- Invoice Act May 2022Documento2 pagineInvoice Act May 2022Pavan kumarNessuna valutazione finora

- Factsheet Nifty High Beta50 PDFDocumento2 pagineFactsheet Nifty High Beta50 PDFRajeshNessuna valutazione finora

- Case Study On Insider TradingDocumento2 pagineCase Study On Insider TradingAyushi Singh100% (2)

- Ifgl Refractories: Executive SummaryDocumento14 pagineIfgl Refractories: Executive SummaryMitulsinh M RavaljiNessuna valutazione finora

- Monetary Policy and Central BankingDocumento45 pagineMonetary Policy and Central BankingAGONCILLO SOPIA NICOLENessuna valutazione finora

- MMT and Its CritiquesDocumento10 pagineMMT and Its CritiquestymoigneeNessuna valutazione finora

- 5-Deductions From Gross IncomeDocumento7 pagine5-Deductions From Gross IncomeMs. ANessuna valutazione finora

- Chinabank ThesisDocumento29 pagineChinabank ThesisApple Santos MabagosNessuna valutazione finora

- Mergers & Acquisitions: Master in Management - Investment BankingDocumento21 pagineMergers & Acquisitions: Master in Management - Investment Bankingisaure badreNessuna valutazione finora

- Internship Mid-Review ReportDocumento10 pagineInternship Mid-Review ReportRawoof ShahNessuna valutazione finora