Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

VVVVVVVVVVV

Caricato da

virenderjpTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

VVVVVVVVVVV

Caricato da

virenderjpCopyright:

Formati disponibili

WELCOME [ Log In </_Login?redirect=Cash-Management> ** Register </_Register> ] SITE [ Search <_Search?

p=1&c=1&a=1> ** Page Index <_Index> ** Recent Changes <_Recent> ] RSS </rss.xml> Encyclopedia of Credit Encyclopedia of Credit Free business credit resource from Credit Management Association * Home * About * Upcoming Educational Events <Educational-Events> * * * * * * * * * Home </Home> Bankruptcy and Bankruptcy Code </Bankruptcy> Business Entities </Business-Entities> Departmental Operations </Credit-Operations> Credit Practices </Credit-Practices> Fair Debt Collection Practices Act </Collection-Practices> Financial Analysis </Financial-Analysis> Financing Methods </Financing-Methods> International Credit and Collections </International-Credit> o Customs Regulations </Customs-Regulations> o Exporting and Importing </Exporting-and-Importing> o Financing International Sales </Financing-International-Sales> o International Banking </International-Banking> + Balance of Payments </Balance-of-Payments> + Cash Management + Correspondent Banks </Correspondent-Banking> + Foreign Exchange Rate Risk; Currency Risk; FX Related Risk </Currency-Risk> + Exchange Regulations </Exchange-Regulations> + Forward Contracts </Forward-Contracts> + Funded Exposures </Funded-Exposures> + Hedging Foreign Currency Related Risk; FX Risk; Foreign Exchange Rate Risk </Hedging-Foreign-Currency> + The U.S. Agency for International Development </International-Development-Cooperation-Agency-IDCA> + Spot Transaction; Spot FX Transaction; Foreign Exchange; Exchange Risk </Spot-Transaction> + Swap; Currency Swap; Foreign Exchange Swap; Forex </Swap> + Trust Receipt </Trust-Receipt> + The World Bank </World-Bank> o Letters of Credit </Letters-of-Credit> o The Three Cs of International Credit </3-Cs-of-International-Credit> o Denied Parties; Export Administration Regulations </Denied-Parties> o Letter of Credit Discrepancies </Discrepancies-with-Letters-of-Credit> o Ex-Im Bank </Ex-Im-Bank> o Export Credit vs International Credit </Export-Credit-vs-International-Credit> o Letter of Credit Instructions </Exporters-Tips> o Credit Insurance; and the Foreign Credit Insurance Association </FCIA> o The Foreign Corrupt Practices Act </Foreign-Corrupt-Practice-Act> o The Growth of International Credit </Future-of-International-Credit> o Credit Insurance; Trade Credit Insurance; Credit Risk Insurance; International Credit Insurance </Insurance-Commercial-Credit-Risk>

* * * * * * * * * * * *

o Export Credit Risk; International Commercial Risk, Export Trade Credit Risk </International-Commercial-Risk> o Forfeiting; International Financing </Forfeiting> o International Credit Policy; Open Account vs. Letter of Credit </International-Credit-Policy> o Foreign Financial Statement Analysis; IASB; International Accounting Standards Board </International-Financial-Statement-Analysis> o Marine Cargo Insurance; Cargo Insurance; Ocean Marine Insurance </Marine-Cargo-Insurance> o International Payment Terms; Methods of Payment for International Sales </Methods-of-Payment-for-International-Sales> o Political Risk Insurance; Export Credit Insurance </Political-Risk-Insurance> o Silent Confirmation </Silent-Confirmation> o Sovereign Risk; Political Risk; Country Risk </Sovereign-Risk> o Uniform Customs and Practice for Documentary Credits; UCP 600 </UCP-Uniform-Customs-and-Practice-for-Documentary-Credits> o Gathering Information about Foreign Credit Applicants </Gathering-Credit-Information-about-Foreign-Applicants> o International Open Account Terms </International-Open-Account-Terms> o Common Reasons for International Customer Payment Default </Common-Reasons-for-International-Customer-Payment-Default> o Analyzing Foreign Financial Statements </Interpreting-Foreign-Financial-Statements> o Role and Goals of the Ex-im Bank </Goals-of-the-Exim-Bank> Laws and Regulations </Laws-and-Regulations> Payment Methods </Payment-Methods> Security Instruments </Security-Instruments> Career Management, and Job Change </Career-Management> Credit Website Tools </Credit-Tools> Upcoming Educational Events </Educational-Events> Credit and Collections Tools and Tips </Tem-Tips-for-Accelerating-Debt-Collection> Tips on Creating Better Emails </Tips-on-Creating-Better-Emails> Generating Effective Correspondence </Generating-Effective-Correspondence> Exporting </Exporting> Accounting </Accounting> New Years Resolutions </New-Years-Resolutions>

Cash Management Managing cash is an integral part of a company's overall operations. Cash is required to sustain the operating cycle, and cash managers ensure that a company's operating cycle is adequately financed. Therefore, the objectives of cash management are closely related to the management of the operating cycle. *Objectives* The primary objective of cash management is to utilize cash as efficiently as possible in a manner consistent with a company's overall strategic objectives. Major objectives of cash management include: 1.*Maintaining Liquidity* - Liquidity refers to a company's ability to meet upcoming obligations in a timely and cost effective manner. 2. *Optimizing Cash Resources *- Cash managers establish systems that

reduce holdings of non-earning cash balances to minimum levels while still providing adequate liquidity. Any excess cash balances are either invested to generate additional income or used to reduce interest expense through the repayment of debt. 3.*Financing *- Cash managers assist in obtaining both short- and long-term borrowed funds in a timely manner and at an acceptable cost. These credit facilities are used to fund a company's cash shortages. 4. *Managing Risk* - Cash managers help in the monitoring and controlling of a company's exposure to interest rate, foreign exchange, and other risks. 5. *Coordinating Financial Functions* - Cash managers help ensure that managers in other areas of the company understand and implement policies that are consistent with cash management objectives. *Roles of Cash Managers:* *Funds Management* * Monitoring the daily cash position * Controlling cash balances on deposit at financial institutions * Moving funds from concentration accounts or other accounts to where they are needed *Banking System Administration* * Managing bank relationships, including compensation for banking services * Conducting analytical reviews and feasibility studies of banking services *Liquidity Management* * Short-term borrowing * Short-term investing *Forecasting* * Projecting future cash shortages and surpluses * Monitoring the accuracy of prior projections *Systems Design, Implementation, and Evaluation* * Analysis, design, and implementation of cash management systems * Ongoing evaluation of cash management systems *Reporting Relationships* In most companies, the cash manager reports directly or indirectly to the treasurer who, in turn, reports to the CFO. In a small company, the cash manager's job may be a responsibility of the treasurer or assistant treasurer, but in a large company a staff of several people may be devoted to cash management activities. *Coordination with Other Internal Functions* Cash management requires teamwork and cooperation with other internal departments of a company. The activities of other departments, such as credit management and accounts payable, have a direct impact on the cash

management function. Often these departments report to managers outside the treasury area, such as the controller. Therefore, the cash manager must often interact with these departments and assert informal influence to ensure that overall cash management objectives are met. /Source: Essentials of Cash Management, Sixth Edition, a publication of the Treasury Management Association/ Credit Management Association <http://www.creditmanagementassociation.org> a not-for-profit association that supports business credit management. Copyright 2011 Credit Management Association <http://nacmwrcc.com/>

Potrebbero piacerti anche

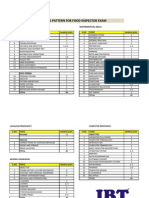

- 5960expected Food Inspector Exam PatternDocumento2 pagine5960expected Food Inspector Exam PatternvirenderjpNessuna valutazione finora

- Impact Surrogate AdsDocumento2 pagineImpact Surrogate AdsvirenderjpNessuna valutazione finora

- Sach DevaDocumento3 pagineSach DevavirenderjpNessuna valutazione finora

- What Is The WTO?: Fact FileDocumento1 paginaWhat Is The WTO?: Fact FilevirenderjpNessuna valutazione finora

- EthicsDocumento9 pagineEthicsvirenderjpNessuna valutazione finora

- Tarun FinalDocumento3 pagineTarun FinalvirenderjpNessuna valutazione finora

- Gorv QuestionDocumento3 pagineGorv QuestionvirenderjpNessuna valutazione finora

- ExcelDocumento4 pagineExcelvirenderjpNessuna valutazione finora

- WtoDocumento6 pagineWtovirenderjpNessuna valutazione finora

- What Is The WTO?: Fact FileDocumento1 paginaWhat Is The WTO?: Fact FilevirenderjpNessuna valutazione finora

- Questionnaire: As A Part of My Research I Have Designed A Questionnaire On The Topic "To StudyDocumento2 pagineQuestionnaire: As A Part of My Research I Have Designed A Questionnaire On The Topic "To StudyvirenderjpNessuna valutazione finora

- Introduction of MarketingDocumento18 pagineIntroduction of MarketingvirenderjpNessuna valutazione finora

- HeartDocumento2 pagineHeartvirenderjpNessuna valutazione finora

- Life Insurance Companies In India History & Future TrendsDocumento18 pagineLife Insurance Companies In India History & Future TrendsvirenderjpNessuna valutazione finora

- Punjabi Sad Shayari ImageDocumento2 paginePunjabi Sad Shayari ImagevirenderjpNessuna valutazione finora

- Surrogate AdvertisingDocumento7 pagineSurrogate AdvertisingSri RamNessuna valutazione finora

- Helicopter ScamDocumento6 pagineHelicopter ScamvirenderjpNessuna valutazione finora

- HeartDocumento2 pagineHeartvirenderjpNessuna valutazione finora

- Study On Brand Switching in Consumer ProductsDocumento66 pagineStudy On Brand Switching in Consumer Productsjoshmathus100% (7)

- 1223334444Documento2 pagine1223334444virenderjpNessuna valutazione finora

- JPJP 1Documento11 pagineJPJP 1virenderjpNessuna valutazione finora

- F FFF FFFFFFFFDocumento9 pagineF FFF FFFFFFFFvirenderjpNessuna valutazione finora

- Surrogate AdvertisingDocumento7 pagineSurrogate AdvertisingSri RamNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Ethnic Conflicts and PeacekeepingDocumento2 pagineEthnic Conflicts and PeacekeepingAmna KhanNessuna valutazione finora

- P.E 4 Midterm Exam 2 9Documento5 pagineP.E 4 Midterm Exam 2 9Xena IngalNessuna valutazione finora

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDocumento43 pagineLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesNessuna valutazione finora

- Ultramat 2 instructions for useDocumento2 pagineUltramat 2 instructions for useBalaji BalasubramanianNessuna valutazione finora

- IndiGo flight booking from Ahmedabad to DurgaPurDocumento2 pagineIndiGo flight booking from Ahmedabad to DurgaPurVikram RajpurohitNessuna valutazione finora

- Offer Letter for Tele Sales ExecutiveDocumento3 pagineOffer Letter for Tele Sales Executivemamatha vemulaNessuna valutazione finora

- Developments in ESP: A Multi-Disciplinary ApproachDocumento12 pagineDevelopments in ESP: A Multi-Disciplinary ApproachDragana Lorelai JankovicNessuna valutazione finora

- Battery Genset Usage 06-08pelj0910Documento4 pagineBattery Genset Usage 06-08pelj0910b400013Nessuna valutazione finora

- The Awesome Life Force 1984Documento8 pagineThe Awesome Life Force 1984Roman PetersonNessuna valutazione finora

- Write a composition on tax evasionDocumento7 pagineWrite a composition on tax evasionLii JaaNessuna valutazione finora

- Module 6: 4M'S of Production and Business ModelDocumento43 pagineModule 6: 4M'S of Production and Business ModelSou MeiNessuna valutazione finora

- Sigma Chi Foundation - 2016 Annual ReportDocumento35 pagineSigma Chi Foundation - 2016 Annual ReportWes HoltsclawNessuna valutazione finora

- 110 TOP Survey Interview QuestionsDocumento18 pagine110 TOP Survey Interview QuestionsImmu100% (1)

- 2013 Gerber CatalogDocumento84 pagine2013 Gerber CatalogMario LopezNessuna valutazione finora

- An Analysis of Students Pronounciation Errors Made by Ninth Grade of Junior High School 1 TengaranDocumento22 pagineAn Analysis of Students Pronounciation Errors Made by Ninth Grade of Junior High School 1 TengaranOcta WibawaNessuna valutazione finora

- 11th AccountancyDocumento13 pagine11th AccountancyNarendar KumarNessuna valutazione finora

- The Wild PartyDocumento3 pagineThe Wild PartyMeganMcArthurNessuna valutazione finora

- Professional Ethics AssignmentDocumento12 pagineProfessional Ethics AssignmentNOBINNessuna valutazione finora

- ILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTDocumento54 pagineILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTCherry Lyn Belgira60% (5)

- Lesson 2 Globalization of World EconomicsDocumento17 pagineLesson 2 Globalization of World EconomicsKent Aron Lazona Doromal57% (7)

- Developing An Instructional Plan in ArtDocumento12 pagineDeveloping An Instructional Plan in ArtEunice FernandezNessuna valutazione finora

- Tutorial 3 Ans Tutorial 3 AnsDocumento3 pagineTutorial 3 Ans Tutorial 3 AnsShoppers CartNessuna valutazione finora

- Digi-Notes-Maths - Number-System-14-04-2017 PDFDocumento9 pagineDigi-Notes-Maths - Number-System-14-04-2017 PDFMayank kumarNessuna valutazione finora

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDocumento3 pagineNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomNessuna valutazione finora

- Sample Letter of Intent To PurchaseDocumento2 pagineSample Letter of Intent To PurchaseChairmanNessuna valutazione finora

- Tong RBD3 SheetDocumento4 pagineTong RBD3 SheetAshish GiriNessuna valutazione finora

- National Family Welfare ProgramDocumento24 pagineNational Family Welfare Programminnu100% (1)

- Compro Russindo Group Tahun 2018 UpdateDocumento44 pagineCompro Russindo Group Tahun 2018 UpdateElyza Farah FadhillahNessuna valutazione finora

- The Insanity DefenseDocumento3 pagineThe Insanity DefenseDr. Celeste Fabrie100% (2)

- 12 Preliminary Conference BriefDocumento7 pagine12 Preliminary Conference Briefkaizen shinichiNessuna valutazione finora