Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lindberg Phil. vs. City of Makati

Caricato da

xx_stripped520 valutazioniIl 0% ha trovato utile questo documento (0 voti)

194 visualizzazioni15 pagineLindberg Phil. vs. City of Makati

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoLindberg Phil. vs. City of Makati

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

194 visualizzazioni15 pagineLindberg Phil. vs. City of Makati

Caricato da

xx_stripped52Lindberg Phil. vs. City of Makati

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

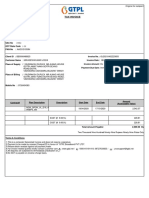

REPUBLIC IF THE PHILIPPINES

Court at Tax Appeals

QUUINCITY

LINBERG PHILIPPINES, INC.,

Petitioner,

-versus-

CITY OF MAKATI and NELIA A.

BARLIS, in her capacity as the

TREASURER OF THE CITY OF

MAKATI,

Respondents.

1/IBA/IC

C.T.A. E.B. NO. 349

(C.T.A. AC NO. 19)

Present:

ACOSTA, P.J.

CASTANEDA, JR.,

BAUTISTA,

UY,

CASANOVA, and

PALANCA-ENRIQUEZ, JJ.

Promulgated:

>

NOv 1 1 200a

X- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -X

DECISION

UY, J.:

Petitioner seeks a review of the Decision dated June 28, 2007 and

Resolution dated November 28, 2007, both rendered by the First Division of

this Court

1

(Court in Division) in C.T.A. AC Case No. 19 entitled "Linberg

Philippines, Inc., petitioner, vs. City of Makati and Nelia A. Barlis,

respondents", pursuant to Section 18 of Republic Act No. 1125, as amended

by Republic Act No. 9282. The dispositive portions thereof read as follows:

1

Ponencia of Presiding Justice Ernesto D. Acosta, concurred by Associate Justice Lovell R. Bautista _v\

and Associate Justice Caesar A. Casanova. rr

DECISION

C.T.A. EB NO. 349

Page 2 of 15

Decision promulgated on June 28, 2007:

"In view of the foregoing, the Petition for Review is

PARTIALLY GRANTED and the tax due against petitioner is

hereby reduced to the amount of Nine Hundred Ninety Three

Thousand Nine Hundred One Pesos 29/100 (P993,901.29),

representing unpaid deficiency tax as contractor for the years,

2000, 2001, 2002, including surcharges and interest provided

under Section 168 of the Local Government Code computed as

follows:

2000 2001 2002 Totals

Total Service

Revenue 212,738,652.00 300,844,703.00 364,410,627.00 877,993,982.00

Allocation 30% 30% 30% 30%

Taxable Base 63,821,595.60 90,253,410.90 109,323,188.10 263,398,194.60

Tax Due

P50m 299,500.00 299,500.00 299,500.00 898,500.00

Over P50m x

75% of 1% 103,661 .97 301 ,900.58 444,923.91 850,486.46

Total Tax Due 403,1 61 .97 601,400.58 744,423.91 1,748,986.46

Less: Tax Payment 348,523.36 451 ,267.Q7 486,916.36 1,286,706.79

Tax Deficiency 54,638.61 150,133.51 257,507.55 462,279.67

Add:

Surcharge (25%) 13,659.65 37,533.38 64,376.89 115,569.92

Total 68,298.26 187,666.89 321,884.44 577,849.59

Add:

Interest

(2% for 36 mos.) 49,174.75 135,120.16 231 ,756.80 416,051 .70

Total Tax

Deficiency 117,473.01 322,787.05 553,641.23 993,901 .29

=========== =========== =========== ===========

SO ORDERED."

2

Resolution promulgated on November 28, 2007:

"WHEREFORE, the Motion for Reconsideration is hereby

DENIED for lack of merit.

SO ORDERED."

3

THE FACTS

The facts, as found by the Court in Division, are undisputed.

2

Docket, pp. 41-59.

3

Docket, pp. 60-62.

DECISION

C.T.A. EB NO. 349

Page 3 of 15

Petitioner is a duly organized corporation, existing under Philippine

laws, with principal office at Suite 20-D, Rufino Pacific Tower, corner Herrera

Street, Ayala Avenue, Makati City. It is engaged in the business of financing

the construction and operation of power plants primarily through "Build-

Operate-Transfer" (BOT) agreements with its customers.

Respondent City of Makati is a public corporation created and existing

pursuant to law. It may be served with notices and other court processes

through the Office of the City Mayor at the Makati City Hall , City of Makati ,

Metro Manila. Co-respondent Nel ia A. Barlis is the incumbent Treasurer of

the City of Makati and is impleaded in her official capacity. She may be

served with notices and other processes of this Honorable Court through the

Office of the City Treasurer, Makati City Hall , City of Makati , Metro Manila.

On March 7, 2003, petitioner received the questioned Notice of

Assessment

4

for deficiency business taxes plus surcharges and interests

covering the taxable years 2000, 2001 and 2002 in the aggregate amount of

Php8,714,744.53. The alleged deficiency business taxes arose from

respondent's reclassification of petitioner's business from a "holding or

investment" company to a "contractor" . Not in agreement with the questioned

assessment, petitioner on May 6, 2003 filed a Letter Protest dated May 5,

2003,

5

but this was denied by respondent City Treasurer in a Letter dated

May 19, 2003

6

, and received by petitioner on June 4, 2003.

On July 3, 2003, petitioner assailed the denial of the protest before the

Regional Trial Court (RTC) of Makati City docketed as Civil Case No. 03-754

4

Annex "C", Petition for Review; Docket; p. 63.

5

Annex "E", Petition for Review; Docket; pp. 65-71.

6

Annex "F", Petition for Review; Docket, pp. 72-73.

DECISION

C.T.A. EB NO. 349

Page 4 of 15

entitled Linberg Philippines, Inc. v. City of Makati and Luz R. Yamane, in her

capacity as the Treasurer of Makati by way of "Appeal with prayer for

Prohibition and Preliminary lnjunction"

7

pursuant to Section 195 of the Local

Government Code.

In a Decision dated August 30, 2005, said case was dismissed for lack

of merit. The Motion for Reconsideration of said Decision was likewise denied

on October 28, 2005.

8

Dissatisfied, petitioner appealed the said denial before

this Court on December 19, 2005, docketed as C.T.A. AC No. 19.

9

On June 28, 2007,

10

the Court in Division rendered the subject assailed

Decision partially granting the petition and reducing the deficiency taxes of

petitioner. Thereafter, a Motion for Reconsideration of the aforesaid Decision

was filed by petitioner on July 24, 2007, but the same was denied in the

assailed Resolution dated November 28, 2007 of the Court in Division.

11

Hence, this recourse before the Court En Bane praying that: (a) the

assailed Decision and Resolution dated June 28, 2007 and November 28,

2007, respectively, be reconsidered; (b) petitioner be declared as not liable to

pay alleged deficiency business tax plus surcharge and interest in the amount

of Nine Hundred Ninety Three Thousand Nine Hundred One and 29/100

Pesos (Php993,901 .29) for the years 2000, 2001 and 2002; (c) respondents

City of Makati and City Treasurer be enjoined from further collecting business

taxes from petitioner; (d) the outstanding Notice of Assessment be withdrawn

and cancelled; and (e) in the alternative, if the Assessment is not cancelled,

7

Annex "G", Petition for Review; Docket, p. 74.

8

Annex "C", Petition for Review, Docket, p. 150.

9

Annex "N", Petition for Review; Docket, pp. 15 1-184.

10

Annex "A", Petition for Review, Docket pp. 41-59.

11

Annex "B", Petition for Review; Docket, pp. 60-62.

DECISION

C.T.A. EB NO. 349

Page 5 of 15

the City Treasurer be ordered to deduct the uncollected sales from the tax

base for the years 2000, 2001 and 2002 upon presentation of proof by

petitioner.

Respondents filed their Comment to the instant petition on February

29, 2008

12

and this case was deemed submitted for decision in the Resolution

dated March 24, 2008.

13

Hence, this Decision.

THE ISSUES

Petitioner raises the following grounds in support of the instant petition

for the Court En Bane' s consideration:

A Respondent Makati City does not have jurisdiction to tax petitioner;

B. It is not legally incumbent upon petitioner to show that it had paid

business taxes in the different localities where its branch offices are

located;

C. Uncollected sales should be deducted from the tax base;

D. Petitioner is not a contractor;

E. Petitioner acted in good faith in representing itself to be a

financing/holding company.

Based on the foregoing grounds, the sole issue for the Court En

Bane's resolution is whether or not the Court in Division committed errors of

12

Docket, pp. 565-574.

13

Docket, p. 576.

DECISION

C.T.A. EB NO. 349

Page 6 of 15

fact or law that would warrant a reversal or modification of its assailed

Decision and Resolution.

14

Petitioner's Arguments

Petitioner submits that upholding the taxing jurisdiction of respondent

Makati City on thirty percent (30%) of sales made in the locality where

petitioner has a branch office is contrary to the situs rules under Section 150

of the Local Government Code and Article 243 of its Implementing Rules and

Regulations (IRR) . The Court in Division allegedly assumed that petitioner

and its customers negotiated and planned the construction of the power

plants in Makati City, and that its sales are recorded in Makati City because

its sales invoices are reviewed and approved in its principal office in Makati.

However, petitioner contends that these are merely assumptions that are not

supported by evidence. If petitioner is classified as a contractor, as

respondent Makati City maintains, all if not substantially all , of the controlling

or operative acts that constitute petitioner's sale of services, must be done in

Makati City.

Further, petitioner argues that Section 150 of the Local Government

Code and Article 243 of the IRR of said Code clearly provide that if a sale

made in a locality where the taxpayer maintains a branch or sales office, the

tax thereon shall accrue and be paid to the city or municipality where such

branch or sales office is located. It is only in a case when there is no branch

office in the locality where the sale transaction is made, that the sale shall

allegedly be duly recorded in the principal office, and the taxes due thereon

14

Section 10 of Rule 43 of the 1997 Rules of Civil Procedure, in relation with Section 4(b) of the

""'"'d Ru\" of tho Court of Ta> Appool. ~

DECISION

C.T.A. EB NO. 349

Page 7 of 15

shall be allocated between the principal office and the factory, project office,

plant or plantation using the 30-70 formula prescribed in Section 150.

Petitioner stresses that it is not a contractor because it does not

perform services to its customers for a fee, as it merely finances the

construction of the power plants for its customers through BOT arrangements.

Petitioner's business cannot allegedly be described as essentially the sale of

services, but is more of a business of a financing company. Contrary to the

conclusions by the Court in Division, petitioner points out that it is of no

consequence that it causes the construction, and/or manages/operates the

power plants, because the fact remains that it advances the necessary capital

for the construction of the power plant, and transfers the ownership thereof,

after the agreed BOT period, to its customer in exchange for a nominal fee, in

some instances, even without the payment of any fee; and that transfer of

ownership, undoubtedly proves that it merely finances the purchase of the

power plant by its customer, and that it does not sell services for a fee.

Respondents' Counter-arguments

Respondents counter-argue that the existence of petitioner's principal

office in Makati City, and the admission thereof, constitutes prima facie

evidence that it is conducting business in said territorial jurisdiction, and

therefore, respondent Makati City has jurisdiction to tax petitioner. Although

petitioner has been insistent, contradicting itself at times, that it has not been

doing business in Makati City but only in its branch offices, it is necessarily

obligated to prove its claim that indeed, the offices maintained outside the

City of Makati are branch offices as defined by law, and that, it has been

DECISION

C.T.A. EB NO. 349

Page 8 of 15

paying its due taxes thereat, otherwise, such bare and naked argument,

allegedly stays as it is, bare and naked.

According to respondents, uncollected sales should be deducted from

the tax base; that the Court in Division noted the definition of gross sales or

receipts, which specifically mention that exclusions from the computation only

enumerate the following: discounts, if determinable at the time of sales, sales

return, excise tax and VAT. Uncollected sales is not allegedly included in the

said definition, hence, it could not be deducted from the tax base.

Petitioner's nature of business allegedly falls squarely under the

definition of a "contractor" under Sections 3A.01 (q) and 3A.02(f) of the Makati

Revenue Code,

15

as well as, under Section 131 of the Local Government

Code. Furthermore, the documents presented by petitioner, such as its

Amended Articles of Incorporation, Statements of Income and Returned

Earnings for the Years ended December 31 , 1999 and 1998, Statements of

Cash Flows for the years ended December 31 , 1999 and 1998 and Notes to

Financial Statements, show that it is engaged in the sale of services and it

serves as an independent contractor.

Lastly, respondents maintain that petitioner was never in good faith in

representing itself to be a financing/holding company, and that the Court in

Division aptly declared that petitioner cannot rightfully claim good faith having

made the representation itself as a holding company during the initial

application of its business permit; and that for its willful neglect to file a correct

return for the proper evaluation of the taxing authority, the taxpayer should

pay a deficiency tax, and if payment has been made before the discovery, a

15

Referring to Municipal Ordi nance No. 072-92, otherwise known as the Makati Revenue Code.

DECISION

C.T.A. EB NO. 349

Page 9 of 15

surcharge of the amount of such tax is proper to be collected.

THE COURT EN BANG'S RULING

Petitioner's arguments are devoid of merit.

A careful and closer look at the arguments set forth by petitioner in the

instant petition for review would readily reveal that the grounds relied upon

and the matters raised herein, are mere restatements of petitioner's previous

arguments raised before the Court in Division, which had already been

exhaustively discussed and passed upon by it in the assailed Decision and

Resolution.

At the outset, petitioner questions the jurisdiction of respondent City of

Makati to tax its business. The Court in Division settled this issue by

pronouncing that the City of Makati, where petitioner's principal office is

found, has the power to tax its business, but as much as only thirty (30%)

percent of petitioner's gross sales/receipts.

We note that aside from petitioner's admission that its principal office is

in Makati City,

16

the Court in Division found that its principal office is in charge

of reviewing and approving the correctness of the invoices issued by the

branch offices. Such activities done in the principal office is evident of

business transactions which should necessarily be recorded. This, petitioner

failed to refute as it did not adduce evidence to prove that there are no

recorded sales or business transactions in its office in Makati City, and its

alleged payments of its business taxes to the municipalities where it has its

branch offices were also not proven.

16

Paragraph 2.1, Petition for Review, p. 3, Docket, p. I 0.

DECISION

C.T.A. EB NO. 349

Page 10 of 15

It bears emphasizing that petitioner cannot merely deny the fact that it

is covered by the taxing jurisdiction of Makati City without adducing evidence

to prove otherwise. Even if it raised mere questions of law in its petition,

petitioner should have strengthened its claim by credibly presenting all its

evidence at the trial court level in order to secure a favorable resolution of the

questions that were raised in its petition.

Petitioner's business involves financing the construction and operation

of private power plants through a Built-Operate-Transfer (BOT) arrangements

with its customers. Admittedly, under the BOT arrangement, petitioner

advances the necessary capital by employing and paying for the services of a

contractor which will build the power plant. These transactions, prior to the

completion of the power plants and branch offices of petitioner, are

considered as activities of doing business, which are necessarily taxable in its

principal office, considering that all the documents and deals were arranged

in its principal office in Makati City.

In this regard, petitioner is correct in invoking the applicability of

Section 150 of the Local Government Code for purposes of determining the

situs of tax in the instant case. However, We would like to stress the

importance of the relevant portion of said provision, to wit:

"Section 150. Situs of the Tax.-(a) xxx. In cases where

there is no such branch or sales outlet in the city or municipality

where the sale or transaction is made, the sale shall be duly

recorded in the principal office and the taxes due shall accrue

and shall be paid to such city or municipality."

We reiterate that in the ordinary course of business, particularly in the

nature of a BOT business, prior to the building and construction of any powet

DECISION

C.T.A. EB NO. 349

Page II of 15

plant at any locality, the usual negotiations thereon, until the full completion of

the contract of BOT, is usually done in the principal office. Naturally, this

transaction is taxable as it is an exercise of a business. Although the power

plants, which are subject of petitioner's contract of BOT, are situated at

different localities, still the act of financing the construction and operation

thereof, are considered as "doing business" which appears to have been

performed at petitioner's principal office in Makati City. It is therefore clear

that respondent City of Makati has jurisdiction to tax petitioner.

Moving on to the issue regarding the uncollected sales as part of the

tax base, We agree with the Court in Division that such amount should be

deducted from the tax base. However, as found by the Court in Division,

petitioner failed to prove which part of the tax base was uncollected and which

part should be deducted. As petitioner was remiss in presenting sufficient

evidence to establish its case during trial , it cannot be made to correct its

negligence before the Court En Bane, as it should have been watchful of the

proceedings at the trial court, much more, of the outcome of the same.

Anent the nature of petitioner's business, We maintain that petitioner is

a contractor, and not a financing or holding company. Contractor is referred

to in the Local Government Code of 1991 as to include persons, natural or

juridical, not subject to professional tax under Section 139 of this Code whose

activity consists essentially of the sale of all kinds of services for a fee

regardless of whether or not the performance of the service calls for the

exercise or use of the physical or mental faculties of such contractor or his

DECISION

C.T.A. EB NO. 349

Page 12 of 15

employees.

17

The same definition is likewise provided now under Section

3A.01 (t) of the Revised Makati Revenue Code.

18

In other words, the term "contractor" includes any person whether

natural or juridical as long as the activity of such person consists essentially of

the sale of services for a fee. In the case at bench, petitioner is definitely

engaged in such sale of services.

In addition, the fact that petitioner is a contractor, and not a financing or

holding company, is further bolstered by petitioner's Amended Articles of

Incorporation which provides, that petitioner's primary purpose is "[t]o carry on

the business of managing and operating power plants, including, but not

limited to, the acquisition by purchase, exchange, assignment, importation or

otherwise, and to sell, assign, transfer, exchange, mortgage, pledge, traffic or

otherwise to enjoy and dispose of machineries, equipment and buildings, and

generally perform, preserve, improve or enhance the value of any such

machineries, equipment and buildings to the extent permitted by law" .

19

Based on the aforementioned primary purpose of petitioner, it is readily

apparent that the business it is supposed to carry on, fall within the ambit of

performing some form or kind of service.

Moreover, as found by the Court in Division, the nature of petitioner's

operations as described in its financial statements, can be categorized as a

contractor based on the Makati Revenue Code, the provisions of which are

17

Section 13 l (h) of the Local Government Code of 1991.

18

City Ordinance No. 2004-A-025, otherwise known as "An Ordinance Adopti ng The Revised Makati

Revenue Code" [formerly under Section 3A.Ol(q) of Municipal Ordinance No. 072-92, otherwise

known as the Makati Revenue Code].

19

Assailed Decision, p. 10 (adopting the factual findings of the Regional Trial Court of Makati City in

Civi l Case No. 03-754, entitled "Lindberg Philippines, Inc. vs. The City of Makati and Luz R. Yamane,

io hoc oop.oity " tho T""""" of Mok"i"); Dookot, p. 50. ~

DECISION

C.T.A. EB NO. 349

Page 13 of 15

applicable to petitioner. Further, it is worth pointing out that even in the case

of Tatad vs. Garcia

20

cited by petitioner, it was expressly mentioned therein

that under the BOT arrangement (which petitioner is engaged in) , there is not

only the financing of the project that is involved, but also the construction,

maintenance and operation thereof. Thus, petitioner is undeniably not only

engaged in financing or investment activities, but also in the sale of services

which readily classifies it as a contractor.

Finally, on the issue regarding the imposition of surcharge and

penalties, We find that the same to be in accordance with law.

Section 168 of the Local Government Code of 1991 , categorically

provides:

"SEC. 168. Surcharges and Penalties on Unpaid Taxes,

Fees, or Charges. - The sanggunian may impose a surcharge

not exceeding twenty-five percent (25%) of the amount of taxes,

fees or charges not paid on time and an interest at the rate not

exceeding two percent (2%) per month of the unpaid taxes, fees

or charges including surcharges, until such amount is fully paid

but in no case shall the total interest on the unpaid amount or

portion thereof exceed thirty-six (36) months."

Clearly, under the authority granted in the foregoing provision,

respondent City of Makati can impose surcharges for late payments of and

interests on unpaid taxes, and penalties thereto, as provided in Sections

38.04, 38.05, and 38.06, respectively, of City Ordinance No. 2004-A-025

otherwise known as the Revised Makati Revenue Code (formerly under

Sections 3A.09 and 3A.1 0 of the Makati Revenue Code

21

) .

I

20

243 SCRA 436.

21

Municipal Ordinance No. 072-92.

DECISION

C.T.A. EB NO. 349

Page 14 of 15

Consequently, upon discovery by the local government that petitioner

misrepresented itself and caused a different tax rate to be applied to it, there

is legal basis to impose surcharge and penalties.

Even granting for the sake of argument that it was respondent who

classified petitioner as a holding or investment company, still , it was petitioner

who submitted certain documents which misled or caused respondent to

believe that petitioner was engaged in an investment business. Petitioner's

failure to cause the correction of such classification is a sign of bad faith on its

part because such classification appears to be more beneficial to it with

regard to tax liabilities.

In the light of the foregoing discussions, the Court En Bane finds no

reversible error committed by the Court in Division that would merit a reversal

of its assailed Decision and Resolution dated June 28, 2007 and November

28, 2007, respectively.

WHEREFORE, premises considered, the instant petition is hereby

DENIED DUE COURSE, and, accordingly, DISMISSED for lack of merit.

SO ORDERED.

Asso ustice

WE CONCUR:

ERNESTO D. ACOSTA

Q .

JtrANiro c. cAsTANEDA, SR.

Associate Justice

DECISION

C.T.A. EB NO. 349

Page 15 of 15

CAESAR A. CASANOVA

Associate Justice

~ ~ E Z

Associate Justice

CERTIFICATION

Pursuant to Section 13, Article VIII of the Constitution, it is hereby

certified that the conclusions in the above decision were reached in

consultation before the case was assigned to the writer of the opinion of the

Court En Bane.

((-= \..- . Q '-VL_

ERNESTO D. ACOSTA

Presiding Justice

Potrebbero piacerti anche

- Revenue Memorandum Circular No 48-90Documento2 pagineRevenue Memorandum Circular No 48-90UGHNESSNessuna valutazione finora

- Atty Ligon Tx2Documento92 pagineAtty Ligon Tx2karlNessuna valutazione finora

- Ateneo Central Bar Operations 2007 Remedial Law Summer ReviewerDocumento74 pagineAteneo Central Bar Operations 2007 Remedial Law Summer Reviewertere_aquinoluna828Nessuna valutazione finora

- Kepco v. CIRDocumento4 pagineKepco v. CIRWhere Did Macky GallegoNessuna valutazione finora

- SOL Digests (Compiled)Documento43 pagineSOL Digests (Compiled)melaniem_1Nessuna valutazione finora

- Punsalan Vs Municipal Board of ManilaDocumento3 paginePunsalan Vs Municipal Board of ManilaGayFleur Cabatit RamosNessuna valutazione finora

- Warsaw and Montreal Convention FinalDocumento17 pagineWarsaw and Montreal Convention FinalCE SherNessuna valutazione finora

- 115 Bradford V CIR (1956) SubidoDocumento2 pagine115 Bradford V CIR (1956) SubidoFrancis Kyle Cagalingan SubidoNessuna valutazione finora

- Torts CasesDocumento480 pagineTorts CasespaescorpisoNessuna valutazione finora

- CBK Power V CIRDocumento6 pagineCBK Power V CIRJenny LoNessuna valutazione finora

- Merc Digest PoolDocumento83 pagineMerc Digest PoolJoey MapaNessuna valutazione finora

- TAX 1 ExamDocumento3 pagineTAX 1 ExamOnat PNessuna valutazione finora

- 66 CIR Vs LednickyDocumento9 pagine66 CIR Vs LednickyYaz CarlomanNessuna valutazione finora

- Tax CasesDocumento65 pagineTax CasesMaria BethNessuna valutazione finora

- Tax 2 Syllabus - DDL - 2019 PartA 11jan2019Documento7 pagineTax 2 Syllabus - DDL - 2019 PartA 11jan2019ebernardo19Nessuna valutazione finora

- Jose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Documento2 pagineJose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Iris Mikaela P. RamosNessuna valutazione finora

- Cta Eb CV 01590 D 2017dec18 AssDocumento25 pagineCta Eb CV 01590 D 2017dec18 AssaudreydqlNessuna valutazione finora

- Jardine Davies Inc vs. JRB Realty Inc. 463 SCRA 555Documento6 pagineJardine Davies Inc vs. JRB Realty Inc. 463 SCRA 555morningmindsetNessuna valutazione finora

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocumento11 pagine35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNessuna valutazione finora

- Daywalt vs. La Corporacion de Los Padres Agustinos RecoletosDocumento9 pagineDaywalt vs. La Corporacion de Los Padres Agustinos Recoletosbingkydoodle1012Nessuna valutazione finora

- Lim SR Vs CADocumento15 pagineLim SR Vs CAPia Christine BungubungNessuna valutazione finora

- Eternal Gardens Memorial Park Corporation Petitioner Versus The Philippine American Life Insurance Company Respondent DigestDocumento12 pagineEternal Gardens Memorial Park Corporation Petitioner Versus The Philippine American Life Insurance Company Respondent Digestemmaniago08Nessuna valutazione finora

- Tax Case DigestDocumento11 pagineTax Case DigestPrincess Caroline Nichole IbarraNessuna valutazione finora

- Tenchavez V Escano DigestDocumento2 pagineTenchavez V Escano DigestPatrick Violago ArcellanaNessuna valutazione finora

- CIR V Puregold Duty FreeDocumento4 pagineCIR V Puregold Duty FreeCelina Marie Panaligan0% (1)

- DBP v. Spouses OngDocumento4 pagineDBP v. Spouses OngbearzhugNessuna valutazione finora

- Tax 2 Cases Local TaxationDocumento77 pagineTax 2 Cases Local TaxationNeil-San G. PatagNessuna valutazione finora

- CIR vs. TokyoDocumento8 pagineCIR vs. TokyoColeen Navarro-RasmussenNessuna valutazione finora

- RCBC v. CA, 289 SCRA 292 (1998)Documento14 pagineRCBC v. CA, 289 SCRA 292 (1998)KristineSherikaChyNessuna valutazione finora

- CIR vs. BenipayoDocumento5 pagineCIR vs. BenipayoHannah BarrantesNessuna valutazione finora

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDocumento2 pagineJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningNessuna valutazione finora

- 15 Republic Vs AblazaDocumento5 pagine15 Republic Vs AblazaYaz CarlomanNessuna valutazione finora

- Digest Garchitorena Vs PanganibanDocumento2 pagineDigest Garchitorena Vs PanganibanDiana BoadoNessuna valutazione finora

- C25. Bloomberry Resort v. BIR, G.R. 212530, Aug 10, 2016 PDFDocumento19 pagineC25. Bloomberry Resort v. BIR, G.R. 212530, Aug 10, 2016 PDFMaria Jeminah TurarayNessuna valutazione finora

- CIR Vs ReyesDocumento16 pagineCIR Vs Reyes123456789Nessuna valutazione finora

- Tax 1 Cases For Study - Full Tex CasesdocxDocumento209 pagineTax 1 Cases For Study - Full Tex CasesdocxwallyNessuna valutazione finora

- Filipino Metal v. Secreatary of DTIDocumento2 pagineFilipino Metal v. Secreatary of DTIKathleen Kay de GuzmanNessuna valutazione finora

- B. Institution of HeirsDocumento4 pagineB. Institution of HeirsHannah PlopinioNessuna valutazione finora

- City of Manila v. Grecia-CuerdoDocumento2 pagineCity of Manila v. Grecia-CuerdoallisonNessuna valutazione finora

- CCC Insurance Vs CADocumento11 pagineCCC Insurance Vs CATahani Awar Gurar100% (1)

- Jimenez v. City of ManilaDocumento2 pagineJimenez v. City of ManilaVEDIA GENONNessuna valutazione finora

- Soriquez Vs SandiganbayanDocumento7 pagineSoriquez Vs SandiganbayanAnonymous U7Az3W8IANessuna valutazione finora

- 104 Zamboanga Barter Traders Kilusang Bayan Vs PlagataDocumento3 pagine104 Zamboanga Barter Traders Kilusang Bayan Vs PlagataMara ProllamanteNessuna valutazione finora

- Case #3 (Batch 7)Documento3 pagineCase #3 (Batch 7)Reinald Kurt VillarazaNessuna valutazione finora

- Torts & Damages1Documento7 pagineTorts & Damages1Edward AngelesNessuna valutazione finora

- 82 Supreme Court Reports Annotated: Philippine Petroleum Corp. vs. Municipality of Pililla, RizalDocumento10 pagine82 Supreme Court Reports Annotated: Philippine Petroleum Corp. vs. Municipality of Pililla, RizalAaron ReyesNessuna valutazione finora

- Tax1 Syllabus For LyceumDocumento6 pagineTax1 Syllabus For Lyceumpokeball001Nessuna valutazione finora

- San Beda Corporation Law ReviewerDocumento29 pagineSan Beda Corporation Law ReviewerMuhammad FadelNessuna valutazione finora

- City Ordinance No. 5-2013Documento2 pagineCity Ordinance No. 5-2013Lc FernandezNessuna valutazione finora

- 12 CIR vs. Phoenix (GR No. L-19727, May 20, 1965)Documento13 pagine12 CIR vs. Phoenix (GR No. L-19727, May 20, 1965)Alfred GarciaNessuna valutazione finora

- Querol V CIRDocumento2 pagineQuerol V CIRTintin CoNessuna valutazione finora

- VAT Ruling 204-90Documento1 paginaVAT Ruling 204-90Russell PageNessuna valutazione finora

- Tax Doctrines in Dimaampao CasesDocumento3 pagineTax Doctrines in Dimaampao CasesDiane UyNessuna valutazione finora

- Vigilla v. Philippine College of Criminology, IncDocumento1 paginaVigilla v. Philippine College of Criminology, IncAnjNessuna valutazione finora

- Toshiba Information v. CIR G.R. No. 157594 March 9, 2010Documento6 pagineToshiba Information v. CIR G.R. No. 157594 March 9, 2010Emrico CabahugNessuna valutazione finora

- Manila Bankers' Life Insurance Corp. vs. CIR, GR Nos. 199729-30 & 199732-33 Dated February 27, 2019 PDFDocumento22 pagineManila Bankers' Life Insurance Corp. vs. CIR, GR Nos. 199729-30 & 199732-33 Dated February 27, 2019 PDFAbbey Agno PerezNessuna valutazione finora

- Republic vs. Heirs of JalandoniDocumento2 pagineRepublic vs. Heirs of JalandoniJo BudzNessuna valutazione finora

- Linberg v. MakatiDocumento15 pagineLinberg v. MakatiJohn Benedict TigsonNessuna valutazione finora

- G.R. No. 197151Documento6 pagineG.R. No. 197151Hp AmpsNessuna valutazione finora

- Republic of The Philippines Quezon City: Court Oft Ax AppealsDocumento11 pagineRepublic of The Philippines Quezon City: Court Oft Ax AppealsMark Nonette PacificarNessuna valutazione finora

- RTC Noted The Above-Stated Entry of Special Appearance of AttyDocumento10 pagineRTC Noted The Above-Stated Entry of Special Appearance of Attyxx_stripped52Nessuna valutazione finora

- Digest 4Documento2 pagineDigest 4xx_stripped52Nessuna valutazione finora

- Banking LCDocumento5 pagineBanking LCxx_stripped52Nessuna valutazione finora

- Digest 3Documento3 pagineDigest 3xx_stripped52Nessuna valutazione finora

- Digest 6Documento5 pagineDigest 6xx_stripped52Nessuna valutazione finora

- Legal EthicsDocumento13 pagineLegal Ethicsxx_stripped52Nessuna valutazione finora

- Digest 2Documento3 pagineDigest 2xx_stripped52Nessuna valutazione finora

- Far East Bank vs. TentmakersDocumento2 pagineFar East Bank vs. Tentmakersxx_stripped52Nessuna valutazione finora

- Far East Bank vs. TentmakersDocumento2 pagineFar East Bank vs. Tentmakersxx_stripped52Nessuna valutazione finora

- Central Bank vs. CADocumento2 pagineCentral Bank vs. CAxx_stripped52Nessuna valutazione finora

- Simex vs. CADocumento1 paginaSimex vs. CAxx_stripped52Nessuna valutazione finora

- Central Bank vs. CADocumento2 pagineCentral Bank vs. CAxx_stripped52Nessuna valutazione finora

- Simex vs. CADocumento1 paginaSimex vs. CAxx_stripped52Nessuna valutazione finora

- Bank of America vs. CADocumento2 pagineBank of America vs. CAxx_stripped52Nessuna valutazione finora

- SPECPRO Corpus v. Amparo v. DataDocumento11 pagineSPECPRO Corpus v. Amparo v. Dataxx_stripped52Nessuna valutazione finora

- FAR EAST BANK & TRUST COMPANY, Petitioner, vs. DIAZ REALTY INC., RespondentDocumento1 paginaFAR EAST BANK & TRUST COMPANY, Petitioner, vs. DIAZ REALTY INC., Respondentxx_stripped52100% (1)

- Rural Bank of LucenaDocumento2 pagineRural Bank of Lucenaxx_stripped52Nessuna valutazione finora

- Case Digest (My Part) 1.21.2012Documento4 pagineCase Digest (My Part) 1.21.2012xx_stripped52Nessuna valutazione finora

- MacDonald v. National City Bank of New York - DigestDocumento2 pagineMacDonald v. National City Bank of New York - Digestxx_stripped52Nessuna valutazione finora

- Central Bank vs. CADocumento2 pagineCentral Bank vs. CAxx_stripped52Nessuna valutazione finora

- Singson Vs SawmillDocumento1 paginaSingson Vs Sawmillxx_stripped52Nessuna valutazione finora

- Case Digest (My Part) 2.5.2012Documento3 pagineCase Digest (My Part) 2.5.2012xx_stripped52Nessuna valutazione finora

- Bearneza v. DequillaDocumento2 pagineBearneza v. DequillaJerome Azarcon100% (1)

- MU - ÑASQUE Vs CADocumento2 pagineMU - ÑASQUE Vs CAxx_stripped52Nessuna valutazione finora

- Complete Discussion Guide-28 Jan 2013Documento3 pagineComplete Discussion Guide-28 Jan 2013xx_stripped52Nessuna valutazione finora

- Ericsson Telecommunications vs. City of PasigDocumento1 paginaEricsson Telecommunications vs. City of Pasigxx_stripped52100% (2)

- DigestsDocumento5 pagineDigestsxx_stripped52Nessuna valutazione finora

- MacDonald v. National City Bank of New York - DigestDocumento2 pagineMacDonald v. National City Bank of New York - Digestxx_stripped52Nessuna valutazione finora

- City of Iriga vs. CamSurDocumento1 paginaCity of Iriga vs. CamSurxx_stripped52Nessuna valutazione finora

- Report On Financial Market Review by The Hong Kong SAR Government in April 1998Documento223 pagineReport On Financial Market Review by The Hong Kong SAR Government in April 1998Tsang Shu-kiNessuna valutazione finora

- Industrial Relation of LawDocumento3 pagineIndustrial Relation of LawArunNessuna valutazione finora

- Ifrs 5Documento2 pagineIfrs 5Foititika.netNessuna valutazione finora

- I INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowDocumento18 pagineI INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowSimon and SchusterNessuna valutazione finora

- VIVADocumento16 pagineVIVASakshiShineNessuna valutazione finora

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocumento1 paginaTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Six Sigma Black Belt Wk1 Define Amp MeasureDocumento451 pagineSix Sigma Black Belt Wk1 Define Amp Measuremajid4uonly100% (1)

- Mathematics in The Modern World AmortizationDocumento5 pagineMathematics in The Modern World AmortizationLeiLezia Dela Cruz100% (1)

- Xxxxacca Kısa ÖzzetttDocumento193 pagineXxxxacca Kısa ÖzzetttkazimkorogluNessuna valutazione finora

- TOGAF An Open Group Standard and Enterprise Architecture RequirementsDocumento17 pagineTOGAF An Open Group Standard and Enterprise Architecture RequirementssilvestreolNessuna valutazione finora

- Southspin FASHION AWARDS-Title SponsorDocumento32 pagineSouthspin FASHION AWARDS-Title SponsorManikanth Raja GNessuna valutazione finora

- Gujarat Technological University: Comprehensive Project ReportDocumento32 pagineGujarat Technological University: Comprehensive Project ReportDharmesh PatelNessuna valutazione finora

- Best Practice Guidelines For Concrete Placement Planning, Field Testing, and Sample Collection PDFDocumento48 pagineBest Practice Guidelines For Concrete Placement Planning, Field Testing, and Sample Collection PDFandriessebastia9395Nessuna valutazione finora

- Chapter 4 The Market Forces of Supply and DemandDocumento76 pagineChapter 4 The Market Forces of Supply and DemandGiang NguyễnNessuna valutazione finora

- A Flock of Red Flags PDFDocumento10 pagineA Flock of Red Flags PDFSillyBee1205Nessuna valutazione finora

- RDL1 - Activity 1.2Documento1 paginaRDL1 - Activity 1.2EL FuentesNessuna valutazione finora

- Pizza Choice: Submitted By: Submitted ToDocumento11 paginePizza Choice: Submitted By: Submitted ToNeha SharmaNessuna valutazione finora

- Notes On b2b BusinessDocumento7 pagineNotes On b2b Businesssneha pathakNessuna valutazione finora

- ACCT1501 MC Bank QuestionsDocumento33 pagineACCT1501 MC Bank QuestionsHad0% (2)

- أثر السياسة النقدية على سوق الأوراق المالية في الجزائرDocumento21 pagineأثر السياسة النقدية على سوق الأوراق المالية في الجزائرTedjani Ahmed DzaitNessuna valutazione finora

- G2 Group5 FMCG Products Fair & Lovely - Ver1.1Documento20 pagineG2 Group5 FMCG Products Fair & Lovely - Ver1.1intesharmemonNessuna valutazione finora

- 51977069Documento1 pagina51977069Beginner RanaNessuna valutazione finora

- Post Acquisition (HR Issues)Documento16 paginePost Acquisition (HR Issues)Bharat AggarwalNessuna valutazione finora

- GL 003 14 Code of Good Practice For Life InsuranceDocumento19 pagineGL 003 14 Code of Good Practice For Life InsuranceAdrian BehNessuna valutazione finora

- Business Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonDocumento12 pagineBusiness Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonBhavin GhoniyaNessuna valutazione finora

- A Reaction PaperDocumento6 pagineA Reaction PaperRedelyn Guingab Balisong100% (2)

- A Study On Labour Absenteeism in Ammarun Foundries Coimbatore-QuestionnaireDocumento4 pagineA Study On Labour Absenteeism in Ammarun Foundries Coimbatore-QuestionnaireSUKUMAR75% (8)

- Hanan 07 C.V.-aucDocumento6 pagineHanan 07 C.V.-aucAhmed NabilNessuna valutazione finora

- Sales Flow Chart 2019Documento2 pagineSales Flow Chart 2019grace hutallaNessuna valutazione finora

- Assignment Agreement1Documento1 paginaAssignment Agreement1Joshua Schofield100% (2)