Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Asian Banks

Caricato da

DharmikDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Asian Banks

Caricato da

DharmikCopyright:

Formati disponibili

Asian Banking

UNIVERSITY OF MUMBAI ACADEMIC YEAR 2006-2007 SHRI CHINAI COLLEGE OF COMMERCE AND ECONOMICS ANDHERI (EAST), MUMBAI: 400091

PROJECT REPORT ON

ASIAN BANKS (Emerging Developments in Growth, Structure and Efficiency)

PROJECT GUIDE PROF.EKNATH BIRARI

SUBMITTED BY SAVIO DCOSTA T.Y.B.COM (BANKING AND INSURANCE) SEMESTER-V

Asian Banking

Acknowledgement

It gives me an enormous pleasure in submitting the project of Asian Banking-Emerging Developments in Growth, Structure and Efficiency. I would like to take this opportunity to sincerely thank Prof. Eknath Birari my project guide, for extending their support, guidance and co-operation which helped me in completing this project successfully. I would also like to thank Prof. Nishikant Jha for their kindly support and encouragement throughout my project to complete the project in time. I am also thankful to our college as well as our college librarian for availing me the required books on Asian Banking who have made my efforts into success by giving me all the possible help and support in my project. I am also thankful to Sachin sir for availing me the computer lab whenever needed regarding my project.

Asian Banking

DECLARATION

I, SAVIO DCOSTA student Of T.Y.B.Com (Banking & Insurance) Shri Chinai College of Commerce & Economics (semester V th ) hereby declare that I have completed this project on ASIAN BANKS in the academic year 2006-2007 .The information submitted is true and original to the best of my knowledge.

Signature of the student (SAVIO DCOSTA)

CERTIFICATE

I, Prof.EKNATH BIRARI hereby certify that SAVIO DOSTA student of T.Y.B.Com (Banking & Insurance) Shri Chinai College of Commerce & Economics (Semester V th) has completed project ASIAN BANKS in the academic year 2006-2007.The information submitted is true and original to the best of my knowledge.

Signature of Project guide

Asian Banking

Executive Summary

Asian Banks have a good track of services and well developed facilities which has lead to tremendous growth, structure and efficiency of the banks through their performance and their potential to handle the risks.

Objective

My prime objective was to know about the dynamics of Asian banking sectors and the emerging developments in growth, structure and the efficiency of the Asian banks.

Sub-Objective

To learn the Asian banking more particularly from the point of view of one of the Indian bank operating in Asia Like ICICI which got the award for the Best Managed Bank in Asia, in a poll by Euro money for their excellence performance.

Secondary Data: Books Global Banking Asia-Pacific Region - By Kasturi Rao Asian Banking Crisis - By ICFAI UNIVERSITY Journals Reports on the banks performance in Asia (ICICI Bank) ICICI Articles Findings Studying the Asian Banking and more particularly its growth, structure and efficiency one can say that the Asian banks are also emerging as strong banks in all their prospects in order to gain international standard through which they can give very tough competition to the international banks.

Asian Banking

Learning Asian banks are on growing phase and they are trying to develop their banking system so well to operate their functions globally also. Few years from now these banks are going to operate all over the world through their well developed technology and efficiency in their banking functions.

Index

Sr. No. Topics SESSION-I 1 Asian Banking - Part I

Introduction Domestic Credit provided by Banking in Asia Non Performing to Total Loans Banks in Asia Emerging Issues in Asian Banks Growth of Personal Banking in Asia

Page No.

1 2 4 10 12 13

SESSION-II

Asian Banking

Asian Banking - Part II

Growth of Online Banking in Asia Consolidation The Pace of Bank Consolidation in Asia Issues and Imperatives Steps taken to Restrict Banking Crisis

15 16 17 18 18 21

SESSION-III 3 East Asian Banking Restructuring and Regulation Industrial Policy

Introduction Facts/Changes in East Asian banking History of banking in Japan History of banking in Korea Asian Financial Crisis in 1997 Comparison between Japan and Korea

23 24 27 29 34 39 41

SESSION-IV 4 Chinese Banks: On the Reforms Path

Introduction Banking Reforms Interest Rate Policy Behest Lending Non-performing loans Monetary policies of the Central Bank

43 43 44 45 46 47 49

SESSION-V 5 Bank Of China

Introduction A Watershed Year, 2001

6

52 53 53

Asian Banking

Treasury Operations Investment Banking Risk Management Corporate Governance The Business Strategy and Performance

6 7 8 9 10

Case Study Conclusion Annexure List of acronyms Bibliography

55 56 57 57 58 59 66 68 69 70

Asian Banking

List of Tables

Sr. No.

1 2 3 4 5 6 7 8 9 10 11 12

Topic

Country Domestic Credit provided by Banking in Asia Country Domestic Credit provided by Banking in Asia Asian Banks: Emerging Issues in Asian Banks Facts / Changes in East Asian banking Brief history of banking in Japan Brief history of banking in Korea Asian Financial Crisis in 1997 Behest Lending Non-performing loans Treasury Operations As Island of High Wage Earners Priority Sector Credit

Page No.

6 9 13 27 32 37 40 47 48 55 63 64

Asian Banking

Asian Banking - Part I

Introduction Country Domestic Credit provided by Banking in Asia

Asian Banking

Non Performing Loans to Total Loans: Banks in Asia Emerging Issues in Asian Banks Growth of Personal Banking in Asia

Introduction Among the emerging economies, Asian banking is the most energetic and expanding one. In the aftermath of the Asian economic crisis, banks in South East Asia were the worst to get affected, but they are clawing back with aggressive pace, quite often strongly supported by their governments. Despite impressive growth of capital markets in the Asian region, banking remains a strong anchor supporting economic growth. There are three major aspects of Asian banking. I.e. Growth, Structure and Efficiency. Growth depicts the growth of banking activity in the region; Structure describes features such as who owns banking and Efficiency profiles the recent operational performance of banks across the Asian region. In all these aspects suitable comparisons with banking systems in other emerging economies is also done.

10

Asian Banking

Asia has a strong banking presence. Banking industry is spread across the major regions in the world. In the emerging economies, Asia has the largest number of deposits taking institutions and banks, despite closure of a fairly large number of institutions following the 1997 economic crisis. The size of banking assets in Asia is more than the double that of Latin America and several times larger than that of central Europe. Its capital ratios are fairly higher. In emerging economies, banking sector is the single most important source of finance for corporate in the private sector. During the five year period, 1997-2001, of the total corporate domestic funding for the private sector in major emerging markets, a large chunk (63%) came from bank loans, though the share of domestic bonds (22%) has been growing more rapidly than the equities (15%). In respect of international funding too, bank lending (41%) dominates bonds (37%) and equities (22%). This trend is also evident in the private sector domestic funding in the Asia Region where bank loans are the prominent source (78%) of funding but the share of equities (12%) are more than bonds (10%). In international funding for Asia region, all these three are proportionally represented in respect of the public sector funding.

However, it is the bonds that are most prominent both in domestic (91%) and international (73%) sources as compared to other regions, bank loans, as a source of funding in the Asian region is more than other regions. For both the sectors bonds have contributed significantly in funding to the extent of 69%, followed by bank loans with 26% and equities 5%. Another

11

Asian Banking

evidence to show that the growth of banking is more stronger in Asia than the capital market could be evidenced from the fact that domestic private credit as a % of GDP in Asia grew from 90.6% in 1996 to 113.7% in 2002, where as equity market capitalization inched from 64.8% to 71.9% and total bonds outstanding from 31.4% to 48.7%. More than 40% of the worlds population still lives in countries in which the majority of bank assets are in majority-owned state banks. Government ownership tends to be greater in poor countries. Total assets of banking system is about one third of all countries is smaller than $1 billion; another third have banking systems smaller than $10 billion. Asian banking showed significant growth in the last three decades. Domestic credit provided by banking as a percent of GDP, reflects the significance of the banking sector in the economy. It is evident that Asian economies has showed the largest growth in this ratio, and always growing in contrast to the banking systems in other emerging economies. Bank Credit and GDP ratio growth was much faster and spectacular in East and South East Asia as compared to South Asia, as most of the countries in South Asia, namely India and Sri-Lanka have only made marginal gains in this ratio during the decade of the 90s where as in the countries like Pakistan this ratio was actually failed and Bangladesh perhaps scored well in the South Asian region in this regard. Despite several economic crisis that plagued the entire East Asian region, this ratio remained high. This was an evident in the growth of the banking system as well.

Country Domestic Credit provided by Banking in Asia

12

Asian Banking

More than 40% of the worlds population still lives in countries, which the majority of bank assets are in majority owned state banks. Government ownership tends to be greater in poorer countries; Arguments in favor of state control are-

(a) Better allocation of capital. (b) Private ownership may restrict access to banking sectors for many parts of the society. (c) Private banking is more crisis prone. Achievements of the goals of the state ownership have been elusive. Greater ownership of banks to associate with higher interest rate spreads, less private credit, less activity on the stock exchange, and less non-blank credit, even after controlling for many other factors. One study revealed that countries that had greater state ownership of banks in 1970s tended to grow more slowly since then with lower productivity, especially in poor countries.

Asian banking is significantly either state owned or family owned. This is also one of the biggest challenges facing the Asian banking system in the background of globalization and financial liberalization which envisages holding of greater share of banking assets by foreign entities. In the last two decades, ownership of the banks in China has been predominantly stateowned barely changed. Even in India, where both public and private sector co-exist, a large chunk of it is owned by the former. While state-ownership is predominant in some countries, family ownership is sizeable in some others. State and family ownership are not

13

Asian Banking

particularly viewed favorably from the point of view of emerging international financial policy that puts greater thrust on promoting private sector with greater responsibilities on corporate governance in terms of transparency and disclosure. A great deal of pressure is being mounted on this type of ownership by international and domestic policy to transform into a more responsible and accountable. This is explained with the help of following table. Family The Koo family(Koos Group) The Tsai family(Fubon Group) The Wu family(Shing Knog Group) The Fung family The Wu family The Wong family The Li family The Wee family The Lee family The Lien family Azman Hashim The Kwek family (Hong Kong Group) The Hong Piow Rashid Hussain Tan Teong Hean Sophonpanich family Country Taiwan Taiwan Taiwan Hong Kong Hong Kong Hong Kong Hong Kong Singapore Singapore Singapore Malaysia Malaysia Malaysia Malaysia Malaysia Thailand

14

Bank China trust Fubon Commercial Bank Taishin International Bank Wing Hang Bank Wing Lung Bank Dah Sing Bank Bank of East Asia United Overseas Bank Overseas-Chinese Banking Corporation Overseas Union Bank Arab-Malaysian Merchant Bank Hong Leong Credit Public Bank RHB Bank Southern Bank Bangkok Bank

Stake (%) 10 15 15 32 43 38 40 32.1 22.7 15.7 8.4 71.7 28 23.9 22 15

Asian Banking

Lamsam family Thailand Thai Farmers Bank 10 One of the views that were put increasingly by international financial policy as a better option to reduce the state and family ownership to encourage ownership of financial institutions by foreign entities. Since many of the foreign banks taking state in domestic banking systems comes from the mature economies with fairly standardized and stringent regulatory norms, it is envisaged that the greater share of foreign ownership will bring in greater transparency and efficiency in the domestic banking systems. There are however serious concerns in many emerging economies on the entry and expansion of foreign banks. Arguments against foreign banks have destabilized the local financial system and has putted local financial out of business etc., However there is no hard evidence of local presence of foreign banks in this regard. 1990s have been remarkable in enhancing the presence of foreign banks.

For instance in Central Europe, the proportion of bank assets controlled by foreign owned banks rose from 8% in 1994 to 56% in 1999. In some Latin American countries, almost one-half of the total bank assets are now controlled by foreign institutions.

Major factors inducing the growing pace of foreign ownership of banks are; globalization of financial services, lower costs of information and communication that lead to greater economies of scale to expand internationally, surges in telephone and internet banking in which foreign banks are already market savvy. Using bank level data for 80 countries for 1988-1995, Claessens, Demirguc-Kunt, and Huizinga of the World Bank,

15

Asian Banking

have examined the extent of foreign ownership in national banking markets on the basis of net interest margins, overhead, taxes paid, and profitability of foreign and domestic banks. It is found that in developing countries foreign banks tends to have greater profits, higher interest margins, and higher tax payments than domestic banks. Increase in the foreign share of bank ownership has reduced the profitability and overhead expenses in domestically owned banks. Local bank competition gets affected more on the entry of foreign banks rather than after gaining a substantial stake. Foreign control of domestic banks in Asia has not been that particularly easy. Attempt to sell Seoul Bank to HSBC failed, In Malaysia in 1950s the foreign banks had controlled of assets to the tune of 94 %, which is drastically reduced now. Prior to the financial crisis of 1997, Thailand has been relatively closed to foreign banks but this situation is gradually changing. China has withdrawn the sale of Shenzhen Bank, which is almost finalized to a foreign private capital group. Though Thailand increased the limit of foreign ownership from 25% to 100% and several others made significant relaxations in foreign.

Despite a series of liberalization measures on most of the Asian countries the share of foreign ownership in banks is rather limited. In India post-liberalization the number of foreign banks expanded rapidly. An interesting perspective of Indian banking provides that with the positive intervention of the State, turnaround in banking sector could be gradual but more concerted, though how far this strategy will be sustainable is a big question. Bank wise shares of total assets in India for the year ended March 2002 showed that Nationalized banks account for 46% of assets and

16

Asian Banking

42% of net profits, State Bank Group accounts for 29.3% of assets and 29.8% of net profits, Old Private Sector banks account for 6.1% of assets and 8.7% of net profit where foreign banks account for 7.2% of assets and 12.9% of net profit where as new private sector banks account for 11.4% of assets but only 6.7% of net profit. This is explained with the help of following table.

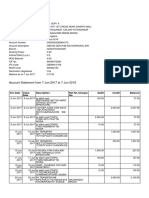

Country India Indonesia Korea Malaysia Pakistan Philippines Thailand Memorandum Items United States Japan Canada United Kingdom

1997 * 0.7 ___ -0.9 ___ -1.2 1.7 -0.8 1.3 0.0 0.7 0.9

*All years figures are in Percentages 1998 1999 2000 2001 2002* * 0.8 -19.9 -3.3 ___ 0.5 0.8 -5.1 1.1 -0.6 0.5 0.8 * 0.5 -9.1 -1.3 1.1 -0.2 0.4 -5.4 1.3 -0.5 0.7 1.0 * 0.7 0.1 -0.6 1.1 -0.2 0.4 -1.6 1.2 0.2 0.7 0.9 * 0.6 0.8 0.8 0.8 0.5 0.4 -0.2 1.1 0.0 0.6 0.6 0.8 1.8 0.8 ___ ___ 0.7 0.7 1.4 -0.4 0.5 0.7

The data published by the International Monetary Fund, for the year 2002, shows that the median ROA is highest in Central Europe(1.4%), followed by Latin America(1.3%) and Asia(0.8%). Asia showed sizeable recovery since 1997, when its ROA was -0.8% that fell further in the next

17

Asian Banking

year to -1.4%, but has been gradually recovered since then to reach 0.8% by the year 2002. The Differences in the ROA of banks in Asian economies are measured by the standard deviation which was at 8% in 1998 gradually declined to 0.5% by 2002. India has been maintaining a ROA of about 0.5% to 0.8% throughout the six year where as Indonesia showed rapid improvement in the last two years. Korea, Malaysia, Philippines and Thailand too showed gradual recovery in the ROA in the last two years. Recovery of bank revenues is evident across the region. If the SAARS does not continue to be a major problem threatening China and East Asia, with the growth prospects currently foresee, banking industry in Asia could see further growth in the immediate term. However, Risk management will be very crucial to realize and sustain gains. Median levels of Non Performing Assets of Asian Banks in 2002 remained more or less similar what it was six years ago. It does not mean that bad-debts stopped growing in these banks, but they have managed to bring down from about a median level of 20% that they have reached in 1998. The latest data puts bad-debts of Asian banks at 10.3% of the assets, similar to Latin America but 2% points than Eastern Europe.

Non Performing Loans to Total Loans: Banks in Asia

Non Banks in Emerging economies have always been prone to crisis. From 1980 to 1995 more than three-quarters of the members of the International Monetary Fund have experienced a serious and costly banking crisis. In 69 of these countries, losses exhausted the net worth of the entire banking systems. The cost of saving the banking system was around

18

Asian Banking

10% to 50% of the GDP. The experience of the last three decades shows that banking systems are prone to crisis, and these could happen in both rich and poor countries. But the ability of the emerging countries in swinging back to the strength and sustainability is an issue that continuously bothers international finance regulation from the point of view of stability and sustainability. Poverty rates rose faster from about 25% to 40% in Indonesia, from 15% to 25% in Korea and 10% to 15% in Thailand in the aftermath of the financial crisis. Most of the Asian economies in the late 1990s have experienced several and intense crisis in the banking sector along with currency crisis and major imperative emerging from this experience are that banks should be particularly careful in not only managing risk but also strategies for overcoming and combating the effect of contagion. Banking crisis in some countries not only wiped off their entire net worth but also cost the governments almost the size of the GDP to put them back in the business.

One encouraging feature is that the banking systems across all the regions in emerging economies possess capital adequacy levels that are considered safe and sound. The median levels of capital adequacy levels in banks in Asia, Latin and Central Europe are around 10% and these have been consistently showing improvement. Korea in the Asian region tops the regulatory capital as a percent to risk weighted assets, a trend which is evident in most of the countries, in particular Philippines, Malaysia etc.., Capital adequacy levels in Asian countries are much higher even compared to the banking systems in the matured economies. Indonesia, Philippines, Thailand, Pakistan remain at higher levels, the problem of which could be

19

Asian Banking

further compounded by any setbacks in the economy either owing to the developments in the domestic sector or international economy. In India in the last six years this capital adequacy ratio hovered around 10% to 11% and given the subdued growth of assets, which remained pretty significant.

Despite the overall improvement in various aspects of operational efficiency, the financial strength of banking systems remains a matter of great concern. The median level Moodys financial strength index for Asia in 2002 stood at 16.7% as against 30.2% for Eastern Europe, 20.9% for Latin America. The position of India is much above the Asian average but as compared to the banking systems in mature economies (excepting Japan), it is far lower.

Asian Banks: Emerging Issues in Asian Banks

Recent trends in banking across the world, which is evident in Asian banking, are(a) Growth of personal banking and credit. (b)Corporate increasing accessing bond markets for their resource requirements increasing use of technology and growth of online banking. (c) Shifts in revenue stream from being interest income based to fee based and a greater degree of consolidation to achieve economies of scale. A brief discussion on each of these is given below.

20

Asian Banking

Country India Indonesia Korea Malaysia Pakistan Philippines Thailand Memorandum Items United States Japan Canada United Kingdom

2001(%) 25.8 1.7 14.2 30.4 2.1 17.5 15.8 77.1 16.7 77.1 83.8

2002(%) 27.5 5.4 16.7 31.7 5.0 20.4 15.8 75.0 12.9 75.0 83.8

Growth of Personal Banking

Asian banks have experienced enormous growth in personal banking in the recent period fuelled by expansion in household credit, online banking, credit cards etc., In Korea, household credit now accounts for about half of the total outstanding bank loans and this trend was evident in several other Asian economies. In China as per the recent report of the Lehman Brothers, mortgage and consumer credit in China grew by 70% in 2001 and already reached 10% of the total bank loan outstanding. Korea, Thailand, Malaysia, Taiwan and Philippines experienced growth in credit cards in the range of 20% in 2002 and Chinas credit card market is expected to grow around 75% to 100% in the next three years. In Korea value of credit debt

21

Asian Banking

now accounts for about 16% of the total household borrowing and about 11% of the total private credit outstanding. In 2002, Value of credit card debt outstanding has registered a growth of 47% in Korea, 34% in Philippines, 30% in Thailand, 28% in Taiwan, 21% in Malaysia and as a percentage of total domestic credit, it ranges from 3% in Malaysia to 11% in Korea.

Growth in the household credit/personal loans was further accentuated by a number of relief measures announced by the governments to promote housing loans, use of credit cards and supplemented by additional measures announced by banks such as fee waivers, higher credit limits etc., With the growth of personal banking and household credit, banks are transforming from a transaction-based activities to process based activities that requires sophistication in risk management. While growth of personal loans is expanding consumerism in many Asian economies, which is fine for the regional economies.

22

Asian Banking

Asian Banking - Part II

Growth of Online Banking in Asia Consolidation The Pace of Bank Consolidation in Asia Issues and Imperatives Steps taken by Asian banks to Restrict Banking Crisis

Growth of Online Banking

23

Asian Banking

Online banking is expanding at rapid rate in Asian economies. According to the recent report released by AC Nielsen Online. Active online banking population in the five major Asian economies of South Korea, Hong Kong, Singapore, China and Taiwan, grew 63% in 2001 taking the regional total from 6.5 million to 10.6 million during 2000-2001. The report also shows that 38% of regular internet users across now use online banking services, compared to 29% a year ago and 16% two years ago. South Korea tops online banking population with 5.3 million, followed by China 2.6 million, Taiwan 1.7 million. Of the top 20 internet banks, South Korea has 12, China 5. Levels of the customer satisfaction are found to be higher among the customers of Internet banking. The percentage of internet users in favor of switching over to internet banking is high thought the region from 76% in Taiwan to 93% in China and 65% in Korea. In countries such as United States, online banking adoption will rise from 22% in 2002 to about 38% by 2010. In the 1990s banks laid great thrust on Internet banking drawing from the estimates of very lower cost of transactions in Internet banking.

An interesting development in the growth of Internet banking is that it could promote more of brick and mortar banking as well. A recent report of the Nielsen/Net Ratings observed, In virtually every market, it is the traditional, established brick and mortal banks that are attracting the biggest audiences. A large majority of online customers are most likely also customers of the in-person bank branches. A recent report in the Business Week magazine said that in the height of Internet boom, big banks

24

Asian Banking

declared bank branching dead and were aggressively investigating in technology instead. They hoped to win over customers through their new electronic systems and cut back on expensive bricks and mortar. So they spent heavily on call centers and website and also opened less costly mini branches in grocery and discount stores.

Despite a growing array of online options, customers continue to open 80% of new checking and savings accounts at branches. After a decade of slow growth in deposits, banks are now benefiting from the stock market slump as customers slash money from their banks. Multi product offerings are hoped that will enable branches sustainability. WaMu Bank opened 144 branches last year and is planning 230 this year. ATMs in the early 1980s and Internet in the late 1990s. This trend could flow to the Asian banking systems too soon. Consolidation

Asian economic crisis brought in several changes in the banking landscape. The prudential regulation was not only stepped up but also the consolidation of banks to be followed in order to bring greater efficiencies and financial stability. While bank mergers in the mature economies were more market induced and to gain greater synergies between different markets segments (such as Citibank/travelers) in the emerging economies, policies too supported the consolidation of the banking industries to enhance strength of the banking system and its sustainability. This trend was evident in many of the emerging economies. Though not much progress took place

25

Asian Banking

in foreign acquisitions of domestic banks in Asia, consolidation within the domestic banking institutions is significant and sizeable.

The Pace of Bank Consolidation in Asia Consolidation is taking place at a rapid pace in Asia and the most targeted banks for acquisition are the family owned banks. The size and strength of banking systems in Asia is vastly varied. In the top 330 Asian Banks, as compiled by Asia Week 500 (excluding Japan, Australia and New Zealand) Chinas 25 banks account for 42% of the bank assets, where as Taiwans 48 banks account for 15% of the bank assets. India with 55 banks represented in the top league accounts for just less than 6% of the bank assets. Bank consolidation in South Asia has been relatively at a slow pace as compared to South East Asia.

Issues and Imperatives

Major aspects are that banking in Asia is expanding and diversifyingIn Operations, banks continue to be major forces in financial intermediation, though the recent period witnessed a sharp growth in consumer credit, as corporate sector are moving more towards bonds and equities for their financing. Online banking is rapidly growing across all countries in the region and so as the credit card business. Growth of personal credit is also considered responsible for reviving domestic economic growth

26

Asian Banking

in some economies. But already concerns about growth of personal debt are increasing in many countries. Financial Service Authority of UK discussed about the length of various issues involved in the growth of personal debt in Korea, which witnesses sharp surge in household credit recently announced several measures to reduce the rate of its growth In June 2002, Korean authorities increased the loan loss provisioning requirement for consumer loans, lenders are advised to share the customer information on borrowers with large credit limits and outstanding, reduced loan to value ratios for housing loans, increased risk weight age for home loan mortgages etc., Growth of personal banking gives scope to new types of risk that banks should be well handled to assess and monitor.

In Efficiency, banks are slowly returning to healthy rates of return and containing bad debts though, Asian banks have yet to go a long way to reach the desired and established standards that are evident in stronger banking systems. South East Asia had addressed to the issue of resolution of non-performing assets in a much more focused manner and creating suitable asset reconstruction mechanisms. Most of the banking systems are now suitably capitalized which should not be a major constraint for the continuation of banking growth. In view of the rapid decline of the interest rates in the recent period, there could be some pressure on the margins, but more of consumer credit would mitigate this problem to certain extent as long as the risks are managed. These changes move banks more towards the fee based earnings online with the trends evident in developed banking systems, but the transformation from transaction based to process based

27

Asian Banking

activity will give rise to new types of risks which banks should ready to assess and cope up with.

In Structure, significant consolidation is taking place, though the growth of foreign ownership is not sizeable. With continued pace of international coordination on creating strong and sustained financial architecture, initiatives for giving more access to foreign ownership and consolidation within the domestic institutions could gain speed. Already in much of the Asia family owned banks are increasingly targeted for acquisition. More or less the pace of globalization and removal of controls and barriers which could gain further momentum could also give rise to large regional banks. A World Bank report on Finance for Growth observes, It is obvious that advanced economies have sophisticated financial systems. What is not obvious, but is borne out by the evidence, is that the services delivered by these financial systems have contributed in an important way to the prosperity of these countries. They promote growth and reduce volatility, helping the poor. Getting the financial systems of developing countries to function more effectively in providing the full range of financial servicesincluding monitoring of managers and reducing risk is a task that will be well rewarded with economic growth. At the same time, it is the banking systems that have the evidence of becoming most vulnerable at the first signs of opening up or financial liberalization. The World Bank report sums up If finance in fragile, banking is its most fragile part. The most important aspect of managing better banking is through responsibility of major constituents of the banking systems, right type of regulation and

28

Asian Banking

quality of response in a crisis. The last two decades of financial liberalization, equipped banks with enormous experience and expertise in dealing with a wide range of challenges and crisis. This hopefully would be handy for them in charting new areas of growth in the background of next generation reforms. Then banking could generate and sustain long-term prosperity.

Steps taken by Asian banks to Restrict Banking Crisis

Screen out imprudent, incompetent, dishonest bank owners: Fit and Proper Tests that bank owners and managers must pass to quality for banking license. Prudential Supervision that covers leverage and asset quality Capital adequacy, risk management, restrictions on connecting lending etc.

Termination of Authority in case of excessive insolvency, exposure Regulation and disposition of bank before it exhausts its net worth and causes losses to depositors. To protect depositors from loss and remove the incentive for depositors to run from other banks thought to be jeopardy Lender of the Last Resort to enable solvent institutions to meet the claims of liability holders by Borrowing against assets rather than selling illiquid assets at fire sale prices Protection of Monetary Authority from Cumulative Collapse by neutralizing any shifts in the public demand for cash thus protecting the Volume of bank reserves.

29

Asian Banking

30

Asian Banking

East Asian Banking Restructuring & Regulation Industrial Policy

Introduction Facts/Changes in East Asian banking History of banking in Japan History of banking in Korea Asian Financial Crisis in 1997 Comparison between Japan and Korea

Introduction

31

Asian Banking

The impact of transition from a price-cap regulation (deposit/loan rate control) to a rate-of-return regulation on banking industry structure. A simple theoretical model of banking competition suggests that the relative dominance of the two objective functions are influenced by industrial policy via preferential rates and relaxing price-cap regulation reduces the equilibrium number of banks. The result is supported by empirical evidence from Japan and Korea, which have undergone a substantial consolidation. The analysis is applied to a unique data set of the entire commercial banking sector in Japan and Korea, which covers both pre and post banking crisis periods. The evolution of the banking structure is based on the StructurePerformance relationship. Throughout the last decade, the East Asian banking industry has adopted a more concentrated market structure. In particular, the Japanese and Korean banks have made a radical move towards consolidation to deal with their respective economic crisis. East Asian banks were simply regarded as a means of supporting the real sector in the process of pursuing economic development; the economic crisis triggered the restructuring process in the banking sector. Hence, the recent financial crisis in Asia renewed recognition of the significance of the banking industry and its regulation for the overall economy of the region. Previous bank structure has primarily focused on the impact of exogenous change in regulation and the subsequent change in competition environment. However, the industrial policy in East Asia dominated the banking sector regulation and competition prior to the crisis. Banking regulation has been nothing new in Japan and Korea in terms of entry barriers, branching restrictions, and deposit rate

32

Asian Banking

ceilings. East Asian banking regulation was designed to facilitate the development of strategic industries. The deposit rate regulation, Allowed the banks to have access to cheap funding. With cheap funding and with the help of government subsidies, the strategic industries could grow fast generating supernormal profits and remained as high quality customers to banks. This kind of growth pattern continued in East Asia until they faced economic crisis recently. Not only Japan and Korea have led the economic growth in East Asia, but also some other East Asian countries which have replicated many of the development patterns set by Japan and Korea Moreover, the two countries have similarities in their industrial structure due to their strong trade networks. Since the modern banking system in Korea was established during the Japanese occupation, it seems natural that Korea followed the Japanese type of banking establishments when they had much in common in the structure of the real sector. However, there is some evidence of divergence in terms of recent restructuring of the banking sector. World Bank data categorizes Japan, Korea, China, Hong Kong, Indonesia, Malaysia, Philippines, Singapore and Thailand as East Asia. However, Japan and Korea have dominated the regional economy and its growth representing 78% to 90% of East Asian GNP over the period 1960-1997. Their Contribution to the regional growth has been more than 80%, which fell down to 50% to 60% in the 1990s. It is important to note that the banking industry has some special attributes due to its nature of service industry and hence an industry-specific approach is inevitable.

33

Asian Banking

First, the role of East Asian banks in industrialization is analyzed by comparing the evolution of the banking system with the countrys macroeconomic position. The uniqueness of this approach lies in the sense of inter-industry comparison between financial and non-financial industries using an industrial organizational framework. It is important to note that financial and non-financial industries have different attributes and therefore, it is interesting to investigate how they evolved together. Second, a theoratical model of banking competition is based on the circular model. The two objective functions of banks: a revenue maximizing bank under regulation and a profit maximizing bank under deregulation. The relative dominance of the two objective functions is influenced by industrial policy, thus by regulation which has an impact on the market structure in terms of equilibrium number of banks in the market.

Finally, it empirically investigates the consequences of the regulation and deregulation on entry, branching and deposit rates. The different types of regulation and deregulation are defined and separately analyzed from the country specific perspectives. The relationship between concentration (Structure) and the degree of competition (Conduct) in Japan and Korea is examined. The effects of deregulation on the structure of the banking industry and the profitability (Performance) of the banks are tested. The evolution of banking industry in the two countries is compared and which shows the evidence of divergence in the restructuring process of the banking sector between Japan and Korea.

34

Asian Banking

Facts/Changes in East Asian banking In the post war period, East Asian governments actively promoted heavy and chemical industries and certain academics like Cho (1994) and Castle (1999) argued that the financial sector was lagging behind the fastdeveloping real sector. Moreover, the pattern of fast growth in the real sector and the lagging financial sector was common for all East Asian countries. In particular, the similarities between Japan and Korea were significant due to their strong trade networks. Thus, it is fair to say that the Korean industrialization process followed that of Japanese with a time lag of almost a decade. This overlapping transfer of industrial structures from Japan to Korea was explained by the Japanese relocation process, which was started in the late 1960s. This is explained with help of following table. Japan and Korea: changes in industrial structures Period 1950 1960 1970 Japan Light industries (textiles) Heavy industries(steel & ships) Korea Primary products(food products) Light

industries(textiles) Knowledge industries & heavy Heavy industries(steels, industries chemicals, electronics & ships) Heavy industries Knowledge-intensive

1980 1990

Knowledge-intensive(hightech) industries High-tech & service industries

35

Asian Banking

industries Source: Castle (1999), Koreas Economic Miracle Ishii (1997) claimed the reason for the high growth rate in East Asia is its high rate of savings. Even in the 1980s the rate of savings of the household economy in Japan was around 17% which was twice as much as those in the advanced Western countries. It is true that the high rate of savings in East Asia is one of the common factors for its fast growth. However, the role of banks in the process of allocating the funds into appropriate industries and enterprises should not be overlooked. As Ishii (1997) pointed out for Japan, the main part of the funds for industrialization in East Asia was not procured directly from the capital market but supplied indirectly through various kinds of banks, and the respective central banks provided these banks with funds if necessary. Cho (1994) explains that the East Asian governments were heavily involved in the direction of savings fund to achieve development goals in the real sector. Industrialization in East Asia has not only meant for a transformation of an agrarian economy into an industrial economy, but it also means a more focused industrial development in strategic industries such as heavy industries. Thus, the financial sector has never developed independently of the real sector in East Asia. More importantly, the industrial policy dominated financial sector developments leaving the banking sector subordinate to the real sector. Brief history of banking in Japan

36

Asian Banking

It is worth looking at the formation of modern banking system in Japan as it set a prototype for the region. The Meiji restoration in 1868 provided a ground for the modern banking system in Japan. A structural framework including, operating principles and regulatory issues started to form and continued to develop from 1868 up to the mid 1990s. The development phases of Japanese banking reflects three distinctive periods, the period from the Restoration through World War II and the Allied occupation, the high growth era of the 1950s to the 1970s, and the quarter century since the oil shock of 1973.

WWII-1868 A modern banking system was built by adopting a variety of Western models on top of a legacy of indigenous financial practices between 1868 and World War I. The main institutional feature of the banking evolution in Japan was characterized under the Bank Act 1890, which took effect in 1893. National banks began to change to ordinary banks in substantial numbers from the end of 1896, when the charters started to expire and by 1899 no national banks remained. This amalgamated three classes of banking institutions National, Private, and Quasi-bank into one. Interestingly, the new bank law did not set any minimum bank size in favor of free competition. As a result, unit banking was predominant in Japan until

37

Asian Banking

World War I. With the development of Zaibatsu (former enterprise type of Keiretsu), the Mitsubishi and Sumitomo Zaibatsu transformed their finance department into banks in 1895. This made the monetary crisis more several because these banks were suspected to failure during recessions. The Big Five banks (Mitsui, First, Mitsubishi, Sumitomo, Yasuda) dominated the sector until World War I. Special banks started to emerge during this period as well, such as the Tokohama Special Bank (established in 1880) to finance foreign trade. Within the five year period between 1897 & 1902, the government founded the Hypothec Bank of Japan (Nippon Kangyo Ginko), 46 affiliated prefectural Agricultural and Industrial Banks, the Hokkaido Colonial Bank and the Industrial Bank of Japan (Nippon Kogyo Ginko). Most of these banks were designed to finance the transition from an agrarian economy to an industrial economy. During the 1920s and 1930s, Japanese banking underwent with considerable adjustment in terms of the relationship between private institutions and state regulators. The trigger to this legislative reform was the Banking Crisis in 1927 caused by the post World War I recession. With the intensification of official regulation, concentration in commercial banking has increased. However, public and private interactions were dynamic and complex and the bureaucracy could not simply dictate policy to the banks. Zaibatsu banks continued to be the leading institutions in the system while a new Hugh (1999) well documented the Japanese banking system in historical perspectives in Banking in Japan (1999) edited by Tsutsui.

38

Asian Banking

WWII-1973 There were some institutional changes in the banking sector after the WWII as post-war reorganization of the financial system was carried out by dissolving wartime institutions and establishing private long-term credit institutions and financial institutions for small and medium sized firms and agriculture. During high growth era between 1952 and 1973, Japanese banking established the uniqueness of the system. The predominant pattern of banking activities was over-loan and over- borrowing in indirect financing in order to facilitate the investment led growth.

Post 1973 Japan tried to reform the banking industry once again to cope up with the difficulties in the real sector and the driving force of the reform was from market liberalization with various deregulation measures. The main focus of liberalization was on lifting interest rate regulation starting with short-term rates. Branching restriction and cross-financial sector entry restriction started to relax later. In the 1980s, banks were allowed to diversify their financial products and services. Enactment of the Financial System Reform Act of 1993 enabled banks and securities firms to enter each others fields.

39

Asian Banking

One of the most significant liberalization measures in recent Japanese banking history, was Big-Bang programmed initiated in 1996 by the then Prime Minister Hashimoto. Various reforms were scheduled to be implemented based upon the three guiding principles of Freedom, Fairness, and Globalization, so that the Tokyo financial market could attain a status on par with New York and London by 2005. Restructuring has accelerated following the Asian crisis in 1997. The bank-on-bank holding companies created a new environment for financial institutions so that they can form alliances. This can be explained with the help of following table.

Japanese Banking Liberalization: Post-1978 Liberalization measure Date effective Short-term interest rates liberalized 1978 Issuance of CD started May 1979

FX control eased by amending the Dec 1980 Law Regulation on conversion of foreign Jun 1984 currency into the yen abolished Money market certificate created Investment business law enacted Apr 1985 Nov 1986

40

Asian Banking

Financial

System

Reform

Act Apr 1993

allowed banks to enter securities business Interest rates of Time deposits Jun 1993 liberalized completely Interest rate on demand deposits Oct 1994 liberalized (ex. current account) Restrictions on the number of a Jun 1995 banks new branches removed Regulation on deposit products Oct. 1995 relaxed Big Bang reform announced PM Nov 1996 Hashimotos idea of1/freedom 2/fairness 3/globalisation Ban on financial holding companies Dec 1997 lifted Amended FX and Foreign Trade Apr 1998 Law making FX transactions free from governmental authorization Bank allowed to sell investment trust Dec 1998 over-the-counter Restriction on subsidiaries/securities trust bank Oct 1999 company

subsidiaries Abolished Bank allowed to issue Oct 1999 straight bonds Banks, securities companies to be End 2000

41

Asian Banking

allowed to enter insurance business A new Financial Services Law to be enacted Source: Japanese Banks 2000 (Zenginkyo, 2000)

Brief history of banking in Korea The Korean banking system seems to replicate the Japanese system as the introduction of a modern banking system into Korea dates back to the beginning of Japanese domination over the country. WWII-1878 In 1878, the First National Bank (a Japanese bank) opened in Pusan and this was followed by Korean banks openings. However, most Korean banks only existed for See Japanese Banks 2000 (2000), Japanese Bankers Association (JBA). In May 2001, Sony Corp. filed a formal application for a bank in cooperation with Sakura Bank and JP Morgan that utilizes the internet. In 1909, the Old Bank of Korea was founded and was renamed the Bank of Chosun in 1910. During the early 1900s, numerous banks were established including Chosun Industrial Bank, Chosun Commercial Bank (later renamed the Commercial Bank of Korea), Cho Hung Bank, Korea First Bank (1929) and Hanil Bank (1932). In 1959, Bank of Seoul was established and became nation wide in 1962. Since the government had owned commercial banks

42

Asian Banking

until government owned stocks were sold in the late 1950s, these banks exercised very little autonomy.

WWII 1982 The establishment of the new banking system followed the liberation from Japan in 1945 and the inauguration of the Republic of Korea in 1948. At that time, The Korean banking system was reorganized for the purpose of financing the five years Economic Development Plan more efficiently. The Bank of Korea Act was amended in 1962 and various specialized banks were introduced to facilitate financial support for underdeveloped or strategically important industries such as Small and Medium Industry Bank, Citizens National Bank, Korea Exchange Bank and The Korea Housing Bank.

Post 1982 The General Banking Act was revised in 1982 and commercial banks started to be privatized. These included Hanil Bank, Korea First Bank, Bank of Seoul and Trust, Chohung Bank. One of the main reasons was the shift from direct credit controls through credit ceilings on individual banks to indirect controls through management of bank reserves. In 1984, the preferential rates on policy loans by commercial banks were abolished and band system in loan rates was introduced, in which banks are allowed to

43

Asian Banking

charge different rates. The ceilings on various rates (inter-bank call rates and issuing rates of unsecured corporate bonds) were also lifted. As a measure to provide a more competitive environment in banking, Shinhan Bank and Koram Bank opened in 1982 and 1983 respectively. It is important to note that Shinhan Bank was the first banking establishment financed by private capital only. In the 1980s, to encourage the domestic banks to improve their banking practices and managerial skills, numerous foreign bank branches were allowed to open. In 1988, interest rates were extensively deregulated to increase banking competition in the process of financial liberalization. Entry barriers were further lowered in 1989, adding 3 new commercial banks Dongwha Bank, Dongnam Bank and Daedong Bank. Also, Korea Exchange Bank changed its status from a specialized bank to a nation-wide commercial bank. Between 1991 and 1997, a four-stage plan for interest rates deregulation was completed. The main focus of liberalization was on lifting interest rate regulation starting with short-term rates while branching restriction and cross-financial sector entry restriction has not been fully relaxed. Further deregulation is in the process of being implemented in the aftermath of the Asian financial crisis of 1997. This can be explained with the help of following table.

44

Asian Banking

Korean Banking Liberalization: post-1990 Liberalization measure Date effective Short-term interest rates and interest Nov 1991 rates on time deposits with maturity over 3 years liberalized Liberalized interest rates on time Nov 1993 deposits with maturity over 2 years Rates on strategic loans (BOK Dec 1994 induced) were partially liberalized as the band of preferred rates for this category was guided by the government Liberalized interest rates on time Dec 1994 deposits with maturity over 1 years Liberalized interest rates on time Jul 1995 deposits with maturity over 6 months Liberalized interest rates on time Nov 1995 deposits with maturity below 6 months (completed 4 stage deregulation on interest rates:19911997, earlier than planned) Branching restriction still remains 2000 Source: Korean Financial System (Bank Of Korea, 1998)

45

Asian Banking

As one of the most significant changes of banking regulation in Korea, the restriction on foreign ownership of domestic commercial banks has been lifted and now there is virtually no restriction on foreign ownership. The current changes within the Korean banking structure are being propelled by the recent financial crisis, as government officials realized that Korean banks were not competitive enough to survive. To improve the banking standards, Financial Supervisory Service (FSS) enforced the new accounting standards in accordance with internationally accepted standards. Changes in the management structure, in particular with the presence of foreign management, will definitely affect the structure of the Korean banking industry.

However, Asian banks showed evidence of maximizing lending during the regulated period as their interest margins were protected by the deposit rate ceilings and the guaranteed minimum lending rate for strategic industries. Asian banks started to focus more on profit maximization as their objectives following market deregulation. Thus, recent transformation in the Asian bank objectives is in part due to the increasing non-performing loans following the economic crisis. The banks realized that revenue maximizing does not protect them from losses due to non-performing loans considering lending as equivalent to revenues of non-financial firms. Asian Financial Crisis in 1997

46

Asian Banking

In order to test the predictions of SCP paradigm with modification for feedback, a set of variables for Structure (concentration), Conduct (branching and pricing) and Performance (profitability) were chosen and the relevant indices computed with respect to the strategic variable and deposits. The number of branches per bank measured the size of the branch network. Finally, three variables were used to capture the effect of various types of deregulation. The sample consists of 16 city banks and 64 regional banks in Japan (80 banks) and 17 city banks and 10 regional banks in Korea (27 banks) over the period of 1976 to 1999. For both countries, the data for all banks were aggregated. The econometric model is tested on commercial banks (i.e. nation-wide city banks and regional banks), as foreign bank branches and specialized banks do not participate in the majority of competitive activities given the prevailing regulation. Moreover, city and regional banks represent nearly 50% of the deposit market and they are the ones that compete in the more realistic sense. This can be explained with the help of following table.

Evolution of the number of commercial banks

Dec1976 Japanese Banks NationWide Regional 13 63 -3 0 -1 0 0 0 0 1 Dec 1985 13 64 8 64 M&A R T A Peak Dec2002

47

Asian Banking

Korean Banks Nation5 -6 0 3 9

Dec 1987 16 8

Wide Regional 10 -4 0 0 0 10 6 Source: Japanese Banks- Principles Financial Institutions By Zenginkyo, & Korean Bank Management. Where, M-Mergers & Acquisitions, R-Revocation, T-Transformation, A-Authorization of new entities

4.3 Comparison between Japan and Korea

Many economists showed similarities between Japan and Korea during the industrialization period after World War II, very few people tried to explain differences between the two countries. Despite the close interdependency with respect to trade and industrial structure, the banking sector has shown some evidence that they were taking fundamentally different steps towards restructuring. Japan seemed to have taken a prolonged plan for restructuring, as banks cannot truly compete in interest rates as they are bounded around zero. By contrast, Korea seemed to move much faster towards restructuring, growth and efficiency.

48

Asian Banking

49

Asian Banking

Chinese Banks: On the Reforms Path

Introduction Banking Reforms Interest Rate Policy Behest Lending Non-performing loans Monetary policies of the Central Bank

50

Asian Banking

Chinese Banks: On the Reforms Path

Introduction With the chinas entry into the WTO-fold, Chinese banks have to gear up, to face competition from foreign banks, which will be entering china shortly.

China is a very fast growing major economy in the world, with a strong domestic demand and substantial foreign direct investment. It has joined WTO during December, 2001. But its banking system is in a crisis with a very high level of NPAs and behest lending to state-managed enterprises, which have been faring very poorly. With the entry into WTOfold, foreign banks will get the green signal to carry out business in foreign currency with their domestic clients. Within two years, they will also be allowed to conduct wholesale banking business in local currency & within five years, they will be permitted to do retail business with the Chinese population. So, obviously there is an urgent need for the unsophisticated & ailing Chinese banks to perform better and been in the competition with the foreign banks.

51

Asian Banking

Banking Reforms Chinese banking reforms were initiated during 1978, a clear 14 years ahead of Indian economic reforms of 1992. The PBOC which functioned both as a central bank has been split to form four specialized banks and one central bank, which retained the name of PBOC. The four specialized banks are the Agricultural Bank of China (ABC), the China Construction Bank (CCB), The Bank of China (BOC) & The Industrial & Commercial Bank of China (ICBC). These four banks were also known as Policy Banks, as they were charged with the responsibility of implementation of the government plans and policies relating to agriculture, construction, foreign exchange, urban commercial and industrial development. However, by 1994 they shed the Policy Banks tag to become commercial banks. However, the policy execution functions have been entrusted to three state-run banks namely, China Development Bank (CDB), Export Import Bank of China (XIB) and Agricultural Bank of China (ABC). But as these new banks lacked network of branches, the separation of policy banks from the commercial banks was not very well-defined and effective.

Presently there are four wholly state-owned commercial banks (the Big Four Banks), 10 joint equity commercial banks and 90 city commercial banks. The four largest banks in china account for about 70% of assets, deposits and loans of the entire banking system, thereby depicting the dominance of the big four banks.

52

Asian Banking

Interest Rate Policy PBOC follows a regulated interest rate policy, which means the big four government banks virtually face no competition either in loan pricing or deposit interest rates, thereby according a monopoly status. The Central Bank Authority (PBOC), however, claims that interest rates, though not deregulated, are tending to be market-determined.

Behest Lending The big four banks undertake substantial behest lending to stateowned enterprises. It is no surprise that these banks are gradually loosing their position of prominence in profitability, thanks to the poor performance of SOEs and mounting NPAs of the banks.

Explicit guarantees by the central government for the deposits placed with the big four provided them with abundance of deposits, a source used to finance the SOEs. While SOEs are the chief contributors to the employment sector, pension funds and housing, their dismal performance has been a big drag on the performance of the big four banks. There are about 1.7lakh state-owned enterprises, which are the social legacy of China. These SOEs never had profit focus and were notorious for inefficiency. The fourth generation of leaders, to whom political power has been transferred during October, 2002, has now realized that it is better to commercialize SOEs rather then wholesale privatization. In fact, reforms are in place for the better

53

Asian Banking

management

of

these

establishments

in

the

form

of

ownership

transformation and commercialization, so that both public and private ownership could co-exist. Radical efforts to reduce staff and curtail wastage are also showing better results. One paradoxical situation that the Chinese authorities have faced is that many of these SOEs may have to be declared bankrupt if stringent bankruptcy laws which are on the avail are to be implemented. In such a case, the financing banks will obviously take a bigger hit on the NPAs front. This can be explained with the help of following table (Table-8)

China: Surges Ahead 1998 Growth Rates(%,y-y) GDP Merchandise exports Merchandise imports Ratios(% of GDP) Current account balance Government debt Levels(US$) Foreign exchange (billions) Net FDI inflow (billions) Income per capita 7.8 0.5 -1.5 3.4 17.8 1999 7.1 6.1 18.2 2.1 20.9 2000 8.0 27.8 35.8 1.9 22.8 2001 7.3 6.8 8.2 1.5 24.5 2002 8.0 22.3 21.2 1.7 25.3

reserves 145.0 154.7 165.6 212.2 286.4 41.1 37.0 37.5 37.4 41.8 740.0 780.0 840.0 890.0 940.0

China has concentrated both on macroeconomic stability and improving the performance of the banks, especially the state-owned banks.

54

Asian Banking

Non-Performing Loans There was a need to recapitalize the banks with the help of NPA (Non-Performing Asset) levels. In 1998, an amount of US $ 33billion has been recapitalized, through a special bond issue, so as to make the transaction fund flow neutral. In 1999, four AMCs have been started to acquire the NPAs of the big four. Chinese banks have adopted the five classification loan structure (pass loans, special mention loans, substandard, doubtful & loss loans). The AMCs were to exchange their bonds, in a phased manner, over a period of 10 years, with the NPLs of the big four. These bonds carry the guarantee of the central government. So far, the AMCs have taken about US $170 billion NPL accounts from the big four banks.

However, the NPLs problem has acquired crisis proportions, with over 25% level for the big four (2001), showing only a 3% fall from the previous years level. It is worth recording here that analysis placed the NPLs figure for the big four as high as 35-50%. At the targeted level of 3% reduction every year, (either through recoveries, write-offs or sale to AMCs), it will take 12 to 16 years to bring down their level to an acceptable percentage. This is explained with the help of following table (Table-9). Recovery Rate in NPL Sales(%)as of End of Year 2001 AMCs Oriental Great Wall Huarong 2001 24.2 7 32.5 Cinda 35

55

Asian Banking

Monetary policies of the Central Bank The PBOC has been designated as the central banking authority, in the year 1995. It charged with the main function of formulating and implementing monetary policy and supervision of the financial services sector. In its report for the fiscal 2002, it claims that it has encouraged commercial banks to strengthen loan marketing, improve financial services, and intensify financial support to economic growth, besides creating a favorable condition for the sustained, rapid and healthy development of the economy. It also stated that monetary and credit supply was basically commensurate with the trend of economic growth. The central banking authority appears to be taking conscious steps to reduce the significance of cash as an intermediate monetary target by facilitating the growth of settlement instruments such as commercial bills and credit cards.

There is significant increase in Renminbi loans and foreign currency loans by 17% in total for the year 2002. Wholly-owned state banks, and joint stock commercial banks besides policy banks, as usual, contributed to this rise. The growth in deposits was also significant. PBOC has declared that for the year 2003, monetary policy instruments of various kinds will be flexibly used to keep appropriate increase of money supply. The interest rate and exchange rate policy will be kept stable, in the process of market based interest rate reform. Credit policy will be applied to support economic restructuring.

56

Asian Banking

Chinas monetary policy was fairly successful in keeping interest rates and inflation very low. What is more, it did not allow the economy to fall into a deflationary spiral, through a sound monetary policy, coupled with the proactive fiscal policy of the government.. Other features of the monetary policy are preserving the exchange rate stability & improving the monetary policy transmission mechanism. PBOC has counseled the SMEs, starved of bank credit, to attempt for enterprise restructuring, so as to improve creditworthiness. Banks have also been advised to aggressively market credit to eligible SMEs sector borrower.

57

Asian Banking

58

Asian Banking

Bank of China

Introduction A Watershed Year, 2001 Treasury Operations Investment Banking Risk Management Corporate Governance The Business Strategy & Performance

59

Asian Banking

Introduction Bank of China is a major government bank with strong foreign exchange operations. It proposes to strengthen its operations in insurance, investment banking and foreign exchange business to become an international bank. It has been strengthening risk management and corporate governance functions, besides computerization level. BOC was established 90 years ago, and is one of the major government banks in china, popularly known for its foreign exchange operations. It is ranked 8th among 300 Asian banks, with respect to net profit.

A Watershed Year, 2001

60

Asian Banking

For BOC, 2001 signifies radical changes. The entire bank was focused on the development of its core activities, as a matter of priority. During this year, the bank has continued to build a robust decision-making system. It has also fine-tuned risk management through a due diligence process and a system of follow up evaluation. Asset disposition review committee and procurement review committee have also been established.

The bank has also followed prudent accounting principles with a view to improve transparency. It has also adopted the five-tier approach in loan classification with a view to provide transparency. It has also adopted the five-tier approach in loan classification with a view to provide transparency and clarity about asset quality. It is during 2001, that the bank, in compliance with the prudent accounting principles has undertaken massive write-off of bad-debts, besides providing substantially, for substandard and doubtful debts. It has even reversed uncollected overdue interest. Three years of restructuring efforts have resulted into better standards of risk management & transparency.

In the credit area for 2002, it has added US $ 103 billion by May 2002 to the retail lending sector, to take the total exposure over US $ 250 billion. The areas-of retail lending includes consumer loans, auto loans, travel and personal loans.

BOC has significant overseas presence with 585 branches in 26 countries. Thirty seven percent of Chinas international trade is routed

61

Asian Banking

through this bank. BOC has put in place, performance-based reward and disciplinary processes. The evaluation results are linked to bonuses, promotions, training, job assignment etc.

Treasury Operations The bank provides market information and option for risk management through the hedging services for assets and liabilities, the bank garners impassive revenues.

Sector Structure of the Loans Sector December 31,2001 Manufacturing 3,36,965 Commerce 1,29,062 Real Estate 1,67,140 Others 9,53,770 Total 15,86,937 Source: Bank of China, 2001 Annual Report.

December 31,2000 3,13,541 1,18,856 1,98,810 8,73,838 15,05,045

The bank is very strong in foreign exchange services, with a volume of US $ 160 billion (2001). It is a lending player in foreign currency clearing business in domestic market. During 2002, the foreign exchange business was amounted to US $196 billion.

For corporate clients with global operations, an innovative product is called as Global Credit Line which has been introduced during 2001, to facilitate overseas development of Chinese enterprises. It also introduced

62

Asian Banking

factoring & forfeiting services and cash management solutions. Credit to the sales outlets of the multinationals is provided through two new products namely, Distribution Passport and Startup winners. By the end of 2002, corporate deposits had been increased US $963 billion, a growth of 11% over the previous year.

In the credit cards area, the bank issues two types of cards namely, the Great Wall International Card and the Great Wall Electronic Debit Card, this is the domestic card. In 2001, the issue of domestic cards reached a level of 4.6 million, recording a growth of 13%. The international cards totaled to 110,000, with a growth rate of 112%. At the end of 2002, the number of Great Wall Cards in issue was 5.25 million. The number of international cards has swelled to 23,000. Investment Banking The bank participated in the IPOs of eight enterprises in 2001. Total capital raised by these enterprises accounted for over 70% of the amount of capital raised in the Hong Kong Stock Market in 2001. The bank acted as the joint global coordinator, joint book runner, joint sponsor and joint lead underwriter for the biggest IPO project in Hong Kong in 2001, China National Offshore Oil Corporation (CNOOC). In 2002, it remained the number one arranger of IPOs. Risk Management

63

Asian Banking The banks risk management system reflects the principles of segregation of duties between risk management and business operational roles. Cross-departmental Risk Management Committee, Asset and Liability Management and Budget Committee functions under the direct control of the top management, while individual departments take care of the credit, market and liquidity risk. The bank is trying to implement Basel capital accord norms while managing the various risks.

Corporate Governance

The bank plans to attain international standards in corporate governance within three to five years. As a first step, the bank has focused on the following six key areas: Clear strategy for business expansion, sound decision-making mechanism and strengthened financial risk control, prudent accounting principles and increased transparency, strategically linked performance evaluation, human resource development and establishment of a truly accountable board.

During 2001, the bank has been adjudged the best bank of china by Euro money, the Best Domestic Bank in china by Asset, and the Best Retail Bank in China by the Asian Banker. The bank hopes to acquire the status of a leading universal international bank very soon, by foraying into insurance and securities through strategic alliances. It proposes to concentrate on commercial banking, investment banking and insurance.

64

Asian Banking

The Business Strategy The bank has paid special attention to improving the penetration of information technology besides focusing on corporate and retail banking. The bank has further strengthened its risk management and internal control infrastructure.

Performance Highlights for 2002 The bank has principal exposures in manufacturing commerce, real estate and other sectors. At the end of 2002, domestic retail loans reached US $155.5 billion, an increase of US $73.1 billion, the highest growth rate in the Chinese banking industry. Number one in cards business in china. Top 50 arranger of European syndicated lending. The asset quality of Bank of China improved considerably in 2002. At the year-end, the non-performing assets ratio of Bank of China group was 22.5%, down 5% points from the previous year. In the banks domestic operations, non-performing assets of US $59.6 billion have been resolved, resulting in cash recoveries of US $34.7 billion. Number one arranger of IPOs in Hong Kong. 30% growth in insurance income.

65

Asian Banking

Case-Study ICICI Bank

ICICI Bank has been a consistent performer. It has occupied the first place among the private sector banks & second place among over all the banks on the basis of its assets. This tech-savvy bank always follows welldefined business strategies. Its present emphasis is on retail banking. While it has many strengths and opportunities, it is likely to face challenges in the form of higher incidence of NPAs, unfavorable funding composition and the needs to comply with the 40% priority sector norms in the coming years. ICICI Bank has become the largest private sector bank and the second largest bank in India. As a universal bank, ICICI Bank has transformed itself from the role of mere financial intermediary into a provider of a wide range of services, in addition to an originator of credit. The product range is

66

Asian Banking

impressive: Home Loans, Car Loans, Consumer Loans, Credit Cards, Debit Cards, Smart Cards, E-Cheques, Private Banking, Demat Services, NRI Services, all these in retail banking, driven by branches, ATMs, internet and call centers. Being a tech-savvy bank, it has taken full advantage of a liberalized economy and availability of superior technology. Its retail distribution and services are truly technology-driven.

Well-defined Strategies ICICI Bank has adopted a well-defined, carefully planned strategy for development. The key elements of its strategy have been capitalization of new business opportunities; build up of a strong brand and distribution capability, leveraging technology, establishment of robust systems and human capital.

Strategic Initiatives-Retail Banking The banks retail assets continued 49% of advances and 42% of customer assets as on December 31, 2003. The bank continued to focus on securitization of its customer assets. During April to December 2003 the total sell-down/securitization of assets was Rs.7, 900 cr. The bank has base of over 6, 50,000 credit cards at the end of fiscal 2002. Most of the Indian

67

Asian Banking

banks do not appear to be successful in profitability conducting credit cards business. It is not known whether ICICI Bank is earning profits from this retail business. The bank has issued 6, 00,000 debit cards as well. The bank has been aggressively marketing retail deposits as well, with a view to reduce the cost of funds besides creating a stable funding base. Its retail clientele, as a consequence has increased from 3.2 million to over 5 million during 2001-2002. The average cost of funds has come down to 5.30% during fiscal 2003. Other retail initiatives include electronic trading on the stock exchanges, called ICICI Direct. The bank produces digitally signed contract notes, allowing customer to view and print contract notes online. Its multi-channel distribution strategy is fairly successful. The branches now account for about one-third of the transactions, the rest being done through one thousand ATMs, and internet banking accounts. It has over 10,00,000 retail internet banking accounts. It offers internet-based inter bank funds transfer facility in eight cities through e-cheques. Its call centers can be accessed by customers in 100 cities, providing a single point of contract for customers across all products, besides self-service options and personalized communication with customer service officers. Corporate Banking Strategy The bank adopts the strategy of customized financial solutions to clients. It follows risk-based pricing and proactive portfolio management. It has been actively partaking in the ongoing public sector disinvestment

68

Asian Banking

process through structuring and advisory services. The bank has created a market for securitized debt. It is a dominant player in project finance, loan syndication and international business in the form of ethnic banking services to NRIs. It also leverages its home country links for capturing market shares in select international markets. As Island of High Wage Earners The bank pays high salaries to its executive cadre staff and very high level salaries for other officers. A general managers salary is easily in the range of Rs.25, 00,000 to Rs.50, 00,000 gross per annum, depending on the performance. CEO, managing director, joint managing directors, and executive directors clear more than a cr. of rupees annually. It has introduced Employee Stock Option Scheme (ESOS), two years ago to enable its employees participate in the future growth and profits of the bank.

Public Recognition During fiscal 2003, the bank received several prestigious awards in recognition of its business strategies, customer service levels, technology focus and human resource practices, linking: Bank of the Year 2002, in India by The Banker magazine of UK; Bank of the Year from the emerging markets by The Banker magazine of UK; Best Bank in India by Global Finance; Best Consumer Internet Bank in India by Global Finance; Best Foreign Exchange Bank in India by Global Finance;

69

Asian Banking

Indias Most Admired Bank 2002 in the BB-TN Sofres Mode Poll; Best Managed Bank in Asia, in a poll by Euro money; Indias Top 5 most respected companies Business World magazine; Excellence in Retail Banking award by Asian Banker journal;