Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ECON 261 - Principles of Finance

Caricato da

Ushna AkberTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ECON 261 - Principles of Finance

Caricato da

Ushna AkberCopyright:

Formati disponibili

Lahore University of Management Sciences Econ 261 Principles of Finance

Spring 2013

Instructor Room No. Office Hours Email Telephone Secretary/TA TA Office Hours Course URL (if any)

Ushna Akber 265 TBA ushna@lums.edu.pk EXT 2263 TBA TBA

Course Basics Credit Hours Lecture(s) Recitation/Lab (per week) Tutorial (per week) Course Distribution Core Elective Open for Student Category Close for Student Category COURSE DESCRIPTION

4 2 Per Week N/A TBA

Duration Duration Duration

110

No Yes Sophomore/Junior

This course introduces the theory and practice of finance to students who are largely unfamiliar with finance. This course explores the first part of Financial Management and introduces the framework, tools and techniques for making Investment decisions. Specifically, we will cover Time Value of Money, Stock and Bond Valuation, Capital Budgeting, Modern Portfolio Theory and RiskReturn Relationship. At the end of the course students should have a clear understanding of financial decision making practices required to be an effective manager. COURSE PREREQUISITE(S) Principles of Microeconomics Principles of Macroeconomics Statistics

Grading Breakup and Policy Quizzes: 25% (Announced) Midterm Examination: 25% Project/Presentation: 15% Final Examination: 35%

Lahore University of Management Sciences

Examination Detail Yes/No: Yes Combine Separate: Combine Duration: In class Preferred Date: TBA Exam Specifications: Closed books and closed notes; help sheet not allowed; formula sheet not allowed; calculators allowed.

Midterm Exam

Final Exam

Yes/No: Yes Combine Separate: Combine Duration: TBA Exam Specifications: Closed books and closed notes; help sheet not allowed; formula sheet not allowed; calculators allowed.

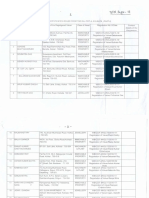

Session

2,3,4 5 6

7, 8

9, 10 11,12 13 14 15 16 17 18 19 20, 21 22 23 24, 25 26, 27, 28

COURSE OVERVIEW Topics Introduction to the course An Introduction To Finance The firm and the financial manager. An Overview of Financial Environments (Capital Markets and Corporate Finance) An Introduction to Financial Markets, Financial Institutions and Financial Instruments, Consumption, Savings and Investment. Accounting and Finance Balance Sheet; Income Statements and Cash Flow Statements; Taxes Ratio analysis and DuPont. Time Value Of Money Compounding and Discounting; Future and present value. Perpetuities and Annuities; Various Application of TVM; TVM as Basis of Valuation of Financial Instruments, Effective interest rate; Inflation and real interest rate. TVM and Bond Valuation Bond Characteristics; Basic Valuation Model; Bond Prices and Yields; Different Types of yields. Valuation Valuing Bonds Bond Prices and Interest Rates: Price Volatility: Price Sensitivity; Bond Duration and Convexity. Valuation Stocks Different Type of Stocks and markets they are traded in; Some Stock Classifications. Book Value and Market Value;Dividend Discount Models and Other Models Valuation Valuing Bond & Stocks DDM with constant growth ; Intro to technical and fundamental analysis; Puzzles in stock valuation Investment Criteria; Net Present Value NPV; Other Investment Criteria(IRR, payback); Mutually Exclusive Projects; Capital Rationing. Discounted Cash Flow Analysis DCF; Sunk Costs and Opportunity Costs; Discount Nominal Cash Flow by Nominal Cost of Capital; Separate Investment and Financing Decision; Calculating Cash Flows. Project Analysis How Firms organize the Investment Process; Sensitivity Analysis and Scenario Analysis; Accounting Breakeven Analysis; Operating Leverage and Financial Leverage; Real Options. Mid term An Introduction to Risk and Return Risk and Return Basics; Opportunity Cost of Capital; A Review of Rate of Return; Measuring Risk; Risk and Diversification; Different Varieties of Risks.; Expected Risk & Return. An Introduction To Portfolio Theory Risk and Return , Portfolio of Risky and Risk less Assets; Efficient Frontiers; Capital Market Line. Risk, Return and Capital Budgeting Measuring Market Risks; The CAPM Model; Beta and Security Market Line; Use of CAPM for Estimating and Calculating Risk, Company vs Project Risk. Cost of Capital Weighted Average Cost Of Capital; Measuring Capital Structure; Calculating Required Rate of Return; Calculating and Interpreting the Weighted Average Cost of Capital; Beta levering and re levering. Debt Policy Dividend Policy International Financial Management (optional) Options Presentations

Readings

BMM Ch 1 and 2

BMM Ch 3 and 4 BMM Ch 5 BMM Ch 5

BMM Ch 6

BMM Ch 7

BMM Ch 8 BMM Ch 9 BMM Ch 10

BMM Ch 11

BMM Ch 12 BMM Ch 13 BMM Ch 16 BMM Ch 17 BMM Ch 22 BMM Ch 23

Lahore University of Management Sciences

Textbook(s)/Supplementary Readings Brealey, Myers & Marcus, 2009, 6 edition, Fundamentals of Corporate Finance, McGrawHill Irwin.

th

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Business FundamentalsDocumento7 pagineBusiness FundamentalsjfasldjflakdjqdfNessuna valutazione finora

- Ch-5 - Stock ValuationDocumento27 pagineCh-5 - Stock ValuationTas MimaNessuna valutazione finora

- List of Registered Valuers of Different Classes of Assets Dated 31 03 2021Documento18 pagineList of Registered Valuers of Different Classes of Assets Dated 31 03 2021DivyanshNessuna valutazione finora

- Swap RatioDocumento24 pagineSwap RatioRajesh SharmaNessuna valutazione finora

- Pertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanDocumento20 paginePertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanTawang Deni WijayaNessuna valutazione finora

- SBUX - 4M 2019-05-15 (KDR) - RevisedDocumento87 pagineSBUX - 4M 2019-05-15 (KDR) - RevisedKhuert Jirioz CooperNessuna valutazione finora

- FM Model Question PaperDocumento10 pagineFM Model Question PaperSugandhaNessuna valutazione finora

- Normalization AdjustmentsDocumento1 paginaNormalization AdjustmentsAbraham ChinNessuna valutazione finora

- Tutorial 8 ACC POLICIES, ESTIMATES, ERRORSFileDocumento9 pagineTutorial 8 ACC POLICIES, ESTIMATES, ERRORSFileAisyah OthmanNessuna valutazione finora

- Eaton V - FIN711 - Week 8 - Individual Leadership Plan Addendum - FinanceDocumento14 pagineEaton V - FIN711 - Week 8 - Individual Leadership Plan Addendum - FinancevjeatonNessuna valutazione finora

- WFG Upgrade From CIBCDocumento9 pagineWFG Upgrade From CIBCForexliveNessuna valutazione finora

- Chapter 7 Case - Valuation Ratios in The Restaurant IndustryDocumento2 pagineChapter 7 Case - Valuation Ratios in The Restaurant IndustrySarah Ihugo40% (5)

- Chapter 4 Stock Valuation (Student)Documento10 pagineChapter 4 Stock Valuation (Student)Nguyễn Thái Minh ThưNessuna valutazione finora

- SAB 107 SEC Share Based PaymentsDocumento64 pagineSAB 107 SEC Share Based PaymentsAlycia SkousenNessuna valutazione finora

- Delhi NCR ReportDocumento154 pagineDelhi NCR ReportNAVEDNessuna valutazione finora

- CMKTQT HGDocumento32 pagineCMKTQT HGGiang Thái HươngNessuna valutazione finora

- The Stewardship Role of AccountingDocumento11 pagineThe Stewardship Role of AccountingcrazydownloaderNessuna valutazione finora

- Warren Buffett CalculationsDocumento24 pagineWarren Buffett Calculationseric_stNessuna valutazione finora

- Biotech Valuation ModelDocumento8 pagineBiotech Valuation ModelsachinmatpalNessuna valutazione finora

- Guerrero Leon F 201308 MS PDFDocumento68 pagineGuerrero Leon F 201308 MS PDFganNessuna valutazione finora

- Module IIIDocumento29 pagineModule IIImanoj mlpNessuna valutazione finora

- Abdul Mohd Nasir ThesisDocumento129 pagineAbdul Mohd Nasir Thesisgarych72Nessuna valutazione finora

- MBA SyllabusDocumento28 pagineMBA SyllabusKarthika NathanNessuna valutazione finora

- Tech Sector Update 01122022Documento4 pagineTech Sector Update 01122022VictorioNessuna valutazione finora

- Annual Report: Petrochina Company LimitedDocumento292 pagineAnnual Report: Petrochina Company LimitedJennieNessuna valutazione finora

- Sap Co Material FullDocumento284 pagineSap Co Material FullS VenkatakrishnanNessuna valutazione finora

- Duration and Bonds - 27 Pages of Q & ANSDocumento27 pagineDuration and Bonds - 27 Pages of Q & ANSAbdulaziz FaisalNessuna valutazione finora

- Inter Taxation 50 Important Questions 1676977237180910Documento79 pagineInter Taxation 50 Important Questions 1676977237180910Tushar MittalNessuna valutazione finora

- Mercer-Capital FinTech 18Q1 PDFDocumento13 pagineMercer-Capital FinTech 18Q1 PDFGabriel Fioravanti CantuNessuna valutazione finora

- Ax2012 Enus Civ 03Documento26 pagineAx2012 Enus Civ 03rajaNessuna valutazione finora