Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Maths

Caricato da

Aftab HossainDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Maths

Caricato da

Aftab HossainCopyright:

Formati disponibili

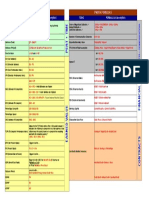

OVERVIEW OF BUSINESS MATHEMATICS: Description Diagram 1. Single Cash Flow PV= ? k= ? FV= ? n=? 2.

Multiple Constant Cash Flows PVA= ? k=? PMT=? FVA=? n=? 3. Perpetual Cash Flows PV= ? k=? n= PMT=? PV= ? 0 10 20 30 Present Value

PVn = FV/ (1+ k)n or PVn = FV/ (1+ k/q)nq PVAn= PMT [{1- 1 (1+k)n} k] or PVAn= PMT [{1- 1 (1+k/q)nq} k/q] Annuity Due: Multiply formulas by the factor (1+ k). above

4. Complex Cash Flows PV= ? -10-10 20 20 FV=?

PV = PMT / k or PV = PMT1 / (kg)

Combination of two or more formulas.

Future Value

FVn = PV (1+ k)n or FVn = PV (1+ k/q)nq

FVAn= PMT [{(1+k)n 1} k] or FVAn= PMT [{(1+k/q)nq 1} k/q] Annuity Due: Multiply formulas by the factor (1+ k).

For example, bond valuation need Not Applicable. Cash flows will continue forever. to use following two formulas: Therefore, no FV calculation. PVn = FV/ (1+ k)n + above PVAn= PMT [{1- 1 (1+k)n} k] Again, for share valuation we might need to use single/multiple cash flow(s) formula plus perpetuity formula (or other combinations).

Period

n = log (FV/PV) log (1+k) or nq= log (FV/PV) log (1+k/q) k = (FV/PV)1/n 1 or kq = (FV/PV)1/nq 1

Use financial calculator / MS Excel to Not Applicable. solve for n. n= . Use interpolation formula to solve for k = PMT/PV k or IRR. k = (PMT1 / PV) + g Use financial calculator / MS Excel to solve for k. PMT= PVAn[{1-1 (1+k)n} k] or PMT=PVAn[{1-1 (1+k/q)nq} k/q] PMT= PV / k or

Rate

EIR = (1 + k/q)q -1 RRR=[(1+NRR)(1+INF)]-1 Payments

Not Applicable. Single cash flow. No cash flow(s) PMT= FVAn[{(1+k)n 1} k] or in between PV and FV. PMT= FVAn[{(1+k/q)nq 1} k/q]

PMT1= PV / (kg)

AN OVERVIEW OF BUSINESS MATHEMATICS: TIME VALUE OF MONEY

I) FUTURE / PRESENT VALUE CALCULATION (SINGLE CASH FLOW): 1. What will be the future value (FV) of Tk. 5,000 deposited today after 5 years at 10% annual interest rate? FVn = PV (1+ k)n [Ans. Tk. 8,052.55] 2. You will inherit Tk. 2,000,000 after 10 years. At 10% annual interest rate what is the present value (PV) of that? PVn = FV/ (1+ k)n [Ans. Tk. 771,086.58] 3. Your investment of Tk. 500,000 grew to Tk. 800,000 in 2 years. What percentage of interest (k) did you earn on that investment? k = (FV/PV)1/n 1 [Ans. 26.49%] 4. How many years (n) will it take for an investment to grow from Tk. 1,000,000 to grow to Tk. 5,000,000 at 10% interest per annum? n = log (FV/PV) / log (1+k) [Ans. 16.89 Years] 5. For a savings account ABC Bank pays interest 10% per annum, compounded (q) quarterly. If you deposit Tk. 100,000 in that account, how much you will get after 2 years? FVn = PV(1 + k/q)nq [Ans. Tk. 121,840.29] 6. Your target is to have Tk. 1,000,000 as savings after 5 years. XYZ Bank has a savings product which will give you 12% interest per annum, compounded (q) monthly. How much money you need to deposit today in order to achieve your target in five years? PVn = FV / (1 + k/q)nq [Tk. 550,449.62] 7. Calculate the effective interest rate (EIR) for an account yielding nominally 12% per annum, compounded monthly. EIR = (1 + k/q)q -1 [Ans. 12.68%] II) FUTURE/ PRESENT VALUE OF AN ANNUITY (MULTIPLE, CONSTANT CASH FLOWS): 8. You have decided to deposit Tk. 100,000 in a savings account at the end of each year for next 30 years of your working life. The money can be invested at an interest rate of 10% p.a. How much you will save in 30 years? FVAn= PMT [{(1+k)n 1} / k] [Ans. Tk. 16,449,402.27] 9. What is the present value (PVA) of the investment that will pay you Tk. 100,000 at the end of each year for next 5 years? Assume interest rate will be 12% per annum. PVAn= PMT [{1- 1/ (1+k)n} / k] [Ans. Tk. 360,477.62] 10. You have decided to save Tk. 5,000 in a savings account at the end of each month (q) for next 30 years. The money can be invested at an interest rate of 7% a year. How much you will be able to save in 30 years? FVAn= PMT [{(1+k/q)nq 1} (k/q)] [Ans. Tk. 6,099,854.98] 11. How much money you must have today in order to withdraw Tk. 5,000 at the end of each month (q) for next 30 years? Assume an interest rate of 10% p.a. PVAn= PMT [{1- 1/ (1+k/q)nq} (k/q)] [Ans. Tk. 569,754.10]

Installment (PMT) Calculation: Annuities 12. In order to have Tk. 10,000,000 after 15 years from now, how much you should save per month at 8% interest rate p.a? PMT = FVAn [{(1+k/q)nq 1} (k/q)] [Ans. Tk. 28,898.54] 13. If you take out a Tk. 1,000,000 car loan for five years at an interest of 18%, who much you will have to pay per month as installment? PMT = PVAn [{1- 1/ (1+k/q)nq} (k/q)] [Tk. 25,393.43] III) PRESENT VALUE CALCULATION: PERPETUAL CASH FLOWS a) Present value calculation: Perpetuity with no growth 14. What is the present value (PV) of an investment that will give you Tk. 60,000 at the end of each year forever at 12% required return? PV = PMT / k [Ans. Tk. 500,000] b) Present value calculation: Perpetuity with constant growth 15. Your friend wants you to invest in his business. He told you that he will give you Tk. 100,000 as profit at the end of the first year. Thereafter, he promises to pay 5% more each year forever. If your required rate of return is 12% p.a., how much should you pay for this investment opportunity? PV = PMT1 / (k g) [Ans. Tk. 1,428,571.43] IV) PRESENT VALUE CALCULATION : COMPLEX CASH FLOWS 16. Calculate the present value of the following year-end cashflows. The discount rate is 12% p.a. Cashflows Year Present Value ? 0 1 200 2 200 3 200 200 4 5 Annuities 200 6 500 7 500 8 500 .500 9 Perpetuities [Ans. Tk. 2,754.67] 17. You are planning to retire in 30 years. You plan to spend Tk. 100,000 a month in retirement, which should last for about 25 years. If you could earn 8% p.a on your retirement savings, how much you will need to save per month for next thirty years? [Ans. Tk. 8,693.51] Solving problems using MS Excel / Financial Calculator: Open MS Excel => Go to insert pull down menu => click on Function (fx) => select a category => Financial => try PV, FV, NPER, RATE, PMT formula. Try to solve all the problems using MS Excel. Useful Formulas: FVn = PV (1+ k)n , PVn = FV/ (1+ k)n , k = (FV/PV)1/n 1, n = log (FV/PV) / log (1+k), FVn = PV(1 + k/q)nq , EIR = (1 + k/q)q -1 FVAn= PMT [{(1+k/q)nq 1} (k/q)] and PVAn= PMT [{1- 1/ (1+k/q)nq} (k/q)] PV of Perpetuity = PMT / k, PV of perpetuity with growth = PMT1 / (k g)

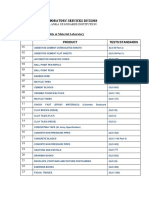

Time Value of Money: Practice Problems

1. What will a deposit of $4,500 at 7% annual interest be worth if left in the bank for nine years? 2. What will a deposit of $4,500 at 10% compounded semiannually be worth if left in the bank for six years? 3. What will a deposit of $4,500 at 12% compounded monthly be worth at the end of 10 years? 4. How much will $1,000 deposited in a savings account earning an annual interest rate of 6 percent be worth at the end of 5 years? 5. How much will $1,000 deposited in a savings account earning an annual interest rate of 6 percent be worth at the end of 3 years? 6. Given an annual opportunity cost of 10%, what is the future value of a $1,000 ordinary annuity for 1 year? 7. Given an annual opportunity cost of 10%, what is the future value of a $1,000 ordinary annuity for 10 years? 8. If you require a 9 percent annual return on your investments, you would prefer $15,000 five years from today rather than an ordinary annuity of $1,000 per year for 15 years. 9. How long does it take for $5,000 to grow into $6,724.44 at 10% compounded quarterly? 10. How long does it take for $856 to grow into $1,122 at an annual interest rate of 7%? 11. How much will an ordinary annuity of $650 per year be worth in eight years at an annual interest rate of 6 percent? 12. How much will an ordinary annuity of $650 per year be worth in eight years at an annual interest rate of 8 percent? 13. How much must you deposit at the end of each year in an account that pays an annual interest rate of 20 percent, if at the end of 5 years you want $10,000 in the account? 14. The Wintergreens are planning ahead for their son's education. He's eight now and will start college in 10 years. How much will they have to set aside at the end of each year to have $65,000 in 10 years if the annual interest rate is 7%? 15. What annual interest rate would you need in order to have an ordinary annuity of $7,500 per year accumulate to $279,600 in 15 years? 16. What annual interest rate is implied if you lend someone $1,850 and are repaid $2, 078.66 in two years? 17. What nominal annual interest rate is implied if you borrow $12,500 and repay $21,364.24 in three years with monthly compounding? 18. You have $10,000 to invest. Assuming annual compounding, how long will it take for the $10,000 to double if it is invested at an annual interest rate of 14 percent? 19. The Tried and True Corporation had earnings of $0.20 per share in 1978. By 1995, a period of 17 years, its earnings had grown to $1.01 per share. What was the compound annual rate of growth in the company's earnings?

20. What is the present value of $800 to be received at the end of 8 years, assuming an interest rate of 20 percent, quarterly compounding? 21. What is the present value of $800 to be received at the end of 8 years, assuming an annual interest rate of 8 percent? 22. What would you pay for an ordinary annuity of $2,000 paid every six months for 12 years if you could invest your money elsewhere at a nominal interest rate of 10% compounded semiannually? 23. Thirty years ago, Jesse Jones bought 10 acres of land for $1,000 per acre in what is now downtown Houston. If this land grew in value at an annual interest rate of 8 percent, what is it worth today? 24. What would you be willing to pay for a $1,000 bond paying $70 interest at the end of each year and maturing in 25 years if you wanted the bond to yield an annual interest rate of 7 percent? 25. What would you be willing to pay for a $1,000 bond paying $70 interest at the end of each year and maturing in 25 years if you wanted the bond to yield an annual interest rate of 12 percent? (Note: At maturity, the bond will be retired and the holder will receive $1,000 in cash. Bonds typically are issued with $1,000 face, or par, values. The actual market value at any point in time will tend to rise as interest rates fall and fall as interest rates rise.) 26. A $10,000 car loan has payments of $361.52 due at the end of each month for three years. What is the nominal interest rate? 27. Joe Ferro's uncle is going to give him $250 a month for the next two years starting today. If Joe deposits every payment in an account paying a nominal annual interest rate of 6% compounded monthly, how much will he have at the end of three years? 28. Find the present value of $1,000 to be received at the end of 2 years at a 12% nominal annual interest rate compounded quarterly. 29. Find the present value of $1,000 to be received at the end of 4 years at a nominal annual interest rate of 12%, compounded semiannually. 30. Given a 15% annual opportunity cost, $1.00 three years from now is worth more than $2.00 nine years from now. 31. Your great-uncle Claude is 82 years old. Over the years, he has accumulated savings of $80,000. He estimates that he will live another 10 years at the most and wants to spend his savings by then. (If he lives longer than that, he figures you will be happy to take care of him.) Uncle Claude places his $80,000 into an account earning 10 percent annually and sets it up in such a way that he will be making 10 equal annual withdrawals (the first one occurring 1 year from now) such that his account balance will be zero at the end of 10 years. How much will he be able to withdraw each year? 32. Your parents have discovered a $1,000 bond at the bottom of their safe deposit box. The bond was given to you by your late great-aunt Hilda on your second birthday. The bond pays an annual interest rate of 5 percent. Interest accumulates and is paid at the time the bond is redeemed. You are now 27 years old. What is the current worth of the bond (principal plus interest)? 33. Your mother is planning to retire this year. Her firm has offered her a lump sum retirement payment of $50,000 or a $6,000 lifetime ordinary annuity-whichever she chooses. Your mother is in reasonably good health and expects to live for at least 15 more years. Which option should she choose, assuming that an 8 percent annual interest rate is appropriate to evaluate the annuity? 34. A life insurance company has offered you a new "cash grower" policy that will be fully paid up when you turn 45. At that time, it will have a cash surrender value of $18,000. When you turn 65, the policy

will have a cash surrender value of $37,728. What annual rate of interest is the insurance company promising you on your investment? 35. Strikler, Inc. has issued a $10 million, 10-year bond issue. The bonds require Strikler to establish a sinking fund and make 10 equal, end-of-year deposits into the fund. These deposits will earn 8 percent annually, and the sinking fund should have enough accumulated in it at the end of 10 years to retire the bonds. What are the annual sinking fund payments? 36. A Baldwin United Company agent has just presented the following offer. If you deposit $25,000 with the firm today, it will pay you $10,000 per year at the end of years 8 through 15. If you require a 15 percent annual rate of return on this type of investment, would you make this investment? 37. Determine the value at the end of 3 years of a $10,000 investment (today) in a bank certificate of deposit (CD) that pays a nominal annual interest rate of 8 percent, compounded monthly. 38. Determine the value at the end of 3 years of a $10,000 investment (today) in a bank certificate of deposit (CD) that pays a nominal annual interest rate of 8 percent, compounded semiannually. 39. An investment requires an outlay of $100,000 today. Cash inflows from the investment are expected to be $40,000 per year at the end of years 4, 5, 6, 7, and 8. If you require a 20 percent annual rate of return on this type of investment, should the investment be undertaken? 40. Calculate the present value of a perpetuity bond that is expected to pay $50 of interest per year forever if the investor requires an annual return of 8 percent. 41. Steven White is considering taking early retirement, having saved $400,000. White desires to determine how many years the savings will last if $40,000 per year is withdrawn at the end of each year. White feels the savings can earn 10 percent per year. 42. What is the monthly rate of interest that will yield an annual effective interest rate of 12 percent?

Potrebbero piacerti anche

- Unit 3: This Study Resource WasDocumento9 pagineUnit 3: This Study Resource WasAnanda Siti fatimah100% (2)

- Walt DisneyDocumento56 pagineWalt DisneyDaniela Denisse Anthawer Luna100% (6)

- FRM Index (Revised)Documento28 pagineFRM Index (Revised)api-3717306Nessuna valutazione finora

- Investigating The Value of An MBA Education Using NPV Decision ModelDocumento72 pagineInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriNessuna valutazione finora

- Project WorkflowDocumento1 paginaProject WorkflowAnnaNessuna valutazione finora

- AFM QuizDocumento47 pagineAFM QuizDhaya100% (1)

- Mass of Christ The Savior by Dan Schutte LyricsDocumento1 paginaMass of Christ The Savior by Dan Schutte LyricsMark Greg FyeFye II33% (3)

- Compromise Pocso Delhi HC 391250Documento9 pagineCompromise Pocso Delhi HC 391250Iasam Groups'sNessuna valutazione finora

- Performance Evaluation of Construction PDocumento10 paginePerformance Evaluation of Construction PMarioNessuna valutazione finora

- LCC FormulaDocumento3 pagineLCC Formulasomapala88Nessuna valutazione finora

- Analysis of Transaction CostDocumento383 pagineAnalysis of Transaction CosthjsdNessuna valutazione finora

- LR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004Documento36 pagineLR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004apzambonNessuna valutazione finora

- Pipe & Pipe FittingsDocumento10 paginePipe & Pipe FittingsSalim BakhshNessuna valutazione finora

- Material Comparison ChartDocumento2 pagineMaterial Comparison Chartg_sanchetiNessuna valutazione finora

- Cost Estimation Manual Manual Number SM014Documento0 pagineCost Estimation Manual Manual Number SM014pankajmayNessuna valutazione finora

- Ch2-General Design Considerations Week2Documento61 pagineCh2-General Design Considerations Week2ميثة الغيثيةNessuna valutazione finora

- SEEP FRAME Tool, Version 2.02Documento159 pagineSEEP FRAME Tool, Version 2.02anish-kc-8151Nessuna valutazione finora

- Material-Handling EquipmentDocumento7 pagineMaterial-Handling EquipmentNickiNessuna valutazione finora

- Scheduling ExcelDocumento58 pagineScheduling ExcelSafety Inspector Daop 7Nessuna valutazione finora

- Metals, Test Methods and Analytical ProceduresDocumento1 paginaMetals, Test Methods and Analytical ProceduresSARATH KRISHNAKUMARNessuna valutazione finora

- Core Chapter 04 Excel Master 4th Edition StudentDocumento150 pagineCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNessuna valutazione finora

- ArgumentsDocumento21 pagineArgumentsSaddam MullaNessuna valutazione finora

- Applying Fundamental Excel Skills and Tools in Problem SolvingDocumento119 pagineApplying Fundamental Excel Skills and Tools in Problem SolvingRishabh JainNessuna valutazione finora

- EF19D - Inteface Project Data - Updated 05.02.2017-RajDocumento250 pagineEF19D - Inteface Project Data - Updated 05.02.2017-Rajrajkamal_eNessuna valutazione finora

- Excel SolutionsDocumento12 pagineExcel SolutionsGörkem DamdereNessuna valutazione finora

- Progress SummaryDocumento1 paginaProgress SummaryIrwan KurniawanNessuna valutazione finora

- Excel Project Timesheet FullDocumento4 pagineExcel Project Timesheet Fullprateekchopra1Nessuna valutazione finora

- Pmbok Formulas Pmbok Formulas: Topic FORMULA (Or Description) Topic FORMULA (Or Description)Documento1 paginaPmbok Formulas Pmbok Formulas: Topic FORMULA (Or Description) Topic FORMULA (Or Description)jpcdellNessuna valutazione finora

- XyzDocumento1 paginaXyzUsman TahirNessuna valutazione finora

- Linear Programming On Excel: Problems and SolutionsDocumento5 pagineLinear Programming On Excel: Problems and Solutionsacetinkaya92Nessuna valutazione finora

- Laboratory Services Division: Sri Lanka Standards InstitutionDocumento4 pagineLaboratory Services Division: Sri Lanka Standards InstitutionAbcNessuna valutazione finora

- Benefit To Compensation Ratio CalculationsDocumento6 pagineBenefit To Compensation Ratio CalculationsRamkishor PandeyNessuna valutazione finora

- Cash Flow Sample (Planned / Actual) : Data Date: 1-Dec-12Documento4 pagineCash Flow Sample (Planned / Actual) : Data Date: 1-Dec-12freannNessuna valutazione finora

- Analysis and Design of Multi Storyed Building by Using Staad ProDocumento6 pagineAnalysis and Design of Multi Storyed Building by Using Staad ProarjunNessuna valutazione finora

- Material Carbon Steel Stainless Steel (SS) Low Alloy Steel (Las) Low Temp. Carbon Steel (LTCS)Documento2 pagineMaterial Carbon Steel Stainless Steel (SS) Low Alloy Steel (Las) Low Temp. Carbon Steel (LTCS)Jasbir SinghNessuna valutazione finora

- Ce 1402 Estimation and Quantity SurveyingDocumento26 pagineCe 1402 Estimation and Quantity SurveyingNagaraja Prasanna RassNessuna valutazione finora

- Man Hour EstimationDocumento2 pagineMan Hour EstimationSergio SmithNessuna valutazione finora

- Building Control (Accredited Checkers and Accredit PDFDocumento18 pagineBuilding Control (Accredited Checkers and Accredit PDFmoe3kaNessuna valutazione finora

- Cash Flow Forecast ADocumento7 pagineCash Flow Forecast Am qaiserNessuna valutazione finora

- Risk and Return - Section 11.2Documento99 pagineRisk and Return - Section 11.2Dane JonesNessuna valutazione finora

- Timesheet: January, February, MarchDocumento4 pagineTimesheet: January, February, MarchkhuonggiaNessuna valutazione finora

- Lecture 6fDocumento30 pagineLecture 6fhiteshNessuna valutazione finora

- 3.NPER Function Excel Template 1Documento9 pagine3.NPER Function Excel Template 1w_fibNessuna valutazione finora

- Process Engineering: 1. Basic Engineering Design (BED)Documento2 pagineProcess Engineering: 1. Basic Engineering Design (BED)Sushant PaiNessuna valutazione finora

- Employee Timecard1Documento34 pagineEmployee Timecard1Ebiyele Olusegun OwoturoNessuna valutazione finora

- Harleya Simple Designs:: Painting Estimate Acid Neutralizer EstimateDocumento4 pagineHarleya Simple Designs:: Painting Estimate Acid Neutralizer EstimateMugen SkgNessuna valutazione finora

- PERT-CPM-WBS (ES 12 Engineering Management)Documento70 paginePERT-CPM-WBS (ES 12 Engineering Management)ebrahim maicom100% (1)

- Piping Study: Home Blog Feedback Disclaimer Pipingstudy Forum MORE..Documento10 paginePiping Study: Home Blog Feedback Disclaimer Pipingstudy Forum MORE..bratishkaityNessuna valutazione finora

- Excels For Solution ManualDocumento116 pagineExcels For Solution ManualDimple PandeyNessuna valutazione finora

- Rate of ReturnDocumento38 pagineRate of ReturnPraz AarashNessuna valutazione finora

- Cost EstimatingDocumento36 pagineCost EstimatingVisal ChengNessuna valutazione finora

- IC Construction Budget 8531 V1Documento30 pagineIC Construction Budget 8531 V1danilo m.sampagaNessuna valutazione finora

- Project Management TopicsDocumento10 pagineProject Management Topicsmuhamadrafie1975Nessuna valutazione finora

- Delay Analysis 1Documento8 pagineDelay Analysis 1Eslam AshourNessuna valutazione finora

- S08 - Cash Flow StatementDocumento55 pagineS08 - Cash Flow StatementYassin DyabNessuna valutazione finora

- SRD Tollgate BasedProjectManagementDocumento9 pagineSRD Tollgate BasedProjectManagementKulanthaivelu RamasamyNessuna valutazione finora

- Economic ReportDocumento9 pagineEconomic ReportYeeXuan TenNessuna valutazione finora

- Materials ChartDocumento4 pagineMaterials ChartRajaSekarsajjaNessuna valutazione finora

- Cost CriteriaDocumento39 pagineCost CriteriaAbhiyan Anala ArvindNessuna valutazione finora

- Technical SpecificationDocumento51 pagineTechnical SpecificationKarthick KumarNessuna valutazione finora

- Topic 04 - Study GuideDocumento45 pagineTopic 04 - Study GuideHany FathyNessuna valutazione finora

- Cash Flow Forecast TemplateDocumento1 paginaCash Flow Forecast TemplateMohamed Ahmed100% (1)

- Earned Value CalculationDocumento1 paginaEarned Value CalculationRupesh KaushikNessuna valutazione finora

- Value Of Work Done A Complete Guide - 2020 EditionDa EverandValue Of Work Done A Complete Guide - 2020 EditionNessuna valutazione finora

- Time Value of MoneyDocumento10 pagineTime Value of MoneyAnu LundiaNessuna valutazione finora

- BeximcoDocumento27 pagineBeximcoAftab HossainNessuna valutazione finora

- Session 2 VisionDocumento34 pagineSession 2 VisionAftab HossainNessuna valutazione finora

- CB MBA Assignment 1 Sec BDocumento4 pagineCB MBA Assignment 1 Sec BAftab Hossain100% (1)

- Tri State International: Bills SL# Date Voucher Number Total AmountDocumento2 pagineTri State International: Bills SL# Date Voucher Number Total AmountAftab HossainNessuna valutazione finora

- Prime InsuranceDocumento32 paginePrime InsuranceAftab Hossain100% (1)

- Sunbeam Model - Fpsbcmm901Documento10 pagineSunbeam Model - Fpsbcmm901Andreah YoungNessuna valutazione finora

- Traditions and Encounters 3Rd Edition Bentley Test Bank Full Chapter PDFDocumento49 pagineTraditions and Encounters 3Rd Edition Bentley Test Bank Full Chapter PDFsinhhanhi7rp100% (7)

- School Intrams 2023Documento2 pagineSchool Intrams 2023ROBERT S. SUYONessuna valutazione finora

- European Decarb Industry Report ICFDocumento52 pagineEuropean Decarb Industry Report ICFGitan ChopraNessuna valutazione finora

- Principles of PR Measurement 0 PDFDocumento15 paginePrinciples of PR Measurement 0 PDFVisai_kitasNessuna valutazione finora

- S F R S (I) 1 - 2 1: Accounting For The Effects of Changes in Foreign Currency Exchange RatesDocumento40 pagineS F R S (I) 1 - 2 1: Accounting For The Effects of Changes in Foreign Currency Exchange RatesRilo WiloNessuna valutazione finora

- CPAR FLashcardDocumento3 pagineCPAR FLashcardJax LetcherNessuna valutazione finora

- CrackJPSC Mains Paper III Module A HistoryDocumento172 pagineCrackJPSC Mains Paper III Module A HistoryL S KalundiaNessuna valutazione finora

- Quality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection StandardsDocumento29 pagineQuality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection Standardsjohn432questNessuna valutazione finora

- Career Development Cell: Kamla Nehru Institute of TechnologyDocumento1 paginaCareer Development Cell: Kamla Nehru Institute of TechnologypiyushNessuna valutazione finora

- ObliconDocumento3 pagineObliconMonica Medina100% (2)

- Sencor-Scooter-One-App-EN YeaaDocumento7 pagineSencor-Scooter-One-App-EN Yeaaeh smrdimNessuna valutazione finora

- Existentialist EthicsDocumento6 pagineExistentialist EthicsCarlos Peconcillo ImperialNessuna valutazione finora

- Unit 14 Opinion Full EssayDocumento1 paginaUnit 14 Opinion Full EssayQuân Lê ĐàoNessuna valutazione finora

- NYSERDA AnalysisDocumento145 pagineNYSERDA AnalysisNick PopeNessuna valutazione finora

- Music in Chishti SufismDocumento17 pagineMusic in Chishti SufismkhadijaNessuna valutazione finora

- Commonly Asked Questions in An InterviewDocumento1 paginaCommonly Asked Questions in An InterviewlovemoreworrylessNessuna valutazione finora

- Mini Flour Mill KarnalDocumento9 pagineMini Flour Mill KarnalAnand Kishore100% (2)

- The Power of GodDocumento100 pagineThe Power of GodMathew CookNessuna valutazione finora

- 2016-10-26 Memo Re Opposition To MTDDocumento64 pagine2016-10-26 Memo Re Opposition To MTDWNYT NewsChannel 13Nessuna valutazione finora

- Soal Asking and Giving OpinionDocumento2 pagineSoal Asking and Giving OpinionfitriaNessuna valutazione finora

- Chapter 10 E-Commerce: Digital Markets, Digital GoodsDocumento9 pagineChapter 10 E-Commerce: Digital Markets, Digital Goodsabdalla jaradatNessuna valutazione finora

- Army Aviation Digest - Jan 1994Documento56 pagineArmy Aviation Digest - Jan 1994Aviation/Space History Library100% (1)

- Carollo Motion To StayDocumento7 pagineCarollo Motion To Stayal_crespoNessuna valutazione finora

- Oxford University Colleges' ProfilesDocumento12 pagineOxford University Colleges' ProfilesAceS33Nessuna valutazione finora