Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

A Study of Mergers in Aviation Industry

Caricato da

Brijesh TrivediCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

A Study of Mergers in Aviation Industry

Caricato da

Brijesh TrivediCopyright:

Formati disponibili

A Study of Mergers & Acquisitions in Aviation Industry in India and Their Impact on the Operating Performance and Shareholder

Wealth

Nisarg A Joshi Ahmedabad Institute of Technology

Jay M Desai Ahmedabad Institute of Technology

ABSTRACT The objective of this paper is to study, why organisations take the inorganic mode of expansion. However, the main focus is on studying the operating performance and shareholder value of acquiring companies and comparing their performance before and after the merger. To conduct a uniform research and arrive at an accurate conclusion, we restrict our research to only Indian companies. To get a perspective on India, we study aviation sector. We will test feasibility that mergers improve operating performance of acquiring companies. However on studying the cases, we conclude that as in previous studies, mergers do not improve financial performance at least in the immediate short term.

INTRODUCTION The air travel market grew up originally to meet the demand of business travelers as companies became increasingly wide-spread in their operations. On the other hand, rising income levels and extra leisure time led holidaymakers to travel to faraway places for their vacation. A further stimulus to the air travel market was provided by the deregulation and the privatization of the aviation industry. Stateowned carriers that hitherto enjoyed monopoly status were now exposed to competition from private players. However, one development that changed the entire landscape of the industry was the emergence of low cost carriers (LCCs). These carriers were able to offer significantly cheaper fares on account of their low-cost business models and thereby attract passengers who might not otherwise be willing to fly. LCCs have achieved rapid growth in market share in the U.S. domestic market, short-haul market in Europe and recently in Asia. Since 1970, the international passenger traffic has grown by an average rate of more than 6%, compared to a 7% increase in the domestic passenger traffic. The aviation industry is highly cyclical. However, in times of recession, the decline in the industry growth rate is much sharper when compared to the world economy. After witnessing a strong growth during the late 1990s, the industry saw a sharp reversal in fortune as a result of a global economic downturn in 2001. The situation was further aggravated by 9/11 attack, the Iraq war and the SARS epidemic. The mammoth financial losses incurred by the scheduled carriers during this period led to a long-overdue restructuring among the full service carriers (FSCs). Many airlines embarked upon severe cost-cutting and fleet-rationalisation programmes as they struggled to remain afloat. The conditions for FSCs were further worsened with the advent of budget carriers in the U.S. and Europe.

There was however a strong rebound in traffic in 2004, led by a strong recovery in the world economic growth and which continued for the next two years (2005 and 2006). According to ICAO (International Civil Aviation Organisation), the revenue per passenger kilometers (calculated as the number of seats multiplied by the kilometers flown) for international services has grown by 8.5% in 2005 and is estimated to have grown by 6% in 2006. The strong growth in the traffic and recovery of higher fuel cost through surcharges resulted in strong revenue growth for airline companies. However, this did not translate into a recovery in profitability, primarily on account of a significant increase in fuel costs. According to IATA, the combined losses posted by the world's scheduled carriers amounted to US$ 6 bn in 2005, following a cumulative loss of US$ 36 bn in the previous four years. Future Outlook: As per the estimates of aircraft manufacturers and other industry bodies, the world passenger traffic is expected to grow at 5% p.a. in the medium to long-term. The growth will however be slower in matured economies, but faster in under-penetrated and growing economies like India and China. The primary reason for the increase in passenger traffic over the years has been decline in airline passenger yields. As per an estimate, after adjusting for the general inflation, the average airline yields (revenue per passenger kilometers) have almost halved since 1970. During the same period, the real revenue growth (by combining growth in traffic and decline in yields) has averaged only 2% to 3%. Since aviation industry is a high fixed cost industry, a small increase in operating cost can have a sharp impact on the profitability of the companies. High fuel prices, congestion cost, higher security and insurance cost can increase the overall cost of operations and thereby impact the demand for air travel services. However, there is room for cost reduction in the form of distribution cost and cost synergies from industry

consolidation. Overall, we believe that consolidation is the only solution for addressing the problem of excess capacity and poor financial ratios of the company.

OVERVIEW OF WORLD MARKET Air travel remains a large and growing industry. It facilitates economic growth, world trade, international investment and tourism and is therefore central to the globalization taking place in many other industries. In the past decade, air travel has grown by 7% per year. Travel for both business and leisure purposes grew strongly worldwide. Scheduled airlines carried 1.5 billion passengers last year. In the leisure market, the availability of large aircraft such as the Boeing 747 made it convenient and affordable for people to travel further to new and exotic destinations. Governments in developing countries realized the benefits of tourism to their national economies and spurred the development of resorts and infrastructure to lure tourists from the prosperous countries in Western Europe and North America. As the economies of developing countries grow, their own citizens are already becoming the new international tourists of the future. Business travel has also grown as companies become increasingly international in terms of their investments, their supply and production chains and their customers. The rapid growth of world trade in goods and services and international direct investment has also contributed to growth in business travel.

Worldwide, IATA, International Air Transport Association, forecasts international air travel to grow by an average 6.6% a year to the end of the decade and over 5% a year from 2000 to 2010. These rates are similar to those of the past ten years. In Europe and North America, where the air travel market is already highly developed, slower growth of 4%-6% is expected. The most dynamic growth is centered on the Asia/Pacific region, where fast-growing trade and investment are coupled with rising domestic prosperity. Air travel for the region has been rising by up to 9% a year and is forecast to continue to grow rapidly, although the Asian financial crisis in 1997 and 1998 will put the brakes on growth for a year or two. In terms of total passenger trips, however, the main air travel markets of the future will continue to be in and between Europe, North America and Asia. Airlines' profitability is closely tied to economic growth and trade. During the first half of the 1990s, the industry suffered not only from world recession but travel was further depressed by the Gulf War. In 1991 the number of international passengers dropped for the first time. The financial difficulties were exacerbated by airlines over-ordering aircraft in the boom years of the late 1980s, leading to significant excess capacity in the market. IATA's member airlines suffered cumulative net losses of $20.4bn in the years from 1990 to 1994.

OVERVIEW OF AVIATION INDUSTRY IN INDIA Air Traffic: The Airport Authority of India (AAI) manages total 122 Airports in the country, which include 11 International Airports, 94 domestic airports and 28 civil enclaves. Top 5 airports in the country handle 70% of the passenger traffic of which Delhi and Mumbai together alone account for 50%. Passenger and cargo traffic has growth at an average of about 9% over the last 10 years.

Growth: Estimated domestic passenger segment growth is at 12% per annum. Anticipated growth for International passenger segment is 7% while the growth for International Cargo is likely to grow at a healthy rate of 12%. Privatization: Privatization of International Airports is in offing through Joint Venture route. Three Greenfield airports are getting developed at Kochi,

Hyderabad and Bangalore with major shareholding of private sector. The work on Bangalore airport is likely to commence shortly. Few selected non-metro airports are likely to be privatized.100% foreign equity has also been allowed in construction and maintenance of airports with selective approval from Foreign Investment Promotion Board. Air movements: The total aircraft movements handled in October 2003 has shown an increase of 15.4 percent as compared to the aircraft movement handled in October 2002. The international and domestic aircraft movements increased by 15.4 percent each during the period under review. The reason for increase in aircraft movements is due to increase of operation of smaller aircraft by airlines and the introduction of new airlines viz., Air Deccan in southern region and international airlines (Air Canada, Polar Air Cargo, Qatar Airways (Freighter), Turkish Airways, Air Slovakia at IGI Airport with effect from October 2003. International and Domestic passenger traffic handled in

Passenger Traffic:

October 2003 has increased by 15.4 percent and 6.7 percent over the period of October 2002 leading to an overall increase of 9.4 percent. The total passenger increased by 9.2 percent, 7.6 percent, 8.9 percent and 17.0 percent respectively at

five international airports six developing international airports, eight custom airports and 26 Domestic airports. Cargo Traffic: The total cargo traffic handled in October 2003 has shown an increase of 3.5 percent as compared to the cargo handled in October 202. The international and domestic cargo traffic increased by 4.3 percent and 2.1 percent respectively during the period. India's domestic aviation market expansion has been the strongest in the world tripling in the past five years, according to the International Air Transport Associations (IATA) report. India has also signed the bilateral Aviation Safety Agreement (BASA) with the USA. India is currently the ninth largest aviation market in the world, according to a RNCOS report Indian Aerospace Industry Analysis. The Government's open sky policy has attracted many foreign players to enter the market and the industry is growing in terms of both players and the number of aircrafts. Given the strong market fundamentals, it is expected that the civil aviation market will register a compound annual growth rate (CAGR) of more than 16 per cent during 2010-2013. India's domestic air traffic grew at a rate, which is the second highest after Brazil, according to global figures for June 2011, compiled by IATA. The country's domestic traffic grew by 14 per cent in the same period as against Brazil's 15.1 per cent. Indian airlines reported a continuous growth trend and a strong domestic passenger growth rate of 22.3 per cent in July 2011. Passenger traffic has grown at 18 per cent year on year (y-o-y) basis and the year 2010 closed at 90 million passengers

both domestic and international. India is the fastest growing aviation market and expected to be within 4-5 big aviation markets by 2020 and 3rd in terms of domestic market after US and China. In July 2011, airlines in India handled 5 million domestic passengers, according to data released by the Directorate General Civil Aviation (DGCA) on September 12, 2011, marking the 11th consecutive month of double-digit growth. Indias domestic market has witnessed passenger growth for 26 consecutive months now. In July 2011, Indias airlines handled 1.3 million international passengers, an increase of 8.5 per cent y-o-y, according to DGCA. Passengers carried by domestic airlines during Jan-Aug 2011 were 39.63 million as against 33.41 million during the corresponding period of previous year thereby registering a growth of 18.6 per cent, according to data released by DGCA. India is expected to cross the 450 million mark of domestic passengers by 2020. During the last two decades from a fleet of only about 100, the scheduled operators now have reached 435 aircrafts connecting the nation and the world. Private carriers are anticipated to post a combined profit of US$ 350US$ 400 million for the fiscal years 2011-12, as reported by Centre for Asia Pacific Aviation (CAPA) India, in its 2011-12 - Aviation Industry outlook. Domestic capacity is also projected to grow by 12-14 per cent for the assessment period. The Role of Aviation Industry in India GDP in the past few years has been phenomenal in all respects. The Aviation Industry in India is the most rapidly growing aviation sector of the world. With the rise in the economy of the country

and followed by the liberalization in the aviation sector, the Aviation Industry in India went through a complete transformation in the recent period.

Role of Aviation Industry in India GDP-Facts

With the entry of the private operators in this sector and the huge cut in air prices, air travel in India were popularized On February 18, 1911, the first commercial flight was made from Allahabad to Naini by a French pilot named Monseigneur Piguet

Role of Aviation Industry in India GDP-Growth Factors

The growth in the Indian economy has increased the Gross Domestic Product above 8% and this high growth rate will be sustained for a good number of years Air traffic has grown enormously and expected to have a growth which would be above 25% in the travel segment In the present scenario around 12 domestic airlines and above 60 international airlines are operating in India With the growth in the economy and stability of the country India has become one of the preferred locations for the trade and commerce activities The growth of airlines traffic in Aviation Industry in India is almost four times above international average

Aviation Industry in India have placed the biggest order for aircrafts globally Aviation Industry in India holds around 69% of the total share of the airlines traffic in the region of South Asia

Role of Aviation Industry in India GDP-Future Challenges

Initializing privatization in the airport activities

Modernization of the airlines fleet to handle the pressure of competition in the aviation industry Rapid expansion plans for the major airports for the increased flow of air traffic Immense development for the growing Regional Airports

Role of Aviation Industry in India GDP-FDI Policy The Reserve Bank of India (RBI) announced that foreign institutional investors might have shareholdings more than the limited 49% in the domestic sector.

Airports Foreign equity up to 100% is allowed by the means of automatic approvals pertaining to establishment of Greenfield airports Foreign equity up to 74% is allowed by the means of automatic approvals pertaining to the existing airports Foreign equity up to 100% is allowed by the means of special permission from Foreign Investment Promotion Board, Ministry of Finance, pertaining to the existing airports

Air Transport Services Up to 49% of foreign equity is allowed by the means of automatic approvals pertaining to the domestic air transport services Up to 100% of NRI investment is allowed by the means of automatic approvals pertaining to the domestic air transport services

OVERVIEW OF GROWTH OF AVIATION INDUSTRY

Growth Potential In India, the industry sector continues to look promising. The liberalization of the Indian aviation sector in the mid nineties resulted in significant growth due to the entry of private service airlines. There was, and continues to be a strong surge in demand by domestic passengers, due primarily to the burgeoning middle class with its massive purchasing power, attractive low fares offered by the low cost carriers, the growth of domestic tourism in India and increasing outbound travel from India. In addition, the Government has also focused on modernizing non-metro airports, opening up new international routes, establishing new airports and renovating existing ones. Some estimate industry growth at 25% YoY. Unfortunately, most major airline operators in India such as Air India, Indian Airlines, Jet Airways and Kingfisher Airlines have reported large losses since 2006, due to high aviation turbine fuel (ATF) prices, rising labor costs and shortage of skilled labor, rapid fleet expansion, and intense price competition. The problem was also compounded by new players entering the industry even before the existing players could stabilize their operations. As a result of the already weak domestic scenario, the airlines suffered even further when the recession, which exacerbated all these factors, hit. Suffice to say, though that the Indian aviation industry has been more resilient than its global counterparts. Despite many private airlines being in the red, the industry itself remains robust. According to Kapil Kaul, CEO India & Middle East, Centre for Asia Pacific Aviation (CAPA), India's civil aviation passenger growth is among the highest in the world. The sector is slated to cruise far ahead of other Asian giants like China

or even strong economies like France and Australia. The number of passengers who will be airborne by 2020 is a whopping 400 million. To keep pace with this accelerated demand, existing players have been trying to increase fleets and widen their footprint to regional destinations as well.

MAJOR COMPANIES IN THE INDUSTRY An aircraft maintenance engineer (AME) is a licensed professional whose duties include daily inspection and routine servicing of aircrafts to ensure that they fulfill national and international aviation standard

Aviation - Market Players

During July 2011, Vijay Mallya-promoted Kingfisher was the largest domestic standalone carrier with around 1.1 million passengers, based on CAPA calculations. Jet Airways/JetLite had a combined passenger level of 1.2 million passengers, or around 26 per cent of the market IndiGo started its international air services from September 1, 2011 after completing the mandatory five years of wholly domestic operations. The low cost carrier (LCC), the largest in the domestic Indian market, marks the start of its foray into international markets with direct services to Dubai, followed by Singapore and Bangkok in the first phase connecting all key global business hubs Dubai's first low cost airline, flydubai, will start flights to the city of Ahmedabad in Gujarat from August 27, 2011. Ahmedabad is the world's

third fastest growing city in the world and it will become the third Indian city on flydubai's rapidly expanding network. The airline will offer seats from Ahmedabad to Dubai beginning at Rs 7,500 (US$ 156.25) inclusive of taxes and seven kilograms of hand baggage. The flights will operate once in a week on Saturdays only. Hyderabad-based GVK Power & Infrastructure would be paying Rs 114 (US$ 2.37) for each equity share to Siemens Project Ventures to buy the latter's 14 per cent stake in Bengaluru International Airport Ltd (BIAL)

Name of the players

Market Share

Kingfisher Airlines and Kingfisher Red (previously 28% Air Deccan) Jet Airways and Jet Lite (previously Air Sahara) Air India and Indian (previously Indian Airlines) IndiGo SpiceJet GoAir Paramount Airways MDLR Airlines 25% 16% 14% 12% 3% 2% 0.004%

Airline Air Services of India Airways (India) Limited Archana Airways Bhaarat Airways Crescent Air Cargo Damania Airways Deccan Airways Darbhanga Aviations East-West Airlines Elbee Airlines Gujarat Airways Himalayans Air Transport & Survey Limited Himalayan Aviation Indian Indian National Airways Indian Overseas Airlines Indian (ISAS) State Air Service

Commenced Operations 1936 1945 1991 1995 2000 1993 1992 1950 1992 1995 1995 1934 1948 1953 1933 1947 1929

Ceased Operations 1953 1955 1999 1999 2006 1996 2004 1962 1995 2001 2001 1935 1953 2011 1945 1950 1931

Headquarters Kolkata Kolkata New Delhi Mumbai Chennai Kolkata Mumbai Kolkata Mumbai Mumbai Ahmedabad Kolkata Kolkata New Delhi Kolkata Mumbai Kolkata

Indian Airlines

Transcontinental

1933 2006 1934 1948 2007 1994 1991 1947 1946 1932 1981 1993 1981 2005

1948 2007 1939 1949 2009 1996 2006 1960 1953 1946 1997 1996 1997 2010

Kolkata New Delhi Chennai Mumbai New Delhi Mumbai Mumbai Chennai Kolkata Mumbai New Delhi Mumbai Chennai Chennai

Indus Airways Irwaddy Flotilla & Airways Jupiter Airways MDLR Airlines ModiLuft Sahara Airlines Skyline NEPC Orient Airways Tata Airlines Vayudoot VIF Airways Vijay Airlines Paramount Airways

Jet Airways: This airline offers services to different countries like India,Hong Kong ,Italy , Japan ,Kenya, Kuwait,Malaysia, Mauritius, Nepal,New Zealand ,Oman, Philippines ,Qatar ,Singapore and many more places.It also provides domestic as well as international services.

Airsahara.net: They have been in the business for over a decade and have made a secure place for themselves in the domestic airlines industry. Take a look at the number of fleet they have. If you want a career with them, find out what vacancies they have. You can easily view the facilities they provide for their flyers and also all the special offers that they give. Find out now.

Book.goindigo.in: Planning a trip? Want to go for affordable flights? Well, Indigo airline has the perfect solution for you. Browse through their site and find out which routes they ply in and plan your trip easily. Check flight status, ask questions at their information center or simply check the site for its features. Visit the site now. Spicejet.com: Spice jet allows you travel cheap as well as in style. Now you can travel to a lot of places at not so high price. Book your flight with this domestic airline and have a nice trip. Check spice destinations and also get travel tips from them. They are here with the mission to become Indias preferred low cost airline. Their high investment in safety and high level of maintenance will take them a long way. Find out more from the site.

Jetairways.com: Claiming to be the most preferred airline, Jet Airways has soared to new heights. View their site to find out the routes they ply in. Look for the facilities this domestic airline provides. Do not miss out on the new offers that they give you. Book your tour with Jet Airways and relax all the way to your destination. Have a nice trip. Take a look.

Flykingfisher.com: With them flying is an experience beyond just getting from one place to another. When you want to fly in style, you fly Kingfisher. They put a lot of stress on flyer safety and in gaining their trust. See the flight schedules online. If you are a travel agent you can become a member. There are a horde of services that this domestic airline offers. Take a look to find out about all of them. Paramountairways.com: This domestic airline plies all over south India. So if you are traveling anywhere between Bangalore and Vishakapattanam dont forget to check out their flight details. You may retrieve your booking at any point of time. Find a flight, create a profile, track a flight or check in with the internet, you can do all of this in this site. Hurry up and take a look now. Go air. in: Still in its nascent stage, Go Air is quietly making a place for itself. It does not however cover all the sectors like all the other big airlines. But for a start they have covered quite a big sector. Take a look at their site and find out. Locate Go outlets in your city and find out fares with this airline. Take a look now.

LITERATURE REVIEW There are various strategic and financial objectives that influence mergers and acquisitions. Two organizations with often different corporate personalities, cultures and value systems are bought together. The terms mergers and acquisitions are often used interchangeably. In lay parlance, both are viewed as the same. However, academics have pointed out a few differences that help determine whether a particular activity is a merger or an acquisition. A particular activity is called a merger when corporations come together to combine and share their resources to achieve common objectives. In a merger, both firms combine to form a third entity and the owners of both the combining firms remain as joint owners of the new entity (Sudarsanam, 1995)[1]. An acquisition could be explained as event where a company takes a controlling ownership interest in another firm, a legal subsidiary of another firm, or selected assets of another firm. This may involve the purchase of another firms assets or stock (Donald M. DePamphilis, 2008)[2]. Acquiring all the assets of the selling firm will avoid the potential problem of having minority shareholders as opposed to acquisition of stock. However the costs involved in transferring the assets are generally very high. There is another term, takeover which is often used to describe different activities. Takeover is slightly different than acquisition however the meaning of the later remaining the same. When the acquisition is forced in nature and without the will of the target companys management it is known as a takeover. Takeover normally undergoes the process whereby the acquiring company directly approaches the

minority shareholders through an open tender offer to purchase their shares without the consent of the target companys management. In mergers and acquisitions scenario the terms mergers, acquisitions, takeover, consolidation and amalgamation are used interchangeably (Source: Chandra, 2001)[3]. Mergers of corporations in similar or related product lines are termed as horizontal mergers. These mergers lead to elimination of a competitor, leading to an increase in the market share of the acquirer and degree of concentration of the industry (M&A, Milford Green, 1990)[51]. However there are strict laws and rules being enforced to ensure that there is fair competition in the market and to limit concentration and misuse of power by monopolies and oligopolies. In addition to increasing the market power, horizontal mergers often tend to be used to protect the dominance of an existing firm. Horizontal mergers also improve the efficiency and economies of scale of the acquiring firm (Lipczynski, Wilson, 2004)[4].Recent examples of horizontal mergers in the international market are those of the European airlines. The Lufthansa-Swiss International link up and the Air France- KLM merger are cases of horizontal mergers (Lucey, Smart and Megginson, 2008)[5].Horizontal mergers have been the most important and prevalent form of merger in India. Various studies like those of Beena, 1998[6] has revealed that post 1991 or post liberalisation more than 60% of mergers have been of the horizontal type as cited in Mehta, 2006[7]. Recently there have been many big mergers of this type in India like Birla L&T merger in the cement sector.

The aviation sector has also witnessed quite a few such mergers like the Kingfisher airline Air Deccan merger and the Jet Airways Air Sahara merger.

A vertical merger is the coming together of companies at different stages or levels of the same product or service. Generally the main objective of such mergers is to ensure the sources of supply (Babu, 2005)[8].In vertical mergers, the manufacturer and distributor form a partnership. This makes it difficult for competing companies to survive due to the advantages of the merger. The distributor need not pay additional costs to the supplier as they both are now part of the same entity (learnmergers.com). Such increased synergies make the business extremely profitable and drive out competition. Purchase of automobile dealers by manufacturers like Ford and Vauxhall are examples of vertical mergers. Fords acquisition of Hertz is an example of a vertical merger (Geddes, 2006)[9]. The acquisition of Flag Telecom by Indian telecom company Reliance Communications Ltd was a very significant vertical merger. Conglomerate mergers occur between firms that are unrelated by value chain or peer competition. Conglomerates are formed with the belief that one central office would have the know-how or knowledge and expertise to allocate capital and run the businesses better than how they would be run independently (Robert Bruner, 2004)[10]. The main motive behind the formation of a conglomerate is risk diversification as the successful performers balance the badly performing subsidiaries of the group (Brian Coyle, 2000)[11]. Conglomerate mergers can also be explained as a merger between companies which are not competitors and also do not have a buyer seller relationship. The general observation has been that such conglomerate mergers are not very successful. Where only a few conglomerates like General Electronics (GE) have been successful, most others have failed (Patrick Gaughan, 2007)[12].

Such acquisitions are not very commonly discussed while classifying mergers and acquisitions. Such acquisitions are driven by the financial logic of transactions. They generally fall under either Management Buyouts (MBOs) or Leveraged Buyouts (LBOs) (H. Ross Geddes, 2006)[9]. Factor affecting mergers change with the changing legal, political, economic and social environments (Kaushal, 1995)[13]. Business Organization literature has identified two common reasons which are derived out of mergers and acquisitions i.e. efficiency gain and strategic rationale (Neary, 2004)[14]. Efficiency gain means the merger would result into benefits in the form of economies of scale and economies of scope. Economies of scale and scope are achieved because of the integration of the volumes and efficiencies of both the companies put together. Secondly the strategic rationale is derived from the point that mergers and acquisition activity would lead to change in the structure of the combined entity which would have a positive impact on the profits of the firm. However, we shall discuss these and various other factors that lead to mergers and acquisitions. Synergy has been described as 2+2=5 (Pearson, 1999)[15]. In other words, the whole would be greater than the sum of its parts (Sherman, 1998)[16]. It implies that the combined handling of different activities in a single combined organisation is better, larger or greater than what it would be in two distinct entities (Bakker, Helmink, 2004)[17].The word synergy comes from a Greek word that means to cooperate or work together (Bruner, 2004)[10]. Mergers theoretically revolve around the same concept where two corporations with come together and pool in their expertise and resources to perform better. Estimating synergies and its effect is an important decision in the merger process, primarily for four reasons. Firstly, mergers are meant for value creation and hence assessing the value that would be

created by the synergies is important. Secondly, assessing how investors would react to the merger deal is another important consideration. Thirdly, managers need to disclose these strategies and benefits of such deals to investors and hence their perfect estimation and knowledge is important. Lastly, valuing synergies is important for developing post merger integration strategies (Bruner, 2004)[10]. However important valuing synergies may be, practically very few companies actually develop a transactional team, draw up a joint statement regarding the objectives of the deal or solve the post closing operating and financial problems timely. Synergies can be further discussed as being financial, operating or managerial synergies. Operational synergies refer to those classes of resources that lead to production and/or administrative efficiencies (Peck, Temple, 2002)[18]. Product related diversification mergers are often carried out keeping operational synergies in mind. These synergies help firms bring down unit costs due to product relatedness. Common technology, marketing techniques like common brand and manufacturing facilities like common logistics are essentially the components of operational synergy (Peng, 2009)[19].Operational synergy can be explained as a combination of economies of scale, which would reduce average costs as a result of more efficient use of resources and economies of scope, which would help a company deliver more from the same amount of inputs (Bakker, Helmink, 2004)[17]. Financial synergy refers to the impact of mergers and acquisitions on lowering the cost of capital of the merged or newly formed entity (DePamphilis, 2005)[20]. Financial synergies lead to reduced cost of capital and / or increased borrowing power (Hankin, Seidner and Zietlow, 1998)[21]. Conglomerate mergers generally focus on financial synergies that increase the competitiveness for each individual

unit controlled by one centralized parent company beyond what could have been achieved by each unit competing individually (Peng, 2009[19]). Along with a lower cost of capital, financial synergies also bring about a larger capital base which helps funding of larger investments. In case of conglomerate mergers, financial diversification can bring about various other advantages like more stable cash flows, lower performance variations, insurance gains and other tax advantages (Bakker, Helmink, 2004)[17]. Financial synergies are possible between related and unrelated firms unlike operational synergies that take place only between related firms. (Source: Peck, Temple, 2002). Managerial synergy refers to the increased efficiency as a result of management teams of two firms coming together. Often management teams have different strengths and their coming together could result in improved managerial expertise (Ross,Westerfield, Jaffe, 2004)[22].These synergies occur when competitively relevant skills possessed by managers of previously independent companies can be successfully transferred to the merged entity (Hitt, Harrison, Ireland, 2001)[23]. Growth is imperative for any firm to succeed. This growth can be achieved either through organic or inorganic means. However, mergers (inorganic) are considered a quicker and a better means of achieving growth as compared to internal expansions (organic). Along with additional capacity, mergers bring with them additional consumer demand as well (Sloman, 2006)[24]. One argument often presented in favour of mergers is that they help in diversifying the groups lines of businesses and hence helps reduce risk. Risk could be interpreted as risk from the point of view of shareholders, lenders i.e. insolvency risk, business risk, etc.

Mergers can benefit the corporations and individuals in their own way by helping them reduce the tax bill. However, with stricter laws, undue advantage taken by corporations of tax reduction can be managed. Often large profitable corporations merge with certain loss making ones to help them take advantage of reduced expenditure on taxation. However, small shareholders of acquired companies tend to receive substantial tax benefits on merger with large corporations. There is a tendency among managers, especially those of corporations where ownership and control are distinct, to enter into mergers for the lure of a higher pay packet and more rewards. Mergers are often carried out to achieve a better standing in the market by means of an increased market share and by becoming a leading player in the concerned sector. Reducing competition is another key concern when contemplating mergers. Often it is necessary to protect a key source of supply from a competitor which can be done through mergers.

Empirical Studies Regarding Post Merger Performances Several researchers have tried to study the performances of acquiring firms post the merger. However, there has been no concrete conclusion or consensus regarding the same. The most popular forms of empirical studies are event studies, accounting studies, clinical studies and executive surveys. From most of the studies conducted till date, it only appears that mergers do not improve the financial performance of the acquirers.

Event studies and accounting studies as such point to the fact that these gains are either small or nonexistent. However, it must also be noted that there have been studies conducted that show that post merger performance also largely depends on the industry or sector and cannot be generalized.

Accounting Studies This method involves the study of financial statements and ratios to compare the pre merger and post merger financial performance of the acquiring company. It is also used to study whether the acquirers outperformed the non acquirers .Various ratios like return on equity or assets; EPS, liquidity, etc are studied. Whether a merger actually improves the operating performance of the acquiring company is uncertain, but mostly leads to a conclusion that mergers do not really benefit in improving operating performances. A research conducted on Indian companies also showed no real signs of better post merger operating performance of the acquiring company.

Causes of Failures There could be many causes of failed mergers and acquisitions. It is most likely that a failed merger would be a result of poor management decisions and overconfidence. There could be personal reasons considering which managers tend to enter into such activities and hence tend to ignore the primary motive of mergers, creating shareholder value. Sometimes however, good decisions may also backfire due to pure business reasons. These factors can be summarized by the following points.

Overpayment A very common cause of failed mergers is overpayment. This situation arises essentially due to overconfidence or the urge for expansion. Overpayment often has disastrous consequences. Overpayment leads to expectations of higher profitability which is often not possible. Excessive goodwill as a result of overpaying needs to be written off which reduces the profitability of the firm.

Integration issues It is rightly said that Few business marriages are made in heaven (Sadler, 2003)[25].Both merging companies need to be compatible with each other. Business cultures, traditions, work ethics, etc. need to be flexible and adaptable. Inefficiencies or administrative problems are a very common occurrence in a merger which often nullifies the advantages of the merger (Straub, 2007)[26]. Often it is necessary to identify the people needed in the future to see the merger through. There must be some urgency between the parties and good communication between them. Due to lack of these qualities, mergers often do not produce the desired results (Sadler, 2003)[25].

Personal Motives of Executives Managers often enter into mergers to satisfy their own personal motives like empire building, fame, higher managerial compensation, etc. As a result, they often lose focus on the fact that they need to look at the strategic benefits of the merger. As a result, mergers that do not necessarily benefit the organisation are entered into. These executives enter into these mergers for the purpose of seeking glory and satisfying their executive ego, leading to failure of mergers.

Selecting the target Selecting the appropriate target firm is an extremely important stage in the merger process. Executives must be able to select the target that suits the organizations strategic and financial motives and needs. Often the incapability or lack of motivation and interest on the part of executives leads to incorrect target selection. Lubatkin (1983)[50] very appropriately said that selecting a merger candidate may be more of an art than a science (Straub, 2007)[26].

Strategic Issues Strategic benefits should ideally be the primary motive of any merger activity. However, managers sometimes tend to overlook this aspect. Faulty strategic planning and unskilled execution often leads to problems. Over expectation of strategic benefits is another area of concern surrounding mergers. (Schuler, Jackson, Luo, 2004)[27]. These issues which form the core of all merger activities are not addressed adequately leading to failures of mergers.

PROBLEM STATEMENT It is said that a problem which is well defined is half solved. The main problem area which the research is testing related to the subject of mergers and acquisitions. In this, we want to investigate whether mergers and acquisitions have an impact on the operating performance of the acquiring firm and does it create wealth for the shareholders. This problem stems from the fact that there have been mergers and acquisitions which have created wealth only for the acquiring firms and few have created wealth for only the target firms. Likewise mergers and acquisitions have sometimes benefitted the shareholders of only the target company and vice versa. We are trying to find out whether mergers and acquisitions impact the operating performance of the acquiring firm and enhance shareholder wealth.

Aim of the Research The main aim of the research is to analyze the feasibility and the impact of mergers and acquisitions on the operating performance of the firm.

DATA & ANALYSIS The Indian airline industry underwent liberalization in the year 1990 when the private sector companies were allowed to start its business. Many companies like Damania, East-West, Air Sahara and NEPC entered the market but after nearly a decade none of them survived. However in todays scenario there have been number of private airline companies operating in this sector with players like Air Deccan, Kingfisher, Jet Air, Go Air, Spice Jet and many other players. The Indian aviation has only two Government controlled airline companies i.e. Air India and Indian Airlines. Sahara Airlines is one of the oldest private sector airline companies in India which commenced business in 1991 and then was rebranded as Air Sahara in 2000. Similarly the government owned domestic airline company Indian Airlines was rebranded as Indian under its plan to revamp the position in the airline industry. Later the government announced the merger of Air India and Indian which would build an airline giant in India. Jet Airways is one private player which operated both on domestic and international routes in India and holds a major share in the aviation industry in India. Spice Jet, Go Air and Air Deccan are the low cost no frill airline companies in India. Kingfisher airlines was being considered as the closest competitor to private players and it operates in both domestic and international routes.

Strategic alliance and mergers have been one of the buzz words in the airline industry. According to Oum, Park and Zhang (2000)[28] for the airline industry strategic alliances refer to a long term commitment and partnership with two or more companies who attempt to gain competitive advantage collectively by fighting their competitors by sharing resources, cutting costs and improving profitability.

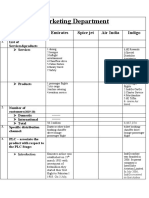

The following is the market share of different airline companies in the year 2008.

Indian 18%

Jet 24%

Jet Jet Lite K Red

Indigo 10% Go Air 3% Paramount 2% Spice Jet 9% Kingfisher 15%

Jet Lite 9%

Kingfisher Spice Jet Paramount Go Air Indigo

K Red 10%

Indian

KINGFISHER AIRLINES AND AIR DECCAN MERGER One of the significant moves in the airline industry was the merger between Air Deccan, the first low cost carrier in India and Kingfisher Airlines. Air Deccan has created waves in the airline industry by offering people the lowest cost flying experience and shifted rail travelers to airline travelers. However Air Deccan and Kingfisher Airlines have now merged and known as Kingfisher Aviation. The merger started when Kingfisher Airlines owner Dr. Vijay Mallya bought 26% controlling stake in Air Deccan.

Synergy The combined entity now has a fleet size of 71 aircrafts covering 70 destinations and more than 550 flights in a single day. The merger would benefit the entity by offering operational synergies like inventory management, maintenance, engineering and overhaul which would reduce the overall cost by 4% to 5% i.e. around 300 million (Financial Express, 2007)[29]. Further the company would be able to rationalize its routes in a better way by changing its fare structure which will attract more passengers (Business Standard, 2007)[30]. The merged entity would also have clear business model with reaching wider domestic base with Air Deccan capabilities and Kingfisher Airlines would reach international destinations. Synergies can be seen in two directions, financial and operational. On operational grounds this merger would help Kingfisher expand its international base as it finishes 5 year mandatory period to fly domestic before getting an international license. Secondly on financial grounds it would mean a lot to Kingfisher because of savings on operation cost. With the growth expected in the industry, the combined entity would make better profits in the coming years. Other reasons for merger with Air Deccan was totally logistical like both the companies have the same maintenance contract with Lufthansa Tecknik, both the companies have Airbus fleet and same types of engines and brakes.

Financial Analysis The merger between Kingfisher Airlines and Air Deccan took place in the year 2006. Hence below analysis has been done two years prior to the merger i.e. during 2004-05 and 2005-06 and two years after the merger i.e. 2007-08 and 2008-09 respectively.

Kingfisher Airlines Operating Profit Margin Gross Operating Margin Net Profit Margin Return on Capital Employed Return on Net Worth Debt-Equity Ratio EPS P/E

2004-05 2005-06 10.2% -4% -6.4% 15.4% -143% 20.8 -63.0 -1.9 -1.3% -24.6% -27.5% -9.8% -347.5% 4.6 -347.5 -0.3

2006-07 -21.9% -21% -23.6% 7.5%

2007-08 2008-09 -51.5% -47.8% -13.1% -19.6% -26.5% -33.9% -30.5% -24.4%

-287.4% -129.8% -809% 6.3 -31.0 -4.6 6.4 -13.9 -9.6 4.7 -118.5 -0.4

From the above ratios it can seen that before 2008 (Pre- merger) operating profit margin has increased to 14.57 % from 10.23 % .The operating profit has increased to 22.33 % , so we called it a successful merger. However, due to recession it has decreased to 10.50 %. From the above ratios it can be seen that before 2008 (Premerger) Net profit margin has decreased over a period of time. We called it a successful merger. Because net loss margin has decreased .However, due to recession Net loss margin increased to (30.53) %. The figure of net worth has increased to 384.7 crores which was decreased after merger and due to the recession time it has decreased to (2125.34) crores and debt to equity ratio has come closer to 2.66:1 which is near to ideal ratios. To sum up, It was indeed a good deal Here, no of shares has increased which directly affected the EPS of the

company which resulted in to loss of the company in terms of per share `Of (72.33). Above ratios depicts that there is direct relationship between market price and EPS as both figures were decreasing which resulted in to negative price to earnings ratio. Return on net worth has increased to 75.7 % which attracts the investors to continue with the company and new investors to put their money in companys equity. From the above ration efficiency and profitability of a company's capital investments has determined which is fluctuated over a period of time. It was 10.62 % in June 2006 which comes to 63.54 %. So , there is overall increased in return on capital employed .ROCE as currently defined is erroneous and capable of misleading investors and other interested parties on the performance of an enterprise

JET AIRWAYS & AIR SAHARA MERGER Jet Airways started its business operations in 1993 and is now the largest company in the airline industry in terms of market share. The company has a fleet size of 88 aircraft and flies over 60 destinations worldwide with over 360 flights scheduled for a single day. Synergy Fleet B737-300 B737-400 B737-700 B737-800 B737-900 CRJ-200 ATR-72 A330-200 A340-300 TOTAL Jet Airways 6 13 28 2 8 2 3 62 Air Sahara 2 3 7 7 7 26 Merged Entity 2 9 20 35 2 7 8 2 3 88

The major efficiency and synergy comes because both the companies use B737 as their domestic fleet efficiencies. Air Sahara has B737s which are more than 10 years old and CRJ-200 which were taken on lease for higher rentals. Jet Airways will have to rationalize the cost aspect of operating and maintaining the fleet size. Since Jet Airways does not have a proper mix of aircrafts this would lead to higher maintenance cost for merged entity.

Financial Analysis The acquisition between Jet Airways and Air Sahara took place in the year 2006. Hence below analysis has been done two years prior to the merger i.e. during 2004-05 and 2005-06 and two years after the merger i.e. 2007-08 and 2008-09 respectively. Jet Airways Operating Profit Margin 2004-05 2005-06 33.2% 24.8% 2006-07 2007-08 14.7% 8.6% 2008-09 5.2%

Gross Operating Margin

24%

19.8%

6.6%

4.1%

-6.4%

Net Profit Margin

9%

7.9%

0.4%

-2.9%

-3.5%

Return on Capital Employed

31.6%

21.2%

13.8%

6.3%

4%

Return on Net Worth

22.4%

21.1%

1.3%

-13.7%

-31.1%

Debt-Equity Ratio

1.7

2.3

2.9

6.5

12.6

EPS

45.4

52.4

3.2

-29.3

-46.6

P/E

27.6

18.5

195.8

-17.7

-3.3

On carefully looking at the above figures it can be seen that the operating margins of Jet Airways were very strong in the year 2004-05. Later the operating margins started slowing down in the coming years. Post merger the operating margins of Jet

Airways had gone down to 5.2% from an earlier five year high of 33.2%. Gross Profit margin was very strong at 24% in 2004-05 however post merger it has moved into a negative territory of (6.4%). Return on capital employed proves the efficiency with which the business is maintained. Looking at the post merger results the shareholders who act as owners would surely be disappointed with only 4% return compared to 31.6% in 2004-05. Similarly the return on Net Worth for the company has also gone negative and post merger it has not added any significant value for shareholders. The debt-equity ration of the firm at the current level is around 10 times higher than in the year 2004-05 which shows the level of leverage which the company wants to drive on. The EPS which is the crude factor for any shareholder has seen a dip of -46.6%. Looking at the P/E ratio clearly shows that the stock has been highly undervalued and shareholders wealth has been deteriorated.

Overall it can be seen that Jet Airways has been able to post positive operating margins post mergers however Kingfisher Airlines have failed to do that. Kingfisher Airlines also has a negative return on capital employed compared to Jet Airways. But on other parameters like EPS, Return on Net Worth and Net Profit Margin have been negative for both the companies. It can be thus inferred that mergers and acquisitions have not created enough shareholder wealth post merger.

CONCLUSION In 2007 alone, Indian aviation saw three mergers -- Kingfisher Airlines acquiring Air Deccan at Rs 550 crore (Rs 5.5 billion) and Jet Airways acquiring Air Sahara at Rs 1,450 crore (Rs 14.5 billion) besides the forced merger of national carriers Air India and Indian Airlines. Industry analysts say Kingfisher's merger with Air Deccan gave the merged entity rights to fly international. After considering the state of Jet Airways and Air Sahara along with the scenario of the Indian Aviation Industry this acquisition was a good decision taken at the right time. This move further strengthened the position of Jet Airways and helped it fight with the other competitors and maintain its market leadership. Also Air Sahara found an easy bailout option to clear its debts. Thus this deal was beneficial for both Jet Airways and Air Sahara. Jet-Sahara or Kingfisher-Deccan and Air India-Indian Airlines had different corporate cultures. This makes a merger process difficult. Fortunately, Jet Airways has kept JetLite as a subsidiary. "Otherwise they would have killed the airline." However, some feel that apart from the reasons cited above, external factors like slowdown in the Indian aviation market because of recession have contributed to the failure of the merger. Post merger the operating margins of Jet Airways had gone down to 5.2% from an earlier five year high of 33.2%. Gross Profit margin was at a very strong 24% in 2004-05 however post merger it has moved into a negative territory of (6.4%). Return on capital employed proves the efficiency with which the business is maintained. Looking at the post merger results the shareholders who act as owners

would surely be disappointed with only 4% return compared to 31.6% in 2004-05. Similarly the Return on Net worth for the company has also gone negative and post merger it has not added any significant value for the shareholders. Shareholders wealth of Kingfisher airlines has deteriorated significantly post merger with Air Deccan. The P/E ratio of the firm also states that the stock has been undervalued over the years and does not look that an immediate upward movement in share price or EPS basis which the P/E will go up. Overall it can be seen that Jet Airways has been able to post positive operating margins post merger however Kingfisher Airlines have failed to do that Kingfisher Airlines also has a negative return on capital employed compared to Jet Airways. But on the other parameters like Earnings per share, Return on Net Worth and Net Profit Margin have been negative for both the companies. It can thus be inferred that mergers and acquisitions have not created enough shareholder wealth post merger.

REFERENCES

1. Sudarsanam, P.S. (1995) The Essence of Mergers and Acquisitions Prentice Hall, London, ISBN 0-13-310889-9.

2. Depamphilis, D.M. (2008), Mergers, Acquisitions, and Other Restructuring Activities, 4th Ed., Elsevier Inc., London.

3. Chandra P., (2001), Financial Management, Tata- Mc Graw Hill Publication.

4. Lipczynski, J., Wilson J., (2004), The Economics of Business Strategy, Pearson Education Limited.

5. Megginson, W.L.m Smart, S.B., Lucey, B.M., (2008), Introduction to Corporate Finance, Cengage Learning EMEA, London.

6. Beena, P.L. (2004), Towards understanding the merger wave in the Indian Corporate sector a comparative perspective, Working Paper 355, February, CDS, Trivendrum, pp. 1-44.

7. Mehta, P.S., (2006), A Functional Competition Policy for India, Academic Foundation, New Delhi.

8. Babu, G.R. (2005), Financial Services in India, Concept Publishing Company, New Delhi.

9. Geddes, H.R., (2006), An Introduction to Corporate Finance. Transactions and Techniques, 2nd Ed. John Wiley & Sons Ltd., West Sussex.

10. Bruner, R.F., (2004), Applied Mergers & Acquisitions, John Wiley & Sons, Inc. New Jersey.

11. Coyle, B. (2000), Mergers & Acquisitions, Fitzroy Dearborn Publishers, USA.

12. Gaughan, P.A., (2005), Mergers: What can Go Wrong and How to Prevent It, John Wiley & Sons, Inc. New Jersey.

13. Kaushal, V.K., (1995), Corporate Takeovers in India, Sarup & Sons, New Delhi.

14. Neary, P., (2004), Cross Border Mergers as Instruments of Comparative Advantage, University College Dublin and CEPR.

15. Pearson, B., (1999), Successful Acquisition of Unquoted Companies. A Practical Guide. 4th ed., University Press, Cambridge, United Kingdom.

16. Sherman, A.J., (1998), Mergers and Acquisitions from A to Z. Strategic and Practical Guidance for Small and Middle Market Buyers and Sellers, AMACOM, United States of America.

17. Bakker, H.J.C., Helmink, J.W.A. (2004), Successfully Integrating Two Businesses, Gower Publishing Limited, Hampshire.

18. Peck, S., Temple, P., (2002), Mergers & Acquisitions. Critical Perspectives on Business and Management, Routledge, London.

19. Peng, M.W., (2009), Global Strategy, Cengage Learning, USA.

20. Depamphilis, D.M., (2005), Mergers, Acquisitions, and other Restructuring Activities, 3rd ed., Elsevier Inc., London.

21. Hankin, J.A., Seidner, A., Zietlow, J., (1998), Financial Management of Non Profit Organisations, John Wiley & Sons, USA.

22. Ross, S.A., Westerfield, R.W., Jaffe, J., (2004), Corporate Finance, Tata Mcgraw Hill, New Delhi.

23. Hitt, M.A., Harrison, J.S. Ireland, R.D. (2001), Mergers & Acquisitions: A Guide to Creating Value for Stakeholders, Oxford University Press Inc., New York. 24. Sloman, J., (2006), Economics, 6th ed., Pearson Education Limited, England.

25. Sadler, P., (2003), Strategic Management, Kogan Page Limited, Great Briain.

26. Straub, T., (2007), Reasons for Frequent Failure in Mergers and Acquisitions. A Comprehensive Analysis, DUV, Germany.

27. Schuler, R.S., Jackson, S.E., Luo, Y., (2004), Managing Human Resources in Cross-border Alliances, Routledge, London.

28. Oum et al, (2000), Globalization and Strategic Alliances: The case of the Airline Industry, Pergamon, Oxford, UK..

29. Financial Express, (2007), Demerger before merger of Kingfisher, Available at: http://www.financialexpress.com/news/demerger-befor-merger-for-

kingfisher-experts/253080/ Business Standard, (2007)

30. American bar association (2005), The Market Power Handbook Competition Law and Economic Foundations, ABA Publishing, USA.

31. Andrade, G, Mitchell M, Stafford E. (2001), New Evidence and Perspectives on Mergers, Journal of Economic Perspectives, 15(2), pp. 103 120.

32. Auerbach A.J., (1988), Corporate Takeovers: Causes and Consequences, The University of Chicago Press, United States of America.

33. Berkovitch, E., Narayanan, M.P., (1993), Motives for takeovers: An Empirical Investigation, Journal of Financial and Quantitative Analysis, vol. 28(3), pp. 347-362.

34. Bruner, R.F., (2001), Does M & A Pay? A survey of Evidence for the Decision-maker. 35. Cameron, E., Green, M., (2004), Making Sense of Change Management. A Complete Guide to the Models, Tools and Techniques of Organizational Change, Cogan Page Limited, UK.

36. CFA, (2007), Indian Aviation: A promising Future, Chartered Financial Analyst, Vol. XI(6), pp. 25-27.

37. Defriez, A. (2000), A Practitioners Guide to the City Code on Takeovers and Mergers, Biddles Limited, Guildfor and Kings Lyun, Great Britain.

38. Dickerson, A.P., Gibson, H.D.m Tsakalotos, E., (1997), The Impact of Acquisitions on Company Performance: Evidence from a Large Panel of UK Firms, Oxford Economic Papers, vol. 49(1997), pp. 344-361.

39. Eun, C., Kolodny, R., Scheraga, C. (1996), Cross-border acquisitions and shareholders wealth: Tests of the synergy and internalization hypotheses, Journal of Banking & Finance, 1996, vol. 20(9), pp. 1559-1582.

40. Ghosh A., Das B., (2003), Mergers and Takeovers, The Management Accountant, vol. 38(7), pp. 543-545.

41. Goldberg, W.H., (1986), Merger Motives Modes Methods, Gower Publishing Company Limited. 42. Jensen, M.C., (1986), Agency Costs of Free Cash Flow, Corporate Finance and Takeovers, The American Economic Review, vol. 76(2), pp. 323-329.

43. Kaur, S., (2002), Ph.D. Thesis Abstract, A study of Corporate Takeovers in India, Submitted to University of Delhi, pp. 1-11.

44. Krishanmurti, C., Vishwanath, S.R., (2008), Mergers, Acquisitions, and Corporate Restructuring, Response Books, New Delhi.

45. Kumar, R., (2009), Post Merger Corporate Performance: An Indian Perspective, Management Research News, vol. 32(2), pp. 145-157.

46. Lamoreaux, (1989), The great merger movement in American Business, Cambridge University Press, pp. 1985-2004.

47. Malatesta, P.H., (1983), The Wealth Effect of Merger Activity and the Objective Functions of Merging Firms, Journal of Financial Economics, vol. 11(1-4), pp. 155-181.

48. Mantravadi, P., Reddy, A.V., (2008), Post Merger Performance of Acquiring Firms from Different Industries in India, International Research Journal of Finance and Economics, vol. 22, pp. 193-204.

49. Moeller, S.B., Schlingemann, F.P., Stulz, R.M., (2003), Firm Size and Gains from Acquisitions, Journal of Financial Economics, vol. 00 (2002), pp. 137.

50. Roll, R., (1986), The Hubris Hypothesis of Corporate Takeover, Journal of Business, vol. 59(2), pp. 197-216.

Appendix 1:

KINGFISHER INCRORE 2004-05 AIRLINES Operating Profit Margin Operating profit Net Sales 305.55 31.28

June 2006

June 2007

March 20008

March 20009 -553.2

-113.44

-262.4

-325.18

1285.42

1800.21

1456.28

5269.17

Net Profit Margin Return On capital Employed Return On Net Worth

Net Profit Net Sales EBIT Capital Employed Net Profit

-19.53 305.55 20.11 189.37

-340.55 1285.42 -150.97 241.75

-419.58 1800.21 -290.91 852.25

-188.14 1456.28 155.16 445.95

-1608.83 5269.17 174.37 -274.42

-19.53

-340.55 224.13

-419.55 384.7

-188.14 198.88

-1608.83 -2125.34

Net Worth 13.66

Debt-Equity Ratio

Debt Equity

284.48 13.66

451.66 224.13

916.71 384.7

934.38 198.88

5665.56 -2125.34

EPS

PAT

-19.53

-340.55

-419.58

-188.14

-1608.83

No. Equity 1,553,226 49,904,959 99,326,445 135,668,051 222,434,428 Share

PE

MPS EPS

85.85 -68.23

137.65 -42.24

122.05 -13.87

33.25 -72.33

Appendix 2:

JET AIRWAYS Operating Profit Margin

INCRORE Operating profit Net Sales

2004-05 1461.39

2005-06 1431.64

2006-07 1037.12

2007-08 755.1

2008-09 601.83

4338.01 391.99 4338.01

5693.73 452.04 5693.7

7057.78 27.94 7057.78

8811.1 -253.06 8811.1

11,571.15 -402.34 11,571.15

Net Profit Margin

Net Profit Net Sales

Return On capital Employed

EBIT Capital Employed

1212.68 3895.11

1071.08 5801.42

873.1 6072

734.71 12394.15

310.29 16198.98

Return On Net Worth

Net Profit Net Worth

391.99 1750.89

452.04 2143.86

27.94 2104.81

-251.86 1851.75

-402.34 1294.65

Debt-Equity Ratio(lakh)

Debt Equity

2,964.84 1,750.84

4,895.6

6,056.3

12,015.04 1,851.75

16,323.53 1,294.65

2,143.86 2,104.81

EPS

PAT No. Equity Share

391.99 7.298

452.04 8.633

27.95 8.633

-251.86 8.633

-402.34 8.633

PE

MPS EPS

1210.05 45.78

933.4 52.1

647.75 3.23

557.5 -29.31

172.9 -46.4

Potrebbero piacerti anche

- 1 DySO Final Web07022018Documento92 pagine1 DySO Final Web07022018Brijesh TrivediNessuna valutazione finora

- OfferDocumento1 paginaOfferBrijesh TrivediNessuna valutazione finora

- Foresight SchoolDocumento17 pagineForesight SchoolBrijesh TrivediNessuna valutazione finora

- A Study of Mergers in Aviation IndustryDocumento46 pagineA Study of Mergers in Aviation IndustryBrijesh TrivediNessuna valutazione finora

- Indian Coal Mining ControversyyyyyyyyyyyyyyyyyyyyyyyyyyyyyDocumento15 pagineIndian Coal Mining ControversyyyyyyyyyyyyyyyyyyyyyyyyyyyyyBrijesh Trivedi0% (1)

- ANOVA AssumptionsDocumento25 pagineANOVA AssumptionsBrijesh TrivediNessuna valutazione finora

- ANOVA AssumptionsDocumento25 pagineANOVA AssumptionsBrijesh TrivediNessuna valutazione finora

- Research Proposal: "Impact of Rbi Policy On Sensex"Documento4 pagineResearch Proposal: "Impact of Rbi Policy On Sensex"Brijesh TrivediNessuna valutazione finora

- Strategy and Mgt. AccountingDocumento23 pagineStrategy and Mgt. AccountingShaheen MahmudNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5782)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Air IndiaDocumento60 pagineAir IndiaManjesh Kumar100% (1)

- Science: Quarter 1 - Module 1 To 8Documento44 pagineScience: Quarter 1 - Module 1 To 8Mildred Vigilia CuadrasalNessuna valutazione finora

- Gmail - FW - Your IndiGo Itinerary - SBPD5LDocumento5 pagineGmail - FW - Your IndiGo Itinerary - SBPD5LRishabh Sanghavi SoulflowerNessuna valutazione finora

- IndigoDocumento3 pagineIndigodev.tokanNessuna valutazione finora

- Indigo Passenger (S) : GST InformationDocumento4 pagineIndigo Passenger (S) : GST InformationRohan AnandNessuna valutazione finora

- 4L2M72Documento3 pagine4L2M72Avir YadavNessuna valutazione finora

- Chapter 4 Emirates and IndigoDocumento7 pagineChapter 4 Emirates and IndigoajendraNessuna valutazione finora

- Ms Delisha Lachhwani Ms Ruhaani Lachhwani: Indigo Passenger (S)Documento4 pagineMs Delisha Lachhwani Ms Ruhaani Lachhwani: Indigo Passenger (S)Ruhi RanaNessuna valutazione finora

- Indigo Airlines - Final ReportDocumento22 pagineIndigo Airlines - Final Reportanand_lihinarNessuna valutazione finora

- Your Indigo Itinerary - Bi55HwDocumento2 pagineYour Indigo Itinerary - Bi55HwsarthakNessuna valutazione finora

- MR Bhaskar Flight TicketDocumento5 pagineMR Bhaskar Flight TicketAbhishek GandhiNessuna valutazione finora

- Mummy Ji Ticket To Chandigarh 20 May 2023Documento4 pagineMummy Ji Ticket To Chandigarh 20 May 2023ashish tripathiNessuna valutazione finora

- Frankfinn AssignmentDocumento65 pagineFrankfinn AssignmentAviation presentation100% (5)

- Book IndiGo flight from Delhi to BhubaneswarDocumento2 pagineBook IndiGo flight from Delhi to BhubaneswarAnkit pattnaikNessuna valutazione finora

- Facebook and Telegram Groups and ChannelsDocumento50 pagineFacebook and Telegram Groups and ChannelsKARTHIKEYAN MNessuna valutazione finora

- PNR/Booking Ref.: XPBV7KDocumento3 paginePNR/Booking Ref.: XPBV7Kmdasifkhan2013Nessuna valutazione finora

- Sir Greg Final Lesson PlanDocumento15 pagineSir Greg Final Lesson PlanAllan Cesario AbadNessuna valutazione finora

- Questions From Class 8 NCERT SOcial History CHapter 3Documento3 pagineQuestions From Class 8 NCERT SOcial History CHapter 3roxibo3817Nessuna valutazione finora

- Microeconomic Analysis of Civil Aviation Industry - Indigo Market LeaderDocumento289 pagineMicroeconomic Analysis of Civil Aviation Industry - Indigo Market LeaderAPOORV ASTHANANessuna valutazione finora

- CHM Issue 9 Revision 01 - 6E Portal - 00054Documento244 pagineCHM Issue 9 Revision 01 - 6E Portal - 00054Corporate KingNessuna valutazione finora

- INDIGO by Ravi ShahDocumento38 pagineINDIGO by Ravi ShahRavi RanjanNessuna valutazione finora

- Spectrum of Atom HeliumDocumento5 pagineSpectrum of Atom HeliumAdrianiNessuna valutazione finora

- Elledge Celia - The Basics of Color Psychology. Meaning and Symbolism of Colors - 2020Documento53 pagineElledge Celia - The Basics of Color Psychology. Meaning and Symbolism of Colors - 2020Jumbo Zimmy100% (1)

- 22 Jan Ccu BomDocumento3 pagine22 Jan Ccu BomB MNessuna valutazione finora

- Dada Hyd To AwbDocumento4 pagineDada Hyd To AwbSamam AsarNessuna valutazione finora

- ItineraryDocumento4 pagineItineraryPrakharNessuna valutazione finora

- OBJECTIVE: Illustrate Well-Defined Sets, Subsets, Universal Sets, and The Null Set and Cardinality of SetsDocumento35 pagineOBJECTIVE: Illustrate Well-Defined Sets, Subsets, Universal Sets, and The Null Set and Cardinality of SetsRoger GeasinNessuna valutazione finora

- Aviation Industry in India: Submitted To: Dr. Jagdish Shettigar Dr. Pooja MishraDocumento33 pagineAviation Industry in India: Submitted To: Dr. Jagdish Shettigar Dr. Pooja Mishrasy dayNessuna valutazione finora

- Earnings-Call-Transcript Q3FY22Documento17 pagineEarnings-Call-Transcript Q3FY22Bhav Bhagwan HaiNessuna valutazione finora

- Learn Brazilian Portuguese vocabulary fast with Word Power 101Documento112 pagineLearn Brazilian Portuguese vocabulary fast with Word Power 101josenato1970Nessuna valutazione finora