Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

UR Entrepreneurs February Newsletter: Things To Know For Your Next Finance Interview

Caricato da

Lin ZhangTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

UR Entrepreneurs February Newsletter: Things To Know For Your Next Finance Interview

Caricato da

Lin ZhangCopyright:

Formati disponibili

UR

Entrepreneurs Monthly Article

February 2013

Things to Know for Your Next Finance Interview

-Oranich Aimcharoen 14

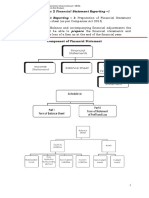

A lot of people may wonder what it takes to do well in a finance interview. What kind of things do we have to know anyways? One of the fundamental things that each finance or non-finance majors are expected to know is how to analyze financial statements. These three statements allow investors to extrapolate and judge the financial standing of the company that they may be interested in investing with. Each of these financial statements are very detailed, and for the first edition of our monthly newsletter, I will walk you through the analysis of the Balance Sheet. You may all be wondering, what is a balance sheet? It is a financial statement that provides a snapshot of a companys financial health at a specified date! I can guarantee you that if you take a snapshot of yourself today and another one sixty years from now, you will look very different. That is why if you were to compare the balance sheet of different companies, you need to select balance sheets that come from the same time frame; otherwise your conclusions will not be relevant. So what goes into a balance sheet? Balance sheets in general outline how much assets, liabilities, and shareholder equity a company has. Dont be scared and discouraged by the technical terms. Assets in general are what the company owns. Think about yourself. Yours assets will be how much money you have, the number of shoes you own, or your jewelry collection. For businesses, its the same way. Assets for companies normally take the form of cash, property, inventory, etc. Liabilities are what the

company owes. For you, it would the loan that you have to pay back mom and dad for your college education. Companies do the same thing. Some of them choose to borrow and take out loans from banks. Companies also purchase inventories (the stuff that goes into production) from suppliers so they may also owe suppliers. Shareholders equity is essentially the net worth of the business. Before you even begin analyzing the balance sheet, simply remember the fundamental rule Asset= Liabilities+ Shareholders Equity At this point, you all are probably baffled at what I am talking about. How is it useful for someone to know how much assets, liabilities, and shareholders equity a company has? Believe me, it is extremely important. If we look at the break down of these three categories, you will start to understand why. What goes under asset? Too many things. But the important ones that you are expected to know fall under the sub-categories of current assets and long-tern assets. The differences between these three categories are that current assets can be easily converted into cash within one year. The typically line items that you will see are cash, accounts receivable, inventory, etc. Long-term assets are a little different. They are typically assets that are owned for a long time and contribute to the companys operations. Think about plant, property and equipment. The factories! Liabilities operate in a similar manner. Liabilities can be split into current liabilities and longterm liabilities. The key factor that separates these two

-Oranich Aimcharoen 14

How to Analyze Financial Statements (Balance Sheet)

Liabilities operate in a similar manner. Liabilities can be split into current liabilities and long-term liabilities. The key factor that separates these two categories is the time period of payment. Current liabilities are expected to be paid within one fiscal year while the latter is greater than one year. So what are some of the liabilities that we should be familiar with, especially for interviews? Debt is always number one! Accounts payable is also very common. Shareholder equity as we had discussed is the companys net worth. Always remember the general formula Asset= Liabilities+ Shareholders Equity Shareholders Equity = Asset - Liabilities So if we re-arrange it, you will see that shareholders equity is just the difference between assets and liabilities. Thats the balance sheet!

A Basket of Broken Eggs

Remember the time when Lehman Brothers Holding filed for bankruptcy? What about when Bear Stearns had no option but to engage in emergency sales? Five years ago, it would be hard to imagine that happening to the bulge brackets. Today, it is no longer the case. Both Goldman Sachs and Morgan Stanley are regarded as respectable and stable investment banks. However, after the financial panic that took place, there have been talks about Goldman no longer being the golden egg and that Morgan Stanley will not be able to preserve its current standing as an independent investment bank. The CEO of Morgan Stanley, Jack Mack, in an attempt to counter critics claims, said, "[The firm has] strong earnings and $179 billion in liquidity -there is no rational basis for the movements in our stock or credit default spreads." Although the heads of both companies emphasized that they are financially capable of maintaining their status quo, external analysts seem to disagree. Looking at the numbers, both Goldman and Morgan Stanley are not in such sound positions. Recently, share prices have plunged which reflected investors fear on the banks stability. Goldman experienced a drop of 14% while Morgan Stanley saw their prices fall by 24%. As the financial crisis continues, these two firms may be forced to sell themselves to commercial banks that can provide them with reliable streams of funds. Further fear of credit defaults within the general investment market has further created an adverse atmosphere for Goldman and Morgan Stanley as anxious investors bid up prices of insurance on debt issued. With the current economic environment, it is hard to determine which way the pendulum would swing, but both companies vowed to maintain their position as traditional investment banks.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Steel Authority of India Limited Working Capital Management: About SailDocumento4 pagineSteel Authority of India Limited Working Capital Management: About SailHarsh ChadhaNessuna valutazione finora

- Finance 2Documento19 pagineFinance 2suriNessuna valutazione finora

- 1 Tolentino Vs Gonzales, 50 Phil 558Documento9 pagine1 Tolentino Vs Gonzales, 50 Phil 558Perry YapNessuna valutazione finora

- LIC Customer SatisfactionDocumento51 pagineLIC Customer Satisfactionnikunj_shahNessuna valutazione finora

- Radiowealth Finance Company vs. Spouses Del RosarioDocumento2 pagineRadiowealth Finance Company vs. Spouses Del RosarioApril Joy Fano BoreresNessuna valutazione finora

- China National Machinery vs. SantamariaDocumento2 pagineChina National Machinery vs. SantamariaArmstrong Bosantog75% (4)

- Kumarmangalam Report On Corporate GovernanceDocumento22 pagineKumarmangalam Report On Corporate Governancepritikopade020% (1)

- University of Pennsylvania The Wharton SchoolDocumento18 pagineUniversity of Pennsylvania The Wharton SchoolBassel ZebibNessuna valutazione finora

- Asics CorporationDocumento6 pagineAsics Corporationasadguy2000Nessuna valutazione finora

- Youthonomics Global Index 101315Documento57 pagineYouthonomics Global Index 101315Leonardo GuittonNessuna valutazione finora

- Lehman Brothers and LIBOR ScandalDocumento16 pagineLehman Brothers and LIBOR Scandalkartikaybansal8825Nessuna valutazione finora

- AccA P4/3.7 - 2002 - Dec - QDocumento12 pagineAccA P4/3.7 - 2002 - Dec - Qroker_m3Nessuna valutazione finora

- War at The End of The DollarDocumento10 pagineWar at The End of The Dollarrichardck61Nessuna valutazione finora

- Gold LoanDocumento4 pagineGold LoansekarkarthicNessuna valutazione finora

- Window Dressing of Satyam Company: A Project Report ONDocumento6 pagineWindow Dressing of Satyam Company: A Project Report ONYogesh RathiNessuna valutazione finora

- BCom PDFDocumento67 pagineBCom PDFSwathi Nandhagopal100% (1)

- AC EXAM PDF 2019 - LIC Assistant Main Exam (Jan-Dec14th) by AffairsCloud PDFDocumento309 pagineAC EXAM PDF 2019 - LIC Assistant Main Exam (Jan-Dec14th) by AffairsCloud PDFRajaram RNessuna valutazione finora

- Casestudy 4Documento3 pagineCasestudy 4Shubhangi AgrawalNessuna valutazione finora

- Financial Statement ReportingDocumento20 pagineFinancial Statement ReportingAshwini Khare0% (1)

- ADVANCED ACCOUNTING PART 1 QUIZZESDocumento5 pagineADVANCED ACCOUNTING PART 1 QUIZZESAnne Camille AlfonsoNessuna valutazione finora

- Tiner Insurance ReportDocumento44 pagineTiner Insurance ReportNikhil FatnaniNessuna valutazione finora

- Internship Report UBLDocumento133 pagineInternship Report UBLInamullah KhanNessuna valutazione finora

- Analyze Financial Ratios to Evaluate Business PerformanceDocumento13 pagineAnalyze Financial Ratios to Evaluate Business PerformanceAtyaFitriaRiefantsyahNessuna valutazione finora

- Bust Am Ante v. Rosel - G.R. No. 126800Documento1 paginaBust Am Ante v. Rosel - G.R. No. 126800eiram23Nessuna valutazione finora

- Chapter 23 HomeworkDocumento10 pagineChapter 23 HomeworkTracy LeeNessuna valutazione finora

- Playing The REITs GameDocumento2 paginePlaying The REITs Gameonlylf28311Nessuna valutazione finora

- CHAPTER 3 Financial Markets and InstitutionsDocumento13 pagineCHAPTER 3 Financial Markets and InstitutionsMichelle Rodriguez Ababa100% (4)

- How Open Banking Can Support SME FinanceDocumento13 pagineHow Open Banking Can Support SME FinanceADBI EventsNessuna valutazione finora

- General Banking LawDocumento21 pagineGeneral Banking LawCresteynNessuna valutazione finora

- Consigna V PPDocumento3 pagineConsigna V PPCourt Nanquil100% (1)