Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ezzahti, Ali - The Accuracy of The Black Scholes Model in Pricing AEX Index Call Options, Literature and Emperical Study

Caricato da

Edwin HauwertDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ezzahti, Ali - The Accuracy of The Black Scholes Model in Pricing AEX Index Call Options, Literature and Emperical Study

Caricato da

Edwin HauwertCopyright:

Formati disponibili

Bachelor Thesis Finance

Th e accu racy of th e Black Schol es model in p ricing AEX ind ex call o ption s:

Li te ra tu re a nd empi rica l study

Name: ANR: Supervisor: Date:

Ali Ezzahti S558900 Jiajia Cui 29 June 2007

Bachelor thesis

Table of Contents

Introduction 1 1.1 1.2 2 2.1 2.2 2.3 3 3.1 3.2 3.3 3.4 3.5 4 4.1 4.2 4.3 5 5.1 5.2 What determines the price of an option? Main factors Lesser known factors How can options be priced? Black Scholes Model Binomial model Risk neutral valuation What if the assumptions of the Black Scholes model do not hold? Volatility Geometric Brownian motion Constant risk-free interest rate No transaction costs Elasticity of variance and other properties Validity of a pricing model 3 5 6 7 7 8 9 10 12 12 13 13 14 14 15

How large are the pricing errors with use of the Black Scholes model? 17 Whaley Rubinstein Dan Galai, Macbeth and Merville Rubinstein How accurate is the Black Scholes model in pricing AEX index call options? In the case of historical volatility In the case of implied volatility 17 18 19 20 20 23

6 What are the causes in the eventually pricing errors, and how can they be reduced? 6.1 6.2 6.3 Dividend payments Risk-free interest rate Lognormal distribution 27 27 27 28 30 31 33

2

Conclusion Appendix References

Bachelor thesis

Introduction

Many investors invest in the AEX-index options. Forecasting the option price is a very important issue for these investors.The option prices will reflect the "likelihood" of the option finishing "in the money (2).There are a lot of options, and also different kinds of options. The prices of these options are determined by a lot of factors. In chapter 1 you will get an insight in these factors and how important each factor is. Also there will be showed which kind of important options there exist. The factors that are mentioned in chapter 1 are used in option pricing techniques. There are three important option pricing techniques. The Black Scholes model, Binomial model and the Risk Neutral valuation model will be highlightened in chapter 2. The main differences between these option pricing techniques will be mentioned, and there will be concluded which of these three techniques is best to use. The Black scholes model, the most popular and common used model, can be better used to price options. But the option price you get with the use of the Black Scholes model is not identical with the actual option price. A possible reason for this is that the assumptions that the Black Scholes model make can not be true in reality. A lot of researcher state that some of the assumptions are not true, and suggest other possible ways to get a better option price. This will be considered in chapter 3. The validity of the Black Scholes model has been researched by a lot of researchers. Because you have different kind of options, this also leads to different kind of results from these researchers. In chapter 4 there will be given the results of the empirical research on the pricing errors that arise with the use of the Black Scholes model. There has not been done research on the validity of the Black Scholes model in the pricing of the AEX-index options. Volatility is an important factor in the pricing of the AEX-index option. But researchers still not agree about which kind of volatility (historical or implied) is best to use (1) In chapter 5 there will be done data analyze where the validity of the Black Scholes formula will be tested. There will be showed how much pricing error consists in the pricing of the AEX-index options with the use of Black Scholes model. Further there will also be analyzed which kind of volatility is best to use. These results shall be compared with the results of other empirical research discussed in

Bachelor thesis

chapter 3. How much are these results in line? In chapter 6 there will be finally analyzed in which ways the pricing error errors can be reduced. The possible reasons for these pricing errors will also be mentioned.

Bachelor thesis

What determines the price of an option?

Options are types of financial derivatives contracts, where the future payoffs to the buyer and seller of the contract are determined by the price of the underlying. The underlying can be the stock price, interest rates, currency rates etc. You have two kinds of options, call options and put options. A call option is an agreement that gives the holder (owner) the right (not the obligation) to purchase the underlying security at a predetermined price called the strike price either at the calls expiration date (European-style options) or anytime during the life of the option (American-style options). The value of an option consists of two components, the intrinsic value and the time value (time premium). The intrinsic value is the difference between the exercise price of the option (the strike price, K) and the current value of the underlying instrument (spot price, S). The time value is the difference between the value of the option and the intrinsic value. Time value derives from what might happen in the future. The options time value captures the possibility that the option may increase in value due to volatility in the underlying asset. The time value depends on the time until the expiration date and the volatility of the underlying price. In time the time value declines and is zero at the expiration date.

Figure 1.1 Value of a call option

Bachelor thesis

When the option does not have positive value, its referred as out the money. When an option is out the money then it will not be exercised, so the option will never have a value less than zero.

Value of call option = Max [ (S K), 0 ] -c Value of put option = Max [ (K S), 0 ] -c The price (c) that you must pay for the option declines the value of an option.

1.1

Main factors

There are many factors that influence the option price or option premium. The following factors are the more influential and better-known factors that determine the option price:

Price of the underlying; this influences the intrinsic value of the option. Strike price of the option; this also influence the intrinsic value of the option.

The price of the underlying and the strike price of the option do also influence the time value of the option. All other factors being equal, the closer an options strike price is to the price of the stock, the greater the chance the stock will move sufficiently to give the option intrinsic value before expiration. Consequently this also gives greater time value. The time value tends to have the greatest value with at- the-money options, while deeplyin-the-money or deeply-out-the-money has the least time value.

Time remaining before the expiration; the longer the time remaining, the greater the time value. If there is a longer period ahead, there is also more time for the stock to potentially reach a price level that would yield a significant profit for the option holder. Volatility of the underlying; with high volatility the probability of the option ending inthe-money is greater. Higher volatility implies also greater time value. Dividend payout of the underlying (if there is a payout); as dividends rise, prices decrease for calls and increase for puts.

Bachelor thesis

Risk-free interest rate; if the interest rate increases then the price of call options increases and the price of put options decreases. The risk-free interest rate has the opposite influence to that of dividends on option prices.

1.2

Lesser known factors

The following factors are the lesser-known factors that can determine the option price:

Skewness; this is a measure of symmetry, or more precisely, the lack of symmetry. A distribution, or data set, is symmetric if it looks the same to the left and right of the centre point (normal distribution). With a normal distribution the coefficient of the skewness is 0. Kurtosis; this is a measure of whether the data are peaked or flat relative to a normal distribution. The coefficient of the kurtosis in the case of a normal distribution is 3. Cycles, seasonal effects and events; this generate news at some point in the future. An example of these is earnings report and financial news about a certain firm.

Bachelor thesis

How can options be priced?

There are a lot of techniques with where you can price options with. I will highlighten three important option pricing techniques. The three option pricing techniques I will analyze are; Black Scholes Model, Risk-neutral valuation and The Binomial model. Further I will look to the difference between these techniques and conclude which one is best to use.

2.1

Black Scholes Model

The most popular and common used option pricing technique is the Black Scholes Model, discovered by Fischer Black and Myron Scholes (1973). The Black Scholes Model is used to calculate a theoretical price of an option, for both call and put options. There are some assumptions that this model uses. Here follows the assumptions that the Black Scholes Model uses to determine the theoretical price of an option.

The underlying asset pays no dividends during the life of the option; but you can adjust the formula to take into account the payout of dividends. European exercise terms are used. Markets are considered to be efficient. There are no commissions being charged and also no transaction costs. The risk-free interest rate and asset volatility remain constant and known functions of time over the life of the option. Returns are log normally distributed.

The Black Scholes formula uses the five key determinants of an options price; underlying price (S), strike price (X), volatility (v), time to expiration (T-t), short-term risk-free interest rate (r). The original Black Scholes formula for calculating the theoretical option price (OP) is as follow:

Where:

Bachelor thesis

The meaning of the variables is provided in the appendix. The Black Scholes Model doesnt only provide the theoretical price of an option but also other useful products. These products are called Greeks; Delta, Gamma, Theta, Vega and Rho. Delta; also known as the hedge ratio, measures how much an options premium is likely to change in response to a small change in the price of the underlying. Gamma; the rate at which Delta changes with movement in the underlying price. Theta; rate which measures the calculated option value's sensitivity to small changes in time until maturity. Vega; measures the options sensitivity to changes in the volatility. Rho; measures the sensitivity of option prices to interest rates.

The main advantage of the Black Scholes model is that you can very quickly calculate the theoretical price of an option. But it is not very appropriate to calculate American options because the formula can determine the price only at one time in a moment (expiration date).

2.2

Binomial model

There is also an opportunity to calculate the option price with the binomial model (Cox, Ross and Rubenstein, 1979). An important assumption that the binomial model makes is that the stocks return can only take one of two values every period. So the distribution of the stock return is independent, with this assumption the stock price follows the binomial distribution. The binomial model breaks down the time to expiration into potentially a very large number of time intervals. In each time period, from present to expiration the stock price will be calculated. At each time period it is assumed that the stock price will move up or down by a certain amount (in percent). This amount can be calculated using

Bachelor thesis

the volatility and time to expiration. With this procedure you can produce the binomial distribution, a tree with the underlying stock prices. With this tree you can get al possible paths that the stock price could take during the life of the option. At the expiration date (time period at the end of the tree) you can get the option price because al the possible final stock prices are known. This option price (at the end of the tree) equals the intrinsic value because at expiration there is no time value. Then the option prices can be calculated at each step working back from expiration to the present. Within the binomial model there is also the opportunity to take into account dividends payout. The stock price should be adjusted; to do this you should extract the present value of the dividends from the stock price. Dividends are cash outflow within a company; this means that a dividend payout decreases the value of a company. So a dividend payout also decreases a stock price. To get a better insight in how this model works I will give an example of a call options that last one period .See the appendix for this example. This example gives an insight for how you can calculate the price of an option with one period, with the same method you can also calculated where there are a lot of time periods. You can use computer programmes to calculate the option price quickly. The advantage of the binomial model is that it's possible to check at every point in an option's life (every time period of the binomial tree) for the possibility of early exercise. Further you can calculate the option price at every moment during the life of the option. So the big advantage that the binomial model has over the Black-Scholes model is that it can be used to price American options. But the binomial model is very slow, there must be made a lot of calculations before the option price can be determined. However these two models have the same underlying assumptions regarding stock prices; stock prices follow a stochastic process. As a result of this, pricing of European options with the binomial model (if the time periods increase infinite) converges to the same prices with the Black-Scholes model (Jarrow Robert A, 1983). Thus, the best way you to price options of European style is the Black Scholes model.

2.4

Risk neutral valuation

Option pricing techniques like Black Scholes model, binomial model and risk neutral

10

Bachelor thesis

valuation is derivered from the option pricing theory of arbitrage-free pricing. This fundamental theory states that there is no arbitrage only if there exist a risk neutral measure that is equivalent to the original probability measure. The Black Scholes model assumes that the value of an option does not depend on the expected rate of return () of the underlying. The input of the Black and Scholes formula are parameters that do not measure the risk preference, so al the parameters (volatility, exercise price etc) are independent of risk preferences. These observations led financial economists Cox and Ross to develop an important tool known as risk-neutral valuation method. The principle of the risk-neutral valuation states that when pricing options, it is valid to assume that the world is risk neutral (all individuals are indifferent to risk). Also that the resulting option prices are correct, not only in a risk-neutral world but also in the real world. Cox and Ross give the reasoning as follows: If the stocks prices follow a random motion, then the option values must be the same as the values predicted by the Black-Scholes formula so that there are no arbitrage opportunities. This formula should be valid where it does not matter what the average investors view is towards risk because the formula does not use the parameter of the expected return of the underlying asset. As long as the investment world satisfies the main basic assumptions of the Black and Scholes formula, the option values given by the formula will be true (Hull and John C, 2000). Cox and Ross have derived the option valuation formula where they assumed a riskneutral investment world. You can characterise a risk neutral world as a place where the investors require no risk premium for their investments. In other words, the investors always demand only the risk-free rate of interest as the average expected return on their investments. The option prices can be determined by discounting the expected value by the risk-free rate. The expected value is calculated using the intrinsic values from the option going up or the option going down. So the present option price must represent its expected value discounted at the risk free rate. See the appendix for the formula.

11

Bachelor thesis

What if the assumptions of the Black Scholes model do not hold?

In chapter 2 there are mentioned the assumptions of the Black Scholes model. Pricing options should be accurate if these assumptions hold. The most important assumption shall be discussed.

3.1

Volatility

An important input to calculate the price of an option is volatility. This is also the most critical parameter for option pricing because option prices are very sensitive to changes in volatility. Volatility however cannot be directly observed; it is not given and can only be estimated. The input of volatility in the Black and Scholes model is very important to get the accurate option price. There are different kinds of volatility; historical and implied volatility. Historical volatility is the volatility of the underlying during the past. If you know the actual option price you can calculate the implied volatility. With past data you can get al the input of the Black Scholes formula and keep the volatility unknown while the actual option price is already known. With solving this equation you get the implied volatility. Basically implied volatility will give you the price of an option while historical volatility will give you an indication of its value. Before you can get an option price you must have an estimate of the future volatility. The future volatility can be better estimated with the implied volatility rather than the historical volatility. The implied volatility can be a function of the stock price. There is some empirical evidence that there is a negative correlation between the stock price and the volatility of stocks for small firms (Stulz, 2003). An explanation for this can be as follow; if firm value drops (stock price drops) then leverage will rise, and if leverage rise then equity becomes riskier so that the volatility will increase. The Black and Scholes model is modified to take to in account the negative relationship between stock prices and volatility. If the volatility can change randomly and it not perfectly correlated with the stock price then the binomial model will not longer work. There are a lot reasons why volatility could change randomly, a good example of one of these reasons is the announcement of earnings. The Black Scholes model assumes that the volatility is constant during the life of the option. If the time to maturity is long for a specific option, than there is some bias in

12

Bachelor thesis

calculating the option price with the Black Scholes model. The chance is great that the volatility will change during the life of the option; this means that the constant volatility input can create bias. A better option pricing technique for an option with a long time to maturity is the Binomial model because there is the opportunity to change the volatility during the life of the option.

3.2

Geometric Brownian motion

The Black Scholes model also assumes that the price of the underlying security follows a geometric Brownian motion with constant volatility. This means that all options on the same underlying should produce the same implied volatility. However many empirical research, like research by Rubinstein (1994), Dumas (1998), Tompkins (2001), have shown that there is an existence of a systematic relationship between the implied volatility and the strike price. This is known as the volatility smile. With the volatility smile there is a long-observed pattern in which at-the-money options tend to have lower implied volatilities than other options. A related concept of the researchers is that of the term structure of volatility, this refers to that implied volatility differs on options with the same underlying security and the same strike price but with different times to maturity. This means that the log-normality assumption (geometric Brownian motion) of the Black Scholes model does not hold. Empirical study of Jackwerth and Rubinstein (1996) has also shown this. They show that the implied risk-neutral probability densities are heavily skewed to the left and are highly leptokurtic. A distribution with a positive kurtosis is called leptokurtic, this means that the distribution has more a peak around the mean (a higher probability of returns near the mean than thats the case with a normally distributed return) and has more fat tails (a higher probability of extreme returns than thats the case with a normally distributed return). So this means that the log-normality assumption in the Black Scholes model does not hold (Tobias Herwiq, 2006).

3.3

Constant risk-free interest rate

Another assumption of the Black Scholes model that could not be hold is that there is a known risk-free interest rate that remains constant during the life of the option. You can

13

Bachelor thesis

use a stochastic interest rate instead of a constant risk-free rate to price options. A model that uses a stochastic interest rate is that of Amin and Jarrow (1992). Their has been done empirical research by Krister Rindell (1994) to check whether the Black Scholes model price stock index options better than of the model of Amin and Jarrow. He has used data on European style stock index options from the Swedish option market. Krister Rindell concluded that the Amin and Jarrow model outperforms the Black Scholes model. He has found pricing errors (difference between the observed options price and the price found with the model) with the Black Scholes model, if the model is correct these errors should be random. But these errors are correlated with the time-to-maturity of the options so there is time-to-maturity bias. This time-to-maturity bias found in the test of the Black Scholes model disappears when the options are priced with the Amin and Jarrow model.

3.4

No transaction costs

The Black Scholes model also assumes that there are no transaction costs, this is not true in the real world. The Black Scholes model is based on the theory of no arbitrage, but arbitrage relationships in theory are always affected by the transaction costs in practice. This means that transaction costs create bounds around the theoretical price within which the market price may fall without giving rise to a profitable arbitrage opportunity large enough to cover the cost of exploiting it. (Stephen Figlewski, 1989) This effect of the transaction cost that lead to market efficiency is also stated by Black and Scholes, see page 17.

3.5

Elasticity of variance and other properties

Important empirical research about the pricing of options with the Black Scholes model has been done by C.Cox and Mark Rubinstein. They have created alternative option pricing models and compared it with the Black Scholes model. They have created these alternative option pricing models by assuming that some of the following important properties that led to the Black Scholes formula will not be true: The possible percentage changes in the stock price over any period will not depend on the level of the stock price at the beginning of the period. So it is assumed that there is a random walk.

14

Bachelor thesis

Over a very small interval of time, the size of the change in stock prices is also small. This means that although we were certain a change in the price of the underlying would occur, not much could happen before we could do something about it. Over a single period, only two stock price outcomes were possible. This feature is also used by the Binomial model. By considering one of the properties not true, like the second of the above properties, you consider the probability that the stock price can have a jump movement. There has been concluded that the alternative option pricing models has less bias then that of the Black Scholes model. The model of Cox uses the constant elasticity of variance to price options. The constant elasticity of variance functions of C.Cox calculates the sensitivities, theoretical price and implied volatility of options. Thereby they use a valuation technique based on the constant elasticity of variance option pricing model. This model considers the possibility that the volatility of the underlying asset is dependent upon the price of the underlying asset while the Black Scholes model assumes an elasticity of zero. Also empirical study of Black (1976) and Beckers (1980) have found that the variance of the rate of return is inversely related to stock prices. Other researchers, like Thorp and Gelbaum (1980) say that the model of Cox is a more realistic version of the Black-Scholes model because studies have shown that price variances do change as the asset price changes. Although the Black-Scholes model assumes a constant asset price volatility regardless of the level of the security price.

3.6

Validity of a pricing model

You have seen that there is a lot of research that stated that some assumptions made by the Black Scholes model do not hold. There cannot directly said that the Black Scholes model should be rejected due to these deviations from the basic assumptions of the model. A study of Bhattacharya (1981) shows that even if the Black Scholes model can give a wrong price of the option if some of the underlying assumptions do not hold, the deviations are usually small and on average insignificant. He state that the deviations usually decrease as time to maturity increases and as the degree of the option that is in the money increases. According to Milton Friedman (American economist and noble price

15

Bachelor thesis

winner), the validity of a model should not be tested by testing its assumptions approximation of reality. He state that the validity of a model should be tested by its ability to predict future events. There are four approaches of validating option pricing models (Katz, 2005):

(1) Testing pricing models by means of simulations and quasi-simulations of deviations from the basic assumptions of the model. (2 )Comparing the prices calculated by the model with the actual prices. (3) Creating a neutral hedge positions and testing the behavior of the returns from the investment. This approach is suggested by Black and Scholes in 1972. The idea of this approach is to create with options and their underlying security a position. This position should be riskless if the option pricing model is correct. (4) Imputing the standard deviations (volatility) from actual option prices by using an option pricing model.

16

Bachelor thesis

How large are the pricing errors with use of the Black Scholes model?

There has been a lot of research to investigate the performance of option pricing models. The first few researchers have used historical volatility. The problem with this is that such an estimate of historical volatility reflects the pas history of the stock, while the relevant volatility is the one that market expects to hold over the life of the option. So a better input is implied volatility, the most recent papers have used this implied volatility.

4.1

Whaley

A comprehensive empirical study of the pricing of stock options has been done by Whaley (1982). He has used the Black and Scholes model to price 15,582 call prices. These call prices are of dividend paying call options. If you look at dividend paying call options there is need for dividend information to calculate the options prices. This can be accurately estimated by inspection of the underlying historical dividend payments. This has also been done by Whaley. Whaley found an average mistake of 3.16 cent for call options with an average call price of 4.1388. This is 0.76 % of the average call price. He has concluded that the Black Scholes model performed well but has some bias. The Black Scholes model has overpriced options on high volatility stocks and underpriced options on low volatility stocks. Whaley stated that this phenomenon, a lot of researchers come to these same result, could be attributed to the following resources: non-stationarity of the stock return standard deviation parameter assumption of a known dividend assumption of a zero tax rate differential between the dividend and capital gain income Black and Scholes have also found the above mentioned result on their own model. Thereby they used past data to estimate the variance and state that this is the reason why there is an underpricing of low volatility stocks, and overpricing of high volatility stocks. With a better measurement of the volatility this problem can be solved. This means that if someone buys and sells options for his own account where he uses the Black Scholes valuation model to price options, then he can expect to lose money if other traders have information about the volatility that is not contained in the past data. If it is assumed that all market traders uses all available information efficiently, then the buying of an

17

Bachelor thesis

undervalued option at the Black Scholes model price and selling an overvalued option at the Black Scholes model price would result in significantly negative excess portfolio returns. But buying an undervalued option at the market price and selling an overvalued option at the market price will result in significantly positive excess portfolio returns. So while the model overestimates the value of an option on a high variance security, market traders will underestimate and vice versa. However if you include the transaction cost of trading in options than the implied profits of buying options on a low volatility securities and selling options on a high volatility securities will disappear. This means that there is market efficiency (Black and Scholes, 1972). But Whaley (1995) has not found a significant relation between the underpricing of the options with the Black Scholes model and the degree of moneyness of the options (how much an option is in the money; underlying price minus the exercise price minus the option premium), so the underpricing cannot be explained by the degree of the moneyness. This result is contradicting with other research results. Whaley also has found a significant relationship between the pricing errors and the dividend yield, and also with the time to maturity. He found less pricing errors if the dividend yield increased (negative correlation). If the time to maturity increased, then also the pricing errors increased (positive correlation). Hence, the Black Scholes model underprices options on high-dividend stocks and overprices options with a long time to maturity. (Whaley, 1995)

4.2

Rubinstein

Another import research that has been done to look at the Black Scholes pricing errors is a study of Rubinstein (1985). He has considered the prices of two options of the same stock that differ along some dimension. For example it could be that one option has a higher price than the other option. With the Black Scholes formula both options should have the same implied volatility. If this is not true, for example, if the option with the higher exercise price has a higher implied volatility then there could be implied means that the Black Scholes formula has some bias. Rubinstein found that there were statistically significant differences between the implied volatilities. He found that the implied volatility of out-of-the-money options increases as time to maturity becomes shorter. Thus, short-maturity options are valued more than implied by the Black Scholes

18

Bachelor thesis

model. The biases that Rubinstein documented changed over time. The important changes in the biases of the Black Scholes model took place after the stock market crash of 1987. After 1987 there has also been a lot of analysis of stock index options like the S&P500. Also the stock index option can be good priced with the Black Scholes model where you can treat the index as the underlying. There also has been found that deep-inthe-money and deep-out-of-the-money of the stock index options have higher implied volatility (Stulz, 2003).

4.3

Dan Galai, Macbeth and Merville

Dan Galai also has looked at the validity of the Black Scholes model in pricing of options. He has concluded the following: The Black Scholes model approximates market prices well for at-the-money options with medium to long time-to-maturity, although unexplained deviations from model predictions are still observed for these options. There are significant relative deviations between market prices and model prices for deep-in and deep-out-the-money options. This result is also found by the study of Whaley. If the option is close to maturity, then there are more observed violations. No other alternative model offers a consistently better explanation for the actual behavior of option prices over time than the Black Scholes model does. Despite the deviations from model predictions, the markets for options seem to be quite efficient in the sense of at allowing a trader to make consistently above-normal profits on an after-commissions and after-tax basis. Also the study of MacBeth and Merville in 1979 found that the Black Scholes model underestimates (overestimates) market prices for in-the-money (out-of-the-money) options. Further they found that the extent of the mispricing decreases as the time to maturity decreases.

19

Bachelor thesis

How accurate is the Black Scholes model in pricing AEX index call options?

The most AEX- index options have short time to maturity, I will use the Black Scholes model to price these call options. There will also be an analyse of call option with a long time maturity, so that there can be done a comparison. Further there will be only data analyse of the call options. To check the validity of the Black Scholes model in this case I will compare the prices calculated with the Black Scholes model with the actual prices (method 2, see page 16). The call options start at different days in May (16, 17 and 24 May) and the most of this end in a couple months. But there are also options that just mature in years like the year 2010. These AEX-index call options are of European style. The AEX index is not adjusted for the dividend payments of the firms that are in the AEX index. The stock market is working on a new AEX index that is adjusted for the dividend payments. To calculate the option price I have collected the five inputs and the actual option price on the website of Euronext Amsterdam and converted it to excel. The risk free interest rate has been found on the website of de nederlandse bank, this interest rate is about 3.3%. This interest rate is also for the month May. The most important input, the volatility, can be found in different ways. First I will use historical volatility to price the call options.

5.1

In the case of historical volatility

There has been used historical data of the AEX-index prices over the last five years, from 28 May 2002 until 28 May 2007. To get the volatility I have calculated the returns with the following formula:

Return (St) = (St St-1) / St-1 These are daily returns because I have used the daily AEX-index prices. With the use of the function STDEV in excel there has been found the daily volatility, this has been converted to the yearly volatility. To calculate the yearly volatility I have used 250 days in the year, because that is the number of trading days in a year. The calculated historical

20

Bachelor thesis

volatility is 22.52 %. With the use of this volatility there has been calculated the Black Scholes option prices. The average pricing errors is 10.78 with an average call option price of 34.78. The standard deviation is also large, its 10.64. The average pricing error is about 30.98% of the average actual call price. There can be concluded that the Black Scholes model is not accurate with the use of historical volatility. I also have looked at the difference in pricing errors between call options with a short maturity and a long maturity. I have divided the call options in 2 sides; call options with a short maturity (less than a half year) and with a long maturity (longer than a half year). The average pricing errors of the call options with a short maturity is 5.22 with a standard deviation of 4.44 while that of options with a long maturity is 20.72 with a standard deviation of 11.27. Thus, the pricing errors with the use of historical volatility are less with options with a short maturity but are still great. Empirical research of Whaley, MacBeth and Merville has stated that there is a positive correlation between time to maturity and pricing error. This means that the pricing error rises if also the time maturity rises. The next graph shows the relationship between the pricing error of the AEX-index call options and the time maturities of these call options.

Figure 5.1 Relationship between pricing error and time to maturity

Historical volatility

60

Pricing error (euro's)

40

20

0 0,1 0,1 1,6 0,09 0,17 0,19 0,26 0,34 0,44 0,58 0,83 1,09 4,6

-20

Tim e to m aturity (years)

On this graph can be seen that the pricing error rises if the time-to-maturity increase. The correlation coefficient has been calculated with the use of excel function CORREL, the

21

Bachelor thesis

correlation coefficient is 0.94. This is a very high correlation coefficient, so there is a highly positive correlation between the pricing error and time to maturity. Thus, AEX index call options with a short time to maturity contain less error. This result is in line with the empirical study of Whaley, Macbeth and Merville. Another result of the study of Whaley is that there is no significant relationship between the pricing error of call options and the degree of moneyness. But research of Bhattacharya has stated that the pricing error decrease as the degree of moneyness increase. The degree of moneyness can be calculated as follow:

Underlying price / strike price

If this ratio is more (less) than 1, than the call option is in the money (out the money). With a ratio of 1 then the call option is at the money, if the ratio differs far from 1 than the option is deeply out (in) the money. The next scatter diagram shows the relationship between the pricing error and degree of moneyness. Remember that the pricing error contains the difference between the calculated Black Scholes model price and the actual call price.

Figure 5.2 Relationship between pricing error and degree of moneyness

Historical volatility

60 50 Pricing error 40 30 20 10 0 -10 0 0,5 1 1,5 2 2,5 3 3,5

Degree of moneyness

22

Bachelor thesis

On this diagram can not be clearly seen a pattern. The correlation coefficient between these two variables is -0.17. So there is a slightly negative correlation between the pricing errors and degree of moneyness. This has also been concluded by the study of Bhattacharya, but in this case its also almost the same as the result of Whaley because the correlation coefficient of -0.17 is not far from 0 (no correlation). In other words, AEX-index call options that are in the money contain a little bit less pricing error. This information tells us not much because I have concluded that the pricing of the call options with the use of historical volatility is not so accurate. Other researcher also stated that historical volatility is a poor input to calculate the option prices, they stated that historical volatility is a poor estimator of the future volatility.

5.2

In the case of implied volatility

Implied volatility can maybe be better used to price call options. But how can the implied volatility of the AEX-index be found? The volatility of the American market is almost the same as that of the Netherlands. In other words, the volatility of the SP500 is the same as that of the AEX-index. There exists a volatility index on the SP500, the VIX. The value of VIX is the same as the implied volatility of the AEX-index. So I have used the value of the VIX on the date when I started to price the options, namely on 24 May. The implied volatility is less than the historical volatility, its 14.02%. This means that we can expect that the pricing errors with the use of implied volatility is less, because option price is low with a low volatility. Vice versa, option price is high with a high volatility. We have seen that the average option pricing error with the use of historical volatility is 10.78 above the actual option price. This means that the pricing error is less than 10.78 with a lower volatility; there is also a greater change that the pricing error is negative. In other words that the Black Scholes model price is less than the real price (underpricing). I have calculated the call prices with the use of the implied volatility. The average pricing error is 0.29 with a standard deviation of 4.08. This is about 0.82 % of the average actual call price. Whaley has found an average pricing error of 0.76% of the average call prices and concluded that the Black Scholes model is accurate enough. In this case there also can be concluded that the pricing of the AEX index call options with the Black Scholes model is accurate enough. The pricing errors, like expected, are less than in the

23

Bachelor thesis

case that there has been used historical volatility. Thus, implied volatility can be better used to price AEX-index call options. The average pricing error of the call options with a short maturity is -0.95 with a standard deviation of 2.15, this negative sign means that the Black Scholes model price is less than the actual option price (underpricing). So we can conclude that the pricing of the call options with a short maturity is accurate. The average pricing error of the call options with a long maturity is 2.50 with a standard deviation of 5.55. With the next table you can compare the results of the pricing errors with the use of historical and implied volatility.

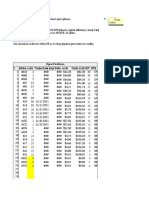

Table 5.1 Pricing error Pricing error Average (historical volatility) Total 10.7755 Average (implied volatility) 0,2863 Standard deviation (historical vol) 10.6444 Standard deviation (implied vol.) 4,0834

Short

5.2190

-0,9512

4.4432

2,1451

Long

20.7188

2,5008

11.2677

5,5526

With the use of implied volatility I also can conclude that the pricing errors are less with call options with a short maturity. Pricing AEX index call options with a long maturity is also better with the use of implied volatility rather than with the historical volatility. The following graph shows us the relationship between time to maturity and pricing errors.

24

Bachelor thesis

Figure 5.3 Relationship between pricing error and time to maturity

Implied volatility

40

Pricing error (euro's)

20

0 0,1 0,1 1,6 0,09 0,17 0,19 0,26 0,34 0,44 0,58 0,83 1,09 4,6

-20

Tim e to m aturity (years)

There can be seen that the pricing error rise with time to maturity. To see how high the correlation is between these two variables there has been calculated the correlation coefficient. There is also a high correlation between the time to maturity and pricing error because the correlation coefficient is 0.72. The correlation between the time to maturity and pricing error is much higher if there has been used historical volatility (0.94) rather than implied volatility (0.72). This means that with the use of implied volatility the pricing error increase less with time to maturity. With the use of a scatter diagram can also be seen the relationship between the pricing error and the degree of moneyness.

Figure 5.4 Relationship between pricing error and degree of moneyness

Implied volatility

35 30 25 Pricing error 20 15 10 5 0 -5 0 -10 Degree of moneyness 0,5 1 1,5 2 2,5 3 3,5

25

Bachelor thesis

There can be seen that the AEX index call options that are out the money contain less pricing error than in the money options. Vice versa, call options that are in the money contain more pricing error. To check how strong this correlation is I have calculated the correlation coefficient, this is 0.20. So there is not a strong positive correlation between the degree of moneyness and the pricing error.

26

Bachelor thesis

6 What are the causes in the eventually pricing errors, and how can they be reduced?

In the previous chapter there has been described the pricing error that exist in pricing the AEX index call options with the Black Scholes model. There has been concluded that implied volatility as input is a better way to price the call options. But also in this case there remains pricing error. Can the pricing error further been reduced?

6.1

Dividend payments

In calculating the AEX index options there has been used the AEX index as underlying price. But this index has not been adjusted for the dividend payments of the 25 firms that are in the AEX. So there must been developed a new index that takes the dividend payments in account. With the adjusted AEX index the pricing error can be less with the use of the Black Scholes model.

6.2

Risk-free interest rate

Another input that can be discussed is the risk-free interest rate. There has been used a risk free interest rate of 3.3 %, maybe this risk free rate is to low or to high. To check of another interest rate provides less error, I have used different interest rates to check whether the pricing errors reduce. With increasing the interest rate the pricing error also increase, so the interest rate should not be higher. But if there has been reduced the interest rate then the pricing error first decrease and then increase. The interest rate at which the decrease change in an increase is 3%. Thus, a risk free interest rate of 3 %, 3.1% and 3.2% provides less pricing error. The optimal interest rate of 3.1 % provides an average pricing error of -0.05598 with a standard deviation of 3.78. So both the average and standard deviation are less with the use of a risk free interest rate of 3.1 %. Because the interest rate is not far from 3.3%, it can be that the actual risk free interest rate in the period that I started pricing the options is 3.1%. Another way in which pricing error can be reduced is by using stochastic interest rate. The Black Scholes model assumes a constant risk free rate interest rate; with using a stochastic interest rate in the model of Amin and Jarrow pricing error can be reduced. The AEX index call options that I have

27

Bachelor thesis

priced are that of in the days 16, 17 and 24 May. Because there has been little time between these days there can be assumed that the risk free interest rate is constant, so using stochastic interest rate shall not reduce the pricing error a lot. This also the case for stochastic volatility.

6.3

Lognormal distribution

Another assumption of the Black Scholes model is that the returns of the underlying are lognormal distributed. The causes of the pricing error can maybe explained by the fact that the assumption of a lognormal distributed returns does not hold. To test this assumption I have collected the AEX index prices from 28 May 2002 until 28 May 2007. The lognormal returns are calculated with excel, the formula used to calculate these log returns is: Log returns (St) = LOG (St) LOG (St-1). The calculated log returns are converted to SPSS to make a histogram with a normal curve.

Figure 6.1 Lognormal distribution of the AEX index

28

Bachelor thesis

The above histogram shows that the distribution of the AEX index seems like a lognormal distribution. The coefficients of the skewness and kurtosis are calculated with SPSS to have more information how accurate the lognormal distribution is. With a lognormal distribution the coefficient of the skewness is 0 and coefficient of the kurtosis is 3.

Table 6.1 log returns of the AEX index N Valid Missing Skewness Std. Error of Skewness Kurtosis Std. Error of Kurtosis 1925 0 -,106 ,056 3,888 ,112

The calculated skewness coefficient is -0.106 and that of kurtosis is 3.888. So there can be concluded that the lognormal distribution is not perfect. This also can be one of the causes of the calculated pricing error in chapter 5.

29

Bachelor thesis

Conclusion

In the literature review there has been stated that the Black Scholes model is accurate in the pricing of call options. This is also the case for AEX index options if there will be used implied volatility. Implied volatility is a much better way to price options rather than with historical volatility. With the use of historical volatility there is no accuracy in pricing the AEX index options. These pricing errors are larger for call options with a long time to maturity and if the degree of moneyness decrease (out the money options). The pricing error for call options with a long time to maturity is also larger in the case there has been used implied volatility, but this positive correlation is not so large is in the case of historical volatility. This time to maturity bias has also been found by other empirical researchers like Whaley. Investors can better use other pricing techniques like the Binomial model to price AEX index call options with a long time to maturity. The time to maturity bias can not be reduced with the model of Amin and Jarrow because there has only be observed call options on three days in the same week. This means that stochastic interest rate that is used in the model of Amin and Jarrow shall not reduce the pricing error that I have calculated. The relationship between the pricing error and degree of moneyness in the case that there has been used implied volatility is the opposite as in the case of historical volatile. So pricing error increase as the AEX index options are more in the money, but this positive correlation is not strong. This result is not in line with empirical research of Whaley, MacBeth and Merville because they found no relationship between the two variables. If the risk-free interest rate decrease with 0.1% than the pricing error is minimal given that other inputs remain unchanged. This means that the observed risk-free interest rate may not be correct. Their are also other reasons that can explain the pricing error. An important one is that the AEX index is not been adjusted for the dividend payments of the 25 firms that are in the AEX index. Further can be stated that the distribution of the AEX index is not perfect lognormal distributed. There exist some skewness and kurtosis that create the pricing error. The pricing error can maybe decrease if these reasons will be taken into account. There can be done research in the future to check how much the pricing decrease if these reasons are taken into account.

30

Bachelor thesis

Appendix

Black scholes formula:

S = underlying price X = strike price t = time remaining until expiration, expressed as a percent of a year r = current continuously compounded risk-free interest rate v = annual volatility of the underlying price (the standard deviation of the short-term returns over one year). ln = natural logarithm N(x) = standard normal cumulative distribution function e = the exponential function

Example of the Binomial model Consider a call option that lasts only one period. Assume that at the end of the period the underlying stock can only have 2 possible values. The current stock price is S0 = 50, and at the end of the period the stock price will either grow (with 30%) to S1, upp = (1.3)*50 = 65, or fall (with 20%) to S1, down = (0.8)*50 = 40. The call strike price X is 48, and the risk-free rate is 10% per period. S0 = 50 Su = (1.3)50 = 65 Sd = (0.8)50 = 40 C0 = ? Cu =Max[0,65-48] = 17 Cd = Max[0,40-48] = 0

31

Bachelor thesis

Stock price tree

Call price tree

Su= 65

Max(0, 65-48)= 17

S0=50 Sd= 40

C0= Max(0, 40-48)= 0

Before you can determine the cal price (C0) you must determine a replicating portfolio. The value of the replicating portfolio must be the same as the call price. Consider the following replicating portfolio: number of shares and R dollars invested in the risk-free

bonds with a risk free rate of 10 %.

RPu= 65 + 1,1 R

RP0= 50 + R RPd= 40 + 1,1 R

So the value of the replicating portfolio should be the same as the option values. 65 + 1,1 R = 17 40 + 1,1 R = 0 With solving this you get = 0.68 and R = -24.73 C0 = S =R = 50*0.68 24.73 = 9.27 Risk-neutral valuation formula Call option value = [ p Option up + (1-p) Option down] (1+r) = [ p (S up - strike) + (1-p) (S down - strike) ] (1+r)

32

Bachelor thesis

References Articles Avramidis Athanassios N and L'Ecuyer Pierr, 2006, Efficient Monte Carlo and QuasiMonte Carlo Option Pricing Under the Variance Gamma Model, Management science; vol.52 (2006) nr.12 p.1930-1944 (15 refs.) Black Scholes, 1972, The valuation of option contracts and a test of market efficiency, Journal of Finance Chriss, Neil A, 1997, Black-Scholes and Beyond pages 190-192. Chicago, IL: Irwin Professional Publishing. Duan J.-C and Yu M.-T, 1999, Capital standard, forbearance and deposit insurance pricing under GARCH., Journal of banking and finance; vol.23 (1999) nr.11 (November) p.1691-1706 Figlewski,Stephen, 1989, Options arbitrage in imperfect markets, Journal of finance Kimmel R, 2007, Maximum likelihood estimation of stochastic volatility models, Journal of financial economics; vol.83 (2007) nr.2 (February) p.413-452 Koch, I. , Schepper, A.D, 2007, Distribution-free option pricing, Insurance; vol.40 (2007) nr.2 (March) p.179-199

Krister Rindell, 1994, pricing of index stock options when interest rates are stochastic, journal of banking and finance;1994) vol.19 (1995) nr.5 (08) p.785-802 Minton,Bernadette A,, Schrand,Catherine M, Walther,Beverly R, 2002, The Role of Volatility in Forecasting; Review of accounting studies, vol.7 (2002) nr.2-3 (June) p.195215 Szakmary,A, Ors,E, Kyoung Kim J,Davidson, W.N, 2003, The predictive power of implied volatility: Evidence from 35 futures markets, Journal of banking and finance; vol.27 (2003) nr.11 (November) p.2151-2175

Books Whaley, Robert, 1995, Valuation of American call options on dividend paying stocks; Emperical test, Journal of Financial Economics

33

Bachelor thesis

Zimmermann H and Hafner W and Hafner W, 2007, Amazing discovery; Vincenz Bronzin's option pricing models, Journal of banking and finance;vol.31 (2007) nr.2 (February) p.531-546 Brenner and Menachem, 1983,Option pricing : theory and applications Herwiq and Tobias, 2006, Market-conform valuation of options Huisman and Juno J.M, 1999, Effects of strategic interactions on the option value of waiting Hull and John C, 2006, Options, futures, and other derivatives Jarrow Robert A and Rudd, 1983, Option pricing Kabir and Rezaul, 1997, New evidence on price and volatility effects of stock option introductions Kallianpur, Gopinath, 2000, Introduction to option pricing theory, p32 Katz Jeffrey Owen, Advanced Option pricing models, page 91 Shaffer and Sherrill, 1989, Immunizing options against changes in volatility Stulz, 2003, risk management and derivatives Willmott and Paul, 1995, Option pricing : mathematical models and computation, page 41

Internet

http://hccbeleggenforum.nl/index.php?option=com_content&task=view&id=158&Itemid =93 ). http://www.investopedia.com/articles/optioninvestor/02/031102.asp http://en.wikipedia.org/wiki/Rational_pricing#Arbitrage_free_pricin g ). http://www.hoadley.net/options/bs.htm) http://en.wikipedia.org/wiki/Volatility_smile

34

Bachelor thesis

http://www.fintools.com/docs/risk_neutral_valuation.pdf http://www.behr.nl/Beurs/aex.htmlT http://www.sbtionline.com/nist/eda/section3/eda3661.htm http://en.wikipedia.org/wiki/Option_time_value (http://www.fintools.com/doc/options/optionsConstant_Elasticity_of_Variance_.html

35

Potrebbero piacerti anche

- Sales, Sales Management, Sales StrategyDocumento20 pagineSales, Sales Management, Sales StrategyViet Long PlazaNessuna valutazione finora

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsDa EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNessuna valutazione finora

- OI Volatility Volume GreeksDocumento9 pagineOI Volatility Volume Greeksbakchod BojackNessuna valutazione finora

- A Great Volatility TradeDocumento3 pagineA Great Volatility TradeBaljeet SinghNessuna valutazione finora

- Sports Bar Business PlanDocumento33 pagineSports Bar Business PlanNathaniel MadugaNessuna valutazione finora

- Option Pricing A Simplified ApproachDocumento34 pagineOption Pricing A Simplified ApproachJamie VoongNessuna valutazione finora

- Advanced Accounting Vol.-IDocumento792 pagineAdvanced Accounting Vol.-ISaibhumi80% (5)

- 7 Option Trading Strategies AnswersDocumento4 pagine7 Option Trading Strategies AnswersAssia ENessuna valutazione finora

- Short Butterfly Spread With Calls - FidelityDocumento8 pagineShort Butterfly Spread With Calls - FidelityanalystbankNessuna valutazione finora

- 7776 ContentsDocumento4 pagine7776 ContentsMonica SainiNessuna valutazione finora

- Investopedia. Using - The Greeks - To Undersand OptionsDocumento5 pagineInvestopedia. Using - The Greeks - To Undersand OptionsEnrique BustillosNessuna valutazione finora

- Costaccounting IIDocumento255 pagineCostaccounting IIAbith MathewNessuna valutazione finora

- Long Iron ButterflyDocumento3 pagineLong Iron ButterflypkkothariNessuna valutazione finora

- Static Versus Dynamic Hedging of Exotic OptionsDocumento29 pagineStatic Versus Dynamic Hedging of Exotic OptionsjustinlfangNessuna valutazione finora

- Predicting Option Prices and Volatility With High Frequency Data Using Neural NetworkDocumento3 paginePredicting Option Prices and Volatility With High Frequency Data Using Neural NetworkBOHR International Journal of Finance and Market Research (BIJFMR)Nessuna valutazione finora

- What Are Some Basic Points Which We Must Know Before Go For Options TradingDocumento7 pagineWhat Are Some Basic Points Which We Must Know Before Go For Options TradingAnonymous w6TIxI0G8lNessuna valutazione finora

- Carolan, C. (1998) - Spiral Calendar - TheoryDocumento21 pagineCarolan, C. (1998) - Spiral Calendar - Theorystummel6636100% (8)

- Synthetic OptionDocumento6 pagineSynthetic OptionSamuelPerezNessuna valutazione finora

- Optimal Delta Hedging For OptionsDocumento11 pagineOptimal Delta Hedging For OptionsSandeep LimbasiyaNessuna valutazione finora

- Butterfly Spread OptionDocumento8 pagineButterfly Spread OptionVivek Singh RanaNessuna valutazione finora

- Bull or Bear, We Don'T Care !: Resource Guide For Trading Without Predicting Market DirectionDocumento7 pagineBull or Bear, We Don'T Care !: Resource Guide For Trading Without Predicting Market DirectionRuler ForGood2Nessuna valutazione finora

- Option GreeksDocumento2 pagineOption GreeksajjupNessuna valutazione finora

- Options Trade Evaluation Case StudyDocumento7 pagineOptions Trade Evaluation Case Studyrbgainous2199Nessuna valutazione finora

- Options The GreeksDocumento5 pagineOptions The Greekspiwp0wNessuna valutazione finora

- Valuation of OptionsDocumento47 pagineValuation of Optionsasifanis100% (1)

- Delta Hedging, Gamma and Dollar GammaDocumento4 pagineDelta Hedging, Gamma and Dollar GammaEmanuele QuagliaNessuna valutazione finora

- Writing Demand LettersDocumento2 pagineWriting Demand LettersJc AraojoNessuna valutazione finora

- Ichapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresDocumento14 pagineIchapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresJessalyn DaneNessuna valutazione finora

- Session 2: Options I: C15.0008 Corporate Finance Topics Summer 2006Documento31 pagineSession 2: Options I: C15.0008 Corporate Finance Topics Summer 2006Devita OctaviaNessuna valutazione finora

- IC 46 - One Word Q & ADocumento9 pagineIC 46 - One Word Q & Ameatul80% (5)

- Towers Watson Tail Risk Management Strategies Oct2015Documento14 pagineTowers Watson Tail Risk Management Strategies Oct2015Gennady NeymanNessuna valutazione finora

- Implied Vol Surface Parametrization PDFDocumento40 pagineImplied Vol Surface Parametrization PDFsoumensahilNessuna valutazione finora

- Kick The (Slippage) Tires Before Investing in A Trading SystemDocumento5 pagineKick The (Slippage) Tires Before Investing in A Trading SystemintercontiNessuna valutazione finora

- The Behaviour of Indias Volatility IndexDocumento10 pagineThe Behaviour of Indias Volatility Indexaruna2707Nessuna valutazione finora

- Equity Option Strategies - Buying CallsDocumento47 pagineEquity Option Strategies - Buying CallspkkothariNessuna valutazione finora

- Options Obv Feb2013Documento7 pagineOptions Obv Feb2013zhaozilongNessuna valutazione finora

- Lecture Option and DerivativeDocumento15 pagineLecture Option and Derivativeazkunaga_economistNessuna valutazione finora

- Earnings Theory PaperDocumento64 pagineEarnings Theory PaperPrateek SabharwalNessuna valutazione finora

- Ch08TB PDFDocumento15 pagineCh08TB PDFMico Duñas CruzNessuna valutazione finora

- Black-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDocumento8 pagineBlack-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDickson phiriNessuna valutazione finora

- Republic Act No. 7279Documento25 pagineRepublic Act No. 7279Sharmen Dizon GalleneroNessuna valutazione finora

- Greeks and Volatility SmileDocumento51 pagineGreeks and Volatility SmilestanNessuna valutazione finora

- Gold Monetization SchemeDocumento27 pagineGold Monetization SchemeAnonymous NffVDTgNessuna valutazione finora

- Diagnostic Exam 1.23 AKDocumento13 pagineDiagnostic Exam 1.23 AKmarygraceomacNessuna valutazione finora

- The Covered CallDocumento8 pagineThe Covered CallpilluNessuna valutazione finora

- Arbitrage PresentationDocumento26 pagineArbitrage PresentationSanket PanditNessuna valutazione finora

- MCQ Income Taxation Chapter 13docx PDF FreeDocumento14 pagineMCQ Income Taxation Chapter 13docx PDF FreeMichael Brian TorresNessuna valutazione finora

- Jesper Andreasen Local VolatilityDocumento55 pagineJesper Andreasen Local VolatilityAL RAFI0% (1)

- Pricing OptionsDocumento6 paginePricing Optionspradeep3673Nessuna valutazione finora

- Assignment Option Pricing ModelDocumento28 pagineAssignment Option Pricing Modeleccentric123Nessuna valutazione finora

- Option Pricing and The Black - Scholes Model: A Lecture Note From Master's Level Teaching Perspective - Kapil Dev SubediDocumento5 pagineOption Pricing and The Black - Scholes Model: A Lecture Note From Master's Level Teaching Perspective - Kapil Dev Subedikapildeb100% (1)

- Covered Call Strategies P1 PDFDocumento10 pagineCovered Call Strategies P1 PDFThành Tâm DươngNessuna valutazione finora

- Viziya Scheduler Quick GuideDocumento3 pagineViziya Scheduler Quick GuideSaq IbNessuna valutazione finora

- Volatility Information Trading in The Option MarketDocumento33 pagineVolatility Information Trading in The Option MarketTiffany HollandNessuna valutazione finora

- Stocks: Fundamental Analysis: Sample Investing PlanDocumento5 pagineStocks: Fundamental Analysis: Sample Investing PlanNakibNessuna valutazione finora

- The Greek LettersDocumento18 pagineThe Greek LettersSupreet GuptaNessuna valutazione finora

- 1improvement Algorithms of Perceptually Important P PDFDocumento5 pagine1improvement Algorithms of Perceptually Important P PDFredameNessuna valutazione finora

- NewDocumento5 pagineNewChen CenNessuna valutazione finora

- Figlewski Stephen - What Does An Option Pricing Model Tell Us About Option PricesDocumento5 pagineFiglewski Stephen - What Does An Option Pricing Model Tell Us About Option PricesJermaine R BrownNessuna valutazione finora

- Black ScholesDocumento57 pagineBlack ScholesAshish DixitNessuna valutazione finora

- An Error of Collateral Why Selling SPX Put Options May Not Be ProfitableDocumento29 pagineAn Error of Collateral Why Selling SPX Put Options May Not Be ProfitableSeaSeaNessuna valutazione finora

- Lecture8 OptionsTrading StrategiesDocumento21 pagineLecture8 OptionsTrading StrategiesRasesh ShahNessuna valutazione finora

- Options Market StructureDocumento17 pagineOptions Market StructureAnkit VyasNessuna valutazione finora

- 5paisa DerivativesDocumento129 pagine5paisa DerivativespkkothariNessuna valutazione finora

- BLK Risk Factor Investing Revealed PDFDocumento8 pagineBLK Risk Factor Investing Revealed PDFShaun RodriguezNessuna valutazione finora

- Trinity System - Theta Engine (Formerly 45+ DTE)Documento404 pagineTrinity System - Theta Engine (Formerly 45+ DTE)trungNessuna valutazione finora

- What Is An OptionDocumento30 pagineWhat Is An OptionsanketgharatNessuna valutazione finora

- Livevol Database StructureDocumento15 pagineLivevol Database StructureJuan LamadridNessuna valutazione finora

- The Sketch GenDocumento8 pagineThe Sketch GenEd williamsonNessuna valutazione finora

- Fourier Transform Methods in Option PricingDocumento40 pagineFourier Transform Methods in Option PricingespacotempoNessuna valutazione finora

- Short Note VP AtolityDocumento12 pagineShort Note VP AtolityceikitNessuna valutazione finora

- THE CRASH of 87: Was It Expected? The Evidence From Options MarketsDocumento7 pagineTHE CRASH of 87: Was It Expected? The Evidence From Options MarketsJitender ThakurNessuna valutazione finora

- 21Documento1 pagina21Edwin HauwertNessuna valutazione finora

- POKER Science - Aay2400.fullDocumento13 paginePOKER Science - Aay2400.fullEdwin HauwertNessuna valutazione finora

- 22Documento1 pagina22Edwin HauwertNessuna valutazione finora

- 24Documento1 pagina24Edwin HauwertNessuna valutazione finora

- 23Documento1 pagina23Edwin HauwertNessuna valutazione finora

- 25Documento1 pagina25Edwin HauwertNessuna valutazione finora

- 8Documento1 pagina8Edwin HauwertNessuna valutazione finora

- 18Documento1 pagina18Edwin HauwertNessuna valutazione finora

- 20Documento1 pagina20Edwin HauwertNessuna valutazione finora

- 10Documento1 pagina10Edwin HauwertNessuna valutazione finora

- 11Documento1 pagina11Edwin HauwertNessuna valutazione finora

- Lighthouse Special Report Who Moved My RecessionDocumento17 pagineLighthouse Special Report Who Moved My RecessionEdwin HauwertNessuna valutazione finora

- 19Documento1 pagina19Edwin HauwertNessuna valutazione finora

- 9Documento1 pagina9Edwin HauwertNessuna valutazione finora

- 2008H SornetteDocumento73 pagine2008H SornetteEdwin HauwertNessuna valutazione finora

- 6Documento1 pagina6Edwin HauwertNessuna valutazione finora

- 7Documento1 pagina7Edwin HauwertNessuna valutazione finora

- 2Documento1 pagina2Edwin HauwertNessuna valutazione finora

- 3Documento1 pagina3Edwin HauwertNessuna valutazione finora

- 4Documento1 pagina4Edwin HauwertNessuna valutazione finora

- EAPC Kampala 2011Documento31 pagineEAPC Kampala 2011Edwin HauwertNessuna valutazione finora

- CorporatePresentation Jan 2012Documento33 pagineCorporatePresentation Jan 2012Edwin HauwertNessuna valutazione finora

- 5Documento1 pagina5Edwin HauwertNessuna valutazione finora

- 1Documento1 pagina1Edwin HauwertNessuna valutazione finora

- Financial Management: Weighted Average Cost of CapitalDocumento11 pagineFinancial Management: Weighted Average Cost of Capitaltameem18Nessuna valutazione finora

- Gundlach Mirror MirrorDocumento66 pagineGundlach Mirror MirrorEdwin HauwertNessuna valutazione finora

- Chalmers, Keryn G. and Godfrey, Jayne M. and Navissi, Farshid - The Systematic Risk Effect of Hybrid Securities' Classifications (2007)Documento26 pagineChalmers, Keryn G. and Godfrey, Jayne M. and Navissi, Farshid - The Systematic Risk Effect of Hybrid Securities' Classifications (2007)Edwin HauwertNessuna valutazione finora

- Optimal Capital StructureDocumento14 pagineOptimal Capital StructuretomydaloorNessuna valutazione finora

- General Mills Prediction Market Thesis VDocumento106 pagineGeneral Mills Prediction Market Thesis VEdwin HauwertNessuna valutazione finora

- Budgeting BasicsDocumento2 pagineBudgeting BasicsaleemuddinNessuna valutazione finora

- AerDocumento205 pagineAerAndi AmirudinNessuna valutazione finora

- Drivers of Liquidity in Corp BondsDocumento38 pagineDrivers of Liquidity in Corp BondssoumensahilNessuna valutazione finora

- Capital StructureDocumento26 pagineCapital StructureN ArunsankarNessuna valutazione finora

- Tif 1Documento7 pagineTif 1James BurdenNessuna valutazione finora

- Problem 8-31Documento4 pagineProblem 8-31Majde QasemNessuna valutazione finora

- CA FINAL DT Amendment Book BY Durgesh SinghDocumento115 pagineCA FINAL DT Amendment Book BY Durgesh SinghRaviteja GundabattulaNessuna valutazione finora

- Aurora TextileDocumento8 pagineAurora TextileAnonymous IGyLrlrTOZNessuna valutazione finora

- Harrogate College PT Prospectus 2010 - 2011Documento12 pagineHarrogate College PT Prospectus 2010 - 2011Harrogate CollegeNessuna valutazione finora

- Maryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Documento3 pagineMaryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Hasnain BhuttoNessuna valutazione finora

- Eln 1461613Documento39 pagineEln 1461613Roshanthan SakayanathanNessuna valutazione finora

- Accounting Crossword Puzzle Answer KeyDocumento1 paginaAccounting Crossword Puzzle Answer KeyFru RyNessuna valutazione finora

- MP2 Hacks For Advance InvestorsDocumento18 pagineMP2 Hacks For Advance InvestorsChristopher BrownNessuna valutazione finora

- Agriculture Accounting PDFDocumento32 pagineAgriculture Accounting PDFAmarnath OjhaNessuna valutazione finora

- Chapter 11,12,13Documento20 pagineChapter 11,12,13Nikki GarciaNessuna valutazione finora

- General Concept of Islamic BankingDocumento28 pagineGeneral Concept of Islamic BankingEmranNessuna valutazione finora

- Minimum Value (Threshold Tickets)Documento6 pagineMinimum Value (Threshold Tickets)Nikita SharmaNessuna valutazione finora

- Central Proteina Prima TBKDocumento3 pagineCentral Proteina Prima TBKDenny SiswajaNessuna valutazione finora