Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Street, Apple, & General Systems Theory

Caricato da

David SchneiderCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Street, Apple, & General Systems Theory

Caricato da

David SchneiderCopyright:

Formati disponibili

The Street, Apple, & General Systems Theory

The Noise

It is the 4th quarter of 2012. Shares in Apple are faltering. Analysts following Apple for well-known investment banks send their assistants to Apple stores to count customers. A popular CNBC host from Summit, NJ ponders that people must be selling Apple to evade higher capital gains taxes that are coming in 2013. What else could it be? Apples i-Phone 5 had been subject to pre-orders, to prevent mobs which overwhelmed stores in prior iterations. So, investors are told not to worry about the lack of lines for the new phone. Apple has upended Samsung in a major patent case in the US, so there should be no stopping the Cupertino juggernaut. Samsung will be relegated to selling kimchee in Koreatown. Delays in getting components are alleviated; the 5 is becoming more available, so the December quarter is all but in the bag. Growing at 25% a year, Apple is the cheapest tech stock on the planet selling at < 10x forward earnings after stripping out cash. Apple will introduce a smaller iPhone, and it will create a fire under the stock. The top brass at Apple are headed over to China, and just wait till they get that deal done. Doubters are saying that the company is simply too big and it is impossible for it to get bigger. There has never been a company valued so richly before. (Heard all of the above on CNBC)

What we have here is a failure to communicate

The nave conclusions of experts are a demonstration of linear thinking and a complete lack of appreciation of general systems theory (GST), whose father is Ludwig von Bertalanffy. It is as if NASA had decided to go to the moon without knowing that gravity exists. If he had been a securities analyst, how would Ludwig have looked at Apple? Wall Street is enamored at one of Apples leaders in design, Jonathan Ive. Simply put, the consensus is that Ives designs are the best. His designs create the most intuitive and user-friendly experience for each device created. It is obvious from his title that design itself is a word related to the word style and suggests a way of doing things. Ives leadership in design had given Apple a substantial differentiation in style. Bertalanffy realizes that since competitive advantages are Darwinian - Ives designs had given Apple such a competitive advantage that it was almost as if the system of Apple must be discontinuous with that Samsung and others. If they were not, then the trend towards equilibrium meant that Apples competitive advantages would be reduced as each iteration of Ives designs had diminishing returns. Feedback loops had to exist between Apple and its competitors. It was simple Boolean logic. If the systems were in communication, then this unusual state of things would seek equilibrium. If Samsung & others were in a different market, then consumers would not be comparing products before they bought. Regarding Ive and design, if there is one way of doing things, there should be other ways. When Apple introduces a product with a retina display which one launch day is the most appealing display on the market, then what is Apples is not some proprietary ownership of having the most appealing display but marketing that display until another firm markets an equal or better display. Nothing special here. Apple has the best display on Monday and another firm introduces a phone, tablet, etc. six weeks later with a better display.

Bertalanffy would admire the wonderful slimmer style from the prior model. Such an attractive brushed metal shell. Surely, anyone wanting to be seen with their phone would desire such an attractive instrument? But whats this? The user has to conceal the beauty & buy a case, which adds bulk and conceals the beauty of the device. How odd. Not such a good design. Maybe something better could come along. With a few days before Christmas, he then reviews the popular bullish arguments for Apple in combination with explanations as to why the stock is not acting well. 1. Higher Capital Gains Avoidance: While enjoying a glass of sherry after dinner, Ludwig sends a telegram to a CNBC host residing in Summit, NJ and numerous sellside analysts pointing out that if Apple is one of the cheapest tech stocks out there, and is trading off of $50 in estimated earnings for 2013, then surely at the end of 2013 it will be selling on 2014 estimated earnings of something north of $55. If that is the case, and if it only trades at 11x 2014 estimates excluding year end 2013 cash then it makes no sense to sell the stock to avoid an increase in capital gains since the stock would be dramatically higher at the end of 2013 blowing away any effect of higher taxes. Bertalanffy asks those who cite capital gains tax changes as the reason for the stock acting poorly have done these simple calculations. He offers to lend them a slide rule if they have trouble with multiplication & long division. 2. Apple is growing at 25% a year: Being new to the stock market but being the father of GST, Ludwig suspects that investors invest with the intent of selling in the future. Although this is only a suspicion, he takes a random sample of 30 CFAs and 30 CFPs and concludes that without a doubt, people invest for the future, not the past. He concludes that the past growth rate for the company is irrelevant in determining the value of the stock, and that forward growth is the issue. He does not understand why such bright people are using backward looking growth rates to determine the value of something in the future. But they dress nice on TV, so why argue with them? 3. Apple will introduce additional iPhone models that will light a fire under the stock. Having studied the factors which have contributed to Apples past success, he concludes that one factor is long production runs of massive quantities of specific products, which create enormous buying power for components, and high gross margins as manufacturing gets more efficient over time. His conclusion regarding breaking up those higher manufacturing runs with more models is the opposite of the conclusion of the street. His conclusion is that shorter production runs will result in downward margin pressure. Following the principles of GST, Bertalanffy asks why the new iPhone models will be introduced. He knows that it is not good enough to observe the process in action but vitally critical to know why what are the drivers of each mechanism in this case new i-Phone models, and in turn what are the downstream effects. His conclusion is that this effort is a defensive move, as a result of changes in the competitive landscape. The change from offense to defense is worth noting, he thinks. 4. Apples top guys are in China & when their deals are signed, the stock will run. Bertalanffy looks at the history of Apple in regards to other wireless carriers, and concludes that the Chinese firms believe that Apple is earning unnecessary profits on the hardware. They are in little rush to cede profits to Apple via subsidies in fact lowering the price of the Apple products would make Chinese brands less competitive to the Chinese consumer. That would not be

patriotic. The sight of Apples leaders going to China is therefore a negative. Apple must be getting desperate. 5. Bottlenecks for components and the iPhone itself are being alleviated & you dont have to wait to get a phone anymore. The father of GST realizes that there could be more than one reason for this. Not ever mentioned by analysts is that the increased availability could have something to do with demand coming in below what Apple had projected. Given items #1-4 above, what is the likelihood that there is a shortfall in demand? Would GST take this into consideration? Of course. He concludes that what we have is a failure to communicate. The failure is not from industry to analysts or analysts to the media. God Forbid! The failure is a failure to see the connections between factors. Firms were so busy measuring the lines in stores, that they never considered that thinking about the functional structure of an industry was relevant. He then evaluated the negative comments & rationale who believed that Apple was in serious trouble. 1. Apple is too big to continue to grow because no other company ever grew beyond Apples market capitalization. After hearing that from an esteemed analyst on television, he checked his bottle of chianti (the sherry was gone & Dudley the angel didnt refill it*) to make sure that he hadnt drank too much. He puts a phone call to that analyst and asks if he realizes that nothing ever happens until it does. (Dudley, as played by Cary Grant) http://www.youtube.com/watch?v=2N9-nJWw7x4 2. Everybody who wants a smartphone pretty much has one, so all of the forward estimates for Apple are wrong. Ludwig thinks about this, pulls out his slide rule and does some calculations. He has trouble reading some of the numbers on his slide rule & concludes that even if everybody who wants a slide rule has one, if somebody came out with one where the slides would not stick after all those coffee spills & Dorito crumbs, everybody would replace their current slide rule with new ones. He then observes that Apple is allowed to create new products. He notices that no Apple competitor has a legislated monopoly globally on consumer electronics and concludes that the company still can sell phones if the public likes their particular model(s). It was getting late and being a giver and a people person, Ludwig von Bertalanffy had decided that his nieces slide rule was not doing her any favors. She wasnt getting any dates, since the boys at school made fun of her for not having a pocket calculator. So, it being Christmas Eve and needing to get her a gift, Ludwig went out and bought his niece a pocket calculator. He wanted her to go from being a nerd in junior high to one of the cool kids. He remembered seeing a Texas Instruments SR-10 on sale in the early 1970s for $100. But that was then and this is now. All the SR-10 could do was the 4 basic functions. Being the father of one of the most important disciplines in science, he would spare no expense to make his niece happy. And so, on that Christmas Eve of 2012, Ludwig von Bertalanffy went out and got the coolest, hippest calculator that he could find. He found a pretty good one. It was called

the iPhone 5. It had a great calculator on the utilities icon it and even makes phone calls. A lot of the other calculators he saw shrink wrapped at Staples & Office Deport couldnt do phone calls. But they only cost $20. Those were commodities. He didnt have time to wait for this calculator/phone device to drop in price, so he got it anything for the niece.

Potrebbero piacerti anche

- Apple'S Iphone: EconomicDocumento5 pagineApple'S Iphone: EconomicGopal GurjarNessuna valutazione finora

- So How Did They Do It?: 1. Ignore Your CriticsDocumento25 pagineSo How Did They Do It?: 1. Ignore Your Criticsmunish747Nessuna valutazione finora

- Apple SWOT Analysis 2022Documento7 pagineApple SWOT Analysis 2022Lê Hồng LinhNessuna valutazione finora

- English1103JosephCamp 1Documento13 pagineEnglish1103JosephCamp 1bfaig56Nessuna valutazione finora

- Business StrategyDocumento9 pagineBusiness Strategyapi-210208453Nessuna valutazione finora

- Apple Captures Most Value from iPad and iPhone Global Supply ChainsDocumento11 pagineApple Captures Most Value from iPad and iPhone Global Supply ChainsMysstery KhanNessuna valutazione finora

- Apple Inc Harvard Case StudyDocumento4 pagineApple Inc Harvard Case StudySarah Al-100% (1)

- Ch3-Apple Biz Environment - NewDocumento6 pagineCh3-Apple Biz Environment - Newánh TrầnNessuna valutazione finora

- Apple INCDocumento7 pagineApple INCAnas MujaddidiNessuna valutazione finora

- Operations Strategy of Apple IncDocumento6 pagineOperations Strategy of Apple IncSoumya Ranjan50% (2)

- AppleDocumento5 pagineApplesandymakhijaNessuna valutazione finora

- Apple IpadDocumento6 pagineApple Ipaddivjn3Nessuna valutazione finora

- Apple Inc. - A Brand History Analysis (With Focus On China)Documento5 pagineApple Inc. - A Brand History Analysis (With Focus On China)Ioana VoineagNessuna valutazione finora

- Chapter 3-Analysis of Organizational EnvironmentDocumento7 pagineChapter 3-Analysis of Organizational EnvironmentTạ Xuân TrườngNessuna valutazione finora

- Undertake A Competitive Analysis of Both Apple and Nokia - Who Is The Stronger?Documento3 pagineUndertake A Competitive Analysis of Both Apple and Nokia - Who Is The Stronger?herrajohnNessuna valutazione finora

- 8 Leadership Lessons From Apple and SamsungDocumento3 pagine8 Leadership Lessons From Apple and SamsungPhương VũNessuna valutazione finora

- AppleDocumento5 pagineAppleKaustubh ChakravartiNessuna valutazione finora

- Apple Vs Samsung ThesisDocumento7 pagineApple Vs Samsung Thesisafknbiwol100% (2)

- Apple's unprecedented success across 11 areasDocumento7 pagineApple's unprecedented success across 11 areasAzis MuhdianaNessuna valutazione finora

- Apple Inc. SWOT and Future StrategiesDocumento18 pagineApple Inc. SWOT and Future StrategiesYacki LuengoNessuna valutazione finora

- Table of ContentDocumento20 pagineTable of Contentn2bhukyaNessuna valutazione finora

- Apple Literature ReviewDocumento8 pagineApple Literature Reviewmpymspvkg100% (1)

- APPLE Inc 2012 Strategic ManagementDocumento11 pagineAPPLE Inc 2012 Strategic ManagementAyoub Bokhabrine100% (1)

- What Would Apple Do?: How You Can Learn from Apple and Make MoneyDa EverandWhat Would Apple Do?: How You Can Learn from Apple and Make MoneyNessuna valutazione finora

- SWOT Analysis of Apple IphoneDocumento4 pagineSWOT Analysis of Apple IphoneihtashamNessuna valutazione finora

- Apple Pay Research PaperDocumento5 pagineApple Pay Research Paperafeavbpwg100% (1)

- Apple Inc. - Julia-Aya Reineke-KrieteDocumento1 paginaApple Inc. - Julia-Aya Reineke-KrieteDare LekutiNessuna valutazione finora

- AppleDocumento21 pagineAppleFun Toosh345Nessuna valutazione finora

- SWOT Analysis of Apple: Strengths, Weaknesses, Opportunities and ThreatsDocumento3 pagineSWOT Analysis of Apple: Strengths, Weaknesses, Opportunities and ThreatsAmey PatilNessuna valutazione finora

- Marketing 361 Phase 2Documento10 pagineMarketing 361 Phase 2api-401091599Nessuna valutazione finora

- Building A " Backdoor" To Iphone - An Ethical DilemmaDocumento5 pagineBuilding A " Backdoor" To Iphone - An Ethical Dilemmachocobearsweets75% (4)

- Apple's Marketing Strategy: Empathy and Customer ExperienceDocumento48 pagineApple's Marketing Strategy: Empathy and Customer ExperiencePortia SikderNessuna valutazione finora

- Apple Company AnalysisDocumento10 pagineApple Company AnalysisEvansNessuna valutazione finora

- Apple's Premium Pricing Strategy Maximizes Profits and Brand ValueDocumento27 pagineApple's Premium Pricing Strategy Maximizes Profits and Brand ValueJeffery HortonNessuna valutazione finora

- Final Artifact Management Theory IIDocumento11 pagineFinal Artifact Management Theory IIapi-651643566Nessuna valutazione finora

- Thesis On Apple IncDocumento7 pagineThesis On Apple Incrikkiwrightarlington100% (2)

- UntitledDocumento8 pagineUntitledMuhammad FaizanNessuna valutazione finora

- Apple Wins Big Over SamsungDocumento2 pagineApple Wins Big Over SamsungTuan NguyenNessuna valutazione finora

- Apple Inc. Strategic Marketing Analysis and Evaluation: Xuanyi Chen Yiran Liu Hanzhen GongDocumento9 pagineApple Inc. Strategic Marketing Analysis and Evaluation: Xuanyi Chen Yiran Liu Hanzhen GongAishwarya MishraNessuna valutazione finora

- Business Policies - AppleDocumento15 pagineBusiness Policies - AppleMohammedNessuna valutazione finora

- Do You Think Apple Can Continue To Grow by Developing Breakthrough Products That Create New Markets, As It Did With The Ipod, Iphone, and Ipad?Documento2 pagineDo You Think Apple Can Continue To Grow by Developing Breakthrough Products That Create New Markets, As It Did With The Ipod, Iphone, and Ipad?H,M Momotajul MonowerNessuna valutazione finora

- Apple Inc 2010 ScribdDocumento6 pagineApple Inc 2010 ScribdshampresNessuna valutazione finora

- Milestone Two Economic Environments and Risk MitigationDocumento4 pagineMilestone Two Economic Environments and Risk MitigationFatima AyyatNessuna valutazione finora

- Apple Inc 2012 Strategic ManagementDocumento11 pagineApple Inc 2012 Strategic ManagementIra PutriNessuna valutazione finora

- Iphone Term PaperDocumento5 pagineIphone Term Paperaflslwuup100% (1)

- Case Study On Tablet PC Market: Submitted ToDocumento12 pagineCase Study On Tablet PC Market: Submitted ToAnnette CoxNessuna valutazione finora

- Apple Iphone Research PaperDocumento4 pagineApple Iphone Research Paperh039wf1t100% (3)

- Final Project - Gap Model On Apple Inc.Documento7 pagineFinal Project - Gap Model On Apple Inc.Jawad AhmedNessuna valutazione finora

- Microeconomic Analysis PaperDocumento21 pagineMicroeconomic Analysis PaperLinh Nguyễn88% (8)

- Apple Collective Write-UpDocumento5 pagineApple Collective Write-Upapi-356475460Nessuna valutazione finora

- Based On The Movie JOBS and On The Lessons Learned So Far, What Do You Think Is The Biggest Stumbling Block For APPLE?Documento2 pagineBased On The Movie JOBS and On The Lessons Learned So Far, What Do You Think Is The Biggest Stumbling Block For APPLE?Kyree VladeNessuna valutazione finora

- 2020:3 Summer, BUAD6800 (MERGED) Info Technology and E-Business Assignment ReportDocumento5 pagine2020:3 Summer, BUAD6800 (MERGED) Info Technology and E-Business Assignment ReportAnitra ViswanathanNessuna valutazione finora

- Perception of BrandDocumento7 paginePerception of BrandISHITA SHARMA - DMNessuna valutazione finora

- SWOT and PEST Analysis of Apple Inc.Documento5 pagineSWOT and PEST Analysis of Apple Inc.CheapestPapers100% (1)

- Manage Theory 2Documento7 pagineManage Theory 2api-640981642Nessuna valutazione finora

- Apple and Lenovo BenchmarkingDocumento5 pagineApple and Lenovo BenchmarkingSaad Anwar100% (2)

- Final Apple DraftDocumento8 pagineFinal Apple Draftapi-219822436Nessuna valutazione finora

- Running Head: APPLE IPHONE 7 1Documento7 pagineRunning Head: APPLE IPHONE 7 1SK WaithimaNessuna valutazione finora

- Your First Pixel Phone: The Ridiculously Simple Guide to the Pixel 4 and 4XL (and Other Devices Running Android 10)Da EverandYour First Pixel Phone: The Ridiculously Simple Guide to the Pixel 4 and 4XL (and Other Devices Running Android 10)Nessuna valutazione finora

- Ratio Analysis of Vijai Electricals LtdDocumento70 pagineRatio Analysis of Vijai Electricals LtdPrakash Babu100% (2)

- Design of Cumene Producing PlantDocumento57 pagineDesign of Cumene Producing PlantAylin Uçar88% (17)

- Inv How-To Manual V Erwin OpallaDocumento264 pagineInv How-To Manual V Erwin OpallaBudi SafrudinNessuna valutazione finora

- Report Marketing 243Documento17 pagineReport Marketing 243Zul Fiqar63% (16)

- Chapter 13 Solutions Excluding HomeworkDocumento26 pagineChapter 13 Solutions Excluding HomeworkMissing PersonNessuna valutazione finora

- The Magic of MarketDocumento7 pagineThe Magic of MarketRadu DragoşNessuna valutazione finora

- The Emergence of E-Procurement As An Important Tool Used by BusinessDocumento11 pagineThe Emergence of E-Procurement As An Important Tool Used by BusinesssinghelNessuna valutazione finora

- Ratio Analysis of Coca-ColaDocumento26 pagineRatio Analysis of Coca-ColaWajid Ali71% (7)

- Green Productivity PDFDocumento341 pagineGreen Productivity PDFSisca Wiryawan100% (1)

- 2014 - Reference FormDocumento287 pagine2014 - Reference FormUsiminas_RINessuna valutazione finora

- D3 - The Underwriting Profit ProvisionDocumento9 pagineD3 - The Underwriting Profit ProvisionANessuna valutazione finora

- CAHWs Training ModuleDocumento30 pagineCAHWs Training ModuleZainal Anuar Ruslan100% (1)

- Case Analysis Kuok 5-2Documento28 pagineCase Analysis Kuok 5-2Levi Lazareno Eugenio89% (9)

- Project Report On Amarajan BatteryDocumento79 pagineProject Report On Amarajan BatterySourav Roy100% (1)

- Chapter 1Documento4 pagineChapter 1avinashgoyalNessuna valutazione finora

- Cost Accounting 1-8 FinalDocumento17 pagineCost Accounting 1-8 FinalKristienalyn De AsisNessuna valutazione finora

- Quantitative Aptitude Tricks - PDF Download: ImplificationDocumento12 pagineQuantitative Aptitude Tricks - PDF Download: ImplificationSwapnarani JadavNessuna valutazione finora

- Financial Analysis of Unilever PKDocumento37 pagineFinancial Analysis of Unilever PKmc100206981100% (1)

- Investment Appraisal PDFDocumento3 pagineInvestment Appraisal PDFHazwan JamhuriNessuna valutazione finora

- Siemens 2020 VisionDocumento46 pagineSiemens 2020 VisionSudeep KeshriNessuna valutazione finora

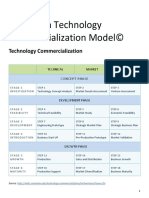

- Goldsmith Technology Commercialization Model©Documento24 pagineGoldsmith Technology Commercialization Model©FiqriNessuna valutazione finora

- F7 Examiner's report key pointsDocumento5 pagineF7 Examiner's report key pointskevior2Nessuna valutazione finora

- Berkshire Hathway - Conclusions From LettersDocumento8 pagineBerkshire Hathway - Conclusions From LettersAnonymous yjwN5VAjNessuna valutazione finora

- Efficacy of Economic Value Added Concept in Business Performance MeasurementDocumento8 pagineEfficacy of Economic Value Added Concept in Business Performance Measurementaaditya01Nessuna valutazione finora

- Lisa Lenell - Starbucks CaseDocumento2 pagineLisa Lenell - Starbucks Caseldandrea1Nessuna valutazione finora

- Computer Shop Business Plan in BasilanDocumento17 pagineComputer Shop Business Plan in BasilanEmamMsHome-hyhy50% (2)

- Nawab Traders, Sargodha: B.Z.U Sub-Campus D.G.KhanDocumento39 pagineNawab Traders, Sargodha: B.Z.U Sub-Campus D.G.KhanMuhammad FarhanNessuna valutazione finora

- Vision Statement of MacdonaldDocumento2 pagineVision Statement of MacdonaldlalirisyaNessuna valutazione finora

- The Impact of Human Resource Management On Organizational PerformanceDocumento24 pagineThe Impact of Human Resource Management On Organizational Performancesweetlittlegirl_92Nessuna valutazione finora