Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Description: Tags: Nevada

Caricato da

anon-655431Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Description: Tags: Nevada

Caricato da

anon-655431Copyright:

Formati disponibili

Archived Information

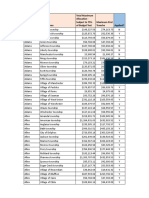

Fiscal Year 2006 Title I Grants to Local Educational Agencies - NEVADA

Maximum Required

Expenditures For

Choice-Related Maximum Per-Child

Transportation Expenditure For

FY 2006 Title I And Supplemental Supplemental

LEA ID District Allocation* Educational Services** Educational Services***

3200390 CARSON CITY SCHOOL DISTRICT 1,140,243 228,049 906.39

3200030 CHURCHILL COUNTY SCHOOL DISTRICT 772,600 154,520 1,062.72

3200060 CLARK COUNTY SCHOOL DISTRICT 59,889,152 11,977,830 1,358.40

3200090 DOUGLAS COUNTY SCHOOL DISTRICT 531,500 106,300 798.05

3200120 ELKO COUNTY SCHOOL DISTRICT 932,382 186,476 856.18

3200150 ESMERALDA COUNTY SCHOOL DISTRICT 21,600 4,320 1,661.56

3200180 EUREKA COUNTY SCHOOL DISTRICT 30,326 6,065 798.05

3200210 HUMBOLDT COUNTY SCHOOL DISTRICT 380,669 76,134 813.40

3200240 LANDER COUNTY SCHOOL DISTRICT 113,323 22,665 827.17

3200270 LINCOLN COUNTY SCHOOL DISTRICT 138,132 27,626 1,000.96

3200300 LYON COUNTY SCHOOL DISTRICT 973,753 194,751 932.71

3200330 MINERAL COUNTY SCHOOL DISTRICT 171,021 34,204 994.31

3200360 NYE COUNTY SCHOOL DISTRICT 1,165,352 233,070 1,016.89

3200420 PERSHING COUNTY SCHOOL DISTRICT 170,641 34,128 997.90

3200450 STOREY COUNTY SCHOOL DISTRICT 32,881 6,576 1,060.67

3200480 WASHOE COUNTY SCHOOL DISTRICT 9,536,530 1,907,306 1,207.31

3200510 WHITE PINE COUNTY SCHOOL DISTRICT 223,298 44,660 1,058.29

3299998 Undistributed 0 0 0.00

3299999 PART D SUBPART 2 488,297 97,659 0.00

* Actual amounts received by LEAs will be smaller than shown here due to State-level adjustments to Federal Title I allocations. States adjust

allocations, for example, to reflect LEA boundary changes or the creation of new LEAs, including charter school LEAs, that are not accounted

for in the statutory calculations. States also are permitted to reserve up to 1 percent of allocations for administration and generally must

reserve 4 percent in fiscal year 2006 for school improvement activities. These adjustments will reduce the actual amounts available

under all three columns of the table.

** An LEA must use up to an amount equal to 20 percent of its Title I, Part A allocation (the “20-percent reservation”) received from the State

to cover choice-related transportation costs for students who exercise a choice option and to pay for supplemental educational services for

students whose parents request such services. The 20-percent reservation may include Title I, Part A funds or funding from other Federal,

State, local, and private sources. The amount shown in this column is the Department’s estimate of the amount that affected LEAs - those

with schools identified for improvement, corrective action, or restructuring - may have to spend to meet this requirement. Actual

expenditures will depend on such factors as the number of students exercising a choice option or receiving supplemental educational services and

the costs of satisfying these requests. An LEA has discretion to determine the allocation of these funds between choice-related transportation

and supplemental educational services, except that it must spend at least one-quarter of the 20-percent reservation - or an amount equal to

5 percent of its Title I, Part A allocation - on each activity if there is demand for both from students and their parents.

*** An LEA that must arrange for supplemental educational services is required to pay, for each child receiving services, the lesser of the actual cost

of the services or an amount equal to the LEA’s Title I, Part A allocation received from the State divided by the number of poor students in the

LEA, as determined by estimates produced by the US Bureau of the Census. Thus the amount shown in this column reflects the statutory “cap”

on per-child expenditures for supplemental educational services.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Nme Entrepreneurship Report Jan 8 2014Documento240 pagineNme Entrepreneurship Report Jan 8 2014mono1984Nessuna valutazione finora

- Human Trafficking Around The World: Hidden in Plain Sight, by Stephanie Hepburn and Rita J. SimonDocumento17 pagineHuman Trafficking Around The World: Hidden in Plain Sight, by Stephanie Hepburn and Rita J. SimonColumbia University Press100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Path To National Suicide - Lawrence Auster PDFDocumento66 paginePath To National Suicide - Lawrence Auster PDFAlderon TyranNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Targets of The Illuminati and The Committee of 300Documento4 pagineTargets of The Illuminati and The Committee of 300David Chey100% (1)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- "Taking Baghdad: Some US Marine Memoirs of The Invasion of Iraq" by John NewsingerDocumento14 pagine"Taking Baghdad: Some US Marine Memoirs of The Invasion of Iraq" by John NewsingerCEInquiryNessuna valutazione finora

- (The Routledge Histories) Jonathan Daniel Wells - The Routledge History of Nineteenth-Century America-Routledge (2018)Documento389 pagine(The Routledge Histories) Jonathan Daniel Wells - The Routledge History of Nineteenth-Century America-Routledge (2018)John HarrisonNessuna valutazione finora

- 2004 DBQ EssayDocumento3 pagine2004 DBQ Essaypetercyh175100% (2)

- Starbucks Supply ChainDocumento5 pagineStarbucks Supply ChainYovani GunawanNessuna valutazione finora

- T64 PDFDocumento24 pagineT64 PDFÁlvaro Sánchez AbadNessuna valutazione finora

- Analysis of Financial Statement at Kirloskar Project Report Mba FinanceDocumento87 pagineAnalysis of Financial Statement at Kirloskar Project Report Mba FinanceBabasab Patil (Karrisatte)100% (3)

- Remembering George KennanDocumento16 pagineRemembering George KennanHugo Harvey ValdésNessuna valutazione finora

- Internship Report of Outlook MagazineDocumento32 pagineInternship Report of Outlook MagazineAnant Maurya67% (9)

- Bailey SG33Documento1 paginaBailey SG33firekitsunestar6262Nessuna valutazione finora

- MDP Letter To The Office of Congressional Ethics Regarding Roscoe Bartlett and Alex MooneyDocumento2 pagineMDP Letter To The Office of Congressional Ethics Regarding Roscoe Bartlett and Alex MooneyMaryland Democratic PartyNessuna valutazione finora

- The Consumers Culture The Consumers Culture Consumer Diversity Consumer DiversityDocumento14 pagineThe Consumers Culture The Consumers Culture Consumer Diversity Consumer DiversityRushan SabiqueNessuna valutazione finora

- This Organization Participates in E-VerifyDocumento1 paginaThis Organization Participates in E-VerifyMs Mariia MykhailenkoNessuna valutazione finora

- Test Bank For Physical Geology 13th Edition by PlummerDocumento36 pagineTest Bank For Physical Geology 13th Edition by Plummercovinousnematoidtnfo100% (24)

- (Lumbao) Monetary AuthoritiesDocumento233 pagine(Lumbao) Monetary Authoritiesskz uniteNessuna valutazione finora

- Department of Labor: Highlights 05Documento8 pagineDepartment of Labor: Highlights 05USA_DepartmentOfLaborNessuna valutazione finora

- DataDocumento396 pagineDataCésar ChávezNessuna valutazione finora

- Effects of WWI LEQ ActivityDocumento4 pagineEffects of WWI LEQ ActivityAnh TranNessuna valutazione finora

- IRAC Analysis of Brown vs. Board of EducationDocumento3 pagineIRAC Analysis of Brown vs. Board of Educationkelly lyn wilson100% (1)

- Turmoil Over TaxationDocumento28 pagineTurmoil Over Taxationapi-246972945100% (1)

- GDP Chapter 15 GuideDocumento8 pagineGDP Chapter 15 GuideTienNessuna valutazione finora

- Status of Whether Ohio Municipalities Have Applied For Federal StimulusDocumento54 pagineStatus of Whether Ohio Municipalities Have Applied For Federal StimulusDougNessuna valutazione finora

- IntEco Case 99-Mexico FordDocumento22 pagineIntEco Case 99-Mexico FordVarun GargNessuna valutazione finora

- Food Beverage Outlook Survey 2013Documento48 pagineFood Beverage Outlook Survey 2013Mega RantyNessuna valutazione finora

- Phil History ReportDocumento11 paginePhil History ReportMelody muffy Diomangay100% (1)

- Essay On Hollywood and PropagandaDocumento4 pagineEssay On Hollywood and PropagandaArnold Waswa-IgaNessuna valutazione finora

- A Classification of Livestock Production SystemsDocumento10 pagineA Classification of Livestock Production SystemsPaula RincónNessuna valutazione finora