Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FDTSRHF

Caricato da

Joe Dal BoscoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FDTSRHF

Caricato da

Joe Dal BoscoCopyright:

Formati disponibili

C H A P T E R

MODULE 4

22

Revision: Business-related mathematics

22.1 Multiple-choice questions

1 Bennet invested $15 000 for 3 years. He earned 6.5% per annum interest, compounding annually. The value of his investment at the end of three years, to the nearest dollar, is: A $15 004 B $18 119 C $18 220 D $17 925 E $35 850

2 Chen purchased a second-hand car for $20 250. She paid a deposit of $3000 and made repayments of $600 per month over 3 years. The total amount of interest Chen paid is: A $350 B $2350 C $4350 D $6350 E $7250

3 Suppose that Chen was offered an alternative repayment scheme, where she still paid a deposit of $3000 but a at rate of interest of 10% per annum for 3 years on the outstanding balance. The total amount of interest paid now would be: A $275 B $1725 C $2025 Date 1 April 30 April 21 May 28 May 30 Jun 1 July D $5175 Credit $7260 $1824 $1380 $1730 Debit E $6075 Interest Balance $2270 $9350 $7706 $6326 $8056

4 The following is an extract from a bank account showing all transactions for the period 1 April to 30 June.

Interest is calculated at a rate of 3% per annum on the minimum monthly balance and paid into the account quarterly. Interest for the April, May, June quarter is paid on 1 July. The amount of interest paid on 1 July is closest to: A $37.31 B $44.87 C $49.19 D $447.66 E $590.28

Cambridge University Press

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

608

Chapter 22 Revision

609

5 A loan of $80 000 is to be paid back over 20 years at an interest rate of 7.2% per annum on a reducing monthly balance. The monthly repayment will be closest to: A $353.82 B $397.17 C $629.88 D $1362.07 E $4256.77 [VCAA pre 2006]

Revision

6 For a reducing balance loan with quarterly repayments, which one of the following statements is always true? A B C D E The amount of interest paid on the loan remains constant each quarter. The amount of principal repaid each quarter increases with each payment made. Every instalment reduces the principal by the same amount. By halfway through the loan period, half the principal has been repaid. The amount of interest paid is approximately double that paid if the loan had been calculated using simple interest. [VCAA pre 2006]

7 A company purchased a machine for $5000 on the rst of January one year, and depreciates its value at a rate of 20% of its purchase price per year. When the book value falls below $1500 the company will write it off. The length of time that the machine will be in use is closest to: A 2 years B 2 1 years 2 C three years D 3 1 years 2 E four years

8 A printing machine is bought for $20 000. Using at rate depreciation, its value after 5 years will be $4000. Which of the following graphs best represents the value of the machine at the end of each year for this 5-year period?

Value ($000s) Value ($000s) 20 10 0 0 1 2 3 4 5 Year Value ($000s) Value ($000s)

20 10 0 0 1 2 3 4 5 Year

20 15 10 5 0 0 1 2 3 4 5 Year

20 10 0 0 1 2 3 4 5 Year

Value ($000s)

20 10 0 0 1 2 3 4 5 Year

[VCAA pre 2006]

9 Three thousand dollars is placed in an investment account compounding monthly at an interest rate of 6% per annum. The balance in dollars, after n years, is given by: A 3000 1.005n D 3000 1.0612n B 3000 1.00512n E 3000 .06n C 3000 1.06n [VCAA pre 2006]

10 Tahlia wants to earn $2400 interest on a 3-year investment at 2.5% per annum simple interest. The amount she needs to invest is closest to: A $288 000 B $7200 C $96 000 D $18 000 E $32 000

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

610

Essential Further Mathematics Module 4 Business-related mathematics

Revision

11 Kylie has $5000 in an investment account paying interest at a rate of 6% per annum compounding monthly. If she makes monthly deposits of $500 to the account, the value of the investment at the end of the second year is: A $17 000.00 B $17 720.00 C $18 351.78 D $17 978.00 E $19 655.34

12 Isabella invests $6350 at 5.9% interest per annum compounding quarterly. The amount of interest she earns during the 5th year of the investment is: A $8510.50 B $2160.50 C $484.14 D $8026.36 E $1676.36

13 Savitri wishes to set up a fund so that every year $1400 is donated in her name to a promising singer. If the interest on her initial investment averages 3.5% per annum, compounded annually, the amount she should invest is closest to: A $90 000 B $98 000 C $490 000 D $140 000 E $40 000

14 A loan of $18 000 is to be repaid by making 48 payments of $480 per month. For this loan, the effective rate of interest per annum is closest to: A 7% B 13.7% C 26.7% D 28.0% E 54.9% [VCAA pre 2006]

15 A machine is bought for $36 000. Its value depreciates at a rate of $0.16 for each unit it produces. On average, the machine produces 24 000 units per year. Using the unit cost method of depreciation, the value of the machine after 6 years of use is closest to: A $3840 B $7200 C $12 960 D $23 040 E $32 160 [VCAA pre 2006]

16 Ravi has a loan of $135 000 at 7% per annum interest, compounding monthly. The loan is to be repaid monthly over 20 years. The scheduled repayments are $1046.65 per month. However, he nds that he can afford to pay $1200 per month and decides to do so for the duration of the loan. The amount of time this will save in paying off the loan is closest to: A 6 months B 1 year C 5 years D 10 years E 15 years

3600 3400 3200 3000 2800 2600 2400 2200 2000 1800 0 2 4 6 Year 8

[VCAA pre 2006]

17 The graph represents the growth of an investment over several years. If A dollars is the value of the investment after n years, then a rule for describing the growth of this investment could be: A A = 2000 (1.06)n B A = 2000 (0.06)n C A = 2000 1.06n D A = 2000 0.06n n E A = 2000 + (1.06)

Value ($)

10

[VCAA pre 2006] 18 Denise wants to increase the price of the products she sell by 10%. She increases the price by 5%, and then a week later increases the price by another 5%. As a result, the products have a price increase (from the original price) of: A 10.00% B 25% C 9.5% D 10.25% E 11.05%

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

Chapter 22 Revision

611

Questions 19 and 20 require the use of the tax table shown below Tax subdivision ($) (%) tax payable (marginal rate) 06000 0 6 00121 600 17 21 60170 000 30 70 001125 000 42 125 001+ 47

Revision

1 2 3 4 5

19 Wallys gross salary is $54 000 per year. How much tax does he pay per year, correct to the nearest dollar? A $9180 B $16 200 C $12 372 D $17 880 E $9720

20 John makes a prot of $3345 on shares in one nancial year. His other income for that nancial year is $45 677. How much capital gains tax will he pay on the prot he makes on the shares, correct to the nearest dollar? A $0 B $568.65 C $1003.50 D $1404.90 E $1572.15

21 A mobile phone bill for one month has a total gure of $92.80, including GST. How much would the mobile phone bill be without GST? A $102.08 B $9.28 C $103.11 D $84.36 E $91.88

22 Jemima borrowed $220 000 at 6.1% per annum compounding monthly. The repayments are $1800 per month. The balance of the loan at the end of 5 years is closest to: A $112 000 B $172 000 C $119 000 D $150 000 E $184 000

23 Zoltan is running a convenience store. He buys equipment for $6500. It is anticipated that the equipment will last 5 years and have a depreciated value of $2000. Assuming the straight line method of depreciation, the equipment depreciates annually by: A $400 B $900 C $1027 D $1300 E $4500 [VCAA pre 2006]

24 Interest is paid monthly into an account at a rate of 3% per annum. Each month, immediately after the interest is paid, the account is debited $5 in fees. No other transactions take place. The initial amount of money in the account is $12 200. After all interest has been paid and fees debited, the balance in the account at the end of two months is: A $12 251.06 B $12 261.08 C $12 271.09 D 12 932.83 E $12 953.13 [VCAA pre 2006]

25 Lim invested $8000 in an investment account, earning r% interest per annum, compounding quarterly. The balance in dollars, after 5 years, is given by: A 8000 1 + D 8000 1 +

r 5 100 r 20 400

B 8000 1 + E 8000 1 +

r 20 100 60 r 1200

C 8000 1 +

r 5 400

[VCAA pre 2006]

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

612

Essential Further Mathematics Module 4 Business-related mathematics

Revision

26 Peter borrows $80 000 for 10 years at 5.6% per annum, compounding monthly, with monthly repayments of $555. Which one of the following statements is true? A B C D E The loan will be fully paid out in 10 years. At the end of 5 years, the balance of the loan will be $40 000. The amount of interest paid each month during the loan increases. Weekly payments of $132 compounding weekly would reduce the period of the loan. If one extra payment of $2000 is to be made, it would be better to make it at the end of year 8 than at the end of year 2. [VCAA pre 2006]

27 At the start of each year, Joes salary increases to take ination into account. Ination averaged 2% per annum last year and 3% per annum the year before that. Joes salary this year is $42 000. Joes salary two years ago, correct to the nearest dollar, would have been: A $39 900 B $39 925 C $39 925 D $39 976 E $39 977 [VCAA 2007]

28 Alf and Rani each invest $2500 for ve years. Alfs investment earns simple interest at the rate of 8.5% per annum. Ranis investment earns interest at the rate of 7.25% per annum compounding monthly. After 5 years, correct to the nearest dollar, Alf will have: A $26 less than Rani B $26 more than Rani C $16 less than Rani D $16 more than Rani E the same amount of money as Rani 29 $5000 is invested at a rate of r % per annum compounding quarterly. The value, in dollars, of this investment after two-and-a-half years is given by: r 2.5 r 2.5 r 10 C 5000 1 + B 5000 1 + A 5000 1 + 100 400 100 10 2.5 r r E 5000 1 + D 5000 1 + 400 1200

22.2 Extended-response questions

1 Adele decides to spend her money as follows: $40 000 on a new car $40 000 on the latest computer equipment Adele knows that the car will depreciate by 25% per annum based on the reducing value of the car, whereas the computer equipment will depreciate at a at rate of $8000 per year. a What is the value of the car after: i one year? ii three years? b What is the value of the computer equipment after two years? c After how many full years does the depreciated value of the car rst exceed the depreciated value of the computer equipment? d Determine the annual percentage at rate depreciation applied to the computer equipment. [VCAA pre 2006]

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

Chapter 22 Revision

613

2 Sallys credit union passbook looked like this in June 2012. Date 01 July 2011 15 Dec 2011 02 Feb 2012 14 May 2012 20 June 2012 Particulars Brought forward Deposit ATM withdrawal Interest ATM withdrawal Deposits 1200.00 85.50 450.00 2635.50 Withdrawals Balance 2400.00 3600.00 3000.00

Revision

a What was: i the amount withdrawn on 2 February 2012? ii the account balance for 14 May 2012? b Interest on this account was paid at a rate of 0.3% per month, based on a minimum monthly balance. How much interest did Sally earn for the month of December 2011? [based on VCAA pre 2006] 3 On 1 July 2012, Sally invested $4000 in a new term deposit that offered a total of $416 interest after two years. a What was the annual simple interest rate offered for this term deposit? b An alternative option for Sally had been to invest with a bank at a rate of 4.8% per annum compounding annually. To calculate the total amount in this account after two years with this option, Sally wrote down an equation that looked like this: total amount = 4000 c c What number should Sally have used for c? c What annual compounding interest rate, correct to two decimal places, would Sally have needed to earn $416 interest in two years on a $4000 investment? [based on VCAA pre 2006] 4 Lucy wants to borrow $25 000. Interest is calculated quarterly on the reducing balance at an interest rate of 7.9%. a If Lucy can afford to repay her loan at $1600 per quarter: i How much of Lucys rst payment is interest? ii Will repayments of $1600 enable Lucy to repay the loan within four years? Explain. b Suppose Lucy arranges to pay $1525 per quarter. i How long will it take her to pay back the loan? Give your answer to the nearest quarter. ii How much will the period of Lucys loan be reduced if her payments are increased to $1745? Give your answer to the nearest quarter. 5 Eric wants to buy a photocopier. Crazy Bobs normally sells them for $4450, but they have a special discounted price of $3800 for this week. a What is the percentage discount? Write your answer correct to one decimal place. b Crazy Bobs offers to sell the photocopier for the discounted price of $3800, with terms of $500 deposit and $330 per month for 12 months. (contd.)

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

614

Essential Further Mathematics Module 4 Business-related mathematics

i What is the total cost of the photocopier on these terms? ii What is the annual at rate of interest charged? c Eric sees the same photocopier for sale at Discount House, also for $3800. The terms of the sale there require no deposit and monthly repayments over two years at an interest rate of 8.5% per annum, calculated monthly on the reducing balance. i What is the monthly repayment for this loan? Write your answer in dollars correct to two decimal places. ii What is the total cost of the machine from Discount House on these terms? Write your answer correct to the nearest dollar. d Whose terms, Crazy Bobs or Discount House, offer the lowest total cost for the photocopier? Justify your answer by calculating the difference in total money paid. 6 Brad buys a coffee machine for his caf with an initial value of $3100. He considers two e methods of depreciating the value of the coffee machine. a Suppose that the value of the machine is depreciated using the reducing balance method over 3 years and reducing at a rate of 15% per annum. What is the depreciated value of the machine after 3 years? Write your answer correct to the nearest dollar. b Alternatively, suppose that the machine is depreciated using the unit cost method. Brad sells 15 000 cups of coffee per year and the unit cost per cup is 3.0 cents. Determine the depreciated value of the machine after 3 years. Write your answer correct to the nearest dollar. c Brad wants the depreciated value of the machine after 3 years to be the same when calculated by both methods of depreciation. What would the unit cost per cup of coffee have to be for this to occur? Write your answer in cents, correct to one decimal place. [VCAA pre 2006] 7 Roslyn earns an annual salary of $54 200, which is paid monthly. She did not join the superannuation fund until her 37th birthday and she now pays 7% of her gross salary to the superannuation fund. Her employer contributes a further 14%. a What amount of money is placed each month into her superannuation fund? b The superannuation fund pays 4.2% per annum compound interest, compounded monthly. Assuming that Roslyns annual salary remains constant, what is the amount of superannuation she will have available at her 60th birthday? c If there is an average of 2.5% ination over the period of time that Roslyn is working, what is the purchasing power of the amount of superannuation determined in part b? d Suppose that when Roslyn retires she places her superannuation in a perpetuity that will provide a monthly income without using any of the principal. If the perpetuity pays 4.25% per annum compounding monthly, what monthly payment will Roslyn receive? 8 Shelly decides to sell her business and invest the proceeds in an investment account that pays 5.5% per annum interest, compounding monthly. She plans to continue to work for ve more years and add another $1500 per month to the account, and then retire.

Revision

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

Chapter 22 Revision

615

a If she makes a prot of $825 000 on her business, how much will Shelly have in the investment account when she retires? b If there has been an average ination rate of 3.2% over the 5-year period of her investment, what is the purchasing power of the amount of money Shelly has in her account? c When she retires in ve years, Shelly plans to use her money to buy an annuity, which pays 5.75% per annum compounding monthly. If she receives $8400 per month for her living expenses, how long will the annuity last? d Alternatively, Shelly could place the money in a perpetuity. If the perpetuity she selects pays 5.75% per annum compounding monthly, how much is the monthly payment that Shelly will receive? 9 Glenda decides to buy a house worth $250 000 with a deposit of $80 000, and a loan of $170 000 from a building society. To repay the loan of $170 000, Glenda pays the building society $1850 per month for 10 years. a Calculate the total amount of Glendas repayments to the building society. b Determine the total interest on the loan during the 10 years. c Find the annual at rate of interest charged by the building society. Give your answer correct to one decimal place. 10 Robyn invests $100 000 to provide a scholarship valued at $10 000 to the best mathematics student in the nal year at her old school. She invests the money into an annuity at an interest rate of 8.25% per annum compound interest. She makes the payment to the winning student each year immediately after the interest is paid into the account. a How much money is left in the account after the rst two scholarships are awarded? b Determine the amount that is left in Robyns account after 10 years of awarding scholarships. Give your answer to the nearest cent. c What would be the maximum value for each scholarship if they are to be awarded forever? d How much would Robyn need to invest to be able to pay the $10 000 scholarship in perpetuity? Give your answer to the nearest dollar.

Revision

ISBN: 9781107655904 Peter Jones, Michael Evans, Kay Lipson 2012 Photocopying is restricted under law and this material must not be transferred to another party

Cambridge University Press

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Continuous Casting Investments at USX Corporation: Group 9Documento5 pagineContinuous Casting Investments at USX Corporation: Group 9Kartik NarayanaNessuna valutazione finora

- As 3993-2003 Equipment For The Pasteurization of Milk and Other Liquid Dairy Products - Continuous-Flow SysteDocumento8 pagineAs 3993-2003 Equipment For The Pasteurization of Milk and Other Liquid Dairy Products - Continuous-Flow SysteSAI Global - APACNessuna valutazione finora

- Ammonia WeeklyDocumento18 pagineAmmonia Weeklymtarek2k100% (1)

- CV-JM Van StraatenDocumento5 pagineCV-JM Van StraatenJovan Van StraatenNessuna valutazione finora

- SCM SummaryDocumento47 pagineSCM SummaryEmanuelle BakuluNessuna valutazione finora

- A SWOT Analysis On Six SigmaDocumento10 pagineA SWOT Analysis On Six SigmasmuNessuna valutazione finora

- Sustainable Entrepreneurship DefinedDocumento13 pagineSustainable Entrepreneurship Definedmsohaib7Nessuna valutazione finora

- VD Balanced Scorecard - Set of Templates For Building A Balanced Scorecard (Top Five)Documento38 pagineVD Balanced Scorecard - Set of Templates For Building A Balanced Scorecard (Top Five)Quynh Anh Nguyen MaiNessuna valutazione finora

- Diongzon V Mirano (Ethics)Documento1 paginaDiongzon V Mirano (Ethics)MMACNessuna valutazione finora

- Currensee Correlation - OANDADocumento1 paginaCurrensee Correlation - OANDAwim006100% (1)

- Project AnalysisDocumento31 pagineProject Analysisapi-239371964Nessuna valutazione finora

- ICMS Postgraduate Brochure 2019 e 0 PDFDocumento23 pagineICMS Postgraduate Brochure 2019 e 0 PDFPamela ConcepcionNessuna valutazione finora

- Key Account ManagementDocumento34 pagineKey Account Managementmanin1804100% (1)

- Macroeconomic ProblemsDocumento14 pagineMacroeconomic ProblemsRifat MahmudNessuna valutazione finora

- DSIJ3203Documento68 pagineDSIJ3203bra techNessuna valutazione finora

- Bidder's Checklist of Requirements For Its Bid, Technical ProposalsDocumento2 pagineBidder's Checklist of Requirements For Its Bid, Technical ProposalsJoseph Santos GacayanNessuna valutazione finora

- Report On Different Modes of Investment of IBBLDocumento72 pagineReport On Different Modes of Investment of IBBLMickey Nicholson83% (6)

- Johnson, Chalmers. 1982. MITI and The Japanese Miracle Ch. 1Documento20 pagineJohnson, Chalmers. 1982. MITI and The Japanese Miracle Ch. 1Carrie MartinNessuna valutazione finora

- IT Governance at INGDocumento19 pagineIT Governance at INGChandan KhandelwalNessuna valutazione finora

- Roshan ProjectDocumento253 pagineRoshan ProjectAmit PrajapatiNessuna valutazione finora

- BPSM NotesDocumento3 pagineBPSM Notesankit1844Nessuna valutazione finora

- Auto Components Manufacturing IndustriesDocumento9 pagineAuto Components Manufacturing IndustriesAnubhuti SharafNessuna valutazione finora

- Department of Labor: 2005 05 27 17 FLSA ShiftsDocumento2 pagineDepartment of Labor: 2005 05 27 17 FLSA ShiftsUSA_DepartmentOfLaborNessuna valutazione finora

- Repco Micro Finance Limited: Corporate Office, Chennai-35Documento4 pagineRepco Micro Finance Limited: Corporate Office, Chennai-35Abaraj IthanNessuna valutazione finora

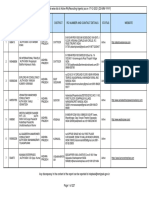

- Ra List Report Updatedupto17dec2021Documento227 pagineRa List Report Updatedupto17dec2021Geetha KarunakaranNessuna valutazione finora

- Benefits of Centralized LearningDocumento8 pagineBenefits of Centralized LearningAqeel ShaukatNessuna valutazione finora

- Molson Brewing CompanyDocumento16 pagineMolson Brewing CompanyVictoria ColakicNessuna valutazione finora

- M 3. Process AnalysisDocumento60 pagineM 3. Process Analysishardlex313Nessuna valutazione finora

- Project Finance and Equator PrinciplesDocumento8 pagineProject Finance and Equator PrinciplesSushma Jeswani TalrejaNessuna valutazione finora

- 22-10-2010 Quiz Controlling) + AnswersDocumento3 pagine22-10-2010 Quiz Controlling) + AnswersRaymond Setiawan0% (1)