Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Steel Industry Update #279

Caricato da

Michael LockerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Steel Industry Update #279

Caricato da

Michael LockerCopyright:

Formati disponibili

Steel Industry Update/279

October 2012

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

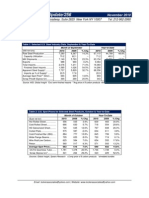

Table 1: Selected U.S. Steel Industry Data, August & Year-to-Date, 2012

Month of August

2012

2011

% Chg

Raw Steel Production ........................8,402

8,199

2.5%

(000 net tons)

2012

67,395

Year-to-Date

2011

63,375

% Chg

6.3%

Capacity Utilization .......................... 76.3

75.7

--

77.8

74.7

--

Mill Shipments ...................................8,377

8,305

0.9%

66,405

60,494

9.8%

Exports ..............................................1,172

1,189

-1.4%

9,534

8,659

10.1%

Total Imports......................................2,674

2,462

8.6%

23,083

19,727

17.0%

Finished Steel Imports .....................2,049

1,834

11.7%

17,875

15,021

19.0%

Apparent Steel Supply* ......................9,254

8,950

3.4%

74,746

66,856

11.8%

Imports as % of Supply*................... 22.1

20.5

--

23.9

22.5

--

Average Spot Price** ($/ton) ............... $731

$821

-10.9%

$781

$898

-13.1%

Scrap Price# ($/ton) ............................ $393

$436

-9.9%

$412

$440

-6.3%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 3 carbon products

#shredded scrap

Table 2: U.S. Spot Prices for Selected Steel Products, October & Year-to-Date, 2012

Hot Rolled Band....

Cold Rolled Coil........

Coiled Plate..................

Month of October

2012

2011

% Chg

$605

$681

-11.2%

705

773

-8.8%

739

975

-24.2%

Year-to-Date

2012

2011

$666

$773

765

869

866

1,008

% Chg

-13.9%

-11.9%

-14.1%

Average Spot Price....

$683

$810

-15.6%

$766

$883

-13.3%

OCTG*

$1,914

$2,030

-5.7%

$1,985

$1,910

3.9%

#1 Heavy Melt...

Shredded Scrap...

#1 Busheling.

$301

330

337

$396

440

485

-24.0%

-25.0%

-30.5%

$362

401

414

$403

440

477

-10.0%

-8.9%

-13.2%

Iron Ore ($/dmtu)...

Pig Iron ($/tonne)...

$99

$481

$177

$492

-44.1%

-2.2%

$131

$468

$174

$486

-24.8%

-3.7%

($ per net ton)

Sources: World Steel Dynamics, Spears Research; SteelOnTheNet.com; IndexMundi.com; *OCTG data

is September 2012; Pig Iron data is September 2012, $/dmtu: US$/dry metric tonne unit

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Steel Industry Update/279

Table 3: World Crude Steel Production, September & Year-to-Date, 2012

Month of September

Year-to-Date

(000 metric tons)

2012

2011

% Chg

2012

2011

Region

% Chg

European Union.

14,105

14,672

-3.9%

129,625

135,927

-4.6%

Other Europe.

3,197

3,214

-0.5%

28,722

27,422

4.7%

C.I.S.

9,597

9,081

5.7%

84,732

84,477

0.3%

North America

9,680

9,924

-2.5%

92,792

89,277

3.9%

South America...

3,600

3,900

-7.7%

35,055

36,781

-4.7%

Africa/Middle East.....

2,661

2,617

1.7%

25,554

25,425

0.5%

Asia..

80,285

79,587

0.9%

748,560

737,262

1.5%

Oceania......

511

626

-18.3%

4,378

5,917

-26.0%

Total

123,637

123,622

0.0% 1,149,417 1,142,489

0.6%

China.......

Japan...

57,950

8,798

57,600

8,889

0.6%

-1.0%

542,340

81,321

533,270

81,022

1.7%

0.4%

United States..

7,015

7,233

-3.0%

68,154

64,726

5.3%

India(e).

6,155

5,829

5.6%

56,851

55,134

3.1%

Russia..

6,234

5,416

15.1%

53,777

51,538

4.3%

South Korea.......

5,602

5,503

1.8%

52,160

50,637

3.0%

Germany...

3,563

3,643

-2.2%

32,444

34,128

-4.9%

Turkey

3,052

2,997

1.9%

27,153

25,058

8.4%

Brazil...

2,848

2,859

-0.4%

26,045

26,842

-3.0%

Ukraine(e)...

2,708

2,954

-8.3%

25,124

26,546

-5.4%

All Others....

19,712

20,699

-4.8%

184,048

193,588

-4.9%

Country

Source: World Steel Association, 10/12; e=estimate

Graph 1: World Crude Steel Production, September 2012

Source: World Steel Association, 10/12; in million metric tons

-2-

Steel Industry Update/279

Graph 2: World Steel Capacity Utilization, September 2012

Source: World Steel Association, 10/12

Table 4: Short-range Outlook for Apparent Steel Use (ASU), 2011-2013

Apparent Steel Use (Mt)

Region

European Union (27)

Other Europe

CIS

NAFTA

Central & S. America

Africa

Middle East

Asia & Oceania

World

Growth Rate, %

2011

153.1

33.2

54.8

121.3

45.7

23.9

48.2

900.6

2012 (f)

144.5

34.4

55.2

130.4

47.4

25.3

49.9

922.2

2013 (f)

148.1

36.0

57.4

135.1

50.4

27.3

52.8

947.9

2011

5.9

12.7

13.8

9.0

2.6

-3.4

2.9

5.9

2012 (f)

-5.6

3.8

0.8

7.5

3.8

5.8

3.5

2.4

2013 (f)

2.4

4.5

3.9

3.6

6.3

7.7

5.9

2.8

1,380.9

1,409.4

1,454.9

6.2

2.1

3.2

Developed Economies

Emerging/Dev. Economies

China

BRIC

MENA

395.6

985.2

623.9

759.7

59.8

394.6

1014.8

639.5

779.9

62.7

402.1

1,052.8

659.2

806.0

66.9

6.2

6.3

6.2

6.4

-2.0

-0.3

3.0

2.5

2.7

4.9

1.9

3.7

3.1

3.3

6.7

World, excl China

757.0

769.9

795.6

6.3

1.7

3.3

Source: WorldSteel.com, 10/18/12; finished steel products

-3-

Steel Industry Update/279

Table 5: US Exports of Steel Mill Products, August 2012

Aug12

106,367

102,020

Jul12

97,346

92,789

% Chg

9.3%

9.9%

Aug11

104,436

97,333

% Chg

1.8%

4.8%

Heavy structural shapes

94,166

100,952

-6.7%

90,566

4.0%

Hot-rolled steel

74,326

87,130

-14.7%

62,806

18.3%

Cold-rolled steel

60,114

53,966

11.4%

54,155

11.0%

Blooms, billets and slabs

41,315

26,135

58.1%

47,582

-13.2%

Plate in coil

41,293

47,712

-13.5%

85,048

-51.4%

Line pipe

34,714

28,752

20.7%

14,595

137.8%

Oil country goods

33,372

32,852

1.6%

38,221

-12.7%

995,316

940,967

5.8%

1,014,921

-1.9%

67,910

42,766

58.8%

63,748

6.5%

1,063,226

983,734

8.1%

1,078,669

-1.4%

Product

Cut-to-length

Hot-dipped gal sheet/strip

Total carbon and alloy

Stainless

Total Exports

Source: American Metal Market, 10/16/12

Table 6: London Metal Exchange Nonferrous Base Metal Averages, September 2012

Commodity

Aluminum

Copper

2011 Cash Avgs

$1.09

$4.00

Sept. 2012 Avgs

$0.93

$3.66

YTD Avgs*

$0.92

$3.62

Lead

$1.09

$0.98

$0.92

Nickel

$10.38

$7.81

$8.05

Zinc

$1.00

$0.91

$0.88

Tin

$11.80

$9.39

$9.52

No.1 HMS composite*

$411.72

$347.50

$369.67

Source: Export Tax Advisors, 10/16/12; cents/lb except No 1 HMS

-4-

Steel Industry Update/279

Table 8: Top 20 Largest Scrap Metal Processors, 2011

Company

Ferrous Tons

Processed (2011) CEO

Emp

Plants

Eur Metal Recycling (EMR)

11 million

3,000

150

U.K., U.S., Germany, The

Netherlands

Chris Sheppard

Nations

Scholz Group

10.7 million

B Scholz, O Scholz

7,500

500

Germany, Austria, Poland,

Czech Republic, Slovakia,

Hungary, Bulgaria, Romania,

Turkey, Slovenia, Croatia,

Bosnia, Serbia

Sims Metal Management

10.2 million

Daniel Dienst

6,600

250

Europe, North America,

Australia, Asia

TSR Recycling

8 million (est.)

Ulrich Althoff

1,900

160

Germany, Netherlands,

Austria, Czech Republic,

Slovakia, Hungary, Poland

OmniSource Corp/Steel Dyn

5.2 million

Russel Rinn

2,000+

43

United States, Canada

David J. Joseph Co./Nucor

5 million

Keith Grass

2,200

69

United States, Canada

US, Canada, Belgium, China,

France, Indonesia, Mexico,

Serbia, Singapore, Slovakia,

S Africa, Taiwan, Trinidad,

UAE, U.K., Vietnam

Tube City LLC

5 million

Joseph Curtin

3,900

20

Derichebourg Environment

4.9 million

Daniel Derichebourg

3,500

140

Stena Metall Group

4 million (est.)

Anders Jansson

3,486

250

Commercial Metals Co

3.3 million

Joseph Alvardo

800

60+

France, Germany, U.K., U.S.,

Mexico, Italy, Spain, Belgium

Sweden, Norway, Denmark,

Finlas, Poland, Italy

United States, Czech

Republic, Poland

9,000

70+

Germany, Poland,

Netherlands, Italy, Spain,

Slovenia, Bos & Herz, Austria,

Czech Republic, Hungary,

Bulgaria, US, China, Belgium,

Slovakia

A. Gerdau Johannpeter

na

17

United States, Canada

Howard Sherman

700

20

United States, Canada

2.5 million (est.)

Mike Giampaolo

350

16

Canada, US, Mexico

Kuusakoski Recycling

2.2 million (est.)

Petri Halonen

2,950

100+

OneSteel Recycling

2.1 million

Geoff Plummer

550

39

Australia, China, New

Zealand, United States,

Indonesia, Malaysia,

Philippines, Thailand

China Metal Recycling

2 million

Chun Chi Wai

600

10

China, Hong Kong

Ecore Group

2 million

Claude Dauphin (mng

dir)

1,300

105

France, Romania, Hungary,

Germany, Switzerland,

Netherlands, Belgium,

Luxembourg, China, India

Galloo Group

1.85 million

Rik Debaere

850

52

Suez-Environment

1.76 million

Jean-Louis Chaussade

na

645

Alba Group

2.85 million

Dr. Axel Schweitzer

Gerdau Long Steel Recycling

2.8 million

Ferrous Processing & Trading

2.7 million

Triple M Metal

Finland, Russia, Estonia,

Latvia, Lithuania, Poland,

Sweden, Denmark, U.K.,

United States, China, Taiwan

Belgium, France, the

Netherlands

Europe, the Americas, Asia,

Africa, Australia

Source: Recycling Today, 7/12

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2012 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-5-

Steel Industry Update/279

-6-

Steel Industry Update/279

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

U.S. Scrap Prices

($ per ton)

($ per ton)

500

1100

#1 Busheling

Plate

1000

450

Shredded

Scrap

900

400

CR Coil

800

350

700

#1 Heavy Melt

Rebar

HR Band

300

600

250

500

400

200

'07 '08 '09 '10 1q 2q 3q 4q

'07 '08 '09 '10 1q 2q 3q 4q

Locker Associates Steel Track: Performance

U.S. Raw Steel Production

10.0

(mil net tons)

2012

2012

2011

9.0

80%

7.0

70%

6.0

60%

5.0

50%

4.0

40%

2011

90%

8.0

3.0

U.S. Capacity Utilization

100%

30%

2012 8.5 8.3 8.8 8.6 8.7 8.0 8.1 8.4

2012 78% 81% 80% 81% 79% 75% 73% 76%

2011 7.9 7.4 8.1 7.8 7.9 8.0 8.1 8.2

2011 73% 75% 75% 74% 73% 76% 75% 76%

Steel Mill Products: US Imports, August & Year-to-Date, 2012

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border

Off Shore

Month of August

2012

2011

% Chg

469

520

-9.8%

206

240

-14.2%

402

443

-9.3%

570

323

76.5%

264

169

56.2%

757

739

2.4%

0

17 -100.0%

6

12

-50.0%

2,674

2,462

8.6%

Year-to-Date

2012

2011

4,050

4,082

1,753

2,106

3,045

2,262

3,836

2,941

2,883

1,905

7,197

5,633

249

671

70

125

23,083

19,727

265

1,359

384

654

13

2,852

11,244

3,872

4,971

144

179

1,265

344

644

28

Source: AISI; *includes Russia

Update #279

-7-

48.0%

7.4%

11.6%

1.6%

-53.6%

2,302

8,717

3,690

4,870

148

% Chg

-0.8%

-16.8%

34.6%

30.4%

51.3%

27.8%

-62.9%

-44.0%

17.0%

23.9%

29.0%

4.9%

2.1%

-2.7%

Steel Industry Update/279

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government clients.

By combining expert business and financial analysis with a sensitivity to labor issues, the firm is

uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labor-management

effort. Locker Associates also produces a widely read monthly newsletter, Steel Industry Update

that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Metallic Lathers and Reinforcing Ironworkers (2010-Present): strategic industry research and

ongoing advisement on major industry trends and companies to help enhance the competitive

position of the unionized NYC construction industry

Building & Construction Trades Council of Greater NY (BCTC) (2011-present): analysis and

advisement regarding major trends in the New York City construction industry, including capital

market developments which affect BCTC members

Communication Workers of America (CWA) (2011-present): research and analysis to prepare

CWA for nationwide contract negotiations with AT&T

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Metallurgical Coal Producer (2011): prepared a detailed study on the major trends in the world

metallurgical coal market for a large metallurgical coal producer

-8-

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Functions of Quality DepartmentDocumento5 pagineFunctions of Quality DepartmentsachinNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Affidavit of FactDocumento3 pagineAffidavit of FactMortgage Compliance Investigators100% (8)

- Vol 1 CLUP (2013-2022)Documento188 pagineVol 1 CLUP (2013-2022)Kristine PiaNessuna valutazione finora

- Perry I Dr. - Transitions To School PDFDocumento301 paginePerry I Dr. - Transitions To School PDFAdrijana Visnjic JevticNessuna valutazione finora

- What Is Logos in The BibleDocumento6 pagineWhat Is Logos in The BibleIvan BrodićNessuna valutazione finora

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 pagineCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNessuna valutazione finora

- Steel Industry Update #277Documento9 pagineSteel Industry Update #277Michael LockerNessuna valutazione finora

- Steel Industry Update 283Documento9 pagineSteel Industry Update 283Michael LockerNessuna valutazione finora

- Steel Industry Update #282Documento9 pagineSteel Industry Update #282Michael LockerNessuna valutazione finora

- Steel Industry Update #278Documento9 pagineSteel Industry Update #278Michael LockerNessuna valutazione finora

- Steel Industry Update #280Documento10 pagineSteel Industry Update #280Michael LockerNessuna valutazione finora

- Steel Industry Update #281Documento6 pagineSteel Industry Update #281Michael LockerNessuna valutazione finora

- Steel Industry Update #276Documento7 pagineSteel Industry Update #276Michael LockerNessuna valutazione finora

- Steel Industry Update #272Documento7 pagineSteel Industry Update #272Michael LockerNessuna valutazione finora

- Steel Industry Update #273Documento8 pagineSteel Industry Update #273Michael LockerNessuna valutazione finora

- Steel Industry Update #274Documento8 pagineSteel Industry Update #274Michael LockerNessuna valutazione finora

- Steel Industry Update #275Documento9 pagineSteel Industry Update #275Michael LockerNessuna valutazione finora

- Steel Industry Update #270Documento9 pagineSteel Industry Update #270Michael LockerNessuna valutazione finora

- Steel Industry Update #271Documento9 pagineSteel Industry Update #271Michael LockerNessuna valutazione finora

- Steel Industry Update #266Documento8 pagineSteel Industry Update #266Michael LockerNessuna valutazione finora

- Steel Industry Update #264Documento10 pagineSteel Industry Update #264Michael LockerNessuna valutazione finora

- Steel Industry Update #267Documento9 pagineSteel Industry Update #267Michael LockerNessuna valutazione finora

- Steel Industry Update #269Documento8 pagineSteel Industry Update #269Michael LockerNessuna valutazione finora

- Steel Industry Update #268Documento13 pagineSteel Industry Update #268Michael LockerNessuna valutazione finora

- Steel Industry Update #265Documento7 pagineSteel Industry Update #265Michael LockerNessuna valutazione finora

- Steel Industry Update #262Documento7 pagineSteel Industry Update #262Michael LockerNessuna valutazione finora

- Locker RPA Transcript 6-9-11Documento2 pagineLocker RPA Transcript 6-9-11Michael LockerNessuna valutazione finora

- Steel Industry Update #263Documento10 pagineSteel Industry Update #263Michael LockerNessuna valutazione finora

- Steel Industry Update #260Documento6 pagineSteel Industry Update #260Michael LockerNessuna valutazione finora

- Steel Industry Update #258Documento8 pagineSteel Industry Update #258Michael LockerNessuna valutazione finora

- Steel Industry Update #261Documento8 pagineSteel Industry Update #261Michael LockerNessuna valutazione finora

- Steel Industry Update #259Documento10 pagineSteel Industry Update #259Michael LockerNessuna valutazione finora

- Steel Industry Update #257Documento8 pagineSteel Industry Update #257Michael LockerNessuna valutazione finora

- Steel Industry Update #256Documento11 pagineSteel Industry Update #256Michael LockerNessuna valutazione finora

- CV - Mai Trieu QuangDocumento10 pagineCV - Mai Trieu QuangMai Triệu QuangNessuna valutazione finora

- Workweek Plan Grade 6 Third Quarter Week 2Documento15 pagineWorkweek Plan Grade 6 Third Quarter Week 2Lenna Paguio100% (1)

- Anti-Bullying Policy For EmployeesDocumento2 pagineAnti-Bullying Policy For Employeespaulth2Nessuna valutazione finora

- DowryDocumento34 pagineDowryRashid ZubairNessuna valutazione finora

- Common List 2nd Yr UG Boys & Girls (Batch 2020) Shifting From LBS & NVH HallDocumento57 pagineCommon List 2nd Yr UG Boys & Girls (Batch 2020) Shifting From LBS & NVH Hallkaran vaishnavNessuna valutazione finora

- Cleveland Metroparks Zoo - Asian Lantern Festival Frequently Asked QuestionsDocumento2 pagineCleveland Metroparks Zoo - Asian Lantern Festival Frequently Asked QuestionsjtruxallNessuna valutazione finora

- "Mero Share" Application Form: Æd) /F) Z) O/æ SF) ) JF LNGSF) Nflu LGJ) BG KMF/FDDocumento2 pagine"Mero Share" Application Form: Æd) /F) Z) O/æ SF) ) JF LNGSF) Nflu LGJ) BG KMF/FDANKITNessuna valutazione finora

- The Urbanization of An Idea Imagining Nature Through Urban Growth Boundary Policy in Portland OregonDocumento28 pagineThe Urbanization of An Idea Imagining Nature Through Urban Growth Boundary Policy in Portland OregoninaonlineordersNessuna valutazione finora

- The Macabre Motifs in MacbethDocumento4 pagineThe Macabre Motifs in MacbethJIA QIAONessuna valutazione finora

- Dalisay vs. SSS - Action To Quiet Title - Dacion en PagoDocumento28 pagineDalisay vs. SSS - Action To Quiet Title - Dacion en PagohlcameroNessuna valutazione finora

- Jas PDFDocumento34 pagineJas PDFJasenriNessuna valutazione finora

- Sub Contract Agreement TabukDocumento7 pagineSub Contract Agreement TabukHanabishi RekkaNessuna valutazione finora

- Thesis On Performance Appraisal SystemDocumento8 pagineThesis On Performance Appraisal Systemydpsvbgld100% (2)

- OPEN For Business Magazine June/July 2017Documento24 pagineOPEN For Business Magazine June/July 2017Eugene Area Chamber of Commerce CommunicationsNessuna valutazione finora

- OB Escription: Job Title: Delivery DriverDocumento2 pagineOB Escription: Job Title: Delivery DriverMarisa Arizky PutriNessuna valutazione finora

- Kinds of Sentences - Positives.Documento20 pagineKinds of Sentences - Positives.Vamsi KrishnaNessuna valutazione finora

- Pakistan The Factories Act, 1934: CHAPTER I - PreliminaryDocumento56 paginePakistan The Factories Act, 1934: CHAPTER I - Preliminarydanni1Nessuna valutazione finora

- BUBBIO, Paolo. - Hegel, Heidegger, and The IDocumento19 pagineBUBBIO, Paolo. - Hegel, Heidegger, and The I0 01Nessuna valutazione finora

- Week 4 & 5 DDG (Designing Channel Networks)Documento32 pagineWeek 4 & 5 DDG (Designing Channel Networks)Aqib LatifNessuna valutazione finora

- DR Sebit Mustafa, PHDDocumento9 pagineDR Sebit Mustafa, PHDSebit MustafaNessuna valutazione finora

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento2 pagineCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNessuna valutazione finora

- MD - IMO - 269 - EU of ACS2 Sys. Cont.Documento1 paginaMD - IMO - 269 - EU of ACS2 Sys. Cont.remakermaritime.cgpNessuna valutazione finora

- Victor GaetanDocumento5 pagineVictor GaetanTorregiani PaoloNessuna valutazione finora

- Bangalore & Karnataka Zones Teachers' Summer Vacation & Workshop Schedule 2022Documento1 paginaBangalore & Karnataka Zones Teachers' Summer Vacation & Workshop Schedule 2022EshwarNessuna valutazione finora

- Financial Accounting Harrison 10th Edition Test BankDocumento24 pagineFinancial Accounting Harrison 10th Edition Test BankNicoleHallrktc100% (46)