Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Strategic Marketing Plans and Collaborative Networks

Caricato da

1ayanshaikhTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Strategic Marketing Plans and Collaborative Networks

Caricato da

1ayanshaikhCopyright:

Formati disponibili

The current issue and full text archive of this journal is available at www.emeraldinsight.com/0263-4503.

htm

Strategic marketing plans and collaborative networks

Marcos Fava Neves

University of Sao Paulo, Ribeirao Preto, Brazil

Abstract

Purpose This paper seeks to propose a new framework for the marketing planning process that is better adjusted to the modern operational environment, with particular emphasis on the exploitation of collaborative company networks in optimising the potential of the plan. Design/methodology/approach A review of the academic literature of marketing planning, three participant-observation case studies and a focus group, the latter two in Brazil, provided the conceptual input for a very detailed stepwise model for marketing planning in a network environment. Findings The new model, including its focus on collaborative action, earned considerable support among participants in the second and third phases of the research. The plan itself was found to be applicable in practice. Obstacles to the achievement of collaborating networks were identied, and solutions are proposed. Research limitations/implications The study proposes and tentatively tests a systematic, sequential framework for marketing planning. It also casts light on networks and working relationships from an unusual angle, which may be transferable to other contexts. Suggestions for further research mainly concern the application and testing of the new model in practice. Limitations concern the representativeness of the case-study and focus-group respondents, and the timescale. Practical implications The major managerial implication of this research study is the planning instrument it proposes and, tentatively, tests. It holds the promise of more making marketing budgets work harder, via more systematic planning and exploitation of the power of networks. Originality/value The proposed model differs from other marketing planning frameworks in treating the company to which it is applied as member of a network, not an individual. The study took place in a very large second-world economy, a setting very different from those in which conventional marketing plans have been proposed and applied. Keywords Marketing planning, Network, Operating systems, Brazil Paper type Research paper

Strategic marketing plans

175

Received February 2005 Revised November 2006 Accepted December 2006

Introduction: room for change in the marketing planning process The growth in international trade, opening of economies and global access to information have brought increasing competition in several industries, resulting in strong consolidation and reduction of margins. This new environment introduced marketing strategists to an era of strict budgetary control and coordination, demanding very careful decision making with respect to where and how to spend what resources were available. In response to the constraints imposed by the globalization of markets, which often have no conventional boundaries, rms and their marketing function have become more international, and recognized a growing need to focus on their core businesses, outsourcing activities and contractual relationships, so as to

The author is grateful for the input from the anonymous blind reviewers, which revealed several directions for improvement of the submitted manuscript. The author also thanks Professor Marco Conejero for his support.

Marketing Intelligence & Planning Vol. 25 No. 2, 2007 pp. 175-192 q Emerald Group Publishing Limited 0263-4503 DOI 10.1108/02634500710737951

MIP 25,2

176

manage their inputs and distribute their outputs efciently. Real networks are being developed, focusing on relationships, and continuous and sustainable development (Heide and Miner, 1992; Hertz and Mattsson, 2001; Noonan, 1999; Webster, 1992). Several joint activities relate to the companys supply chain. Collaborative buying groups are linking autonomous companies such as Fiat and General Motors or Carrefour with other retailers and groups of agricultural producers. The savings to be achieved in input and transaction costs are clear. At the same time, cooperation in the marketing channels and with clients has also been receiving increasing attention, and is advocated by practitioners and academics as a way to mange the operational costs of marketing more effectively (Biong et al., 1997; Blois, 1997; Bucklin and Sengupta, 1993; Heydebreck and Maier, 1997; Gemunden et al., 1997). Cooperation and collaboration networks may be vertical, between players at technologically distinct stages (for example, suppliers and distributors) or horizontal, involving competitors or even rms supplying complementary products to the same target-market (Gemunden and Ritter, 1997; Gulati, 1998). The collaborative approach aims to make companies more demand-driven and better adapted to operate in the increasingly competitive market environment, by reducing costs of all kinds and improving efciency in the buying and selling processes. The literature of marketing planning and control processes has not so far emphasized strong collaborative networks (Campomar, 1983; Westwood, 1995; Cooper and Lane, 1997; Las Casas, 1999; Lambin, 2000; Jain, 2000; McDonald, 2002). The rm has not been perceived as part of a network linking the suppliers of its production needs with actors in its marketing channels and with its competitors. As outsourcing, partnerships, alliances and other forms or arrangements become more important and pressure on margins increases, planners and strategists have the opportunity to adapt existing methods and establish the design and management of collaborative action as a formalized and structured corporate objective, enshrined in the marketing plan. Objectives The research presented in this paper had four central objectives: (1) to review existing marketing planning methods and assess the scope for improvements; (2) to design a sequential strategic marketing planning and management (SMPM) process that incorporates a strong network and collaborative element; (3) to verify the applicability of the proposed model; and (4) to assess companies readiness for structured networking and collaboration in their marketing operations. Methodology First, a systematic review of the literature of marketing planning and control models was undertaken, to extract potential ingredients of a more comprehensive SMPM process. Current practice in three companies was then examined in depth over three years, during which modications to the existing marketing plans were proposed to the management, and the outcomes monitored. This was, in short, a form of participant observation. The ndings were added to the inputs to the developing framework for the eventual plan.

To assess the applicability of the proposed structure and sequence in practice, and the acceptability of the underlying idea of cooperation, collaboration and commonality, ten marketing directors were recruited for a focus group discussion. They were drawn from multinational rms in Brazil that supplying the beef and dairy industries, operating in a market worth about US$ 10 billion a year. Although selling to the same clients, their companies were not direct competitors. They included, for example, one fertilizer company, one producer of supplements and one of feedstuffs, one supplier of veterinary products, a company specializing in genetics, a provider of infrastructure services, and so on. A schema of the research plan and procedure is presented below: (1) Understand structures and sequences of published models for marketing planning (desk research and literature review). (2) Develop an alternative model, incorporating a networking approach. (3) Apply this in three companies over a period of three years (case studies). (4) Improve the proposed model (desk research). (5) Test acceptability and applicability (focus group). (6) Propose list of marketing activities (focus group). (7) Propose list of potentially collaborative activities (focus group). (8) Compile list of feasible collaboration activity (focus group). (9) Identify possible problems and consider how to deal with them (focus group). During discussion and evaluation of the model derived from the literature and the three case examples, participants tried to set up a common agenda of collaborative marketing initiatives, to predict problems that could threaten potential collaborative activities, and to explore ways avoid them. At a critical stage in the exercise, the traditional focus group procedure became more structured, as participants were instructed to complete individual questionnaires containing open and multiple-choice questions. They were asked to: . say whether or not their companies carried out the marketing activities proposed in the sequence; . evaluate on a ten-point scale the importance of the activities, in the context of their own companies; . evaluate on a ten-point scale how much their companies benet by performing these activities collaboratively; and . estimate on a ten-point scale the probable commitment to engagement in such collaboration. The ndings from this exercise were added to the output of the previous two, to form the total conceptual framework from which the SMPM planning model was developed. Literature review Marketing planning and control models The models, schemes, plans, templates and descriptions identied in the literature are summarized in Table I. It is judged unnecessary to elaborate the details here, partly on account of the inevitable length of a thorough discussion, but mostly because most if

Strategic marketing plans

177

MIP 25,2

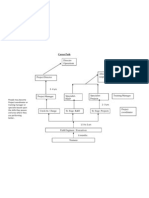

not all of the ten planning processes reviewed are both well known and commonly used. The main aim of the table is to give a general overview, identify the steps or stages involved in each, and permit personal comparison and consolidation. Table II provides further commentary on the convergences and divergences between and among the 11 approaches analysed. Company network approach The theoretical model of a company network is dened here as the group of supplier companies and distributors that are responsible for the ow of products, services, communications, information, orders and payments necessary to connect the company under consideration with its raw material suppliers and the nal consumers of its products, services or derivatives. It is shown schematically in Figure 1. The term network can be used in many ways depending on context, even within marketing (neural networks, franchising networks, industrial networks, retail chains, and so on). Here, it refers specically to the working relationships established and maintained by a rm or organisation, what is commonly refereed to as the company network. According to Lazzarini et al. (2001), the analysis of networks provides the tools for mapping the structure of inter-organizational relationships and liaisons, based on the acknowledgement that the structure in networks both limits and is informed by the constituent actors actions. The company network concept thus provides marketing strategists and planners with the means to analyse a company and its pool of suppliers and distributors, competitors, environment, facilitators and others, in a meaningful way, to map the existing relationships among them, and to assess the impact of the competition and the operating environment in general. Treating a company as a complex network enriches strategic analysis, better linked to the fast changing environment that has characterised the past decade. This is in essence the relationship and interaction approach, which has been widely reported in the literature (Omta et al., 2001; Neves et al., 2001; Gemunden et al., 1997; Bridgewater and Egan, 2002; Ford, 1998; Hakansson and Snehota, 1998, Gadde and Hakansson, 2001) and has had an important impact on business network management and relationship marketing (Mattsson, 1997). Focusing on the network of a company under study permits additional consideration of the facilitator companies (such as transportation companies, insurance agencies, certication companies, warehousing services, logistics specialists, banks, and so on) that perform functions to facilitate the ow its products to market. Similarly, inclusion in the analysis of direct competitors and other companies not in direct competition but operating in the same target market, permits consideration of the collaborative marketing initiatives (such as trade associations, exporting joint ventures, cooperative generic advertising, and many others) which are at the heart of the SMPM paradigm. The term company network management denes the process of managing relationships with all the many associates, facilitators, collaborators and competitors that are logically included in a companys network, as dened here. It has two main components: management of distribution channels and management of the supply chain. The focus of the SMPM framework on the whole network reects the increasing importance of control over the supply process, due to the recent trend to product traceability and the potential negative impact of problems in the supply chain on corporate reputation and brand equity.

178

Lambin (2000) Kotler (2000) Executive summary Executive summary Present position Mission Internal and external situation analysis Objectives Restructuring of action programme Segmentation Positioning Pricing Promotion Product Point of sale Expected marketing margin Scheduling SWOT analysis Strategic analysis (external and internal environment) Wood (2004) Jain (2000) Executive summary

Westwood (1995)

Wright et al. (2000)

Las Casas (1999)

Cooper and McDonald Lane (1997) (2002)

Campomar (1983)

Gilligan and Wilson (2002)

Strategic mission

Set corporate objectives

External audit External audit Marketing audit

Current marketing situation

Internal audit

Objectives

Internal audit

External marketing research Internal marketing research

External Analysis of data opportunities and threats in the external environment Analysis of the Internal data internal environment Determine future development Current marketing situation Opportunity analysis

Background and context of plan Organizational vision, mission and aspirations

SWOT analysis

Goals

Objectives and key-drivers Target market

Set objectives

Marketing objectives and expected results

Formulation of strategies

Objectives and goals

Marketing strategy

Marketing mix strategies Objectives

Assumed conditions

Analysis of strategic skills and directions Formulation of strategies

Market and situation analysis Internal analysis

(continued)

Strategic marketing plans

Table I. Marketing planning models proposed in the literature

179

MIP 25,2

180

Lambin (2000) Kotler (2000) Action programme Demonstration Marketing of results programme Monitoring Expected and results revision Marketing strategy Marketing Marketing plan objectives and preparation strategies Wood (2004) Jain (2000)

Choice of strategic direction

Marketing budget Write down the Tests of robustness; plan analysis of vulnerability and risk Communication of the plan Implementation and control

Contingency plan

Table I.

Wright et al. (2000) Las Casas (1999) Cooper and McDonald Lane (1997) (2002) Campomar (1983) Gilligan and Wilson (2002) Strategy of External implementation analysis and and control marketing audit Marketing Critical strategies aspects and positioning Control Financial plans Alternative plans Budgeting Control Main assumptions Characteristics of the target market Implementation of the plan Preliminary objectives by market, products line and brand Positioning Competitive and marketing strategies Management of seven Ps Brand development Budget Revision and reformulation of objectives

Westwood (1995)

Develop Marketing marketing strategies strategies and and action plan budgeting Implementation Projection of Programmes of strategies gains and that include losses advertising and promotion plans Budgeting Control Control

Control system Revision and updating

Lambin (2000) 1. Executive summary 1. Executive summary

Westwood (1995)

Wright et al. (2000) Kotler (2000) Wood (2004) Jain (2000)

Campomar Las Casas (1999) (1983)

Gilligan and Wilson (2003)

1. Executive 1. Selection of a summary perspective for elaboration of the plan Corporate 2. Denition of 1. Establishment of 3. Vision, mission objectives strategic mission corporate objectives and aspirations 2.1Understanding 4. Analysis of the 1.Environmental 1. External 2. External marketing 1. Analysis of Analysis of the 3. External audit: market and the of competition analysis: threats analysis: research opportunities and external analysis of situation identication of 2.2 Focus in the and threats in the environment environmental 6. External customer threats and opportunities external attractiveness 2.3 Sweep of the analysis 9. Target opportunities environment market and environment characteristics 5. Internal 2. Strengths and 3.1 Corporate 2. Actual 2. Internal 3. Internal marketing 2. Analysis of the 2. Actual Analysis of the 4. Internal audit: analysis weaknesses analysis internal situation situation analysis: internal 4.1Competitiveness research 3.2 Measurement strengths and 4. SWOT analysis environment analysis environment of strengths and weaknesses weaknesses All steps that deal 4.1 Selection of 5. Establishment of 3. Target 3. Advantages Singular aspect with strategy and the strategy suppositions (scenarios) market and of strategic factors 4.2 Portfolio disadvantages the model within the stages analysis in market 4.3 Denition of organizational structure 4. Objectives 10. Preliminary 4. Objectives 3. Objectives Marketing 4.2 Denition of 6. Denition of objectives 3. Objectives objectives objectives objectives 5.Programmes and key of action factors 5. Action 5. Strategic tools 12. Marketing 5. Marketing 4. Marketing 3. Formulation of 4. Marketing 7. Development of Establishment/ 4.3 Choice of programme 6. Marketing strategies strategy strategy strategy strategies implementation strategic direction strategies/action plans strategies 13. Management 6. Marketing target-public 4. Implementation 8. Denition of of of seven Ps programmes 5. Positioning programmes/communication of strategies marketing 14. Brand 6. Marketingplans strategies management mix strategy 7. Action plan 15. Budget 16. Revision and reformulation of objectives

Introduction

1. Audit in strategic marketing

Strategic marketing plans

181

Table II. Commentary on the models

MIP 25,2

Flows of products, services and marketing communications Flows of market/consumer information, financials and product requests

182

Impact of Macro-Environmental Variables (Uncontrollable) Legal-Political, Econ./Natural, Social-Cultural and Technological

S U P P L I E R S

SUPPLIER A

Direct competitors

CHANNEL A

LIERSUPP B

FOCAL COMPANY

CHANNEL B

SUPPLIER C

CHANNEL C Companies with the same target market

D I S T R I B U T O R S

F I N A L C O N S U M E R

Facilitator companies: logistics operators, transportation companies, warehouses, banks, insurance companies, and certification companies

Figure 1. The company network

Focal company supply chain

Focal company marketing channels

Focus group The SMPM sequence was readily accepted by all ten participants. Among activities related to marketing intelligence, every company represented did conduct competitor analysis, but little or nothing else. On the other hand, marketing intelligence received an average score of more than ve out of ten in the questionnaire phase of the exercise. Managers apparently believe they can gain from conducting formal marketing research and that the input can be enhanced by collaboration in such cases as investigation of consumers decision-making processes. Some relevant initiatives have in fact since been implemented. Turning to the structured phase that concluded the focus group session, questionnaire responses show that the most commonly used vehicles for implementing the marketing communications strategy were magazines, catalogues, folders, point-of-sale displays, and routine use of the companies symbols and logos.

Participants recognized the value of collaborative video presentations and similar communication techniques, to instruct potential consumers of somewhat technical products and services in the arguments for their adoption. Answers relating to sales promotion show that technical eld tests, conferences and discount schemes were the most popular tools, all of which participants thought could offer good opportunities for collaboration within the company network. With respect to public relations, participants reported that sponsorships were the most common activity, but the considered company visits and eld trips to be the most important, offering scope for collaborative initiatives. All companies represented by the ten participants already performed the activities in the SMPM framework relating to the sales force, and regarded as fundamentally important. However, participants did not think that collaborative salesforce activities would hold out the prospect of higher gain in practice. There was a surprising lack of agreement about product policy. With regard to channel management, which all participants considered to be very important, the only initiative thought likely to be enhanced by network collaboration was the provision of familiarisation and training programmes for customers. There was a surprisingly negative opinion of the potential for fruitful cooperation in exporting. None of the companies was in fact involved in export markets at the time of the discussions, and seemed uninterested in initiating any joint export activities in the short-term. This patter of responses could be thought to be fairly typical of business-to-business marketers, especially in less developed marketing environments. Although many activities investigated by the questionnaire were seen to offer some potential gain if performed together, only two or three of the companies represented by the participants expressed active interest in any particular one. The outcome could be collective action among these two or three, but collaboration seems likely to remain the exception rather than the rule in general. To conclude the focus-group session, participants were asked to identify and discuss the main threats to potential marketing alliances, and to suggest ways in which to reduce their effect. The ndings are summarised in Table III. The sequence does not imply a perceived order of importance. Case studies Over a period of three years, three distinctively different rms operating in the Brazilian agribusiness market, two multinationals and one domestic company, were studied as they implemented the SMPM process fully or in part. The research aim was to use these real-time observations to test and adjust the prescriptions for collaborative action. Table IV describes the three companies in terms of ownership, objectives, products, markets, turnover, market share and competitors. It also summarises their activities with respect to marketing intelligence, information systems, product strategy, support services, branding, promotional strategy, channel strategy, salesforce strategy, and pricing strategy. During the period of the study, various planning initiatives were recommended to the companies. They are described in the relevant sections of the table. The nal row highlights key weaknesses to be addressed by the SMPM process after the period of study.

Strategic marketing plans

183

MIP 25,2

What are the threats to joint collaborative activities? Different companies internal policies

How can they be overcome?

184

Table III. Focus group ndings

Meet frequently to ensure cohesion within the management team Conict of interest and a degree of competition in Make clear where the boundaries of the joint some product lines activity lie Need for coordination and measurement of results Set up impartial coordinating committee Include measurements in the plan Potential conict between sales representatives in Design regional programmes, setting aside areas competitors in particular areas where these problems may occur Different size of the rms, affecting marketing Establish a scale of investment and budget budgets separately for specic actions. Geographical distance between rms (Brazil is a Make use of information technology and regional very large country) ofces Threat of inside information being delivered to Create a code of ethics outsiders Need for short-term return Measure results; foster planning ethos and strategic vision Different marketing priorities Segment activities and ensure internal exibility among participants.

The SMPM plan Table V describes the steps to be taken in implementing the proposed sequential planning framework. The key differences between this model and the actual situation summarised in Tables I and II are as follows: . The structure reects a rationale that is as demand driven as possible, given that the nal consumer and the environmental scan are the starting points of the analysis. . The plan is more comprehensive than the ten discussed in the literature review, by virtue of incorporating lessons from that review, form the focus groups and from the case study experience. . It incorporates a strong company-network element throughout, to realise the potential of inter-rm relationships and the benets of networking, as identied in the literature. . Steps 1-5 set guidelines for the setting up of the plan, Step 5 in particular explaining how the objectives of the plan are to be achieved. . Steps 6-10 use the marketing mix as an explicit framework for implementation of collaborative action almost a philosophy, given the unsophisticated state of current practice noted in the case studies. . Steps 11 and 12 transforms the plan into actionable projects, with explicit team responsibilities, tasks, budgets and deadlines. Figure 2 shows the plan as a owchart, emphasising its systematic nature and sequential structure.

Topic 2002 National Corrugated paper packaging for all types of user. Non-durables (single use) US$ 100 million per year 10-20 30-40 At least 20 per cent prot growth per year Other multinational companies, plus natural breeding practices. Only 5 per cent of market uses articial insemination From sales management software system None before the plan except sales per representative and region. Now has MkIS installed, with continuous after-sales feedback, and monitoring of competitive environment US$ 10-20 million per year 2000 to 2002 Multinational Genetics: articial insemination of livestock. Non-durable service (single use)

Company 1

Company 2

Company 3

Period of study Ownership Product/market

2001 and 2002 Multinational Low-volume drip-irrigation systems for farmers and agro-industries. Consumer durables (in use for at least ten years) US$ 50-100 million per year

Turnover in local market Market share (percentage) Strategic objectives

40-50

30 per cent growth per year

Competition

One other strong company and small independent companies, plus importers agents for international manufacturers

Marketing Still very preliminary; reluctant to establish intelligence information systems Information systems None before the plan except sales per region; has since designed MkIS, not yet implemented

Product line

Perceived as best in the market, with almost no competitors (premium). Aims to introduce new lines for gardening and water treatment

Services

Very important factor in sales pitch, because of customers very specic needs for projects, training and constant maintenance. Clients rate level of service below positioning of product

Gain second position in the market by reaching at least 20 per cent of market share Market dominated by three companies accounting for greater than 60 per cent of total market. Many small regional players, competing strongly on price From industry association. Image research among clients None before the plan except sales per representative and region. Now has MkIS installed, with continuous after-sales feedback, and monitoring of competitive environment. Shares some research with competitors (network approach) One competitor has better positioning in quality and service. Aims for image differentiation through social action (sustainable development) Factor in competitive advantage, mainly after-sale service. Trying out customization and cost reduction

Perceived as best in the market. Expanding some product lines according to suggestions from advisory board created during the period of the study Service level considered to match product positioning

(continued)

Strategic marketing plans

185

Table IV. Case study ndings

MIP 25,2

186

Topic Company brand only

Branding

Company brand, but independent outlets typically add their own branding Promotional strategy No plan. Budget mostly allocated to trade exhibitions. Reluctant to engage in active communication planning Channel strategy Distributes through 90 independent outlets. Problems with direct sales (key accounts) and lack of support. Plan during study set up three-way classication of outlets and correspondingly different levels of marketing support. Outlet staff retrained to function as part of collaborative network Salesforce strategy Five sales regions, with regional managers and sales reps drawn mostly from the retailers. During period of study, sales manual was developed, for sales force and regional managers

Pricing strategy

Main difculties

Table IV.

Company 2 Company 3 Company brand, plus provenance of product Very little activity; some promotion to buyers Budget allocated to catalogues, sales force and limited use of social messages promotions and trade fairs Direct channel to buyers: 68 sales reps, and Direct channel, operating with 68 sales reps, and key accounts. Started to sell via an key accounts. During study, thorough internet and television during period of study analysis of customers buying decision processes was used as basis for evaluation of market segmentation strategy Five sales regions, with regional managers and team of sales reps. Some problems of geographical coverage identied Networking initiatives started during period of study Premium, though margins eroded during period of study because of difculties in raising prices CEO is foreign, but well adapted to local and company culture. Potential future problem if successor integrates less well. Collective action proving difcult to coordinate

Company 1

Six sales managers with teams of reps. Geographical overlapping as a result of acquisitions addressed by the new plan Programmes implemented during period of study for improving working relationships among all managers and reps Competitive parity. Discounting for new Premium; prices depend on project specication client development by poaching and for Suggestions to have more control of costs, to collective pricing initiatives nationalize some equipment and to offer nancial solutions to clients via buyers of farmers products (trading nancing network) Very centralized, decision-making process New commercial director and established complex and slow. Level of service perceived regional managers, causing some adjustment by some customer to be inconsistent with difculties. Strong need to change focus from product positioning sales to marketing. Geographical overlaps. Questions of motivation

Steps 1. Introduction

Actions

Strategic marketing plans

Write brief history of the company and its alliances Check for pre-existing plans Verify compatibility with other operational plans: nance, human resources, production, etc. Identify teams that will participate in SMPM Study corporate culture and assess implications for implementation 2. Environmental Describe existing company network (Figure 1) analysis Gather market intelligence from primary and secondary sources, as required Build general market analysis and trend analysis Conduct SWOT analysis Research and explain choice behaviour of nal and intermediate consumers Research and explain decision-making processes at network level Evaluate marketing information systems Draw up proactive list of collective actions for gathering and using marketing intelligence Set budget for this phase Analyse competition and identify trends 3. Competitor and Compare strengths and weaknesses with competitors internal Establish benchmarks; set up formal benchmarking committees situation analysis List possible collaborative actions to counter identied weaknesses 4. Objectives Dene qualitative and quantitative objectives and targets, under as many category headings as necessary, for the period of the plan (normally 3-5 years) Calibrate objectives and targets, to permit valid post-evaluation 5. Key strategies Consolidate main strategies directed at achievement of objectives, under the category headings introduced at Step 4 Assess general scope for establishing networks and undertaking collective initiatives 6. Product and services Analyse production capacity Assess technological capability Evaluate product line Launch new products Offer new services Make branding decisions Make packaging decisions Assess scope for partnerships, collective action and networking (bundling, joint product development, joint market development, licensing, common quality control, etc.) Set budget for this phase 7. Communications Identify target audiences Set marketing communications (or promotional) objectives Decide allocation of resources across marketing communications mix Assess scope for collaborative generic and other advertising campaigns, public relations, lobbying, joint participation in trade fairs and exhibitions, etc. Set budget for this phase, including elements for networked activities Set up evaluation procedures and allocate responsibilities for assessment of effectiveness 8. Channels Analyze channels and services provided Develop new channels (continued)

187

Table V. The SMPM plan

MIP 25,2

Steps

Actions Conduct asset and risk analysis Set benchmarks Conduct power and conict analysis, for governance choices and decisions Evaluate commercial policies analysis Conduct contractual analysis Initiate new partnerships in new and existing markets Dene functions and responsibilities within the channel Assess scope for collaboration in the network with respect to market segmentation, joint entry into unfamiliar markets, pre-empting of competition, economies of scale, joint ventures, franchising, etc. Set budget for this phase, including elements for networked activities Assess current size and structure Determine sales objectives Assess remuneration policy Evaluate supervision, motivation and training Assess scope for sharing sales forces, customer databases, training programmes, market analysis, and so on, across the network Set budget for this phase, including elements for networked activities Dene pricing objectives Conduct demand analysis Determine production costs, for company and competitors Identify pricing model(s) in use Identify price variation Assess scope for collaborative pricing within the network, to offer price incentives, increase perceived value for money, reduce price elasticity, cut cost, etc. Evaluate cost-effectiveness of pricing strategy Homologate proposed budgets for Steps 2, 6, 7, 8 and 9, and set overall marketing budget Transform plan into series of projects Allocate teams to tasks, appoint team leaders and set project deadlines Conrm budget available Set up monitoring committees, and a xed schedule of meetings to evaluate short-term, medium-term and long-term progress towards operational, tactical and strategic objectives Monitor operating environment, revising existing projects and setting up new ones as necessary Close successfully completed projects Conduct periodic strategy reviews and disseminate ndings selectively across the network

188

9. Sales force

10. Pricing

11. Budgeting 12. Management

Table V.

Managerial implications, limitations and suggestions for future research A review of the academic marketing literature shows that the conventional frameworks for marketing planning and control do not imply a collaborative network approach, but rather consider how an individual company might plan in isolation. Most furthermore adopt an operational standpoint, rather than taking the strategic view.

6 PRODUCTS DECI SIONS

12 11

Strategic marketing plans

I N T R O D U C T I O N

ENVIRONMEN TAL ANALYSIS O B J E C T I V E S S T R A T E G I E S

7 COMMUNICATIONS DECISIONS B U D G E T

8 MARKETING CHANNELS DECISIONS

COMPETITOR AND INTERNAL SITUATION ANALYSIS

9 SALES FORCE DECISIONS

M A N A G E M E N T

189

10 PRICING DECISIONS

Figure 2. The SMPM planning framework

Huge changes have take place over last 20 years, in markets, information technology, worldwide communication, environmental regulations, consumer behaviour, and the extent of globalisation. Long-term planning seems static as environmental change accelerates. The emergence of a more strategic approach to management has been the response of academics and practitioners, to address this issue. The new way of thinking could be summed up in just two words: demand driven. As companies specialize, there is an increase in the possibility of partnerships, alliances and collaborative actions, to pool core competences. In this scenario, it is important that traditional approaches to the planning can adapt to the new scenario and prepare companies for sustainable growth. The major managerial implication of the study reported in this paper is to offer to marketing academics and marketing planners a new and superior framework for the marketing planning process, capable of meeting demand-driven imperative by allowing it to become more strategic, more forward focused. Given that margins have decreased in several industries, a more rational approach is equally crucial. One solution, for which several marketing activities provide excellent scope, is the collaborative approach, offering a win-win situation to the companies involved. Companies cannot allow themselves to be isolated in the new world economy, but must nd their place in exible networks. This paper has described a systematic sequence of logical steps, comprising the SMPM framework for marketing planning, derived from the literature, the ndings of three case studies and a focus-group discussion, all in the Brazilian context. This SMPM model is new in treating the company to which it is applied as part of a network

MIP 25,2

190

and making use of inter-rm relationships at every phase of the process. There are many opportunities for collaboration among rms that operate in the same markets as competitors or suppliers of complementary products. The implementation of the plan, the management control aspect of the model, has received special attention here. The assumption is that, once this new culture permeates the organization, then a really demand-driven, long-term plan is achievable. The ndings of this study show that many rms have a considerable desire to coordinate their marketing actions, and that many have already begun to do so, even in Brazil. The main implication for managers is that more can be done with the same marketing budgets, by applying the SMPM model. Several limitations of the study need to be acknowledged. The companies studied number only three and do not operate in the same market. The study period covers the same three years but the periods of observation do not exactly coincide. Existing marketing plans were revised and developed at different times by different teams. The ten participants in the focus group were all drawn from the agribusiness sector, and it would be inappropriate to generalise the ndings too enthusiastically. In short, the study must be treated as exploratory and the conclusions as tentative. Suggested topics for future research are: application of the SMPM plan in practice, renements to the structure and sequence, deeper analysis of each step, formation and formalization of collaborative actions, and management controls for successful implementation. It would be also useful to study the creation of partnerships at a more general level, particularly with regard to mutual commitment and trust.

References Biong, H. et al. (1997), Why do some companies not want to engage in partnering relationships?, in Gemunden, G.H., Ritter, T. and Walter, A. (Eds), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 91-107. Blois, K.J. (1997), When is a relationship a relationship?, in Gemunden, H.G., Ritter, T. and Walter, A. (Eds), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 53-64. Bridgewater, S. and Egan, C. (2002), International Marketing Relationships, Palgrave/Macmillan, Basingstoke. Bucklin, L.P. and Sengupta, S. (1993), Organizing successful co-marketing alliances, Journal of Marketing, Vol. 57 No. 2, pp. 32-46. Campomar, M.C. (1983), Revisando um modelo de plano de marketing, Marketing, Vol. 17 No. 121, pp. 44-7. Cooper, J. and Lane, P. (1997), Practical Marketing Planning, Macmillan Business, London. Ford, D. (1998), Two decades of interaction, relationships and networks, in Naude, P. and Turnbull, P.W. (Eds), Network Dynamics in International Marketing, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 3-15. Gadde, L.E. and Hakansson, H. (2001), Supply Network Strategies, Wiley, New York, NY. Gemunden, H.G. and Ritter, T. (1997), Managing technological networks: the concept of network competence, in Gemunden, H.G., Ritter, T. and Walter, A. (Eds), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 294-304.

Gemunden, H.G., Ritter, T. and Walter, A. (1997), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, p. 460. Gilligan, C. and Wilson, R.M.S. (2002), Strategic Marketing Planning, Butterworth-Heinemann, Oxford. Gulati, R. (1998), Alliances and networks, Strategic Management Journal, Vol. 19 No. 4, pp. 293-317. Hakansson, H. and Snehota, I. (1998), The burden of relationships: who is next?, in Naude, P.W. and Turnbull, P. (Eds), Network Dynamics in International Marketing, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 16-25. Heide, J.B. and Miner, A.S. (1992), The shadow of the future: effects of anticipated interaction and frequency of contact on buyer-seller cooperation, Academy of Management Journal, Vol. 35 No. 2, pp. 265-91. Hertz, S. and Mattsson, L. (2001), Dynamics of contemporary international markets-strategic alliances and reconguration of network structures, Proceedings of the Conference of the European Marketing Academy, Bergen, Norway, 8-11 May. Heydebreck, P. and Maier, J.C. (1997), Need bundles of innovation-oriented services and resources, in Gemunden, H.G., Ritter, T. and Walter, A. (Eds), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 427-44. Jain, S.C. (2000), Marketing Planning & Strategy, 6th ed., Thomson Learning, Cincinnati, OH. Kotler, P. (2000), Administracao de Marketing, Prentice-Hall, Sao Paulo. Lambin, J.J. (2000), Marketing Estrategico, 4th ed., McGraw-Hill, Lisbon. Las Casas, A.L. (1999), Plano de Marketing para Micro e Pequena Empresa, Editora Atlas, Sao Paulo. Lazzarini, S.G., Chaddad, F.R. and Cook, M. (2001), Integrating supply and network analysis: the study of netchains, Journal on Chain and Network Science, Vol. 1 No. 1, pp. 7-22. McDonald, M. (2002), Marketing Plans: How to Prepare them, How to Use them, Butterworth-Heinemann, Oxford. Mattsson, L. (1997), Relationship marketing in a network perspective, in Gemunden, H.G., Ritter, T. and Walter, A. (Eds), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 37-47. Neves, M.F., Zuurbier, P. and Campomar, M.C. (2001), A model for the distribution channels planning process, Journal of Business & Industrial Marketing, Vol. 16 No. 7, pp. 518-40. Noonan, C. (1999), CIM Handbook of Export Marketing, 2nd ed., Butterworth-Heinemann, Oxford. Omta, O., Trienekens, J. and Beers, G. (2001), Chain and network science: a research framework, Journal on Chain and Network Science, Vol. 1 No. 1, pp. 1-6. Webster, F.E. Jr (1992), The changing role of marketing in the corporation, Journal of Marketing, Vol. 56 No. 3, pp. 1-17. Westwood, J. (1995), Plano de Marketing, Makron Books, Sao Paulo. Wood, M.B. (2004), Marketing Planning: Principles into Practice, Prentice-Hall, Harlow. Wright, P., Kroll, M.K. and Parnell, J. (2000), Administracao Estrategica: Conceitos, Atlas, Sao Paulo.

Strategic marketing plans

191

MIP 25,2

Further reading Brennan, R. and Turnbull, P.W. (1997), The process of adaptation in inter-rm relationships, in Gemunden, H.G., Ritter, T. and Walter, A. (Eds), Relationships and Networks in International Markets, Pergamon International Business and Management, Elsevier Science, Oxford, pp. 65-80. Corresponding author Marcos Fava Neves can be contacted at: mfaneves@usp.br

192

To purchase reprints of this article please e-mail: reprints@emeraldinsight.com Or visit our web site for further details: www.emeraldinsight.com/reprints

Potrebbero piacerti anche

- Pilot'S Operating Handbook: Robinson Helicopter CoDocumento200 paginePilot'S Operating Handbook: Robinson Helicopter CoJoseph BensonNessuna valutazione finora

- PartitionDocumento5 paginePartitionKotagiri AravindNessuna valutazione finora

- Concrete For Water StructureDocumento22 pagineConcrete For Water StructureIntan MadiaaNessuna valutazione finora

- Benchmarking for Businesses: Measure and improve your company's performanceDa EverandBenchmarking for Businesses: Measure and improve your company's performanceNessuna valutazione finora

- Chapter Two Complexity AnalysisDocumento40 pagineChapter Two Complexity AnalysisSoressa HassenNessuna valutazione finora

- What To Benchmark - A Systematic Approach and CasesDocumento12 pagineWhat To Benchmark - A Systematic Approach and CasesJorsant EdNessuna valutazione finora

- Competive Analysis IntroDocumento5 pagineCompetive Analysis IntromathiyazhaganNessuna valutazione finora

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocumento11 paginePaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- Delta PresentationDocumento36 pagineDelta Presentationarch_ianNessuna valutazione finora

- Lean Six SigmaDocumento14 pagineLean Six Sigmababudukku100% (10)

- A Study of Marketing Strategy of HavellsDocumento30 pagineA Study of Marketing Strategy of HavellsKaran Dev Singh100% (3)

- The Financial Impact of CRM ProgrammesDocumento15 pagineThe Financial Impact of CRM ProgrammesPrabhu ReddyNessuna valutazione finora

- Literature Review of Marketing Strategy ManagementDocumento8 pagineLiterature Review of Marketing Strategy ManagementtwfmadsifNessuna valutazione finora

- Putang Ina - 5-AbstractDocumento3 paginePutang Ina - 5-AbstractSurprised MotherfuckerNessuna valutazione finora

- Addisu Mkting Article RVWDocumento5 pagineAddisu Mkting Article RVWdanielNessuna valutazione finora

- Journal of Services MarketingDocumento12 pagineJournal of Services MarketingI Putu Eka Arya Wedhana TemajaNessuna valutazione finora

- Review For OR Research PaperDocumento5 pagineReview For OR Research Paperdaksh.agarwal180Nessuna valutazione finora

- Sample Thesis ChapterDocumento4 pagineSample Thesis Chapterjedidia15Nessuna valutazione finora

- Planning of Marketing Communication Strategies by Car Dealer ShipsDocumento11 paginePlanning of Marketing Communication Strategies by Car Dealer ShipsvehiclesalesbeaekaNessuna valutazione finora

- Purpose F 2016Documento5 paginePurpose F 2016samuel tilahunNessuna valutazione finora

- 838-Article Text-5111-7476-10-20191210Documento12 pagine838-Article Text-5111-7476-10-20191210AmanNessuna valutazione finora

- Chapter One 1.1 Back Ground of The StudyDocumento40 pagineChapter One 1.1 Back Ground of The StudyAmir sabirNessuna valutazione finora

- Strategic Marketing Planning: A Grounded Investigation: Nicholas J. AshillDocumento31 pagineStrategic Marketing Planning: A Grounded Investigation: Nicholas J. AshillGustavo EchevarriaNessuna valutazione finora

- Metrics EvolutionDocumento29 pagineMetrics EvolutionAri TristiantoNessuna valutazione finora

- Supply Chain AssignmentDocumento12 pagineSupply Chain AssignmentAjithNessuna valutazione finora

- Unit IV Marketing ResearchDocumento8 pagineUnit IV Marketing ResearchKurikuriNessuna valutazione finora

- McDonald-Market Segmentation EJMDocumento26 pagineMcDonald-Market Segmentation EJMmabdulazeez01100% (1)

- Marketing Mix Modeling For The Tourism Industry-A Best Practices ApproachDocumento15 pagineMarketing Mix Modeling For The Tourism Industry-A Best Practices ApproachOmkar VedpathakNessuna valutazione finora

- Positioning, Product and Pricing (1) WordDocumento33 paginePositioning, Product and Pricing (1) WorddaritiNessuna valutazione finora

- Marketing Strategy Thesis SampleDocumento7 pagineMarketing Strategy Thesis Sampleserenabrowncincinnati100% (2)

- Notes Airline & Airport Marketing Management 2408Documento44 pagineNotes Airline & Airport Marketing Management 2408Anirudh K NNessuna valutazione finora

- Idic ModelDocumento12 pagineIdic ModelBhosx KimNessuna valutazione finora

- Lit Rev FullDocumento8 pagineLit Rev FullAYSHA JASRA AJWADNessuna valutazione finora

- Marketing Strategy Thesis PaperDocumento5 pagineMarketing Strategy Thesis Paperjpwvbhiig100% (1)

- Development of An Intelligent Decision Support System For Benchmarking Assessment of Business PartnersDocumento20 pagineDevelopment of An Intelligent Decision Support System For Benchmarking Assessment of Business PartnersSalmanyousafbandeshaNessuna valutazione finora

- Marketing Mini ProjectDocumento21 pagineMarketing Mini Projectsrividya balajiNessuna valutazione finora

- Ce Evaluation in Collaborative DesignDocumento18 pagineCe Evaluation in Collaborative DesignChariz AudreyNessuna valutazione finora

- Improving Warehouse Productivity: WarehousingDocumento14 pagineImproving Warehouse Productivity: WarehousingEllah Mae Cao - CasitasNessuna valutazione finora

- Role of Shared Information Systems in Distribution ChannelsDocumento7 pagineRole of Shared Information Systems in Distribution ChannelsSatish_Kumar_4711Nessuna valutazione finora

- Research Paper: V.Navaneethan (07MBI058) 07-Dec-11Documento7 pagineResearch Paper: V.Navaneethan (07MBI058) 07-Dec-11Naveen NavaNessuna valutazione finora

- And Heightened Communication Described As "Two Way Street." The Intent of The HeightenedDocumento3 pagineAnd Heightened Communication Described As "Two Way Street." The Intent of The Heightenedujjal khanNessuna valutazione finora

- The Role of Multichannel Integration in CRMDocumento12 pagineThe Role of Multichannel Integration in CRMSixto Lira GuzmanNessuna valutazione finora

- Literature Review On Marketing Strategy PDFDocumento7 pagineLiterature Review On Marketing Strategy PDFfuhukuheseg2100% (1)

- Mukiwa Contemporary Issue in Marketing Model AnswersDocumento8 pagineMukiwa Contemporary Issue in Marketing Model AnswersMadalitso MukiwaNessuna valutazione finora

- A Study On Analysing The Impact of Marketing On The Sales Performance of The Company Ijariie16206Documento8 pagineA Study On Analysing The Impact of Marketing On The Sales Performance of The Company Ijariie16206Amit PaulNessuna valutazione finora

- Strategic Management of Declining Industries - A Literature ReviewDocumento7 pagineStrategic Management of Declining Industries - A Literature Reviewc5r9j6zjNessuna valutazione finora

- Media ROI Measurement & Spend Optimization For Global Beverage BrandsDocumento12 pagineMedia ROI Measurement & Spend Optimization For Global Beverage BrandsNiraj AgrawalNessuna valutazione finora

- Sales & Operations Planning: An Exploratory Study and FrameworkDocumento46 pagineSales & Operations Planning: An Exploratory Study and Frameworkranga.ramanNessuna valutazione finora

- AR ProjectDocumento5 pagineAR Projectgs adminNessuna valutazione finora

- III. RelevanceDocumento4 pagineIII. RelevanceGet BurnNessuna valutazione finora

- Excellence in Communicating Organizational Strategy: An IntroductionDocumento0 pagineExcellence in Communicating Organizational Strategy: An IntroductionjibranqqNessuna valutazione finora

- Value Chain Analysis and Competitive Advantage: Prescott C. EnsignDocumento25 pagineValue Chain Analysis and Competitive Advantage: Prescott C. Ensignsitisinar dewiameliaNessuna valutazione finora

- Estimating Benefi Ts of Demand Sensing For Consumer Goods OrganisationsDocumento17 pagineEstimating Benefi Ts of Demand Sensing For Consumer Goods OrganisationsIsmael SotoNessuna valutazione finora

- Thesis Marketing AutomationDocumento5 pagineThesis Marketing Automationheatheredwardsmobile100% (1)

- Journal of ResearchDocumento23 pagineJournal of ResearchTatyana KOVPAKNessuna valutazione finora

- An IntraDocumento16 pagineAn IntraUnachittranjan KumarNessuna valutazione finora

- Anatomy of Internet Marketing MixDocumento5 pagineAnatomy of Internet Marketing MixmgambettaNessuna valutazione finora

- Strategy Development Processes As Determinants of B2B E-Commerce Performance A Comparative Model in A Supply Chain Management ContextDocumento25 pagineStrategy Development Processes As Determinants of B2B E-Commerce Performance A Comparative Model in A Supply Chain Management ContextMoh SaadNessuna valutazione finora

- Strategies For Social Media: Linking Vision, Mission and Goals With MetricsDocumento8 pagineStrategies For Social Media: Linking Vision, Mission and Goals With Metricstelloy3kNessuna valutazione finora

- Harmonising Strategic Marketing and Finance: Accounting ArticleDocumento4 pagineHarmonising Strategic Marketing and Finance: Accounting ArticleMustajab HaiderNessuna valutazione finora

- Article in Press: The Asian Journal of Shipping and LogisticsDocumento11 pagineArticle in Press: The Asian Journal of Shipping and Logisticsaisyah nsNessuna valutazione finora

- Thesis On Marketing Mix StrategiesDocumento8 pagineThesis On Marketing Mix Strategiesamberrodrigueznewhaven100% (1)

- Abstract ImcDocumento6 pagineAbstract ImcPrateek SinghNessuna valutazione finora

- 07 Supply-Chaiscn Operating ModelDocumento6 pagine07 Supply-Chaiscn Operating ModelAbhishek GangwarNessuna valutazione finora

- New Microsoft Word DocumentDocumento33 pagineNew Microsoft Word DocumentRaminder Singh100% (1)

- Marketing and Logistics Strategy The IntDocumento5 pagineMarketing and Logistics Strategy The IntShahira IbrahimNessuna valutazione finora

- Praksa Je PokazalaDocumento9 paginePraksa Je PokazalaVladimirNataša NatašaVladimirNessuna valutazione finora

- Marketing ManagementDocumento64 pagineMarketing Managementjagadishprasad100% (1)

- Customer Targeting and Acquisition: Essential Foundations of Loyalty and ProfitabilityDocumento22 pagineCustomer Targeting and Acquisition: Essential Foundations of Loyalty and Profitability1ayanshaikhNessuna valutazione finora

- Distributed Scheduling To Support A Call Centre: A Co-Operative Multi-Agent ApproachDocumento26 pagineDistributed Scheduling To Support A Call Centre: A Co-Operative Multi-Agent Approach1ayanshaikhNessuna valutazione finora

- Career Path 111Documento1 paginaCareer Path 111ezhilmanickamNessuna valutazione finora

- Call CentreDocumento42 pagineCall Centre1ayanshaikh100% (1)

- VISCOROL Series - Magnetic Level Indicators: DescriptionDocumento4 pagineVISCOROL Series - Magnetic Level Indicators: DescriptionRaduNessuna valutazione finora

- CPE Cisco LTE Datasheet - c78-732744Documento17 pagineCPE Cisco LTE Datasheet - c78-732744abds7Nessuna valutazione finora

- INTERNSHIP PRESENTATION - Dhanya - 2020Documento16 pagineINTERNSHIP PRESENTATION - Dhanya - 2020Sanitha MichailNessuna valutazione finora

- Gis Tabels 2014 15Documento24 pagineGis Tabels 2014 15seprwglNessuna valutazione finora

- Dmta 20043 01en Omniscan SX UserDocumento90 pagineDmta 20043 01en Omniscan SX UserwenhuaNessuna valutazione finora

- WhatsApp Chat With JioCareDocumento97 pagineWhatsApp Chat With JioCareYásh GúptàNessuna valutazione finora

- PlsqldocDocumento21 paginePlsqldocAbhishekNessuna valutazione finora

- Manuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Documento46 pagineManuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Franzis Jayke BatallantesNessuna valutazione finora

- Tindara Addabbo, Edoardo Ales, Ylenia Curzi, Tommaso Fabbri, Olga Rymkevich, Iacopo Senatori - Performance Appraisal in Modern Employment Relations_ An Interdisciplinary Approach-Springer Internationa.pdfDocumento278 pagineTindara Addabbo, Edoardo Ales, Ylenia Curzi, Tommaso Fabbri, Olga Rymkevich, Iacopo Senatori - Performance Appraisal in Modern Employment Relations_ An Interdisciplinary Approach-Springer Internationa.pdfMario ChristopherNessuna valutazione finora

- Certification and LettersDocumento6 pagineCertification and LettersReimar FerrarenNessuna valutazione finora

- A CMOS Current-Mode Operational Amplifier: Thomas KaulbergDocumento4 pagineA CMOS Current-Mode Operational Amplifier: Thomas KaulbergAbesamis RanmaNessuna valutazione finora

- Lemon AidDocumento17 pagineLemon AidJade Anne Mercado BalmesNessuna valutazione finora

- ISP Flash Microcontroller Programmer Ver 3.0: M Asim KhanDocumento4 pagineISP Flash Microcontroller Programmer Ver 3.0: M Asim KhanSrđan PavićNessuna valutazione finora

- Soneri Bank Compensation PolicyDocumento20 pagineSoneri Bank Compensation PolicySapii MandhanNessuna valutazione finora

- Minor Ailments Services: A Starting Point For PharmacistsDocumento49 pagineMinor Ailments Services: A Starting Point For PharmacistsacvavNessuna valutazione finora

- ReviewerDocumento2 pagineReviewerAra Mae Pandez HugoNessuna valutazione finora

- Journal of Economic LiteratureDocumento28 pagineJournal of Economic LiteratureEkoKurniadiNessuna valutazione finora

- FBW Manual-Jan 2012-Revised and Corrected CS2Documento68 pagineFBW Manual-Jan 2012-Revised and Corrected CS2Dinesh CandassamyNessuna valutazione finora

- Durga Padma Sai SatishDocumento1 paginaDurga Padma Sai SatishBhaskar Siva KumarNessuna valutazione finora

- Customer Satisfaction-ICICI Bank-Priyanka DhamijaDocumento85 pagineCustomer Satisfaction-ICICI Bank-Priyanka DhamijaVarun GuptaNessuna valutazione finora

- Floor Paln ModelDocumento15 pagineFloor Paln ModelSaurav RanjanNessuna valutazione finora

- Tenancy Law ReviewerDocumento19 pagineTenancy Law ReviewerSef KimNessuna valutazione finora

- MBA - Updated ADNU GSDocumento2 pagineMBA - Updated ADNU GSPhilip Eusebio BitaoNessuna valutazione finora

- Question Paper: Hygiene, Health and SafetyDocumento2 pagineQuestion Paper: Hygiene, Health and Safetywf4sr4rNessuna valutazione finora