Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

26

Caricato da

sharathk916Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

26

Caricato da

sharathk916Copyright:

Formati disponibili

MODEL EXAMINATION 2011

Part III Score : 60 HSE( II) Time: 2 Hrs. ACCOUNTANCY WITH COMPUTERISED ACCOUNTING Part-A Accounting

1. Fill in the blanks :Bank Account (Furniture realized on dissolution ) Dr. 8500 8500

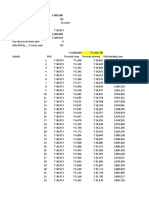

(score - 1) 2. Malappuram Ltd. Purchased machinery costing Rs.99000. It was agreed that the purchase consideration be paid by issue of 15% debentures of Rs.100 each. Assume debentures have been issued at a discount of 10%. Pass necessary journal entries. (score - 1) 3. (a) Rahim and Suresh are equal partners. Rahim got a govt. job. So decided to dissolve their business on 31.1.2011. (b) John and Jaffer are partners sharing profits and losses in the ratio 5:2. They decided to rearrange their profits in the ratio of 3:4. Identify the above type of dissolution and also discuss the difference between these two types of dissolution. (score - 2) 4. M/s Marble Brothers closed their business on 31.12.2010. The balance of capital accounts and general reserve are given below. Capital account :Abraham 40500 Msuthafa 32250 General reserve -- 20000 Their realization account is as follows :Realisation account Particulars Assets Bank Rs. 195000 55000 Particulars Liabilities workmens compensation Bank Abrahams capital - 1000 Musthafas capital - 1000 Rs. 60000 8000 18000 2000 250000 ======= (score - 3) 1

250000 ======= Prepare Capital accounts from the above information.

5. Ramu and Raju are partners in a firm. Ramu withdrew Rs.4000 at the beginning of every month. Raju withdrew Rs.3600 during the year at the middle of every month. According to the partnership agreement interest on drawings to be charged @ 10% p.a. Calculate interest on drawings using appropriate formula. (score - 3) 6. Give journal entries for the issue and redemption of debentures:(i) Issued 4000 12% debentures of Rs.100 each at a premium of 5% and redeemable at par. (ii) Issued 4000 12% debentures of Rs. 100 each at a discount of 3% and redeemable at 5% premium. (score - 4) 7. A,B and C are partners in the ratio of 3:2:1. B retires as per the agreement. For this purpose, goodwill is valued at 2 years purchases of average profits of last three years. The profits for the last three years are as under:First year - Rs.15000 Second year - Rs.19000 Third year - Rs.20000 Record necessary journal entries for goodwill on retirement of B (score - 4) 8. Ajith and Abijith are partners in a firm sharing Profit and Loss in the ratio of 2:1. As on 1.4.2009 the balances on their capital accounts were Rs.50,000, Rs.25,000 respectively. Their current account for the year 2009-10 is given below:Partners current account Ajith Abijith Particulars 40000 2000 By Balance 125 75 Salary 16875 13225 Commission Interest on capital P/L appropriation 21000 15300

Particulars To Drawings Interest on drawings Balance c/d

Ajith 10000 6000 ---3200 1800 21000

Abijith 8000 ---4000 2400 900 15300

Now they decided to maintain their capital accounts under fluctuating capital method. Help them to prepare the capital accounts for the year 2009-10 under this method. Also find the net profit or loss of the firm during the financial year 2009-10 as per profit and loss account. (score - 4) 9. Raju and Saju are partners in a small firm. They had been sharing profits and losses equally. They decide to change their profit sharing ratio to 3:2 from the next year. They increase the value of buildings by Rs.30,000 and decrease machinery by Rs.12,000 before change in profit sharing. What is the profit on revaluation. Give entries for revaluation and prepare the revaluation account. (score - 4)

10. Alfa Ltd. Co. issues 25,000 shares at Rs.10 each. Applications received for 20,000 shares. The money collected as follows: On Application Rs.2 On allotment Rs.3 On First Call Rs.3 On Second and First Call - balance amount All the amounts due were received except the final call money on 800 shares. These shares were forfeited. Pass necessary journal entries in the books of the company to record the above share capital transactions. (Score 6) 11a. Ramu and Raju are partners sharing profit in the ratio of 6:3. The balance sheet of the firm on 31st march 2009 is as follows:Balance sheet Liabilities Creditors Bills Payable Reserve Fund Capital :Ramu Raju Rs. 31000 25000 4000 75000 60000 Assets Cash in hand Rs. 5000

Bank 45000 Machinery 15000 Debtors 25000 Less Provision 3000 22000 Stock 20000 Furniture 15000 Land & Buildings 65000 P/L Account 8000

195000 195000 ====== ====== th They admit Sajeer for 1/8 share on the following terms:1. Sajeev is to bring Rs.40,000 as capital and brings his share of goodwill Rs.25,000 2. Stock is revalued at Rs.23,000. 3. Provision for Bad debt is required at Rs.4,600 4. Land & Building is revalued at Rs.68,000 5. Furniture and Machinery be depreciated by 10% 6. There was a joint life policy of Rs.40,000 having a surrender value of Rs. 6,000 on the date of admission. 7. Creditors of Rs.7,000 are recorded in the stock register has not been recorded in the books of account. You are required to prepare necessary ledger accounts and Balance Sheet of the new firm. OR 11b. A company offered 1,00,000 shares of Rs.10 each to the public on the following terms. Rs.3 payable on application, Rs.4 on allotment, the balance as and when required. Appliactions were received for 1,40,000 shares. Allotment was made as under : 80,000 applications were given 80,000 shares 50,000 applications were given 20,000 shares 10,000 applications - Nil 3

Application money is to be applied towards allotment and balance beyond that is to be returned. A share holder who applied for 1000 shares and was given 1000 shares failed to pay the allotment money. His shares were forfeited. And the directors decided to re-issue the shares at Rs.8 per share as fully paid. Pass necessary journal entries. (score - 8)

Part-B Computerised Accounting

1. The functional key used to get the detailed balance sheet on display of the balance sheet. a) F2 b) F1 c)F5 d)F11 (score - 1) 2. Credit purchase of furniture is entered through ----------- voucher. a)contra b) journal c)purchase d)payment (score - 1) 3. Customers accounts are opened under -------- account. (score - 1) 4. An excel file is called a ---------(score - 1) 5. Based on the given hint, fill the blanks Hint : Buildings = Fixed Assets a) Drawings = ------------b) Depreciation = ------------c) Closing Stock = ------------d) Wages = ------------e) Purchase return = ------------f) Sales Tax = ------------(score 3) 6. Write the formula or command for the following calculations to be performed through MS EXCEL, based on the details given below. CELL A1 B1 C1 D1 E1 Content NAME B.P DA (25% of HRA (10% of GROSS B.P) B.P) PAY a) DA in C2 b) HRA in D2 c) Gross pay in E2

(score - 3) 7. Enter the details of ledger creation and voucher entry for the following transactions in the given table. a) Commenced business with cash. b) Purchased Machinery from Star Traders on Credit. c) Sold goods to Santhosh. d) Paid Salary. Sl.No. Ledgers to be Created Under Voucher Type

(score 4) 8. A. Explain the procedure to display the Final Accounts by considering any 6 imaginary transcation. OR B. Mr. Ramkumar found that the balance as shown by his cash book not agrees with that of the bank pass book. Explain to him the procedure needed to agree both the balances by using Tally. (score 6) -----------------------------------------------------------------4

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Model Question Paper: EconomicsDocumento3 pagineModel Question Paper: Economicssharathk916Nessuna valutazione finora

- 2 25 EconomicsDocumento3 pagine2 25 Economicssharathk916Nessuna valutazione finora

- System Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 EconomicsDocumento6 pagineSystem Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 Economicssharathk916Nessuna valutazione finora

- 2 25 EcosyrDocumento5 pagine2 25 Ecosyrsharathk916Nessuna valutazione finora

- 4Documento4 pagine4sharathk916Nessuna valutazione finora

- 2 25 EconomicsDocumento3 pagine2 25 Economicssharathk916Nessuna valutazione finora

- EconomicsDocumento5 pagineEconomicssharathk916Nessuna valutazione finora

- Higher Secondary Model Examination-February 2011: EconomicsDocumento5 pagineHigher Secondary Model Examination-February 2011: Economicssharathk916Nessuna valutazione finora

- 30Documento4 pagine30sharathk916Nessuna valutazione finora

- Accountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)Documento43 pagineAccountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)sharathk916Nessuna valutazione finora

- 1Documento62 pagine1sharathk916Nessuna valutazione finora

- 1Documento6 pagine1sharathk916Nessuna valutazione finora

- Model Evaluation February 2011 AccountingDocumento4 pagineModel Evaluation February 2011 Accountingsharathk916Nessuna valutazione finora

- 29Documento3 pagine29sharathk916Nessuna valutazione finora

- TH TH STDocumento3 pagineTH TH STsharathk916Nessuna valutazione finora

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocumento3 pagineGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916Nessuna valutazione finora

- 24Documento4 pagine24sharathk916Nessuna valutazione finora

- Higher Secondary Examination March 2011: Accoutancy With Computerised AccountingDocumento2 pagineHigher Secondary Examination March 2011: Accoutancy With Computerised Accountingsharathk916Nessuna valutazione finora

- 25Documento6 pagine25sharathk916Nessuna valutazione finora

- 22Documento5 pagine22sharathk916Nessuna valutazione finora

- 16Documento4 pagine16sharathk916Nessuna valutazione finora

- 20Documento7 pagine20sharathk916Nessuna valutazione finora

- 17Documento3 pagine17sharathk916Nessuna valutazione finora

- Cluster Centre MGM HSS: Prepared byDocumento6 pagineCluster Centre MGM HSS: Prepared bysharathk916Nessuna valutazione finora

- 12Documento3 pagine12sharathk916Nessuna valutazione finora

- 15Documento5 pagine15sharathk916Nessuna valutazione finora

- 8Documento2 pagine8sharathk916Nessuna valutazione finora

- 11Documento2 pagine11sharathk916Nessuna valutazione finora

- Model Examination Feb 2010-2011: Computerised AccountingDocumento3 pagineModel Examination Feb 2010-2011: Computerised Accountingsharathk916Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PledgeDocumento9 paginePledgeMel Manatad100% (1)

- Questions FinanceDocumento5 pagineQuestions FinanceallhomeworktutorsNessuna valutazione finora

- Floreindo v. MetrobankDocumento1 paginaFloreindo v. MetrobankSarah Jane UsopNessuna valutazione finora

- Flora Vs PradoDocumento6 pagineFlora Vs Pradobloome9ceeNessuna valutazione finora

- Coinage and Money in The Latin Empire of ConstantinopleDocumento11 pagineCoinage and Money in The Latin Empire of ConstantinopleByzantine Philology100% (1)

- Overview of Fusion Payables.V1Documento42 pagineOverview of Fusion Payables.V1Suresh Chandrashekhar MishraNessuna valutazione finora

- Bank ReconciliationDocumento10 pagineBank ReconciliationYogun BayonaNessuna valutazione finora

- Banking ReviewerDocumento81 pagineBanking ReviewerApril Gan CasabuenaNessuna valutazione finora

- Accounting Problem Book 2011 PDFDocumento103 pagineAccounting Problem Book 2011 PDFViệt Đức Lê67% (3)

- AgreementDocumento2 pagineAgreementItsumo AmorNessuna valutazione finora

- Green Finance Study - 2016 - MyanmarDocumento27 pagineGreen Finance Study - 2016 - MyanmarTHAN HANNessuna valutazione finora

- The Banko Sentral NG PilipinasDocumento37 pagineThe Banko Sentral NG PilipinasJustice PajarilloNessuna valutazione finora

- Research OjtDocumento17 pagineResearch Ojtsherraine aurellano86% (7)

- Republic Glass Corp Vs Qua 144413Documento19 pagineRepublic Glass Corp Vs Qua 144413JamesAnthonyNessuna valutazione finora

- Bills of Exchange ProjectDocumento7 pagineBills of Exchange ProjectNishaTambe100% (1)

- 6.1.6 PracticeDocumento2 pagine6.1.6 PracticeKyrieSwervingNessuna valutazione finora

- Appointment of TrusteeDocumento2 pagineAppointment of Trusteedrno69Nessuna valutazione finora

- Dbms LabDocumento3 pagineDbms Labanpsg1431139Nessuna valutazione finora

- JCI World CongressDocumento1 paginaJCI World CongressJCINessuna valutazione finora

- Toys "R" Us, Inc.: United States Securities and Exchange Commission FORM 10-QDocumento38 pagineToys "R" Us, Inc.: United States Securities and Exchange Commission FORM 10-QAdam Miguel LopezNessuna valutazione finora

- EMI Prepayment CalculatorDocumento17 pagineEMI Prepayment Calculatorashish 123Nessuna valutazione finora

- Impact of Micro FinanceDocumento61 pagineImpact of Micro FinancePerry Arcilla SerapioNessuna valutazione finora

- NJ PersDocumento58 pagineNJ PersHPAE5094Nessuna valutazione finora

- The Investment Environment - Topic OneDocumento39 pagineThe Investment Environment - Topic OneRita NyairoNessuna valutazione finora

- Ceo AssignmentDocumento17 pagineCeo AssignmentANINDA NANDINessuna valutazione finora

- PROP Set 1 Cases Art. 414-418 PDFDocumento63 paginePROP Set 1 Cases Art. 414-418 PDFIris MendiolaNessuna valutazione finora

- Philippine National Bank, Plaintiff-Appellant, vs. Jose C. ZuluetaDocumento46 paginePhilippine National Bank, Plaintiff-Appellant, vs. Jose C. ZuluetaLavin AguilarNessuna valutazione finora

- Browerville Blade - 12/08/2011Documento12 pagineBrowerville Blade - 12/08/2011bladepublishingNessuna valutazione finora

- DepreciationDocumento19 pagineDepreciationVishal ShahNessuna valutazione finora

- Noc TCFPL0453000010004925 20102018 1540022971670 PDFDocumento1 paginaNoc TCFPL0453000010004925 20102018 1540022971670 PDFShuvabrata GanaiNessuna valutazione finora