Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Check Your Eligibility For Challenge Pathway/direct CFP Exam 5/final

Caricato da

keyur1975Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Check Your Eligibility For Challenge Pathway/direct CFP Exam 5/final

Caricato da

keyur1975Copyright:

Formati disponibili

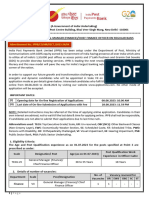

Dear CFP Aspirant, Professional with having min.

5 years of work experience (financial or non financial) with professional Qualification like (III Licensiate/Associate, MBA, Postgraduate,Intermediate CA, LLB, CAIIB etc.-exhausive list attached) is an eligible for CFP Exam 5/Final/AFP or challenge pathway registration. 1) Eg. MBA (other than finance) with IRDA/AMFI certification is an eligible for challenge pathway registration provided 5 year of work exp. 2) Independent Financial Advisors (IFAs/LIC advisors) with 5 year work exp and III Licensiate/Post Graduate (commerce, economics etc.) is and eligible for challenge pathway registration. 3) MBA (Finance) in distance learning is also eligible. CFP Exam 5/AFP/Final is an exhaustive Case Study based exam which is divided in two categories. 1) Inflation adjusted Goal Corpus calculation and Finding Investment Required(Monthly/Annual/Limited Years/Lump Sum)-50% weightage 2) 5 Modules (Investment/Tax planning/Insurance/Retirement/Intro.)-50% weightage

In Module Exams, 20% weight age is Intro. FP (basic Knowledge required of all modules + Code of Ethics + Practice Guideline).

The CFP Certification is attracting the attention of a wide cross section of the student and professional community in India. There have been expressions of interest from professionals as diverse as

CM

Chartered Accountants, Masters of Business Administration, Engineers etc. as well as from persons employed with some of the biggest financial service organizations in the country. However, such expressions of interest have not always translated into registrations for the course due to the apprehension that their hectic schedules will not permit them to devote adequate time for academics.

FPSB India recognizes that these professionals already possess certain skill sets and proficiency which is expected of Financial Planners. Hence, in order to enable eligible professionals (both in terms of education as well as experience) to acquire the CFP Certification in a more time efficient manner, FPSB India has introduced a fast track Certification Program in line with global certification practices which

CM

has been christened as Challenge Status Program.

Qualification Criteria

Only candidates who are Graduates from a Recognized University and having the following additional Educational Qualifications or equivalent would be eligible under the Challenge Status Program:

S.No. 1 2 3 4 5 6 7 8 9 10 11 12

Name of the Qualification Chartered Accountant (CA) / Intermediate level from Institute of Chartered Accountants of India (ICAI) Chartered Financial Analyst (CFA) from CFA Institute, USA Cost Accountant (ICWA) from the Institute of Cost and Works Accountants of India (ICWAI) Certified Associate of Indian Institute of Bankers (CAIIB) PhD./ M.Phil in Economics, Econometrics, Statistics, Commerce, Mathematics, Finance, Management, Financial Planning/ Advising, Investment (or any other similar discipline) Post Graduate1 in Economics, Econometrics, Statistics, Commerce, Mathematics, Finance, Management 2, Financial Planning/ Advising, Investment (or any other similar discipline) LLB (Law) or equivalent Licentiate/Associate/ Fellowship of Life Insurance from Insurance Institute of India Actuary from Institute of Actuaries of India Civil Service Examinations by Union Public Service Commission (UPSC)3 Company Secretary from Institute of Company Secretaries of India. Fellow, Financial Services Institute (FFSI) / Fellow, Life Management Institute (FLMI)from LOMA

1. Candidates with Post Graduation in Management (other than Finance) qualifications need to have compulsory SEBI/ IRDA mandated Certification as well.

2. Post Graduation qualification implies at least two years of full time education in an education institution: Alternatively equivalence as recognized by appropriate statutory authority viz. UGC/AICTE etc. as Post Graduation qualification (deemed) may also be considered.

3. Candidates having cleared the Civil Service Examinations (Mains) conducted by Union Public Service Commission (UPSC) in the prescribed subjects viz. Commerce, Engineering, Economics, Law, Mathematics, Management, Physics and Statistics and having at least 3 years work experience OR candidates having cleared the Services Examinations conducted by Union Public Service Commission (UPSC) and having at least 3 years work experience in Accounts, Finance and related Departments shall also be eligible to appear for the Challenge Status Program.

Advanced Wealth Management Course from IIBF: FPSB India has entered into a Memorandum of Understanding with Indian Institute of Banking and Finance (IIBF) allowing the candidates who have successfully cleared IIBFs Advanced Wealth Management Course to attain CFP Certification through the Challenge Status Program.

CM

Experience Criteria

A candidate is required to provide a valid proof of one's adequate experience (3 years or 5 years, as described below) prior to applying for Advanced Financial Planning exam (Exam 5) under Challenge Status Pathway along with proof of having completed a higher qualification than a Graduate, viz. a Post Graduate qualification in select specified streams or a specified professional qualification. In respect of the pre-requirement of adequate experience in the CSP, a candidate may be categorized as working in a Financial Institution or Corporate entity engaged in financial services. Here also the candidate should be engaged in core financial services identified by the abilities under any one of the six components of Financial Planning, viz. Financial Management, Asset Management, Risk Management or Insurance Planning, Tax Planning, Retirement Planning and Estate Planning. Three years' prior experience is considered as adequate for eligibility under CSP for such candidates. A candidate working in a Financial Institution or Corporate entity engaged in financial services may, however, be engaged in 'other financial services'1 not specifically identifiable by the abilities under any one of the six components of Financial Planning. Similarly, a candidate may be working for a Corporate entity not engaged in financial services (viz. it can be a company engaged in manufacturing, services, etc.), but he/she may be posted in the finance department of the company dealing with one or more of 'other financial services'1. Such candidate shall be required to have five years' prior experience to be considered as adequate for eligibility under CSP.

Experience criteria for candidates applying through CSP are illustrated in the following table:

Category

Nature of Corporate

Experience Sector One of the six Financial Planning components Other Financial Services Other Financial Services Financial Planning Services, or one or more Financial Planning components Other Financial Services

Years of Experience 3 Years

Requirement of having completed the Experience criterion for CSP Prior Experience before applying for CSP

Financial Services Corporate NonFinancial Services

5 Years

Prior Experience before applying for CSP

5 Years

Prior Experience before applying for CSP

-Self Employed --

3 Years

Prior Experience before applying for CSP

5 Years

Prior Experience before applying for CSP

Other Financial Services

a. b. c. d. e.

Accounting including Fund Accounting in collective investment schemes and Audit Financial Consulting, or Intermediation in Financial/Investment Products Stock broking and trading services Journalism in Personal Finance Corporate Finance

Verification of Work Experience

All work experience related documents should be supported by evidence and certificates duly attested by a Gazetted Officer or Notary Public appointed by a State Government or Central Government. The candidates employed with banks, financial institutions and Charter Member organizations of FPSB India can get the documents attested by their Head - HRD. If, at any time prior to or after conferring the certification, it is found that the work experience certificates are not authentic and information provided is false, the Board reserves the right to reject the respective application or cancel the certification and forfeit the certification fees, such forfeiture of fees not being limitation of any other action foreseen by the Board. The Board reserves the right of determining acceptable work experience and may call candidates (at their own expense) for an interview. The decision made thereafter by the Board is final.

The following is an indicative list of evidence to be provided by a candidate forwarding his/her portfolio under unsupervised work experience:

Sufficient number (at least ten) of real Financial Plans made for clients which cover four or more Financial Planning Components. (Considered as Strong evidence) Statements of customized Retirement solution; financial projection to fund retirement expenses and strategies to meet shortfall; Net Worth current as well as at different points such as retirement and bequeathing; Cash flow management; Risk covers life and assets, optimum risk covers and gap analysis; Risk profiling of client; Ascertaining client's risk appetite and risk tolerance; Exposure to financial risk; Optimum asset allocation and investment strategies planned for various goals; Analysis of investment portfolio and rebalancing strategies; determination of return band-width, required rate of return to meet a certain goal and choice of appropriate investment instruments; Determining Client's current, deferred and future tax liabilities; taxability of assets and liabilities at different strategic points; evaluation of existing tax strategies and their financial impact; various cost-benefit analyses of a client's tax management options in overall tax planning strategy; assessment of liquidity of estate at death; relative advantages and disadvantages of each estate planning strategy for a client; detailed implementable estate planning strategies with analysis of specific needs of beneficiaries, etc. (Considered as Strong evidence when they collectively cover all six Financial Planning Components of at least ten clients in the subject experience period)

Candidate having experience in Financial sectors, will have to provide a short job description of the profile been handled which need not be attested.

Fee Structure for Challenge Status Program

S.No. 1 2 FPSB India

Challenge Status Route

Fees 19101.20 16854

Fees Includes Registration Fees valid for 1 year, Basic Study Material, Administration & Processing Fees Registration Fees valid for 1 year, Administration & Processing Fees

Education Partner

3 4

IIBF-Advanced Wealth Management Course Charter Member (Extended Special Offer)

5618 2247.20

Registration Fees valid for 1 year, Administration & Processing Fees Registration Fees valid for 1 year, Administration & Processing Fees

Potrebbero piacerti anche

- Note On Challenge Status ProgramDocumento4 pagineNote On Challenge Status Programamareshlucky1Nessuna valutazione finora

- Check Your Eligibility For Challenge Pathway - CFPCMDocumento3 pagineCheck Your Eligibility For Challenge Pathway - CFPCMmayank007Nessuna valutazione finora

- CFP BrochureDocumento25 pagineCFP BrochureBinuNairNessuna valutazione finora

- Personal Financial SpecialistDocumento5 paginePersonal Financial SpecialistNiño Rey LopezNessuna valutazione finora

- The Alphabet Soup of Financial CertificationsDocumento11 pagineThe Alphabet Soup of Financial CertificationsRnaidoo1972Nessuna valutazione finora

- Become a Chartered Accountant (CADocumento10 pagineBecome a Chartered Accountant (CADimple DamniwalaNessuna valutazione finora

- CA Career GuideDocumento8 pagineCA Career GuideHimanshu BajajNessuna valutazione finora

- CFP Certification Program DetailsDocumento1 paginaCFP Certification Program DetailsBharat SahniNessuna valutazione finora

- General Faqs: 1. What Is The Job of Cost Accountant ?Documento3 pagineGeneral Faqs: 1. What Is The Job of Cost Accountant ?Abu AsmaNessuna valutazione finora

- Audit Assurance MidtermDocumento8 pagineAudit Assurance MidtermMohammad Farhan SafwanNessuna valutazione finora

- Career As A Chartered AccountantDocumento3 pagineCareer As A Chartered AccountantAashish AashriNessuna valutazione finora

- Financial Accounting:: PersonalityDocumento3 pagineFinancial Accounting:: PersonalityShubham MaheshwariNessuna valutazione finora

- CFPDocumento16 pagineCFPOrange Noida100% (1)

- Central Bank of India Recruitment 2013, Vice President, Manager, Executive Officer - Sep 2013Documento10 pagineCentral Bank of India Recruitment 2013, Vice President, Manager, Executive Officer - Sep 2013malaarunNessuna valutazione finora

- Sl. No. Associ Ateship Membership GuidelinesDocumento1 paginaSl. No. Associ Ateship Membership GuidelinesBadshahNessuna valutazione finora

- CFPDocumento31 pagineCFPNikhil DedhiaNessuna valutazione finora

- Profession of CharteredDocumento20 pagineProfession of CharteredSaru BashaNessuna valutazione finora

- Advertisement No.: IPPB/CO/HR/RECT./2023-24/04Documento5 pagineAdvertisement No.: IPPB/CO/HR/RECT./2023-24/04P S ShahilNessuna valutazione finora

- Education in India: Company SecretaryDocumento18 pagineEducation in India: Company Secretaryamrut9Nessuna valutazione finora

- Common Proficiency Test (CPT)Documento4 pagineCommon Proficiency Test (CPT)Sny Kumar DeepakNessuna valutazione finora

- Internship Program in Financial Content Writing: ObjectiveDocumento9 pagineInternship Program in Financial Content Writing: ObjectiveKushaal SainNessuna valutazione finora

- CfaDocumento6 pagineCfaRohan HaldankarNessuna valutazione finora

- Guide to Retirement PlannersDocumento2 pagineGuide to Retirement PlannersNiño Rey LopezNessuna valutazione finora

- 880 1 AIASL ADVT June 2020 Final Revised 1Documento19 pagine880 1 AIASL ADVT June 2020 Final Revised 1JoemonNessuna valutazione finora

- Profile: DGM & Managerial CadreDocumento5 pagineProfile: DGM & Managerial Cadreankit singh narukaNessuna valutazione finora

- Assistant Manager, FareastDocumento4 pagineAssistant Manager, FareastAhm Ehsanul HaqueNessuna valutazione finora

- CIPA Fellowship now offered in Bangladesh for accounting professionalsDocumento4 pagineCIPA Fellowship now offered in Bangladesh for accounting professionalsrakhalbanglaNessuna valutazione finora

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsDa EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNessuna valutazione finora

- Accounting Standard 15: It's Relevance To GRCDocumento6 pagineAccounting Standard 15: It's Relevance To GRCTulika JeendgarNessuna valutazione finora

- Membership PDFDocumento11 pagineMembership PDFdeolah06Nessuna valutazione finora

- Terms of Reference For Consultancy Services Financial Sustainability Assessment - SCALE UP Beneficiary InstitutionsDocumento6 pagineTerms of Reference For Consultancy Services Financial Sustainability Assessment - SCALE UP Beneficiary Institutionswaxkale igadhehNessuna valutazione finora

- Guide To CA Foundation Exam 2023Documento5 pagineGuide To CA Foundation Exam 2023CA Entrance Exam BooksNessuna valutazione finora

- AFP Certification Education Program - Eng v2Documento4 pagineAFP Certification Education Program - Eng v2cnvb alskNessuna valutazione finora

- Google Slides #2 - Accounting CertificationsDocumento12 pagineGoogle Slides #2 - Accounting CertificationsCQ0% (1)

- Iplan CFA BrochureDocumento9 pagineIplan CFA BrochureRajat GuptaNessuna valutazione finora

- REVIEWERDocumento14 pagineREVIEWERgrace bruanNessuna valutazione finora

- Icf LCF A BrochureDocumento8 pagineIcf LCF A BrochureKiran GadelaNessuna valutazione finora

- ICAPCatalouge 2014Documento24 pagineICAPCatalouge 2014Yousaf BhuttaNessuna valutazione finora

- P3 Professional-Practice-Of-AccountancyDocumento38 pagineP3 Professional-Practice-Of-AccountancyMa. Elene MagdaraogNessuna valutazione finora

- AUSAid Adviser Remuneration FrameworkDocumento9 pagineAUSAid Adviser Remuneration FrameworkjohnmontagueNessuna valutazione finora

- Asstt - Finance - Officer - Detailed AdvertisementDocumento6 pagineAsstt - Finance - Officer - Detailed AdvertisementRaja1234Nessuna valutazione finora

- Management Trainee ProgramDocumento2 pagineManagement Trainee ProgramAfaq AhmadNessuna valutazione finora

- Accounting Basics and Career OpportunitiesDocumento6 pagineAccounting Basics and Career OpportunitiesYvonne BascoNessuna valutazione finora

- Certified Management AccountantDocumento6 pagineCertified Management AccountantEurich EstradaNessuna valutazione finora

- CPAs in The PhilippinesDocumento3 pagineCPAs in The PhilippinesJewel GonzalesNessuna valutazione finora

- Finance 11Documento2 pagineFinance 11Anshul SinhaNessuna valutazione finora

- With at Least Seven Years of Experience in A Relevant Position or Business SectorDocumento8 pagineWith at Least Seven Years of Experience in A Relevant Position or Business Sectorwaxkale igadhehNessuna valutazione finora

- BSACt & BSA - Accounting DegreesDocumento6 pagineBSACt & BSA - Accounting DegreesErme Fradejas DulceNessuna valutazione finora

- A Rewarding Business Career: Professional Accounting BodiesDocumento8 pagineA Rewarding Business Career: Professional Accounting BodiesMax TanNessuna valutazione finora

- Federal Govt Financial Sustainability AssessmentDocumento7 pagineFederal Govt Financial Sustainability Assessmentwaxkale igadhehNessuna valutazione finora

- Recognition of Acca and CatDocumento4 pagineRecognition of Acca and CatMonir HossainNessuna valutazione finora

- Rolling FaridabadDocumento4 pagineRolling FaridabadNandan SrivastavaNessuna valutazione finora

- ACA Advanced Level 2019 Syllabus V2Documento49 pagineACA Advanced Level 2019 Syllabus V2Isavic AlsinaNessuna valutazione finora

- CA Vs CS: Which Career Has More Scope?Documento2 pagineCA Vs CS: Which Career Has More Scope?Naineshp87Nessuna valutazione finora

- Career Path in AccountancyDocumento11 pagineCareer Path in AccountancyYennie AHGASENessuna valutazione finora

- CFA BrochureDocumento11 pagineCFA Brochuremohammad10000Nessuna valutazione finora

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersDa EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNessuna valutazione finora

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsDa EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNessuna valutazione finora

- QGLP: "Buy Right - Sit Tight"-Wealth Creation Through EquityDocumento8 pagineQGLP: "Buy Right - Sit Tight"-Wealth Creation Through Equitykeyur1975Nessuna valutazione finora

- CFP Classes in MumbaiDocumento1 paginaCFP Classes in Mumbaikeyur1975Nessuna valutazione finora

- Red Ocean To Blue OceanDocumento39 pagineRed Ocean To Blue Oceankeyur1975Nessuna valutazione finora

- Bangalore CFP Learning Conference Welcome Speech 15th May 2016Documento19 pagineBangalore CFP Learning Conference Welcome Speech 15th May 2016keyur1975100% (1)

- Expert Coach & Trainer of CFPDocumento3 pagineExpert Coach & Trainer of CFPkeyur1975Nessuna valutazione finora

- Certification For CFPDocumento4 pagineCertification For CFPkeyur1975Nessuna valutazione finora

- DR L. Ravindran, CFP, Ph. D, Founder Managing Director & CEO, Wealthmax Enterprises Management P LTD, BangaloreDocumento14 pagineDR L. Ravindran, CFP, Ph. D, Founder Managing Director & CEO, Wealthmax Enterprises Management P LTD, Bangalorekeyur1975Nessuna valutazione finora

- Buy Right... Sit Tight... Wealth Creation Through EquityDocumento28 pagineBuy Right... Sit Tight... Wealth Creation Through Equitykeyur1975Nessuna valutazione finora

- Agenda: Hyderabad 17th July CFP Learning ConferenceDocumento4 pagineAgenda: Hyderabad 17th July CFP Learning Conferencekeyur1975Nessuna valutazione finora

- CFP Financial ExamsDocumento5 pagineCFP Financial Examskeyur1975Nessuna valutazione finora

- Happy To Share 7 Success Stories of November 2015Documento7 pagineHappy To Share 7 Success Stories of November 2015keyur1975Nessuna valutazione finora

- Financial Adviser & Planner of CFPDocumento3 pagineFinancial Adviser & Planner of CFPkeyur1975Nessuna valutazione finora

- Bangalore CFP Learning Conference Welcome Speech 15th May 2016Documento19 pagineBangalore CFP Learning Conference Welcome Speech 15th May 2016keyur1975100% (1)

- HHappy To Share Our 203rd Success Story: Appy To Share Our 203rd Success StoryDocumento2 pagineHHappy To Share Our 203rd Success Story: Appy To Share Our 203rd Success Storykeyur1975Nessuna valutazione finora

- DonDocumento4 pagineDonKeyur ShahNessuna valutazione finora

- Financial Management ClassesDocumento3 pagineFinancial Management Classeskeyur1975Nessuna valutazione finora

- Mr. Keyur Shah Speech On 11th January Conference.Documento11 pagineMr. Keyur Shah Speech On 11th January Conference.keyur1975Nessuna valutazione finora

- A Journey From CFP Aspirant To CFP PractitionerDocumento5 pagineA Journey From CFP Aspirant To CFP Practitionerkeyur1975Nessuna valutazione finora

- Certification For CFPDocumento4 pagineCertification For CFPkeyur1975Nessuna valutazione finora

- The CFP Aspirant Club - Website OfflineDocumento117 pagineThe CFP Aspirant Club - Website Offlinekeyur1975Nessuna valutazione finora

- CFP Financial Classes in MumbaiDocumento2 pagineCFP Financial Classes in Mumbaikeyur1975Nessuna valutazione finora

- 56th Mega Fast Track CFP TrainingDocumento3 pagine56th Mega Fast Track CFP Trainingkeyur1975Nessuna valutazione finora

- 11th January'2015 Conference AgendaDocumento5 pagine11th January'2015 Conference Agendakeyur1975Nessuna valutazione finora

- 11th January'2015 Conference AgendaDocumento5 pagine11th January'2015 Conference Agendakeyur1975Nessuna valutazione finora

- 11th January'2015 Conference AgendaDocumento5 pagine11th January'2015 Conference Agendakeyur1975Nessuna valutazione finora

- A Journey From CFP Aspirant To CFP Practitioner: Opportunities & Challenges in 2015Documento3 pagineA Journey From CFP Aspirant To CFP Practitioner: Opportunities & Challenges in 2015keyur1975Nessuna valutazione finora

- 77+success Stories of Our Fast Track CFP Training WS - 24062013Documento19 pagine77+success Stories of Our Fast Track CFP Training WS - 24062013keyur1975Nessuna valutazione finora

- Successfully Conducted Mumbai - 18th Batch of FAST TRACK CFP EXAM 5/4/3 +CPFA + FPC Preparation Training Workshop Dated 7th-8th and 9th December'12 .Documento1 paginaSuccessfully Conducted Mumbai - 18th Batch of FAST TRACK CFP EXAM 5/4/3 +CPFA + FPC Preparation Training Workshop Dated 7th-8th and 9th December'12 .keyur1975Nessuna valutazione finora

- 11 (Eleven) More Participants of Our Fast Track CFP Exam 5/4/3 Training Workshops Have Successfully Cleared/passed Their CFP Exam 5/module Exams Post Training Workshop in Last One Month.Documento1 pagina11 (Eleven) More Participants of Our Fast Track CFP Exam 5/4/3 Training Workshops Have Successfully Cleared/passed Their CFP Exam 5/module Exams Post Training Workshop in Last One Month.keyur1975Nessuna valutazione finora

- Asset Management Plan FleetDocumento34 pagineAsset Management Plan FleetThiago AmieiroNessuna valutazione finora

- HSE Plan SubcontDocumento22 pagineHSE Plan SubcontTaufan Arif ZulkarnainNessuna valutazione finora

- Determinants of Bangladesh Stock Market Debacle 2010-2011Documento33 pagineDeterminants of Bangladesh Stock Market Debacle 2010-2011Falguni Chowdhury100% (1)

- Definition, Justification and Emergence of Property RightDocumento10 pagineDefinition, Justification and Emergence of Property Rightazzam dupanNessuna valutazione finora

- AT 1701 Auditing Theory Discussion PDFDocumento11 pagineAT 1701 Auditing Theory Discussion PDFJulie Pearl GuarinNessuna valutazione finora

- Risk analysis techniques for capital budgeting decisionsDocumento59 pagineRisk analysis techniques for capital budgeting decisionsDiptish RamtekeNessuna valutazione finora

- Request For Expressions of Interest (Reoi) For Design and Supervision Consultancy Services For Rural Roads Upgrading in Ogun StateDocumento17 pagineRequest For Expressions of Interest (Reoi) For Design and Supervision Consultancy Services For Rural Roads Upgrading in Ogun StateDuncan josefNessuna valutazione finora

- Hs-Hoo-Tp-120017-Hse-Pl-01 Project Hse PlanDocumento62 pagineHs-Hoo-Tp-120017-Hse-Pl-01 Project Hse PlanMoaatazz NouisriNessuna valutazione finora

- Engineering Ethics in Practice ShorterDocumento44 pagineEngineering Ethics in Practice ShorterAlparslan GureNessuna valutazione finora

- LPM - What Is Loss PreventionDocumento14 pagineLPM - What Is Loss PreventionBiscuit_WarriorNessuna valutazione finora

- Social Media OsintDocumento24 pagineSocial Media OsintBagaNessuna valutazione finora

- ENTREPRENUERSHIP Lesson 1Documento12 pagineENTREPRENUERSHIP Lesson 1Cheese CakeNessuna valutazione finora

- Ia Chapter 4 Valix 2019Documento5 pagineIa Chapter 4 Valix 2019M100% (1)

- A Guide To Fire Safety EngineeringDocumento38 pagineA Guide To Fire Safety EngineeringJunior Torrejón100% (2)

- Lab4 IAA202Documento5 pagineLab4 IAA202Đào Mạnh CôngNessuna valutazione finora

- The Coca Cola Company S Approach To Global Quality and Food SafetyDocumento18 pagineThe Coca Cola Company S Approach To Global Quality and Food SafetyJawad WaheedNessuna valutazione finora

- Word of Mouth A Literature ReviewDocumento10 pagineWord of Mouth A Literature ReviewCarlo Angelo S. BanateNessuna valutazione finora

- Delegate Workbook - Modules 1 and 2Documento24 pagineDelegate Workbook - Modules 1 and 2sushant_moreyNessuna valutazione finora

- BSBRSK501 Unit Assessment PDFDocumento20 pagineBSBRSK501 Unit Assessment PDFamanuel assefa31% (13)

- TR Local Guiding Services NC IIDocumento52 pagineTR Local Guiding Services NC IIleijulia75% (4)

- Unit 2 PDFDocumento19 pagineUnit 2 PDFMir UmarNessuna valutazione finora

- C MiniriskDocumento9 pagineC MiniriskwadaenatorNessuna valutazione finora

- Risk and Return Chapter 5 FinManDocumento51 pagineRisk and Return Chapter 5 FinManSteven Kyle PeregrinoNessuna valutazione finora

- Overview of Health and Safety in Tunnel Construction.: D. R. LamontDocumento12 pagineOverview of Health and Safety in Tunnel Construction.: D. R. LamontHarold TaylorNessuna valutazione finora

- ISO 27001 Information Security Policies and ReviewsDocumento116 pagineISO 27001 Information Security Policies and ReviewsragaNessuna valutazione finora

- Sky Blue System Description 1Documento76 pagineSky Blue System Description 1Mihail AvramovNessuna valutazione finora

- RCGP NSPCC Safeguarding Children ToolkitDocumento223 pagineRCGP NSPCC Safeguarding Children ToolkitMirela Cojocaru StetcoNessuna valutazione finora

- Prateek Singhal CV PDFDocumento3 paginePrateek Singhal CV PDFtarun slowNessuna valutazione finora

- 5 - Contractors HSE ForumDocumento49 pagine5 - Contractors HSE ForumDheeraj MenonNessuna valutazione finora

- 17 Individual Decision Making and CreativityDocumento17 pagine17 Individual Decision Making and CreativityMark AlbaNessuna valutazione finora