Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Palms Club, Orlando Florida

Caricato da

roylee91829Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Palms Club, Orlando Florida

Caricato da

roylee91829Copyright:

Formati disponibili

T h e Pa l m s C l u b

O r l a n d o , F l o r i da

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

Ta b l e O F C O n T e n T s

Overview...................................................................................................page 3 Area / Location .........................................................................................page 5 Resort / Community Information ...............................................................page 9 Property / Financial Information................................................................page 12 Gallery ......................................................................................................page 19 Next Steps ................................................................................................page 21

them to my contacts and look forward to do more business with them in the future. Thanks again guys!

I would like to thank everybody at Torcana that helped me with my first property purchase. Everything was clear and the process was easy to follow. I would refer

sTyve FrOm new yOrk

Home

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

exeCuTive summary

An unprecedented combination of high sales volumes and low new build activity has resulted in a critically low availability of condos in Orlando Florida. Incredibly, there are now less than 1000 condos listed for sale in a major city which receives over 50 million visitors per year. The number located in safe middle class neighborhoods is lower still. This critical lack of supply ensures that finding high quality units at a competitive price is extremely challenging. Very few firms have matched Torcanas consistency and quality of service in this market over the past four years. We believe that our refusal to compromise on build quality, location, financial stability and the caliber of onsite management sets us apart from the competition. Our latest offering in the insatiable Orlando condo market is called The Palms Club, a beautifully designed and financially stable community located in the epicenter of Orlandos tourism and economic corridor on Kirkman Avenue. A wide selection of spacious and well appointed one, two and three bed condos are available to purchase from $84,900 - $104,900. The landscaping and architectural style is Italian / Tuscan and the on-site amenities are probably the best we have ever seen. Torcana owns a condo in this neighborhood and we are very familiar with the local rental demand and all the other advantages conferred by its location alongside Orlandos world famous shopping, dining, entertainment, studio theme parks and major employers.

Home

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

DevelOPmenT summary

The Palms Club is a beautifully designed community on Kirkman Avenue which benefits from a high visibility on one of the busiest streets in South Orlando. Built in 1999 to a high standard with hard wearing Spanish tile roofs and incorporating circa 350 units, this community was condo converted and completely refurbished in 2007. The properties within The Palms Club have large, well apportioned floorplans with vaulted ceilings, alarm systems, walk in closets, modern appliances, balconies, sunrooms and ample free parking. The onsite amenities have to be seen to be believed. They include a beautiful clubhouse, fitness center, two pool areas with jacuzzi, sauna and steam rooms, lighted tennis courts, a themed indoor childrens playroom, air conditioned racquet ball & basketball courts, a huge yoga room and a private bowling alley! With an outstanding location in very close proximity to Universal Studios, Lockheed Martin, The Orlando Convention Center, Valencia College, and International Drive; this is a safe and busy middle class residential area heavily populated by people who live, work and study in a multitude of industries. Torcana have secured a wide selection of one, two and three bedroom condos throughout the community, the majority of which are tenanted and achieving excellent rents. The long term security and viability of The Palms Club is secured with an extremely well maintained community with a strong and well funded Home Ownership Association (HOA) and a healthy budget surplus.

Home

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

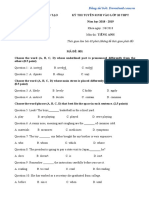

a r e a i n F O r m aT i O n

Why Invest in the USA? The market crash in 2006-2007 resulted in the dramatic falls in property prices among many industrialised nations, but as the graphs opposite illustrate, prices in the USA have both fallen further and stabilised for longer than other major nations. According to The Economist, the ratio of house prices to rents is another indicator of a balanced market. Over the long term the average should be 100 and if a market is overpriced, the ratio will be very high. As you can see from the top graph opposite, there are ratios ranging from 130-150 in the UK, China and Spain (overpriced) compared to 84 in the USA (underpriced). Not only is the USA the only major economy to have recovered to its long term average, a ratio of 84 actually represents historically good value. In a further sign that USA property market conditions are improving, foreclosures nationally fell by a whopping 24% year-on-year, according to CoreLogics first national foreclosure report. The figures reveal that there were 830,000 U.S. foreclosures nationwide in 2011 compared with 1.1 million in 2010.

Home

Please click here to enlarge

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

a r e a i n F O r m aT i O n

Why purchase in Florida? Florida is the 4th most populous state in the country and has been the 3rd fastest growing population in the USA over the last 20 years. No other location in the western hemisphere can match Floridas unique combination of a strategic geographic position, strong knowledge base, stateof-the-art infrastructure, entrepreneurial spirit, and concentration of corporate, financial and tourist resources. This is a diverse, wealthy and resilient economy with a very safe and secure legal system that has been protecting foreign buyers for decades. With real estate prices at historical lows and statistics showing rental rates increasing for several consecutive quarters, there has never been a better opportunity to invest in this market. In our view, the properties with the best rental and capital appreciation potential will be in the neighborhoods near great schools where middle class professionals rent and buy their homes. *With 50 million baby boomers expected to retire in the next 20 years many are going to choose Florida as their retirement destination. Wave after wave of both young professionals and retiring baby boomers* have been and will continue to relocate to Florida in their millions. The reasons are simple and very difficult to replicate:

Beautiful weather Low cost of living Lots of space No state income and no estate taxes Some of best medical facilities in the world Some of the best schools and universities in the world

Home

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

a r e a i n F O r m aT i O n

Why Orlando? Orlando is visited by 50 million people a year, thats 1 million a week! It is the most visited city in the USA beating New York, Chicago and Las Vegas. This amazing city has simply too many attractions, restaurants, shopping malls and outlet malls, excursions and entertainment parks and facilities to list in this section. The biggest attractions - Universal Studios, Islands of Adventure, Sea World, Discovery Cove and Wet & Wild are all within a short drive of The Palms Club. The Mall at Millennia, Florida Mall, Premium Outlets and the Premier Outlets are all very accessible and can be reached within 5-10 minutes. Homebuyers have been gradually chipping away at Orlandos oncetowering inventory. The number of existing homes available for purchase in Orlando is continuing a steady decline that began in back in January 2009 at 22,613 and now rests at 8,642. The current inventory equates to a 3.67-month supply of homes in Orlando, a level not seen since the red hot housing market in December 2005. The average sales price of an Orlando property increased 10% between April 2011 and April 2012. There can be no doubt that the Orlando housing market turned a corner and that demand has been outpacing supply for some time.

Orlando inventory levels from January 2009 April 2012

25000 21000 17000 13000 9000 5000

Jul-09

Jul-10

Mar-09

Mar-10

Mar-11

Jul-11

May-09

May-11

May-10

Home

Mar-12

Jan-09

Jan-10

Jan-11

Sep-09

Nov-09

Sep-11

Nov-10

Nov-11

Sep-10

Jan-12

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

l O C aT i O n

The Palms Club is located in the epicentre of South Orlandos economic and tourist corridor on Kirkman Avenue. It is an outstanding location in very close proximity to Downtown Orlando and the trendy Restaurant Row area of Sand Lake Road. The surrounding area is very well served with restaurants, schools, sport and leisure activities. Universal Studios, with its massive theme park resort is less than 5 minutes away. Universal Studios employs in the region of 15,000 people directly and many thousands more indirectly. Lockheed Martin, a global military systems contractor is 10 minutes away and employs 7,200 people. Valencia College is located directly across the street. Valencia College is part of the UCF (University of Central Florida) and between the four campuses there is an enrolment of 35,000 students. The Orlando Convention Center, the second largest in the USA is 5 minutes away. This convention center has an economic impact of over $2 billion and creates employment for over 25,000 people. The famous International Drive, home to a huge variety of hotels, shops and restaurants is also within 5 minutes.

Please click here to enlarge map.

Home

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

resOrT ameniTies

The Palms Club is a beautifully designed community on Kirkman Avenue with an architectural style that is Italian / Tuscan with a Floridian influence. Gated with 24 hour mobile security Beautiful clubhouse with residents lounge and catering facility Two pool areas with Jacuzzis Sauna and steam room Lighted tennis courts Indoor childrens play area Specially designed dog park Indoor air conditioned racquet ball courts Huge yoga room Air conditioned basketball courts Wonderfully equipped fitness center Business center with professional meeting rooms A private bowling alley

Home

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

P r i C e s & ava i l a b i l i T y

There are 350 units in this community with a wide selection of one, two and three bed condos on offer at an incredible price range of $84,900 - $104,900. Please click here for a high resolution site plan and a full availability list which is updated daily.

Home

10

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

P r O P e r T y i n F O r m aT i O n

The Palms Club properties are spacious, well appointed and meet all the stringent building standards that young communities must adhere to. We were very impressed with the extra high ceilings, balcony storage areas, walk in wardrobes and the general flow of the properties. Large and well proportioned floorplans Vaulted ceilings Alarm systems Modern appliances and cabinetry Plush carpeting in the living, dining and bedrooms Ceramic tile flooring in kitchens and bathrooms Large walk in closets Air conditioning Choice of balcony or sunroom Additional storage areas Ample free parking

Home

11

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

FlOOr Plans

Unit # 1-108 Purchase Price Bedrooms / Bathrooms Size Gross monthly rental income Gross rental yield Monthly Running Costs Management @ 10% Estimated Real Estate Taxes HOA Fees Estimated Insurance Monthly net cash flow Estimated net rental yield $84,900 1 bed / 1 bath 840 sq ft $785 11.1% $78.50 $56 $225 $35 $391 5.5%

Home

12

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

FlOOr Plans

Unit # 6-207 Purchase Price Bedrooms / Bathrooms Size Gross monthly rental income Gross rental yield Monthly Running Costs Management @ 10% Estimated Real Estate Taxes HOA Fees Estimated Insurance Monthly net cash flow Estimated net rental yield $95,900 2 bed / 1 bath 1,018 sq ft $975 12.2% $97.50 $66 $275 $38 $499 6.2%

Home

13

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

FlOOr Plans

Unit # 4-102 Purchase Price Bedrooms / Bathrooms Size Gross monthly rental income Gross rental yield Monthly Running Costs Management @ 10% Estimated Real Estate Taxes HOA Fees Estimated Insurance Monthly net cash flow Estimated net rental yield $92,900 2 bed / 2 bath 1,159 sq ft $1,040 13.4% $104.00 $75 $313 $38 $510 6.6%

Home

14

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

FlOOr Plans

Unit # 4-210 Purchase Price Bedrooms / Bathrooms Size Gross monthly rental income Gross rental yield Monthly Running Costs Management @ 10% Estimated Real Estate Taxes HOA Fees Estimated Insurance Monthly net cash flow Estimated net rental yield $92,900 2 bed / 2 bath 1,208 sq ft $983 12.7% $98.30 $77 $325 $38 $445 5.7%

Home

15

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

FlOOr Plans

Unit # 12-210 Purchase Price Bedrooms / Bathrooms Size Gross monthly rental income Gross rental yield Monthly Running Costs Management @ 10% Estimated Real Estate Taxes HOA Fees Estimated Insurance Monthly net cash flow Estimated net rental yield $104,900 3 bed / 2 bath 1,191 sq ft $1,175 13.4% $117.50 $70 $320 $42 $626 7.2%

Home

16

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

s Ta n Da r D r u n n i n g C O s T s

Home Ownership Association (HOA) Each community has a Home Owners Association who is responsible for looking after the community as a whole i.e. common areas and facilities from the swimming pool down to the security gate and rubbish collection. They are also responsible for the structures of the buildings within the community and insuring all common areas. Real Estate Taxes This is a tax levied on every single building in the United States and is similar in some respects to the Council Tax in Britain. Property taxes are calculated by the County Tax Appraiser and are based on local services, amenities and average property values within the vicinity. In October each year an estimate of the current years property taxes is published and you can view this estimate on the County Tax Appraisers website. Insurance The usage of the property determines the type of insurance required. If its a long term rental investment, minimum contents cover is required. If it is short term and your contract is with a management company, an insurance aspect will be built into their management fees. Closing Costs You should budget approximately $2000 to cover legal, title and agency fees. Please click here for the latest price & availability list.

Home

17

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

l O n g T e r m s T raT e g y

Many investment decisions right now are being made solely on the basis of net rental yield and the 5-8% net yields currently available in a community of this calibre are certainly high enough to get most buyers attention. However, the fact remains that the bulk of profits in real estate are made from a combination of buying at the right time, capital appreciation and managing your tenants well. Falling unemployment, increased economic activity, a falling inventory, a stable rental market and purchase prices at record lows all indicate that this is a great time to purchase. Capital appreciation is always most assured in safe and low density locations where the top tier of affluent professionals work, send their children to school and earn a high income per household. Failure to adhere to the fundamentals above can be extremely expensive and time consuming. As inventory has tightened across Florida, there has been a large increase in the numbers of people buying and promoting low quality and poorly managed communities that look great on paper. Rental yields are in these locations are often inflated by artificially low management fees, low HOA fees and a failure to include insurance in the running costs. With rigorous due diligence, these pitfalls can easily be avoided. A Buy and Hold Strategy (5 / 10 / 15 years) The Palms Club Purchase Price Closing Costs (legal/title fees) Annual net rental Income* Year 1 Years 2-5 Years 6-10 Years 11-15 Total Net Income Earned Property Value** Potential Pension Pot*** $4,692 $20,218 $28,878 $33,478 $87,266 $254,700 $341,966 $5,988 $25,803 $36,855 $42,725 $111,370 $287,700 $399,070 1 Bed Unit $84,900 $2,000 2 Bed Unit $95,900 $2,000

* assume 3% increase per year on average after HOA, taxes, insurance & mgt ** lets modestly assume that house prices are back to 2006 levels by 2026 *** these numbers dont take into account any equity release that may be possible

Home

18

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

resOrT PiCTures

Home

19

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

PrOPerTy PiCTures

Home

20

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

summary OF serviCes

As any property landlord will know, selecting and paying for the unit is only the first step to ensure that your asset is as profitable and trouble free as possible. For this reason, Torcana has built strong relations with companies and individuals who are well placed to assist buyers with a range of important sales and aftersales issues in the US real estate market. Optional services that our partners can provide include: Arranging property inspections Opening a local US bank account Arranging insurance for your property Currency transfer service Obtaining non-resident social security number(s) US notary services, required for the IRS and saving a trip to the US Embassy Annual tax returns For non US based buyers in particular, these services can offer peace of mind, avoid unnecessary penalties and save huge amounts of time, energy and money.

Home

21

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

PurChase PrOCeDure

Once a unit has been selected, a purchase agreement will be sent to you via email which should be signed and faxed back to our affiliate brokerage office. A $2,500 deposit needs to be wired to the relevant Title Company and confirmation of transfer supplied. Once the deposit and contracts are received the property is then officially under reservation. You will have a 15 day inspection period to complete a professional home inspection and/or a personal site visit which we will be glad to facilitate. You can rescind your contract at any stage during this period and receive a full refund of your deposit. After the inspection period has passed and you are satisfied with everything, the official closing will be within 15 to 20 days and the full purchase price must be paid to the Title Company before the agreed Closing Date. Closing costs will depend on the unit but generally range from $1,500 - $2,000 In The Palms Club, the most popular option for both rentals and resale are the corner waterfront units and they will be snapped up extremely quickly. Call us today* to discuss how you can secure the best available property. * USA: +1 321 806 1195 / Ireland: +353 1 4433 991 / UK: +44 207 193 4024

Home

22

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

F r e q u e n T ly a s k e D q u e s T i O n s

After purchasing a family home, the purchase of an investment property is the second most important financial decision in most peoples lives. When done correctly, it can be a highly satisfying and profitable experience. Below are short answers to some of the questions we most often receive. How are net yields calculated? This is your net income expressed as a percentage of the purchase price after all overheads are deducted. The same overheads apply to practically every property in Florida. You must pay HOA fees, real estate taxes, property management fees and home insurance. What does a title company do? Title companies are independent legal firms who transact every property purchase within the United States. Instructed to represent both the seller and purchaser, their role is to ensure that the title is transferred to the new party, completely free of all liens and encumbrances and that conditions signed up to within the purchase agreement are adhered to. What exactly does a property management company do to earn its fees? Your management company is responsible for arranging lease agreements, liaising with your tenant, ensuring they pay on time, organising any repairs necessary, communicating with you on a regular basis, paying you the balance of your rent, providing income statements and placing new tenants whenever necessary. When and how do I receive rental payments? Funds are generally deposited into your bank account around the 10th of each month.

Home

23

Overview

Area/Location

Resort/Community information

Property/Financial information

Gallery

Next Steps

C O n Ta C T

If you wish to learn more about The Palms Club or indeed discuss any of our other US opportunities please call one of our highly experienced members of staff. We will talk you through the available options and discuss the market as a whole to ensure you are well informed to make the best purchase decisions. Torcana Ltd

USA: +1 321 806 1195 Ireland: +353 1 4433 991 UK: +44 207 193 4024 Skype: torcanaltd

investments@torcana.com www.torcana.com

This document contains general information relating to the purchase of property and its contents should not be construed as legal or other professional advice. This is not an investment offering. While all reasonable care has been taken in the compilation and publication of this information, Torcana Ltd make no representations or warranties, whether expressed or implied, as to its accuracy or completeness and the content is provided for information purposes only. All rents listed are current and are based on the existing lease information provided by third parties. Torcana does not oblige any buyer to use existing property management services and recognizes their right to rent his or her property independently. Furthermore, Torcana Ltd shall not be liable, directly or indirectly, to the user or any other third party for any damage resulting from the use of the information contained or implied in this document. Buyers should always seek appropriate legal, tax & financial advice from suitably qualified professionals before taking, or refraining from taking, any action.

Home

24

Potrebbero piacerti anche

- Ke Ola 2010 Nov-Dec IssueDocumento76 pagineKe Ola 2010 Nov-Dec Issueroylee91829Nessuna valutazione finora

- Top World BanksDocumento1 paginaTop World Banksroylee91829Nessuna valutazione finora

- Ke Ola Magazine 2010-09-10Documento68 pagineKe Ola Magazine 2010-09-10roylee91829Nessuna valutazione finora

- Ke OlaDocumento60 pagineKe Olaroylee91829Nessuna valutazione finora

- BFF Protein Bar RecipeDocumento3 pagineBFF Protein Bar Reciperoylee91829Nessuna valutazione finora

- I Love Marketing - 45Documento32 pagineI Love Marketing - 45roylee91829Nessuna valutazione finora

- IKEA Range Brochure BESTA 2012Documento13 pagineIKEA Range Brochure BESTA 2012roylee91829Nessuna valutazione finora

- Belly Fat Free 3 RecipesDocumento2 pagineBelly Fat Free 3 Recipesroylee91829Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDocumento40 paginePPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshNessuna valutazione finora

- Sweetlines v. TevesDocumento6 pagineSweetlines v. TevesSar FifthNessuna valutazione finora

- JAR23 Amendment 3Documento6 pagineJAR23 Amendment 3SwiftTGSolutionsNessuna valutazione finora

- Marine Insurance Final ITL & PSMDocumento31 pagineMarine Insurance Final ITL & PSMaeeeNessuna valutazione finora

- IB English L&L Paper 1 + 2 Tips and NotesDocumento9 pagineIB English L&L Paper 1 + 2 Tips and NotesAndrei BoroianuNessuna valutazione finora

- Software Project Sign-Off DocumentDocumento7 pagineSoftware Project Sign-Off DocumentVocika MusixNessuna valutazione finora

- San Beda UniversityDocumento16 pagineSan Beda UniversityrocerbitoNessuna valutazione finora

- ISO 50001 Audit Planning MatrixDocumento4 pagineISO 50001 Audit Planning MatrixHerik RenaldoNessuna valutazione finora

- Prisons We Choose To Live InsideDocumento4 paginePrisons We Choose To Live InsideLucas ValdezNessuna valutazione finora

- True or FalseDocumento3 pagineTrue or FalseRB AbacaNessuna valutazione finora

- Civil Litigation MCQ FeedbackDocumento17 pagineCivil Litigation MCQ Feedbackbennyv1990Nessuna valutazione finora

- Guidelines For ValuationDocumento6 pagineGuidelines For ValuationparikhkashishNessuna valutazione finora

- IMRANADocumento4 pagineIMRANAAji MohammedNessuna valutazione finora

- Unit Test: VocabularyDocumento2 pagineUnit Test: VocabularyTrang PhạmNessuna valutazione finora

- E-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPDocumento8 pagineE-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPjpcmeNessuna valutazione finora

- Class Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseDocumento17 pagineClass Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseNidhi ShahNessuna valutazione finora

- WordAds - High Quality Ads For WordPress Generate IncomeDocumento1 paginaWordAds - High Quality Ads For WordPress Generate IncomeSulemanNessuna valutazione finora

- ERP in Apparel IndustryDocumento17 pagineERP in Apparel IndustrySuman KumarNessuna valutazione finora

- 2011 Grade Exam ResultDocumento19 pagine2011 Grade Exam ResultsgbulohcomNessuna valutazione finora

- Murder in Baldurs Gate Events SupplementDocumento8 pagineMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- Northern Nigeria Media History OverviewDocumento7 pagineNorthern Nigeria Media History OverviewAdetutu AnnieNessuna valutazione finora

- Learn Jèrriais - Lesson 1 2Documento19 pagineLearn Jèrriais - Lesson 1 2Sara DavisNessuna valutazione finora

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDocumento5 pagineĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiNessuna valutazione finora

- The Big Mac TheoryDocumento4 pagineThe Big Mac TheoryGemini_0804Nessuna valutazione finora

- Pub. 127 East Coast of Australia and New Zealand 10ed 2010Documento323 paginePub. 127 East Coast of Australia and New Zealand 10ed 2010joop12Nessuna valutazione finora

- Nifty Technical Analysis and Market RoundupDocumento3 pagineNifty Technical Analysis and Market RoundupKavitha RavikumarNessuna valutazione finora

- Lughaat Al Quran G A ParwezDocumento736 pagineLughaat Al Quran G A Parwezscholar786Nessuna valutazione finora

- The Lesser Key of SolomonDocumento142 pagineThe Lesser Key of Solomonmagnus100% (5)

- Social media types for media literacyDocumento28 pagineSocial media types for media literacyMa. Shantel CamposanoNessuna valutazione finora

- Pharma: Conclave 2018Documento4 paginePharma: Conclave 2018Abhinav SahaniNessuna valutazione finora