Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Buying A Site Right Procedure

Caricato da

chandra.sroDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Buying A Site Right Procedure

Caricato da

chandra.sroCopyright:

Formati disponibili

Right procedure: Check title for defects while purchasing land Buying a plot, however big or small it might

be, needs to be done with careful consideration. A small piece of land can become a big nightmare for a buyer, if the basic details are not scrutinised properly. Whether it is for investment option or to build a house, a buyer cannot afford to ignore the basic points before purchase. The list given below will be a handy note for those planning to purchase to a plot. The process is 1. Check the title of the land. 2. Get the approvals from the statutory bodies. 3. Complete the documentation of purchase of the land. 4. Handle post-registration issues. Let us examine each one separately Check the title of the land Find out whether the seller is individual/partnership/HUF/etc. Thoroughly check and satisfy yourself with the marketability of the property title in terms of whether the owner is the original owner and whether the title deed is original. Obtain legal opinion through an advocate of repute, who can examine the deeds to establish the ownership of the property by the seller. Similarly, if you are buying a resale plot, ask for the purchase agreement, which is the agreement between the current seller and the previous owner and get it scrutinised by an advocate. He/she will identify whether the seller is truly entitled to sell the property, whether any mortgage exists on the property and if it has been paid off and whether there is any lien on the property. Retain a copy of this document and also check the original. Get approval from the statutory bodies The nature of land, whether residential/commercial/ industrial/agricultural, has to be ascertained. All land in India is considered as revenue land or agricultural land. A conversion order is the base for any land to become any one of the above categories. This order has to be issued by government authorities. This has to be verified. Ask for all the legal documents in original. Check whether a No Encumbrance Certificate has been obtained to ensure that no mortgage exists/has been existing on the property. Get a No Objection Certificate from the builder/society. Check for authentic approvals from government agencies such as land development, planning authority and Income Tax Department. Ask for original documents and certificates.

Get a full and true disclosure of all outgoings such as municipal and other local taxes, taxes on income, water charges, electrical charges etc. Take a declaration from the seller on what add-on, if any, he is giving along with the property. Complete the documentation Make sure to include every conceivable clause in the Sale Agreement. A Sale Agreement is the only written evidence of the deal, so it should include everything from payment terms to exact description of the title. Understand the finer details of the sale contract properly to arm yourself with knowledge that shall be beneficial during and after the transaction is complete. Take care that all the duties that are to be paid on the property like stamp duty, registration fees and taxes are included in the Sale Deed/Agreement to Sell. Ask for any other information and documents as may be prescribed under the law. Post-registration activities Subsequent to the registration of sale deed, you should: Verify that all the taxes, statutory payments in respect of the property including power, water charges are paid till date. Collect deposit receipts given by power and water supply agencies from the seller. Without delay, apply to the power/water supply authorities to transfer the meters and deposits in your name. Ensure that the Khata in the records of the local bodies, gram panchayats or the City Corporation is transferred in your name. The original authorisation letter of the seller and a copy of the new Khata have to be enclosed with the application of transfer. (A Khata is a document that includes complete details of the land or property in question for the payment of tax). In Tamil Nadu, it is called patta; in Kerala, it is called Thanda. Get a good idea of the costs of various components like monthly outgoings, costs of utilities. Do research on the mode of payment and the tenure for which you will be liable to pay taxes. It is useful to obtain Encumbrance Certificates at least once a year, and make it a routine exercise.

Owning a property is an important thing in ones life. However, one needs to be careful while purchasing a land in each point to avoid falling into legal hassles. Precaution is needed from the initial stages of deciding on a property till the registration. The legal status of the land is one of the first issues that you should address before confirming a property. Dont make any confirmation by paying advance before checking the legal status of the property. Before purchasing a property, there are a number of enquiries that need to be done to confirm that the land has a clear and marketable title. The first thing is to find out the tenure and legal right of the holder of the land in government records. The tenure or possession right could be freehold, leasehold or may be held under a government grant. Freehold land is always most preferable. The seller should provide all the necessary documents to the buyer. There are certain documents which need to be taken care while purchasing the property. Title Deeds First and foremost, check the title deed of the property which is being purchased. Confirm whether the property is in the name of the seller and the rights to sell the property lies with only him and no other person is involved in it. Dont satisfy yourself with the copy of the title deed. Insist on seeing the original deed. Sometimes the seller may have taken a loan by pledging the original deed. It also needs checking whether the seller has permitted any access to others through this land and whether any other fact has been left undisclosed by the owner of the land.It is better to get the original deed examined by a lawyer. Along with the title deed, the buyer can also demand to see the previous deeds of the land available with the seller. Tax receipt and bills Property taxes which are paid to government or municipality are a first charge on the property. Hence, enquiries must be made in government and municipal offices to ascertain whether all taxes have been paid up to date. The owner should also possess the latest tax paid receipts, which you may inspect. While investigating in different departments of the municipality, you need to ascertain whether any notices or requisitions relating to the property have been issued and are outstanding and not yet complied.While inspecting the property tax receipt, it can be noted that there are two columns in the tax receipt. Make sure that the name entered in the owner's column is correct. The second column will be for the name of the one who paid the tax. Sometime the owner may not have the tax receipt with him, in such cases, contact the village office with the survey number of land and confirm the original owner of the land. If you are buying a house along with the property, then the house tax receipt should also be checked. Also make sure water bills and electricity is been paid up to date and if there any is balance payment to be made, ensure that it is made by the seller. Encumbrance Certificate Before purchasing the land or house, it is important to confirm that the land does not have any legal dues. Check the Encumbrance Certificate issued by the sub register office where the deed has been registered, stating that the said land does not have any legal dues and complaints.

Pledged land Some people may have taken loan from the bank by pledging their land. Ensure that the seller has paid back the entire amount due. Don't be satisfied with the receipt of the payment made. Release certificate issued by the bank is necessary for all the debts over the land. You could buy a land without the release certificate. But if you want to take a loan in future, the release certificate is a must. Measuring the land It is wise to measure the land before registering property in your name. Confirm if the measurements of the land are accurate. You can do this with the help of a recognized surveyor to avoid problems in the future. You could also take the Survey Sketch of the land from the Survey Department and compare for accuracy.

1. Conveyance / Sale deed : Document by which the title of a property is conveyed by the seller to the purchaser 2. ULC [Urban Land (Ceiling & Regulation) Act] : 3. 7/12 extract is a document, which shows the names of the owners of the property. It contains details such as the Survey numbers, area, date from which the current owners names were registered as owners. The 7/12 extract is issued by the Tehsildar or the concerned land authorities. 4. Index II Index II is a document issued by the office of the Sub- Registrar of Assurances. It mainly mentions the names of the sellers & purchasers of a property for which the document is registered. 5. Search report & Title certificate A Title certificate is issued by an advocate after conducting a search of the title of the property, which is intended to be purchased. The title certificate would state if the property is unencumbered and has a clear marketable title.(30 years) 6. Non Agricultural (N.A) permission 7. Development Agreement : entered into by the builder with the landowner. It contains details regarding the terms and conditions on which the landowner has permitted development of his property. This is where the landowner engages a third party (i.e. the developer) to develop and build on their plot of land. This agreement is generally accompanied by a Power of Attorney in favour of the developer. 8. Approved building plans need to be checked necessarily. The plans must be approved by the Municipal Corporation/ Town Planning authority or other concerned authorities like CIDCO, MHADA, HUDCO, Gram Panchayat, etc. as applicable depending on the location of the project. Approved plan of the building along with the number of floors. Check if occupancy certificate has been issued by the municipality authority with the approved of Building Plan. 9. Commencement certificate is given by the Municipal Corporation permitting the developer to begin construction. 10. Completion/occupation certificate is given by the concerned authorities to the developer once the said building is complete in all respects and fit for occupation. 11. Stamp Duty & Registration:

12. Registration of an agreement 13. Approved layout plan 14. ownership documents. Check if the land on which the builder is building is his or he has undertaken an agreement with a landlord. If so, check the title of the land ownership with the help of an advocate. 15. Ensure that urban land ceiling NOC (if applicable) has been obtained or not. 16. NOC from water and electricity authorities also have to be obtained. 17. NOC from lift authorities. 18. Has your builder/promoter acquired the approvals from Municipal Corporation, Area Development Authorities, Electricity Boards, Water Supply & Sewerage Boards, Airport Area Authorities? 19. Ensure execution of proper sale agreements on your initial payments. 20. IOD (Intimation of disapproval) 21. Encumbrance certificate PAPERS TO BE SUBMITTED TO BANK In addition to the application form(in duplicate) and two passport size photographs, the following papers are to be submitted to the Bank. PROOF OF INCOME In case of salaried persons: i. ii. Salary certificate showing deductions. Authorisation to deduct monthly installments from the salary of employee for credit of the loan account wherever available.

a. In the case of self employed / professional / business men. Audited accounts and Balance Sheets/income tax assessment orders/Returns/Memo/Statements of computation of taxable income filed for the last 3 years. DOCUMENTS TO BE SUBMITTED FOR CONSTRUCTION / IMPROVEMENT OF HOUSES i. ii. A copy of the plan inclusive of site plan approved by the Corporation/ Municipality/Development Authority/Panchayat as required. A copy of the building permit issued by the Corporation/ Municipality / Panchayat as required. In areas where building permit is not required a No Objection Certificate from the authority concerned. Estimate approved by licenced Egineers/Architects approved by local bodies. Original and prior title deeds. Latest tax receipts. Possession Certificate

iii. iv. v. vi.

vii. viii. ix. x.

Encumbrance certificate from the Sub Registrar for the last 15 years. Title clear certificate from the banks approved advocate. Valuation report from the banks approved valuator. An affidavit cum Undertaking from the person that he shall not violate the sanctioned plan.

1. DOCUMENTS TO BE SUBMITTED FOR PURCHASE OF HOUSES/FLATS i. ii. iii. iv. v. vi. vii. A copy of the agreement for sale. A copy of the Title deeds of the present owner. A copy of the land tax receipt. A copy of the building tax receipt. Encumbrance certificate from the Sub Registrar for the last 15 years. Title clear certificate from the banks approved advocate. Valuation report of the property and building from the banks approved valuator.

NOTE: After the sale deed is executed, the original deed along with fresh encumbrance certificate and possession certificate should be submitted. For purchase of plot alone all the documents as above except the no. iv are to be submitted. After availment of the loan, encumbrance certificate for four months after the date of mortgage is to be produced.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Water Purification Marketing Plan FinalDocumento45 pagineWater Purification Marketing Plan FinalAtif Jamil83% (12)

- The Red-Bearded BaronDocumento6 pagineThe Red-Bearded BaronSarith Sagar100% (2)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- ChamberDocumento5 pagineChamberFaisal OmarNessuna valutazione finora

- Oracle PrerequisitesDocumento2 pagineOracle Prerequisiteschandra.sroNessuna valutazione finora

- Server ConfigDocumento4 pagineServer Configchandra.sroNessuna valutazione finora

- Oracle PrerequisitesDocumento2 pagineOracle Prerequisiteschandra.sroNessuna valutazione finora

- Vcs Error FixDocumento2 pagineVcs Error Fixchandra.sroNessuna valutazione finora

- CRDocumento1 paginaCRchandra.sroNessuna valutazione finora

- Vcs Error Fix1Documento2 pagineVcs Error Fix1chandra.sroNessuna valutazione finora

- CR TaskDocumento1 paginaCR Taskchandra.sroNessuna valutazione finora

- Verify and Synchronize HACMPDocumento2 pagineVerify and Synchronize HACMPchandra.sroNessuna valutazione finora

- Embedded CurriculamDocumento2 pagineEmbedded Curriculamchandra.sroNessuna valutazione finora

- Sync SHDocumento2 pagineSync SHchandra.sroNessuna valutazione finora

- Embedded CurriculamDocumento2 pagineEmbedded Curriculamchandra.sroNessuna valutazione finora

- Embedded CurriculamDocumento2 pagineEmbedded Curriculamchandra.sroNessuna valutazione finora

- Embedded CurriculamDocumento2 pagineEmbedded Curriculamchandra.sroNessuna valutazione finora

- Sync SHDocumento2 pagineSync SHchandra.sroNessuna valutazione finora

- Embedded CurriculamDocumento2 pagineEmbedded Curriculamchandra.sroNessuna valutazione finora

- Embedded ToolsDocumento6 pagineEmbedded Toolschandra.sroNessuna valutazione finora

- EMbedded Software Engineer ResponsibiltiesDocumento10 pagineEMbedded Software Engineer Responsibiltieschandra.sroNessuna valutazione finora

- Vio UpgradeDocumento2 pagineVio Upgradechandra.sroNessuna valutazione finora

- Embedded CurriculamDocumento2 pagineEmbedded Curriculamchandra.sroNessuna valutazione finora

- C Study GuideDocumento10 pagineC Study Guidechandra.sroNessuna valutazione finora

- EMbedded Software Engineer ResponsibiltiesDocumento10 pagineEMbedded Software Engineer Responsibiltieschandra.sroNessuna valutazione finora

- Personal DetailsDocumento1 paginaPersonal Detailschandra.sroNessuna valutazione finora

- C Study GuideDocumento10 pagineC Study Guidechandra.sroNessuna valutazione finora

- Software Package Namesoftware Group Name Package Version Ip Address Machine Name User Login IdDocumento2 pagineSoftware Package Namesoftware Group Name Package Version Ip Address Machine Name User Login Idchandra.sroNessuna valutazione finora

- CMG Virt ConceptsDocumento25 pagineCMG Virt Conceptschandra.sroNessuna valutazione finora

- Embedded ToolsDocumento6 pagineEmbedded Toolschandra.sroNessuna valutazione finora

- UntitledDocumento1 paginaUntitledchandra.sroNessuna valutazione finora

- New Microsoft Office Word DocumentDocumento7 pagineNew Microsoft Office Word Documentchandra.sroNessuna valutazione finora

- IRCTC LTD, Booked Ticket PrintingDocumento2 pagineIRCTC LTD, Booked Ticket Printingchandra.sroNessuna valutazione finora

- Running Head: The Valuation of Wal-Mart 1Documento9 pagineRunning Head: The Valuation of Wal-Mart 1cdranuragNessuna valutazione finora

- NIMIR Chemicals Annual Report 2016Documento104 pagineNIMIR Chemicals Annual Report 2016Nisar Akbar KhanNessuna valutazione finora

- Module 4 - Decisions Under UncertaintyDocumento19 pagineModule 4 - Decisions Under UncertaintyRussell Lito LingadNessuna valutazione finora

- Investment Principles and Checklists OrdwayDocumento149 pagineInvestment Principles and Checklists Ordwayevolve_us100% (2)

- Commitment LetterDocumento306 pagineCommitment LetterNoor Azah AdamNessuna valutazione finora

- Student Coin WhitepaperDocumento28 pagineStudent Coin WhitepaperBorsa SırlarıNessuna valutazione finora

- Management Theory and PracticesDocumento15 pagineManagement Theory and Practicessajidsfa100% (2)

- Financial Report of Nepal Bank Limited (NBL)Documento17 pagineFinancial Report of Nepal Bank Limited (NBL)Sarose ThapaNessuna valutazione finora

- SBM QuestionsDocumento148 pagineSBM QuestionsGeorge NicholsonNessuna valutazione finora

- AS310 Midterm Test Sep Dec2021 PDFDocumento1 paginaAS310 Midterm Test Sep Dec2021 PDFGhetu MbiseNessuna valutazione finora

- HDFC Card DetailsDocumento12 pagineHDFC Card DetailsRahul AskNessuna valutazione finora

- Merrill Lynch - Assessing Cost of Capital and Performance 2015Documento16 pagineMerrill Lynch - Assessing Cost of Capital and Performance 2015CommodityNessuna valutazione finora

- Annual Report 2014-15 Hindalco 2015Documento220 pagineAnnual Report 2014-15 Hindalco 2015Anonymous orRwZt8ibNessuna valutazione finora

- Amarpali NoticeDocumento4 pagineAmarpali NoticeSharjeel AhmadNessuna valutazione finora

- Analysis of Annual Report:: AbstractDocumento6 pagineAnalysis of Annual Report:: Abstractapi-301617324Nessuna valutazione finora

- Admin Law Cases Week 3Documento18 pagineAdmin Law Cases Week 3bidanNessuna valutazione finora

- Formation of Joint Stock CompanyDocumento5 pagineFormation of Joint Stock CompanyHemchandra PatilNessuna valutazione finora

- Zach DeGregorio Civil Complaint Filed 01-03-2022Documento261 pagineZach DeGregorio Civil Complaint Filed 01-03-2022DamienWillisNessuna valutazione finora

- Aaa Erori ManagementDocumento33 pagineAaa Erori ManagementAndrei IoanNessuna valutazione finora

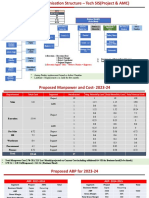

- Proposed Org Chart - Tech SIS.Documento5 pagineProposed Org Chart - Tech SIS.Santosh KumarNessuna valutazione finora

- Economic Value Added: EVA Is An Estimate of A Firm's Economic Profit - BeingDocumento7 pagineEconomic Value Added: EVA Is An Estimate of A Firm's Economic Profit - BeingSunil Kumar SahooNessuna valutazione finora

- 4 Managing Debts Effectively PDFDocumento48 pagine4 Managing Debts Effectively PDFLawrence CezarNessuna valutazione finora

- IM ACCO 20173 Business and Transfer Taxes Module 5 PDFDocumento5 pagineIM ACCO 20173 Business and Transfer Taxes Module 5 PDFMakoy BixenmanNessuna valutazione finora

- 1 - IjarahDocumento31 pagine1 - IjarahAlishba KaiserNessuna valutazione finora

- 9 CNG Cost Components PDFDocumento9 pagine9 CNG Cost Components PDFReno SaibihNessuna valutazione finora

- The Concept of Advance Payment of Tax-Taxation Law-Sem VDocumento16 pagineThe Concept of Advance Payment of Tax-Taxation Law-Sem VAUNNESHA DEYNessuna valutazione finora

- LAW 20013 Law On Obligations and Contracts Midterm ReviewDocumento14 pagineLAW 20013 Law On Obligations and Contracts Midterm ReviewNila Francia100% (1)