Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mtechtips Commodity Market News 2: NATO Patriot Missile Deployment Keeps Crude Oil Supported

Caricato da

MtechTipsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mtechtips Commodity Market News 2: NATO Patriot Missile Deployment Keeps Crude Oil Supported

Caricato da

MtechTipsCopyright:

Formati disponibili

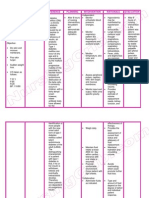

MTECHTIPS COMMODITY MARKET NEWS 2

MTECHTIPS:-NATO supported Patriot Missile deployment keeps Crude Oil

With NATO approving the deployment of Patriot missiles along the borders of Turkey and Syria to prevent the latter from using chemical weapons on any target, crude oil prices are enjoying a firm support. The deployment may take weeks according to experts.Possible spillover of a potential conflict is keeping the markets on a bullish pedestal.Earlier, the fiscal cliff woes had taken the markets down with Brent crude oil closing below the $110/ barrel psychological support.In response to Turkeys request, NATO has decided to augment Turkeys air defence capabilities in order to defend the population and territory of Turkey and contribute to the de-escalation of the crisis along the Alliances border. NATO said in a statement.Brent Crude oil for January delivery climbed 0.33% to touch $110.08 a barrel on the ICE Futures Europe as on 10.29 AM, IST. Its trans-Atlantic counterpart, WTI crude oil climbed 0.42% to touch $88.88 a barrel on NYMEX.We welcome the intention of Germany, the Netherlands and the United States to provide Patriot missile batteries, subject to their respective national procedures. These systems will be under the operational command of the Supreme Allied Commander Europe (SACEUR). Any deployment will be defensive only. It will in no way support a no-fly zone or any offensive operation. the NATO statement read.

MTECHTIPS:-Why Gold prices are crashing? Answer: QE3!

Gold prices may have recovered a bit aided by the uncertainty prevailing in Eurozone area; but investors seem to abandon the commodity in droves as US fiscal cliff issue continues to keep markets on tenterhooks.While only a handful would predict that US would go off the click, the day-to-day developments in the US political arena is adding to the uncertainty in markets in a big way. When there is uncertainty in the markets, people hardly invest. They would simply sell and markets yesterday saw just that!Gold is being sold along with just about everything else in commodities with the worries on the fiscal cliff, Bart Melek, the Toronto-based head of commodity strategy at TD Securities, said in a telephone interview to Bloomberg. The metal is usually said to be a safe haven, but the threat to economies globally from the fiscal cliff is having knock-on effects.Now, one would be surprised if I say that QE 3 is having a role in this crash. The money supply did improve subsequent to $40 billion a month unlimited QE 3. But the Adjusted Monetary Base of the US Federal Reserve remained flat.

MTECHTIPS:-What is the near term support level for MCX Gold

Gold snapped the psychological key $1700-level for the first time in a month yesterday. Profit booking hit the markets as funds liquidated their respective positions. Options related selling sent bullion prices below a key technical support and on MCX prices settled near Rs 31400 in early session.On Wednesday morning, spot gold and silver opened slightly positive following weakness in USD and MCX Gold February contract gained along with the spurt in international market prices.Now, technically market is getting support at Rs.31350 and below could see a testing of Rs.31100 level; resistance is now likely to be seen at Rs.31550.Gold investors are now focusing on the US non-farm payrolls data due on Friday. It is forecast to be 91K which is positive for gold and negative for USD, as compared to 171K reported previously.

MTECHTIPS:-Copper: Weak demand and low expectations in store, says CESCO meet

Analysts with Barclays Capital said that many views expressed during last weeks CESCO Asia Copper Week were for weak demand and low expectations. During the week, Codelco offered to cut 2013 premiums for China.Many traders had hoped for a bigger cut, but most participants we talked to expect contracted tonnages to fall only by around 10%, given the need to maintain a steady supply amid uncertainties, said Barclays. According to the British bank, market participants also expected treatment and refining charges to rise, reflecting increased mine supply. The higher mine supply means considerable downside risk to its first-half copper price forecast of $8,850 a metric ton.A sustained improvement in prices looks unlikely until there is evidence of draws in Chinese inventories. Feedback on physical demand was mixed but expectations were mostly for soft demand overall, with some semi producers reporting an increase in orders. But many others painted a deteriorating picture. Lackluster demand may have been exacerbated by overcapacity, Barclays added.

MTECHTIPS:-China Steel grabs global market on improved quality, price competitiveness: MEPS

Against the backdrop of lower output of steel in the rest of the world , Chinas exports of rolled steel products has risen 12.3% during the first nine months of 2012 compared to the same period last year. The exports rose 3 million tons to 27.36 million tons, according to MEPS International, London.The reasons increased demand for China steel is its price competitiveness, the quality of commercial grades is now acceptable for most applications around the world and the demand from the countries with a shortfall in supply continues to grow.These nations have obtained their requirements in the past from Chinese steelmakers, and are expected to continue purchasing from this source. The competitive price situation will come as no surprise to MEPS subscribers to China Steel Review. Significant differences between domestic prices in China and its main trading partners have been highlighted for most of this year.Average rolled steel prices, in the main Asian consuming nations, have been $US200 per tonne above those in China for all the year. In recent months, the figure has moved above $US250. Such differences provided ample opportunities for the mills in

China to cover all the costs of administration, freight and local transport to their foreign customers.

MTECHTIPS:-Bull run expected in India's MCX Copper only above Rs.450

Technically on daily charts MCX Copper February contract looks sideways to positive but it's trading near to it's very important resistance level of Rs 450.Now the next bull run is expected in copper only above Rs.450 and if prices sustain above Rs.450 then one can expect Rs.465 levels in coming sessions, On the bottom side very good support is expected at Rs.443 and if prices sustain below Rs.443 only then I would expect some correction in copper prices to Rs.432 levels. he added.So traders are advised to take a fresh position on either side in copper only above/below the aforesaid levels for coming sessions as long as the trade takes place in the range of Rs 443-450.Meanwhile, on India's MCX, copper for February delivery was seen trading at Rs.446.25 a kilogram, a marginal gain of 0.12% around 1.48 PM IST, Wednesday.

MTECHTIPS:-The one factor that can take MCX Natural Gas above Rs.200

Short term outlook for MCX Natural gas remains negative until the prices stay below Rs.200 mark on closing basis.Daily charts are not looking much positive for now. Sell on rise is recommended for natural gas December contract near Rs 197 with stop loss of Rs 200 for target near Rs 190. said Ankush Kumar Jain, Manager-Research, Metals-Energy, Commodity Online.Overall sentiment for natural gas is looking bearish for this week; any big change in weekly inventory data may take natural gas above Rs.200. Till then it's expected to remain bearish.In the near term, the December weather forecast for US is currently showing 3% warmer-than-normal heating degree days, while production has not shown any signs of declines. At the same time, more nuclear generation is likely to return in December, Barclays said in its weekly report on natural gas sent recently.Although higher y/y nuclear outages are likely to lend support to gas burn still, the m/m reduction in nuclear outage is likely to take away more than 1 Bcf/d of demand for gas if one assumes gas is the only fuel that benefits from the nuclear shortfall.

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Diagnostic Report: Patient Name: Pranav Chauhan PRANM050319990B 0009VA060799Documento2 pagineDiagnostic Report: Patient Name: Pranav Chauhan PRANM050319990B 0009VA060799pranav chauhanNessuna valutazione finora

- Global Governance and Interstate SystemDocumento25 pagineGlobal Governance and Interstate SystemRay Stephen SantosNessuna valutazione finora

- Symbolic Interaction Theory: Nilgun Aksan, Buket Kısac, Mufit Aydın, Sumeyra DemirbukenDocumento3 pagineSymbolic Interaction Theory: Nilgun Aksan, Buket Kısac, Mufit Aydın, Sumeyra DemirbukenIgor Dutra BaptistaNessuna valutazione finora

- On Bullshit A Problem or An OpportunityDocumento37 pagineOn Bullshit A Problem or An OpportunityEricPezoaNessuna valutazione finora

- Paula Moraga (Author) - Geospatial Health Data-Modeling and Visualization With R-InLA and Shiny-Chapman and Hall - CRC (2019)Documento295 paginePaula Moraga (Author) - Geospatial Health Data-Modeling and Visualization With R-InLA and Shiny-Chapman and Hall - CRC (2019)M Khahfi ZuhandaNessuna valutazione finora

- Pay Scale WorkshopDocumento5 paginePay Scale WorkshopIbraNessuna valutazione finora

- Nursing Care Plan Diabetes Mellitus Type 1Documento2 pagineNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Chapter 7 Integration Testing PDFDocumento74 pagineChapter 7 Integration Testing PDFebrgsrtNessuna valutazione finora

- Philippines and Singapore Trade Relations and Agreements: 1. What Leads To Said Agreement?Documento11 paginePhilippines and Singapore Trade Relations and Agreements: 1. What Leads To Said Agreement?Ayrah Erica JaimeNessuna valutazione finora

- University Physics With Modern Physics 2nd Edition Bauer Test BankDocumento24 pagineUniversity Physics With Modern Physics 2nd Edition Bauer Test BankJustinTaylorepga100% (42)

- C MukulDocumento1 paginaC Mukulharishkumar kakraniNessuna valutazione finora

- Tia Portal V16 OrderlistDocumento7 pagineTia Portal V16 OrderlistJahidul IslamNessuna valutazione finora

- Perceptual Objective Listening Quality Assessment (POLQA), The Third Generation ITU-T Standard For End-to-End Speech Quality Measurement Part I-Temporal AlignmentDocumento19 paginePerceptual Objective Listening Quality Assessment (POLQA), The Third Generation ITU-T Standard For End-to-End Speech Quality Measurement Part I-Temporal AlignmentmewarulesNessuna valutazione finora

- ADP ObservationDocumento15 pagineADP ObservationSanjay SNessuna valutazione finora

- WB-Mech 120 Ch05 ModalDocumento16 pagineWB-Mech 120 Ch05 ModalhebiyongNessuna valutazione finora

- BLDG Permit Form (Back To Back)Documento2 pagineBLDG Permit Form (Back To Back)ar desNessuna valutazione finora

- 1973 Essays On The Sources For Chinese History CanberraDocumento392 pagine1973 Essays On The Sources For Chinese History CanberraChanna LiNessuna valutazione finora

- Tok EssayDocumento2 pagineTok EssayNeto UkpongNessuna valutazione finora

- PQS Catalogue 4 2Documento143 paginePQS Catalogue 4 2sagarNessuna valutazione finora

- Psychological Well Being - 18 ItemsDocumento5 paginePsychological Well Being - 18 ItemsIqra LatifNessuna valutazione finora

- Robe Draft Geotechnical Report - Edited by k2nDocumento43 pagineRobe Draft Geotechnical Report - Edited by k2nASAMNEW GULILATNessuna valutazione finora

- National Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyDocumento8 pagineNational Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyNisha PasariNessuna valutazione finora

- Acute Conditions of The NewbornDocumento46 pagineAcute Conditions of The NewbornCamille Joy BaliliNessuna valutazione finora

- Pursanova IXC ManualDocumento16 paginePursanova IXC ManualHector Serrano MagañaNessuna valutazione finora

- MP CRPDocumento2 pagineMP CRPankutupanaNessuna valutazione finora

- LPP - Problem Number 2Documento9 pagineLPP - Problem Number 2CT SunilkumarNessuna valutazione finora

- C779-C779M - 12 Standard Test Method For Abrasion of Horizontal Concrete SurfacesDocumento7 pagineC779-C779M - 12 Standard Test Method For Abrasion of Horizontal Concrete SurfacesFahad RedaNessuna valutazione finora

- Vacuum Braking SystemDocumento20 pagineVacuum Braking SystemPrashant RaiNessuna valutazione finora

- FS1 Worksheet Topic 6Documento2 pagineFS1 Worksheet Topic 6ALMALYN ANDIHNessuna valutazione finora

- Test Plan TemplateDocumento3 pagineTest Plan TemplateMurtazaNessuna valutazione finora