Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Quarterly Acc 3rd 2011 12

Caricato da

Asif Al AminCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Quarterly Acc 3rd 2011 12

Caricato da

Asif Al AminCopyright:

Formati disponibili

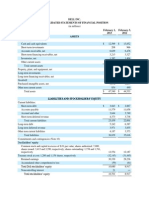

Investment Corporation of Bangladesh and its Subsidiaries

Consolidated Balance Sheet as at 31 March 2012

(Unaudited)

(Audited)

March 31, 2012

Taka

June 30, 2011

Taka

Cash and Bank Balances

Investments:

Capital Investment in Other Institutions

Marketable Securities- at Market value

Investment in Bangladesh Fund

11,776,620,649

30,710,931,427

48,752,837

25,662,178,590

5,000,000,000

10,619,121,963

32,493,168,953

92,418,140

30,134,050,813

2,266,700,000

Loans and Advances:

Margin Loan Secured

14,186,958,924

10,887,465,235

158,967,181

12,951,259

272,071,723

56,275,081

940,665,843

700,000,000

1,158,562,601

12,715,206,292

10,428,306,591

121,565,631

18,733,310

295,998,806

56,275,081

878,350,840

915,976,033

145,527,215

143,664,997

3,310,404,050

60,130,442,265

4,438,423,076

60,409,585,281

5,491,500,000

31,500,000

5,460,000,000

31,500,000

31,500,000

-

22,972,127,340

68,000,000

26,617,059

7,712,539,470

36,270,783,869

22,711,873,351

68,000,000

26,617,059

7,540,847,182

30,378,837,592

Property and Assets

Unit & Mutual Fund Advance Account Secured

Consumer Credit Scheme

Bridging Loan

Debenture Loan

Lease Receivables

Advance Against equity

Other Loans and Advances

Premises and Equipment

(at cost less depreciation)

Other Assets

Total Assets

Liabilities and Capital

Liabilities

Borrowings:

Government Loan

Borrowings From Different Banks

Deposits

Debentures

Deferred Interest

Other Liabilities and Provisions

Carried forward

Investment Corporation of Bangladesh and its Subsidiaries

Consolidated Balance Sheet as at 31 March 2012 (Contd.)

(Unaudited)

(Audited)

March 31, 2012

Taka

June 30, 2011

Taka

Minority Interest

Capital / Shareholders Equity

Paid-up Capital

Reserves

Revaluation Reserve for investment

Retained Earnings

36,270,783,869

21,808

23,859,636,588

3,375,000,000

10,568,655,030

6,655,651,109

3,260,330,449

30,378,837,592

33,875

30,030,713,814

2,500,000,000

8,028,145,114

12,480,522,802

7,022,045,898

Total Liabilities and Shareholders Equity

60,130,442,265

60,409,585,281

0.51

0.06

622,476,000

72,476,000

550,000,000

2,122,976,000

500,000

72,476,000

2,050,000,000

Brought forward

Contra Entries

Off-Balance Sheet Items:

Contingent Liabilities:

Penalty imposed by SEC-RPO of Golden Son Ltd.

Commitment on NBL on A/C of Nasrin-Arju Cattle Goat Feed

Guarantee to DSE & CSE on behalf of ISTCL

Commitments:

2,872,700,000

2,872,700,000

Lease Financing

Debenture Financing

Pre-IPO Placement

Investment in Direct Equity

Investment in Bond

Purchase of Preference Share

250,000,000

542,500,000

706,600,000

763,600,000

350,000,000

260,000,000

250,000,000

542,500,000

706,600,000

763,600,000

350,000,000

260,000,000

Total Off-Balance Sheet Items

3,495,176,000

4,995,676,000

Investment Corporation of Bangladesh and its Subsidiaries

Consolidated Profit and Loss Account

For the period of 9 months ended 31 March

(UNAUDITED)

for the 9 months ended 31

March

July 01, 2011 to March

31, 2012

Taka

July 01, 2010 to

March 31, 2011

Taka

for the 3rd quarter ended 31

March

January 01, 2012 to

March 31, 2012

Taka

(Restate)

January 01, 2011 to

March 31, 2011

Taka

(Restate)

Operating Income

Interest Income

Less: Interest paid on Deposits, Borrowings, etc.

Net Interest Income

Dividend

Capital Gain

Fees, Commissions & Service Charges

Other Operating Income

Total Operating Income (a)

2,041,803,326

2,339,430,351

(297,627,025)

433,544,893

1,887,683,545

606,767,093

26,646,449

2,657,014,954

1,962,055,999

1,250,419,742

711,636,257

142,034,757

3,526,797,247

1,277,604,539

27,060,059

5,685,132,859

789,464,164

1,007,270,807

(217,806,643)

269,672,168

422,536,209

144,767,657

3,120,362

622,289,752

675,372,335

412,638,807

262,733,528

16,466,130

719,203,912

263,977,034

2,652,644

1,265,033,248

Operating Expenses

Salary and Allowances

Rent, Taxes, Insurance, Electricity, etc.

Legal Expenses

Postage, Stamps, Telegram & Telephone

Auditors Fees

Stationary, Printing, Advertisement, etc.

Directors Fees & Allowances

Repair, Maintenance & Depreciation-Premises &

Equipment

Brokerage

Other Operating Expenses

Total Operating Expenses (b)

237,887,830

35,903,401

732,739

2,276,990

138,750

10,776,319

1,653,250

22,878,632

239,259,955

37,633,625

1,683,402

2,094,015

46,500

14,866,364

1,222,750

25,888,095

58,747,573

5,364,732

272,223

1,096,117

53,750

3,373,324

617,000

3,068,287

72,150,535

12,721,665

309,005

878,588

25,500

5,967,180

437,250

8,136,266

26,306,618

88,686,518

427,241,046

120,483,909

227,842,762

671,021,376

7,384,579

7,421,755

87,399,339

21,758,472

19,994,412

142,378,872

Operating Profit (a-b)

2,229,773,908

5,014,111,483

534,890,413

1,122,654,375

Add: Non-operating Income

Profit before Provision

19,104,710

2,248,878,618

12,419,815

5,026,531,298

534,890,413

4,188,000

1,126,842,375

Provision against Loans and Advances

Other Provisions

Total Provision (d)

Profit before Tax (c-d)

Less: Provision for Taxation

286,225,187

25,034,350

311,259,537

1,937,619,081

516,595,764

196,650,000

30,000,000

226,650,000

4,799,881,298

754,499,148

115,683,500

5,034,350

120,717,850

414,172,563

93,050,000

10,000,000

103,050,000

1,023,792,375

Net Profit After Tax

1,421,023,317

4,045,382,149

176,566,042

237,606,521

227,889,148

795,903,227

Less: Minority Interest

Net Profit Available for Appropriation

Earnings Per Share

3,600

10,700

1,307

755

1,421,019,717

42.10

4,045,371,450

119.86

237,605,213

7.04

795,902,472

23.58

Investment Corporation of Bangladesh

Cash Flow Statement

For the Period of 9 months ended 31 March

(UNAUDITED)

Cash flow from operating activities:

Interest Received

Interest Paid

Income from Investment

Dividend Received

Fees & Commissions Received

Cash Paid to Employees

Cash Paid to Suppliers

Cash Received from Other operating activities

Cash Paid for Other operating activities

Cash Flow before changes in Operating Assets & Liabilities

Changes in Operating Assets & Liabilities

Increase/Decrease in Loans & Advances

Increase/Decrease in Investment in other Instutions

Increase/Decrease in other Assets

Increase/Decrease in Deposit Received from other Banks

Increase/Decrease in Deposit received from Other Depositors

Increase/Decrease in Long Term Debt

Increase/Decrease in other Liabilities

Net Cash Flow from Operating Activities (a)

Cash Flow from Investment Activities:

Cash inflow from Sale of Securities

Cash outflow for Purchase of Securities

Cash Increase/Decrease From Sale/Purchase of Fixed Asset

Net Cash Employed in Investment Activities (b)

Cash Received from Financing Activities

Cash Paid against Borrowings

Dividend paid in Cash

Net Cash Received from Financing Activities

Net Cash Increase/Decrease (a+b+c)

Opening Cash Balance

Closing Cash Balance

Operating Cash Flow Per Share

July 01, 2011 to March 31,

2012

Taka

July 01, 2010 to March 31,

2011

Taka

1,991,745,721

(2,131,232,698)

1,887,683,545

416,389,450

556,089,652

(230,845,789)

(72,568,081)

45,751,159

(115,270,636)

2,347,742,323

1,852,827,332

(930,428,591)

3,526,797,247

141,453,079

1,277,604,539

(239,259,955)

(82,212,000)

39,479,874

(349,549,421)

5,236,712,104

(1,471,752,632)

43,665,303

(4,187,545,123)

(2,619,525,291)

(2,197,084,719)

(53,402,640)

(9,345,569,172)

(3,119,525,291)

2,879,779,280

5,460,000,000

802,999,991

907,621,528

3,255,363,851

7,050,000,000

7,397,303,234

(268,278,588)

4,968,433,516

2,115,352,060

(3,696,091,292)

1,128,019,026

(452,720,206)

8,253,436,147

(15,317,955,985)

(39,290,073)

(7,103,809,911)

(2,134,568,980)

(273,377,958)

1,222,860,923

(241,305,849)

(2,407,946,938)

394,696,707

3,427,362,083

3,867,058,790

96.46

981,555,074

(1,153,821,321)

1,867,582,792

860,200,034

147.21

Investment Corporation of Bangladesh and its Subsidiaries

Consolidated Statement of changes in Equity

For the period of 9 months ended 31 March 2012

(UNAUDITED)

Paid up Capital

Particulars

Balance as at 1 July 2011

Stock Dividend Transfer to Paid up Capital

Amount Transferred to Different Reserves

(Taka)

2,500,000,000

875,000,000

-

Amount adjusted to Revaluation Reserve for

Investment during the period

Stock Dividend paid by the subsidiary companies

Dividend Cash for FY 2010-2011

Amount Transferred to Benevolent Fund

Addition during the period

Balance as at 31 March 2012

Reserve

(Taka)

20,508,667,916

2,674,583,942

(5,958,945,719)

3,375,000,000

17,224,306,139

Retained

Earnings

(Taka)

7,022,045,898

(875,000,000)

(2,674,583,942)

(1,219,599,592)

(375,000,000)

(38,551,631)

1,421,019,717

3,260,330,449

Total

(Taka)

30,030,713,814

(5,958,945,719)

(1,219,599,592)

(375,000,000)

(38,551,631)

1,421,019,717

23,859,636,588

(1,065,965,591)

Consolidated Statement of changes in Equity

For the period of 9 months ended 31 March 2011 (Restated)

(UNAUDITED)

Particulars

Balance as at 1 July 2010 (Restated)

Stock Dividend Transfer to Paid up Capital

Amount Transferred to Different Reserves

Paid up Capital

(Taka)

2,000,000,000

500,000,000

-

Amount adjusted to Revaluation Reserve for

Investment during the period

Dividend Cash for FY 2009-2010

Amount Transferred to Benevolent Fund

Addition during the period

Balance as at 31 March 2011

Reserve

(Taka)

19,395,796,906

2,562,500,000

Retained

Earnings

(Taka)

6,245,327,817

(500,000,000)

(2,562,500,000)

(844,233,873)

-

2,500,000,000

21,114,063,033

Total

(Taka)

27,641,124,723

(844,233,873)

(306,000,000)

(50,000,000)

4,045,371,450

6,872,199,266

(306,000,000)

(50,000,000)

4,045,371,450

30,486,262,300

Investment Corporation of Bangladesh

Balance Sheet as at 31 March 2012

(Unaudited)

(Audited)

Note

March 31, 2012

Taka

June 30, 2011

Taka

11,308,882,556

28,919,757,082

9,724,164,561

30,228,678,394

5.1

5.2

5.3

5.4

579,499,100

48,752,837

23,291,505,145

5,000,000,000

579,499,100

92,418,140

27,290,061,154

2,266,700,000

6.1

6.2

6.3

6.4

6.5

6.6

6.7

6.8

11,223,384,995

3,478,967,821

158,967,181

12,951,259

272,071,723

56,275,081

940,665,843

700,000,000

5,603,486,086

10,047,050,947

3,659,155,578

121,565,631

18,733,310

295,998,806

56,275,081

878,350,840

5,016,971,701

Property and Assets

Cash and Bank Balances

Investments:

Capital Investment in ICB Subsidiary Companies

Capital Investment in Other Institutions

Marketable Securities- at Market value

Investment in Bangladesh Fund

Loans and Advances:

Margin Loan Secured

Unit & Mutual Fund Advance Account Secured

Consumer Credit Scheme

Bridging Loan

Debenture Loan

Lease Receivables

Advance Against equity

Other Loans and Advances

Premises and Equipment

(at cost less depreciation)

77,885,187

74,910,516

Other Assets

Total Assets

2,962,549,570

54,492,459,391

2,699,576,142

52,774,380,560

5,491,500,000

31,500,000

9.1

9.2

31,500,000

5,460,000,000

31,500,000

-

10

11

12

13

22,972,127,340

68,000,000

26,617,059

4,527,192,493

33,085,436,892

22,711,873,351

68,000,000

26,617,059

4,145,837,045

26,983,827,455

Liabilities and Capital

Liabilities

Borrowings:

Government Loan

Borrowings From Different Banks

Deposits

Debentures

Deferred Interest

Other Liabilities and Provisions

Carried forward

Investment Corporation of Bangladesh

Balance Sheet as at 31 March 2012 (Contd.)

(Unaudited)

(Audited)

March 31, 2012

Taka

June 30, 2011

Taka

33,085,436,892

26,983,827,455

14

16.1

16.2

21,407,022,499

3,375,000,000

9,209,237,927

7,245,029,068

25,790,553,105

2,500,000,000

6,959,237,927

12,253,656,020

17

1,577,755,504

4,077,659,158

54,492,459,391

52,774,380,560

Notes

Brought forward

Capital / Shareholders Equity

Paid-up Capital

Reserves

Revaluation Reserve for investment

Retained Earnings

Total Liabilities and Shareholders Equity

(0)

Contra Entries

Off-Balance Sheet Items:

Contingent Liabilities:

550,000,000

550,000,000

2,050,000,000

2,050,000,000

Commitments:

Lease Financing

Debenture Financing

Pre-IPO Placement

Investment in Direct Equity

Investment in Bond

Purchase of Preference Share

2,872,700,000

250,000,000

542,500,000

706,600,000

763,600,000

350,000,000

260,000,000

2,872,700,000

250,000,000

542,500,000

706,600,000

763,600,000

350,000,000

260,000,000

Total Off-Balance Sheet Items

3,422,700,000

4,922,700,000

Guarantee to DSE & CSE on behalf of ISTCL

Investment Corporation of Bangladesh

Profit and Loss Account

For the period of 9 months ended 31 March

(UNAUDITED)

for the 9 months ended 31 March

July 01, 2011 to

March 31, 2012

Taka

Operating Income

Interest Income

Interest paid on Deposits, Borrowings, etc.

Net Interest Income

Dividend

Capital Gain

Fees, Commissions & Service Charges

Other Operating Income

Total Operating Income

July 01, 2010 to

March 31, 2011

Taka

(Restate)

1,698,044,995

1,609,871,177

(2,339,430,352)

(1,250,419,742)

(641,385,357)

359,451,435

for the 3rd quarter ended 31

March

January 01, 2012 to

March 31, 2012

Taka

January 01, 2011 to

March 31, 2011

Taka

(Restate)

664,007,302

562,818,285

(1,007,270,808)

(343,263,506)

(412,638,807)

150,179,478

394,141,613

114,823,794

261,872,302

8,426,083

1,613,941,785

2,941,184,320

402,614,627

678,767,622

147,356,300

324,770,462

49,220,945

98,215,893

1,264,960

431,279

1,515,319,300

3,740,661,289

531,814

370,976,181

59,350

935,648,425

129,323,041

137,704,816

24,431,898

37,082,897

21,973,775

21,811,504

2,220,536

7,222,250

497,219

1,409,102

106,703

195,005

1,733,669

1,456,372

881,377

698,186

Operating Expenses

Salary and Allowances

Rent, Taxes, Insurance, Electricity, etc.

Legal Expenses

Postage, Stamps, Telegram & Telephone

Auditors Fees

Stationary, Printing, Advertisement, etc.

90,000

30,000

5,445,093

7,076,894

1,805,255

3,150,261

775,000

398,000

290,000

140,000

Repair, Maintenance & Depreciation-Premises &

Equipment

Brokerage

10,176,774

8,509,966

13,237,199

62,801,169

580,752

5,022,296

3,114,841

10,156,678

Other Operating Expenses

28,226,047

24,683,680

Total Operating Expenses

206,750,583

270,578,734

9,059,251

42,520,612

7,393,602

71,061,174

1,308,568,717

3,470,082,555

328,455,569

864,587,251

Directors Fees & Allowances

Operating Profit

Non-operating Income

Profit before Provision

Provision against Loans and Advances

Provision against Investments

19,104,710

12,419,815

1,327,673,427

3,482,502,370

328,455,569

4,188,000

868,775,251

23,802,948

76,650,000

10,000,000

23,050,000

Other Provisions

25,000,000

30,000,000

Total Provision

48,802,948

1,278,870,479

Profit before Tax

Provision for Taxation

Net Profit Available for Appropriation

Earnings Per Share

(240,222,501)

106,650,000

5,000,000

15,000,000

10,000,000

33,050,000

3,375,852,370

313,455,569

835,725,251

(498,502,249)

1,038,647,978

2,877,350,121

(92,635,923)

220,819,646

(146,892,249)

688,833,002

30.77

85.25

6.54

20.41

Investment Corporation of Bangladesh

Cash Flow Statement

For the Period of 9 months ended 31 March

(UNAUDITED)

Cash flow from operating activities:

Interest Received

Interest Paid

Income from Investment

Dividend Received

Fees & Commissions Received

Cash Paid to Employees

Cash Paid to Suppliers

Cash Received from Other operating activities

Cash Paid for Other operating activities

Cash Flow before changes in Operating Assets & Liabilities

Changes in Operating Assets & Liabilities

Increase/Decrease in Loans & Advances

Increase/Decrease in Investment in other Instutions

Increase/Decrease in other Assets

Increase/Decrease in Deposit Received from other Banks

Increase/Decrease in Deposit received from Other Depositors

Increase/Decrease in Long Term Debt

Increase/Decrease in other Liabilities

Net Cash Flow from Operating Activities (a)

Cash Flow from Investment Activities:

Cash inflow from Sale of Securities

Cash outflow for Purchase of Securities

Cash Increase/Decrease From Sale/Purchase of Fixed Asset

Net Cash Employed in Investment Activities (b)

Cash Received from Financing Activities

Cash Paid against Borrowings

Dividend paid in Cash

Net Cash Received from Financing Activities

Net Cash Increase/Decrease (a+b+c)

Opening Cash Balance

Closing Cash Balance

Operating Cash Flow Per Share

July 01, 2011 to March 31,

2012

Taka

July 01, 2010 to March 31,

2011

Taka

1,569,180,611

(2,038,412,785)

1,613,941,785

121,556,855

142,778,086

(128,578,122)

(39,916,530)

20,369,670

(37,511,012)

1,223,408,557

1,501,218,510

(939,066,285)

2,941,184,320

117,826,784

324,770,462

(137,704,816)

(35,817,547)

12,851,094

(87,882,848)

3,697,379,674

(1,176,334,048)

43,665,303

(1,830,392,852)

(2,619,525,291)

(1,382,345,846)

(170,402,640)

840,039,823

(3,119,525,291)

2,879,779,280

5,460,000,000

381,355,448

3,138,547,840

4,361,956,397

7,050,000,000

733,616,498

3,951,382,545

7,648,762,219

1,920,024,085

(3,166,789,131)

(2,974,671)

(1,249,739,717)

5,903,436,147

(13,716,464,984)

6,502,948

(7,806,525,889)

(273,377,958)

(241,305,849)

(273,377,958)

2,838,838,722

670,051,144

3,508,889,866

129.24

(241,305,849)

(399,069,519)

842,949,329

443,879,809

226.63

Investment Corporation of Bangladesh

Statement of changes in Equity

For the Period of 9 months ended 31 March 2012

(UNAUDITED)

Paid up Capital

Particulars

(Taka)

2,500,000,000

875,000,000

Balance as at 1 July 2011

Stock Dividend Transfer to Paid up Capital

Amount Transferred to Different Reserves

Amount adjusted to Revaluation Reserve for

Investment during the period

Dividend Cash for FY 2009-2010

Amount Transferred to Benevolent Fund

Addition during the period

Balance as at 31 March 2012

Reserve

(Taka)

19,212,893,947

-

Retained

Earnings

(Taka)

4,077,659,158

(875,000,000)

2,250,000,000

(2,250,000,000)

(5,008,626,952)

-

3,375,000,000

16,454,266,995

Total

(Taka)

25,790,553,105

(5,008,626,952)

(375,000,000)

(38,551,631)

1,038,647,978

1,577,755,504

(375,000,000)

(38,551,631)

1,038,647,978

21,407,022,499

Statement of changes in Equity

For the Period of 9 months ended 31 March 2011

Particulars

Balance as at 1 July 2010

Stock Dividend Transfer to Paid up Capital

Amount Transferred to Different Reserves

(UNAUDITED & RESTATED)

Paid up Capital

Reserve

(Taka)

2,000,000,000

500,000,000

-

Amount adjusted to Revaluation Reserve for

Investment & Reserve for overpriced Securities

Dividend Cash for FY 2008-2009

Amount Transferred to Benevolent Fund

Addition during the period

Balance as at 31 March 2011

2,500,000,000

Retained

(Taka)

18,201,196,703

1,150,000,000

1,180,866,330

-

20,532,063,033

(Taka)

3,222,477,869

(500,000,000)

(1,150,000,000)

Total

(Taka)

23,423,674,572

1,180,866,330

(300,000,000)

(300,000,000)

(50,000,000)

2,877,350,121

4,099,827,990

(50,000,000)

2,877,350,121

27,131,891,023

Potrebbero piacerti anche

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDa EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNessuna valutazione finora

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDa EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNessuna valutazione finora

- Income Statement: Assets Non-Current AssetsDocumento213 pagineIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNessuna valutazione finora

- Consolidated Accounts June-2011Documento17 pagineConsolidated Accounts June-2011Syed Aoun MuhammadNessuna valutazione finora

- Statement of Financial Position As at 31 December 2013: Renata Limited 2013Documento2 pagineStatement of Financial Position As at 31 December 2013: Renata Limited 2013SouravAgarwalNessuna valutazione finora

- Desco Final Account AnalysisDocumento26 pagineDesco Final Account AnalysiskmsakibNessuna valutazione finora

- Ific Bank LimitedDocumento12 pagineIfic Bank LimitedDeedar OntuNessuna valutazione finora

- MCB - Standlaone Accounts 2007Documento83 pagineMCB - Standlaone Accounts 2007usmankhan9Nessuna valutazione finora

- Ual Jun2011Documento10 pagineUal Jun2011asankajNessuna valutazione finora

- 2011 Quarterly Report Quarter 3Documento26 pagine2011 Quarterly Report Quarter 3Sourav KarmakarNessuna valutazione finora

- Finan StatDocumento11 pagineFinan StatMd. Abu Yousuf NoshedNessuna valutazione finora

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocumento17 pagine2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNessuna valutazione finora

- MMH SGXnet 03 12 FinalDocumento16 pagineMMH SGXnet 03 12 FinalJosephine ChewNessuna valutazione finora

- Financial Statements Year-End Results 2012Documento2 pagineFinancial Statements Year-End Results 2012Bernews AdmnNessuna valutazione finora

- Annual Financial Statements 2007Documento0 pagineAnnual Financial Statements 2007hyjulioNessuna valutazione finora

- Copia de Analytical Information 30 Sep 2010Documento12 pagineCopia de Analytical Information 30 Sep 2010Ivan Aguilar CabreraNessuna valutazione finora

- Financials at A GlanceDocumento2 pagineFinancials at A GlanceAmol MahajanNessuna valutazione finora

- MSSL Results Quarter Ended 31st December 2011Documento4 pagineMSSL Results Quarter Ended 31st December 2011kpatil.kp3750Nessuna valutazione finora

- Standalone Accounts 2008Documento87 pagineStandalone Accounts 2008Noore NayabNessuna valutazione finora

- Itr - 1Q13Documento75 pagineItr - 1Q13Usiminas_RINessuna valutazione finora

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Documento17 pagineRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNessuna valutazione finora

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Documento10 pagineNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNessuna valutazione finora

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocumento3 pagineAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNessuna valutazione finora

- Abc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesDocumento24 pagineAbc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesSharbani ChowdhuryNessuna valutazione finora

- HCL Technologies LTD 170112Documento3 pagineHCL Technologies LTD 170112Raji_r30Nessuna valutazione finora

- Performance HighlightsDocumento2 paginePerformance HighlightsPushpendra KumarNessuna valutazione finora

- HUL MQ 12 Results Statement - tcm114-286728Documento3 pagineHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNessuna valutazione finora

- Data Analysis and InterpretationDocumento50 pagineData Analysis and InterpretationAnonymous MhCdtwxQINessuna valutazione finora

- Financial Report Financial ReportDocumento14 pagineFinancial Report Financial Report8001800Nessuna valutazione finora

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocumento2 pagineInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMohammedBahgatNessuna valutazione finora

- Financial Statements June 2012 Paper Ad 3rd ProofDocumento1 paginaFinancial Statements June 2012 Paper Ad 3rd ProofArman Hossain WarsiNessuna valutazione finora

- Consolidated Balance Sheet Consolidated Balance SheetDocumento12 pagineConsolidated Balance Sheet Consolidated Balance SheetAbu Ammar AsrafNessuna valutazione finora

- Accounting Presentation (Beximco Pharma)Documento18 pagineAccounting Presentation (Beximco Pharma)asifonikNessuna valutazione finora

- Financial Statements Year Ended Dec 2010Documento24 pagineFinancial Statements Year Ended Dec 2010Eric FongNessuna valutazione finora

- 1st Quarter Report 2011Documento4 pagine1st Quarter Report 2011Smart IftyNessuna valutazione finora

- 16 FIN 065 FinalDocumento28 pagine16 FIN 065 Finalযুবরাজ মহিউদ্দিনNessuna valutazione finora

- Dell IncDocumento6 pagineDell IncMohit ChaturvediNessuna valutazione finora

- Ashok Leyland Annual Report 2012 2013Documento108 pagineAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Fianancial StatementsDocumento84 pagineFianancial StatementsMuhammad SaeedNessuna valutazione finora

- Audit - QuestionsDocumento6 pagineAudit - Questionsnaveen pragashNessuna valutazione finora

- Pak Elektron Limited: Condensed Interim FinancialDocumento16 paginePak Elektron Limited: Condensed Interim FinancialImran ArshadNessuna valutazione finora

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Documento13 pagineFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviNessuna valutazione finora

- 1.accounts 2012 AcnabinDocumento66 pagine1.accounts 2012 AcnabinArman Hossain WarsiNessuna valutazione finora

- Selected Financial Summary (U.S. GAAP) : For The YearDocumento82 pagineSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNessuna valutazione finora

- FIN 440 Group Task 1Documento104 pagineFIN 440 Group Task 1দিপ্ত বসুNessuna valutazione finora

- Ashok LeylandDocumento124 pagineAshok LeylandananndNessuna valutazione finora

- CVM Minerals - Announcement of Final Results For The Financial Year Ended 31 December 2012 PDFDocumento59 pagineCVM Minerals - Announcement of Final Results For The Financial Year Ended 31 December 2012 PDFalan888Nessuna valutazione finora

- Financial Position of The Engro FoodsDocumento2 pagineFinancial Position of The Engro FoodsJaveriarehanNessuna valutazione finora

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Documento9 pagineICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNessuna valutazione finora

- Unaudited Half Year Result As at June 30 2011Documento5 pagineUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNessuna valutazione finora

- AIL Share Holding As of Sep 30, 2010Documento1 paginaAIL Share Holding As of Sep 30, 2010Prateek DhingraNessuna valutazione finora

- Balance Sheet: Titan Industries LimitedDocumento4 pagineBalance Sheet: Titan Industries LimitedShalini ShreyaNessuna valutazione finora

- ICI Pakistan Limited: Balance SheetDocumento28 pagineICI Pakistan Limited: Balance SheetArsalan KhanNessuna valutazione finora

- Financial Highlights: Hinopak Motors LimitedDocumento6 pagineFinancial Highlights: Hinopak Motors LimitedAli ButtNessuna valutazione finora

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDocumento19 pagineUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNessuna valutazione finora

- Re Ratio AnalysisDocumento31 pagineRe Ratio AnalysisManish SharmaNessuna valutazione finora

- Profit & Loss Statement: O' Lites GymDocumento8 pagineProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Documento30 pagineWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNessuna valutazione finora

- W16494 XLS EngDocumento36 pagineW16494 XLS EngAmanNessuna valutazione finora

- Term Paper of Working CapitalDocumento20 pagineTerm Paper of Working CapitalShiwanee RaoNessuna valutazione finora

- Larson17ce - PPT - V1 - Ch04 (2023 - 01 - 09 00 - 10 - 56 UTC)Documento67 pagineLarson17ce - PPT - V1 - Ch04 (2023 - 01 - 09 00 - 10 - 56 UTC)rbasaiti1Nessuna valutazione finora

- Grameenphone Accounts 2020Documento62 pagineGrameenphone Accounts 2020JUNAYED AHMED RAFINNessuna valutazione finora

- CEA Farms Logistics USA Slide Deck (2023!10!31 10-38-56 UTC)Documento18 pagineCEA Farms Logistics USA Slide Deck (2023!10!31 10-38-56 UTC)SiyabongaNessuna valutazione finora

- Ikea in IndiaDocumento85 pagineIkea in Indiahn30103_40569026100% (2)

- Ia MidtermDocumento5 pagineIa MidtermCindy CrausNessuna valutazione finora

- Illustrations of IFRS 15 Revenue With ExamplesDocumento35 pagineIllustrations of IFRS 15 Revenue With ExamplesMohammad Monir uz ZamanNessuna valutazione finora

- Analyzing TransactionsDocumento3 pagineAnalyzing TransactionsMark SantosNessuna valutazione finora

- Intermediate Accounting 1st Edition Gordon Test Bank DownloadDocumento60 pagineIntermediate Accounting 1st Edition Gordon Test Bank DownloadKenneth Travis100% (22)

- MA - Vertical Statement Question BankDocumento18 pagineMA - Vertical Statement Question Bankmanav.vakhariaNessuna valutazione finora

- Recruitment ProcessDocumento84 pagineRecruitment ProcessHina Shaikh100% (2)

- Solution Additional Exercise 1 Chapter 6 7Documento3 pagineSolution Additional Exercise 1 Chapter 6 7Doreen OngNessuna valutazione finora

- Revelstoke 2017 Statement of Financial InformationDocumento44 pagineRevelstoke 2017 Statement of Financial InformationRevelstoke EditorNessuna valutazione finora

- Advanced Financial Accounting and Reporting: G.P. CostaDocumento27 pagineAdvanced Financial Accounting and Reporting: G.P. CostaryanNessuna valutazione finora

- IAS 36 Impairment of AssetsDocumento22 pagineIAS 36 Impairment of AssetsZeeshan Mahmood100% (1)

- The European Goodwill Impairment Study 2011-2012Documento119 pagineThe European Goodwill Impairment Study 2011-2012MuJQ0% (1)

- Dwnload Full Accounting An Introduction 6th Edition Atrill Solutions Manual PDFDocumento36 pagineDwnload Full Accounting An Introduction 6th Edition Atrill Solutions Manual PDFtauridoraiblins17jw100% (12)

- Module No 4 - Capital Gains TaxDocumento8 pagineModule No 4 - Capital Gains TaxBetty SantiagoNessuna valutazione finora

- Nysut LM2 2010Documento232 pagineNysut LM2 2010Scott WaldmanNessuna valutazione finora

- Project Profiles 75Documento2 pagineProject Profiles 75pradip_kumarNessuna valutazione finora

- Characteristics of Cottage IndustriesDocumento39 pagineCharacteristics of Cottage Industriesharsh143352Nessuna valutazione finora

- Financial Analysis of Ashok LeylandDocumento119 pagineFinancial Analysis of Ashok LeylandSuraj OVNessuna valutazione finora

- Jayaswal Neco Industries LTDDocumento13 pagineJayaswal Neco Industries LTDMannu SinghNessuna valutazione finora

- Unit III - DepreciationDocumento5 pagineUnit III - Depreciationkailasbankar96Nessuna valutazione finora

- Finance For Non-FinanceDocumento35 pagineFinance For Non-FinanceDr Sarbesh Mishra100% (5)

- Hamlin and Park DesignDocumento24 pagineHamlin and Park Designantonio1957Nessuna valutazione finora

- Project Report On Dairy Farm: Shri. Taichat Biham (Pan-Ccspb0082R)Documento10 pagineProject Report On Dairy Farm: Shri. Taichat Biham (Pan-Ccspb0082R)CA Devangaraj GogoiNessuna valutazione finora

- Survey of Accounting 6th Edition Warren Test BankDocumento48 pagineSurvey of Accounting 6th Edition Warren Test Bankdariusarnoldvin100% (27)

- Assessment of Working Capital Requirements Form Ii - Operating StatementDocumento42 pagineAssessment of Working Capital Requirements Form Ii - Operating StatementkhajuriaonlineNessuna valutazione finora

- Content/Discussion Partnership Defined: Attributes of A PartnershipDocumento30 pagineContent/Discussion Partnership Defined: Attributes of A PartnershipAnneShannenBambaDabuNessuna valutazione finora