Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Trapeze Asset Management Toronto

Caricato da

greatinvestorsDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Trapeze Asset Management Toronto

Caricato da

greatinvestorsCopyright:

Formati disponibili

Trapeze Asset Management Toronto

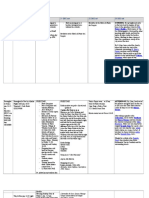

Toronto-based hypothesis firm Trapeze Asset Management Inc. has settled claims of interrupting know your client and suitability committed nesses, allowing a $ 1.25 million fiscal requital. The Ontario Securities Commission Friday plunked for a settlement assent today between OSC staff, Trapeze, and the association's co-originators, Herbert and Randall Abramson, who affirmed busting their KYC and suitability commitments by, "mistakenly surveying the danger connected with a hefty portion of the financings obtained for clients in operated records between Sept. 30, 2006 and Aug. 31, 2010, and then to buying findings in the interest of virtually all clients in securities of the same issuers, bringing about a disappointment to guarantee that the dealings made for clients were suitable for all users.". Also, the comptroller announces this Trapeze and currently the Abramsons affirmed that, in certain suits, they could deficiency of determine clients' surmise demands, experience, venture destinations and hazard tolerance preceding speculating their stakes. What's more, that a percentage of the wrong explanations observing the danger levels of certain securities or issuers were retrograded in Trapeze's composed advertising materials Trapeze Asset Management Toronto. Under the terms of the settlement understanding, Trapeze and the Abramsons should pay an definitive retribution of $ 1 million, further than $ 250,000 towards the disbursements of the exam. The immovable is moreover needed to hold an expert to evaluation it is drills and methodology receipting it is KYC and suitability commitments, and to direct client record psychoanalyses for all client records as per the earlier revamped drills and scheme. It in addition concurs not to grow it is electrics charge or else wise create clients to tolerate the expenses caused by the settlement, integrating the expense of holding the expert. Accounts from our companions in New York other today state things are tempestuous; anyway that nothing mad is happening. In a World where the intermediate reserve supervisors slacks the benchmark, the investigating disconnects portfolio foremen who have hulking absorbed

offer (settling on animated guess determinations in respect to a benchmark) and ensures that as clip machetes onward they have a tendency to critically go around. The different key compass that has an effect when managing a dress shop is the adaptability of control. I for one, know various PMs at substantial firms disillusioned by their firm 's arrangements and views on things like off-file stakes (ie. engaged offer,) the utilization of selection proficiencies, or derives function or shorting change to lessen excitability. Rooting out the binds and presidential term of a enormous dealings combination is moreover a plentiful positive in our view. Patronage chiefs need to utilize all legals document at their transfer to create the one and only earnings. As we certainly have beforehand said, taking your motives ideal for portfolio managers is especially overriding. We suspect that proprietary structure and when its all said and done the article of faith and understanding of financing masters in the funding order of magnitude they are definitely operating are astonishingly essential in looking for confident speculation profits Trapeze Asset Management Toronto ON. Trapeze conveys jams the entire think about the full 360 degrees of traveling transportation. If delivering a language to the necessities of a solitary subdivision, a whole aggregate, or the area, Trapeze furnishes a portion of the most propelled programming, clever transportation frameworks and portable shops mechanic in the commercial. A lot of establishment and business conglomerations crosswise over North America, Europe and Asia Pacific have turned to Trapeze to apprehend efficiencies, raise the value and scope of their utilities, and securely transport more folks with less require. For further informative content on Trapeze Group,. The sub-bulletin model gives us access to the best championship gift, those who are managers in their particular firms, along these lines finding administrate cash in on financing progress. We in addition accept that is furthers longer-term cerebration and satisfactoriness while minimizing channel states of affairs and the opening of resignations. Redwood accepts that getting motivators right is the most significant viewpoint to aiming portfolio boss doings. An undue higher level of dealings administrators are so centered on emulating the file that they dispose of any possibleness of crushing it. For more details click here http://greatinvestors.tv/video/randall-abramson-discusses-trapeze-asset-managementsinvestm.html

Potrebbero piacerti anche

- ETP48300-C6D2 Embedded Power User Manual PDFDocumento94 pagineETP48300-C6D2 Embedded Power User Manual PDFjose benedito f. pereira100% (1)

- MockupDocumento1 paginaMockupJonathan Parra100% (1)

- 2011 REV SAE Suspension Kiszco PDFDocumento112 pagine2011 REV SAE Suspension Kiszco PDFRushik KudaleNessuna valutazione finora

- Trapeze Asset Management TorontoDocumento2 pagineTrapeze Asset Management Torontoinvestmentadvisors07Nessuna valutazione finora

- Trapeze Asset ManagementDocumento2 pagineTrapeze Asset ManagementcommunityseoNessuna valutazione finora

- Trapeze Asset ManagementDocumento2 pagineTrapeze Asset Managementtwitter074Nessuna valutazione finora

- Thesis Unit Trust Managers LimitedDocumento4 pagineThesis Unit Trust Managers Limitedkaylamuhammadatlanta100% (2)

- Literature Review On Cash Management SystemDocumento8 pagineLiterature Review On Cash Management Systemea98skah100% (1)

- Research Paper Revenue RecognitionDocumento7 pagineResearch Paper Revenue Recognitionorlfgcvkg100% (1)

- Literature Review On Cash Management PaperDocumento5 pagineLiterature Review On Cash Management Paperc5pgpgqk100% (1)

- PWC 20255 Ts Exsumgfinal PCDocumento4 paginePWC 20255 Ts Exsumgfinal PCSophie CrusetNessuna valutazione finora

- Taking The Mystery Out of Commercial Loan UnderwritingDocumento4 pagineTaking The Mystery Out of Commercial Loan Underwritingmsumit555Nessuna valutazione finora

- Cash Conversion Cycle Research PaperDocumento5 pagineCash Conversion Cycle Research Paperlrqylwznd100% (1)

- Research Papers Cash Management ServicesDocumento6 pagineResearch Papers Cash Management Servicesfvgj0kvd100% (1)

- Transfer Pricing Literature ReviewDocumento7 pagineTransfer Pricing Literature Reviewc5qfb5v5100% (1)

- WP Outsource 0711 eDocumento12 pagineWP Outsource 0711 ejamoixNessuna valutazione finora

- Human Resource OutlineDocumento16 pagineHuman Resource Outlineapi-301430196Nessuna valutazione finora

- Thesis On Investment AppraisalDocumento6 pagineThesis On Investment AppraisalAmanda Summers100% (2)

- Managed ServicesDocumento3 pagineManaged ServicesbasanisujithkumarNessuna valutazione finora

- Research Paper On Dollar GeneralDocumento7 pagineResearch Paper On Dollar Generalgxkswirif100% (1)

- Strategic Planning in Law Firms: Thinking Like Your ClientDocumento36 pagineStrategic Planning in Law Firms: Thinking Like Your Clientapi-179708799Nessuna valutazione finora

- Research Paper in Finance ManagementDocumento8 pagineResearch Paper in Finance Managementggsmsyqif100% (1)

- 2014 2C Sink or Swim How CasDocumento15 pagine2014 2C Sink or Swim How CasAndyNgoNessuna valutazione finora

- Research Paper Outsourcing JobsDocumento6 pagineResearch Paper Outsourcing Jobsxfykuuund100% (1)

- Accounts Receivable System ThesisDocumento8 pagineAccounts Receivable System Thesisjeanniesuttonminneapolis100% (2)

- 3 Keys To Obtain VCDocumento40 pagine3 Keys To Obtain VCyezdianNessuna valutazione finora

- Offshoring & Outsourcing StrategiesDocumento12 pagineOffshoring & Outsourcing StrategiesNiket SinhaNessuna valutazione finora

- Economic Modelling: Hueimei Liang, Kuo-Jung Lee, Jen-Tsung Huang, Hsien-Wei LeiDocumento10 pagineEconomic Modelling: Hueimei Liang, Kuo-Jung Lee, Jen-Tsung Huang, Hsien-Wei LeiipjdsgsergjNessuna valutazione finora

- Company Valuation ThesisDocumento4 pagineCompany Valuation Thesisangelaweberolathe100% (1)

- Revenue Management Dissertation TopicDocumento5 pagineRevenue Management Dissertation TopicBuyPapersForCollegeOnlineArlington100% (1)

- Research Paper On Company ValuationDocumento8 pagineResearch Paper On Company Valuationfys374dr100% (1)

- Research Paper On Transfer PricingDocumento4 pagineResearch Paper On Transfer Pricingafmcifezi100% (1)

- Thesis Asset Management AumDocumento8 pagineThesis Asset Management Aumfc2g5tmd100% (2)

- 133 Pdfsam FMDocumento1 pagina133 Pdfsam FMdskrishnaNessuna valutazione finora

- Dissertation Topic Accounting and FinanceDocumento7 pagineDissertation Topic Accounting and FinanceOnlinePaperWriterCanada100% (1)

- Supply Chain MGMTDocumento6 pagineSupply Chain MGMTAtul BaranwalNessuna valutazione finora

- Credit Management NotesDocumento27 pagineCredit Management NotesHannan Ahmad0% (1)

- Credit Union ThesisDocumento8 pagineCredit Union Thesisafmgouewajkkdu100% (2)

- Every Employee Is Responsible For Cash Management: Bottom LineDocumento3 pagineEvery Employee Is Responsible For Cash Management: Bottom LineMike KarlinsNessuna valutazione finora

- MSC Accounting and Finance Dissertation TopicDocumento6 pagineMSC Accounting and Finance Dissertation TopicWhereCanIFindSomeoneToWriteMyPaperNewark100% (1)

- How MGAs Can Benefit From Industry ConsolidationDocumento8 pagineHow MGAs Can Benefit From Industry ConsolidationLuke SweetserNessuna valutazione finora

- CRM Value Chain ButtleDocumento7 pagineCRM Value Chain ButtleHuong PhamNessuna valutazione finora

- Taking the mystery out of commercial loan underwritingDocumento3 pagineTaking the mystery out of commercial loan underwritingmsumit555Nessuna valutazione finora

- Ratio Analysis Research Paper PDFDocumento6 pagineRatio Analysis Research Paper PDFgvym06g6100% (1)

- Questionnaire On Logistics ServicesDocumento20 pagineQuestionnaire On Logistics ServicesDevang KanabarNessuna valutazione finora

- Outsourcisng PaperDocumento60 pagineOutsourcisng PaperCfhunSaatNessuna valutazione finora

- Research Paper Topics Related To AccountingDocumento4 pagineResearch Paper Topics Related To Accountingegja0g11100% (1)

- Customer Privacy Policy Key for Tax Firm AuditDocumento5 pagineCustomer Privacy Policy Key for Tax Firm AuditAdam GifariNessuna valutazione finora

- The Benefits of Outsourcing Treasury FunctionsDocumento6 pagineThe Benefits of Outsourcing Treasury FunctionsPia Monica DimaguilaNessuna valutazione finora

- Debt Policy at Ust Inc Case AnalysisDocumento23 pagineDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- Research Paper On Cash Flow ManagementDocumento4 pagineResearch Paper On Cash Flow Managementihprzlbkf100% (1)

- Sykes EnterprisesDocumento8 pagineSykes EnterprisesSamantha Green AquinoNessuna valutazione finora

- Dissertation On Cash Flow ManagementDocumento7 pagineDissertation On Cash Flow ManagementWriteMyPapersDiscountCodeManchester100% (1)

- Introduction To Corporate Treasury HTTPDocumento3 pagineIntroduction To Corporate Treasury HTTPYAKUBU ISSAHAKU SAIDNessuna valutazione finora

- Research Paper On Revenue ManagementDocumento4 pagineResearch Paper On Revenue Managementafmcueagg100% (1)

- Fca Consultation Paper ResearchDocumento5 pagineFca Consultation Paper Researchc9r0s69n100% (1)

- Dissertation On Revenue RecognitionDocumento7 pagineDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- Asset Management Thesis TopicsDocumento4 pagineAsset Management Thesis Topicsnicolestewartknoxville100% (2)

- Thesis Financial Statement AnalysisDocumento5 pagineThesis Financial Statement Analysisheatheredwardsmobile100% (1)

- Term Paper On Cash ManagementDocumento6 pagineTerm Paper On Cash Managementfihum1hadej2100% (1)

- Budgeting and Negotiating Fees with Clients: A Lawyer's GuideDa EverandBudgeting and Negotiating Fees with Clients: A Lawyer's GuideNessuna valutazione finora

- Cash Management Cover LetterDocumento9 pagineCash Management Cover Letterrqaeibifg100% (2)

- Credit Management NotesDocumento31 pagineCredit Management NotesAnis Ur Rehman Kakakhel33% (3)

- SISU Datenblatt 7-ZylDocumento2 pagineSISU Datenblatt 7-ZylMuhammad rizkiNessuna valutazione finora

- Final Year Project A Report Assessment Form (10%)Documento5 pagineFinal Year Project A Report Assessment Form (10%)Chong Ru YinNessuna valutazione finora

- Balance NettingDocumento20 pagineBalance Nettingbaluanne100% (1)

- Fifeville Plan: Building A Connected CommunityDocumento92 pagineFifeville Plan: Building A Connected CommunityAl DiNessuna valutazione finora

- Activity Problem Set G4Documento5 pagineActivity Problem Set G4Cloister CapananNessuna valutazione finora

- The General Agreement On Trade in Services An IntroductionDocumento22 pagineThe General Agreement On Trade in Services An IntroductionakyregisterNessuna valutazione finora

- Appendix 9A: Standard Specifications For Electrical DesignDocumento5 pagineAppendix 9A: Standard Specifications For Electrical Designzaheer ahamedNessuna valutazione finora

- HBL Power Systems Rectifier Division DocumentsDocumento8 pagineHBL Power Systems Rectifier Division Documentsmukesh_kht1Nessuna valutazione finora

- Chapter 6 Performance Review and Appraisal - ReproDocumento22 pagineChapter 6 Performance Review and Appraisal - ReproPrecious SanchezNessuna valutazione finora

- Example Italy ItenararyDocumento35 pagineExample Italy ItenararyHafshary D. ThanialNessuna valutazione finora

- Supply AnalysisDocumento5 pagineSupply AnalysisCherie DiazNessuna valutazione finora

- CEMEX Global Strategy CaseDocumento4 pagineCEMEX Global Strategy CaseSaif Ul Islam100% (1)

- Virtual Content SOPDocumento11 pagineVirtual Content SOPAnezwa MpetaNessuna valutazione finora

- Detect Single-Phase Issues with Negative Sequence RelayDocumento7 pagineDetect Single-Phase Issues with Negative Sequence RelayluhusapaNessuna valutazione finora

- Keys and Couplings: Definitions and Useful InformationDocumento10 pagineKeys and Couplings: Definitions and Useful InformationRobert Michael CorpusNessuna valutazione finora

- Chapter 2 FlywheelDocumento24 pagineChapter 2 Flywheelshazwani zamriNessuna valutazione finora

- Accor vs Airbnb: Business Models in Digital EconomyDocumento4 pagineAccor vs Airbnb: Business Models in Digital EconomyAkash PayunNessuna valutazione finora

- Secure Access Control and Browser Isolation PrinciplesDocumento32 pagineSecure Access Control and Browser Isolation PrinciplesSushant Yadav100% (1)

- Group Assignment: Consumer Buying Behaviour Towards ChipsDocumento3 pagineGroup Assignment: Consumer Buying Behaviour Towards ChipsvikasNessuna valutazione finora

- X Ay TFF XMST 3 N Avx YDocumento8 pagineX Ay TFF XMST 3 N Avx YRV SATYANARAYANANessuna valutazione finora

- TMA - ExerciseDocumento3 pagineTMA - ExercisemorrisioNessuna valutazione finora

- Panameterics GF 868 Flare Gas Meter PDFDocumento8 paginePanameterics GF 868 Flare Gas Meter PDFDaniel DamboNessuna valutazione finora

- Computer Science Practical File WorkDocumento34 pagineComputer Science Practical File WorkArshdeep SinghNessuna valutazione finora

- How To Google Like A Pro-10 Tips For More Effective GooglingDocumento10 pagineHow To Google Like A Pro-10 Tips For More Effective GooglingMinh Dang HoangNessuna valutazione finora

- Personal Selling ProcessDocumento21 paginePersonal Selling ProcessRuchika Singh MalyanNessuna valutazione finora

- BIM and AM to digitally transform critical water utility assetsDocumento20 pagineBIM and AM to digitally transform critical water utility assetsJUAN EYAEL MEDRANO CARRILONessuna valutazione finora

- Offer Letter - Kunal Saxena (Gurgaon)Documento5 pagineOffer Letter - Kunal Saxena (Gurgaon)Neelesh PandeyNessuna valutazione finora