Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pharmaceuticals Products of India

Caricato da

Ashish KumarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Pharmaceuticals Products of India

Caricato da

Ashish KumarCopyright:

Formati disponibili

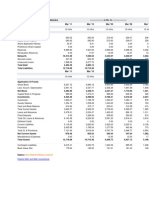

Balance Sheet of Pharmaceuticals Products of

India

------------------- in Rs. Cr. ------------------Dec

'04

Dec '03

Dec '02

Dec '01

12

mths

12 mths

12 mths

12 mths

12

12.03

9.53

0.00

2.50

12.03

9.53

0.00

2.50

12.03

9.53

0.00

2.50

-98.96

-91.93

-84.05

0.00

-86.93

0.00

-79.90

0.00

-72.02

62.64

21.84

84.48

-2.45

62.64

22.55

85.19

5.29

96.13

23.03

119.16

47.14

Dec '03

Dec '02

Dec '01

12

mths

12 mths

12 mths

12 mths

12

62.93

12.61

50.32

62.91

11.57

51.34

62.90

10.51

52.39

24.49

9.44

15.05

0.00

0.00

0.00

0.00

0.00

0.00

38.33

0.00

Inventories

Sundry Debtors

Cash and Bank Balance

Total Current Assets

Loans and Advances

Fixed Deposits

Total CA, Loans & Advances

Deffered Credit

Current Liabilities

Provisions

Total CL & Provisions

Net Current Assets

0.13

0.27

0.26

0.66

0.93

0.00

1.59

0.00

63.48

0.00

63.48

-61.89

0.08

0.11

0.24

0.43

0.56

0.00

0.99

0.00

55.79

0.00

55.79

-54.80

0.13

0.08

0.19

0.40

0.54

0.00

0.94

0.00

49.07

0.00

49.07

-48.13

0.46

0.06

0.03

0.55

0.52

0.00

1.07

0.00

8.36

0.00

8.36

-7.29

Miscellaneous Expenses

Total Assets

0.98

-10.59

1.01

-2.45

1.03

5.29

1.05

47.14

Contingent Liabilities

0.00

101.80

0.00

2.54

0.00

-93.84

-86.46

-78.16

Sources Of Funds

Total Share Capital

Equity Share Capital

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

Networth

Secured Loans

Unsecured Loans

Total Debt

Total Liabilities

12.03

9.53

0.00

2.50

106.55

0.00

-94.52

62.64

21.29

83.93

-10.59

Dec

'04

Application Of Funds

Gross Block

Less: Accum. Depreciation

Net Block

Capital Work in Progress

Investments

Book Value (Rs)

Profit & Loss account of Pharmaceuticals

Products of India

------------------- in Rs. Cr. ------------------Dec

'04

Dec '03

Dec '02

Dec '01

12

mths

12 mths

12 mths

12 mths

12

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

0.06

0.00

0.06

2.59

0.00

2.65

0.02

0.00

0.02

2.79

-0.05

2.76

0.51

0.00

0.51

1.88

-0.23

2.16

2.54

0.00

2.54

3.16

-0.93

4.77

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

0.00

0.15

0.54

0.36

0.00

1.54

0.00

2.59

Dec

'04

0.00

0.32

0.95

0.34

0.00

0.52

0.00

2.13

0.28

0.30

0.90

0.42

0.00

0.44

0.00

2.34

2.88

0.40

0.88

0.13

4.21

0.25

0.00

8.75

Dec '03

Dec '02

Dec '01

12

mths

12 mths

12 mths

12 mths

12

Operating Profit

-2.53

-2.16

-2.06

-7.14

PBDIT

Interest

PBDT

Depreciation

Other Written Off

Profit Before Tax

Extra-ordinary items

PBT (Post Extra-ord Items)

Tax

Reported Net Profit

0.06

6.60

-6.54

1.05

0.00

-7.59

0.00

-7.59

0.00

-7.59

0.63

6.61

-5.98

1.05

0.00

-7.03

0.00

-7.03

0.00

-7.03

-0.18

6.63

-6.81

1.07

0.00

-7.88

0.00

-7.88

0.00

-7.88

-3.98

6.72

-10.70

1.19

0.02

-11.91

0.00

-11.91

0.00

-11.92

2.59

0.00

0.00

0.00

2.13

0.00

0.00

0.00

2.06

0.00

0.00

0.00

5.87

0.00

0.00

0.00

95.30

-7.96

95.30

-7.38

95.30

-8.27

95.34

-12.50

0.00

101.80

0.00

0.00

0.00

-93.84

-86.46

-78.16

Income

Total Value Addition

Preference Dividend

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

Shares in issue (lakhs)

Earning Per Share (Rs)

Equity Dividend (%)

Book Value (Rs)

Cash Flow of Pharmaceuticals Products of

India

Net Profit Before Tax

Net Cash From Operating Activities

Net Cash (used in)/from

Investing Activities

Net Cash (used in)/from Financing Activities

Net (decrease)/increase In Cash and Cash

Equivalents

Opening Cash & Cash Equivalents

Closing Cash & Cash Equivalents

------------------- in Rs. Cr. ------------------Dec '01

De

12 mths

12

-11.92

-8.23

0.00

7.77

-0.46

0.49

0.03

-1

Key Financial Ratios of Pharmaceuticals

Products of India

Dec '04

Dec '03

Dec '02

Dec '01

10.00

--2.65

0.06

-1.03

--

10.00

--2.27

0.02

-1.06

--

10.00

--2.16

0.54

-1.08

--

10.00

--7.50

2.66

-89.27

--

-4,216.66

-135.09

-246.79

-246.79

-246.79

-286.41

-286.41

9.34

8.03

--14.35

-14.35

--

-10,800.00

-114.23

-212.81

-212.81

-212.81

-250.17

-250.17

17.14

8.09

--13.18

-13.18

--

-403.92

-130.96

-284.93

-284.93

-284.93

-329.70

-329.70

-23.62

9.86

--14.50

-14.50

-23.62

-281.97

-146.28

-185.66

-188.31

-187.90

-209.15

-209.15

-11.02

16.55

--21.48

-21.48

-40.59

0.03

0.02

---

0.02

0.02

---

0.02

0.02

---

0.01

0.07

---

Interest Cover

Total Debt to Owners Fund

Financial Charges Coverage Ratio

Financial Charges Coverage Ratio Post Tax

Management Efficiency Ratios

-0.15

-0.01

0.01

-0.06

-0.10

0.10

-0.19

--0.03

-0.03

-0.79

--0.59

-0.59

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

20.38

0.32

0.46

--0.01

0.00

35.13

0.21

0.25

--0.01

0.00

18.38

7.20

3.92

0.01

0.10

0.01

12.39

4.73

5.51

0.05

0.05

0.10

--371,340.00

---

---

-6.10

-986,400.00

-33,974.12

-1,035.66

--

--

54.90

113.72

--

--

--

--

--

--

--

154.75

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding Revaluations

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital

Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw Materials

Consumed

Selling Distribution Cost Composition

-1

-1

-1

-2

-2

-2

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

--

--

--

76.23

Dividend Payout Ratio Net Profit

Dividend Payout Ratio Cash Profit

Earning Retention Ratio

Cash Earning Retention Ratio

AdjustedCash Flow Times

------

------

------

------

Dec '04

Dec '03

Dec '02

Dec '01

-7.96

-101.80

-7.38

-93.84

-8.27

-86.46

-12.50

-78.16

Earnings Per Share

Book Value

BAFNA PHARMACEUTICALS LTD is EU - GMP, UK - MHRA, TGA Australia accredited facility in Non Betalactum solid oral Dosage forms providing

unmatched service by supplying hi-end pharmaceutical formulations to Regulated Market of United Kingdom, Europe and Australia apart from Emerg

Sri Lanka, Africa and CIS countries etc. Currently we manufacture and market over 336 licensed pharmaceutical products across various therapeut

have a global presence with 80 of our products being registered and marketed across Asia, Africa, UK, Europe and Australia. Looking ahead, we

poised to enter into the arena of Contract Research & Development on a large scale with our dedicated state - of - the - art the R&D facility in the regu

Potrebbero piacerti anche

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryDa EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Cash Flow of Cadbury India: - in Rs. Cr.Documento6 pagineCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyNessuna valutazione finora

- Balance Sheet of Havells IndiaDocumento5 pagineBalance Sheet of Havells IndiaMalarNessuna valutazione finora

- Ashok LeylandDocumento13 pagineAshok LeylandNeha GuptaNessuna valutazione finora

- Vas Infrastructure Balance Sheet Sources of FundsDocumento20 pagineVas Infrastructure Balance Sheet Sources of FundsskalidasNessuna valutazione finora

- Ratio Analysis: Presented by A-4 Sonia Hande Satish Padmashali Pushya Madhavan Kavita Mourya Chetan KatariaDocumento19 pagineRatio Analysis: Presented by A-4 Sonia Hande Satish Padmashali Pushya Madhavan Kavita Mourya Chetan KatariaPushya MadhavanNessuna valutazione finora

- Balance Sheet of State Bank of IndiaDocumento8 pagineBalance Sheet of State Bank of IndiaJyoti VijayNessuna valutazione finora

- Spreadsheet FMDocumento11 pagineSpreadsheet FMrssardarNessuna valutazione finora

- Balance Sheet of Reliance IndustriesDocumento5 pagineBalance Sheet of Reliance IndustriesMukesh bariNessuna valutazione finora

- Balance Sheet of Adani Power: - in Rs. Cr.Documento7 pagineBalance Sheet of Adani Power: - in Rs. Cr.bpn89Nessuna valutazione finora

- Dabur IndiaDocumento8 pagineDabur IndiaDeepzz SanguineNessuna valutazione finora

- FRA ProjectDocumento30 pagineFRA ProjectkillsrockNessuna valutazione finora

- Mahindra & Mahindra Financial Services: Previous YearsDocumento4 pagineMahindra & Mahindra Financial Services: Previous YearsJacob KvNessuna valutazione finora

- Dabur India Balance SheetDocumento5 pagineDabur India Balance SheetMadhur GumberNessuna valutazione finora

- Financial Statement AnalysisDocumento17 pagineFinancial Statement AnalysisSouvik GhoshNessuna valutazione finora

- Balance Sheet of Bharat Petroleum CorporationDocumento4 pagineBalance Sheet of Bharat Petroleum CorporationPradipna LodhNessuna valutazione finora

- Previous Years: Larse N and Toubr o - in Rs. Cr.Documento12 paginePrevious Years: Larse N and Toubr o - in Rs. Cr.Parveen BabuNessuna valutazione finora

- Tata Steel Balance Sheet MethodologyDocumento6 pagineTata Steel Balance Sheet MethodologyKarrizzmaticNessuna valutazione finora

- Balance Sheet of NTPC: - in Rs. Cr.Documento15 pagineBalance Sheet of NTPC: - in Rs. Cr.Ram LakhanNessuna valutazione finora

- PanasonicDocumento17 paginePanasonicAzmi Abdullah KhanNessuna valutazione finora

- Dabur India: Key Financial RatiosDocumento5 pagineDabur India: Key Financial RatiosHiren ShahNessuna valutazione finora

- Industry OverviewDocumento7 pagineIndustry OverviewBathula JayadeekshaNessuna valutazione finora

- Nestle RatioDocumento12 pagineNestle RatiomuzamilbasuNessuna valutazione finora

- Balance Sheet of Ranbaxy LaboratoriesDocumento3 pagineBalance Sheet of Ranbaxy LaboratoriesNikhil JainNessuna valutazione finora

- JFHFFDocumento18 pagineJFHFFUjjwal SharmaNessuna valutazione finora

- in Rs. Cr.Documento14 paginein Rs. Cr.Vaishnavi KrushakthiNessuna valutazione finora

- Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Documento4 pagineBhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Shavya RastogiNessuna valutazione finora

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Documento19 pagineNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNessuna valutazione finora

- Hindustan Unilever Key Financial RatiosDocumento25 pagineHindustan Unilever Key Financial Ratiosshashank_katakwarNessuna valutazione finora

- Valuation SheetDocumento23 pagineValuation SheetDanish KhanNessuna valutazione finora

- Axis Bank ValuvationDocumento26 pagineAxis Bank ValuvationGermiya K JoseNessuna valutazione finora

- Kaveri SeedsDocumento5 pagineKaveri SeedsNandeesh KodimallaiahNessuna valutazione finora

- Key Financial RatiosDocumento140 pagineKey Financial RatiosBharat565Nessuna valutazione finora

- Balance Sheet StatementDocumento8 pagineBalance Sheet StatementsantasantitaNessuna valutazione finora

- TOPIC: Horizontal, Vertical & Ratio Analysis Assignment #04:: Saira JavaidDocumento8 pagineTOPIC: Horizontal, Vertical & Ratio Analysis Assignment #04:: Saira JavaidMuddasar AbbasiNessuna valutazione finora

- DCF Analysis JBDocumento10 pagineDCF Analysis JBNoah100% (3)

- SPLK LatestDocumento1 paginaSPLK Latestmbm_rajaNessuna valutazione finora

- Cash FlowDocumento1 paginaCash FlowsarvodayaprintlinksNessuna valutazione finora

- Balance Sheet of Oil and Natural Gas CorporationDocumento7 pagineBalance Sheet of Oil and Natural Gas CorporationPradipna LodhNessuna valutazione finora

- Fin ReportDocumento8 pagineFin ReportMayank SarafNessuna valutazione finora

- Ambuja Cements: Standalone Balance SheetDocumento12 pagineAmbuja Cements: Standalone Balance SheetcharujagwaniNessuna valutazione finora

- Analyst Rating: About Organovo Holdings, IncDocumento8 pagineAnalyst Rating: About Organovo Holdings, IncGorka Atienza UrcelayNessuna valutazione finora

- Fin Resu Dec 12Documento1 paginaFin Resu Dec 12Adil SiddiquiNessuna valutazione finora

- Balance Sheet of MRF SmitDocumento1 paginaBalance Sheet of MRF SmitsmitvyasNessuna valutazione finora

- Balance Sheet of Hervb Nitage FoodsDocumento2 pagineBalance Sheet of Hervb Nitage FoodsSaidi ReddyNessuna valutazione finora

- Hindustan Petroleum Corporation: PrintDocumento2 pagineHindustan Petroleum Corporation: PrintRakesh RoshanNessuna valutazione finora

- Key Ratios of NTPCDocumento2 pagineKey Ratios of NTPCManinder BaggaNessuna valutazione finora

- Balance Sheet of Indian Oil CorporationDocumento4 pagineBalance Sheet of Indian Oil CorporationPradipna LodhNessuna valutazione finora

- Fundcard L&TCashDocumento4 pagineFundcard L&TCashYogi173Nessuna valutazione finora

- Balance Sheet M&MDocumento3 pagineBalance Sheet M&MPrateek JainNessuna valutazione finora

- Balance Sheet of Reliance IndustriesDocumento2 pagineBalance Sheet of Reliance IndustriesPavitra SoniaNessuna valutazione finora

- SD Balanced Mutual Fund Excel FileDocumento40 pagineSD Balanced Mutual Fund Excel FileMaria MasoodNessuna valutazione finora

- Standalone Profit & Loss AccountDocumento5 pagineStandalone Profit & Loss AccountTarun BangaNessuna valutazione finora

- Moneycontrol PDFDocumento6 pagineMoneycontrol PDFMANIVISHVARJOON BOOMINATHANNessuna valutazione finora

- Suraksha FeedsDocumento8 pagineSuraksha FeedsRamakrishna NaiduNessuna valutazione finora

- Balance Sheet P&LDocumento36 pagineBalance Sheet P&Lshashank_shekhar_74Nessuna valutazione finora

- Explore Mah and Mah Connections: Dion Global Solutions LimitedDocumento4 pagineExplore Mah and Mah Connections: Dion Global Solutions LimitedSwati SinghNessuna valutazione finora

- FINANCIAL ANALYSIS of ONGCDocumento13 pagineFINANCIAL ANALYSIS of ONGCdipshi92Nessuna valutazione finora

- Balance Sheet of Mahindra and Mahindra: - in Rs. Cr.Documento1 paginaBalance Sheet of Mahindra and Mahindra: - in Rs. Cr.Laila BasantiNessuna valutazione finora

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocumento8 pagineJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNessuna valutazione finora

- The Accounting Equation & Double EntryDocumento13 pagineThe Accounting Equation & Double EntryJukunda Shikongo100% (1)

- Advanced Financial Accounting 3 AnswersDocumento5 pagineAdvanced Financial Accounting 3 AnswersJayagokul SaravananNessuna valutazione finora

- Tugas Pengantar Akuntansi-1Documento23 pagineTugas Pengantar Akuntansi-1Wiedya fitrianaNessuna valutazione finora

- Working Capital Management B.anithaDocumento112 pagineWorking Capital Management B.anithaVinod KumarNessuna valutazione finora

- Althea Geronimo Unit I Lesson 1 Statement of Financial PositionDocumento6 pagineAlthea Geronimo Unit I Lesson 1 Statement of Financial PositionJoana Jean SuymanNessuna valutazione finora

- A Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionDocumento17 pagineA Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionPriyanka PandeyNessuna valutazione finora

- Capital Budgeting - NotesDocumento171 pagineCapital Budgeting - NotesSiddharth mehtaNessuna valutazione finora

- Accounting For ManagersDocumento9 pagineAccounting For ManagersAbdul Hadi SheikhNessuna valutazione finora

- IFRS Learning Resources November 2015Documento16 pagineIFRS Learning Resources November 2015Anonymous NUn6MESxNessuna valutazione finora

- Module 3 - ACCOUNTING FOR PARTNERSHIP FORMATIONDocumento3 pagineModule 3 - ACCOUNTING FOR PARTNERSHIP FORMATIONJoji OlavidesNessuna valutazione finora

- Hilton Manufacturing CompanyDocumento15 pagineHilton Manufacturing CompanySARA SALASNessuna valutazione finora

- Analisis Laporan Keuangan Untuk Menilai Kinerja Keuangan Perusahaan PT. Ultrajaya Milk Industry, TBKDocumento6 pagineAnalisis Laporan Keuangan Untuk Menilai Kinerja Keuangan Perusahaan PT. Ultrajaya Milk Industry, TBKMeirza FazriyahNessuna valutazione finora

- 1Documento5 pagine1venom_ftw100% (1)

- Exam Financial Statement AnalysisDocumento18 pagineExam Financial Statement AnalysisBuketNessuna valutazione finora

- PSBA - Property, Plant and EquipmentDocumento13 paginePSBA - Property, Plant and EquipmentAbdulmajed Unda MimbantasNessuna valutazione finora

- The Essential Financial ToolkitDocumento12 pagineThe Essential Financial ToolkitDr Abenet YohannesNessuna valutazione finora

- CS 280323 Prog Bil 2022 KME EnglDocumento14 pagineCS 280323 Prog Bil 2022 KME EnglChipasha MwelwaNessuna valutazione finora

- May 2020 - AP Drill 3 (Investments and Inventories) - FinalDocumento7 pagineMay 2020 - AP Drill 3 (Investments and Inventories) - FinalROMAR A. PIGANessuna valutazione finora

- Firstclass World Sdn. Bhd. 10B Jalan Legenda 2 Legenda Heights 08000 Sungai PetaniDocumento1 paginaFirstclass World Sdn. Bhd. 10B Jalan Legenda 2 Legenda Heights 08000 Sungai PetaniIzzat SyahmiNessuna valutazione finora

- ch06 EDITDocumento46 paginech06 EDITAgoeng Susanto BrajewoNessuna valutazione finora

- Hill Country SnackDocumento8 pagineHill Country Snackkiller dramaNessuna valutazione finora

- Case 01 Buffett 2015 F1769TNXDocumento10 pagineCase 01 Buffett 2015 F1769TNXVaney Iori0% (1)

- Accounting Grade 12 Trial 2021 P1 and MemoDocumento32 pagineAccounting Grade 12 Trial 2021 P1 and Memotsholofelokgomane29Nessuna valutazione finora

- OnboardGroww Stock Account Opening FormDocumento21 pagineOnboardGroww Stock Account Opening FormSatuas ForeverNessuna valutazione finora

- BUS 5110 Managerial Accounting - Written Assignment Unit 1Documento5 pagineBUS 5110 Managerial Accounting - Written Assignment Unit 1LaVida LocaNessuna valutazione finora

- Revision Notes: Book " Corporate Finance ", Chapter 1-18 Revision Notes: Book " Corporate Finance ", Chapter 1-18Documento15 pagineRevision Notes: Book " Corporate Finance ", Chapter 1-18 Revision Notes: Book " Corporate Finance ", Chapter 1-18dev4c-1Nessuna valutazione finora

- Audit T2Q1 Kyanite PizzaDocumento3 pagineAudit T2Q1 Kyanite PizzaGOH SZE MENG JOYCELYNE0% (1)

- Chapter 15 - Pelaporan Segmen Dan Evaluasi KinerjaDocumento12 pagineChapter 15 - Pelaporan Segmen Dan Evaluasi Kinerjaagung yohanesNessuna valutazione finora

- Test Bank Bank For Advanced Accounting 1 E by BlineDocumento28 pagineTest Bank Bank For Advanced Accounting 1 E by BlineTerces50% (4)

- How To Invest $50,000 - Louis Navellier's Emerging GrowthDocumento2 pagineHow To Invest $50,000 - Louis Navellier's Emerging Growthsan MunNessuna valutazione finora

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsDa EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsValutazione: 5 su 5 stelle5/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetDa EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetValutazione: 5 su 5 stelle5/5 (2)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDa EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistValutazione: 4 su 5 stelle4/5 (32)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameDa EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)