Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Currency Daily Report November 12

Caricato da

Angel BrokingDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Currency Daily Report November 12

Caricato da

Angel BrokingCopyright:

Formati disponibili

Currencies Daily Report

Monday| November 12, 2012

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Fundamental Team Nalini Rao - Sr. Research Analyst Nalini.rao@angelbroking.com (022) 2921 2000 Extn. 6135 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn. 6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Monday| November 12, 2012

Highlights

US Prelim UoM Consumer Sentiment rose to 84.9 levels in September. Japans gross domestic product declined to 0.9 percent in July to September quarter. Chinas trade surplus was $32 billion in the month of October. Asian markets are trading on weak note due to weak GDP data from the Japan overshadowing better Chinese exports data. Japans gross domestic product declined to 0.9 percent in July to September quarter from 0.2 percent in the earlier quarter. US Trade Balance was at a deficit of $41.5 billion in September as against a previous deficit of $43.8 billion in August. Unemployment Claims declined by 8,000 to 355,000 for the week ending on 2nd November from previous rise of 363,000 in prior week.

Market Highlights (% change)

Last NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (Nov12) - $/bbl Comex Gold (Dec12) - $/oz Comex Silver(Dec12) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% Yield

5686.3 18683.7 12815.39 1379.9 15181.0 1904.4

as on November 9, 2012 Prev. day

-0.9 -0.9 0.0 0.2 -0.1 -0.5

WoW

-0.2 -0.4 -2.1 -2.4 -3.7 -0.7

MoM

-0.3 -0.6 -4.9 -4.3 -2.1 -3.8

YoY

8.9 7.6 8.8 12.3 0.7 -0.2

57357.7 8757.6 86.60 1731.00 3259.00 7576.00

-0.3 -0.9 1.8 0.3 1.1 -0.9

-1.8 -0.1 -0.6 1.0 1.1 -3.3

-2.7 -0.1 -6.3 -1.8 -4.0 -7.2

-0.3 0.0 -9.5 -3.3 -5.1 -0.4

US Dollar Index

The US Dollar Index (DX) swung between gains and losses and settled firm due to rise in the risk aversion amongst market participants as investors were worried over the fiscal cliff issues and its strategy to be resolved by the US. US equities settled on a bearish note on the back of continued worries that the new government in US may not be able to avoid fiscal cliff issues. Further decline in the trade deficit of the US also indicated that economy is progressing on a slower note. It touched an weekly high of 81.11 and closed at 80.89 in yesterdays trade.

Source: Reuters

US Dollar (% change)

Last Dollar Index US $ / INR (Spot) US $ / INR Nov12 Futures (NSE) US $ / INR Nov12 Futures (MCX-SX)

81.05 54.76 N/A N/A

as on November 9, 2012 Prev. day

0.2 -0.7 N/A N/A

WoW

1.1 -2.1 N/A N/A

MoM

1.2 -3.9 N/A N/A

YoY

3.7 -8.6 N/A N/A

Dollar/INR

The Indian rupee depreciated 1.8 percent week on week on the back of weakness in the equity markets and sustained dollar demand from importers of gold and oil and along with banks. Additionally strength in the DX along with weakness in the global markets also exerted a downside pressure on the domestic currency. However, sharp downside in the currency was cushioned on account of increasing FIIs inflows. It touched an intra-day low of 54.79 in the last week and closed at 54.76 on Friday. For the current month FII inflows totaled at Rs. 3,166.60 crores till 9th November 2012. While year to date basis, net capital inflows stood at Rs. 96,861.50 crores till 9th November 2012. Outlook From the intra-day perspective, we expect Indian Rupee to depreciate on the back of bearish Asian markets. Additionally, strength in the DX is also expected to depreciate the domestic currency.

Source: Reuters

Technical Chart USD/INR

Source: Telequote

Technical Outlook

valid for November 12, 2012 Trend Support 54.5/54.2 Resistance 55/55.2

US Dollar/INR Nov12 (NSE/MCX-SX)

Up

www.angelbroking.com

Currencies Daily Report

Monday| November 12, 2012

Euro/INR

The Euro declined week on week and settled 1 percent lower. Continued concerns of the Greece bailout along with strength in the DX acted as a bearish factor for the currency. Additionally, weak economic data from regions also exerted downside pressure on the currency. The currency touched a weekly low of f 1.2688 and closed at 1.271 on Friday. French Industrial Production declined by 2.7 percent in September as against a rise of 1.9 percent in August. French Gov Budget Balance was at a deficit of 85 billion Euros in September from earlier deficit of 97.7 billion Euros a month ago. Italian Industrial Production declined by 1.5 percent in September as compared to rise of 1.7 percent in August. Outlook In todays session we expect Euro to depreciate on the back of mixed market sentiments along with strength in the DX. Technical Outlook

Trend Euro/INR Nov12 (NSE/MCX-SX) Sideways 69.5/69.3 69.85/70 valid for November 12, 2012 Support Resistance

Euro (% change)

Last Euro /$ (Spot) Euro / INR (Spot) Euro / INR Nov12 Futures (NSE) Euro / INR Nov12 Futures (MCX-SX)

1.2711 N/A N/A

as on November 9, 2012 Prev. day

-0.3 N/A N/A

WoW

-1.8 N/A N/A

MoM

-1.3 N/A N/A

YoY

-6.2 N/A N/A

N/A

N/A

N/A

N/A

N/A

Source: Reuters

Technical Chart Euro

Source: Telequote

GBP/INR

The Pound swung between gains and losses and settled with depreciation of 0.8 percent. Weak global market sentiments along with strength in the DX acted as a bearish factor for the currency. Further weak economic data from the nation also pressurized the currency to depreciate. It touched a weekly low of 1.5887 and closed at 1.5898 on Friday. Outlook In todays session, we expect Pound to depreciate on the back of mixed global market sentiments. Further, strength in the DX might also cause the currency to depreciate. Technical Outlook

Trend GBP/INR Nov 12 (NSE/MCX-SX) Up valid for November 12, 2012 Support 87.1/86.8 Resistance 87.65/87.9

GBP (% change)

Last $ / GBP (Spot) GBP / INR (Spot) GBP / INR Nov12 Futures (NSE) GBP / INR Nov12 Futures (MCX-SX)

1.5902 N/A N/A

as on November 9, 2012

Prev. day

-0.5 N/A N/A

WoW

-1.4 N/A N/A

MoM

-0.6 N/A N/A

YoY

-0.1 N/A N/A

N/A

N/A

N/A

N/A

N/A

Source: Reuters

www.angelbroking.com

Currencies Daily Report

Monday| November 12, 2012

JPY/INR

JPY (% change) The Japanese Yen depreciated 1.2 percent week on week owing to weak data from the nation along with provision of announcement of stimulus measures by the government to aid recovery. However, risk aversion in the global markets towards the end of the week caused demand for the low yielding currency to rise. The currency touched a weekly low of 80.56 and closed at 79.46 on Friday. Japans gross domestic product declined to 0.9 percent in July to September quarter from 0.2 percent in the earlier quarter. Outlook In the intra-day session, we expect to yen to appreciate on the back of mixed global markets resulting from the continued Euro zone concerns which will increase the demand for the low yielding currency. However, unfavorable data from the nation might cushion sharp appreciation. Technical Outlook

Trend JPY/INR Nov 12 (NSE/MCX-SX) Up valid for November 12, 2012 Support 68.80/68.40 Resistance 69.50/69.90 Last JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR Nov12 Futures (NSE) JPY 100 / INR Nov12 Futures (MCX-SX)

Source: Reuters 79.49

as on November 9, 2012 Prev day

0.1

WoW

-0.8

MoM

1.6

YoY

2.2

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on November 12, 2012

Indicator Prelim GDP q/q Tertiary Industry Activity m/m BOJ Gov Shirakawa Speaks New Loans Eurogroup Meetings Bank Holiday Country Japan Japan Japan China Euro US Time (IST) 5:20am 5:20am 8:00am 12 -14

th th

Actual -

Forecast -0.8% 0.0% 45.9

Previous -0.2% 0.4% 45.7

Impact Medium Medium Medium Medium High

All day All day

www.angelbroking.com

Potrebbero piacerti anche

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketDa EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketValutazione: 4.5 su 5 stelle4.5/5 (4)

- Currency Daily Report November 15Documento4 pagineCurrency Daily Report November 15Angel BrokingNessuna valutazione finora

- Currency Daily Report November 16Documento4 pagineCurrency Daily Report November 16Angel BrokingNessuna valutazione finora

- Currency Daily Report November 9Documento4 pagineCurrency Daily Report November 9Angel BrokingNessuna valutazione finora

- Currency Daily Report November 5Documento4 pagineCurrency Daily Report November 5Angel BrokingNessuna valutazione finora

- Currency Daily Report October 10Documento4 pagineCurrency Daily Report October 10Angel BrokingNessuna valutazione finora

- Currency Daily Report October 12Documento4 pagineCurrency Daily Report October 12Angel BrokingNessuna valutazione finora

- Currency Daily Report November 19Documento4 pagineCurrency Daily Report November 19Angel BrokingNessuna valutazione finora

- Currency Daily Report October 30Documento4 pagineCurrency Daily Report October 30Angel BrokingNessuna valutazione finora

- Currency Daily Report November 6Documento4 pagineCurrency Daily Report November 6Angel BrokingNessuna valutazione finora

- Currency Daily Report December 03Documento4 pagineCurrency Daily Report December 03Angel BrokingNessuna valutazione finora

- Currency Daily Report October 16Documento4 pagineCurrency Daily Report October 16Angel BrokingNessuna valutazione finora

- Currency Daily Report December 06Documento4 pagineCurrency Daily Report December 06Angel BrokingNessuna valutazione finora

- Currency Daily Report October 22Documento4 pagineCurrency Daily Report October 22Angel BrokingNessuna valutazione finora

- Currency Daily Report December 10Documento4 pagineCurrency Daily Report December 10Angel BrokingNessuna valutazione finora

- Currency Daily Report October 25Documento4 pagineCurrency Daily Report October 25Angel BrokingNessuna valutazione finora

- Currency Daily Report November 30Documento4 pagineCurrency Daily Report November 30Angel BrokingNessuna valutazione finora

- Currency Daily Report November 20Documento4 pagineCurrency Daily Report November 20Angel BrokingNessuna valutazione finora

- Currency Daily Report October 15Documento4 pagineCurrency Daily Report October 15Angel BrokingNessuna valutazione finora

- Currency Daily Report November 8Documento4 pagineCurrency Daily Report November 8Angel BrokingNessuna valutazione finora

- Currency Daily Report November 7Documento4 pagineCurrency Daily Report November 7Angel BrokingNessuna valutazione finora

- Currency Daily Report December 04Documento4 pagineCurrency Daily Report December 04Angel BrokingNessuna valutazione finora

- Currency Daily Report August 13Documento4 pagineCurrency Daily Report August 13Angel BrokingNessuna valutazione finora

- Currency Daily Report August 22Documento4 pagineCurrency Daily Report August 22Angel BrokingNessuna valutazione finora

- Currency Daily Report October 18Documento4 pagineCurrency Daily Report October 18Angel BrokingNessuna valutazione finora

- Currency Daily Report Dec 13Documento4 pagineCurrency Daily Report Dec 13Angel BrokingNessuna valutazione finora

- Currency Daily Report September 27Documento4 pagineCurrency Daily Report September 27Angel BrokingNessuna valutazione finora

- Currency Daily Report August 10Documento4 pagineCurrency Daily Report August 10Angel BrokingNessuna valutazione finora

- Currency Daily Report, February 11Documento4 pagineCurrency Daily Report, February 11Angel BrokingNessuna valutazione finora

- Currency Daily Report November 22Documento4 pagineCurrency Daily Report November 22Angel BrokingNessuna valutazione finora

- Currency Daily Report December 7Documento4 pagineCurrency Daily Report December 7Angel BrokingNessuna valutazione finora

- Currency Daily Report August 28Documento4 pagineCurrency Daily Report August 28Angel BrokingNessuna valutazione finora

- Currency Daily Report December 11Documento4 pagineCurrency Daily Report December 11Angel BrokingNessuna valutazione finora

- Currency Daily Report November 21Documento4 pagineCurrency Daily Report November 21Angel BrokingNessuna valutazione finora

- Currency Daily Report 19th Dec 2012Documento4 pagineCurrency Daily Report 19th Dec 2012Angel BrokingNessuna valutazione finora

- Currency Daily Report August 31Documento4 pagineCurrency Daily Report August 31Angel BrokingNessuna valutazione finora

- Currency Daily Report August 14Documento4 pagineCurrency Daily Report August 14Angel BrokingNessuna valutazione finora

- Currency Daily Report September 12Documento4 pagineCurrency Daily Report September 12Angel BrokingNessuna valutazione finora

- Currency Daily Report, February 18Documento4 pagineCurrency Daily Report, February 18Angel BrokingNessuna valutazione finora

- Currency Daily Report September 21Documento4 pagineCurrency Daily Report September 21Angel BrokingNessuna valutazione finora

- Currency Daily Report September 24Documento4 pagineCurrency Daily Report September 24Angel BrokingNessuna valutazione finora

- Currency Daily Report November 1Documento4 pagineCurrency Daily Report November 1Angel BrokingNessuna valutazione finora

- Currency Daily Report October 31Documento4 pagineCurrency Daily Report October 31Angel BrokingNessuna valutazione finora

- Currency Daily Report September 10Documento4 pagineCurrency Daily Report September 10Angel BrokingNessuna valutazione finora

- Currency Daily Report August 29Documento4 pagineCurrency Daily Report August 29Angel BrokingNessuna valutazione finora

- Currency Daily Report August 21Documento4 pagineCurrency Daily Report August 21Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report November 9Documento6 pagineDaily Metals and Energy Report November 9Angel BrokingNessuna valutazione finora

- Currency Daily Report September 20Documento4 pagineCurrency Daily Report September 20Angel BrokingNessuna valutazione finora

- Currency Daily Report September 11Documento4 pagineCurrency Daily Report September 11Angel BrokingNessuna valutazione finora

- Currency Daily Report August 27Documento4 pagineCurrency Daily Report August 27Angel BrokingNessuna valutazione finora

- Currency Daily Report October 23Documento4 pagineCurrency Daily Report October 23Angel BrokingNessuna valutazione finora

- Currency Daily Report August 23Documento4 pagineCurrency Daily Report August 23Angel BrokingNessuna valutazione finora

- Currency Daily Report, February 14Documento4 pagineCurrency Daily Report, February 14Angel BrokingNessuna valutazione finora

- Currency Daily Report, February 22Documento4 pagineCurrency Daily Report, February 22Angel BrokingNessuna valutazione finora

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocumento4 pagineContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNessuna valutazione finora

- Currency Daily Report August 17Documento4 pagineCurrency Daily Report August 17Angel BrokingNessuna valutazione finora

- Currency Daily Report September 17Documento4 pagineCurrency Daily Report September 17Angel BrokingNessuna valutazione finora

- Currency Daily Report August 16Documento4 pagineCurrency Daily Report August 16Angel BrokingNessuna valutazione finora

- Currency Daily ReportDocumento4 pagineCurrency Daily ReportAngel BrokingNessuna valutazione finora

- Currency Daily Report, March 12Documento4 pagineCurrency Daily Report, March 12Angel BrokingNessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 12 2013Documento2 pagineDaily Agri Tech Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Currency Daily Report September 13 2013Documento4 pagineCurrency Daily Report September 13 2013Angel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 12Documento2 pagineMetal and Energy Tech Report Sept 12Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 12 2013Documento6 pagineDaily Metals and Energy Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 12 2013Documento4 pagineCurrency Daily Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNessuna valutazione finora

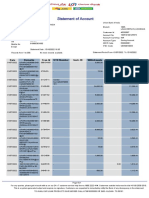

- October StatementDocumento18 pagineOctober StatementSai Durga PrasadNessuna valutazione finora

- IBFS GDR PresentationDocumento25 pagineIBFS GDR PresentationAmit MehraNessuna valutazione finora

- Tata Power - Company UpdateDocumento9 pagineTata Power - Company UpdateRojalin SwainNessuna valutazione finora

- Construction - SectorDocumento11 pagineConstruction - Sectorrishab agarwalNessuna valutazione finora

- Automated Excel DetailsDocumento10 pagineAutomated Excel DetailsPrashant mhamunkarNessuna valutazione finora

- Zerodha Streak Algo Trading PDF PDFDocumento13 pagineZerodha Streak Algo Trading PDF PDFsaubhik chattopadhyayNessuna valutazione finora

- Gandhi Special Tubes LTDDocumento1 paginaGandhi Special Tubes LTDMd jubairNessuna valutazione finora

- National Stock Exchange of IndiaDocumento8 pagineNational Stock Exchange of IndiaBujji BabuNessuna valutazione finora

- Financial Services September 2020Documento33 pagineFinancial Services September 2020saty16Nessuna valutazione finora

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocumento46 pagineIndian Stock Exchange NSE and How Their Indices Are CalculatedUrvashi SharmaNessuna valutazione finora

- Risk & Return Analysis of Nifty Stock in Indian Capital MarketDocumento5 pagineRisk & Return Analysis of Nifty Stock in Indian Capital MarketAkash BNessuna valutazione finora

- 11 - Chapter 5Documento57 pagine11 - Chapter 5Mustaqeem SheikhNessuna valutazione finora

- Nse PDFDocumento23 pagineNse PDFDeepak MaliNessuna valutazione finora

- FINANCIAL MARKETS Notes PDFDocumento11 pagineFINANCIAL MARKETS Notes PDFDivyansh MishraNessuna valutazione finora

- Derivative KitDocumento254 pagineDerivative KitraulrathiNessuna valutazione finora

- Darashaw Is Amongst The OldestDocumento13 pagineDarashaw Is Amongst The OldestShailesh SolankiNessuna valutazione finora

- List ADocumento3 pagineList Arajarao001Nessuna valutazione finora

- Training Report On Anand RathiDocumento92 pagineTraining Report On Anand Rathirahulsogani123Nessuna valutazione finora

- 178 Research Report Sel Manufacturing Company LTDDocumento8 pagine178 Research Report Sel Manufacturing Company LTDPasupathy VkNessuna valutazione finora

- NCFM Model Test Paper Capital MarketDocumento13 pagineNCFM Model Test Paper Capital MarketAmol Raj83% (6)

- Demat Feasibility Working of HSL As A Depository ParticipaDocumento88 pagineDemat Feasibility Working of HSL As A Depository ParticipaNeeraj Katewa100% (1)

- GHCL Limited: October 2020 fc9 JRDocumento4 pagineGHCL Limited: October 2020 fc9 JRprasad patilNessuna valutazione finora

- NSE Midcap Select IndexDocumento3 pagineNSE Midcap Select IndexHsishsbNessuna valutazione finora

- Book Review The TCS Story ... and BeyondDocumento4 pagineBook Review The TCS Story ... and BeyondIshanNessuna valutazione finora

- IDBI Federal Annual Report 2015-2016 PDFDocumento204 pagineIDBI Federal Annual Report 2015-2016 PDFJavaniNessuna valutazione finora

- Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp AstecrhpDocumento295 pagineAstecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp Astecrhp AstecrhpPranav ShandilNessuna valutazione finora

- Preliminary Placement Document2018 PDFDocumento624 paginePreliminary Placement Document2018 PDFAnonymous NFkdXNNessuna valutazione finora

- Induction RMDocumento22 pagineInduction RMkabaatNessuna valutazione finora

- Law Final GauriDocumento10 pagineLaw Final GauriPoonam KhondNessuna valutazione finora

- Bse Listed Top 100 Compnies-2586jDocumento4 pagineBse Listed Top 100 Compnies-2586jsriguruNessuna valutazione finora