Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Daily Agri Report Nov 1

Caricato da

Angel BrokingDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Daily Agri Report Nov 1

Caricato da

Angel BrokingCopyright:

Formati disponibili

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narveker@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Vaishali Sheth - Research Associate vaishalij.sheth@angelbroking.com (022) 2921 2000 Extn. 6133

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

News in brief

Sufficient food grain storage facilities needed to avoid PDS siphoning: KV Thomas

The Union Minister of Consumer Affairs, Food and Public Distribution, Kuruppasserry Varkey Thomas, has urged the states to build sufficient storage facilities at all levels to avoid siphoning in the PDS (Public distribution system) at certain levels. Thomas said that the ministry was in regular contact with provincial government to fill these gaps. "We know when food grains are distributed through the PDS system, there are loopholes and siphoning taking place in the PDS system. But PDS system is basically with the state governments. So we are in constant touch with the state governments to plug these loopholes. So here comes the modernization of the PDS system by computerization, Aaadhar and other systems," Thomas told reporters on Tuesday. Thomas further said that the country has witnessed a record output of food grains in recent years because of which the granaries were full. He also said that even then cases of shortage in availability of food grains were reported regularly and which showed the deficit in the distribution system. Thomas later added that a complete digitisation of the PDS quickly was required once the food security bill was Indian parliament.

(Source: News Track India)

Market Highlights (% change)

Last Prev. day

as on Oct 31, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

18505 5620 53.81 86.24 1718

0.40 0.39 -0.30 0.65 0.41

-1.09 -1.26 0.15 -0.50 0.54

-0.40 -0.53 1.65 -6.11 -3.38

7.04 8.03 8.69 -4.39 -0.30

Source: Reuters

U.S. corn harvest 91 percent complete, soy 87 percent - RTRS

The world's largest corn harvest limped along toward the finish line last week amid rain delays in the Midwest farm belt, but it remained tied with 2010 as the fastest ever, U.S. government data showed on Wednesday. The U.S. Department of Agriculture's weekly crop progress report, which was delayed from its usual release on Monday by the government shutdown tied to superstorm Sandy, said farmers had harvested 91% of their corn as of Sunday. Eleven grains analysts polled by Reuters had expected 93% of the U.S. corn crop - devastated by the worst drought in half a century - to have been harvested. USDA said 87% of the soybean crop had been harvested, near the 88% forecast in the Reuters poll. In the previous week, the corn harvest was 87% complete and soybeans were 80 percent done. The report also provided the first condition ratings of the winter wheat crop, saying 40 percent of the hard red winter and soft red winter crops planted this fall were in good to excellent condition compared with 46% a year ago. (Source: Reuters)

Fungal disease poses hurdle in Iran buying Indian wheat

Iran may import Indian wheat after a long hiatus even as quality aspects remain a thorny issue. Talks between the two nations, which have been going on for the past 11 months, are in advanced stages to tie up a deal on wheat. But the quality issue over the presence of a fungal disease Karnal bunt in the Indian grain has come in the way. Karnal bunt is a fungal disease that affects wheat and lowers yield. A high-level delegation from Iran consisting of officials from General Trading Corporation (the Indian equivalent of State Trading Corporation) and quarantine department are currently in New Delhi discussing the modalities. They (Iran) want zero tolerance to Karnal bunt, sources said. The Iranian quarantine officials held discussions with their Indian counterparts. Sources said Iran is looking to enter into a long-term deal with India to import about six million tonnes spread over three years.

(Source: Business Line)

India may import more raw sugar as local cane prices rise - RTRS

India may import more raw sugar in the current marketing year as mills seek cheap supply in the face of steep price hikes by local cane growers and look to take advantage of high domestic refined sugar prices, industry officials said. The world's biggest sugar consumer has already booked 450,000 tonnes of raw sugar purchases for the year that started on Oct. 1 after exporting sugar for the previous two years. Farmers in the top two sugar-producing states - western Maharashtra and northern Uttar Pradesh - are pushing for a more than 20 percent increase in cane prices to cover their higher costs after the government cut fertiliser subsidies and raised diesel prices. (Source: Reuters)

Ukraine softens wheat export ban stance

Ukraine's Agriculture Ministry on Wednesday softened its position on a wheat export ban this season, saying it will consider all "necessary measures" if the country's wheat stocks fall to a critical level. Last week Agriculture Minister Mykola Prysyazhnyuk said the former Soviet republic would ban wheat exports from Nov.15 due to a high pace of wheat exports and a fall in the harvest due to poor weather, but his deputy said on Wednesday the move was not on the agenda. "We will apply the necessary measures if a critical shortage of food grain appears," Interfax Ukraine news agency quoted Ivan Bisyuk as saying. "At the present moment we see no critical state with food grains," he said. The ministry was unavailable for comment, but traders said that some curbs were likely as the country did not have enough grain in stock to keep exports at the present high level. (Source: Reuters)

Palm-Oil Refining Capacity in Indonesia Seen Exceeding Crop

Palm-oil refining capacity in Indonesia may climb to more than 30 million metric tons next year, exceeding output in the largest producer as companies step up investments following tax changes, according to UBS AG. With the current tax structure there is about $1 billion of investments coming in, Sahat Sinaga, executive director of the Indonesian Vegetable Oil Industry Association, said by phone from Jakarta yesterday. (Source: Bloomberg)

Brazil Seen Beating U.S. in Soybean Trade as China Buys

Brazil, which is set to displace the U.S. as the largest soybean grower this year, may extend that lead as planting is expanded to meet increased demand from China, the biggest buyer, according to Rabobank International. Output will gain to 81.76 million metric tons in 2013-2014 from an estimated 79.88 million tons this year, Oswaldo Junqueira, head of trade commodity finance in Sao Paulo, said in an interview. Brazilian farmers are set to expand sowing by 306,000 hectares (756,142 acres) to 27.4 million hectares, and may add almost 3 million hectares through 2021, Junqueira said. Rising supply from Brazil will intensify competition among exporters, potentially hurting demand for the oilseed grown in the U.S. Futures in Chicago have slumped 14 percent from an all- time high last month on speculation that a record crop in Brazil and supply from Argentina, the third-largest grower, may offset losses in the U.S. after the worst drought in half a century. (Source: Bloomberg)

Rainfall to continue in TN, AP today

Cyclone Nilam crossed the Tamil Nadu coast near Mamallapuram between 4 p.m. and 6 p.m. on Wednesday evening. Y.E.A. Raj, Deputy Director-General of Meteorology at the Regional Meteorological Centre in Chennai, told Business Line that Nilam did not intensify into a severe cyclone. There was a prediction that it might become a severe cyclone but that window effectively had closed as Nilam moved very fast on the home stretch, Raj said. The remnant of the storm will stay active for maximum one day before moving out of the weather charts entirely, he added. (Source: Business Line)

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Chana

Chana futures settled marginally lower on Wednesday as expected higher imports and better sowing prospects is offsetting festive season demand. Chana sowing has started in Maharashtra, AP and Karnataka and is expected to commence soon in MP and Rajasthan too. In Maharashtra, 1.09 lakh ha area has been covered so far which is only 8.8% of the targeted 12.32 lakh ha by the state dept. In AP, chana acreage stood at 41000 hectares as on 17 October, 2012 compared with 98000 hectares during the same period last year. CACP has recommended a hike in minimum support price (MSP) of gram by Rs.200 to Rs.3000 a quintal and Masoor by Rs.100 to Rs.2900 a quintal for upcoming 212-13 Rabi season to boost the production of pulses. As per the NCDEX circular dated 1 October, Special Margin of 10% (in cash) on the Long Side on all the running contracts and yet to be launched contracts in Chana have been withdrawn with effect from beginning of day Thursday, October 04, 2012. Good rains in the month of August and September has raise prospects of Rabi pulses sowing in the coming days.

st th

Market Highlights

Unit Rs/qtl Rs/qtl Last 4638 4703 Prev day -0.25 -0.28

as on Oct 31, 2012 % change WoW MoM 1.11 4.55 1.77 3.98 YoY 32.97 36.28

Chana Spot - NCDEX (Delhi) Chana- NCDEX Nov'12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Nov contract

Sowing progress and demand supply fundamentals

According to the Ministry of Agriculture 99.81 Lakh hectare area has been planted under Kharif pulses as on 21th September, 2012 compared to 108.28 lakh hectare (ha) same period last year. Improved rains towards the end of monsoon season have raised prospects of sowing. According to the first advance estimates of 2012-13 season, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. Kharif pulses harvesting would commence from next month. According to the Fourth advance estimates of 2011-12 season, Pulses output is pegged at 17.21 mn tn in 2011-12 compared with 18.24 mn tn produced in the year 2010-11. While Chana output in 2011-12 is estimated at 7.58 million tones, Tur is estimated at 2.65 million tones, Urad is estimated at 1.83 million tones, Moong is estimated at 1.71 million tones. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch)

Source: Telequote

Technical Outlook

Contract Chana Oct Futures Unit Rs./qtl Support

valid for Nov 1, 2012 Resistance 4745-4788

4610-4660

Outlook

Chana futures in intraday is expected to trade sideways with downward bias as expected higher imports in the coming days amid lower stocks might put pressure on the prices. However, festive season demand might provide support to the prices at lower levels. Going forward, prices may take cues from sowing progress of Rabi pulses. Although, short term trend remain positive for chana, we expect prices to come under downside pressure in the second half of November as supply pressure may ease amid shipments from Australia and Canada.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Sugar

Sugar futures on Wednesday settled higher by 0.59% due to emerging demand at lower levels. Prices had declined considerable during the first three weeks of October on the back of higher quota. However, festive season demand at lower levels is supporting the upside in the prices in the past 3-4session. Decision over hike in import duty on white sugar and duty cut on raw sugar imports shall be taken only after 3 months after considering crushing progress. India, which is likely to produce a sugar surplus for its third year in a row, has decided to allow exports for another year, Food Minster K.V. Thomas said, reflecting confidence about domestic supplies in the world's top consumer of the sweetener. Mills and traders will have to wait for a formal order to export sugar in the new season that began on Oct. 1. Liffe white sugar settled down by 0.53% while ICE raw sugar closed 0.51% lower on Wednesday due to supply pressure from Brazil. Higher output and lower imports expectations for the 2012-13 season from China coupled with higher sugar surplus forecast for fourth straight year is keeping international prices under downside pressure.

Market Highlights

Unit Sugar Spot- NCDEX (Kolkata) Sugar M- NCDEX Nov '12 Futures Rs/qtl Last 3714

as on Oct 31, 2012 % Change Prev. day WoW -0.11 -0.95 MoM -2.25 YoY 14.91

Rs/qtl

3391

0.50

3.73

1.83

15.34

Source: Reuters

International Prices

Unit Sugar No 5- LiffeDec'12 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 541.8 432.44

as on Oct 31, 2012 % Change Prev day WoW -0.53 -0.51 -0.37 -0.36 MoM -6.92 -7.90 YoY -20.44 -24.13

Source: Reuters

Domestic Production and Exports

Crushing has started across Maharashtra and will commence soon in UP too. The area under sugarcane is estimated at 52.88 lakh ha for 2012-13 crop season, up from 50.99 lakh ha on same period a year ago. According to the first advance estimates by agriculture ministry, Sugarcane output is pegged at 335.3 mn tn, down by 6.2% compared to 357.6 mn tn last year. Despite of higher acreage, the producers body has estimated next years sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Sugar production in India the worlds second-biggest producer touched 26 million tonne since October 1, 2011. Industry body ISMA has estimated 6 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 2.5-3 mn tn sugar in 2012-13. With the opening stocks of 6 mn tn, domestic Sugar supplies are estimated at 30mn tn against the domestic consumption of around 22.523 mln tn for 2012-13. Thus, no curbs on exports are seen as of now.

Technical Chart - Sugar

NCDEX Nov contract

Source: Telequote

Technical Outlook

Contract Sugar Oct NCDEX Futures Unit Rs./qtl Support

valid for Nov 1, 2012 Resistance 3415-3435

Global Sugar Updates

Sugar output in Brazil jumped 57% during the first fortnight of October. th And thus output is now lower just by 3.7% as of 16 October at 26.7 mn tn. Unica expects the main center-south cane to yield 32.7 mn tn sugar output in 2012-13, down 1.2 % from the 33.1 mn tn forecast in April. Favorable weather since second half of September should allow harvest and exports to run on schedule despite a couple of days of rain last week that slowed crushing. Thus upside in the international prices may be capped. The International Sugar Organization said it expected a global sugar surplus of 5.86 million tonnes in the season running from October 2012 to September 2013, up from the prior season's surplus of 5.19 million tonnes. The ISO said the stocks/consumption ratio could rise to around 40 percent in 2012/13, from 37.6 percent in 2011/12. (Source: Reuters)

3355-3372

Outlook

Sugar prices may recover as demand is expected to emerge at lower levels. However higher quota is seen offsetting festive season demand which might cap sharp gains. Approval to unrestricted exports may benefit India only if the global sugar prices gain considerably.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Oilseeds

Soybean: After declining in past few sessions, Soybean futures

recovered due emergence of demand at lower levels along with recovery in international prices. The spot as well as the Futures settled 1.08% and 1.46% Higher yesterday. Soybean arrivals at MP that stood at 500000 bags on Wednesday, while in Maharashtra it decreased and stood at 70000 bags. In Rajasthan arrivals stood at 200000 bags on Wednesday. According to first advance estimates, Soybean output is pegged at 126.2 lk tn for 2012-13. However, drop in area under groundnut, sunflower & castor seed may lead to lower output of these oilseeds in 2012-13 which is estimated 9.6% lower at 187.8 lakh tn. CBOT Soybean settled 0.43% higher on account of short coverings after prices fell 1.26% w-o-w. According to the latest crop progress st report released by USDA, as on 1 Nov 2012, US soybean harvest is 87 per cent complete as compared to 80 per cent last week and 78 per cent compared to 5 year average. According to the USDA October monthly report, Global soybean production is projected at 264.3 million tons, up 6.2 million mostly due to an increase for the United States. Ending stocks are seen down from 169 million bushels in 2011-12 to 115 million bushels in 2012-13 season. South American nations are expecting higher plantings and production this season. But Weather is not conducive for soybean sowing in both Brazil and Argentina by now. Production in Argentina is expected to reach 55-60 mn tn crossing record 52.7 mn tn in 2009-10. Brazil could also churn out 81 mn tn of oilseed and replace the drought-stricken US as the world's top soybean producer. Refined Soy Oil: Ref soy oil as well as MCX CPO traded marginally lower on Wednesday on of account of export duty cut by Indonesia for November. This could further dent demand for Malaysian palm oil and exert pressure on the BMD palm oil futures. Exports of Malaysian palm oil products for Oct. 1-25 rose 11 percent. According to latest data from SEA, total vegetable oil imports in September were 993,912 tn, up from 897,018 tn in the previous month. As per MPOBs latest report, Malaysia's September palm oil stocks rose 17 percent to record high 2.48 million tons compared to previous month.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Nov '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Nov '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3290 3298 702.9 686.7

as on Oct 31, 2012 % Change Prev day 1.08 1.46 -0.75 -0.15 WoW 1.04 1.79 0.02 0.56 MoM 8.69 7.25 7.81 8.50 YoY 48.40 45.99 10.01 6.67

Source: Reuters

as on Oct 31, 2012 International Prices Soybean- CBOTNov'12 Futures Soybean Oil - CBOTDec'12 Futures Unit USc/ Bushel USc/lbs Last 1547 50.16 Prev day 0.86 0.14 WoW -1.50 -3.24 MoM 1.08 -0.22

Source: Reuters

YoY 29.75 -1.26

Crude Palm Oil

as on Oct 31, 2012 % Change Prev day WoW 0.08 -0.31 -1.76 0.00

Unit

CPO-Bursa Malaysia Nov '12 Contract CPO-MCX- Oct '12 Futures

Last 2394 424.7

MoM -1.07 3.33

YoY -18.63 -17.82

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Nov '12 Futures Rs/100 kgs Rs/100 kgs Last 4250 4211 Prev day -1.73 -0.75

as on Oct 31, 2012 WoW 2.66 -1.03 MoM 6.25 9.46

Source: Reuters

YoY 37.48 32.05

Technical Chart Soybean Rape/mustard Seed: Mustard Futures declined on Wednesday on

account of profit booking. Also, a prospect of better sowing is weighing on the prices. The Futures settled 0.75% lower on th Wednesday. Mustard sowing as on 25 Oct was reported at 8.37 lakh ha as compared to 20.15 lakh ha in the same period last year. However, on the back of higher returns and improved rains, next years output is expected to be better. Prospects of better sowing shall keep sentiments weak in the medium term. Outlook Edible oil complex may recover during the early part of session on account of recovery in international markets. However, arrival pressure before Diwali festival may pressurize prices at higher levels and thus prices may settled lower towards the end.. Export duty cut on CPO by Indonesia will make available cheaper palm oil for overseas buyers and refiners and could dent demand for Malaysian palm oil and weigh on prices.

NCDEX Nov contract

Source: Telequote

Technical Outlook

Contract Soy Oil Oct NCDEX Futures Soybean NCDEX Oct Futures RM Seed NCDEX Oct Futures CPO MCX Nov Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Nov 1, 2012 Support 673-680 3220-3265 4122-4170 424-430 Resistance 694-700 3345-3390 4245-4275 440-445

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Black Pepper

Pepper futures corrected sharply hitting the 3% lower circuit on expectations of a bumper output this season. Farmers are also trying to liquidate their stocks ahead of the commencement of arrivals of the fresh crop. Higher international supplies coupled with weak exports demand for Indian pepper in the international markets remains weak due to huge price parity also pressurized prices. The Spot remained unchanged while the Futures settled 2.99% lower on Wednesday. th According to the circular released on June 13 2012 the existing Special margin of 10% (cash) on the long side stands withdrawn on all running contracts and yet to be launched contracts in Pepper from beginning of day Friday June 15, 2012. Pepper prices in the international market are being quoted at $8,700/tn(C&F) while Vietnam was offering 550GL at $7,000/tn, Brazil Austa at $6,700/tn, and Indonesia Austa at $6,850/tn (FOB). As per circular dt. 29/06/2012 issued by NCDEX, Hassan will be available as an additional delivery centre for all the yet to be launched contracts. (not applicable to the currently available contracts-till Dec 2012 expiry).

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Nov '12 Futures Rs/qtl Rs/qtl Last 42855 42970 % Change Prev day 0.00 -2.99

as on Oct 31, 2012 WoW 0.40 -3.07 MoM 1.68 -0.51 YoY 24.24 23.67

Source: Reuters

Technical Chart Black Pepper

NCDEX Nov contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till September 2012 is estimated around 80,433 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 14.8% in the first 2 months of the year (2012) to 8810 tn as compared to 10344 tn in the same period previous year. Imports of Pepper in the month of February declined by 16.8% to 3999 tn as compared to 4811 tn in the month of January 2012. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Oct Futures Unit Rs/qtl

valid for Nov 1, 2012 Support 42300-42650 Resistance 43280-43600

Production and Arrivals

The arrivals in the spot market were reported at 25 tonnes while offtakes were 25 tonnes on Wednesday. Global Pepper production in 2012 is expected to increase 7.2% to 3.20 lakh tonnes as compared to 2.98 lakh tonnes in 2011 with sharp rise of 24% in Indonesian pepper output and in Vietnam by 10%. According to latest report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) On the other hand production of pepper in India in 2011-12 is expected to decline further by 5% to 43 thousand tonnes as compared to 48 thousand tonnes in the last year. Production is lowest in a decade.

Outlook

Pepper is expected to trade lower today. Liquidation pressure from farmers as well as low export demand may pressurize prices. Good supplies in the international market from other origins may also keep prices under check. However, festive season demand is expected to support prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Jeera

Jeera Futures traded sideways yesterday. Exporters are not buying at higher levels. Also, prospects of better sowing this season have pressurized prices. However, festive buying has supported prices. Sowing in Gujarat has commenced but is currently lower by 15-20%. However, expectations of good export demand supported prices in the spot. Festive demand is also expected to be good in the coming days. Over the last couple of days, exporters have been buying actively due to escalated tensions between Syria and Turkey. The spot was closed while the Futures settled 0.07% higher on Wednesday. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Around 45 lakh bags of Jeera are reported across India. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,800-2825 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 4-5 lakh bags lower by around 3 lakh bags last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Nov '12 Futures Rs/qtl Rs/qtl Last 15043 14310 Prev day 0.00 0.07

as on Oct 31, 2012 % Change WoW -0.89 -5.37 MoM 3.48 3.08 YoY 4.99 3.49

Source: Reuters

Technical Chart Jeera

NCDEX Nov contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 4,000 bags, while off-takes stood at 6,000 bags on Tuesday. Production of Jeera in 2011-12 is expected to be around 40 lakh bags as compared to 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.22 0.91

as on Oct 31, 2012 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Nov '12 Futures Rs/qtl Rs/qtl

Last 4931 5128

WoW -1.79 2.07

MoM -6.77 -4.83

YoY -12.22 6.57

Outlook

Jeera futures are expected to trade downwards. Exporters may stay away at higher prices and may buy hand to mouth. However, prices may recover if the export demand increases. Festive buying may also lend support to the prices. In the medium term (October-November 2012), prices are likely to stay firm as there are limited stocks with Syria and Turkey.

Technical Chart Turmeric

NCDEX Nov contract

Turmeric

Turmeric Futures recovered again from lower levels on account of short coverings. Traders expect fresh orders from the upcountry market and exporters to improve in November. Stockists have good carryover stocks with them. Turmeric has been sown in 0.58 lakh hectares in A.P as on 10/10/2012. Sowing is also reported 30-35% lower during the sowing period. The Spot as well as the Futures settled 0.22% and 0.91% higher on Wednesday. Special Margin of 20% (in cash) on the Long Side in Turmeric November 2012 and December 2012 expiry contracts will be withdrawn with effect from beginning of day Saturday, Oct 20, 2012.

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad mandi stood at 4,000 bags and 600 bags respectively on Wednesday. Turmeric production for the year 2011-12 is projected at historical high of 90 lakh bags (1 bag= 70 kgs) compared to 69 lakh bags in 201011. Erode is expected to produce 55 lakh bags of turmeric a rise of 29% as compared to previous year. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Oct Futures Turmeric NCDEX Oct Futures Rs/qtl Rs/qtl

valid for Nov 1, 2012 Support 14020-14150 5000-5060 Resistance 14440-14580 5180-5260

Outlook

Turmeric prices are expected to trade sideways today. Lack of fresh orders may pressurize prices. However, a reduction in the special cash margin, lower sowing figures and lower arrivals may support prices. also, expectations of export orders may support prices.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 1, 2012

Agricultural Commodities

Kapas

After staying firm in the past few sessions NCDEX Kapas futures corrected on Wednesday and settled lower by 1.04% on profit taking at higher levels. Also, weak international market weighed on the prices. ICE cotton futures extended losses and settled 1.20% down as cotton harvest pressure is weighing on the prices. Cotton harvesting has commenced in US, in all 38% is harvested as compared to 28% a week ago, versus 39% same period a year ago. Cotton crop condition is 42% in Good/Excellent state same as compares to last week, and 29% same period a year ago as on 23 Oct 2012.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 995.5 16040

as on Oct 31, 2012 % Change Prev. day WoW -0.95 -0.35 -2.55 -3.26 MoM 9.28 -3.26 YoY -7.82

NCDEX Kapas Futures MCX Cotton Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit Usc/Lbs Last 70.07 81.35

as on Oct 31, 2012 % Change Prev day WoW -1.20 -3.66 0.00 0.00 MoM 0.52 0.00 YoY -28.59 -29.20

Domestic Production and Consumption

As on 28 September, 2012, Cotton is being planted on 114 lakh hectares, down, as compared to the last years 119.6 lakh hectares. However, the acreage so far is at par with its normal area of 111.8 lakh hectares. According to the First Advance Estimates, Cotton production for 2012-13 seasons is revised upward to 334 lakh bales compared with 352 lakh bales in 2011-12 season. Also, on account of cheaper cotton available in the global markets, imports have more than double from 5 lakh bales to 12 lakh bales. According to the latest CAB report as on 04 October 2012, exports have dipped sharply by 46% to 7 million bales in the 2012/13 marketing year that began on Oct. 1 compared to 12.7 million bales estimated for 201112 season. The ending stocks figure, has been revised further upward to 3.4 million bales as compared to 2.8 million bales estimated for August 2011-12 season

st

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Global Cotton Updates

Global cotton prices are mainly influenced by China, US and India. USDA estimated US Cotton planting for the season 2012-13 at 12.64 mln acres as compared to 14.74 mln acres last season (2011-12). Ending stocks were at 4.8 mln bales (480 pounds/bales) with Production of 17.65 mln bales and exports of 12.1 mln bales were pegged for the season 2012-13. In its October monthly demand supply report on Thursday, the Agriculture Department (USDA) raised its cotton crop for 2012/13 cotton crop season to 17.29 mln bales (prev 17.11) along with upward revision in end stocks 5.60 mln 480 pounds/bales (prev 5.30). Exports were down to 11.60 mln 480 pounds/bales (prev 11.80). China's 2012/13 cotton crop is estimated at 31.50 mln bales up from previous estimates of 31.00 mln bales given in September, imports 11.00 mln bales down from previous estimates of 12.00 million bales, consumption was pegged at 36.00 mln bales (down from prev 38.00 million bales), end stocks 36.61 mln bales (up from prev 35.51 mln bales)

Source: Telequote

Technical Chart - Cotton

MCX Nov contract

Outlook

Kapas futures in intraday is expected to open lower due to weak international market, but is expected to recover in the later sessions on account of demand and procurement by CCI at lower levels, which might restrict the prices from falling sharply. Also, Prices might take support as farmers are not willing to sell their produce at lower levels. However, fresh arrivals from all over India and higher global cotton ending stocks might cap the sharp upside in medium term.

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Kapas MCX April Cotton MCX November Unit Rs/20 kgs Rs/20 kgs Rs/bale

valid for Nov 1, 2012 Support 972-984 970-980 15980-16120 Resistance 1008-1015 1005-1012 16440-16580

www.angelcommodities.com

Potrebbero piacerti anche

- Derivaties AnswersDocumento3 pagineDerivaties AnswersDavid DelvalleNessuna valutazione finora

- Econ3007 ForexriskDocumento32 pagineEcon3007 ForexriskSta KerNessuna valutazione finora

- GBE CourseraDocumento36 pagineGBE CourseraRevati JadhavNessuna valutazione finora

- Daily Agri Report Oct 23Documento8 pagineDaily Agri Report Oct 23Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 01Documento8 pagineDaily Agri Report, April 01Angel BrokingNessuna valutazione finora

- Daily Agri Report 10th JanDocumento8 pagineDaily Agri Report 10th JanAngel BrokingNessuna valutazione finora

- Daily Agri Report 21st DecDocumento8 pagineDaily Agri Report 21st DecAngel BrokingNessuna valutazione finora

- Daily Agri Report Oct 1Documento8 pagineDaily Agri Report Oct 1Angel BrokingNessuna valutazione finora

- Daily Agri Report Jan 04Documento8 pagineDaily Agri Report Jan 04Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 7Documento8 pagineDaily Agri Report Nov 7Angel BrokingNessuna valutazione finora

- Daily Agri Report, August 12 2013Documento9 pagineDaily Agri Report, August 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 26Documento8 pagineDaily Agri Report, April 26Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 13Documento8 pagineDaily Agri Report Dec 13Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 10Documento8 pagineDaily Agri Report Sep 10Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 12Documento8 pagineDaily Agri Report Dec 12Angel BrokingNessuna valutazione finora

- Daily Agri Tech ReportDocumento8 pagineDaily Agri Tech ReportAngel BrokingNessuna valutazione finora

- Daily Agri Report Nov 26Documento8 pagineDaily Agri Report Nov 26Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 30Documento8 pagineDaily Agri Report Oct 30Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 10Documento8 pagineDaily Agri Report Nov 10Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 14Documento9 pagineDaily Agri Report, June 14Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 28Documento8 pagineDaily Agri Report Aug 28Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 6Documento8 pagineDaily Agri Report Nov 6Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 31Documento8 pagineDaily Agri Report Aug 31Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 24Documento8 pagineDaily Agri Report Sep 24Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 25Documento8 pagineDaily Agri Report Oct 25Angel BrokingNessuna valutazione finora

- Daily Agri Report 14th JanDocumento8 pagineDaily Agri Report 14th JanAngel BrokingNessuna valutazione finora

- Daily Agri Report, June 12Documento7 pagineDaily Agri Report, June 12Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 19Documento8 pagineDaily Agri Report Nov 19Angel BrokingNessuna valutazione finora

- Daily Agri Report, March 28Documento8 pagineDaily Agri Report, March 28Angel BrokingNessuna valutazione finora

- Daily Agri Report, February 15Documento8 pagineDaily Agri Report, February 15Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 27Documento8 pagineDaily Agri Report Aug 27Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 11Documento8 pagineDaily Agri Report Aug 11Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 20Documento8 pagineDaily Agri Report Sep 20Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 25Documento8 pagineDaily Agri Report Sep 25Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 06Documento7 pagineDaily Agri Report, June 06Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 18Documento8 pagineDaily Agri Report, April 18Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 31Documento8 pagineDaily Agri Report Oct 31Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 27Documento8 pagineDaily Agri Report Oct 27Angel BrokingNessuna valutazione finora

- Daily Agri Report 24th DecDocumento8 pagineDaily Agri Report 24th DecAngel BrokingNessuna valutazione finora

- Daily Agri Report Oct 18Documento8 pagineDaily Agri Report Oct 18Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 21Documento8 pagineDaily Agri Report Nov 21Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 8Documento8 pagineDaily Agri Report Nov 8Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 6Documento8 pagineDaily Agri Report Oct 6Angel BrokingNessuna valutazione finora

- Daily Agri Report, February 20Documento8 pagineDaily Agri Report, February 20Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 29Documento8 pagineDaily Agri Report Oct 29Angel BrokingNessuna valutazione finora

- Daily Agri Report September 11 2013Documento9 pagineDaily Agri Report September 11 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 05Documento8 pagineDaily Agri Report, April 05Angel BrokingNessuna valutazione finora

- Daily Agri Report, July 17 2013Documento9 pagineDaily Agri Report, July 17 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report, May 30Documento7 pagineDaily Agri Report, May 30Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 26Documento8 pagineDaily Agri Report Sep 26Angel BrokingNessuna valutazione finora

- Daily Agri Report, May 24Documento7 pagineDaily Agri Report, May 24Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 3Documento8 pagineDaily Agri Report Oct 3Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 20Documento8 pagineDaily Agri Report Nov 20Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 29Documento8 pagineDaily Agri Report Sep 29Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 15Documento8 pagineDaily Agri Report Sep 15Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 08Documento7 pagineDaily Agri Report, June 08Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 30Documento8 pagineDaily Agri Report Aug 30Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 27Documento8 pagineDaily Agri Report Nov 27Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 9Documento8 pagineDaily Agri Report Nov 9Angel BrokingNessuna valutazione finora

- Daily Agri Report, August 16 2013Documento9 pagineDaily Agri Report, August 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 23Documento8 pagineDaily Agri Report Aug 23Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 3Documento8 pagineDaily Agri Report Dec 3Angel BrokingNessuna valutazione finora

- Food Outlook: Biannual Report on Global Food Markets. October 2016Da EverandFood Outlook: Biannual Report on Global Food Markets. October 2016Nessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 12 2013Documento2 pagineDaily Agri Tech Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Currency Daily Report September 13 2013Documento4 pagineCurrency Daily Report September 13 2013Angel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 12Documento2 pagineMetal and Energy Tech Report Sept 12Angel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 12 2013Documento6 pagineDaily Metals and Energy Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Currency Daily Report September 12 2013Documento4 pagineCurrency Daily Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNessuna valutazione finora

- Risk ManagementDocumento19 pagineRisk ManagementcoolchethanNessuna valutazione finora

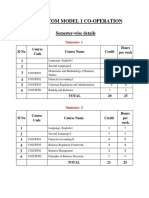

- B Com Model 1 Co OperationDocumento37 pagineB Com Model 1 Co OperationHvffNessuna valutazione finora

- Chapter 09Documento55 pagineChapter 09fatenyousmeraNessuna valutazione finora

- 6-4 201603Q1Documento12 pagine6-4 201603Q1Hannah GohNessuna valutazione finora

- Rapid Fire Equity Builder!: Your Cash Flow Magnet Trading PlanDocumento52 pagineRapid Fire Equity Builder!: Your Cash Flow Magnet Trading Plansoc597269Nessuna valutazione finora

- Chapter 04Documento79 pagineChapter 04MohamedNessuna valutazione finora

- SFM Super 100 Part 2 QuestionsDocumento29 pagineSFM Super 100 Part 2 Questionsanand kachwaNessuna valutazione finora

- Finance Project Report On Commodity MarketDocumento67 pagineFinance Project Report On Commodity MarketSaket VermaNessuna valutazione finora

- Unit 27 Glossary-Basics of Capital MarketDocumento9 pagineUnit 27 Glossary-Basics of Capital MarketVipul AgrawalNessuna valutazione finora

- Options Futures and Other Derivatives 10th Edition Hull Test BankDocumento25 pagineOptions Futures and Other Derivatives 10th Edition Hull Test BankTonyaWilliamswejr100% (40)

- A Mean Reverting ProcessesDocumento5 pagineA Mean Reverting ProcessesSaloni RitoliaNessuna valutazione finora

- Cash Settled Corn Futures Contract - SpecificationsDocumento3 pagineCash Settled Corn Futures Contract - SpecificationsAlexandru DudumanNessuna valutazione finora

- Forex Spectrum - Highly Converting Forex ProductDocumento39 pagineForex Spectrum - Highly Converting Forex ProductAlexandra Loayza HidalgoNessuna valutazione finora

- Investment Analysis and Portfolio ManagementDocumento528 pagineInvestment Analysis and Portfolio ManagementAsra FathimaNessuna valutazione finora

- Nism 8 Equity Derivatives Last Day Revision Test 1Documento54 pagineNism 8 Equity Derivatives Last Day Revision Test 1Nandi Grand86% (7)

- Ethics - Summary of Selected Examples - Standards of Practice Handbook - 11th EdDocumento22 pagineEthics - Summary of Selected Examples - Standards of Practice Handbook - 11th EdKailash Kaju100% (1)

- Baidu (BIDU) Daily Log Scale: Bullish, Right?Documento6 pagineBaidu (BIDU) Daily Log Scale: Bullish, Right?AndysTechnicalsNessuna valutazione finora

- Why Trade Forex Forex vs. FuturesDocumento1 paginaWhy Trade Forex Forex vs. FuturesDickson MakoriNessuna valutazione finora

- Factors Affecting Stock MarketDocumento80 pagineFactors Affecting Stock MarketAjay SanthNessuna valutazione finora

- International Monetary SystemDocumento47 pagineInternational Monetary SystemRavi SharmaNessuna valutazione finora

- Lecture 04 - Currency DerivativesDocumento10 pagineLecture 04 - Currency DerivativesTrương Ngọc Minh ĐăngNessuna valutazione finora

- Nassim Taleb Anti-Fragile Portfolio ResearchDocumento24 pagineNassim Taleb Anti-Fragile Portfolio Researchplato363Nessuna valutazione finora

- Media 1946 Dry Ffas Mar 21Documento32 pagineMedia 1946 Dry Ffas Mar 21KASHANNessuna valutazione finora

- Answers For Chapter 5Documento2 pagineAnswers For Chapter 5Wan MP WilliamNessuna valutazione finora

- Euronext Optiq Market Data Gateway Production Environment v2.1Documento34 pagineEuronext Optiq Market Data Gateway Production Environment v2.1Pramod NayakNessuna valutazione finora

- Futures MarketDocumento31 pagineFutures MarketyanaNessuna valutazione finora

- Consolidated Rules of Bursa Malaysia Securities BHDDocumento323 pagineConsolidated Rules of Bursa Malaysia Securities BHDjerlson83Nessuna valutazione finora