Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Commodities Weekly Outlook 29.10.2012 To 03.11.2012

Caricato da

Angel BrokingDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Commodities Weekly Outlook 29.10.2012 To 03.11.2012

Caricato da

Angel BrokingCopyright:

Formati disponibili

Commodities Weekly Technical Report

29.10.2012 to 03.11.2012

Content

Weekly Technical Levels Strategy/Recommendations

Prepared by

Dhanik Shah Sr. Technical Analyst Dhanik.Shah@angelbroking.com (022) 29212000 Ext. 6129

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Weekly Technical Report

29.10.2012 to 03.11.2012

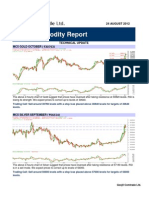

MCX GOLD DECEMBER (CMP 31022 / $ 1710.30)

MCX Gold December as seen in the weekly chart above has opened at 31252 levels and fell sharply for 3 days making a low of 30827, took support at that level and recovered in last 2 sessions and closed the at 31021, ie 267 points lower to previous weeks close For the next week we expect gold prices to find Support at 30820 levels and further below strong support is seen at 30500 levels. Trading consistently below 30500 levels would trigger sharp correction initially towards 30,300 and then finally towards the major support at 30,010 levels. Resistance is observed in the range of 31250-31280 levels. Trading consistently above 31280 levels would lead towards strong resistance at 31550-31600 and then finally at Major resistance level at 31900 MCX / Spot Gold Trading levels for the week Trend: Down S1-30815 / $ 1698 S2-30640 / $ 1689 R1- 31240 / $ 1723 R2-31460 / $ 1735

Recommendation: Buy MCX GOLD Dec between 30860-30910, SL - 30650, Target - 31220 / 31250

www.angelcommodities.com

Commodities Weekly Technical Report

29.10.2012 to 03.11.2012

MCX SILVER DECEMBER (CMP 59703 / $ 32.05)

MCX Silver December as seen in the weekly chart above has opened at 59840, moved sharply lower finding support at 58841, rallied sharply making a high 60066 where is faced resistance and moved lower during last 3 sessions closing at 59703, below the Open and marginally lower than previous weeks close For the next week we expect Silver prices to find Support at 58840 levels and further below strong support seen at 58000 levels. Trading consistently below 58000 levels would trigger sharp correction initially towards 57400 and then finally towards the major support at 56600 levels. Resistance is observed at 60650 levels. Trading consistently above 60650 levels would lead towards strong resistance at 61250 and then finally at Major resistance level at 62400

MCX / Spot Silver Trading levels for the week Trend: Down S1-58840 / $ 31.5 S2- 58000 / $ 31.1 R1-60650 / $ 32.60 R2-61250 / $ 32.90

Recommendation: Buy MCX SILVER Dec between 59100-59200, SL - 58400, Target - 60200 / 60300

www.angelcommodities.com

Commodities Weekly Technical Report

29.10.2012 to 03.11.2012

MCX COPPER NOVEMBER (CMP 425.95 / $ 7770)

MCX Copper November as seen in the weekly chart opened 434.35, immediately made a high of 434.80 faced strong resistance with sellers pushing the price sharply lower throughout the week making a low of 421.30. Copper found good support at 421.30 where buyers pushed prices back on the last 2 sessions of the week closing the week at 425.95, quite lower than previous week. For the next week we expect Copper prices to find support between 418-420. Trading consistently below 418 levels would trigger sharp correction initially towards the strong support at 408 levels and then finally towards the major support at 397. Resistance is now observed in the range of 435-436 levels. Trading consistently above 436 would lead towards strong Resistance at 442 levels and then 446 and finally towards major resistance at 456.

MCX / LME Copper Trading levels for the week Trend: Down S1 418 / $ 7620 S2 408/ $ 7440 R1 435 / $ 7935 R2 442 / $ 8065

Recommendation: Buy MCX COPPER Nov between 423-425, SL - 416, Target - 434 / 436

www.angelcommodities.com

Commodities Weekly Technical Report

29.10.2012 to 03.11.2012

MCX CRUDE NOVEMBER (CMP 4669 / $ 86.24)

MCX Crude October as seen in the weekly chart above has opened at 4899, immediately made a high of 4907, faced strong resistance with sellers emerging driving the prices to 4610 where it found support recovering lost grounds on last 2 trading sessions, however closed the week at 4669, significantly lower than open and also to previous weeks close For the next week we expect Crude prices to find support at 4539 levels. Trading consistently below 4539 would further extend the current decline towards the strong support at 4440. Major support is now seen at 4075 Resistance is now observed 4900 levels. Trading consistently above 4900 would lead towards strong resistance at 5000. Major resistance is now seen at 5350 MCX / NYMEX Crude Oil Trading levels for the week Trend: Down S1- 4539 / $ 83.80 S2- 4440/ $ 82 R1- 4900/ $ 90.50 R2- 5000 / $ 92.40

Recommendation: Buy MCX CRUDE Oil Nov between 4620-4650, SL - 4539, Target - 4770 / 4795 OR Sell MCX CRUDE Oil Nov between 4760-4800, SL - 4902, Target - 4601 / 4575

www.angelcommodities.com

Potrebbero piacerti anche

- B2B Ecommerce White Paper PDFDocumento11 pagineB2B Ecommerce White Paper PDFsudhakarveNessuna valutazione finora

- MCX Silver: 31 July, 2012Documento2 pagineMCX Silver: 31 July, 2012arjbakNessuna valutazione finora

- Manipulation in Forex - A Teen TraderDocumento6 pagineManipulation in Forex - A Teen TraderMANOJ KUMARNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Commodities Weekly Outlook 12.11.2012 To 17.11.2012Documento6 pagineCommodities Weekly Outlook 12.11.2012 To 17.11.2012Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 05 11 12 To 09 11 12Documento5 pagineCommodities Weekly Outlook 05 11 12 To 09 11 12Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 19 11 12 To 23 11 12Documento5 pagineCommodities Weekly Outlook 19 11 12 To 23 11 12Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook, 28th January 2013Documento5 pagineCommodities Weekly Outlook, 28th January 2013Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 22 10 12 To 26 10 12Documento5 pagineCommodities Weekly Outlook 22 10 12 To 26 10 12Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 16 12 13 To 20 12 13Documento6 pagineCommodities Weekly Outlook 16 12 13 To 20 12 13hitesh315Nessuna valutazione finora

- Commodities Weekly Outlook 17 12 12 To 21 12 12Documento5 pagineCommodities Weekly Outlook 17 12 12 To 21 12 12Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 10.12.2012 To 14.12.2012Documento5 pagineCommodities Weekly Outlook 10.12.2012 To 14.12.2012hitesh315Nessuna valutazione finora

- Commodities Weekly Outlook 26.11.2012 To 01.12.2012Documento6 pagineCommodities Weekly Outlook 26.11.2012 To 01.12.2012Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 17 09 12 To 21 09 12Documento6 pagineCommodities Weekly Outlook 17 09 12 To 21 09 12Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 11 11 13 To 15 11 13 PDFDocumento6 pagineCommodities Weekly Outlook 11 11 13 To 15 11 13 PDFhitesh315Nessuna valutazione finora

- Commodities Weekly Outlook 09 09 13 To 13 09 13Documento6 pagineCommodities Weekly Outlook 09 09 13 To 13 09 13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook, 25.03.13 To 30.03.13Documento6 pagineCommodities Weekly Outlook, 25.03.13 To 30.03.13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 10 05 13 To 14 05 13Documento5 pagineCommodities Weekly Outlook 10 05 13 To 14 05 13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook, 24.06.13 To 28.06.13Documento5 pagineCommodities Weekly Outlook, 24.06.13 To 28.06.13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook, 25 02 13 To 01 03 13Documento6 pagineCommodities Weekly Outlook, 25 02 13 To 01 03 13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 30.07.13 To 03.08.13Documento5 pagineCommodities Weekly Outlook 30.07.13 To 03.08.13Angel BrokingNessuna valutazione finora

- Content: Weekly Technical Levels Strategy/RecommendationsDocumento5 pagineContent: Weekly Technical Levels Strategy/RecommendationsAngel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 20 08 12 To 24 08 12Documento5 pagineCommodities Weekly Outlook 20 08 12 To 24 08 12Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook, 22.04.13 To 26.04.13Documento5 pagineCommodities Weekly Outlook, 22.04.13 To 26.04.13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 06 05 13 To 10 05 13Documento6 pagineCommodities Weekly Outlook 06 05 13 To 10 05 13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook, 12.08.13 To 16.08.13Documento5 pagineCommodities Weekly Outlook, 12.08.13 To 16.08.13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 15.07.13 To 19.07.13Documento6 pagineCommodities Weekly Outlook 15.07.13 To 19.07.13Angel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 15 04 13 To 19 04 13Documento6 pagineCommodities Weekly Outlook 15 04 13 To 19 04 13hitesh315Nessuna valutazione finora

- Commodities Weekly Outlook, 08.07.13 To 12.07.13Documento6 pagineCommodities Weekly Outlook, 08.07.13 To 12.07.13Angel BrokingNessuna valutazione finora

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocumento36 pagineSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995Nessuna valutazione finora

- Daily Commodity Market Tips Via ExpertsDocumento9 pagineDaily Commodity Market Tips Via ExpertsRahul SolankiNessuna valutazione finora

- MCX Weekly Report8 AprilDocumento10 pagineMCX Weekly Report8 AprilexcellentmoneyNessuna valutazione finora

- Special Technical Report On MCX Nickel AugustDocumento2 pagineSpecial Technical Report On MCX Nickel AugustAngel BrokingNessuna valutazione finora

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocumento54 pagineSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995Nessuna valutazione finora

- Weekly Reports EquityDocumento6 pagineWeekly Reports EquityexcellentmoneyNessuna valutazione finora

- Weekly Update 24 Sept 2011Documento5 pagineWeekly Update 24 Sept 2011Mitesh ThackerNessuna valutazione finora

- Daily MCX NewsletterDocumento9 pagineDaily MCX Newsletterapi-230785654Nessuna valutazione finora

- July 032012 56030712morningDocumento5 pagineJuly 032012 56030712morningPasam VenkateshNessuna valutazione finora

- Weekly Commodity Report 15 AprDocumento11 pagineWeekly Commodity Report 15 AprNidhi JainNessuna valutazione finora

- Commodity MCX Gold and Silver Market TrendDocumento9 pagineCommodity MCX Gold and Silver Market TrendRahul SolankiNessuna valutazione finora

- Weekly Commodity Outlook 29.06.2015Documento11 pagineWeekly Commodity Outlook 29.06.2015ekarupNessuna valutazione finora

- Free Commodity MCX Market Research ReportDocumento9 pagineFree Commodity MCX Market Research ReportRahul SolankiNessuna valutazione finora

- 301, 3 Floor, Mangal City, Vijay Nagar, Indore Toll Free: 18003157801Documento8 pagine301, 3 Floor, Mangal City, Vijay Nagar, Indore Toll Free: 18003157801Aashika JainNessuna valutazione finora

- Free Commodity Market TipsDocumento9 pagineFree Commodity Market TipsRahul SolankiNessuna valutazione finora

- Weekly Reports EquityDocumento6 pagineWeekly Reports EquityexcellentmoneyNessuna valutazione finora

- Weekly Update 17th Dec 2011Documento6 pagineWeekly Update 17th Dec 2011Devang VisariaNessuna valutazione finora

- Bullion Weekly Technicals: Technical OutlookDocumento16 pagineBullion Weekly Technicals: Technical OutlookMarcin LipiecNessuna valutazione finora

- Commodity Daily Research Report 22-11-2017 by TradeIndia ResearchDocumento8 pagineCommodity Daily Research Report 22-11-2017 by TradeIndia ResearchAashika JainNessuna valutazione finora

- Daily Commodity Research Report 28-12-2017 by TradeIndia ResearchDocumento8 pagineDaily Commodity Research Report 28-12-2017 by TradeIndia ResearchAashika JainNessuna valutazione finora

- Aug 2412 6240812Documento5 pagineAug 2412 6240812k_kestutisNessuna valutazione finora

- Daily Commodity Prediction Report by TrdaeIndia Reserch 27-11-2017Documento8 pagineDaily Commodity Prediction Report by TrdaeIndia Reserch 27-11-2017Aashika JainNessuna valutazione finora

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocumento55 pagineSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995Nessuna valutazione finora

- Today Commodity Gold Market ReportDocumento9 pagineToday Commodity Gold Market ReportRahul SolankiNessuna valutazione finora

- Weekly Update 10nd Dec 2011Documento5 pagineWeekly Update 10nd Dec 2011Devang VisariaNessuna valutazione finora

- Special Technical Report On NCDEX TurmericDocumento2 pagineSpecial Technical Report On NCDEX TurmericAngel BrokingNessuna valutazione finora

- Commodity Market Report 13 Oct 2016Documento9 pagineCommodity Market Report 13 Oct 2016Rahul SolankiNessuna valutazione finora

- Free Commodity Market ReportDocumento9 pagineFree Commodity Market ReportRahul SolankiNessuna valutazione finora

- Investment TipsDocumento38 pagineInvestment TipsPartha PratimNessuna valutazione finora

- Free Prime Time Commodity TipsDocumento9 pagineFree Prime Time Commodity TipsRahul SolankiNessuna valutazione finora

- Indian Commodity Market News and ReportDocumento9 pagineIndian Commodity Market News and ReportRahul SolankiNessuna valutazione finora

- Weekly Trading Highlights & OutlookDocumento5 pagineWeekly Trading Highlights & OutlookDevang VisariaNessuna valutazione finora

- Weekly-Commodity-Report 01 JULY 2013Documento11 pagineWeekly-Commodity-Report 01 JULY 2013Nidhi JainNessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Currency Daily Report September 13 2013Documento4 pagineCurrency Daily Report September 13 2013Angel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 12 2013Documento2 pagineDaily Agri Tech Report September 12 2013Angel BrokingNessuna valutazione finora

- Currency Daily Report September 12 2013Documento4 pagineCurrency Daily Report September 12 2013Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Metals and Energy Report September 12 2013Documento6 pagineDaily Metals and Energy Report September 12 2013Angel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 12Documento2 pagineMetal and Energy Tech Report Sept 12Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 pagineDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNessuna valutazione finora

- 1 Physical Distribution SystemDocumento25 pagine1 Physical Distribution SystemShubham AgarwalNessuna valutazione finora

- I Am The BestDocumento4 pagineI Am The BestJillam Parida67% (3)

- Problems Stocks ValuationDocumento3 pagineProblems Stocks Valuationmimi96Nessuna valutazione finora

- Product Life Cycle and Other Theories of International BusinessDocumento23 pagineProduct Life Cycle and Other Theories of International BusinessSandip Timsina100% (1)

- Mini EssayDocumento4 pagineMini Essaynaveeed dcNessuna valutazione finora

- Ityukta - MECCADocumento31 pagineItyukta - MECCAAditi100% (1)

- HAFSA SCM QuizDocumento3 pagineHAFSA SCM Quizhafsa ishtiaqNessuna valutazione finora

- Conducting A Feasibility Study and Crafting A BusinessDocumento27 pagineConducting A Feasibility Study and Crafting A BusinessMichael BongalontaNessuna valutazione finora

- Erp SimDocumento17 pagineErp SimGautam D100% (1)

- Topic 2 Lecture NotesDocumento21 pagineTopic 2 Lecture NotesFiLo R BrowneNessuna valutazione finora

- Different Types of E-CommerceDocumento11 pagineDifferent Types of E-CommerceTrisha_csedu100% (1)

- ElasticitypracticeDocumento3 pagineElasticitypracticeapi-2605125630% (1)

- CH 11Documento28 pagineCH 11Mike Cheshire0% (1)

- Profit Maximization PracticeDocumento3 pagineProfit Maximization PracticegNessuna valutazione finora

- Chaffey. D., Ellis-Chadwick, F., Johnson, K., & Mayer, R. (2006) - Internet Ed.) Harlow, UK: Prentice Hall FTDocumento3 pagineChaffey. D., Ellis-Chadwick, F., Johnson, K., & Mayer, R. (2006) - Internet Ed.) Harlow, UK: Prentice Hall FTOLIVIANessuna valutazione finora

- Use The Figure Below To Answer The Following QuestionsDocumento5 pagineUse The Figure Below To Answer The Following QuestionsSlock TruNessuna valutazione finora

- TMA 1-B207: Aman Hussain Bba - Iii SemDocumento4 pagineTMA 1-B207: Aman Hussain Bba - Iii SemClass 2Nessuna valutazione finora

- Three: Gwaweru@kyu - Ac.keDocumento4 pagineThree: Gwaweru@kyu - Ac.keDavidNessuna valutazione finora

- Article On Branding by Aaker IMPDocumento3 pagineArticle On Branding by Aaker IMPKen Kurian ManayanickalNessuna valutazione finora

- Essay On IMCDocumento12 pagineEssay On IMCNesimi QarazadeNessuna valutazione finora

- Company EbayDocumento3 pagineCompany Ebayamin233Nessuna valutazione finora

- ECO 101 - Pr. of MicroeconomicsDocumento3 pagineECO 101 - Pr. of MicroeconomicsAniqaNessuna valutazione finora

- 1 Incentive To Raise Prices After A Merger Consider TheDocumento2 pagine1 Incentive To Raise Prices After A Merger Consider Thetrilocksp SinghNessuna valutazione finora

- FN1024 Commentary Prelim 2022Documento11 pagineFN1024 Commentary Prelim 2022Xxx V1TaLNessuna valutazione finora

- Chapter 22: Futures Markets: Problem SetsDocumento8 pagineChapter 22: Futures Markets: Problem SetsMehrab Jami Aumit 1812818630Nessuna valutazione finora

- Revenue Management in SCMDocumento8 pagineRevenue Management in SCMNiranjan ThiruchunapalliNessuna valutazione finora

- Case StudyDocumento2 pagineCase StudyDrRishikesh Kumar25% (4)

- Elasticity - Regression - Q2Documento5 pagineElasticity - Regression - Q2SN KhairudinNessuna valutazione finora