Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 19 Changes in Partnership

Caricato da

Harrison MataraDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 19 Changes in Partnership

Caricato da

Harrison MataraCopyright:

Formati disponibili

CHANGES IN PARTNERSHIP Introduction A change in partnership occurs if there is a change in any of the fundamental agreement among the partners.

Changes in partnership include; 1. Admission of a partner 2. Death or retirement of a partner 3. Amalgamation 4. Conversion to a limited company. In a strict sense a change in partnership leads to formation of a new partnership (or company) separate from the old partnership. This entails valuation of the old business net assets and their transfer to the new business. This chapter is concerned with the admission dearth or retirement of partners. Objectives: After studying this chapter you should be able to: 1. Appreciate the causes of partnership changes 2. Identify the accounting adjustment to effect changes 3. Appreciate the concept of goodwill in partnership 4. Account for admission of a partner 5. Account for death or retirement of a partner 6. Construct the profit and loss account, appropriation account and balance sheet for a change in partnership Admission of a Partner When a new partner is admitted to a partnership, s/he joins in the ownership of the business net asset and is therefore entitled to share in the future profits. For that reason he will be required to bring in capital equal to purchase of his partnership share. This requires a revaluation of the business net assets so as to arrive at the partnerships true worth at the time of admission. It must be noted that partnership accounts are drawn on the basis of the historical cost convention in which the assets are accounted for at their historical cost less accumulated depreciation. The book value of net assets does not reflect the current value of the business. The incoming partner should be charged for the current value of the assets and not their historical cost. The business normally would not have accounted for its goodwill. Goodwill is the value of a business over and above its net separable assets. The value of the business as a going concern is normally worth more than the value of it net separable assets. The value of the business above the value of its net separable assets (i.e. goodwill) should be recognised before a new partner is admitted.

Value of net separable assets = Value of asset (other than goodwill) xxx

Liabilities Net separable asset

(xx) xxx

Book entries for admission of a partner: Transaction 1. Revaluation of asset a/c (Gain on revaluation) 2. Goodwill a/c 3. Reduction in asset in value Dr. Asset a/c Cr. Revaluation

Goodwill a/c

Revaluation

Revaluation a/c

Asset a/c Capital

4. Share revaluation to old Revaluation Partners at profit sharing ratio 5. Capital introduced by new Partner Capital account of new partner:

Bank

Example A and B have been in partnership sharing profits and losses in the ratio of 3:2 respectively. Their balance sheet as at 31st December 2002 is as follows: Capital A B Creditors 5,000,000 Land and building 4,000,000 Plant and machinery Motor vehicle 2,000,000 Stock Debtors Cash 11,000,000 3,000,000 2,000,000 2,500,000 1,500,000 1,000,000 1,000,000 11,000,000

On that date C was admitted and the following was agreed: i. Asset value Land and buildings 3,500,000 Plant and Machinery 2,300,000 Motor vehicle 2,700,000 Stock 1,600,000 Debtors 900,000 Goodwill 1,000,000

ii)

C is to bring in shs. 4,000,000 as his capital.

Required: Draw the relevant accounts to effect the change and the balancesheet after admission. Revaluation Sh. Sh. Debtors 100,000 Land & building 500,000 Plant & Machinery 300,000 Capital A 1,200,000 Motor Vehicle 200,000 B 800,000 Stock 100,000 Goodwill 1,000,000 2,100,000 Goodwill Sh. Revaluation 1,000,000 1,000,000 Sh. Bal c/d 1,000,000 1,000,000 2,100,000

Capital a/c C A B Sh Sh Sh Bal. b/d 5,000,000 4,000,000 Revaluation 1,200,000 800,000 Bal c/d 6,200,000 4,800,000 4,000,000 Bank 4,000,000 6,200,000 4,800,000 4,000,000 6,200,000 4,800,000 4,000,000 A Sh B C Sh Sh

A B and C Partnership. Balance sheet as at 31st December 2002 Capital A B C 4,000,000 6,200,000 4,800,000 Goodwill 1,000,000 Land and buildings 3,500,000 Plant and Machinery 2.300,000 Motor vehicle 2,700,000 Stock 1,600,000 Debtor 900,000

Creditors

2,000,000 17,000,000

Cash

5,000,000 17,000,000

Amortization of Goodwill Partners may choose to write off goodwill immediately after admission. In such a case the amount of goodwill is written off to partners capital accounts in the new partnership in the profit sharing ratio. Example Suppose in the above example the profit sharing ratio in the new partnership is 2:1:1. The new partnership decided to write of goodwill immediately. Suggested solution Goodwill accounts Revaluation 1,000,000 Capital A 500,000 B 250,000 C 250,000 1,000,000 Capital account A B C Sh. 000 Sh. 000 Sh. 000 G/W 500 250 250 Bal b/d Bal c/d 5,700 4,550 3,750 C 6,200 4,800 4,000 A B C Sh. 000 Sh.000 Sh. 000 6,200 4,800 4,000 6,200 4,800 4,000 1,000,000

A B and C partnership. Balance sheet Capital A B C Creditors 5,700,000 Land and build. 3,500,000 4,550,000 Plant and mach. 2.300,000 3,750,000 Motor vehicle 2,700,000 Debtor 900,000 2,000,000 Cash 5,000,000 Stock 1,600,000 16,000,000 16,000,000

Example 2 A, B & C in partnership sharing profit and losses in the ratio 3: 2:1. They agree to admit D when their Balance Sheet is as follows: Balance Sheet as at 31/12/03 Sh. 000 3,000 2,000 1,000 500 500 300 3,200 10,500 Sh. 000 4,000 3,000 2,000 1,000 500

Capital A B C Current A B C Creditors

Land & building Plant & Machinery Stock Debtor Cash

10,500

For the purpose of admitting D the following was agreed. 1) Asset value Land & Building 4,500,000 Plant & Machinery 3,500,000 Stock 2,200,000 Goodwill 600,000 2) New profit sharing ratio is 3: 1: 1: 1 for A, B, C and D respectively. 3) D is to bring in capital so as to equal that of C after writing off goodwill. Required: Draw the relevant books of accounts and balance sheet after admission. Suggested solution Revaluation A/C Sh Sh 900,000 Land and building 500,000 600,000 Plant & machinery 500,000 300,000 Stock 200,000 Goodwill 600,000 1,800,000 1,800,000 Goodwill Revaluation 600,000 capital A 300,000

Capital A B C

600,000

B C D

100,000 100,000 100,000 600,000 Capital a/c

G/W

Sh. A 300

Sh. B 100

Sh. C 100

Sh D 100

Bal. b/d Rev Bank

Sh. Sh. Sh. A B C 3000 2000 1000 900 600 300

Sh D

1,300 3,900 2,600 1,300 1,300

Bal c/d

3,600 2,500 1,200 1,200 3,900 2,600 1,300 1,300

A, B, C and D Partnership Balance sheet as at 31st December 2003 Capital A B C D Current A B C D Creditors 3,600 2,500 1,200 1,200 500 500 300 3,200 13,000 Land and building Plant & Machinery Stock Debtors Cash 4,500 3,500 2,200 1,000 1,800

13,000

Death or Retirement When a partner dies or retires, the assets of the business must be re-valued at the date of death or retirement so as to adjust the capital accounts of all the partners and arrive at the amount of claim to the outgoing partner. The administrator of the dead partners estate or the retired partner (as the case may be will be) paid his share in manner agreed upon by the partners. He may be paid in full on the date of retirement (or death) or soon thereafter. Payment may be in cash or by taking away part of the partnership assets or a combination of the two. He may be paid in part and the balance remaining as a loan to the partnership attracting interest at an agreed rate.

Example XYZ have been in partnership sharing profits in the ratio 3: 2: 1. Z retired at a time when their balance sheet was as follows; Balance sheet 31/12/02 Sh. 000 3,000 2,000 1,000 200 200 100 500 7,000 Sh. 000 Land and building 2,000 Plant 1,500 Motor 1,200 Stock 1,300 Debtors 500 Cash 500

Capital X Y Z Current X Y Z Creditors

7,000

1. Assets value Land and building 2,500,000 Plant 1,700,000 Motor vehicle 1,400,000 Goodwill 600, 000 2. X and Y are to continue in partnership sharing profits/losses at 2:1 respectively 3. Z took a motor vehicle valued at Ksh 600,000, He was paid Sh. 400,000 of all that he is owed and the balance to remain as a loan at 10% interest. 4. Goodwill is written off in the new partnership Required: Relevant books of accounts to effect the partnership change and balance sheet after retirement. Suggested solution Revaluation Motor Veh. Capital X 750,000 Land & Build Y 500,000 Plant Z 250,000 Goodwill 1,500,000 200,000 500,000 200,000 600,000 1,500,000

Capital accounts

Goodwill Cash M/V Loan a/c Bal.c/d

X 400

Y 200

Z 400 600 350 Bal b/f Revaluation Current a/c

X 3,000 750

Y 2,000 500

Z 1,000 250 100

3,350v 2,300 3,750 2,500 1,350 3,750 2,500 1,350

X and Y partnership Balance sheet as at 31st December 2002 Capital X Y Current X Y Creditors Loan 3,350 2,300 Land and Building Plant Motor 200 Stock 200 Debtor Cash 500 350 2,500 1,700 800 1,300 500 100

6,900

6,900

Example A, B, and C are in partnership sharing profits and losses in the ratio 3: 2: 1. D was admitted on 30th June 2002. The trial balance as at 31st December 2002 is: Dr. 9,000 Cr. 4,000 3,000 2,000 2,000 1,000 500 500 15,000 2,000 8,000 5,000 5,000

Fixed Assets Capital A B C Current A B C D (drawings) Sales Opening stock Purchases Expenses Debtors

Cash Creditors Cash paid by D

2,000 2,000 3,000 32,000

32,000 Additional information 1. Fixed assets were revalued on 30/6/02 at a gain of 1,200,000. 2. For the purpose of admission, goodwill is valued at 1,500,000. 3. New profit sharing ratio is 3:2:2:1 4. Goodwill is to be written off. 5. Sales are evenly distributed throughout the year but the expenses were spread at ratio of 2:3 between 1st and 2nd half of the year. 6. Interest on capital is provided at the rate of 10% p.a. 7. No adjustments have been made in the books for the purpose of admitting D. Required: i) ii) iii) iv)

Draw capital account to show changes Trading profit and loss appropriation account Partners current account Balance sheet as at 31/12/02

Suggested solution Revaluation Account Sh 000 1,350 900 450 2,700 Capital account A B C D A B C D Sh 000 Sh 000 Sh 000 Sh 000 Sh 000 Sh000 Sh 000 Sh000 G/W 562.5 375 375 187.5 Bal/b/d 4,000 3,000 2,000 Rev 1,350 900 450 Bal c/d 4,787.5 3,525 2,075 2,812.5 Bank 3,000 5,350 3,900 2,450 3,000 5,350 3,900 2,450 3,000 Sh. 000 Fixed assets 1,200 Goodwill 1,500

Capital A B C

2,700

Trading account Sh. 000 Sales Opening stock Purchases Gross profit 2,000 8,000 Sh. 000 15,000

(10,000) 5,000

Profit and loss and Appropriation account For year ended 31/12/02 Sh. 000 Gross profit Less expenses Net profit /loss Less Interest on capital A 200 B 150 C 100 D Profit (Loss) share A B C D Sh. 000 2,500 (2,000) 500 Sh. 000 Sh. 000 2,500 (3,000) (500)

(450) 50

200 150 100 150

(600) (1,100)

25 16.7 8.3 -

(50) -

412.5 275 275 137.5

1,100

Current account A B C D A B C D Bal b/d 500 500 Bal. b/d 2,000 1,000 Loss 412.5 275 275 137.5 Int.on capital 400 300 200 150 Share Profit share 25 16.7 8.3 Bal c/d 566.7 487.5 Bal. c/d2,012.5 1041.7 2,425 1,316.7 725 637.5 2,425 1,316.7 77.5 637.5

Balance sheet

Sh 000 Fixed assets Debtors Cash Less creditors Financed by: Capital account A B C D Current account A B C D 5,000 2,000 7,000 (2,000)

Sh. 000 10,200

5,000 15,200

4,787.5 3,525 2,075 2,812.5 13,200 2,012.5 1,041.7 (566.7) (487.5)

2,000 15,200

Examination Questions Question One Awino , Chebet and Enzibo have been in partnership sharing profits in the ratio 5 : 3 : 2 respectively. On 30 June 1998 Awino retired and Chebet and Enzibo decided to continue the partnership, sharing profits equally. The partnership trial balance as at 31 December 1998, was as follows: Ksh Land at cost 120,000 Buildings: cost 320,000 Buildings: depreciation at 1 January 1998 Shop and office equipment: Cost 48,000 Depreciation at 1 January 1998 Accounts receivable 68,400 Allowance for doubtful debts 1 January 1998 Cash at bank 4,200 Accounts payable Capital accounts at 1 January 1998: Awino 180,000 Ksh

24,000 11,000 2,100 81,200

Capital accounts at 1 January 1998: Chebet 170,000 Enzibo Current accounts at 1 January 1998: Awino 3,000 Current accounts at 1 January 1998: Chebet 2,000 Enzibo Drawings accounts: Awino (to 30 June 1998) 21,000 Chebet (to 31 December 1998) 37,000 Enzibo (to 31 December 1998) 36,000 Inventory at 1 January 1998 81,000 Purchases 291,000 Sales revenue Staff wages 58,600 Rent 25,000 General administrative expenses 14,200 Bad debts written off 900 1,127,300

160,000

2,000

494,000

1,127,300

Notes (1) Profits are to be assumed to accrue equally in the periods before and after Awinos retirement. (2) The balance due to Awino is to remain in the partnership from 1 July 1998 as a loan carrying no interest until 1 January1999. (3) The value of the partnership goodwill at 30 June 1998 was agreed by all three partners at Ksh200,000. Goodwill is not toappear in the balance sheet after the adjustments necessary at 30 June 1998. (4) It was decided, as part of the process of valuing Awinos share of the partnership, to revalue the land at 30 June fromKsh120,000 to Ksh160,000. The increased value is to be included in the balance sheet. (5) The inventory at 31 December 1998 was Ksh90,000. (6) Accruals and prepayments at 31 December 1998 were: Rent: paid in advance to 31 March 1999 Ksh5,000. General administrative expenses: prepayments Ksh 1,800 accruals Ksh 6,200 (7) The allowance for doubtful debts is to be increased to Ksh2,400. (8) Depreciation is to be provided as follows: Buildings 2% per annum straight line

Shop and office equipment 15% per annum straight line. (9) No adjustments has been made with respect to Awinos retirement . Required: (a) Prepare the income statement and a statement showing the division of the profit for the year ended 31 December 1998 and balance sheet as at that date; (16 marks) (b) Show the partners capital and current accounts for the year and Awinos loan account. (8 marks) (Total 24 marks)

Awino Chebet and Enzibo Trading profit and loss account for the year ended 31 December 1998 Sales 494,000 Opening stock 81,000 Purchases 291,000 Closing stock (90,000) (282,000) Gross profit 212,000 Staff wages 58,600 Rent 20,000 Bad debts 900 General expenses 18,600 Depreciation building 6,400 Shop & office 7,200 Allowance for bad debts 300 (112,000) Net profit 100,000 Profit and loss appropriation account 1st half 50,000 Awino (25,000) Chebet (15,000) Enzibo (10,000) Capital account A Goodwill Loan Balance c/f 307,000 142,000 307,000 242,000 B 100,000 A Balance b/f 180,000 Revaluation 120,000 108,,000 Current a/c 7,000 208000 307,000 E 100,000 B 170,000 720,000 E 160,000 48,000

2nd half 50,000 (25,000) (25,000)

242,000

208,000

Current account Drawings Capital a/c Balance c/f A 21,000 7,000 5,000 28,000 42,000 1,000 37,000 28,000 42,000 208,000 B 37,000 C 36,000 Balance b/f Profit A 3,000 25,000 B 2,000 40,000 C 2,000 35,000

Chebet and Enzibo Balance sheet as at 31 December 1998 Cost Land 160,000 Buildings 320,000 Shop & furniture 48,000 Stock Prepayment Accounts receivables Cash Creditors Accruals Loan Net assets Financed by: Capital Chebet Enzibo 250,000 Current a/c Chebet Enzibo 90,000 6,800 66,000 4,200 81,200 6,200

Depreciation 30,400 18,200

NBV 160,000 289,600 29,800 479,400

167000

(87,400)

79,600 559,000 (307,000) 252,000

142,000 108,000

5,000 1,000 252,000

6,000

Question Two Kyamba, Onyango and Wakil were partners in a manufacturing and retail business and shared profits and losses in the ratio 2:2:1 respectively. Given below is the balance sheet of the partnership as at 31 March 2001:

Balance Sheet as at 31 March Assets Non-current assets: Fixed assets Current assets: Stocks Debtors 2001 Sh. Sh. 465,000 294,000 209,000 503,000 968,000 Capital and liabilities Capital accounts: Kyamba Onyango Wakil Current accounts Kyamba Onyango WakiL

160.000 140,000 200,000 500,000 65,300 49,000 53,000 167,300 667,300

Current liabilities: Bank overdraft Trade creditors

48,700 252,000 300,700 968,000

Additional information 1. On I April 2001, Wakil retired from the partnership and was to start a business as sole trader while Kyamba and Onyango continued in partnership. On retirement of Wakil, the manufacturing business was transferred to him while Kyamba and Onyango continued with the retail business. 2. The assets and liabilities transferred to Wakil were as follows: Net book value Transfer value Sh. Sh. Fixed asset 260,000 306,000 Stocks 166,000 157,000

Debtors Creditors

172,000 156,000

165,000 156,000

Wakil obtained a loan from a commercial bank and paid into the partnership the net amount due from him. 3. On retirement of Wakil from the partnership, goodwill was valued at Sh. 200,000 but was not to be maintained in the books of the partnership of Kyamba and Onyango. 4. After retirement of Wakil on 1 April 2001, Kyamba and Onyango agreed on the following terms and details of the new partnership: Kyamba and Onyango to introduce additional capitals of Sh. 48, 000 and Sh. 68,000 respectively. Each partner was entitled to interest on capital at 10% per annum with effect from 1 April 2001 and the balance of profits was to shared equally after allowing for annual salaries of Sh. 72,000 to Kyamba and Sh. 60,000 to Onyango. 5. The profit of the new partnership before interest on capitals and partners salaries was Sh. 240,000 for the year ended 31 March 2002. 6. The profits made by the new partnership increased stocks by Sh. 100,000; debtors by Sh. 90,000 and bank balance by Sh. 50,000. 7. Drawings by the partners in the year were Kyamba Sh. 85,000 and Onyango Sh. 70,000. Required: (a) Profit and loss and appropriation account for the year ended 31 March 2002. (4 marks) (b) Capital accounts for the year ended 31 March 2002 (c) Current accounts for the year ended 31 March 2002 (4 marks) (4 marks)

(d) Balance sheet of the new partnership as at 31 March 2002 (8 marks) (Total: 20 marks) a) Kyamba and Onyango Profit and loss appropriation Net profit 240,000

Interest K O Salary: K O Share of profit: K O

20,000 20,000 72,000 60,000

40,000

132,000

34,000 34,000

68,000

(240,000)

b)

Kyamba, Onyango and Wakil Revaluation Account Fixed assets 46,000 Goodwill 200,000

Stocks Debtors Capital: K O W

9,000 9,000 92,000 92,000 46,000 246,000

246,000 Capital Account

K F. Assets Stock Debtors Goodwill Balance c/f

W K 306,000 Balance b/f 160,000 157,000 Creditors 165,000 Revaluation 92,000 100,000 100,000 Current a/c 200,000 200,000 Cash 48,000 300,000 300,000 628,000

O W 140,000 200,000 156,000 92,000 46,000 53,000 68,000 173,000

300,000 300,000 628,000

c) K 85,000 O 70,000 Current account W Bal. b/f 53,000 Interest Salary Profit K 65,300 20,000 72,000 34,000 O 49,000 20,000 60,000 34,000 W 53,000

Drawings Capital a/c Balance c/f

106,300

93,000

191,300

1630,00

53,000

191300

163,000

53,000

Kyamba and Onyango Balance sheet as at 31st march 2001 Fixed assets Stock 228,000 Debtors 127,000 Bank 135,300 490,300 Creditors (96,000) Net assets Financed by: Capital: K 200,000 O 200,000 Current a/c K 106,300 O 93,000

205,000

394,300 599,300

400,000

199,300 599,300

Question Three Rotich and Sinei have been in partnership for several years, sharing profits and losses in the ratio 2:1. Interest on fixed capitals was allowed at the rate of 10% per annum, but no interest was charged or allowed on current accounts. The following was the partnership trial balance as at 30 April 2001: Sh. Sh. Fixed capital accounts Rotich 750,000 Sinei 500,000 Current accounts Rotich 400,000 Sinei 300,000 Leasehold premises (purchased 1 May 2000) 2,250,000 Purchases 4,100,000 Motor vehicle (cost) 1,600,000 Balance at bank 820,000 Salaries (including partners drawings) 1,300,000 Stocks: 30 April 2000 1,200,000

Furniture and fittings (cost) 300,000 Debtors 225,000 Accountancy and audit fees 105,000 Wages 550,000 Rent, rates and electricity 310,000 General expenses (Sh. 352,400 for the six months to 31 October 2000) 660,000 Cash introduced-Tonui 1,250,000 Sales (Sh. 3,500,000 to 31 October 2000) Accumulated depreciation: 1 May 2000 Motor vehicle 300,000 Furniture and fittings 100,000 Creditors ________ 13,420,000

8,750,000

1,070,000 13,420,000

Additional information: 1. On 1 November 2000, Tonui was admitted as a partner and from that date, profits and losses were to be shared in the ratio 2:2:1. For the purpose of this admission, the value of goodwill was agreed at Sh. 3,000,000. No account for goodwill was to be maintained in the books, adjusting entries for transactions between the partners being made in their current accounts. On that date, Tonui introduced Sh. 1,250,000 into the firm of which Sh. 375,000 comprised his fixed capital and the balance was credited to his current account. 2. Interest on fixed capitals was still to be allowed at the rate of 10% per annum after Tonuis admission. In addition after Tonuis admission, no interest was to be charged or allowed on current accounts. 3. Any apportionment of gross profit was to be made on the basis of sales. Expenses, unless otherwise indicated, were to be apportioned on a time basis. 4. A Charge was to be made for depreciation on motor vehicle and furniture and fittings at 20% and 10% per annum respectively, calculated on cost. 5. On 30 April 2001, the stock was valued at Sh. 1,275,000. 6. Salaries included the following partners drawings: Rotich Sh. 150,000, Sinei Sh. 120,000 and Tonui Sh. 62,500 7. A difference in the books of Sh. 48,000 had been written off at 30 April 2001 to general expenses, which was later found to be due to the following clerical errors:

Sales returns of Sh. 32,000 had been debited to sales returns but had not been posted to the account of the customer concerned; The purchases journal had been undercast by Sh. 80,000.

8. Doubtful debts (for which full provision was required) amounted to Sh. 30,000 and Sh. 40,000 as at 31 October 2000 and 30 April 2001 respectively.

9. On 30 April 2001, rates and rent paid in advance amounted to Sh. 50,000 and a provision of Sh. 15,000 for electricity consumed was required.

Required: (a) Trading and profit and loss account for the year ended 30 April 2001. (9 marks) (4 (b) Partners current accounts for the year ended 30 April 2001. marks) (c) Balance sheet as at 30 April 2001. (7 marks) (Total: 20 marks) Suggested solution Rotich, Sinei and Tonui Trading and profit and loss account for the year ended 30 April 2001 Sales 8,750,000 Opening stock 1,200,000 Purchases 4,180,000 Closing stock (1,275,000) (4,105,000) Gross profit 4,465,000 31/10/00 1,858,000 (483,750) (52,500) (275,000) (137,500) (306,000) (160,000) (15,000)) (30,000) 398,250 30/4/2001 2,787,000 (483,750) (52,500) (275,000) (137,500) (306,000) (160,000) (15,000) (10,000) 1,347,250

Gross profit Salaries Accountancy Wages Rent rates &electricity General expenses Depreciation Motor vehicles Furniture Provision for bad debts Net profit Interest on capital

R S T Share of profit R S T

(37,500) (25,000) (223,833) (111,917) 398,250

(77,500) (15,000) (13,750 (496,400) (496,400) (248,200) 1,347,250

Capital account R S T Goodwill 1,200,000 1,200,000 600,000 Bal. c/f 1,550,000 300,000 275,000

Bal. b/f Cash Good will

R 750,000 2,000,000 2,750,000

S 500,000 1,000,000

T 875,000

2,750,000 1,500,000 875,000 Current account R Drawings 150,000

1,500,000 875,000

S 120,000

T 62,500

Balance c/f

1,085,233 1,235,233

828,317 948317

574,450 636,950

Bal. b/f Interest Profit Bank

R 400,000 115,000 720,233 -

S 300,000 40,000 608,317 -

T 13,750 248,200 375,000 636,950

1,235,233 948317

Rotich, Sinei and Tonui Balance sheet as at 30 April 2001 Cost Leasehold premises 2,250,000 Motor vehicles 1,600,000 Furniture 300,000 Current assets Stock Debtors Prepayment Bank Current liabilities Creditors

Depn 620,000 130,000

NBV 2,250,000 980,000 170,000 3,400,000

1,270,000 153,000 50,000 820,000

2,298,000

1,070,000

Accruals Net assets Financed by: Capital R S T Current account R S T Question four

150,000

(1,085,000)

(1,213,000) 4,613,000

1,550,000 300,000 275,000 1,085,233 828,317 574,450

2,125,000

2,488,000 4,613,000

Atieno, Babu and Chesire have been trading in partnership sharing profits/losses in the ratio of 5:3:2 respectively. On 1 April 2000 they admitted their manager. Dagana as a partner and the profit sharing ratio was changed to 4:3:2:1 for Atieno, Babu, Chesire and Dagana respectively. The partners valued the goodwill at Sh. 510,000. Dagana paid in Sh. 200,000 as capital and his share of goodwill, which should be based on capital contributions. The partners do not wish to retain the goodwill account after admission of Dagana. The admission of Dagana has not been fully recorded other than the cash receipt of Sh. 376,500. The following is the trial balance of the partnership as at 31 March 2001. Sh. Sh. Capital accounts Atieno 700,000 Babu 600,000 Chesire 400,000 Current accounts Atieno 350,000 Babu 325,000 Chesire 195,000 Drawings Atieno 250,000 Babu 260,000 Chesire 250,000 Dagana 175,000 Land and buildings at cost 2,000,000 Furniture and fittings at cost 500,000

Provision for depreciation on future and fittings 150,000 Motor vehicles 860,000 Provision for depreciation on motor vehicles 480,000 Trade debtors and creditors 365,000 823,500 Dagana account 376,500 Purchases and sales 3,380,000 5,975,000 Stock 1 April 2000 465,000 Salaries and wages 295,000 Rates 137,000 Telephone and postage 116,000 Vehicles running expenses 396,000 Insurance and subscriptions 162,000 General expenses 72,000 Bank charges and interests 124,000 Bad debts 68,000 Returns inwards and outwards 61,000 75,000 Cash in hand 24,000 Cash at bank 490,000 _________ 10,450,000 10,450,000 Notes: 1. Depreciation on furniture and fittings and motor vehicles is at 10% and 20% on reducing balance respectively. 2. The closing stocks were valued at Sh. 560,000. 3. Accrued salaries and wages and telephone bills amounted to Sh. 24,000 and Sh. 14,000 respectively. 4. Prepaid subscriptions and rates amounted to Sh. 5,000 and Sh. 25,000 respectively. 5. The partners decided that Dagana should be given a monthly salary of Sh. 20,000 for the whole year from 1 April 2000 to 31 March 2001. 6. Dagana took goods for own use at cost amounting to Sh. 185,000. No entry has been made in the books. 7. The old partners shared the cash paid by Dagana for part of his goodwill. Required: (a) Trading, profit and loss account for the year ended 31 March 2001. (10 marks) (2 marks) (b) Partners capital accounts.

(c) Partners current accounts. (d) Balance sheet as at 31 March 2001. (Total: 20 marks) Suggested solution a) Atieno, Babu ,Chesire and Dagana Trading, profit and loss account for the year ended 31 March 2001 Sales (net) Opening stock Purchase Drawings Closing stock Gross profit Salaries & wages Rates Telephone & Postage Vehicle expense Insurance 157,000 General expense Bank charges Bad debts Depreciation: furniture Motor vehicles Net profit Salaries Profit Share: A B C D 5,914,000 465,000 3,325,000 (18,500) (560,000) 319,000 112,000 130,000 396,000 &subscriptions 72,000 124,000 68,000 35,000 76,000 240,000 464,000 348,000 232,000 116,000 (1,489,000) 1,400,000 (4,368,500) 3,025,000

(3 marks) (5 marks)

1,400,000

b)

Current account A B C D Bal Drawings 250,000 260,000 250,000 175,000 b/f Stock 185,000 Cash Salary

350,000 325,000 195,000 176,500 240,000

Bal c/f

564,000 413,000 177,000 172,500 Profit 814,000 673,000 427,000 532,500

464,000 348,000 232,000 116,000 814,000 673,000 427,000 532,500

c) A Capital A Capital B Capital C Bal c/f B

Capital account C D 25,500 15,300 Bal b/f Cash

700,000 600,000 400,000 200,000 25,500 15,300 10,200

10,200 D cap. 725,500 615,300 410,200 149,000 725,500 615,300 410,200 200,000

725,500 615,300 410,200 200,000

Workings Cash paid by Dagana Capital and goodwill Balance to Daganas current account Capital and Goodwill Goodwill share (510,000 *1/10) Balance to Daganas capital account

376,500 (200,000) 176,500 200,000 (51,000) 149,000

Partners share of Gaganas goodwill Atieno: 51,000* 5/10 = 25,500 Babu: 51,00 * 3/10= 15300 and Chesire : 51,000 * 2/10 = 10,200 d) Atieno, Babu ,Chesire and Dagana Balance sheet as at 31 March 2001 Fixed assets Land & building Furniture Motor vehicle Stock Debtors Prepayment Bank Cash Cost Depn 2,000,000 500,000 185,000 860,000 556,000 560,000 365,000 30,000 490,000 24,000 NBV 2,000,000 3,150,000 304,000 2,619,000

1,469,000

Creditors Accruals Net assets Financed by Capital A B C D Current A B C D

823,500 38,000

(861,500) 607,500 3,226,500

725,500 615,300 410,200 149,000 564,000 413,000 177,000 172,500

1,900,000

3,226,500

Question Five Kamau and Kimani are partners sharing profits and losses in the ratio 3:2 respectively. The partnership agreement provides for Kimani to receive a salary of Sh. 4,000,000 per annum and interest on capitals for both partners at 5% per annum. The partnership balance sheet as at 31 December was as follows: Sh. 000 Sh. 000 Sh. 000 Sh. 000 Capital accounts Premises Kamau 16,000 Less depreciation 20,800 Kimani 10,000 26,000 Equipment at cost 8,000 Depreciation (4,800) 3,200 24,000 Current accounts Kamau Kimani Creditors accruals

3,200 (300)

2,900 Stock Debtors 3,300 Cash 32,200 32,200

5,600 2,200 400 8,200

On 1 April 1999 Kimata was admitted to the partnership. He had been a salaried employee, earning Sh. 8,000,000 per annum. The terms of his admission to the partnership were as follows: 1. Kimata should introduce Sh. 12,000,000 in cash as capital into the business.

2. Goodwill should be valued at Sh. 14,000 for the purpose of his admission. It was agreed that goodwill should not be included in the balance sheet of the new partnership. 3. Kimata should receive a salary as a partner of Sh. 6,000,000 per annum. Kimanis salary should be raised to Sh. 6,000,000. 4. Interest on capital should be raised from 5% to 6% per annum and calculated on the capital accounts after the elimination of goodwill. 5. The new profit sharing ratio for Kamau, Kimani and Kimata should be 4:2:1 respectively. In preparing the draft financial statements for the year ended 31 December 1999, the partnership accountant, Otieno calculated that the partnerships profit for the year was Sh. 55,155,000, and that the working capital of the business as at 31 December 1999 was: Sh. 000 12,555 3,500 8,800 3,480

Stock Debtors Cash Creditors and accruals

Profit is assumed to accrue evenly during the year. Partners cash drawings for the year were Kamau Sh. 23,705,000, Kimani Sh. 19,525,000 and Kimata Sh. 8.250,000. Required: (a) The profit and loss appropriation account for the year ended 31 December 1999. (8 marks) (b) The current and capital accounts of the partners for the year ended 31 December 1999. (7 marks) (c) Balance Sheet as at 31 December 1999. (5 marks) (Total: 20 marks) Question Six A, B & C have been in partnership sharing profit in the ratio of 3:2:2. on 31/12/04, they decided to admit D into the partnership on payment of capital of Kshs. 5,000,000 The balance sheet on that date was as follows: Land and building

10,000

Motor vehicles Furniture Current Assets: Stock Debtors Cash and bank Current Liability: Creditors Accruals Net assets Financed by: Capital: A B C Current: A B C

5,000 4,000 3,000.00 2,000.00 1,000.00

6,000.00

2,000.00 1,000.00

(3,000.00)

3,000.00 22,000.00

7,000.00 5,000.00 3,000.00 3,000.00 2,000.00 2,000.00

15,000.00

7,000.00 22,000.00

Additional information: i) For the purpose of admission the assets were revalued as follows: Good will 90,000 Land and building 12,000,000 Motor vehicles 4,000,000 Stock 3,500,000 Debtors 1,500,000 ii) The new partnership does not wish to retain goodwill in its accounts iii) The new profit sharing ratio is 3:3:2:1 to A, B, C, D respectively. Required: a) Partners capital accounts b) Revaluation account c) Balance sheet after admission. Suggested solution Dr. Motor 1,000,000 Debtors 500,000 Capital: A Revaluation a/c 000 vehicle Balance 10,000 Income 26,000 Cr. 000 b/d & Expenditure 36,000

B C

31,200 36.000 Goodwill a/c 900,000 Capital Cr. A B C D 300,000 300,000 200,000 100,000 900,000

Dr. Revaluation

900,000

Dr. Cr. Good will 300,000 300,000 200,00 0

Capital a/c

100,000 Bal b/f Rev. supl Cash

7,000,00 0 814,285

5,000,000 542,851

3,000,00 0 542,858 5,000,00 0

Bal c/f

7,514,28 5 7,814,28 5

5,242,85 7 5,542,85 7

3,242,85 8 3,542,85 8

4,900,0 00 5,000,0 00

7,841,28 5

5,542,85 0,

3,542,85 8

5,000,00 0

Balance sheet (after admission) Land & building Motor vehicles Furniture Stock Debtors Cash & bank Creditors Accruals Net assets Financed by: Capital A B 3,500,000 1,500,000 6,000,000 2,000,000 1,000,000

12,000,000 4,000,000 4,000,000

11,000,000 (3,000,000) 8,000,000 28,000,000 7,514,285 5,242,857

C D Current A B C

3,342,858 4,900,000 3,000,000 2,000,000, 2,000,000

21,000,000

7,000,000 28,000,000

Potrebbero piacerti anche

- Past Papers - Partnership ChangesDocumento10 paginePast Papers - Partnership ChangesFarhan JehangirNessuna valutazione finora

- Partnership Changes... Goodwill and RevaluationDocumento5 paginePartnership Changes... Goodwill and Revaluationtafadzwa tandawaNessuna valutazione finora

- CAF 1 IA Autumn 2020Documento5 pagineCAF 1 IA Autumn 2020Qasim Hafeez KhokharNessuna valutazione finora

- Accounting: Quantitative Information Primarily Financial inDocumento19 pagineAccounting: Quantitative Information Primarily Financial inleeeydoNessuna valutazione finora

- ACW366 - Tutorial Exercises 4 PDFDocumento6 pagineACW366 - Tutorial Exercises 4 PDFMERINANessuna valutazione finora

- Cash Budgets Practice QuestionDocumento1 paginaCash Budgets Practice QuestionDenisa M. Todea50% (2)

- Financial Instruments (2021)Documento17 pagineFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- W7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDocumento8 pagineW7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDanica VetuzNessuna valutazione finora

- E1-4 Determine The Total Amount of Various Types of Costs: InstructionsDocumento7 pagineE1-4 Determine The Total Amount of Various Types of Costs: InstructionsNgọc KhánhNessuna valutazione finora

- Revision - Test - Paper - CAP - II - June - 2017 9Documento181 pagineRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNessuna valutazione finora

- Revision Questions - 2 Statement of Cash Flows - SolutionDocumento7 pagineRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNessuna valutazione finora

- Balance SheetDocumento18 pagineBalance SheetAndriaNessuna valutazione finora

- Far Qualifying ExaminationDocumento30 pagineFar Qualifying ExaminationAlvin BaternaNessuna valutazione finora

- Revaluation-Accounting CompressDocumento13 pagineRevaluation-Accounting CompressEunice Buenaventura100% (1)

- Answers Biological AssetsDocumento4 pagineAnswers Biological AssetsJanella Gail ArenasNessuna valutazione finora

- Division of ProfitsDocumento55 pagineDivision of ProfitsMichole chin MallariNessuna valutazione finora

- Backflush Costing System and Activity Based Costing System With SolutionDocumento15 pagineBackflush Costing System and Activity Based Costing System With SolutionJhazreene ArnozaNessuna valutazione finora

- Q and A PartnershipDocumento9 pagineQ and A PartnershipFaker MejiaNessuna valutazione finora

- Activity 1.1 PDFDocumento2 pagineActivity 1.1 PDFDe Nev OelNessuna valutazione finora

- MCQDocumento3 pagineMCQPeng GuinNessuna valutazione finora

- Chapter 3-Consolidated Statement of Profit and LossDocumento11 pagineChapter 3-Consolidated Statement of Profit and LossSheikh Mass JahNessuna valutazione finora

- A1 Basic Financial Statement Analysis Q8Documento3 pagineA1 Basic Financial Statement Analysis Q8bernard cruzNessuna valutazione finora

- CVP VAnswer Practice QuestionsDocumento5 pagineCVP VAnswer Practice QuestionsAbhijit AshNessuna valutazione finora

- Mathematics Logic PremiseDocumento2 pagineMathematics Logic PremiseLuigi JalandoonNessuna valutazione finora

- 08-Rectification-Of-Errors Good OneDocumento54 pagine08-Rectification-Of-Errors Good OneAejaz MohamedNessuna valutazione finora

- Fully Prepared AccountsDocumento127 pagineFully Prepared AccountsAMIN BUHARI ABDUL KHADER0% (4)

- IAS 12 TaxDocumento12 pagineIAS 12 TaxHarsh KhandelwalNessuna valutazione finora

- Ia Shareholder's Equity Practice ProblemsDocumento5 pagineIa Shareholder's Equity Practice ProblemsMary Jescho Vidal AmpilNessuna valutazione finora

- Cost and Management Accounting: Paper 7Documento31 pagineCost and Management Accounting: Paper 7Atukwatse PamelaNessuna valutazione finora

- Gross Profit AnalysisDocumento5 pagineGross Profit AnalysisInayat Ur RehmanNessuna valutazione finora

- Partnership Liquidation: Problem MDocumento8 paginePartnership Liquidation: Problem MMiko ArniñoNessuna valutazione finora

- Retirement of A PartnerDocumento33 pagineRetirement of A PartnerKriti Shah100% (2)

- Final RequirementDocumento18 pagineFinal RequirementZandra GonzalesNessuna valutazione finora

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocumento12 pagineLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- First Partn - Answer 2Documento5 pagineFirst Partn - Answer 2Monique CabreraNessuna valutazione finora

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocumento19 pagineMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNessuna valutazione finora

- Finals Unit 5 Exercise Short Run Decision MakingDocumento6 pagineFinals Unit 5 Exercise Short Run Decision MakingDia Mae Ablao GenerosoNessuna valutazione finora

- Prob 2Documento1 paginaProb 2Mitch Tokong MinglanaNessuna valutazione finora

- MSC F&A AFG 09101 Supplementary Examination 2023Documento9 pagineMSC F&A AFG 09101 Supplementary Examination 2023Sebastian MlingwaNessuna valutazione finora

- Ias 37 Provisions, Contingent Liabilities & Contingent AssetsDocumento12 pagineIas 37 Provisions, Contingent Liabilities & Contingent AssetsTawanda Tatenda HerbertNessuna valutazione finora

- Assignment 1 AFSDocumento14 pagineAssignment 1 AFSSimra SalmanNessuna valutazione finora

- Qa PartnershipDocumento9 pagineQa PartnershipFaker MejiaNessuna valutazione finora

- Case Study #3: Wake Up and Smell The Coffee!Documento4 pagineCase Study #3: Wake Up and Smell The Coffee!USD 654Nessuna valutazione finora

- This Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)Documento8 pagineThis Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)NCT100% (1)

- Exercises On Issue of Shares and DebenturesDocumento6 pagineExercises On Issue of Shares and Debenturesontykerls100% (1)

- PDF PDFDocumento7 paginePDF PDFMikey MadRatNessuna valutazione finora

- Multiple Choices - Quiz - Chapter 1-To-3Documento21 pagineMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNessuna valutazione finora

- More Practice Problems CH 1-5 EconomicsDocumento23 pagineMore Practice Problems CH 1-5 EconomicsAdam GillNessuna valutazione finora

- 05 - Chapter 5 - Partnership AccountsDocumento16 pagine05 - Chapter 5 - Partnership Accountszubairkhan_leo100% (15)

- Chapter 005 - Valuing Bonds: True / False QuestionsDocumento12 pagineChapter 005 - Valuing Bonds: True / False QuestionsLaraNessuna valutazione finora

- Name:: Score: ProfessorDocumento6 pagineName:: Score: ProfessorkakaoNessuna valutazione finora

- G1 6.4 Partnership - Amalgamation and Business PurchaseDocumento15 pagineG1 6.4 Partnership - Amalgamation and Business Purchasesridhartks100% (2)

- Part IIDocumento58 paginePart IIhaaasaaNessuna valutazione finora

- 19696ipcc Acc Vol2 Chapter14Documento41 pagine19696ipcc Acc Vol2 Chapter14Shivam TripathiNessuna valutazione finora

- Additional Illustratiions 2Documento14 pagineAdditional Illustratiions 2Naman ChotiaNessuna valutazione finora

- Financial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreDocumento17 pagineFinancial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreMaryjoy NemenoNessuna valutazione finora

- Accounting For Treatment For MergerDocumento6 pagineAccounting For Treatment For Mergergoel76vishalNessuna valutazione finora

- Introduction To Partnership AccountsDocumento20 pagineIntroduction To Partnership Accountsanon_672065362100% (1)

- Reviewer in Partnership Corporation MycDocumento22 pagineReviewer in Partnership Corporation MycScwythle65% (20)

- G1 6.3 Partnership - DissolutionDocumento15 pagineG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Retainage Release Invoices in Oracle AP - ErpSchoolsDocumento9 pagineRetainage Release Invoices in Oracle AP - ErpSchoolsK.rajesh Kumar ReddyNessuna valutazione finora

- Harish NatarajanDocumento10 pagineHarish NatarajanbananiacorpNessuna valutazione finora

- StartUp India - Case AnalysisDocumento3 pagineStartUp India - Case AnalysisIrshad AzeezNessuna valutazione finora

- Break Even Point ExplanationDocumento2 pagineBreak Even Point ExplanationEdgar IbarraNessuna valutazione finora

- Cheque and Its TypesDocumento2 pagineCheque and Its Typesdevraj subediNessuna valutazione finora

- RWJ 08Documento38 pagineRWJ 08Kunal PuriNessuna valutazione finora

- PricelistDocumento3 paginePricelist4 fruit companyNessuna valutazione finora

- Jack Daniel'sDocumento17 pagineJack Daniel'sIon TarlevNessuna valutazione finora

- Spisak Parfema NEWDocumento1 paginaSpisak Parfema NEWDouglas CoxNessuna valutazione finora

- Circular FlowDocumento21 pagineCircular FlowSheryl BorromeoNessuna valutazione finora

- Antwoordblad Instaptoets EngelsDocumento4 pagineAntwoordblad Instaptoets EngelskadpoortNessuna valutazione finora

- Putting English Unit14Documento13 paginePutting English Unit14Dung LeNessuna valutazione finora

- Corporate FinanceDocumento11 pagineCorporate Financemishu082002100% (2)

- Business Level StrategyDocumento28 pagineBusiness Level StrategyMohammad Raihanul HasanNessuna valutazione finora

- Gat PreparationDocumento21 pagineGat PreparationHAFIZ IMRAN AKHTERNessuna valutazione finora

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocumento24 paginePowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterJiya Nitric AcidNessuna valutazione finora

- Tennis Ball Activity - Diminishing Returns - Notes - 3Documento1 paginaTennis Ball Activity - Diminishing Returns - Notes - 3Raghvi AryaNessuna valutazione finora

- PinoyDocumento5 paginePinoyLarete PaoloNessuna valutazione finora

- Concentration of SolutionsDocumento32 pagineConcentration of SolutionsRaja Mohan Gopalakrishnan100% (2)

- VisuSon - Business Stress TestingDocumento7 pagineVisuSon - Business Stress TestingAmira Nur Afiqah Agus SalimNessuna valutazione finora

- Akuntansi Keuangan Lanjutan 2Documento6 pagineAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNessuna valutazione finora

- Cash Flows From Operating ActivitiesDocumento5 pagineCash Flows From Operating ActivitiesIrfan MansoorNessuna valutazione finora

- Magazine Still Holds True With Its Mission Statement-Dedicated To The Growth of TheDocumento5 pagineMagazine Still Holds True With Its Mission Statement-Dedicated To The Growth of TheRush YuviencoNessuna valutazione finora

- Chief Executive Officer CPG in West Palm Beach FL Resume James MercerDocumento2 pagineChief Executive Officer CPG in West Palm Beach FL Resume James MercerJames MercerNessuna valutazione finora

- International Marketing - ChinaDocumento10 pagineInternational Marketing - ChinaNaijalegendNessuna valutazione finora

- Tourism PolicyDocumento6 pagineTourism Policylanoox0% (1)

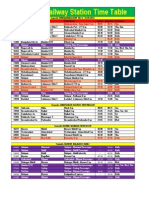

- Solapur Railway Station Time TableDocumento2 pagineSolapur Railway Station Time TableAndrea Lopez33% (3)

- 3.1.2 and 3.1.3.import - LC Open and Amend Karl Mayer - Nov.28.2014Documento8 pagine3.1.2 and 3.1.3.import - LC Open and Amend Karl Mayer - Nov.28.2014thanhtuan12Nessuna valutazione finora

- Respond To Business OpportunitiesDocumento21 pagineRespond To Business OpportunitiesRissabelle CoscaNessuna valutazione finora

- Key Points in Creation of Huf and Format of Deed For Creation of HufDocumento5 pagineKey Points in Creation of Huf and Format of Deed For Creation of HufGopalakrishna SrinivasanNessuna valutazione finora

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (15)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookDa EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookValutazione: 5 su 5 stelle5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyDa EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNessuna valutazione finora

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Da EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Valutazione: 4.5 su 5 stelle4.5/5 (8)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetDa EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetValutazione: 4.5 su 5 stelle4.5/5 (14)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceDa EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceValutazione: 4 su 5 stelle4/5 (1)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDa EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCValutazione: 5 su 5 stelle5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingDa EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingValutazione: 4.5 su 5 stelle4.5/5 (760)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsDa EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsValutazione: 4.5 su 5 stelle4.5/5 (2)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookDa EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNessuna valutazione finora

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessDa EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNessuna valutazione finora