Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Transfer Taxes

Caricato da

beverlyrtanDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Transfer Taxes

Caricato da

beverlyrtanCopyright:

Formati disponibili

TRANSFER TAXES & BASIC PRINCIPLES OF TAXATION The modes of property transfer may be diagramed as follow: Properties: 1.

Real Property 2. 2. Personal Property (Tangible & Intangible Property) Transfer of Property Through Gratuitous Transfer Fact of Death Subject to Estate Tax Donation Subject to Donors Tax Onerous Transfer Normal Course of Business (Sale or Exchange)

Subject to Business Tax (VAT, Percentage Tax & Excise Taxes)

Casual Transfer Capital Gains Tax

TRANSFER TAXES & BASIC PRINCIPLES OF TAXATION The modes of property transfer may be diagramed as follow: Properties: 3. Real Property 4. 2. Personal Property (Tangible & Intangible Property) Transfer of Property Through Gratuitous Transfer Fact of Death Subject to Estate Tax Donation Subject to Donors Tax Onerous Transfer Normal Course of Business (Sale or Exchange)

Subject to Business Tax (VAT, Percentage Tax & Excise Taxes)

Casual Transfer Capital Gains Tax

GROSS ESTATE Illustrative Problem: J. Santos died leaving the following properties: Lot and House in US Car in US Car in the Philippines Jewelries in the Philippines Jewelries in US Farm in the Philippines Accounts Receivable, debtor residing in the Philippines Accounts Receivable, debtor residing in Hong Kong Bank deposit in the Philippines Bank deposit in US Franchise exercised in US Franchise exercised in the Philippines Patent exercised in the Phils. Copyright exercised in US Investment in a partnership established in US' Investment in a partnership established in the Phils. Domestic shares, certificate of stocks kept in US. Domestic shares, certificate of stocks kept in the Phils. Foreign shares Foreign shares, 86% of the business in the Phils. Foreign shares, 70% of the business in the Phils. Foreign shares, 40% of the business is in the Phils. but shares have business situs in the Phils. Required: A. Determine the SITUS of the decedents properties (within & outside the Philippines). B. If J. Santos is a Filipino, resident of US, determine his gross estate taxable in the Philippines (NRC). C. If J. Santos is an American citizen, resident of the Philippines, determine his gross estate taxable in the Philippines (RA). D. If J. Santos is an American citizen, resident of US, determine his gross estate taxable in the Philippines (NRA). a. There is no reciprocity. b. There is reciprocity. 400,000.00 200,000.00 300,000.00 150,000.00 180,000.00 150,000.00 50,000.00 100,000.00 250,000.00 200,000.00 50,000.00 60,000.00 70,000.00 50,000.00 100,000.00 150,000.00 400,000.00 300,000.00 150,000.00 200,000.00 300,000.00 100,000.00

Potrebbero piacerti anche

- Estate Tax Chapter SummaryDocumento4 pagineEstate Tax Chapter SummaryPJ PoliranNessuna valutazione finora

- Introduction To Transfer TaxationDocumento6 pagineIntroduction To Transfer TaxationHazel Jane EsclamadaNessuna valutazione finora

- Introduction To Transfer Taxation (Presentation Slides)Documento16 pagineIntroduction To Transfer Taxation (Presentation Slides)KezNessuna valutazione finora

- Final Tax ExamDocumento10 pagineFinal Tax ExamGerald RojasNessuna valutazione finora

- Estate Tax NotesDocumento13 pagineEstate Tax NotesDonFrascoNessuna valutazione finora

- Solution To Donors Vat Other Perecetnages Taxes ExerciseDocumento6 pagineSolution To Donors Vat Other Perecetnages Taxes ExerciseMarco Alejandro IbayNessuna valutazione finora

- Chapter 6 Deductions From The Gross Estate PDFDocumento7 pagineChapter 6 Deductions From The Gross Estate PDFDudz MatienzoNessuna valutazione finora

- Who bears loss before deliveryDocumento2 pagineWho bears loss before deliverykelo100% (2)

- Oblicon Exam 1Documento6 pagineOblicon Exam 1Nune SabanalNessuna valutazione finora

- What Is Culpa CriminalDocumento4 pagineWhat Is Culpa CriminalDanica Irish RevillaNessuna valutazione finora

- Donor's Tax and Foreign Tax Credit (Presentation Slides)Documento5 pagineDonor's Tax and Foreign Tax Credit (Presentation Slides)Kez100% (1)

- Ch06 Introduction To Transfer TaxesDocumento9 pagineCh06 Introduction To Transfer TaxesRenelyn FiloteoNessuna valutazione finora

- Chapter 7 Introduction To Regular Income TaxationDocumento8 pagineChapter 7 Introduction To Regular Income TaxationJason MablesNessuna valutazione finora

- When, What and How of Insurance Contract (Perfection) When Is It Perfected?Documento9 pagineWhen, What and How of Insurance Contract (Perfection) When Is It Perfected?Jexelle Marteen Tumibay PestañoNessuna valutazione finora

- 1s Law ReviewerDocumento10 pagine1s Law ReviewerJUNGKOOKIENessuna valutazione finora

- MidtermDocumento13 pagineMidtermAlexandra Nicole IsaacNessuna valutazione finora

- Tax Rev GenPrinciplesDocumento8 pagineTax Rev GenPrinciplesAngela AngelesNessuna valutazione finora

- Introduction To Business TaxesDocumento32 pagineIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Contract of Sale EssentialsDocumento11 pagineContract of Sale EssentialsDANICA FLORESNessuna valutazione finora

- CHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)Documento35 pagineCHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)abigael severino100% (1)

- Chapter 6 - Introduction To The Value Added TaxDocumento8 pagineChapter 6 - Introduction To The Value Added TaxJamaica DavidNessuna valutazione finora

- Donor's Tax Rates and ExemptionsDocumento7 pagineDonor's Tax Rates and ExemptionsRanel Clark D. Tabios50% (2)

- G. Nature, Construction, Application, and Sources of Tax LawsDocumento12 pagineG. Nature, Construction, Application, and Sources of Tax LawsDon Dupio100% (1)

- TAXES CORPORATIONSDocumento9 pagineTAXES CORPORATIONSMervidelleNessuna valutazione finora

- Tax Term Quiz TheoriesDocumento6 pagineTax Term Quiz TheoriesRena Jocelle NalzaroNessuna valutazione finora

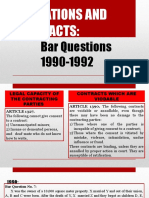

- Obligations and Contracts:: Bar Questions 1990-1992Documento29 pagineObligations and Contracts:: Bar Questions 1990-1992poiuytrewq9115Nessuna valutazione finora

- Deductions From Gross Estate (Presentation Slides)Documento24 pagineDeductions From Gross Estate (Presentation Slides)KezNessuna valutazione finora

- CRB vs. Heirs of Dela Cruz Land Ownership DisputeDocumento10 pagineCRB vs. Heirs of Dela Cruz Land Ownership DisputeDessa ReyesNessuna valutazione finora

- Chapter 14Documento13 pagineChapter 14Team MindanaoNessuna valutazione finora

- Property Ownership and Its ModificationsDocumento573 pagineProperty Ownership and Its ModificationsalbemartNessuna valutazione finora

- Module 4 - Value Added TaxDocumento16 pagineModule 4 - Value Added Taxanon_455551365Nessuna valutazione finora

- TAXATIONDocumento9 pagineTAXATIONkekadiegoNessuna valutazione finora

- Tax On Compensation, Dealings in Properties and CorporationDocumento6 pagineTax On Compensation, Dealings in Properties and CorporationOG FAM0% (1)

- VAT Exempt TransactionsDocumento4 pagineVAT Exempt TransactionsAndehl AguinaldoNessuna valutazione finora

- General Principles: Answer: CDocumento13 pagineGeneral Principles: Answer: CReno PhillipNessuna valutazione finora

- Tax La 1 General Principles Remedies of TaxationDocumento18 pagineTax La 1 General Principles Remedies of TaxationDarlene JacaNessuna valutazione finora

- LAW ON SALES - General provisions and Definition of termsDocumento1 paginaLAW ON SALES - General provisions and Definition of termsEdith DalidaNessuna valutazione finora

- NIRC - Allowable DeductionsDocumento46 pagineNIRC - Allowable DeductionsJeff Sarabusing100% (1)

- Midterm ExamDocumento3 pagineMidterm Examfitz garlitosNessuna valutazione finora

- VAT ReviewerDocumento11 pagineVAT ReviewerMarianne AgunoyNessuna valutazione finora

- Strategic Tax Management - Week 5Documento37 pagineStrategic Tax Management - Week 5Arman DalisayNessuna valutazione finora

- The Philippine Statute of FraudsDocumento3 pagineThe Philippine Statute of FraudsRowena Andaya100% (2)

- Sept 9 Retail Trade Law QuestionsDocumento2 pagineSept 9 Retail Trade Law QuestionsMaria Katelina Marsha BarilNessuna valutazione finora

- Final Exam Taxation 101Documento8 pagineFinal Exam Taxation 101Live LoveNessuna valutazione finora

- ACC 311 ModuleDocumento157 pagineACC 311 ModuleROVIC PAYOTNessuna valutazione finora

- Tax 1 Summative 1 Multiple ChoiceDocumento3 pagineTax 1 Summative 1 Multiple ChoiceVon Andrei MedinaNessuna valutazione finora

- M2u Classification Individual Taxation P1Documento30 pagineM2u Classification Individual Taxation P1Xehdrickke FernandezNessuna valutazione finora

- PAS 12 Income TaxesDocumento24 paginePAS 12 Income TaxesPatawaran, Janelle S.Nessuna valutazione finora

- Special CorporationsDocumento1 paginaSpecial CorporationsSerene Nicole Villena50% (2)

- Final Withholding Tax FWT and CapitalDocumento40 pagineFinal Withholding Tax FWT and CapitalEdna PostreNessuna valutazione finora

- Exclusions To Gross IncomeDocumento8 pagineExclusions To Gross IncomeNishikata MaseoNessuna valutazione finora

- Income Tax 01 General Principles of TaxationDocumento11 pagineIncome Tax 01 General Principles of TaxationJade Ivy GarciaNessuna valutazione finora

- Sale Report - Articles 1489-1518Documento10 pagineSale Report - Articles 1489-1518Mark Joseph DelimaNessuna valutazione finora

- Chapter 03 Gross EstateDocumento16 pagineChapter 03 Gross EstateNikki Bucatcat0% (1)

- Explain The Difference Between Ordinary Assets and Capital Assets?Documento1 paginaExplain The Difference Between Ordinary Assets and Capital Assets?JeromeNessuna valutazione finora

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocumento12 pagine(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNessuna valutazione finora

- Hall 2015 - Planning For US Situs AssetsDocumento42 pagineHall 2015 - Planning For US Situs AssetswuliaNessuna valutazione finora

- Income TaxDocumento35 pagineIncome TaxAmer Hussien ManarosNessuna valutazione finora

- Gross Estate 1Documento12 pagineGross Estate 1Maja SantosNessuna valutazione finora

- Taxation of Individuals and Entities in the PhilippinesDocumento15 pagineTaxation of Individuals and Entities in the PhilippinesCarl Yry BitzNessuna valutazione finora

- TAXATION- KEY CONCEPTS AND CALCULATIONSDocumento18 pagineTAXATION- KEY CONCEPTS AND CALCULATIONSbeverlyrtanNessuna valutazione finora

- TAXATION- KEY CONCEPTS AND CALCULATIONSDocumento18 pagineTAXATION- KEY CONCEPTS AND CALCULATIONSbeverlyrtanNessuna valutazione finora

- Gross Estate of Married DecedentDocumento10 pagineGross Estate of Married Decedentbeverlyrtan85% (13)

- Banking Laws Part 1Documento14 pagineBanking Laws Part 1beverlyrtanNessuna valutazione finora

- Concepts of Donation and DonorDocumento7 pagineConcepts of Donation and DonorbeverlyrtanNessuna valutazione finora

- MMDA Vs GarinDocumento2 pagineMMDA Vs GarinbeverlyrtanNessuna valutazione finora

- Taxation of Capital Gains for Non-ResidentsDocumento25 pagineTaxation of Capital Gains for Non-ResidentsClerry SamuelNessuna valutazione finora

- Mathematical Solutions - Part ADocumento363 pagineMathematical Solutions - Part ABikash ThapaNessuna valutazione finora

- Direct Taxation PDFDocumento396 pagineDirect Taxation PDFmalti j100% (1)

- Taxation Law Mock BarDocumento8 pagineTaxation Law Mock BarKC ManglapusNessuna valutazione finora

- Cia15 Study Guide 4 Bac 103 Taxation Income Taxation SfernandoDocumento23 pagineCia15 Study Guide 4 Bac 103 Taxation Income Taxation Sfernando5555-899341Nessuna valutazione finora

- ITAD BIR Ruling No. 324-14 Dated Dec. 18, 2014Documento13 pagineITAD BIR Ruling No. 324-14 Dated Dec. 18, 2014KriszanFrancoManiponNessuna valutazione finora

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocumento80 pagineGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNessuna valutazione finora

- Finals Barlis TaxDocumento46 pagineFinals Barlis TaxRG BNessuna valutazione finora

- Income Tax Law and PracticesDocumento148 pagineIncome Tax Law and PracticesUjjwal KandhaweNessuna valutazione finora

- Business Tax Ans4Documento24 pagineBusiness Tax Ans4Lars Frias100% (1)

- Compagnie Financiere Sucres Et Deneres Vs CIR - Documentary Stamp TaxDocumento3 pagineCompagnie Financiere Sucres Et Deneres Vs CIR - Documentary Stamp TaxKC ToraynoNessuna valutazione finora

- Basics of Income Tax and Practical AspectsDocumento54 pagineBasics of Income Tax and Practical Aspectsmahek jainNessuna valutazione finora

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Documento29 pagineReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNessuna valutazione finora

- Acctax1 Syllabus t2 (2016-2017)Documento7 pagineAcctax1 Syllabus t2 (2016-2017)OwlHeadNessuna valutazione finora

- The Innovative Enterprise and Developmental State Drive Economic GrowthDocumento51 pagineThe Innovative Enterprise and Developmental State Drive Economic GrowthLautaroNessuna valutazione finora

- Income Tax Study PackDocumento68 pagineIncome Tax Study PackKempton MurimiNessuna valutazione finora

- 1B Introduction To Income TaxDocumento9 pagine1B Introduction To Income Taxnoir cunananNessuna valutazione finora

- Chapter 7 Introduction To Regular Income TaxDocumento76 pagineChapter 7 Introduction To Regular Income TaxANGELU RANE BAGARES INTOLNessuna valutazione finora

- Venture Capital Advantages and DisadvantagesDocumento24 pagineVenture Capital Advantages and DisadvantagesRLC VenturesNessuna valutazione finora

- Unique Questions on PGBP for IPCC StudentsDocumento5 pagineUnique Questions on PGBP for IPCC StudentsRohit GargNessuna valutazione finora

- ICAI MODULE QUESTIONSDocumento15 pagineICAI MODULE QUESTIONSEdwin MartinNessuna valutazione finora

- TAX05 - First Preboard ExaminationDocumento13 pagineTAX05 - First Preboard ExaminationMIMI LANessuna valutazione finora

- Starters' CFO - PresentationDocumento27 pagineStarters' CFO - PresentationAbhishek GuptaNessuna valutazione finora

- Tax RTP May 2020Documento35 pagineTax RTP May 2020KarthikNessuna valutazione finora

- Tax exemptions and incentives for minimum wage earners, BMBEs, cooperatives, non-profit entitiesDocumento2 pagineTax exemptions and incentives for minimum wage earners, BMBEs, cooperatives, non-profit entitiesdailydoseoflawNessuna valutazione finora

- Taxation Preweek and Additional MaterialsDocumento26 pagineTaxation Preweek and Additional MaterialsMarvin ClementeNessuna valutazione finora

- Estate Tax: Sample ComputationDocumento24 pagineEstate Tax: Sample ComputationMarkein Dael VirtudazoNessuna valutazione finora

- Tax Unit FourDocumento32 pagineTax Unit FourHabibuna MohammedNessuna valutazione finora

- Capital GainsDocumento22 pagineCapital Gainssachinkumar3009Nessuna valutazione finora

- Bir 072-10Documento25 pagineBir 072-10Emil A. MolinaNessuna valutazione finora