Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Purpose or Objective of The Proposal

Caricato da

Nikita MaskaraDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Purpose or Objective of The Proposal

Caricato da

Nikita MaskaraCopyright:

Formati disponibili

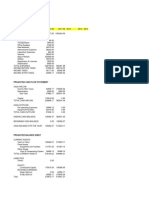

PURPOSE OR OBJECTIVE OF THE PROPOSAL

The firm is considering expanding its operations and working on a higher level

of activities in order to increase the production and reduce the cost per unit.

COST OF THE PROJECT

PARTICULARS

AMOUNT

Land

Factory Building

Plant & Machinery

763000

Motor Vehicles

Office Automation Equipments

Technical know how fees

Development Exp

Franchise and other Deposit Investments

Preliminary Exp.

25000

Provision For Contingences

50000

Working Capital

149000

Total Cost

987000

MEANS OF FINANCE

PARTICULARS

Share capital

AMOUNT

298000

Share premium a/c

other type share capital

other type share premium

cash subsidy

Internal Cash Accruals

Reserve & Surplus

Long term Borrowings

649000

Equated Installment Loans

Debentures/Bonds

Unsecured Loans/Deposits

40000

Total Rs.

987000

PROJECTED PROFITABILITY STATEMENT

2007-08 2008-09 2009-10 2010-11

A SALES

Sales

Add: Others

Less: Excise

Net Income

COST OF

B PRODUCTION

Raw Materials Consumed

Power & Fuel

Employee Expenses

Depreciation

Repairs & Maintenance

Other Mfg. Expenses

Cost of goods Sold

TOTAL

Gross Profit

Administration Expenses

P.& P Expenses Written off

Financial Charges

Long/Medium Term

A Borrowing

On Working Capital

B Borrowing

C Total Financial Charges

Total Cost of Sales

Net Profit Before Tax

Tax on Profit

Net Profit After Tax

Depreciation Added back

P.& P Expenses Written off

added back

Net Cash Accrual

2011-12

2012-13

1411000 1613000 1814000 1814000 1814000 1814000

0

0

0

0

0

0

0

0

0

0

0

0

1411000 1613000 1814000 1814000 1814000 1814000

372000 425000 478000 478000 478000 478000

51000

53000

55000

57000

60000

64000

208000 212000 216000 221000 225000 230000

76000

76000

76000

76000

76000

76000

38000

39000

40000

40000

41000

42000

174000 177000 181000 185000 188000 192000

919000 982000 1046000 1057000 1068000 1082000

1838000 1964000 2092000 2114000 2136000 2164000

492000 631000 768000 757000 746000 732000

256000 261000 266000 272000 277000 283000

3000

3000

3000

3000

3000

3000

91000

75000

59000

43000

26000

10000

0

0

0

0

0

0

91000

75000

59000

43000

26000

10000

1269000 1321000 1374000 1375000 1374000 1378000

143000

0

143000

76000

293000

16000

309000

76000

441000

47000

488000

76000

440000

52000

492000

76000

441000

55000

496000

76000

437000

57000

494000

76000

3000

222000

3000

356000

3000

473000

3000

467000

3000

465000

3000

459000

Statement Showing projected Balance Sheet

rticulars

abilities

Operating years

2007-2008

2008-2009

2009-2010

2010-2011

2011-2012

2012-2013

441000

718000

1112000

1500000

1886000

d : NPAT

143000

277000

394000

388000

386000

380000

d : Additions to Capital

298000

pital At the End of the year

441000

718000

1112000

1500000

1886000

2266000

541000

433000

325000

217000

109000

40000

40000

40000

40000

40000

40000

30000

31000

32000

32000

33000

34000

her Current Liabilities

tal current Liabilities

30000

31000

32000

32000

33000

34000

1052000

1222000

1509000

1789000

2068000

2340000

oss Block

763000

863000

1063000

1363000

1663000

1963000

ss : Depreciation to date

76000

152000

228000

304000

380000

456000

t Block

687000

711000

835000

1059000

1283000

1507000

ock on hand (Incl. Pkg. Crdt.)

31000

35000

40000

40000

40000

40000

ceivables (Incl Exports)

118000

134000

151000

151000

151000

151000

her Current assets

30000

32000

32000

32000

33000

34000

sh and Bank Balances

114000

241000

385000

444000

501000

551000

o the Extent not written off)

22000

19000

16000

13000

10000

7000

her non current Assets

50000

50000

50000

50000

50000

50000

1052000

1222000

1509000

1789000

2068000

2340000

pital at the Beginning

ng / Medium Term Borrowing

oposed Term Loan

secured Loans / Deposits

oposed - Unsecured Loans

rrent Liabilities :

ndry Creditors

tal of Liabilities

sets :

xed Assets

rrent Assets

& P Expenses. &/or Other D.V.P. Exp.

tal of assets

Potrebbero piacerti anche

- Urban WatersDocumento15 pagineUrban WatersRahul Tiwari100% (2)

- CA Excel .Problem - Set A.BDocumento65 pagineCA Excel .Problem - Set A.BStephen McSweeneyNessuna valutazione finora

- Project ValuationDocumento3 pagineProject ValuationThùyy Vy0% (1)

- Income Statements 2010Documento10 pagineIncome Statements 2010Shivam GoelNessuna valutazione finora

- Resolution No: Adoption Budget Period Through Authority Eight 8 Month Budget Incorporated byDocumento3 pagineResolution No: Adoption Budget Period Through Authority Eight 8 Month Budget Incorporated byBrian DaviesNessuna valutazione finora

- 360 Fin - MNGMNTDocumento16 pagine360 Fin - MNGMNTAin AtiqahNessuna valutazione finora

- Proposal of Chart of Account For Execpro ResourcesDocumento4 pagineProposal of Chart of Account For Execpro ResourcesinfoexecproNessuna valutazione finora

- Taparick 20140830Documento31 pagineTaparick 20140830Prakash Philip ZachariaNessuna valutazione finora

- ComparitiveDocumento6 pagineComparitivesanath vsNessuna valutazione finora

- Fianl AccountsDocumento10 pagineFianl AccountsVikram NaniNessuna valutazione finora

- Fd2dbTraditional & Mordern Formats of Finanancial StatementsDocumento6 pagineFd2dbTraditional & Mordern Formats of Finanancial StatementsAmitesh PandeyNessuna valutazione finora

- Investment PlanDocumento23 pagineInvestment PlanKhizar WaheedNessuna valutazione finora

- Description: Monthly Statement of For The Month of February-2009 Date:-17.05.10Documento40 pagineDescription: Monthly Statement of For The Month of February-2009 Date:-17.05.10venkatdevrajNessuna valutazione finora

- TB Items To Be AllocatedDocumento16 pagineTB Items To Be AllocatedMohammed Nawaz ShariffNessuna valutazione finora

- Cash FlowDocumento25 pagineCash Flowshaheen_khan6787Nessuna valutazione finora

- Chema Lite CaseDocumento5 pagineChema Lite CaseSherin VsNessuna valutazione finora

- Income Statement: Altus Honda Cars Pakistan LimitedDocumento23 pagineIncome Statement: Altus Honda Cars Pakistan LimitedTahir HussainNessuna valutazione finora

- Balance Sheet - Annual - As Originally ReportedDocumento6 pagineBalance Sheet - Annual - As Originally Reportedariyanti leonitaNessuna valutazione finora

- List of Accounts SAP Hel-ExportDocumento216 pagineList of Accounts SAP Hel-ExportEnrique MarquezNessuna valutazione finora

- Chapter 4Documento5 pagineChapter 4Kamarulnizam ZainalNessuna valutazione finora

- AFS Project RemianingDocumento16 pagineAFS Project RemianingmustafakarimNessuna valutazione finora

- Hercule Monthly AC JUNE 2014Documento34 pagineHercule Monthly AC JUNE 2014Kyaw Htin WinNessuna valutazione finora

- Basic Understanding of Cash Flow ForecastsDocumento3 pagineBasic Understanding of Cash Flow Forecastssushainkapoor photoNessuna valutazione finora

- FRA Chemlite 038epgp11Documento3 pagineFRA Chemlite 038epgp11thekaizen0% (1)

- SI Session Valuations QuestionDocumento2 pagineSI Session Valuations QuestionLuyanda MhlongoNessuna valutazione finora

- 10 Column WorksheetDocumento4 pagine10 Column WorksheetPrince ShovonNessuna valutazione finora

- Daftar Akun, Jasa, Dagang, ManufakturDocumento14 pagineDaftar Akun, Jasa, Dagang, ManufakturSiti YulandariNessuna valutazione finora

- Cash Flow - Annual - As Originally ReportedDocumento4 pagineCash Flow - Annual - As Originally Reportedvilmos0709Nessuna valutazione finora

- Car Rental Own Company FinalDocumento10 pagineCar Rental Own Company FinalAkshaya LadNessuna valutazione finora

- Cash Flow Statements IIDocumento7 pagineCash Flow Statements IIChris RessoNessuna valutazione finora

- GL Ac ListDocumento6 pagineGL Ac ListshrirangkattiNessuna valutazione finora

- Akun Pt. Adem SegaraDocumento2 pagineAkun Pt. Adem Segaraeffort managementNessuna valutazione finora

- Financial WorksheetDocumento4 pagineFinancial WorksheetCarla GonçalvesNessuna valutazione finora

- Particulars F.Assets Monthly Exp. Others TotalDocumento10 pagineParticulars F.Assets Monthly Exp. Others TotalAmira LiyanaNessuna valutazione finora

- Fund Flow StatementDocumento4 pagineFund Flow Statementsoumya_2688Nessuna valutazione finora

- Journal Entries:: Salary Entries For July 2016 Debit CreditDocumento31 pagineJournal Entries:: Salary Entries For July 2016 Debit CreditBenj LadesmaNessuna valutazione finora

- Amisha 15007 MarionBoatsAndNorthMountainDocumento4 pagineAmisha 15007 MarionBoatsAndNorthMountainAngel Megan0% (1)

- Dea Salon Worksheet On May 31, 2012: Account D K D K D Trial Balance Adjustment Adjusted Trial BalanceDocumento4 pagineDea Salon Worksheet On May 31, 2012: Account D K D K D Trial Balance Adjustment Adjusted Trial BalanceSiti Radiah LestariNessuna valutazione finora

- Basaveshwar Engineering College (Autonomous) : Department of Management StudiesDocumento20 pagineBasaveshwar Engineering College (Autonomous) : Department of Management Studiessagar sherkhaneNessuna valutazione finora

- FM09-CH 24Documento16 pagineFM09-CH 24namitabijweNessuna valutazione finora

- Soalan Presentation FA 3Documento12 pagineSoalan Presentation FA 3Vasant SriudomNessuna valutazione finora

- Chapter 23 - Worksheet and SolutionsDocumento21 pagineChapter 23 - Worksheet and Solutionsangelbear2577Nessuna valutazione finora

- Financial Statements: Tauq Tin FoodDocumento9 pagineFinancial Statements: Tauq Tin FoodPrincess SidNessuna valutazione finora

- Sample Restaurant Training ProposalDocumento7 pagineSample Restaurant Training ProposalSenami ZambaNessuna valutazione finora

- Sebi MillionsDocumento3 pagineSebi MillionsShubham TrivediNessuna valutazione finora

- Empresa The Tesalia Spring Company Balance GeneralDocumento3 pagineEmpresa The Tesalia Spring Company Balance GeneralEdwin ChiligNessuna valutazione finora

- Marvin CoDocumento4 pagineMarvin CoVaibhav KathjuNessuna valutazione finora

- Micky & Pluto Fin. StatementsDocumento5 pagineMicky & Pluto Fin. StatementskhushbookhetanNessuna valutazione finora

- HorngrenIMA14eSM ch16Documento53 pagineHorngrenIMA14eSM ch16Piyal HossainNessuna valutazione finora

- FUEL AND GAS CONSUMPTION FOR April 2014Documento3 pagineFUEL AND GAS CONSUMPTION FOR April 2014shrirangkattiNessuna valutazione finora

- 2007-08 Annual ReoprtDocumento116 pagine2007-08 Annual ReoprtParas PalNessuna valutazione finora

- Akun LKSDocumento6 pagineAkun LKSNiken PurnamasariNessuna valutazione finora

- Financial Statements - chptr4Documento1 paginaFinancial Statements - chptr4mariachristinaparedes4209Nessuna valutazione finora

- Sales 72000000 93600000: Income StatementDocumento3 pagineSales 72000000 93600000: Income StatementSri RamNessuna valutazione finora

- Azam CFDocumento10 pagineAzam CFsahala11Nessuna valutazione finora

- Sui Northern Gas Pipelines Limited Revenue Budget Proposals For Fy 2012-13Documento11 pagineSui Northern Gas Pipelines Limited Revenue Budget Proposals For Fy 2012-13Arshad MalikNessuna valutazione finora

- Ratio Analysis HyundaiDocumento12 pagineRatio Analysis HyundaiAnkit MistryNessuna valutazione finora

- Advance Financial Management QuizDocumento3 pagineAdvance Financial Management QuizZardar Waseem0% (1)

- Cost Sheet Presented BY Chandan Jagtap Nilesh Ghadge Sachin MethreeDocumento13 pagineCost Sheet Presented BY Chandan Jagtap Nilesh Ghadge Sachin MethreeSachin MethreeNessuna valutazione finora

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDa EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Definition of Corporate GovernanceDocumento24 pagineDefinition of Corporate GovernanceNikita MaskaraNessuna valutazione finora

- Becg FinalDocumento30 pagineBecg FinalNikita MaskaraNessuna valutazione finora

- Submitted By: Maskara Nikita (93) Mehta Richa (96) Mehta Trushi (97) Modi Payal (104) Narang PalakDocumento20 pagineSubmitted By: Maskara Nikita (93) Mehta Richa (96) Mehta Trushi (97) Modi Payal (104) Narang PalakNikita MaskaraNessuna valutazione finora

- Morgan StanleyDocumento9 pagineMorgan StanleyNikita MaskaraNessuna valutazione finora

- Ob RawDocumento12 pagineOb RawNikita MaskaraNessuna valutazione finora

- HR Kingfisher Crisis CaseDocumento20 pagineHR Kingfisher Crisis CaseNikita MaskaraNessuna valutazione finora

- HulDocumento17 pagineHulNikita Maskara0% (1)

- Disinvestment in IndiaDocumento19 pagineDisinvestment in IndiaNikita MaskaraNessuna valutazione finora

- Topic Name: Entrepreneur (Adi Godrej) Submitted By:Maskara Nikita 93 Submitted To:Mrs. Radha Vyas Subject:Entrepreneurship DevDocumento12 pagineTopic Name: Entrepreneur (Adi Godrej) Submitted By:Maskara Nikita 93 Submitted To:Mrs. Radha Vyas Subject:Entrepreneurship DevNikita MaskaraNessuna valutazione finora

- Final FMDocumento17 pagineFinal FMNikita MaskaraNessuna valutazione finora

- Assignment On: Corporate Governance in Banking Sector in BangladeshDocumento6 pagineAssignment On: Corporate Governance in Banking Sector in BangladeshFàrhàt HossainNessuna valutazione finora

- Trade FinanceDocumento65 pagineTrade Financeanon_879138113100% (1)

- Utility Pricing ModelsDocumento45 pagineUtility Pricing ModelsMatthew Rees100% (1)

- MFM Project Guidelines From Christ University FFFFFDocumento6 pagineMFM Project Guidelines From Christ University FFFFFakash08agarwal_18589Nessuna valutazione finora

- Ebacl Ips 20161130 Ips Functional Description v09 Draft PWG CleanDocumento59 pagineEbacl Ips 20161130 Ips Functional Description v09 Draft PWG CleanDnyaneshwar PatilNessuna valutazione finora

- 7'P S of Banking in MarketingDocumento15 pagine7'P S of Banking in MarketingAvdhesh ChauhanNessuna valutazione finora

- G.R. No. L-19190 November 29, 1922 THE PEOPLE OF THE PHILIPPINE ISLANDS, Plaintiff-Appellee, vs. VENANCIO CONCEPCION, Defendant-AppellantDocumento2 pagineG.R. No. L-19190 November 29, 1922 THE PEOPLE OF THE PHILIPPINE ISLANDS, Plaintiff-Appellee, vs. VENANCIO CONCEPCION, Defendant-Appellanterikha_aranetaNessuna valutazione finora

- The Business As Usual Behind The Slaughter - Lars SchallDocumento17 pagineThe Business As Usual Behind The Slaughter - Lars SchallAlonso Muñoz PérezNessuna valutazione finora

- The Satyam Case Impact On Indian EconomyDocumento21 pagineThe Satyam Case Impact On Indian EconomyAparna SindujaNessuna valutazione finora

- Fall 2010 - MGT101 - 1 - SOLDocumento1 paginaFall 2010 - MGT101 - 1 - SOLbc100403378Nessuna valutazione finora

- CMA DataDocumento127 pagineCMA DatageetaNessuna valutazione finora

- Sample Partnership DeedDocumento3 pagineSample Partnership DeedParesh ChokshiNessuna valutazione finora

- E-Banking Consumer BehaviourDocumento116 pagineE-Banking Consumer Behaviourahmadksath88% (24)

- VP Service Delivery Manager in Dallas FT Worth TX Resume Rebecca Faith StoneDocumento1 paginaVP Service Delivery Manager in Dallas FT Worth TX Resume Rebecca Faith StoneRebeccaFaithStoneNessuna valutazione finora

- Punjab National BankDocumento4 paginePunjab National BankRicky KishoreNessuna valutazione finora

- Fmch05 (1) Time Value RevisedDocumento76 pagineFmch05 (1) Time Value RevisedMañuel É PrasetiyoNessuna valutazione finora

- Foreign Exchange ManagementDocumento21 pagineForeign Exchange ManagementSreekanth GhilliNessuna valutazione finora

- OTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationDocumento6 pagineOTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationTirthGanatraNessuna valutazione finora

- CCE Quiz Batasan Set - SolutionDocumento4 pagineCCE Quiz Batasan Set - SolutionJoovs JoovhoNessuna valutazione finora

- Calgary Reduce: RowentaDocumento44 pagineCalgary Reduce: RowentaModernBeautyNessuna valutazione finora

- KPMG Top 100 FintechDocumento112 pagineKPMG Top 100 FintechJagdeepNessuna valutazione finora

- Risk Parameters and Currency RiskDocumento8 pagineRisk Parameters and Currency RiskaishwaryadoshiNessuna valutazione finora

- Banking - IntroductionDocumento15 pagineBanking - Introductionsridevi gopalakrishnanNessuna valutazione finora

- Document ChecklistDocumento2 pagineDocument ChecklistSuresh IndhumathiNessuna valutazione finora

- Leave LetterDocumento4 pagineLeave LetterAdepu GajenderNessuna valutazione finora

- Sunlife Balanced Fund KFDDocumento4 pagineSunlife Balanced Fund KFDPaolo Antonio EscalonaNessuna valutazione finora

- ICMarkets Funding InstructionsDocumento1 paginaICMarkets Funding Instructionscampur 90Nessuna valutazione finora

- Case Study On StrikesDocumento2 pagineCase Study On StrikesRiddhi MazumdarNessuna valutazione finora

- The Ceocoin WhitepaperDocumento19 pagineThe Ceocoin WhitepaperDon HoangNessuna valutazione finora

- Republic of The Philippines V. Sandiganbayan, Et Al. G.R. Nos. 166859, 169203 and 180702, 12 April 2011, EN BANC (Bersamin, J.) Doctrine of The CaseDocumento5 pagineRepublic of The Philippines V. Sandiganbayan, Et Al. G.R. Nos. 166859, 169203 and 180702, 12 April 2011, EN BANC (Bersamin, J.) Doctrine of The CaseJerald-Edz Tam AbonNessuna valutazione finora