Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Jacka Pick Article

Caricato da

JameserbeCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Jacka Pick Article

Caricato da

JameserbeCopyright:

Formati disponibili

COMPANY PROFILE COMMODITIES

Pick

the

Pick

the

JACKA RESOURCES LIMITED

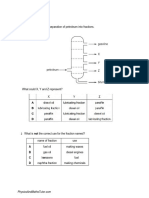

It is a very simple development concept, very similar in nature to what ENI is using. Studies have suggested that the proposed system would be economic on a field size of just 15 million barrels. We are potentially targeting 111 to 213 million barrels. So we have a lot of leeway there, Scott Spencer said. With the field located only 12 km from shore in water depths of 60m, the development concept includes an un-manned offshore platform, with hydrocarbons piped to an onshore processing facility. Similar developments have been providing low cost production options for near shore oil and gas fields in Western Australia for years. The timing of the Hammamet West appraisal well is subject to rigs and equipment availability and a farmout by operator Cooper Energy, but Jacka is hopeful that drilling will begin in the near future. Commercial success at Hammamet West will just be the start of what Jacka is hoping will lead to a string of pearls of drilling opportunities for the Company in the Bargou Block. By paying our share of the Hammamet West well we will have earned our 15% interest in the whole block. That will open the door for us to a good deal of exploration potential, particularly in the southern half of the block, where we are looking at conducting Phase 2 of our exploration activities. This is a block that our exploration guys love. It has been independently assessed that there is approximately 600 million barrels in the block as the potential prize. There are lots of targets already identified to the south that have no bearing on Hammamet West. However if Hammamet comes in there are also leads that are direct analogues to Hammamet that we could then go on and drill with a lot of confidence after having cracked the code there. So they could be easy pick-ups, Scott Spencer said. To further define the potential of the Bargou Block, the joint venture participants are considering acquiring 3D seismic over some of the larger structures in the southern half of the block next year. So there is the possibility of early production with pretty good flow rates on the analogy of the ENI field close by, along with this sizeable exploration upside in a large block. Tunisia really provides us with a really good mix of opportunities.

DIRECTORS

BRETT SMITH Non-Executive Chairman RICHARD ADEN Executive Director STEPHEN BROCKHURST Non-Executive Director SCOTT SPENCER Non-Executive Director

AMANDA WILTON-HEALD Company Secretary

WEB:

www.jackaresources.com.au

REGISTERED OFFICE

Level 3, Suite 33, 22 Railway Rd Subiaco WA 6008 T: (618) 9388 8041 F: (618) 9388 8042

JACKA PREPARING TO DRILL COMPANY CHANGING WELLS IN AFRICA AND AUSTRALIA

The next six months is promising to be a very exciting period for Jacka Resources Limited (ASX: JKA) and investors in the Perth-based oil and gas explorer.

Not bad when you consider that the Company only listed on the ASX just over 12 months ago. However, a quick look at the team behind Jacka provides a strong pointer as to how such a young junior Australian company can make such big strides in such a short time. The common name that crops up amongst the CVs of Jackas board and management is that of former Australian junior Hardman Resources. An investors darling of the early 2000s after drilling success in the African nations of Mauritania and Uganda, Hardman was eventually snapped up by leading European oil and gas exploration and production company Tullow Oil plc for US$1.1 billion in 2007. Jackas Executive Director, Richard Aden, Non-Executive Director, Scott Spencer, and Technical Advisor, Justyn Wood, were all in the thick of the action at Hardman and know what is needed to take a junior to a mid-tier oil and gas company in a relatively short period of time. We have been there before and have shown that we can create tremendous value for our supporters, Scott Spencer told The Pick recently. Add to that the Jacka Boards African experience and contacts and it is no wonder the Company has advanced so far, so quickly. It has certainly given the Company an advantage in identifying and acquiring ready-made targets such as its exploration interests in Tunisia. Tunisia is a bit of unfinished business for me, Scott Spencer told The Pick. When I was at Hardman New Ventures we were looking at North Africa - and Tunisia was one place we focussed on. So when Jacka was looking for opportunities, that was certainly a place we quickly identified as an area where a company of our size can be active. The cost structure is not too high, and if you manage your risk properly, there are opportunities to get into early production. That is certainly the type of opportunity that is looming with the drilling of the upcoming Hammamet West appraisal well in the Bargou Block, offshore Tunisia. While previous drilling failed to provide commercial flows at Hammamet West, the use of new technology and ideas may produce a far different result. The two discoveries were based on 2D seismic which hadnt identified the fracturing that has occurred in the reservoir. The previous wells were vertically drilled, and while they intersected hydrocarbons and recovered some to the surface, there was nothing of any magnitude to encourage them to continue. What we now believe from assessing new 3D seismic data is that if you drill horizontally you will intersect a lot more of the fractured carbonates which we feel increases the potential for the reservoir to flow commercial quantities, Scott Spencer said. Drilling success at Hammamet West could be quite significant, with Jacka earning a 15% interest in a prospect that has a contingent reserve estimate of between 111 million and 213 million barrels. Hammamet Wests potential is boosted by the success Italian oil and gas giant ENI has had in similar geology nearby, where it is producing a total of between 16,000 to 20,000 barrels per day from horizontal wells. If the Hammamet West appraisal well is a commercial success, Jacka and its fellow participants in the field are ready to fasttrack development, with the development concept already successfully reviewed by asset lifecycle specialist Worley Parsons.

AUSTRALIAN SECURITIES EXCHANGE (ASX) CODE:

JKA

Carnarvon Basin Another early drilling candidate for Jacka may be a well in the WA399-P permit off the Western Australian coast. Surrounded by producing and oil and gas fields and others under development, the WA-399-P permit is considered very prospective with an initial mean recoverable reserve estimate for the block of 50 million barrels. The area is so highly regarded that leading US Independent and highly successful offshore WA explorer and developer Apache farmed into the permit last year and is carrying the JV participants through the seismic phase. Apache is currently assessing the data from the Gazelle 3D seismic programme acquired on the block earlier this year and it could move quickly to drill any potentially commercial targets that may be highlighted by its seismic processing work. Certainly Apache has strong knowledge of that area being a part owner in the nearby Macedon-Pyrenees field, so it will have a direct analogue and may be able to see very quickly if there is something to go after. If there is, it generaly has rigs on hire in the area, so there is the potential that it could find a drilling slot in there quite quickly if it sees something attractive, Scott Spencer said. Tanzania The other significant development that has attracted the attention of the oil and gas industry was Jackas recent announcement that it had entered into exclusive negotiations for the award of oil and gas exploration and production rights over the entire Ruhuhu Basin, an onshore area of some 8,400 sq. km in the East African nation of Tanzania. The company is currently in the final stages of negotiations with the Tanzania Petroleum and Development Corporation (TPDC) for the award of 100% of a Production Sharing Agreement (PSA) over the licence area. The area under negotiation is of the same geological age and is as large as the entire onshore Cooper Basin in Australia, Australias most prolific onshore producer. Tanzania is another country well known to Jackas ex-Hardman team and the Company believes the Ruhuhu Basin, like the Cooper Basin, offers opportunities for a variety of play types, from conventional oil and gas through to coal seam gas. The initial focus will be on the Lake Malawi area where 2D seismic lines were previously acquired. East African focus The move into Tanzania followed closely on Jackas announcement that it had entered into a Joint Bidding Agreement with fellow Australian junior Pancontinental Oil & Gas NL under which the two companies will cooperate in evaluating and applying for petroleum acreage in certain areas of East Africa. There are a lot of areas coming up for relinquishment in East Africa which are under-explored and we are looking at those opportunities, with Pancontinental, and on our own behalf, Scott Spencer said. Mr Spencer said Jackas mix of on and offshore assets, potential near term production and exploration acreage in proven producing areas and large holdings in under explored regions with a lot of upside, provides the Company and its shareholders with a strong, high value portfolio. When wrapping up the Jacka Resources story it is quite easy to see that this is a company with highly experienced people behind it with a proven record of success, that have handpicked exploration and appraisal interests in areas that are proven hydrocarbon provinces. That is a recipe that should lead to successful returns for investors.

THE PICK ISSUE 3 SEPTEMBER 2011

VISIT THE PICK WEBSITE AT WWW.THE-PICK.COM.AU

THE PICK ISSUE 3 SEPTEMBER 2011

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Fundamental Reservoir Fluid BehaviourDocumento20 pagineFundamental Reservoir Fluid BehaviourBrian CbtngnNessuna valutazione finora

- GTC RefiningPetrochemical IntegrationDocumento7 pagineGTC RefiningPetrochemical IntegrationKarem Jeanette Saenz BernalNessuna valutazione finora

- GIIGNL 2022 Annual Report 1652020175Documento76 pagineGIIGNL 2022 Annual Report 1652020175Roberto RuizNessuna valutazione finora

- The Reactions of AlkanesDocumento3 pagineThe Reactions of AlkanesManP13Nessuna valutazione finora

- Oil & Gas Sector ReportDocumento19 pagineOil & Gas Sector ReportSarthak ChincholikarNessuna valutazione finora

- Offshore Drilling and Production DocumentsDocumento6 pagineOffshore Drilling and Production DocumentsAmitabhaNessuna valutazione finora

- Meditran S40Documento1 paginaMeditran S40rani wulansariNessuna valutazione finora

- Lubricantes LSCDocumento22 pagineLubricantes LSCAndres PozoNessuna valutazione finora

- Fuel Properties TablesDocumento11 pagineFuel Properties TablesSaravanapriya KarthikNessuna valutazione finora

- 5w 30 Synthetic Oil ComparisonDocumento12 pagine5w 30 Synthetic Oil ComparisonindeskeyNessuna valutazione finora

- Midstream 101: Oil and Gas Processing, Transportation, and Storage ExplainedDocumento3 pagineMidstream 101: Oil and Gas Processing, Transportation, and Storage ExplainedFaizal IrsyadNessuna valutazione finora

- LPG Specifications BIS Standard PDFDocumento5 pagineLPG Specifications BIS Standard PDFd_koticha9193Nessuna valutazione finora

- Organic Chemistry: Alkanes and AlkenesDocumento73 pagineOrganic Chemistry: Alkanes and AlkenesRosemaryTanNessuna valutazione finora

- 1 Overview of UOP Gas Processing Technologies and Applications 02 2010Documento25 pagine1 Overview of UOP Gas Processing Technologies and Applications 02 2010Phong LeNessuna valutazione finora

- LNG Industry Conversions: Conversion FactorsDocumento1 paginaLNG Industry Conversions: Conversion FactorsAmbrose OlwaNessuna valutazione finora

- Indian Oil Corporation LTDDocumento36 pagineIndian Oil Corporation LTDRoss D'souza100% (1)

- Materials System SpecificationDocumento3 pagineMaterials System SpecificationGOSP3 QC MechanicalNessuna valutazione finora

- Sedimentary Petroleum Geology Test: Instructions: Answer All Questions Time: 1hr: 30m Section A: MCQ. 14MrksDocumento3 pagineSedimentary Petroleum Geology Test: Instructions: Answer All Questions Time: 1hr: 30m Section A: MCQ. 14Mrksamin fontemNessuna valutazione finora

- Exchange Summary Volume and Open Interest Energy Futures: FinalDocumento9 pagineExchange Summary Volume and Open Interest Energy Futures: FinalavadcsNessuna valutazione finora

- Azeri Crude Assay CeyhanDocumento1 paginaAzeri Crude Assay Ceyhansakuragi88100% (1)

- Oil Recommendations for Sauer CompressorsDocumento19 pagineOil Recommendations for Sauer CompressorsRaúl Oscar LedesmaNessuna valutazione finora

- Profil PT. Kimia Farma Plant SemarangDocumento14 pagineProfil PT. Kimia Farma Plant SemarangSeptian Wii0% (1)

- Debra Hall Guided Wave ISA Singapore LPG Measurements GWIDocumento33 pagineDebra Hall Guided Wave ISA Singapore LPG Measurements GWIPhilNessuna valutazione finora

- Fuels (Multiple Choice) QPDocumento11 pagineFuels (Multiple Choice) QPGreesha Parag DamaniaNessuna valutazione finora

- Wartsila PDFDocumento12 pagineWartsila PDFfreddy ogiNessuna valutazione finora

- Intro Petroleum Engr Roles EG103/201Documento13 pagineIntro Petroleum Engr Roles EG103/201StyNessuna valutazione finora

- Basra16Y: Exxonmobil Refining and Supply CompanyDocumento4 pagineBasra16Y: Exxonmobil Refining and Supply CompanyAhmed Mohamed Khalil100% (1)

- UNIT 1 - IntroductionDocumento15 pagineUNIT 1 - IntroductionTARANPREET SINGHNessuna valutazione finora

- Office Avg All in OneDocumento685 pagineOffice Avg All in OneMd FaridujjamanNessuna valutazione finora

- Mq2-Sensitivity Chars Withlog WithgraphDocumento7 pagineMq2-Sensitivity Chars Withlog WithgraphAnil NaikNessuna valutazione finora