Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Question No 1: Part A: Financial Assets

Caricato da

Muhammad LuqmanDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Question No 1: Part A: Financial Assets

Caricato da

Muhammad LuqmanCopyright:

Formati disponibili

Question No 1: Part a: Financial assets: Financial assets of Bank: Cash Balances with other banks Lending to financial institutions

tions Investment Advances

Financial assets of Business: Cash Accounts receivable Notes receivable Marketable securities

Mix of Financial Assets differs from firm to firm: Financial assets differ from firm to firm because of Financial structure Growth and Development of firm Policies and regulations Experienced and expertise of management Characteristics of market area

Part b: Functions of Money Supply: Medium of exchange Store of value Unit of account Provide Purchasing power Low transaction costs Settlement of debts

Measures of Money Supply: Money supply is controlled through government policies of interest rates. If Government need money, money supply is reduced through selling of securities. And if she have surplus, money supply increases and securities are purchased.

Part c: Cash and due from other banks Question No 2: Part a: Credit risk: Banks need to manage the credit risk inherent in the entire portfolio as well as the risk in individual credits or transactions. Bank manage credit risk by providing loans to high net worth individuals and corporations by checking their past records. Interest rate risk: When banks see slacking loan demand, management will lower their interest rate outlook. This implies that the nature of the business cycle is changing and that liquidity will be increasing and borrowers will want to extend their loan maturities to take advantage of lower rates. Conversely, when rates rise it means loan demand is rising and more customers need to be accommodated with more money at higher rates. Liquidity Liquidity, or the ability to fund increases in assets and meet obligations as they come due, is crucial to the ongoing viability of any banking organization. Therefore, managing liquidity is among the most important activities conducted by banks. Bank lending finances investments in relatively illiquid assets, but it funds its loans with mostly short term liabilities. Thus one of the main challenges to a bank is ensuring its own liquidity under all reasonable conditions. Banks manage their liquidity risk by carefully monitoring the relationship between their short-term liabilities as opposed to their shortterm assets. Excess funds are typically invested in assets that will provide it with liquidity such as Fed funds loaned and government securities. Banks must maintain a Liquidity Ratio of at least 15%. Capital adequacy The standardized requirements in place for banks and other depository institutions, which determines how much capital is required to be held for a certain level of assets through

regulatory agencies. These requirements are put into place to ensure that these institutions are not participating or holding investments that increase the risk of default and that they have enough capital to sustain operating losses. Banks have to calculate capital ratio which is the percentage of a bank's capital to its risk-weighted assets. Assets and Liabilities A bank with mismatched assets and liabilities can be badly hurt by unexpected interest rate changes. Intense competition for business involving both the assets and liabilities, together with increasing volatility in the domestic interest rates as well as foreign exchange rates, has brought pressure on the management of banks to maintain a good balance among spreads, profitability and long-term viability. Banks manage the risks of asset liability mismatch by matching the assets and liabilities according to the maturity pattern or the matching the duration, by hedging and by securitization. Part b: Sources of funds: 1. Deposit accounts Transaction deposits Savings deposits Time deposits Money market deposits Borrowed funds Fed funds Federal reserve borrowing Repos Eurodollar borrowing Long-term capital Bonds Bank capital

2.

3.

Uses of funds: 1. 2. Cash Loans - main use Working capital loans Term loans Line of credit Revolving credit loan Consumer loans Highly leveraged transact. Real estate loans Direct lease loans

3.

4. 5. 6. 7.

Loan participations Securities investments Treasuries Agencies Tax exempts Corporate bonds Fed funds sold Repos Eurodollar loans Fixed assets

Question No 3: a. Net interest income and Net non interest income Net interest income = Total interest income Total interest expense = 390 235 = 155 Net non interest income = Total non-interest income Total non-interest expense = 127 69 = 58 b. Net income before and after taxes Net interest income + Net non-interest income -Provision for loan losses = Net income before taxes -Income taxes = Net income after taxes 155 58 (27) 186 (14) 172

c. Total operating revenues and expenses Total operating revenue = Total interest income + Total non-interest income = 390 + 127 = 517 Total operating expenses = Total interest expense + Total non-interest expense = 235 + 69 = 304

d. Undivided profits Undivided profit = Net income after taxes Dividend = 172 23 = 149

Potrebbero piacerti anche

- Finm3404 NotesDocumento20 pagineFinm3404 NotesHenry WongNessuna valutazione finora

- BFS - U2Documento44 pagineBFS - U2Abijith K SNessuna valutazione finora

- Chapter 2-Commercial Banks: Bank Put NameDocumento3 pagineChapter 2-Commercial Banks: Bank Put NameYeane FeliciaNessuna valutazione finora

- Bank HWDocumento8 pagineBank HWDương PhạmNessuna valutazione finora

- CHAPTER I Principles of Lending Types of Credit FacilitiesDocumento6 pagineCHAPTER I Principles of Lending Types of Credit Facilitiesanand.action0076127Nessuna valutazione finora

- BaselDocumento27 pagineBaselSimran MehrotraNessuna valutazione finora

- Unit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank ManagementDocumento8 pagineUnit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank Managementመስቀል ኃይላችን ነውNessuna valutazione finora

- Chapter 3Documento25 pagineChapter 3Fahad JavaidNessuna valutazione finora

- Banking Credit ManagementDocumento7 pagineBanking Credit ManagementashwatinairNessuna valutazione finora

- C PPP PPPPPPPPPPPPP P PP PPDocumento7 pagineC PPP PPPPPPPPPPPPP P PP PPWahid MuradNessuna valutazione finora

- What Are The Basic Principals of Banking? Discuss BrieflyDocumento19 pagineWhat Are The Basic Principals of Banking? Discuss BrieflyNihathamanie PereraNessuna valutazione finora

- Npa NotesDocumento8 pagineNpa NotesVijender SinghNessuna valutazione finora

- ch14-Off-Balance Sheet ActivitiesDocumento15 paginech14-Off-Balance Sheet ActivitiesYousif Agha100% (3)

- Concept ChecksDocumento8 pagineConcept ChecksAshraful AlamNessuna valutazione finora

- L-5&6 642 ReserveDocumento44 pagineL-5&6 642 ReserveNiloy AhmedNessuna valutazione finora

- Non Performing Assets (Npa)Documento16 pagineNon Performing Assets (Npa)Avin P RNessuna valutazione finora

- Liquidity - Part 1Documento5 pagineLiquidity - Part 1Mis Alina DenisaNessuna valutazione finora

- Sources of Banks Funds: Brief Introduction About BankDocumento7 pagineSources of Banks Funds: Brief Introduction About BankRaja ShuklaNessuna valutazione finora

- Types of Accounts, Bank Guarantee, LC, Line of CreditDocumento44 pagineTypes of Accounts, Bank Guarantee, LC, Line of Creditkaren sunilNessuna valutazione finora

- Assignment 3Documento4 pagineAssignment 3arina7Nessuna valutazione finora

- BF 437 IntroductionDocumento14 pagineBF 437 IntroductionMorelate KupfurwaNessuna valutazione finora

- Current Market ConditionsDocumento9 pagineCurrent Market ConditionsNguyễn Thảo MyNessuna valutazione finora

- Finance ExamDocumento9 pagineFinance ExamTEOH WEN QINessuna valutazione finora

- Black BookDocumento28 pagineBlack BookAayat ShaikhNessuna valutazione finora

- Securitization SummaryDocumento5 pagineSecuritization SummaryAditya ParmarNessuna valutazione finora

- End Term Examination Third Semester (Mba) December 2009 PAPER CODE: - MS219 SUBJECT: Financial Markets and InstitutionsDocumento23 pagineEnd Term Examination Third Semester (Mba) December 2009 PAPER CODE: - MS219 SUBJECT: Financial Markets and InstitutionsKaran GuptaNessuna valutazione finora

- Assignement of Business Analysisi OriginalDocumento10 pagineAssignement of Business Analysisi Originalngabonziza samuelNessuna valutazione finora

- Gfmi Final 12 & 7Documento9 pagineGfmi Final 12 & 7Dave ConwayNessuna valutazione finora

- Chapter 4 - LIQUIDITY AND RESERVES MANAGEMENT STRATEGIES AND POLICIESDocumento7 pagineChapter 4 - LIQUIDITY AND RESERVES MANAGEMENT STRATEGIES AND POLICIESDewan AlamNessuna valutazione finora

- Cash ManagementDocumento15 pagineCash ManagementChristopher Anniban SalipioNessuna valutazione finora

- AssaignmentDocumento11 pagineAssaignmentMaruf HasanNessuna valutazione finora

- Lending Operations: By: Swathi P Assistant Professor Acharya InstituteDocumento45 pagineLending Operations: By: Swathi P Assistant Professor Acharya InstituteSwathi PNessuna valutazione finora

- Depository Financial InstitutionsDocumento37 pagineDepository Financial InstitutionsToniNessuna valutazione finora

- Chapter 2 Bank FundDocumento31 pagineChapter 2 Bank FundNiloy AhmedNessuna valutazione finora

- CCCCCCCCCC C C CCCCCCCCCCCCCCCCCCCCC C C C C C C C CCCCCCCCCCCCC CCCCCCCCCCC CC CCCCCCCCCCCCCCCCCCCCCCCCCC CDocumento4 pagineCCCCCCCCCC C C CCCCCCCCCCCCCCCCCCCCC C C C C C C C CCCCCCCCCCCCC CCCCCCCCCCC CC CCCCCCCCCCCCCCCCCCCCCCCCCC CVinoth Kannan RameshbabuNessuna valutazione finora

- Banking and Insurance PPT Unit-2,3 and 4Documento88 pagineBanking and Insurance PPT Unit-2,3 and 4d Vaishnavi OsmaniaUniversityNessuna valutazione finora

- Chapter 2 Tutorial AnswersDocumento5 pagineChapter 2 Tutorial AnswersHeri LimNessuna valutazione finora

- Credit Card Securitization ManualDocumento18 pagineCredit Card Securitization ManualRahmi Elsa DianaNessuna valutazione finora

- Managemnt of Capital in BanksDocumento8 pagineManagemnt of Capital in Banksnrawat12345Nessuna valutazione finora

- Liquidity ManagementDocumento17 pagineLiquidity ManagementshoaibdastanNessuna valutazione finora

- Bank AssignmentDocumento2 pagineBank AssignmentJiang LiNessuna valutazione finora

- CH 10Documento20 pagineCH 10NGỌC ĐẶNG HỒNGNessuna valutazione finora

- Module 2Documento57 pagineModule 2Tejaswini TejuNessuna valutazione finora

- Financial Institution AssignmentDocumento10 pagineFinancial Institution AssignmentDina AlfawalNessuna valutazione finora

- The Management of CapitalDocumento17 pagineThe Management of CapitalJahidul IslamNessuna valutazione finora

- Unit 1 Finacial CreditDocumento21 pagineUnit 1 Finacial Creditsaurabh thakurNessuna valutazione finora

- Ch-CM-Depository InstitutionsDocumento59 pagineCh-CM-Depository InstitutionsUzzaam HaiderNessuna valutazione finora

- Corporate Banking: Funded Services Lending /advances CB-CHPP07Documento40 pagineCorporate Banking: Funded Services Lending /advances CB-CHPP07Prakash SharmaNessuna valutazione finora

- Financial Market Institutions Chapter 2 Full 2Documento9 pagineFinancial Market Institutions Chapter 2 Full 2Faisal AhmedNessuna valutazione finora

- Rose Hudgins Eighth Edition Power Point Chapter 15 JimDocumento76 pagineRose Hudgins Eighth Edition Power Point Chapter 15 JimJordan FaselNessuna valutazione finora

- Chapter09 IfDocumento10 pagineChapter09 IfPatricia PamelaNessuna valutazione finora

- PIA 3ra Analisis e Interpretacion Edos FinDocumento2 paginePIA 3ra Analisis e Interpretacion Edos FinEmilio PadronNessuna valutazione finora

- Bank Liqudity Management: 1. Bank Liquidity, Its Essence and ImportanceDocumento5 pagineBank Liqudity Management: 1. Bank Liquidity, Its Essence and ImportanceIsrafil IsgandarovNessuna valutazione finora

- BFSM Unit 2 PMCDocumento16 pagineBFSM Unit 2 PMCJ. KNessuna valutazione finora

- Project Finance Smart TaskDocumento5 pagineProject Finance Smart TaskYASHASVI SHARMANessuna valutazione finora

- FIN204 AnswersDocumento9 pagineFIN204 Answerssiddhant jainNessuna valutazione finora

- BWBB2013 - Topic 4 Part 2Documento11 pagineBWBB2013 - Topic 4 Part 2myteacheroht.managementNessuna valutazione finora

- Capital AdequacyDocumento11 pagineCapital AdequacyTezan RajkumarNessuna valutazione finora

- Chapter-7 Investment ManagementDocumento7 pagineChapter-7 Investment Managementhasan alNessuna valutazione finora

- Customer Relationship ManagementDocumento13 pagineCustomer Relationship ManagementAkhil AwasthiNessuna valutazione finora

- 2020 AICPA Released Questions FAR Blank Answer KeyDocumento52 pagine2020 AICPA Released Questions FAR Blank Answer KeyGift Chali100% (1)

- American International Group, Inc.: Form 10-KDocumento231 pagineAmerican International Group, Inc.: Form 10-KShane EneteNessuna valutazione finora

- Concepts of Retail Price & PricingDocumento14 pagineConcepts of Retail Price & Pricingpradeepsingh_204uNessuna valutazione finora

- Kalaari-SaaS - Founder-Playbook ExplainedDocumento42 pagineKalaari-SaaS - Founder-Playbook ExplainedAditya PatelNessuna valutazione finora

- Prospectus Affin Hwang Select Asia (Ex Japan) Quantum FundDocumento46 pagineProspectus Affin Hwang Select Asia (Ex Japan) Quantum FundElina TangNessuna valutazione finora

- Modul Praktikum APKM - Week 1 - Konsep Akuntansi Manajemen, Konsep Biaya, Dan Klasifikasi BiayaDocumento15 pagineModul Praktikum APKM - Week 1 - Konsep Akuntansi Manajemen, Konsep Biaya, Dan Klasifikasi BiayaYosefin SumbayakNessuna valutazione finora

- Accounts Super Revision Marathon Notes Part 2Documento157 pagineAccounts Super Revision Marathon Notes Part 2gaxovi4187Nessuna valutazione finora

- Budgeting 1Documento53 pagineBudgeting 1MRIDUL GOELNessuna valutazione finora

- Assignments 9.1 and 9.2Documento2 pagineAssignments 9.1 and 9.2carmen.magarinosbNessuna valutazione finora

- The Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocumento1 paginaThe Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsIvan MendozaNessuna valutazione finora

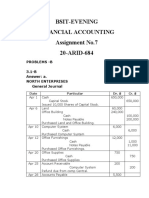

- Assignment No.7 AccountingDocumento7 pagineAssignment No.7 Accountingibrar ghaniNessuna valutazione finora

- Delta PhenomenonDocumento6 pagineDelta Phenomenondhritimohan67% (3)

- Problem 8-3Documento1 paginaProblem 8-3Gilbert MoralesNessuna valutazione finora

- Northern Rock Case Study V 1 1Documento10 pagineNorthern Rock Case Study V 1 1Frank Akinwande WilliamsNessuna valutazione finora

- 2020 Audit Report OneDocumento14 pagine2020 Audit Report OneLeoh NyabayaNessuna valutazione finora

- Revenue Accounting and RecognitionDocumento7 pagineRevenue Accounting and RecognitionjsphdvdNessuna valutazione finora

- Production Analysis: UNIT-3Documento21 pagineProduction Analysis: UNIT-3Rishab Jain 2027203Nessuna valutazione finora

- Jaguar Racing LimitedDocumento24 pagineJaguar Racing LimitedVarun DubeyNessuna valutazione finora

- FAC Accounting CycleDocumento14 pagineFAC Accounting Cycleshubh jainNessuna valutazione finora

- Chapter 8Documento2 pagineChapter 8Wawex DavisNessuna valutazione finora

- Entrepreneurship - 2015-2021 SolutionsDocumento66 pagineEntrepreneurship - 2015-2021 SolutionsJay MaximumNessuna valutazione finora

- Topic 5. Contemporary Approaches To MarketingDocumento39 pagineTopic 5. Contemporary Approaches To MarketingFrancez Anne GuanzonNessuna valutazione finora

- Blue Ocean and E Commerce StrategyDocumento59 pagineBlue Ocean and E Commerce StrategyAdarsh DashNessuna valutazione finora

- ct12010 2013Documento144 paginect12010 2013nigerianhacksNessuna valutazione finora

- FABM FS and Closing EntriesDocumento18 pagineFABM FS and Closing EntriesMarchyrella Uoiea Olin Jovenir100% (1)

- Title DefenseDocumento5 pagineTitle DefenseJaqueline Mae AmaquinNessuna valutazione finora

- Developing An Effective Business Plan - PPT 2Documento27 pagineDeveloping An Effective Business Plan - PPT 2tvglacaba1213Nessuna valutazione finora

- Lecture 6 Media Math RDocumento104 pagineLecture 6 Media Math RZeljana Maric100% (1)

- Vice President Marketing in Boston MA Resume Corinne WyardDocumento2 pagineVice President Marketing in Boston MA Resume Corinne WyardCorinneWyardNessuna valutazione finora