Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

How Life Insurance Agents Fools Me Due To My Laziness.

Caricato da

kirang gandhiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

How Life Insurance Agents Fools Me Due To My Laziness.

Caricato da

kirang gandhiCopyright:

Formati disponibili

How Life insurance agents fools me due to my laziness/unawareness Real life story Ms.

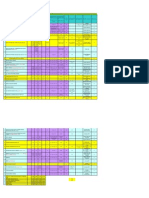

Meena Sharma Deputy manager in TECH MAHendra ( pune ) I am Invested one of the popular plan from LIC JEEVAN SARAL ( most of you have ) What agents say at the time of plan purchasing this is the best plan in the market and this is receive Golden peacock awards. Your money will three times in 20 years and shown the table in word format with the return of 30%p.a. ( But actual return in this plan is 4 to 5% p.a. after 20 years and its prooved) She didnt no all the details whether it will correct or incorrect where is to money invested and all and it suits my financial goals or not. Due to lack of time i am not finding the right person (Independent financial planner )to cross check whether it is right/wrong. How plan works LIC JEEVEN SARAL CHECK MY BALANCE WHETHER IT IS RIGHT/NOT WHAT I OBSERVED AND WHAT I PAID ------------------------------------------------------------------------------------------------------sum assured ! Rs 2000000 (after Death ) ------------------------------------------------------------------------------------------------------Policy tenure ! 20 years ------------------------------------------------------------------------------------------------------Yearly premium ! Rs. 98,004/- ( Rs.8167/- monthly premium) ------------------------------------------------------------------------------------------------------Total Premium Paid ( 3 years ) ! Rs. 2,94,012/------------------------------------------------------------------------------------------------------Current value in the fund (Aft.3 years ) ! Rs. 58,802/-----------------------------------------------------------------------------------------------------Is this a right Investment ? A friend , who is a financial domain trains prospective mutual fund and insurance agents , told me a funny , yet unfortunate incident . One of the insurance companies had appointed a new batch of agents in one of their branches. Soon all the new agents ware out on field wooing clients . But there was one particular agent who stood apart . He was breaking all sales records, bringing in customers by the dozens, not just meeting but exceeding all targets as well ! The branch sales head was a little curious to know how exactly he did this ! So one day , he went with him on a sales call . Here was a conversation he witnessed; Client : which company do you represent ?

Super successful agent :

I come from ABC life insurance company

Client : But I won't buy from any company other than life Insurance Corporation ( LIC) Agent : Why is that ? Client : Because I don't trust private companies . LIC is a government company and has a government guarantee. Agent : Don't worry . ABC private Life insurance company is no different from LIC . In fact , it is one and the same . LIC was growing too big and it was becoming difficult for the government to spread the network anymore . So it floated 14 other divisions , one of them being ABC life insurance company ( ABCLIC ) to manage the growth . Needless to say , the client bought the police , not knowing that private life insurance companies have nothing to do with LIC . They are in fact competitors to LIC . You can now imagine how many lies are told to sell life insurance policies. And as a customer, the only way to protect your self is to know the real facts. Another Real life Story Meet this young professional who wanted to save tax ; ended up making a blundre . >> I BOUGHT A ULIP Name : Anil kulkarni * Age : 32 Profession :Web developer Location : Mumbai Anil work as a web developer in a media company and has been in the profession for six years . He was looking for investment that would also help him save tax , when his friend , an insurance agent , suggested he invest in a Unit Linked insurance plan ( ULIP ) . What his friend told Anil : the policy would yield "good " market - linked returns and would also take care of his tax investment needs . Also , he would only need to pay a premium for three yrars . So ,Anil bought a policy . Let's take closer look at the details . ------------------------------------------------------------------------------------------------------Sum assured ! Rs 1000000 ( After Death ) ------------------------------------------------------------------------------------------------------Policy tenure ! 20 years ------------------------------------------------------------------------------------------------------Yearly premium ! Rs. 100000 ------------------------------------------------------------------------------------------------------Total Premium Paid ( 3 years ) ! Rs. 3,00,000/------------------------------------------------------------------------------------------------Current value in the fund (Aft.3 years ) ! Rs. 1,97,345/------------------------------------------------------------------------------------------------------Today , Anil is unhappy with the product . The reason : the current value of his fund is Rs 197345/- even though he paid a premium of Rs 300000 . Where all the money went

ULIP is a combination of insurance plus investment; you can choose whether to invest a portion of the premium in debt or the equity market. What usually fails to come to light ; the high charges companies , This could be anywhere between 20 to 100 per cent ! This amount takes care of the company's distribution charges , the agents ' commission , etc . But not many investor know a bout this . No doubt , insurance companies do mention the charges in the product brochures . But some agents may conceal information . Or they may not explain it clearly to investors do not enquire about it, " What Anil pays :

------------------------------------------------------------------------------------------------------policy charge in the 1st year ! 40% per cent ------------------------------------------------------------------------------------------------------Deducted amount ! Rs 40,000 -----------------------------------------------------------------------------------------------------Other charges like Policy admin charge,mortality charge,Fund management charge,S.tax etc.. etc.... are different To add to his plight, the fund underperformed . So , Anil now wants to discontinue the plan . What agents don't tell you Anil was asked to pay a premium for only the first three years . Why ? This is because the agent's commission is higher in the first three years . In the bargaining , Anil is losing out , If he wants to withdraw his money after three years , he not get much in hand , because the charges are usually higher in the first three years ; this facts into a major chunk of the premium . If the agent claims that the policy will continue even if you stop paying the premiums after three years , this means that the premium amount you paid in the fund within the first three years , will be used to keep the policy in force after you stop paying premiums ! Once the fund is exhausted, the policy will automatically expired . The road ahead " If Anil wants returns , he should stay invested for at least six to seven years and continue paying his premium beyond three years . On the other hand , he could just pay a premium for another two years and than surrender the policy . In this case , the returns may not be impressive due to the high front -end charges in the initial years. But an investor is still tempted to buy a ULIP he or she could look for low front - end charges offered by insurance companies . Lessons learnt : When buying a ULIP , asked about all charges involved . Track past performance of the ULIP ( if applicable ) brfore buying a policy . Compare ULIPs of various insurance companies to arrive at the best plan .

Things a Life Insurance agnents will tell you and why you shouldnt listen and makes you fool.

1 . INSURANCE IS A GOD INVESTMENT ! THAT'S THE FIRST LIE . INSURANCE IS NOT AN INVESTMENT . THE BASIC PREMISE IS MERELY TO PROTECT YOUR FAMMILY IN CASE OF YOUR DEATH . IF YOU WANT TO MAKE INVESTMENTS , LOOK ELSEWHERE . THIS IS BECAUSE INVESTING IN AN INSURANCE POLICY CAN BE AN EXPENSIVE AFFAIR . MORE ABOUT THAT IN POINT 3 . 2 . A TERM INSURANCE IS A WASTE OF MONEY ! THAT'S THE SECOND LIE . YES , IF YOU BUY A TERM INSURANCE , THERE IS NO MATURITY AMOUNT THAT YOU GET WHEN THE POLICY PERIOD GETS OVER . BUT THAT DOES NOT MEAN IT IS A WASTE OF MONEY . IN A TERM INSURANCE , YOU PAY A LOW PREMIUM OF AROUND RS 3,000 EVERY YEAR FOR A COVER OF RS 10 LAKH FOR 20 YEARS ( IF YOU ARE 30 YEARS OLD ) . IF YOU DIE DURING THIS PERIOD OF 20 YEARS , YOUR FAMILY GETS RS 10 LAKH . IF YOU LIVE UP TO THE MATURITY , YOU GET NOTHING BACK , BUT THEN ISN'T THAT A SMALL PRICE TO PAY FOR THE SECURITY OF YOUR FAMILY ? THE AGENT WILL TELL YOU TO BUY AN INVESTMENT CUM INSURANCE POLICY IN WHICH CASE YOU WILL GET BACK YOUR INVESTMENT AFTER THE TERM IS OVER . BUT THEN , IF ITS THAT GOOD , IT MUST COST AS WELL . FOR THE SAME COVER OF RS 10 LAKH , YOU WOULD HAVE TO SHELL OUT RS 30,000 EVERY YEAR . AND IF YOUR INSURANCE COMPANY IS NOT A GOOD FUND MANAGER , DON'T EXPECT HIGH RETURNS . WHY WILL THE LIE ? ITS SIMPLE . IF YOUR ANNUAL PREMIUM IS RS 3,000 HE MAKES JUST RS 900 . IF IT IS RS 30,000 HE GETS RS 9, 000 ! 3. BUY A ULIP AND WITHDRAW AFTER 5 YEARS ! THE THIRD LIE . A ULIP ( UNIT LINKED INSURANCE POLICY ) IS THE INVESTMENT CUM INSURANCE POLICY THAT HE WILL RECOMMEND YOU TO BUY . AND IF YOU HESITATE , HE WILL SHOW YOU THIS CARROT - BUY NOW , SELL SOON . ULIP ARE BEING SOLD AS GREAT INVESTMENT WITH GREAT LIQUIDITY . YOU PAY PREMIUMS FOR THE FIRST 3 YEARS AND AFTER THAT , YOU CAN WITHDRAW ALL YOUR MONEY . SO IF ITS TAX BENIFITS THAT YOU ARE LOOKING FOR , BUY THE POLICY , KEEP IT FOR A COUPALS OF YEARS AND THEN WITHDRAW YOUR MONEY . THAT WAY , YOU GET TAX BENIFITS WITHOUT HAVING TO LOCK YOUR MONEY IN FOR A LONG TIME . BUT MOVING YOUR MONEY OUT OF A ULIP IN THE FIRST FEW YEARS WILL ACTUALLY LEAVE YOU WITH LESS THAN WHAT YOU STARTED OF WITH . WHAT THE AGENT WON'T TELL YOU IS THAT BECUSE OF THE HIGH FRONT -END CHARGES ON YOUR POLICY , YOU MAY NOT BE LEFT WITH MUCH TO WITHDRAW AT THE END OF 5 YEARS . HERE IS A BIT OF NUMBER CRUNCHING TO TELL YOU WHAT THIS MEANS . A ULIP COMES WITH A LOT OF CHARGES . SOME OF THE MAIN CHARGES ARE : I - ALLOCATION CHARGE THIS VARIES BETWEEN 20 PER CENT TO 100 PER CENT IN THE FIRST YEAR , 4 PER CENT TO 10 PER CENT IN THE SECOND YEAR AND 1 PER CENT THEREAFTER . THIS CHARGE IS A PERCENTAGE OF YOUR PREMIUM AMOUNT . THAT MEANS IF YOU HAVE PAID A PREMIUM OF RS 10,000 EVERY YEAR, THE COMPANY WILL DEDUCT RS 2,000 TO 6,000 AND INVEST ONLY THE BALANCE . THIS CHARGE GOES TOWARDS PAYING THE AGENT'S COMMISSION . II- ADMINISTRATION CHARGES THIS IS A FIXED MONTHLY FEE DEDUCTED AS ADMINISTRATION CHARGES . IT VARIES BETWEEN RS 20 PER MONTH TO RS 60 PER MONTH .

III - FUND MANEGMENT CHAGES THIS IS CHARGED AS A PERCENTAGE OF THE FUND VALUE AND HOVERS BETWEEN 1 PER CENT AND 2.5 PER CENT . THIS FEE IS A CHARGE TO MAINTAIN YOUR INVESTMENTS . THANKS TO THESE CHARGES , YOU WILL NOT BE LEFT WITH MUCH TO WITHDRAW AFTER 3 YEARS . IN FACT , YOU MAY NOT EVEN RECOVERED YOUR PRINCIPAL INVESTMENTS 4.THIS SCHEME WILL GIVE YOU 100 % RETURNS IN A YEAR ! YOUR AGENT IS GOING TO TRY AND SELL YOU THE SCHEME WHICH GOING TO GET HIM THE HIGHEST COMMISSION. THERE'S MORE TO IT . THERE IS A REGULATORY CAP ON HOW MUCH COMMISSION INSURANCE COMPANY CAN PAY THEIR AGENTS . SO COMPANIES HAVE FOUND A WAY AROUND THAT . AGENT HAVE TARGETS AND WHEN THEY MEET BIG TARGETS , THEY GET A VACATION ABROAD WITH THEIR FAMILY OR A LOPTOP AND OTHER GIFTS . SO THAT'S ENOUGH WHY YOU SHOULD TAKE AGENT'S ADVICE WITH PINCH OF SALT . IF AN AGENT PROMISES RETURANS LIKE 100 PER CENT OR 50 PER CENT DON'T BELIVE HIM . THE SCHEME MAY HAVE GIVEN THAT KIND OF RETURN IN THE PAST WHEN THE STOCK MARKETS WERE AT A PEAK . HOWEVER THERE IS NO ASSURANCE THAT IT WILL CONTINUE TO GIVE THAT KIND OF RETURN . TO GET A BETTER PICTURE , SEE THE PERFORMANCE OVER THE PAST 5 YEARS . 5. I CAN SHARE MY COMMISSION WITH YOU ! KICK BACKS ARE ILLEGAL BUT THEY ARE RAMPANT . KICK BACKS ASSUME DIFFREENT FORMS , SOMETIMES CASH AND SOMETIMES KIND . THESE ARE NOTHING BUT A SHARE IN THE COMMISSIONS THAT THE AGENT EARNS FROM THE INSURANCE COMPANY . YOUR AGENT WILL OFFER TO GIVE YOU A PART OF THIS COMMISSION AS BAIT . DON'T BITE IT . THERE IS SELFISH INTEREST . 6 . IF YOU WANT RISK FREE RETURNS , BUY A TRADITIONAL ENDOWMENT OR MONEY BACK POLICY . WELL , TRADITIONAL ENDOWMENT OR MONEY BACK POLICIES ARE DEBT SCHEMES , THAT IS , THEY INVEST IN GOVERNMENT SECURITIES AND OTHER DEBT SCHEMES . HENCE , THE RISK IS FAIRLY LOW . HOWEVER , THESE POLICIES ARE VERY OPAQUE . YOU WILL NAVER KNOW HOW MUCH IS BEING DEDUCTED AS CHARGES AND WHAT IS ACTUALLY INVESTED . THE AGENT WILL TRY TO PUSH A ULIP FIRST . IF THAT DOESN'T WORK , HE WILL TRY SELLING YOU A TRADITIONAL POLICY . THE REASON IS SIMPLE . HIS PRIORITIES ARE IN THE ONDER OF COMMISSION STRUCTURE . 7 . PRIVATE COMPANIES ARE RISKY ! THERE IS ABSOLUTELY NO TRUTH TO THAT . THE INSURANCE REGULATOR ( IRDA ) HASS STRICT NORMS FOR ALL INSURANCE COMPANIES TO FOLLOW , AND THESE NORMS TAKE CARE OF ALL SOLVENCY ISSUES . * TIPS for YOU The most important thing about life insurance is need based . That means , you should buy insurance only when you need it , and not because you want to save tax or because you want to do the agent a favour . Here's when you would need insurance:

When you are the bread winner of the family and your spouse , children , parents , sibility or other members depend on you financially When you have loans and credit card dues , which , on your death would become a liability on your family If you are buying a ULIP , analyse all charges and expenses . Don't buy insurance if you want to withdraw after 3/5 years . The withdrawal option must be exercised only if it is an emergency and that too , after all other means have been adopted . Buy ULIP only if you are prepared to lock -in your funds for a long time, that is , at least more than 10 years . Over a long term of 10-20 years , your costs will get evened out and the effect of compounding can give you good returns . Don't believe it when your agent promises you exaggerated future returns. According to the insurance regulatory authority, an agent can project a future fund value only on the basis of 6 per cent or 10 per cent returns , If an agent is promising guaranteed returns , take it in writing .

Note : The author is Independent Financial Planner not related with any Insurance company or any bank etc.. The above story is real life story some investor are shared with us. If you have any story then do share with us.

Makes Financial Literacy to be simple

Expert Advice :

Financial Planning,Financial Health check up,Net worth Analysis,Asset Alloction strategy,Cash flow Planning,Budget Planning,Tax Planning,Emergency Fund Planning,Insurance Planning,Health Insurance Planning,Child Future / Retirement Planning,Other Financial Goals,Emergency Fund Planning,Risk Analysis ( Investment ),Investment Review,Investment Planning,Estate Planning,Debt Advisory,Insurance Policy Analysis,Financial Literacy and Knowledge Coaching

Investment with Education

Note : Meeting priority to appt only

Investment with Education

For Further Details kindly Contact: Thanks and Regards, Kirang Gandhi Independent Financial Planner

9028142155

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Free Advice Vs Fees Based AdviceDocumento4 pagineFree Advice Vs Fees Based Advicekirang gandhiNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- FII Inflows After ElectionDocumento2 pagineFII Inflows After Electionkirang gandhiNessuna valutazione finora

- Sensex Cross 100,000 by 2020Documento2 pagineSensex Cross 100,000 by 2020kirang gandhiNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- European Central Bank Deposit Rates Are Now Negative.Documento2 pagineEuropean Central Bank Deposit Rates Are Now Negative.kirang gandhiNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- With Marriage Comes Greater Responsibilities - 1Documento4 pagineWith Marriage Comes Greater Responsibilities - 1kirang gandhiNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Income Tax Calculator FY 2014/15 in ExcelDocumento4 pagineIncome Tax Calculator FY 2014/15 in Excelkirang gandhiNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Uncertainty On LiquidityDocumento2 pagineUncertainty On Liquiditykirang gandhiNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Common Money MistakesDocumento3 pagineCommon Money Mistakeskirang gandhiNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Reality of Real EstateDocumento2 pagineReality of Real Estatekirang gandhiNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- FCNR DepositsDocumento2 pagineFCNR Depositskirang gandhiNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- FCNR AccountsDocumento2 pagineFCNR Accountskirang gandhiNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Health Insurance Comparison Chart NEWDocumento10 pagineHealth Insurance Comparison Chart NEWkirang gandhiNessuna valutazione finora

- Market at High What To DoDocumento2 pagineMarket at High What To Dokirang gandhiNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- FMPDocumento2 pagineFMPkirang gandhiNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Lic Jeevan Sugam 5.59% After 10 YearsDocumento2 pagineLic Jeevan Sugam 5.59% After 10 Yearskirang gandhiNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Invite Finacial DisasterDocumento5 pagineInvite Finacial Disasterkirang gandhiNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Invite Finacial DisasterDocumento5 pagineInvite Finacial Disasterkirang gandhiNessuna valutazione finora

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Documento2 pagineFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNessuna valutazione finora

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Documento2 pagineFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNessuna valutazione finora

- April F.D.Documento14 pagineApril F.D.kirang gandhiNessuna valutazione finora

- Investors Lost Rs.1.5 Lakh CroreDocumento7 pagineInvestors Lost Rs.1.5 Lakh Crorekirang gandhiNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Common Mistakes To Avoid The Situation of Financial CrisesDocumento5 pagineCommon Mistakes To Avoid The Situation of Financial Criseskirang gandhiNessuna valutazione finora

- Income Tax Calculator 2013-14Documento2 pagineIncome Tax Calculator 2013-14kirang gandhiNessuna valutazione finora

- FIIs Invest $1 BN in Debt MarketDocumento1 paginaFIIs Invest $1 BN in Debt Marketkirang gandhiNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Points To Consider When Buying Health InsuranceDocumento7 paginePoints To Consider When Buying Health Insurancekirang gandhiNessuna valutazione finora

- Eurozone Debt CrisisDocumento2 pagineEurozone Debt Crisiskirang gandhiNessuna valutazione finora

- Finland Prepares For Expected Euro Zone Break UpDocumento1 paginaFinland Prepares For Expected Euro Zone Break Upkirang gandhiNessuna valutazione finora

- Few Days Are Left To Finish The EuroDocumento2 pagineFew Days Are Left To Finish The Eurokirang gandhiNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Countdown Has Begun Euro Is The HistoryDocumento2 pagineThe Countdown Has Begun Euro Is The Historykirang gandhiNessuna valutazione finora

- Ebook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFDocumento67 pagineEbook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFgina.letlow138100% (27)

- NYS OPRHP Letter Re IccDocumento3 pagineNYS OPRHP Letter Re IccDaily FreemanNessuna valutazione finora

- APLN - Audit Report 2018Documento133 pagineAPLN - Audit Report 2018Dini DesvarhozaNessuna valutazione finora

- 1702758529Documento3 pagine1702758529Szymon SłomskiNessuna valutazione finora

- Poli TipsDocumento83 paginePoli TipsJoyae ChavezNessuna valutazione finora

- SweetPond Project Report-2Documento12 pagineSweetPond Project Report-2khanak bodraNessuna valutazione finora

- FI Period End Closing T-Code and ProcedureDocumento6 pagineFI Period End Closing T-Code and Procedurepraveen_sharma_5Nessuna valutazione finora

- The Six Day War: Astoneshing Warfear?Documento3 pagineThe Six Day War: Astoneshing Warfear?Ruben MunteanuNessuna valutazione finora

- Contrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesDocumento2 pagineContrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesTogay Balik100% (1)

- Armenia Its Present Crisis and Past History (1896)Documento196 pagineArmenia Its Present Crisis and Past History (1896)George DermatisNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- TWG 2019 Inception Reports forERG 20190717 PDFDocumento95 pagineTWG 2019 Inception Reports forERG 20190717 PDFGuillaume GuyNessuna valutazione finora

- Greece and Britain Since 1945Documento1 paginaGreece and Britain Since 1945Νότης ΤουφεξήςNessuna valutazione finora

- Hispanic Heritage MonthDocumento2 pagineHispanic Heritage Monthapi-379690668Nessuna valutazione finora

- Purging CostSavingsDocumento2 paginePurging CostSavingscanakyuzNessuna valutazione finora

- Moodys SC - Russian Banks M&ADocumento12 pagineMoodys SC - Russian Banks M&AKsenia TerebkovaNessuna valutazione finora

- Liquidity Risk Management Framework For NBFCS: Study NotesDocumento5 pagineLiquidity Risk Management Framework For NBFCS: Study NotesDipu PiscisNessuna valutazione finora

- 12 Business Combination Pt2 PDFDocumento1 pagina12 Business Combination Pt2 PDFRiselle Ann SanchezNessuna valutazione finora

- Elizabeth Stevens ResumeDocumento3 pagineElizabeth Stevens Resumeapi-296217953Nessuna valutazione finora

- Industry ProfileDocumento16 pagineIndustry Profileactive1cafeNessuna valutazione finora

- ISA UPANISHAD, Translated With Notes by Swami LokeswaranandaDocumento24 pagineISA UPANISHAD, Translated With Notes by Swami LokeswaranandaEstudante da Vedanta100% (4)

- Gacal v. PALDocumento2 pagineGacal v. PALLynne SanchezNessuna valutazione finora

- First Aid Is The Provision of Initial Care For An Illness or InjuryDocumento2 pagineFirst Aid Is The Provision of Initial Care For An Illness or InjuryBasaroden Dumarpa Ambor100% (2)

- English File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)Documento2 pagineEnglish File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)dzinedvisionNessuna valutazione finora

- Auditing Unit - 5 by Anitha RDocumento16 pagineAuditing Unit - 5 by Anitha RAnitha RNessuna valutazione finora

- Taqwa (Pıety) Beıng Conscıous of Maıntaınıng Allah's PleasureDocumento1 paginaTaqwa (Pıety) Beıng Conscıous of Maıntaınıng Allah's PleasuretunaNessuna valutazione finora

- Morphology & Syntax "Morpheme Forms": Page - 1Documento10 pagineMorphology & Syntax "Morpheme Forms": Page - 1محمد ناصر عليويNessuna valutazione finora

- United States v. Melot, 10th Cir. (2015)Documento6 pagineUnited States v. Melot, 10th Cir. (2015)Scribd Government DocsNessuna valutazione finora

- Mechanisms: For Tabletop RoleplayingDocumento15 pagineMechanisms: For Tabletop RoleplayinglaniNessuna valutazione finora

- SLRC InstPage Paper IIIDocumento5 pagineSLRC InstPage Paper IIIgoviNessuna valutazione finora

- MII-U2-Actividad 4. Práctica de La GramáticaDocumento1 paginaMII-U2-Actividad 4. Práctica de La GramáticaCESARNessuna valutazione finora

- The Hidden Wealth of Nations: The Scourge of Tax HavensDa EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensValutazione: 4 su 5 stelle4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Public Finance: Legal Aspects: Collective monographDa EverandPublic Finance: Legal Aspects: Collective monographNessuna valutazione finora

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDa EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesValutazione: 4 su 5 stelle4/5 (9)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNessuna valutazione finora