Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Daily Agri Report Oct 1

Caricato da

Angel BrokingDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Daily Agri Report Oct 1

Caricato da

Angel BrokingCopyright:

Formati disponibili

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narveker@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Associate anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

News in brief

Raise import duty on raw sugar, Industry requests government

The sugar industry is requesting the government to increase the import duty on raw sugar from 10% to 25% for safeguarding the domestic market from price distortion. The retail price of sugar is around Rs 40 a kg and the industry fears that if imports are not restricted, prices may fall below rs 32, which is lower than the production cost, leading to a situation which may be beneficial for consumers but not for the local sugar industry grappling with lower price realisation and higher cane arrears. "International sugar prices have fallen significantly in the last couple of months due to improved sugar production in Brazil and better production in countries like India, Thailand, China and Russia. Cheaper import of raw sugar will depress domestic sugar prices to unviable levels, putting pressure on the sugar industry," said an industry official who didn't wish to be named. However, it appears that it would be unviable to re-export after processing the imported raw sugar to a global market which is already flushed with around 6 million tonne of surplus sugar. Meanwhile, the government has decided to release 4 million tonne sugar in the open market to keep prices under check during festivals in the next two months. (Source: Economic Times)

Market Highlights (% change)

Last Prev. day

as on Sept 28, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

18580 5650 52.86 92.19 1771

-0.28 -0.25 -0.12 0.37 -0.37

1.25 1.71 -0.96 -0.75 -0.25

5.09 5.59 -5.02 -4.30 6.28

14.96 16.06 6.90 14.89 11.22

Source: Reuters

Indonesia keeps CPO Export tax Unchanged Ministry

As per Indonesias ministry official, Indonesia will keep its crude palm oil export tax to 13.5 percent for October unchanged as compared to previous month. The government will also keep its export tax for RBD palm olein to 6 percent. (Source: Agriwatch)

IGC' Estimate For World Corn Production

As per IGC estimate, World corn production declined by 1% to 833 million tons as compared to last estimate of 838 million tons in August 2012. Weak planting progress in Argentina and lower corn production estimate in US bound them to lower its global corn production estimates. Decline in output has led to the decline of corn carryover stocks for the coming year. (Source: Agriwatch)

Soyabean production set to touch record 127 lt

Soyabean production this season ending June has been projected at a record high of 126.76 lakh tonnes on higher planting of the oilseed and better yield by the Soyabean Processors Association of India. The oilseed output may rise by eight per cent in Madhya Pradesh, the largest grower, while it may inch up marginally in Maharashtra. However, production may shrink in Karnataka and Rajasthan marginally because of scanty monsoon. The crash in prices is likely to prompt the farmers to hold back their produce. Farmers had planted soyabean on a record area of 106 lakh hectares this year against 102 lakh hectares last year. Despite the dry spell affecting the crop in the Kolhapur and Sangli belt of Maharasthra, the State continues to lead in terms of yields at 1.4 tonnes a hectare. In Madhya Pradesh, the yields are pegged at over 1.1 tonne a hectare and Rajasthan at 1.25 tonnes a hectare. SOPAs projections are in line with the Governments first advance estimates which pegged the crop at 126.19 lakh ha. (Source: Business Line)

Malaysia's September palm oil exports down 0.7 pct-ITS

Malaysian palm oil product exports during September fell 0.7 percent to 1,443,836 tonnes from 1,453,544 tonnes in August, cargo surveyor Intertek Testing Services said on Monday. (Source: Reuters)

IGC cuts global wheat output estimates to 657 mt

The International Grains Council (IGC) has further trimmed its global wheat production forecast for 2012-13 to 657 million tonnes (mt) due to decline in output in Russia, Australia and Europe. Last month, the London-based organisation had forecast the output at 662 mt for 201213, lower than the record output of 696 mt last year. World production for 2012-13 is cut by a further five million tonnes to 657 MT, a six per cent year-on-year decline... It is mainly due to downward revision for Russian and Australian wheat, together with EU wheat, IGC said in its latest grains report. The global wheat consumption is expected to decline to 679 mt this year from 691 mt in 2011-12 as high prices are expected to reduce feed demand, it said. World trade is placed a little lower at 132 mt for this year, against 145 mt in the year ago following reduced trade in feed wheat, it added. According to IGC, the carry over stock is estimated to be lower at 175 mt as compared to 197 mt in the review period because major exporters are becoming increasingly tight. On global wheat prices, it said they have outperformed due to concerns over Black Sea exports and dry conditions in Australia. (Source: Reuters)

Corn extends gains as U.S. stockpiles shrink

U.S. corn rose more than 1 percent on Monday, sustaining steep gains from the prior session when prices surged by the daily limit, after the U.S. government said stockpiles of the grain shrank to less than 1 billion bushels for the first time in eight years. Wheat eased after similarly soaring on Friday on smaller than anticipated stocks as of Sept. 1, suggesting that strong demand and drought-hit crops will keep markets tight. The U.S. Department of Agriculture's survey of farmers and warehouses showed 988 million bushels of corn on hand -- 11 percent less than expected -- on Sept. 1. (Source: Reuters)

Tracking monsoon withdrawal: Air moisture drops

Monsoon that has withdrawn from Rajasthan, is gradually withdrawing from over Madhya Pradesh. Officials of the meteorological department Bhopal circle said that air moisture has reduced and withdrawal of monsoon would be declared only if there is no activity for at least five continuous days. Monsoon activities are over in places like Guna and Ratlam districts neighboring Rajasthan, it is yet to be withdrawn from other places, the weathermen added. However, the weather office also rules out possibility of rain at majority of places in the state including Bhopal. More rains are unlikely in the state as the wind direction has changed to north and north-easterly, the weathermen said, adding that a fresh system developing over the Bay of Bengal could only have a slight impact only in east MP. (Source: Times of India)

Argentina says wheat area flooding recedes

Argentina's 2012/13 wheat crop is developing nicely as flood waters recede after heavy August and early September rains, the Agriculture Ministry said in its weekly grains report on Friday. Exporters are eager to know about Argentina's 2012/13 crop, after droughts in the United States and Russia and dry weather in Australia's western wheat region have squeezed global supply. Argentina is the world's No. 6 wheat exporter, No. 3 soybean supplier and No. 2 provider of corn after the United States. Wheat sowing for the 2012/13 crop year ended last month. Corn planting recently began, and soy will start going into the ground in October. (Source:Reuters)

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Chana

Chana futures declined by 0.80% on Saturday amid prospects of better sowing. According to the first advance estimates, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. Kharif pulses harvesting would commence from next month. As per the NCDEX circular dated 20 September, existing Special Margin of 20% (in cash) on the Long side shall be reduced to 10% (in cash) on all the running contracts and yet to be launched contracts in Chana with effect from Monday, September 24, 2012. Prices declined last week on improved rains and reports of expected higher output in Australia, the largest supplier of chickpeas to India. In Australia, chana production rose by 70.5 percent to 8.27 lakh tonnes from 4.85 lakh tonnes in previous year. Ongoing recovery in monsoon and above average rains in the past few days is showing better prospects for Rabi pulses sowing in the coming days. Monsoon has recovered across India, especially in Rajasthan, one of the major chana growing states, and may prove beneficial for the chana sowing.

th

Market Highlights

Unit Rs/qtl Rs/qtl Last 4400 4355 Prev day 0.00 -0.80

as on Sept 29, 2012 % change WoW MoM -4.06 -8.02 -0.87 -6.79 YoY 32.42 31.69

Chana Spot - NCDEX (Delhi) Chana- NCDEX Oct '12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Oct contract

Sowing progress and demand supply fundamentals

According to the Ministry of Agriculture 99.81 Lakh hectare area has been planted under Kharif pulses as on 21th September, 2012 compared to 108.28 lakh hectare (ha) same period last year.

Source: Telequote

Technical Outlook

According to the Fourth advance estimates, Pulses output is pegged at 17.21 mn tn in 2011-12 compared with 18.24 mn tn produced in the year 2010-11. While Chana output in 2011-12 is estimated at 7.58 million tones, Tur is estimated at 2.65 million tones, Urad is estimated at 1.83 million tones, Moong is estimated at 1.71 million tones. As per the latest release, Ministry of Commerce & Industry revealed that 20.23 lakh tones of peas, 2.03 lakh tons of Chana, 4.32 lakh tons of Urad & Moong, 1.12 lakh tons of Masoor and 4.26 lakh tons of Tur has been imported by India during April11-March 12. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch)

Contract Chana Oct Futures Unit Rs./qtl Support

valid for Oct 1, 2012 Resistance 4255-4305

4125-4165

Outlook

Chana futures are expected to trade sideways with upward bias on emergence of fresh demand at lower levels. Estimated lower kharif pulses output may also support the upside in the prices during the intraday. In the medium term to long term, the trend remains positive on account of supply tightness. However, higher imports from Australia may cap the sharp upside in the prices.

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Sugar

Sugar Prices traded on a negative note last week due to higher quota for the next two months, which will increase sugar supplies in the markets to meet the festive demand. However, the spot prices found support at lower levels due to festive demand. The spot as well as the Futures settled 0.33% and 2.32% lower w-o-w. With the release of higher sugar quota for the next two months prices declined further during the intraday however, prices closed on a flat note on expectations of festive season demand. The Government has decided to make available a quantity of 40 lakh tons of non-levy quota, for the months of October, 2012 and November 2012 Indian mills have signed deals to buy up to 450,000 tonnes of Brazilian raw sugar for delivery from October to December as a gap between domestic and overseas prices widens, making room for the first imports in more than two years, five dealers told Reuters. Millers based in western and southern India and global trading firms bought sugar at around $500/ton a CIF basis, as the price in the domestic market has jumped more than 23% to $680/ tn in the past three months. ICE raw sugar and life white sugar futures traded on a mixed note yesterday. ICE raw sugar settled marginally higher by 0.23% while Liffe white sugar settled 0.1% lower on Friday.

Market Highlights

Unit Sugar Spot- NCDEX (Kolkata) Sugar M- NCDEX Oct '12 Futures Rs/qtl Last 3810

as on Sept 29, 2012 % Change Prev. day WoW -0.52 -0.33 MoM 2.17 YoY 23.50

Rs/qtl

3497

-1.16

-2.32

-0.74

26.15

Source: Reuters

International Prices

Unit Sugar No 5- LiffeOct'12 Futures Sugar No 11-ICE Oct '12 Futures $/tonne $/tonne Last 574.5 435.11

as on Sept 28, 2012 % Change Prev day WoW 0.23 -0.10 1.18 0.41 MoM 3.18 -0.91 YoY -11.97 #N/A

Source: Reuters

Technical Chart - Sugar

NCDEX Oct contract

Domestic Production and Exports

The area under sugarcane is estimated at 52.88 lakh ha for 2012-13 crop season, up from 50.99 lakh ha on same period a year ago. According to the first advance estimates by agriculture ministry, Sugarcane output is pegged at 335.3 mn tn, down by 6.2% compared to 357.6 mn tn last year. Despite of higher acreage, the producers body has estimated next years sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Sugar production in India the worlds second-biggest producer touched 26 million tonne since October 1, 2011. Industry body ISMA has estimated 6 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 2.5-3 mn tn sugar in 2012-13. With the opening stocks of 6 mn tn, domestic Sugar supplies are estimated at 30mn tn against the domestic consumption of around 22.523 mln tn for 2012-13. Thus, no curbs on exports are seen as of now.

Source: Telequote

Technical Outlook

Contract Sugar Oct NCDEX Futures Unit Rs./qtl

valid for Oct 1, 2012 Support 3380-3405 Resistance 3450-3475

Global Sugar Updates

Brazilian cane mills produced 3 mn tn of sugar in the first half of August thanks to dry weather. Unica in its latest report stated said that total sugar output since the start of the crushing season is still down 12 percent from the same period a year ago. The International Sugar Organization said it expected a global sugar surplus of 5.86 million tonnes in the season running from October 2012 to September 2013, up from the prior season's surplus of 5.19 million tonnes. The ISO said the stocks/consumption ratio could rise to around 40 percent in 2012/13, from 37.6 percent in 2011/12. (Source: Reuters)

Outlook

Sugar prices may decline in the coming weeks amid higher sugar quota for the next two months and reports of raw sugar import after almost 2 years. However, a delay in crushing in Maharashtra by a month and lower cane output estimates may restrict sharp fall in the short term.

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Oilseeds

Soybean: Soybean futures declined sharply by 7.34% last week due

to the ongoing harvest of the soy crop in India as well as the weak international markets. However, prices recovered on Saturday due to short coverings. CBOT Futures recovered and settled 1.93% higher on Friday after farmers in the US turned bullish on reports that China stepped up exports earlier this week. In Brazil planting has started 10 days earlier amid good rains. If rains continue in the coming weeks as forecast, Brazil could churn out 81 million tonnes of oilseed and replace the drought-stricken US as the world's top soybean producer, according to the USDA. Brazils grain Association expects the number 2 producers of soybean to produce record 81.3 mn tn in 2012-13. In the domestic markets, as on 20 September, 2012, Oilseeds have been sown in 174.39 lakh ha so far, compared with 178.16 lakh ha same period last year. Soybean area is higher at 106.9 lakh ha. According to first advance estimates, Soybean output is pegged at at 126.2 lk tn for 2012-13. However, drop in area under groundnut, sunflower & castor seed may lead to lower output of these oilseeds in 2012-13 which is estimated 9.6% lower at 187.8 lakh tn.

th

Market Highlights

% Change Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Oct '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Oct'12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3278 3202 719.9 663.2 Prev day 0.00 0.91 0.00 -1.84

as on Sept 29, 2012

WoW -17.99 -7.34 -7.28 -6.78

MoM -28.05 -20.18 -9.79 -17.85

Source: Reuters

YoY 49.75 46.66 12.80 7.93

as on Sept 28, 2012 International Prices Soybean- CBOTNov'12 Futures Soybean Oil - CBOTOct '12 Futures Unit USc/ Bushel USc/lbs Last 1601 52.18 Prev day 1.93 0.13 WoW -1.28 -4.17 MoM -6.03 -3.17

Source: Reuters

YoY 16.06 -8.94

Crude Palm Oil

as on Sept 29, 2012 % Change Prev day WoW -2.42 0.49 -6.67 -6.91

Refined Soy Oil: Ref soy oil and MCX CPO futures settled 6.78%

and 6.91% down owing to higher stocks in Malaysia. Although, exports are high the overall stocks of Malaysian palm oil are higher on the back of seasonally higher yield. Exports of Malaysian palm oil products for Sept. 1-25 rose 8 percent to 1,170,720 tonnes from 1,084,343 tonnes shipped during Aug. 1-25. Indias edible oil imports should rise 5.4 percent to a record 10.31 million tonnes in 2012/13, with the entire increase met by palm oil. India imported 112,611 tn of refined palm oil in July, down 9.28 percent from June. Total vegetable oil imports in July were 870,328 tn, up from 783,315 tn in the previous month (Source: Sea of India).

CPO-Bursa Malaysia Oct '12 Contract CPO-MCX- Oct '12 Futures

Unit MYR/Tonne Rs/10 kg

Last 2420 447

MoM -20.18 -20.36

YoY -28.82 -5.08

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Oct '12 Futures Rs/100 kgs Rs/100 kgs Last 4038 3879 Prev day -2.71 0.65

as on Sept 29, 2012 WoW -2.71 -4.97 MoM -6.65 -11.17

Source: Reuters

YoY 39.22 28.78

Rape/mustard Seed: Mustard spot as well as futures settled

2.71% and 4.97% lower last week tracking weak oilseeds markets. Mustard output was lower in 2011-12. However, on the back of higher returns and improved rains, next years output is expected to be better. Sowing of rapeseed starts from October and northwestern Rajasthan is the top producing area in the country. As per NCDEX circular, existing Special Margin of 15% (in cash) on the Long side shall be reduced to 5% (in cash) on all the running contracts and yet to be launched contracts in Rapeseed Mustard Seed with effect from Monday, September 24, 2012. Outlook Edible oil complex is expected to trade on a negative note during intraday. Expectations of improved yield and higher supplies of domestic soybean may keep the downside intact in the short term.

Technical Chart Soybean

NCDEX Oct contract

Source: Telequote

Technical Outlook

Contract Soy Oil Oct NCDEX Futures Soybean NCDEX Oct Futures RM Seed NCDEX Oct Futures CPO MCX Oct Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Oct 1, 2012 Support 637-645 3110-3165 3830-3865 429-436 Resistance 658-662 3235-3275 3965-3995 446-450

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Black Pepper

Pepper traded on a positive note last week due to a supply crunch in the spot markets as farmers are unwilling to sell at lower prices. however, prices corrected towards the end of the week after the regulator, FMC asked NCDEX to find out if there were any irregularities in Pepper trades. Traders are buying pepper directly from the farmers. Exports demand for Indian pepper in the international markets is also said to be low. The Spot as well as the Futures settled 0.26% and 0.24% higher w-o-w. th According to the circular released on June 13 2012 the existing Special margin of 10% (cash) on the long side stands withdrawn on all running contracts and yet to be launched contracts in Pepper from beginning of day Friday June 15, 2012. Pepper prices in the international market are being quoted at $8,4758,450/tonne(C&F) while Indonesia Austa is quoted at $6,750/tonne (FOB). Vietnam was offering 550GL at $6,900/tonne. As per circular dt. 29/06/2012 issued by NCDEX, Hassan will be available as an additional delivery centre for all the yet to be launched contracts. (not applicable to the currently available contracts-till Dec 2012 expiry).

Market Highlights

% Change Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Oct '12 Futures Rs/qtl Rs/qtl Last 42211 43395 Prev day 0.29 0.09

as on Sept 29, 2012 WoW 0.26 0.24 MoM 3.47 5.12 YoY 19.06 20.69

Source: Reuters

Technical Chart Black Pepper

NCDEX Oct contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till June 2012 is estimated around 73000 mt 73,000 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 14.8% in the first 2 months of the year (2012) to 8810 tn as compared to 10344 tn in the same period previous year. Imports of Pepper in the month of February declined by 16.8% to 3999 tn as compared to 4811 tn in the month of January 2012. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Oct Futures Unit Rs/qtl

valid for Oct 1, 2012 Support 42500-42750 Resistance 43350-43710

Production and Arrivals

The arrivals in the spot market were reported at 28 tonnes while offtakes were 30 tonnes on Saturday. Global Pepper production in 2012 is expected to increase 7.2% to 3.20 lakh tonnes as compared to 2.98 lakh tonnes in 2011 with sharp rise of 24% in Indonesian pepper output and in Vietnam by 10%. According to latest report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) On the other hand production of pepper in India in 2011-12 is expected to decline further by 5% to 43 thousand tonnes as compared to 48 thousand tonnes in the last year. Production is lowest in a decade.

Outlook

Pepper is expected to trade sideways with a negative bias today on reports that FMC has asked NCDEX to find out any irregularities in pepper trade. Low demand at higher levels in the domestic markets as well as low export demand may keep the prices under check. Lack of supplies in the domestic markets and festive demand may to support prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Jeera

Jeera prices traded on a positive note last week on expectations of better export figures as well as low arrivals in the spot markets. However, prices corrected towards the end of the week due to reports of higher carryover stocks as compared to last year. Good rains in Gujarat, thereby expectations of better sowing prospects ahead of the rabi sowing have also pressurized the prices. The spot settled 1.13% while the Futures settled 0.11% higher w-o-w. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Around 10 lakh bags of Jeera are reported across India. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,625-2,650 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 7-8 lakh bags as compared to 4-5 lakh bags in the last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Oct'12 Futures Rs/qtl Rs/qtl Last 14438 13628 Prev day -0.43 0.11

as on Sept 29, 2012 % Change WoW -1.13 0.06 MoM -6.14 -4.47 YoY -3.38 -7.65

Source: Reuters

Technical Chart Jeera

NCDEX Oct contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 3,000 bags, while off-takes stood at 4,000 bags on Saturday. Production of Jeera in 2011-12 is expected to be around 40 lakh bags as compared to 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.00 0.28

as on Sept 29, 2012 % Change

Outlook

Jeera futures may trade on a sideways note today. Prices may find support at lower levels on expectations of higher export figures. However, good rains in Gujarat and higher carryover stocks may cap any sharp gains. In the medium term (September-October 2012), prices are likely to witness a bounce back as there are limited stocks with Syria and Turkey.

Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Oct '12 Futures

Unit Rs/qtl Rs/qtl

Last 5513 5654

WoW -7.55 -0.18

MoM 1.98 -6.51

YoY -3.62 8.44

Turmeric

Turmeric Futures traded on a negative note last week after FMC asked NCDEX to find out if there are any irregularities in Turmeric trades. Higher stocks with the stockists also pressurized the prices. However, a reduction in the special cash margin on the long side supported the prices in the Futures at lower levels. Turmeric has been sown in 0.57 lakh hectares in A.P as on 26/9/2012. Sowing is also reported 30-35% lower during the sowing period. The Spot as well as the Futures settled 7.55% and 0.18% lower w-o-w. Special Cash Margin of 40% on the Long side shall be reduced to 20% (cash) on all the running contracts and yet to be launched contracts in Turmeric w.e.f. beginning of day Wednesday, September 26, 2012.

Technical Chart Turmeric

NCDEX Oct contract

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad mandi stood at 4,500 bags and 1,500 bags respectively on Friday. Turmeric production for the year 2011-12 is projected at historical high of 90 lakh bags (1 bag= 70 kgs) compared to 69 lakh bags in 201011. Erode is expected to produce 55 lakh bags of turmeric a rise of 29% as compared to previous year. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Oct Futures Turmeric NCDEX Oct Futures Rs/qtl Rs/qtl

valid for Oct 1, 2012 Support 13580-13725 5510-5560 Resistance 14050-14200 43350-43710

Outlook

Turmeric prices are expected to trade sideways today. Reports that FMC has asked NCDEX to find out any irregularities in turmeric trades may pressurize prices. However, a reduction in the special cash margin, lower sowing figures and lower arrivals may support prices..

www.angelcommodities.com

Commodities Daily Report

Monday| October 1, 2012

Agricultural Commodities

Kapas

NCDEX Kapas futures and MCX Cotton futures on Saturday settled 0.50% higher on short coverings. According to the first advance estimates, released by the ministry of agriculture, Indias 2012/13 cotton output is seen at 33.4 mln bales as compared to 352 lakh bales in 2011-12 seasons. ICE cotton Futures closed 1.26% lower and continued its bearish rally ahead of seasonal selling and pick up in cotton crop harvesting in the US supported the bears. Cotton harvesting has commenced in US, in all 10% is harvested as compared to 6% a week ago, versus 11% same period a year ago. Cotton crop condition is 43% in Good/Excellent state as compared to 43% a week ago, and 29% same period a year ago.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 898 16050

as on Sept 29, 2012 % Change Prev. day WoW 0.50 0.50 -0.17 -0.06 MoM -14.19 -0.06 YoY -14.85

NCDEX Kapas Futures MCX Cotton Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit Usc/Lbs Last 69.15 81.35

as on Sept 28, 2012 % Change Prev day WoW -1.26 -2.62 0.00 0.00 MoM -8.81 0.00 YoY -29.26 -29.20

Domestic Production and Consumption

As on 21 September, 2012, Cotton is being planted on 114 lakh hectares, down, as compared to the last years 119.6 lakh hectares. However, the acreage so far is at par with its normal area of 111.8 lakh hectares. According to the latest updates by Cotton Advisory Board (CAB), Cotton production for 2011-12 seasons is revised upward to 357 lakh bales compared with 347 lakh bales estimated earlier. Also, on account of cheaper cotton available in the global markets, imports have more than double from 5 lakh bales to 12 lakh bales. On the demand front, exports increased to around 127 lakh bales from the earlier estimates of 115 lakh bales taking total cotton consumption to around 382 lakh bales. Thus, the ending stocks figure for 2011-12 season, that would end in September, has been revised upward to 28 lakh bales from the previous estimates of 25 lakh bales. In its September monthly demand supply report on Wednesday, the Agriculture Department (USDA) raised its estimate for the global cotton surplus by next July to a record of 76.5 million 480-pound bales, nearly a two-million bale increase from last month's estimate.

st

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Global Cotton Updates

Global cotton prices are mainly influenced by China, US and India. USDA estimated US Cotton planting for the season 2012-13 at 12.64 mln acres as compared to 14.74 mln acres last season (2011-12). Ending stocks were at 4.8 mln bales (480 pounds/bales) with Production of 17 mln bales and exports of 12.1 mln bales were pegged for the season 2012-13. China's 2012 cotton output is estimated at 6.97 million tns, down 4.2 percent from last year. China's cotton imports in August rose 48 percent on the year to 305,600 tns. Total imports in the first eight months of the year were 3.77 million tns, up 123% from the same period last year, according to the report by the China National Cotton Reserves Corp.

Source: Telequote

Technical Chart - Cotton

MCX Oct contract

Outlook

Kapas futures in intraday is expected to trade range bound as ongoing harvesting in the key states coupled with new cotton crop arrivals from the northern states might pressurize the prices. However, prices in spot market are nearing its MSP, which would restrict any major fall. Also Farm Minister has lowered the output estimates of cotton for the 2012-13 season, that will provide support to the prices in the short term. However, in the international front, cotton harvesting has begun globally which might cap a sharp upside in medium term.

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Kapas MCX April Cotton MCX October Unit Rs/20 kgs Rs/20 kgs Rs/bale

valid for Oct 1, 2012 Support 872-883 868-882 15750-15900 Resistance 908-925 906-921 16150-16280

www.angelcommodities.com

Potrebbero piacerti anche

- ZipGrow Production Estimates Guide - Bright AgrotechDocumento12 pagineZipGrow Production Estimates Guide - Bright Agrotechvinayvasant2020Nessuna valutazione finora

- FreshStart21 1daykit PDFDocumento15 pagineFreshStart21 1daykit PDFAndre Rod100% (3)

- 2010 Succul Plant CatalogueDocumento7 pagine2010 Succul Plant CataloguesangoneraNessuna valutazione finora

- Daily Agri Report 10th JanDocumento8 pagineDaily Agri Report 10th JanAngel BrokingNessuna valutazione finora

- Daily Agri Report Nov 7Documento8 pagineDaily Agri Report Nov 7Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 05Documento8 pagineDaily Agri Report, April 05Angel BrokingNessuna valutazione finora

- Daily Agri Report, August 12 2013Documento9 pagineDaily Agri Report, August 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 3Documento8 pagineDaily Agri Report Dec 3Angel BrokingNessuna valutazione finora

- Daily Agri Report, August 23 2013Documento9 pagineDaily Agri Report, August 23 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report 15th JanDocumento8 pagineDaily Agri Report 15th JanAngel BrokingNessuna valutazione finora

- Daily Agri Report Nov 10Documento8 pagineDaily Agri Report Nov 10Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 13Documento8 pagineDaily Agri Report Dec 13Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 1Documento8 pagineDaily Agri Report Nov 1Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 12Documento8 pagineDaily Agri Report Dec 12Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 26Documento8 pagineDaily Agri Report Nov 26Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 15Documento8 pagineDaily Agri Report Sep 15Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 17Documento8 pagineDaily Agri Report Aug 17Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 10Documento8 pagineDaily Agri Report Sep 10Angel BrokingNessuna valutazione finora

- Daily Agri Report September 03 2013Documento9 pagineDaily Agri Report September 03 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 6Documento8 pagineDaily Agri Report Oct 6Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 3Documento8 pagineDaily Agri Report Oct 3Angel BrokingNessuna valutazione finora

- Daily Agri Report 21st DecDocumento8 pagineDaily Agri Report 21st DecAngel BrokingNessuna valutazione finora

- Daily Agri Report Sep 11Documento8 pagineDaily Agri Report Sep 11Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 23Documento8 pagineDaily Agri Report Oct 23Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 26Documento8 pagineDaily Agri Report, April 26Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 23Documento8 pagineDaily Agri Report Aug 23Angel BrokingNessuna valutazione finora

- Daily Agri Report Oct 25Documento8 pagineDaily Agri Report Oct 25Angel BrokingNessuna valutazione finora

- Daily Agri Report, August 08 2013Documento9 pagineDaily Agri Report, August 08 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 20Documento8 pagineDaily Agri Report Nov 20Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 10Documento7 pagineDaily Agri Report, June 10Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 12Documento7 pagineDaily Agri Report, June 12Angel BrokingNessuna valutazione finora

- Daily Agri Report Dec 4Documento8 pagineDaily Agri Report Dec 4Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 27Documento8 pagineDaily Agri Report Nov 27Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 14Documento9 pagineDaily Agri Report, June 14Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 14Documento8 pagineDaily Agri Report Sep 14Angel BrokingNessuna valutazione finora

- Daily Agri Report, August 06 2013Documento9 pagineDaily Agri Report, August 06 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 28Documento8 pagineDaily Agri Report Aug 28Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 31Documento8 pagineDaily Agri Report Aug 31Angel BrokingNessuna valutazione finora

- Daily Agri Report, June 06Documento7 pagineDaily Agri Report, June 06Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 3Documento8 pagineDaily Agri Report Sep 3Angel BrokingNessuna valutazione finora

- Daily Agri Report, 30th January 2013Documento8 pagineDaily Agri Report, 30th January 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 29 2013Documento9 pagineDaily Agri Report Aug 29 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 26Documento8 pagineDaily Agri Report Sep 26Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 20Documento8 pagineDaily Agri Report Sep 20Angel BrokingNessuna valutazione finora

- Daily Agri Report 9th JanDocumento8 pagineDaily Agri Report 9th JanAngel BrokingNessuna valutazione finora

- Daily Agri Report Aug 13Documento8 pagineDaily Agri Report Aug 13Angel BrokingNessuna valutazione finora

- Daily Agri Report September 12 2013Documento9 pagineDaily Agri Report September 12 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 06 2013Documento9 pagineDaily Agri Report September 06 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report, July 17 2013Documento9 pagineDaily Agri Report, July 17 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Sep 25Documento8 pagineDaily Agri Report Sep 25Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 15Documento8 pagineDaily Agri Report Nov 15Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 9Documento8 pagineDaily Agri Report Nov 9Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 11Documento8 pagineDaily Agri Report Aug 11Angel BrokingNessuna valutazione finora

- Daily Agri Tech ReportDocumento8 pagineDaily Agri Tech ReportAngel BrokingNessuna valutazione finora

- Daily Agri Report Sep 24Documento8 pagineDaily Agri Report Sep 24Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 27Documento8 pagineDaily Agri Report Aug 27Angel BrokingNessuna valutazione finora

- Daily Agri Report, April 01Documento8 pagineDaily Agri Report, April 01Angel BrokingNessuna valutazione finora

- Daily Agri Report Aug 10Documento8 pagineDaily Agri Report Aug 10Angel BrokingNessuna valutazione finora

- Daily Agri Report, February 18Documento8 pagineDaily Agri Report, February 18Angel BrokingNessuna valutazione finora

- Daily Agri Report, July 19 2013Documento9 pagineDaily Agri Report, July 19 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report Nov 8Documento8 pagineDaily Agri Report Nov 8Angel BrokingNessuna valutazione finora

- Daily Agri Report Jan 04Documento8 pagineDaily Agri Report Jan 04Angel BrokingNessuna valutazione finora

- Food Outlook: Biannual Report on Global Food Markets. October 2016Da EverandFood Outlook: Biannual Report on Global Food Markets. October 2016Nessuna valutazione finora

- WPIInflation August2013Documento5 pagineWPIInflation August2013Angel BrokingNessuna valutazione finora

- Technical & Derivative Analysis Weekly-14092013Documento6 pagineTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Documento6 pagineDaily Metals and Energy Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Report September 16 2013Documento9 pagineDaily Agri Report September 16 2013Angel BrokingNessuna valutazione finora

- Oilseeds and Edible Oil UpdateDocumento9 pagineOilseeds and Edible Oil UpdateAngel BrokingNessuna valutazione finora

- Commodities Weekly Outlook 16-09-13 To 20-09-13Documento6 pagineCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNessuna valutazione finora

- Metal and Energy Tech Report November 12Documento2 pagineMetal and Energy Tech Report November 12Angel BrokingNessuna valutazione finora

- Special Technical Report On NCDEX Oct SoyabeanDocumento2 pagineSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNessuna valutazione finora

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 pagineRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNessuna valutazione finora

- International Commodities Evening Update September 16 2013Documento3 pagineInternational Commodities Evening Update September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 16 2013Documento2 pagineDaily Agri Tech Report September 16 2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 14 2013Documento2 pagineDaily Agri Tech Report September 14 2013Angel BrokingNessuna valutazione finora

- Commodities Weekly Tracker 16th Sept 2013Documento23 pagineCommodities Weekly Tracker 16th Sept 2013Angel BrokingNessuna valutazione finora

- Currency Daily Report September 16 2013Documento4 pagineCurrency Daily Report September 16 2013Angel BrokingNessuna valutazione finora

- Derivatives Report 16 Sept 2013Documento3 pagineDerivatives Report 16 Sept 2013Angel BrokingNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Sugar Update Sepetmber 2013Documento7 pagineSugar Update Sepetmber 2013Angel BrokingNessuna valutazione finora

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 pagineDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNessuna valutazione finora

- Technical Report 13.09.2013Documento4 pagineTechnical Report 13.09.2013Angel BrokingNessuna valutazione finora

- Market Outlook 13-09-2013Documento12 pagineMarket Outlook 13-09-2013Angel BrokingNessuna valutazione finora

- TechMahindra CompanyUpdateDocumento4 pagineTechMahindra CompanyUpdateAngel BrokingNessuna valutazione finora

- Derivatives Report 8th JanDocumento3 pagineDerivatives Report 8th JanAngel BrokingNessuna valutazione finora

- MarketStrategy September2013Documento4 pagineMarketStrategy September2013Angel BrokingNessuna valutazione finora

- IIP CPIDataReleaseDocumento5 pagineIIP CPIDataReleaseAngel BrokingNessuna valutazione finora

- MetalSectorUpdate September2013Documento10 pagineMetalSectorUpdate September2013Angel BrokingNessuna valutazione finora

- Daily Agri Tech Report September 06 2013Documento2 pagineDaily Agri Tech Report September 06 2013Angel BrokingNessuna valutazione finora

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 paginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNessuna valutazione finora

- Metal and Energy Tech Report Sept 13Documento2 pagineMetal and Energy Tech Report Sept 13Angel BrokingNessuna valutazione finora

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 pagineTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNessuna valutazione finora

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 pagineJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNessuna valutazione finora

- Remedial Kelas 8 - Reading NarrativeDocumento6 pagineRemedial Kelas 8 - Reading NarrativeAji RamdaniNessuna valutazione finora

- Prime Burger Dinner Menu 07.01.14Documento2 paginePrime Burger Dinner Menu 07.01.14Danielle DawsonNessuna valutazione finora

- Ketahanan Pangan Dan Kemiskinan Di Provinsi AcehDocumento12 pagineKetahanan Pangan Dan Kemiskinan Di Provinsi Acehaisyah pratiwiNessuna valutazione finora

- 46th Croatian & 6th International Symposium On AgricultureDocumento5 pagine46th Croatian & 6th International Symposium On AgriculturevikeshchemNessuna valutazione finora

- Ihegboro IfeomaDocumento118 pagineIhegboro Ifeomaareola olamilekanNessuna valutazione finora

- Question Bank BioDocumento19 pagineQuestion Bank BioMr Sony MathewNessuna valutazione finora

- Agricultural Economics All Courses 1Documento9 pagineAgricultural Economics All Courses 1Rashmi RaniNessuna valutazione finora

- Innocent Life Walkthrough 2Documento53 pagineInnocent Life Walkthrough 2Paul Arvi ReyesNessuna valutazione finora

- 1 Festival in Every RegionDocumento5 pagine1 Festival in Every RegionLiz A. LastradoNessuna valutazione finora

- Unit4 Module 2 Interactions Mms123Documento54 pagineUnit4 Module 2 Interactions Mms123Lebiram Mabz91% (11)

- Lecture 01 - Agricultural Biotechnology - History & ScopeDocumento16 pagineLecture 01 - Agricultural Biotechnology - History & Scoperajiv pathakNessuna valutazione finora

- Agronomy: Response of Drip Irrigation and Fertigation On Cumin Yield, Quality, and Water-Use E Arid Climatic ConditionsDocumento16 pagineAgronomy: Response of Drip Irrigation and Fertigation On Cumin Yield, Quality, and Water-Use E Arid Climatic ConditionsAli HamzaNessuna valutazione finora

- ANDIG1Documento23 pagineANDIG1Manolo MuñozNessuna valutazione finora

- MULGAN-Power and Pork-A Japanese Political LifeDocumento283 pagineMULGAN-Power and Pork-A Japanese Political Lifeapi-3729424Nessuna valutazione finora

- Gen. Chemistry 2 - LAS NO. 2 - JohnJosephS - Castro - VERSION 4Documento5 pagineGen. Chemistry 2 - LAS NO. 2 - JohnJosephS - Castro - VERSION 4Hannah DennisehNessuna valutazione finora

- Watermelon PublicationDocumento21 pagineWatermelon PublicationGelo DizonNessuna valutazione finora

- South Korea's Industrial Development and Role of GovernmentDocumento24 pagineSouth Korea's Industrial Development and Role of GovernmentKamrul MozahidNessuna valutazione finora

- POMAKS-the People On The Crossroads: Mina Petrova BulgariaDocumento13 paginePOMAKS-the People On The Crossroads: Mina Petrova BulgariaMina Petrova PetrovaNessuna valutazione finora

- Agriculture Grade 11 Unit 1Documento48 pagineAgriculture Grade 11 Unit 1tsi92816100% (1)

- 5 Questions - Look and Read. Choose The Correct Words and Write Them On The Lines. There Is One ExampleDocumento11 pagine5 Questions - Look and Read. Choose The Correct Words and Write Them On The Lines. There Is One ExampleDai PhanNessuna valutazione finora

- Kapeng Barako OriginDocumento2 pagineKapeng Barako OriginCes UniqueNessuna valutazione finora

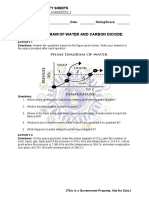

- Basic Hydrology ExperimentsDocumento3 pagineBasic Hydrology ExperimentsShaukat Ali Khan100% (1)

- Inauguration of The Seabass Harvest Function at Uppunda by Dr. Madan Mohan, ADG (Marine Fisheries), ICARDocumento30 pagineInauguration of The Seabass Harvest Function at Uppunda by Dr. Madan Mohan, ADG (Marine Fisheries), ICARNehaNessuna valutazione finora

- Pigeon & Dove RescueDocumento270 paginePigeon & Dove RescuestormbrushNessuna valutazione finora

- Simple P Ent Story 1: ReallyDocumento8 pagineSimple P Ent Story 1: ReallyMichele TerrebleNessuna valutazione finora

- River Bank ProtectionDocumento20 pagineRiver Bank ProtectionNurali MamenNessuna valutazione finora

- PAES 303-2000roller Chains and Sprockets For Agricultural Machines - SpecificDocumento30 paginePAES 303-2000roller Chains and Sprockets For Agricultural Machines - SpecificYanYan CustodioNessuna valutazione finora