Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ABL Toseef Word 2003

Caricato da

Ahsan LaghariDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ABL Toseef Word 2003

Caricato da

Ahsan LaghariCopyright:

Formati disponibili

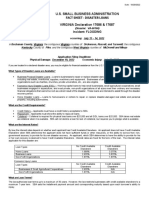

Internship Report on ABL Limited

The Allied Bank

Internship Report

(2011) Master of Business Administration Muhammad Toseef Rizwan SP10-MBA-025 FINANCE 0332-5445784 0346-7925510 toseefrizwan@yahoo.com

COMSATS Institute of Information Technology (WAH Cantt

New bus stands near Pakistan state oil patrol pamp branch kabirwala (0201) 065-2411536-326 Supervisor by Bank Sayed Ali Husnain Shah 065-2411536-325 Starting Date of internship: 01-07-201 Ending Date of internship: 13-08-2011 Report Date: 26-12-2011 Department of Management Sciences 1

Internship Report on ABL Limited

The Allied Bank

Evaluation

Muhammad Toseef Rizwan Completed Internship at ABL new bus stands near PSO patrol pump (0201) Internship Report submitted for the final Evaluation in Partial Fulfillment of the requirement for the Degree of Master in Business Administration It is certified that, the Internship report and the work contained in it conforms to all the standards set by the Institute for the evaluation of any such work.

1. 2. 3. 4.

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

Dedication

I would like to dedicate This internship report To my honorable teachers And my special regards to my most respectful affectionate Loving parents who always prayed my success and betterment.

ACKNOWLEDGEMENT

In the name of ALMIGHTY ALLAH, the most Gracious, Merciful and Compassionate, the creator of the universe, who enabled us to complete this internship, report work successfully. I would also like to thank Branch Manager of branch and branch staff helping and guiding me throughout my learning period. I am thankful specially my parents who help me in every step. Last but not least I would love to thank all my friends for their undying support, help and for being there whenever I need them.

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

PREFACE

In order to be able to cope with the changing environment it is necessary to have some practical experience. As the students of Business Administration we have to pass through a series of various managerial techniques. During this practical course we are provided with an opportunity to learn that how the theoretical knowledge can be implemented in practical grounds. I was selected to do my internship in Allied bank limited Branch Kabirwala. I worked there for six weeks & it gave me a greater practical knowledge about the operations of a bank. In the following pages I have narrated my experience, observations & all the working activities which I observed during my six week internship at ALLIED BANK LIMITED BRANCH KABIRWALA.

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

TABLE OF CONTENTS

Topic

Acknowledgement EXECUTIVE SUMMAR INTRODUCTION TO STUDY

Introduction Scope of the study Methodology of the study

Page No. 3 7 8

8 9 9

IMPORTANCE OF BANKING

Introduction Definition of the Bank Major Function of The commercial Bank Accepting Deposit Making Loans and Advances Over Draft Facility Transfer of Money Investment Role of Commercial Bank Capital Formation Investment in new Enterprises Creator and Distributor of Money Balance Development Helping in Monetary Policy 9

9

9 9 11 11 12 12 12 12 13 13 13 13 14

HISTORICAL BACKGROUND

Origin of Banking Historical Background of Banking in Pakistan Brief History of allied Bank limited Vision Statement Mission Statement Core Values Organization Objectives

14

14 14 16 17 17 17 18

ORGANIZATIONAL STRUCTURE

General Outlook Organization Hierarchy Functional of Hierarchy Board of Director Management Team Department of Management Sciences

18

18 20 21 22 23 5

Internship Report on ABL Limited

The Allied Bank

Domestic Network

24

DEPOSITS DEPARTMENTS

Introduction Types of allied Bank Account PLS Account Current Account Allied Business Account Allied Basic Banking Account Allied E-Severs Account Foreign Currency Deposits Monthly Profit plus Account Allied Advance Profit Scheme Behtar Munafa Account Behtar Munafa Term Deposit Allied Bichat Scheme Rewarding Term Deposit Account Allied Rising Star Account Opening Procedure

28

28 28 29 29 30 30 31 32 32 33 34 36 336 38 39 40

REMITTANCES /CLEARING DEPARTMENT

Introduction Mail Transfer Telegraph Transfer Demand Draft Demand Draft Payment Pay Order Rupee Travellers Cheques

40

40 41 41 41 42 43 43

ADVANCES/FINANCES DEPARTMENT

Introduction Types of Credit Running Finance Cash Finance Demand Finance Agriculture Finance House Building Finance Types of Advances by Allied Bank Limited Procedure For Applying Loan

42

43 44 44 44 45 45 45 45 46

FOREIGN EXCHANGE DEPARTMENT

Introduction Foreign Currency Account Saving Deposit Department of Management Sciences

47

47 48 48 6

Internship Report on ABL Limited

The Allied Bank

Fixed Deposit Current Deposit Travelers Cheques Sales and Purchase of the Foreign Currency Letter of Credit

48 49 49 49 50

MY LEARNING EXPERIENCE FINANCIAL ANALYSIS

Introduction Financial Statements Balance Sheet Statement Profit and Loss Account Statement Analysis of the Financial Statement Index or Horizontal Analysis Index Analysis of Balance Sheet Index Analysis of Profit and Loss Account Common Size or Vertical Analysis Vertical Analysis of Balance Sheet Vertical Analysis of Profit and Loss Account Ratio Analysis

51 53

53 53 54 55 56 58 58 60 61 61 63 64

SWOT ANALYSIS

Strength Weakness Opportunities Threats

80

80 81 82 83

FINDINGS & RECOMMENDATION

Findings Recommendation Conclusion

84

84 87 89

ACTION PLAN

90

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

EXECUTIVE SUMMARY

This document provided details of my achievements in term of practical implementation and understanding of working environment in banks. I had started my internship from Allied Bank Limited kabirwala Branch. From 1st July to 13th august. During the internship I have learnt basic banking work and a lot of practical work which I had not acknowledged before. I worked in different departments and learnt basic operations of the departments that departments are. Account opening department, Clearing department, Remittance department Calling and sorting department etc. I have spent most of my time in Account opening department and hence I learnt what professional attitude to adopt while dealing with external as well as internal customers. I have filled out the different vouchers and slips such as Current Account slip, PLS Saving Account deposit slip, clearing vouchers; online inter branch transaction slip etc. And this document provided aspect of Allied bank limited and one of its branch kabirwala Base. This report is composed of the ABL History, ABL introduction, organizational structure, finance structure, its different Analysis such as critical analysis and SWOT analysis. . Through analysis I found some problems that exist in ABL. At the end I gave some suggestion to improve organization structure and solve these problems.

INTRODUCTION TO STUDY

This is an introductory chapter, which describes the background, purpose, scope, methodology of the report.

INTRODUCTION TO STUDY

Purpose of Study Department of Management Sciences 8

Internship Report on ABL Limited

The Allied Bank

The purpose of the report is to review and analyze the functions performed by ABL. Also to get training in real life situations, applying management knowledge in practice, improving personal skills i.e. human relations, working with people and interviewing people. To write an analytical report on the systems and procedures followed by the organization. Scope of Work This report is concerned with the performance of branch namely, ABL kabirwala Branch. The report brings to light the various functions at the branches however the financial analysis is based on the national operations of the bank. All the branches perform banking services for its customers such as remittances, deposits, advances, foreign exchange etc. The report also covers the credit process including credit procedure and problems relating to the credit. Methodology of Report The methodology for the collection of information and data is based on the two primary modes of data. Primary Data: i. Personal Observation in case where compilation of the data related to 2010 was required which was only possible through personal observation. Secondary Data: i. ii. iii. iv. Web sites. Annual Reports. Bank Manual. News Papers.

IMPORTANCE OF BANKING

This chapter encompasses the major functions of commercial banks and the role of commercial banks in the economic development of Pakistan. Department of Management Sciences 9

Internship Report on ABL Limited

The Allied Bank

INTRODUCTION

It has not so far been decided as to how the word Bank originated. Some authors opine that this word is derived from the words Bancus or Banque which means a bench. The explanation of this origin is attributed to the fact that the Jews in Lombardy transacted the business of money exchange on benches in the market place. Incidentally the word Bankrupt is said to have been evolved from this practice. The opponents of this opinion argue that if it was so, then how it that the Italian money changers were never is called Banchierei in the Middle Ages Other authorities are of the opinion that the word Bank is derived from the Geneva word Back, which means joint stock fund. Later on, when the Germans occupied major part of Italy, the word Bank was italicized into Bank.

MODRN DEFINITION OF BANKS

Banks are the companies which transact the business of banking. The companies operate in accordance with the provisions of the Banking companies ordinance, 1962 section 5(b), which states that Banking means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheques, drafts, and order or otherwise.

MAJOR FUNCTIONS OF THE COMMERCIAL BANKS

The following functions are the major functions of the commercial banks: Accepting deposits Making Loans and advance Overdraft Facility Discounting of Bill 10

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

A)

Cheap Medium of Exchange Transfer of Money Investment ACCEPTING DEPOSIT

The primary function of Allied Bank is to accept and receive surplus money from the people, which they willingly deposit with the Bank. Like all other banks, Allied Bank also tries hard to attract as much deposits of the people as it can. It is therefore it offers different types of deposit schemes to its clients, which includes the following types. i) Current Deposits:

Current deposits are those deposits on which bank offers no interest but it allows the account holders to withdraw their money at any time they want without giving any prior notice to the bank. This type of account is often maintained by the business community, which requires large sums of money very often for their business transaction. ii) Profit And Loss Sharing Account (Saving):

Saving deposit or PLS are those accounts on which bank offers a lower rate of interest and on such deposits; the bank pays very low interest to its customers. After the Islamization of the banking system in the country it has been given the name of PLS saving account. The Bank undertakes to repay deposits on demand up to a certain limit. iii) Fixed Deposits:

Fixed deposits are those, which can be withdrawn only after the maturity of the account. In this type of deposits the Bank allows high rates of interest depending on the time period of deposits. The shorter the period of deposits, the less will be the interest and vice versa.

Department of Management Sciences

11

Internship Report on ABL Limited

The Allied Bank

B)

MAKING LOANS AND ADVANCES

The second major functions of commercial Banks are to make loans and advance to the businessman, traders, exporters, etc. These loans are made against document of title to goods, marketable securities, personal security of the borrowers etc. C) OVERDRAFT FACILITY

It also provides the overdraft facility to its clients. The credit which a bank wants to issue, it is deposited in the account of a debtor in this regard sometimes limit is fixed by the bank for customer up to that particular limit one person can draw an amount, up to that limit. D) DISCOUNTING OF BILLS

Commercial banks also discount the bills and facilities the business for example one businessman purchase anything from other person and promise to pay after one month. The seller will write a bill the buyer and there will be an order that after one month the buyer will pay an amount to the seller. Buyer will sign on the bill in other words if seller is in needs of money he will take it to the bank and will receive the money by discount the bills. E) CHEAP MEDIUM OF EXCHANGE

By using cheques and drafts bank provides cheap medium of exchange. F) TRANSFAR OF MONEY

The commercial bank is very helpful in transferring the money from one place to another by issuing the drafts, payment orders, call deposit, SDRs and through online system which is the quickest mode for transfer of money. I) INVESTMENT

Bank also makes an investment in different companies and industries. Department of Management Sciences 12

Internship Report on ABL Limited

The Allied Bank

ROLE OF COMMERCIAL BANK

Role of Commercial Banks in the Economic Development of Pakistan. Without developed banking system the economy of a country cannot flourish easily and strongly. It will never reach its destination. As the commercial banks plays a very important role in the economic development of any country, which we can discuss as under. a) CAPITAL FORMATION

As we know that development without capital is impossible. So capital is basic requirement of country. In this regard bank plays as active role. The bank stimulates savings and mobilizes the resources for further investment in various sectors. b) INVESTMENT IN NEW ENTREPRESIS

The commercial banks provide capital to the new entrepreneur to take risk and invest in new enterprises. The commercial banks thus help in increasing the production capacity of the economy. c) CRREATOR AND DISTRIBUTOR OF MONEY

Commercial bank is creator and distributor of money. The bank purchases securities and others and allow money for the various productive sources. d) BALANCED DEVELOPMENT

Commercial banks play active role in balanced development in different regions of the country. They help in transferring the funds to develop to less developed area. The less developed area thus get adequate fund for development. e) DEVELOPMENT OF AGRICULTURE AND INDUSTRIES

Commercial banks particularly in developing countries are providing short, medium and long terms loans for the development of area. SBP allocates annual mandatory credit targets for agriculture Department of Management Sciences 13

Internship Report on ABL Limited

The Allied Bank

sector. ABL tries its best to achieve these mandatory targets, thus attributing much more towards the development of economy. f) HELP IN MONETORY POLICY

The control of credit and regulative by the central bank of a country is only possible and effective with co-operation of the banking system in the country. ABL plays its role in this regard.

HISTORICAL BACKGROUND

ORIGIN OF BANKING

.In the middle of 12th century banks were established at Venice and Genoa. Again in 14th century, money lenders in Florence were found. They received money as deposits and also landed money. Generally the word Bank originated in Italy. In the middle of 12th century there was a great financial crisis in Italy due to the war. To meet the war expenses the Government of the period imposed a forced subscribed loan on citizens of the country at the interest of 5% per annum. Such loans were known as Compare Mintuo etc. The development of banking can be divided into various stages. Some are also of the opinion that the word Bank has been derived from the Italian word Banco which means a bench. The Jew money lenders in Italy used to transact their business settings on benches at different market places, if one of them failed to meet his obligations, his Blanco or bench would be broken by the angry creditors. The word bankrupt seems to have evolved from such broken Bancs. Since the banking system originated from money lending business, it is rightly argued that the word bank originated from the word Banco. The 1st stage in development of banking was accepting of deposits of cash from people. The 2nd stage included issuance of bank notes by gold smiths for the money deposited with them. Department of Management Sciences 14

Internship Report on ABL Limited

The Allied Bank

The 3rd stage the lenders started to enjoy charging interests. The 4th stage allowed the depositors overdraft facilities.

HISTORICAL BACKGROUND OF BANKING IN PAKISTAN

The banking system of a country refers to the working process followed by the banking institution. It is defined through a relationship between the apex bank (central bank) and the other banks operating in the country. It embodies the principles and practices relating to the banking transactions prevalent in the country. In Pakistan, there is a central banking system controlled by the state bank of Pakistan which is the central bank. Because the state bank has the monopoly of money supply and is the custodian of foreign exchange resources, it also controls and deregulates the monetary system, so as to stabilize the economy of the state. In the way the central bank (SBP) corrects and controls the activities of other banks operating in the economy .It guides the other commercial banks through the monetary measurements which are very useful for the economic development of our country. Unfortunately the historical background of the banking system in Pakistan was not good and sound. At the time of independence (1947) majority of the offices and staff working in the banks were non-Muslim who migrated to India and they created a serious hiatus which could not be covered due to the lack and absence of professional individuals in the local population. At the time of partition there were 631 offices of schedule banks (having a paid up capital of Rs 5 lac or more). West Pakistan contained 487 and East Pakistan 144 such offices. As a result of transfer of head offices of schedule banks to India by non-Muslim in July, 1948, the number of bank offices was reduce to 81 in west Pakistan and 114 in East Pakistan causing an overall reduction from 631 to 195. There were only two Pakistani banks namely Habib bank Ltd and the Australia bank with their head offices in Pakistan.

Department of Management Sciences

15

Internship Report on ABL Limited

The Allied Bank

However, the challenge was successfully met and the central bank of the country (SBP) was established on July, 1948. The bank took immediate steps necessary for establishing a national banking system in the country. It recommended to the Govt. to establish a new bank, as an agent of the state bank as well as a speared head of its credit policy. The suggestion was accepted by the Govt. and national bank of Pakistan came into existence in November 1949. This bank also helped ABL to expand its organization. From here onward a rapid development took place in the banking system of country. Currency note of the value of Rs 5, Rs 10, Rs 50, and Rs 100 were issued by the state bank for the 1st time in October 1948 and by August 1949, all currency notes issued by Reserve bank of India were with drawn and replace by Pakistani currency. Under the bank nationalization Act of 1974 the commercial banks were nationalized in January 1974. The Nationalized bank includes Habib Bank, United Bank, Allied Bank, Muslim Commercial Bank and National Bank. Beside these nationalized commercial banks (NCBS) and other commercial bank in the private sector, there are certain foreign banks operating in Pakistan like City Bank, ANZ grind lays Bank, Bank Almashriq, Bank of Uman, Bank Alfalah, Meezan Bank, Faisal Bank etc. These foreign banks are under the administrative control of state bank being the central bank of the country.

BRIEF HISTORY OF ALLIED BANK LIMITED

Commercial banks are playing vital role in the development activities covering all spheres of economy of the country. But at the independence, Pakistan had only 755 branches of commercial banks which were further reduced to 195 as a number of branches of different banks shifted to India or U.K at the time of independence there were two main banks of Muslim community i.e. Habib bank limited and Australasia bank limited remained with Pakistan and took over the task of development of banking in Pakistan.

Department of Management Sciences

16

Internship Report on ABL Limited

The Allied Bank

Australasia bank limited was the first Muslim bank which was established on the soil of Pakistan on December 3rd, 1942. ABL contributing its role in the growth and structure of banking system in Pakistan. Under the Banks (Nationalization) Act 1974, all commercial bank were nationalized. Due to it three regional Banks namely Sarhad bank, Pak bank and Lahore Commercial bank were merged into Australasia bank with effect from July 1st 1974, and were renamed as Allied bank of Pakistan Limited. On September 12, 1991 Allied bank became the worlds first bank to be owned and managed by its employees. In August 2004, because of capital reconstruction, the Banks ownership was transferred to a consortium comprising Ibrahim Leasing Limited and Ibrahim Group.

VISION STATEMENT

To become a dynamic and efficient bank providing integrated solutions in order to be the first choice bank for the customers.

MISSION STATEMENT

To provide value added services to our customers. To provide high tech innovative solutions to meet customers' requirements. To create sustainable value through growth, efficiency and diversity for all stakeholders. To provide a challenging work environment and reward dedicated team members according to their abilities and performance.

To play a proactive role in contributing towards the society.

CORE VALUES

Integrity Excellence in Service

Department of Management Sciences

17

Internship Report on ABL Limited

The Allied Bank

High Performance Innovation and Growth

ORGANIZATIONAL OBJACTIVES

Objectives are the ends towards which activity is aimed. These are the result to be achieved. As a commercial bank the primary objectives is to earn profit and maximize it as far as possible. As a commercial business the Allied Bank Ltd. has the following main objectives.

To take measure to promote business in the country. To procure self-employment schemes to the people. To supply or provide employment opportunities to the people. To earn profit for the bank itself and for its shareholders. To help in the development and industrialization of the country.

ORGANIZATIONAL STRUCTURE

GENERAL

General Outlook

OUTLOOK

Organizing is a process of breaking down the overall tasks of the enterprise into individual assignments / activities and then getting them put together in units or departments or groups along with the delegation of authority to a manager/ Head of a unit / departments / group. Organizational structure implies a formalized intentional structure of roles and position. This is not the end in itself, rather a means with which to help achieve certain objectives. A well developed and properly coordinated structure is an extremely important requirement for the successful Department of Management Sciences 18

Internship Report on ABL Limited

The Allied Bank

operation of any organization. It provides the basic framework within which functions and procedures are performed. Organizational structure is the formal hierarchy for management, decision making, establishing accountability, reporting & control. The structure defines line of authority and is based on the functions of the organization and its business, segmented in to departments but interlinked according to the nature of activities performed. There are four main types of organizational structures. Vertical organization Flat organization Matrix organization Hybrid organization

Vertical structure is a management structure characterized by an overall narrow span & relatively more hierarchal levels 1.It is also called top to bottom structure .On the other hand, flat structure is a management structure characterized by an overall broad span of control and relatively few hierarchal levels. The flat level is horizontally dispersed and is a new type of structure. Matrix Structure is an organizational structure that assigns specialists from different functional departments to work on one or more projects being led by project managers. Hybrid structure is a blend of two or more different types of organization design. A hybrid organization is formed that has different levels of the organizational design. The organization chart is represented in the form of an organizational chart, arranged. The chart provides the picture of the operating structure and the decision of labor.

Department of Management Sciences

19

Internship Report on ABL Limited

The Allied Bank

ORGANIZATION HIERAREHY

The organization hierarchy represents the different positions and designations in the hierarchy of the ABL. However, this is not the reporting hierarchy but merely represents the positions and grades on the basis of seniority and grades.

President

Senior Vice President

Vice President Executive Vice President Senior Executive Vice President [rosodmemtPresident Regional Head Managerxecutive Vice President Branch Manager Department of Management Sciences

20

Internship Report on ABL Limited

The Allied Bank

FUNCTIONAL HIERARCHY

The functional hierarchy represents the reporting order in the hierarchy of ABL. The hierarchy has president and directors at top management level and officers Grade I, II and Grade III at the lower level management of ABL. The middle level management consists of regional general Manager and Regional Controller of Operations. These positions are not fixed. Any person in the hierarchy above the branch manager can be appointed as RGM and controller operations.

President and CEO Board of Director Head of Departments

Regional General Manager

Controllers of Operation Branch Manager

Department of Management Sciences

21

Internship Report on ABL Limited

The Allied Bank

Office G-I, II and other lower Staff

BOARD OF DIRECTORS

Pervaiz Iqbal Butt (Director)

Mohammad Waseem Mukhtar (Director)

Farrakh Qayyum (Director)

Sheikh Mukhtar Ahmed (Director)

Abdul Aziz Khan (Director)

Tasneem M. Noorani (Director)

Sheikh Jalees Ahmed (Director)

Nazrat Bashir (Director)

Mohammad Aftab Manzoor\ (CEO)

Mubashir A. Akhtar (Director)

Mohammad Naeem Mukhtar (Chairman) Department of Management Sciences

22

Internship Report on ABL Limited

The Allied Bank

MANAGEMENT TEAM:

Asim Tufail (Group Chief, Consumer & Personal Banking)

Fareed Vardag (Chief Risk Officer)

Iqbal Zaidi (Group Chief, Compliance)

Mohammad Abbas Sheikh (Group Chief, Special Assets Management)

Mohammad Aftab Manzoor (Chief Executive Officer)

Muhammad Jawaid Iqbal (Group Chief, Coprate & Investment Banking)

Muhammad Yaseen (Group Chief, Treasury)

Mujahid Ali (Group Chief, Information Technology)

Department of Management Sciences

23

Internship Report on ABL Limited

The Allied Bank

Shafique Ahmed Uqaili (Group Chief, Human Resources)

Syed Shahid Raza (Head, Business Transformation Team)

Tahir Hassan Qureshi (Chief Financial Officer)

Tariq Mehmood (Group Chief, Operations)

Waheed ur Rehman (Company Secretary)

Zia Ijaz (Group Chief, Commercial & Retail Banking)

Head Office/Registered Office 8-Kashmir/Egerton Road, Lahore. Ph: 92-42-111 110 110 Central Office Khyaban-e-iqbal,main Clifton road bath island Karachi pakistan.ph:92-21-111 110 110

DOMESTIC NETWORK

Allied bank has a domestic network of 830 branches and 580 ATMs have been installed to provide instant banking facility round the clock. Through these Machines ABL offers its customers most wanted banking facilities like account balance enquiry, account mini statement, fund transfer not only to other ABL branch but also to account of other Bank, request for new cheque book and Department of Management Sciences 24

Internship Report on ABL Limited

The Allied Bank

depositing of utility bills. Besides 4 branches in the United Kingdom about 60 domestic branches of the bank spread all over the country are authorized to deal in foreign exchange. There is a network of 59 foreign correspondents of the banks all over the world. In the domestic field operations ABL has established its presence all over the country. Its field operation is one of the most extensive among the leading banks in Pakistan.

Total customers Employees Total branches Total ATMs Regional Head Quarters

4,605,000 6,747 830 580 28

Administratively the bank has been mainly divided in four groups, namely North, South, Central-1 and Central-2. Further there are 28 Regional Head Quarters being the down line controlling offices. For the internal control over this administrative and operational setup in the shape of branches and Department of Management Sciences 25

Internship Report on ABL Limited

The Allied Bank

various controlling offices, there are regional audit offices which scrutinize the affairs of branches and controlling offices.

Department of Management Sciences

26

Internship Report on ABL Limited

The Allied Bank

Department of Management Sciences

27

Internship Report on ABL Limited

The Allied Bank

The details of these regions are given below Regions Abbottabad Region Bahawalpur Faisalabad Gujranwala Hyderabad Islamabad Karachi Lahore Mardan Mirpur (AJK) Multan ISLAMABAD Quetta Sargodha Sialkot Sukkar Email coablatd@brain.net.pk ro_bahawalpur@ikr.abl.com.pk ablcircle@fds.comsats.net.pk ro_gujranwala@lhr.abl.com.pk ro_hyderabad@abl.com.pk ro_Islamabad@isb.abl.com.pk ro_karachi@abl.com.pk ro_lahore@lhr.abl.com.pk allieds@brain.net.pk ro_Mirpurak@isb.abl.com.pk ro_multani@lhr.abl.com.pk ro_peshwar@isb.abl.com.pk ro_quetta@abl.com.pk ro_surgodha@lhr.abl.com.pk ro_sialkot@lhr.abl.com.pk ro_sukkir@abl.com.pk

Department of Management Sciences

28

Internship Report on ABL Limited

The Allied Bank

DEPOSIT DEPARTMENT

This chapter includes the deposits department and its various types. Also present is information about accounts cheques. INTRODUCTION Deposits are the backbone of any financial institution. Deposits are used mainly for lending onward at higher rate than the rate on which they are acquired. Hence, a bank must have a dependable deposit base to ensure its sound operations. Deposit transactions essentially give rise to a unique relationship which stems from the establishment of trust and commitment between the banker and the customer. By accepting the deposit, the bank automatically enters into a binding contract to act as a trustee, taking due care of the customers interest. It is thus, of utmost importance that operational procedures are well defined and elaborated, and correctly applied so as to avoid any operational error which may lead to any false commitment and misunderstanding between the parties to the transaction. The fund is deposited with commercial bank are classified under four main heads:

TYPES OF ALLIED BANK ACCOUNT

PLS Account Current Account Allied Business Account Allied Basic Banking Account Allied E-Savers Account Foreign Currency Deposits 29

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

Monthly Profit Plus Allied Advance Profit scheme Behtar Munafa Account Behtar Munafa Term Deposit Allied Bachat Scheme Rewarding Term Deposit Rewarding Profit Account Allied Rising Star

PLS ACCOUNT

Allied Bank offers the PLS Savings Account facility to its customers with the following attractive features. Attractive return of up to 5.00% per annum Free Cash Deposit / Withdrawal / account to account transfer within city. Free Online Transactions, DD/TT/PO for depositors maintaining an average monthly balance of Rs. 2.500 (M) & above Free issuance of cheque book at the time of account opening

CURRENT ACCOUNT

Allied Bank offers the Current Account facility to its customers with the following attractive features.

Department of Management Sciences

30

Internship Report on ABL Limited

The Allied Bank

Allied Bank offers the Current Account facility for individuals as well as for institutions and commercial customers.

There are free Online Transactions, DD/TT/PO for depositors maintaining an average monthly balance of Rs. 0.5 (M) & above.

Free issuance of cheque book at the time of account opening. Free Cash Deposit / Withdrawal / account to account transfer within city.

ALLIED BUSINESS ACCOUNT

Enjoy unlimited freedom and convenience with numerous free services all with Allied Business Account. Now with your current account you can make unlimited transactions via 830 online Allied Bank branches. On maintaining a daily minimum balance of just Rs. 50,000, you can enjoy the following services FREE of charge:

FREE Pay Orders FREE Demand Drafts FREE Deposit FREE Withdrawals FREE Funds Transfer FREE Telephonic Transfer FREE Internet Banking No Cheque return charges FREE Nationwide Real-time Online Banking

Department of Management Sciences

31

Internship Report on ABL Limited

The Allied Bank

ALLIED BASIC BANKING ACCOUNT

In order to provide basic banking facilities to its lower-middle class customers, Allied Bank has introduced the Allied Basic Banking Account (ABBA). Following are the main attractive features of the (ABBA). Account can be opened with an initial deposit of Rs 1,000/= It is a non-remunerative account with a no minimum balance requirement. The Statement of Account is issued on a yearly basis. The account will be closed automatically if the balance remains zero for one year No service charges on the account for a maximum of 2-withdrawals and 2-deposits during a calendar month. Additional transactions will be subject to a service charge as per the Banks Schedule of Charges for every withdrawal/deposit. Unlimited withdrawals from ATMs

ALLIED E-SAVERS ACCOUNT

Saving has never been so flexible! The Allied e-Savers Account is a unique savings plan where you can earn returns as high as 7.5% with the convenience of 4 withdrawals a month!

ALLIED E-SAVERS

Slabs Rs. 400,00 up to Rs.1500,000 Rs.300,001 up to Rs.400,000 Rs.200,001 up to rs.300,000 Up to Rs.200,000 Salient Features: Department of Management Sciences 32 Profit rate 7.50% 6.00% 5.00% 5.00%

Internship Report on ABL Limited

The Allied Bank

Investment: Rs. 10,000 to Rs. 500,000. Profit: payable on Half Yearly basis. Expected Profit Rate: Up to 7.50% p.a. Eligibility: Individuals.

Additional Benefits: 24 hours phone banking service. Free Internet Banking facility SMS transaction alerts Allied Cash+Shop Visa Debit Card for cash withdrawals through any ATM including our largest network of ATMs across Pakistan and for debit transactions at various retail outlets First free cheque book - A/c Payee only

FOREIGN CURRENCY DEPOSIT

Allied Bank offers the facility of opening Current, Savings and Term deposit Accounts. Foreign Currency accounts can be opened in US Dollar, Pound Sterling, Euro, and Japanese Yen at designated branches.

MONTHLY PROFIT PLUS

Saving has now become all the more appealing with our Monthly Profit plus Scheme, which provides you monthly profits on investments. The scheme is designed for a period of 1 Year with the following profit rates: Tenure Profit Rate Department of Management Sciences 1 Year 11.00% p.a. 33

Internship Report on ABL Limited

The Allied Bank

Profit Payment

Rs.917 * per month

*- Approximate monthly returns calculated on the investment of Rs.100, 000 * Withholding tax, Zakat or other Government Levies are applicable separately Salient Features: Account Type: Term Deposit Term Period: 1 year Profit: Payable on monthly basis Minimum Deposit Amount: Rs.25, 000 Eligibility: Individuals & Institutions (other than financial institutions)

Additional Benefits: Chequing Account for monthly profit credit 24 hour phone banking service Free internet banking facility SMS transaction alerts Allied Cash + Shop Visa Debit Card

ALLIED ADVANCE PROFIT SHEME

In keeping with our objective to bring you new and innovative services and banking products, we now introduce Allied Advance Profit Scheme that gives the entire profit upfront. Department of Management Sciences 34

Internship Report on ABL Limited

The Allied Bank

Product Specifications:

Minimum Investment Amount Rs.25, 000

Investment Terms: 18 months Auto roll-over (optional)

Profit Payment: Profit of Rs.14, 000* will be immediately credited in the customers current accounts.*on an investment of Rs.100, 000 Tax/Zakat will be applicable as per rules Additional Features & Benefits Current account for regular banking needs Allied Cash+Shop Visa Debit Card financing facility of up to 80% on investment Free internet banking facility 24-hour phone banking service

BEHTAR MUNAFA ACCOUNT

A profit bearing Chequing account with attractive rate of return, paid on monthly basis. Rate of Profit:

Department of Management Sciences

35

Internship Report on ABL Limited

The Allied Bank

BEHTAR MUNAFA ACCOUNT Up to Rs.5,000,000 Rs.5,000,001 to Rs.25,000,000 Salient Features: Account Type: Chequing Account Rs.100,000,001 to Rs.250,000,000 Rs.250,000,001 to Rs.500,000,000 Rs.500,000,001 & above Rs.25,000,001 to Rs.50,000,000 Rs.50,000,001 to Rs.100,000,000

RATE

5.00% 6.00% 7.00% 7.50% 8.00% 8.50% 9.00%

Profit:

Payable on monthly basis Highest Profit: Up to 9.00% p.a. Eligibility: Individuals, and institutions

Additional Benefits: 24-hour phone banking service Free internet banking facility SMS transaction alerts Allied Cash + Shop Visa Debit Card

BEHTAR MUNAFA TERM DEPOSIT

Department of Management Sciences 36

Internship Report on ABL Limited

The Allied Bank

If you want to fix your money now to secure your future, this is the product for you. Rate of Profit: BEHTARMUNAFA TERM DEPOSITS: Up To Rs. 5,000,000 Rs.5,000,001 To Rs.25,000,000 Rs.25,000,001 To Rs.50,000,000 Rs.50,000,001 To Rs. 100,000,000 Rs.100,000,001& Above Salient Features: Account Type: Fixed Term Deposit Profit: Payable on maturity Highest Profit: Up to 9.00% p.a. Eligibility: Individuals, and institutions 1 MONTH 3 MONTH 5.00% 5.25% 5.50% 5.75% 6.00% 6.00% 6.50% 7.00% 7.50% 8.00% 6 MONTH 6.50% 7.00% 7.50% 8.00% 8.50% 1 YEAR 7.50% 8.00% 8.50% 8.75% 9.00%

ALLIED BACHAT SCHEME

Allied Bachat Scheme is a PLS Term Deposit Scheme based deposit scheme whereby you can double your investment in just 7.5 years.

Maturity Period: 7.5 years Minimum Deposit: Rs. 50,000/- with multiples of Rs. 10,000/Expected rate of Profit: The deposit amount will be doubled in 7.5 years.

Allied Bachat Scheme is a PLS Term Deposit Account, whereby you can double your investment in just 7.5 years This scheme comes with the following schedule of profit rates: Department of Management Sciences 37

Internship Report on ABL Limited

The Allied Bank

No. of Years 0 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5

Projected Rates ABL 0 7.00% 7.50% 8.00% 8.755 10.00% 10.25% 10.50% 10.755 11.00% 11.25% 11.50% 11.75% 12.00% 13.33%

Repayment amount 50,000.00 53,500.00 55,625.00 58,000.00 60,937.50 65,000.00 67,500.00 71,000.00 74,187.00 77,500.00 80,937.50 84,500.00 88,187.50 92,000.00 100.000.0

Salient Features: Maturity Period: 7.5 years Free Internet Banking facility Minimum Deposit: Rs. 50,000 (additional investment in multiples of Rs. 10,000) Expected Profit Rate: Up to 13.33% p.a. Eligibility: All individuals and institutions

REWARDING TERM DEPOSIT

Department of Management Sciences

38

Internship Report on ABL Limited

The Allied Bank

A term deposit scheme which gives a high rate of return and the flexibility of various tenure. Investment can be made with the minimum of PKR 25, 000 only. Rate of Profit:

DEPOSIT AMOUNT

Rs.25,000 to less than Rs.10 million Rs.10 million to less than Rs.100 million Rs.100 million & Above Salient Features: Account Type: Term Deposit Term Period: 1-12 months Investment: Rs. 25,000 & above Profit: Payable on maturity

1 Month

9.50%p.a 10.00%p.a 10.50%p.a

3 Months

9.75%p.a 10.50%p.a 11.00%p.a

6 Months 12 Months

10.00%p.a 11.00%p.a 11.25%p.a 11.25%p.a 11.75%p.a 12.00%p.a

Eligibility: Individuals & Institutions

REWARDING PROFIT ACCOUNT

Rewarding Profit Account is introduced for the customers who have liquidity and can manage to maintain sizeable monthly average balance and earn greater profit on it. Rate of Profit: Rewarding Profit Account Rs.10 million to less than Rs. 50 million Rs.50 million to less than Rs. 100 million Rs.100 million to less than Rs. 250 million Rs.250 million to less then Rs. 1 billion Department of Management Sciences 8.00% 9.00% 9.50% 10.50% 39

Internship Report on ABL Limited

The Allied Bank

Salient Features: Account type: Chequing Profit: Payable on monthly basis Maximum Investment Amount: Rs. 1 Billion Eligibility: Individuals, and institutions

Additional Benefits: 24-hour phone banking service

ALLIED RISING STAR

Youths 1st Bank Account is a savings account for all youngsters below 18 years of age. It can help you save your pocket money and earn daily profit. And when youve collected enough, theres so much you can do with your savings like buy your favorite books and toys or a special present for your mummy or daddy, or even carry on saving! So if youre below 18 years of age, you can open your very own Allied Rising Star.

ACCOUNT OPENING PROCEDURE

In every bank, there is a procedure through which the customer becomes the client of the bank. Through this procedure, various relationships are established i.e. debtor creditor etc. The bank opens an account in the following manner. AOF (Account Opening Form) The customer is required to fill the AOF of the bank and sign it in front of the concerned officer. Furthermore, his signatures are taken on a specimen signature (S.S) card which will help in verification of his signatures when a cheque is presented for payment. Copy of CNIC is also Department of Management Sciences 40

Internship Report on ABL Limited

The Allied Bank

provided by the customer and original CNIC is got verified from NADRA through online system. In case of rejection from NADRA the account is kept BLOCKED automatically. Inactive / Dormant Accounts Accounts having no transaction activity for 6 months are identified as inactive or dormant accounts by the bank.

REMITTANCES/CLEARING DEPARTMENT

This chapter deals with the Remittances/clearing and its working.

INTRODUCTION

Remittance means the transfer of funds. It is a mode of transferring money from one branch to another branch within the city/outside the city or outside the country. It is an order by a bank to its branch agent or correspondent in a foreign centre. It is an order to pay a specified sum of money to the person named in the instrument. The remittances department of ABL deals with the different funds transfer facilities for its customers. These facilities are discussed below.

MAIL TRANSFAR

When a customer requests the bank to transfer his money from this bank to any other bank or the branch of some other bank in the city/outside the city or out side the country the 1st thing he has to do is to fill an application form. In which he states that I want to transfer the money from this bank to another bank by mail. If the customer is account holder of the bank, then the bank will debit his account. The concerned officer will fill three different forms to make the mail transfer complete. The forms used for this purpose are listed below. Department of Management Sciences 41

Internship Report on ABL Limited a)

The Allied Bank

Debit voucher. Credit voucher. Mail transfer register.

b) c)

If the customer is not the account holder, then firstly, he has to deposits the money and then above said procedure will be adopted to transfer his money.

TELEGRAPHIC TRANSFAR (T.T)

This type of transfer is simple. After filling the application form the concerned officer fills the telegraphic form. This telegram is sent to the concerned bank which on receiving it immediately makes the payment to the customer and afterwards the vouchers are sent to that bank by ordinary mail.

DEMAND DRAFT

Demand draft is just like cheques and is issued when the customer wants to take the draft personally. The idea behind this is that as the cash is not safe to be kept along and a cheque in the shape of a draft is safer and one can easily get cash by presenting it in the bank, on whose favour it has been made. Draft is only issued when the customer is known to the bank and the bank has the confidence that the customer will not do anything wrong with the draft. For the preparation of a draft first of all the customer has to fill and application form. Then the concerned officer fills the following three forms (four in case of foreign exchanged involved) before delivering the draft to the customers. The forms full for this purpose are as follow:

a)

Credit voucher. 42

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

b) c)

Debit voucher. Demand draft registers.

ABL deals in two types of DDS:

1.

Open DD: It is one which is payable directly at the counter and crediting it to the account.

there is no need of

2.

Crossed DD: It is one which payment is done through account. The amount of DD is credited to the favoring account and then he can transact it in ordinary way through cheques.

DEMAND DRAFT PAYMENT

On receipt, DD is checked and verified and payment is made. If advice is not received, managers approval for payment is obtained. Only the applicant who has signed the application form has the right to cancel the DD. He has to make a request in writing.

PAY ORDER

Pay or (P.O) is the most convenient, simple and secure way of transfer of money. Pay order is banker cheque issued favoring a named beneficiary. Application for pay order is stamped and customers account balance is checked or cash received for the amount of pay order and other charges. Pay order leaf is typed and crossed if required and signed by two authorized signatories. It is used for local transfer only.

RUPEE TRAVELER CHEQUES

Department of Management Sciences 43

Internship Report on ABL Limited

The Allied Bank

Issuance of rupee traveler cheques is also an important function of remittances department. Now-adays ABRTCs of Rs.10000/- are issued bearing cost of Rs.5/- each. On issuance, the HO account is credited, and when cashed, the HO account is debited. On loss of ABRTCs, the details are communicated to the HO and the client is either repaid or new ABRTCs are issued.

ADVANCES F/ FINANCES DEPARTMENT

INTRODUCTION

The progress of a countries performance, especially a developing country is heavily dependent upon the dynamic growth of its industries, trade and commerce, as well as agriculture. ABL plays a pivotal role in ensuring the proper employment and distribution of funds for rapid, sustained growth in all these sectors of vital importance. Also, the indicators which mainly reflect the high quality of ABLs management are its prudent financing decisions, proper control of financing and prompt recovery of banks dues, as per borrowers commitment / repayment schedule. Keeping in view all these factors, SBP lays down the regulation / guidelines of credit policy and within this broad framework, ABL develops its own individual financing strategies and policies.

TYPES OF CREDITS

Credits can be classified as fund based which involves immediate provision of fund to the customer upon sanction of the respective lines. Whereas, the second i.e. Non Fund based are contingent facilities such as letter of credit, and letter of guarantees etc. On the basis of time period, credits can be classified as short term up to one year, medium term up to 3 years, and long term above 3 years.

RUNNING FINANCE

This is a multi transaction facility. The funds are allowed in the form of a limit to the customer and drawing power is created in his current account up to the sanctioned limit. The customer is allowed to with draw funds from his account in excess of available funds. The purpose of RF is meeting the Department of Management Sciences 44

Internship Report on ABL Limited

The Allied Bank

short term working capital requirement, usually for 1 year. Expiry date of this facility should fall on the last day of calendar quarter. Mark up is recovered at the end of each quarter. The sanctioned limit is enhanced on the request of borrower/ loanee keeping in view his provided business last year and repayment power.

CASH FINANCE

Cash finance is also called working capital. This finance is purely for manufacturing concerns this facility is provided against the pledge of inventory. The basic purpose is to enable the customer to purchase seasonal raw inventory. Customer can utilize the facility only when the goods are pledged and banks moqadama verifies the quality of pledged goods. This facility is sanctioned for a period of 1 year. This facility commences from the date of procurement of raw material. Since the goods are pledged in lots, therefore finance against each lot is required to be adjusted within 90 days or as the requirement of sanctioning authority. Markup is recovered at the time of issuance of delivery order and at the quarter and, Markup on the outstanding amount is calculated and collected from the customer.

DEMAND FINANCE

This facility is provided to meet short/long term requirements. Since this facility requires a bulk of funds, therefore, this facility is usually sanctioned for more than 1 year. At the time of issuance / sanction, a repayment schedule is prepared by the branch/ sanctioning authority, a copy of which is provided to the customer. Customer is required to pay installments according to repayment schedule.

AGRICULTURE FINANCE

Agriculture is the back bone of our economy. ABL also provides credit facilities to this segment of economy. ABL provides two types of loans to the agricultures. A) Production Loan: which is short term loan and is for the purpose of purchasing of seeds, fertilizers etc. Department of Management Sciences 45

Internship Report on ABL Limited

The Allied Bank

B)

Development Loan: which is for the purpose of development of land or purchase of machinery etc, related with the agriculture?

HOUSE BUILDING FINANCE

The bank extend house building Finance to customers, under the scheme envisaged by the state bank of Pakistan. The house building finance can be considered for the construction or purchases of house or flat. The silent features of this scheme are as under:

i)

The house building finance can be made to a person once in his or her life time. The House building Finance is considered for an amount of more than Rs 1, 50,000 and up to Rs 3, 00,000.

ii)

iii)

The house building Finance is admissible maximum up to 60 % of the value of house and flat to be constructed or purchased.

iv)

The house building finance is repayable during the maximum period of 15 years.

TYPES OF ADVANCES OFFER BY ABL

It is the loan function which produces the major portion of banks income; and as such it is one of the major areas of professional bankers concerned and attention. A bank generally deals in following areas: i) ii) iii) Agriculture Finance. Industrial finance. Export Finance

In addition to the above mention broad areas, there are loans available for small size business men, construction companies etc. In ABL advance department is responsible to deal with the Following cases. Department of Management Sciences 46

Internship Report on ABL Limited

The Allied Bank

i) ii) iii) iv) v) vi)

To handle all the cases of short and long term loans. To process all the loans concerned. To forward the cased for approval and consideration to the higher authorizer. To deal with borrower directly. To make disbursement of loans. To give feed back to higher authorities on advances.

PROCEDURE FOR APPLYING LOAS

Any customer who applies for loan should have an account usually current account with ABL branch concerned. The account must be in running position. When approval comes bank give terrns and conditions to the party. Bank does not advance 100 % loan against a security. Rather a 30 % margin is deducted from all loans. The borrower has to provide some important documents i.e. a) b) c) Charge form Confidential report. Two personal guarantee.

Charge form is taken from party, if it turns bankrupt, bank go to court of law then this agreement helps in this situation.

Foreign Exchange Department

INTRODUCTION

Department of Management Sciences

47

Internship Report on ABL Limited

The Allied Bank

In modern banking system foreign exchange department play very crucial and important role from every aspect. It is parallel banking with general banking with additional function of import and export business controlled by state bank of Pakistan. Rules and regulation are by SBP. International banking at ABL is also carried out by foreign exchange department under SBP regulations. Foreign exchange is being controlled by SBP. No transaction can be effected without permission of SBP under foreign exchange regulation act 1947 and notification issued there under. Exchange control department of SBP is responsible for day to day administration of exchange control. All the transactions shall be done at rate authorized by SBP. For this purpose us dollar rates are fixed by the SBP and the rate of other currencies are calculated. In accordance with the formula approved by SBP and as published daily by the foreign exchange rate committee in Karachi H.O ensure that rate published by foreign exchange committee are received by branches on the same day. Foreign exchanges dept provide services like foreign currency A/C and import export advances etc. These will be discussed one by one.

FOREIGN CURRENCY ACCOUNT

Foreign currency A/C in ABL can be open in 4 major currencies of the world i.e. US dollar, Japans yen, German mark and UK pond sterling. Only authorized branches of ABL can deal in foreign currency account. At present in Pakistan many branches have this facility. Foreign currency account can be opened both by Pakistani citizens and foreigners by introduction and following the procedure required for general account with one exception for the foreigner that they will have to submit a copy of their passport. The account may be personal or joint when the customer will withdraw the money. He will receive the principle amount plus interest in the same foreign

Department of Management Sciences

48

Internship Report on ABL Limited

The Allied Bank

currency. Deposits Schemes of Foreign Currency Accounts are very much related with Pak Rupees Accounts such as saving deposits, fixed deposits and current deposits. SAVING DEPOSIT In these accounts there is no minimum limit for opening the account and the Bank offers certain rates of interests on all Foreign Currency Accounts. Rate of Interests on Saving Accounts For Dollar, 6.5% rate of interest is offered For Sterling, Pound 8% rate of interest is offered For Deutsche Mark, 4.2% rate of interest is offered For Yen 1% rate of interest is offered

FIXED DEPOSIT Fixed deposit facility is also provided to clients. These deposits can be for three months, less than six months, six months, less than twelve months, twelve months, two years, three years, four years and five years. Rate of interests are different for different Currencies for different Period. CURRENT DEPOSIT Multiple withdrawals of any part of balance can be made on demand. Funds can be credited into the current deposit account in the form of Cash, Cheques and other financial instruments drawn on any bank or other branch of ABL. The current account is suited to meet both domestic and business requirements of the customers.

TRAVELAR CHEQUES

Department of Management Sciences

49

Internship Report on ABL Limited

The Allied Bank

It is just like cash. It is a facility given to Pakistani citizen. The traveler cheque may be defined as an order drawn by a bank upon itself to pay a specified sum of money on demand to the purchaser of the traveler cheque. ABL after compeering the signature of purchases which he has sign at the time of purchase makes payment. ABL sells the foreign exchange in the form of traveler's cheques and foreign currency to Pakistani citizen's visiting in Pakistan for travel to foreign countries. For traveler cheque following documents are required. a) b) c) National identify card. Passport and visa. O.K ticket.

SALE AND PURCHASE OF THE FOREIGN CURRENCY

ABL is an authorized dealer of state bank of Pakistan. It can sell and purchase foreign currency. ABL usually involves in sale and purchase of us dollar, Japanese yen, UK pound sterling, German Mark, Saudi Riyal and UAE Dirham. Daily exchange rate issued by State bank of Pakistan from ANZ Grind lays bank Karachi, are sent to all the branches authorized in foreign exchange. Daily sale a purchase of foreign currencies is done according to that rate sheet. The purchase of coin will be avoided only notes will be purchased. Only those foreign currency will be purchased for which resale to customers is possible. Demand for respective currency and regulations of SBP must be kept in view at the time of purchase and sales of foreign currency by ABL. It is the policy of ABL to deal only in the hard currencies i.e. those which are early acceptable. H.O of ABL has fixed a certain limit to each authorized branches about the custody of foreign currency. If the amounts exceed this limit, the branch must transfer it to feeding branch or SSB. All the authorized branches of ABL must submit following reports about foreign exchange business to the; a) Report to General Manager Office. 50

Department of Management Sciences

Internship Report on ABL Limited

The Allied Bank

b) c)

Business report to SBP (monthly barns) Monthly report to head office.

LETTER OF CREDIT A documentary credit is an conditional bank undertaking of payment, expressed move clearly it is a written undertaking by the bank (issuing bank) to the seller at the request and in accordance with the instructions of the buyer (applicant) to effect payment that is be making a payment or by accepting bill of exchange up to state sum of money, with in prescribe time limit and against stipulated documents. These stipulated documents are likely to include those require for commercial official, insurance or transport purposes, such as commercial invoice, certificate of origin, insurance policy and bill of loading.

MY LEARNING EXPERIENCE

One of the most important aims of the student life is to express him correctly and adequately. This was the believe in my mind when I first decided to go to the allied bank to complete my internship program. FIRST WEEK: I started my internship from "General Banking" in the first week. In the first week I learnt many new experiences like how to understand & deal with your customers? How to guide your Department of Management Sciences 51

Internship Report on ABL Limited

The Allied Bank

customers? What should our dressing be? To reach at what time in your office (here bank) or

organization?

The second day of exposure to the practical field was at the (sub department) Account opening. I spent my first working day in Enquiry section. In Enquiry section I learned about how to open an Account, How to deal with customers and how to guide them about opening an account and How to fill the account opening form. I helped many clients to fill their forms. The relationship of customer starts with this department. Everyone is not allowed to come and open an account in the bank, for this purpose there should be an introducer who himself is the account holder in the same branch. He has to introduce the new client by signing the opening account form and then his signatures are verified. I have learnt the procedure that an Account Opening Officer has to follow in order to open and maintain an Account. SECOND WEEK: I have learnt that how bank can deposit cash to their customer accounts. How banks can transfer money online what charges banks can be taken in online transfer of money. THIRD WEEK: In the third week of my internship I was shifted to the Clearing section and Bills for collection section as well. Three days I worked with the "Clearing" and then with the "Bills for collection" section. CLEARING: This is a "Inter-city clearing" i.e. the cheques of KABIRWALA city from different banks like NBP, MCB, UBL, askari bank limited, bank alfalah limited are deposited here. The deposited cheque is received carefully by checking the title of cheque, date, amount, and signature on the cheque. All the cheques go to the State Bank of Pakistan for clearance. BILLS FOR COLLECTION: Two types of cheques are deposited here Department of Management Sciences 52

Internship Report on ABL Limited

The Allied Bank

Outstation cheques ABL other branch cheques (local)

Outstation cheques mean different cities cheques are deposited and Local means ABL other Branches if has Are deposited. All cheques account numbers on the computer and these figures go to SBP. FOURTH WEEK: In the fourth week of internship I was transferred to the "Remittances department". He tells me about the issuance, procedure and the entries of the demand drafts and pay orders. FIFTH WEEK: In the second last week of my internship I worked for two days in the "ATM section" and then In the cash department. SIX WEEK: In the last week I was shifted to the "foreign exchange" department. For the first three days I worked there but in the last three days I was shifted again to the account-opening department due to the absence of one of the Account opening officer. Therefore I was sent back to the account-opening department. At the end of my work I observe that I can work in branch as an employee.

FINANCIAL ANALYSIS

INTRODUCTION OF FINANCIAL ANALYSIS

Financial analysis is the process of identifying the financial strengths and weaknesses of the firm by properly establishing relationships between the items of balance sheet and profit and loss account. The analysis of bank statements is undertaken by analyst, depositors, regulatory authorities, stockholders, borrowers and the bank management etc. A depositor is interested in the solvency of Department of Management Sciences 53

Internship Report on ABL Limited

The Allied Bank

the bank, i.e. the safety and availability of his funds. The regulatory authorities desire to assure themselves that the banks are operating in accordance with the requirements of the law and are in sound financial conditions. Stockholders are interested in the general financial condition of the bank and the earnings, the dividends, and the managements policy with reference to the accumulation of surplus. The borrower is interested in knowing the extent of available funds and the use that is made of the banks resources.

FINANCIAL STATEMENTS

BALANCE SHEET STATEMENT (Rs in millions)

ASSETS Cash and balances with treasury and other banks LIABILITIES Lending to financial institutions Customer deposits Investments- Gross Inter bank borrowings Advances - Gross Bills payable Other liabilities assets Operating Fixed Sub ordinate loans Other assets Total Liabilities Total assets Liabilities Net Assets / Share capital Provisions against non-performing advances Share premium Reserves Other provisions Un - appropriated profit / (loss) Total assets - net of provision Equity - Tier I Department of Management Sciences Surplus on revaluation of assets

2006 24,745 19,050 206,031 47,156 18,410 151,705 2,278 5,119 6,445 2,500 10,800 234,339 259,902 17,688 4,489 (7,672) 4,316 1,817 (203) 5,608 252,027 16,230 1,458 17,688

2007 30,408 18,419 263,972 84,151 22,934 178,524 3,494 7,332 7,549 2,499 11,368 300,231 330,419 19,878 5,386 (10,117) 3,419 2,632 (192) 6,971 320,110 18,408 1,470 19,878

2008 25,751 15,793 297,475 84,602 27,778 223,640 2,952 13,636 11,134 2,498 18,399 344,340 379,319 22,356 6,464 (10,668) 2,341 3,463 (1,956) 8,537 366,696 20,805 1,550 22,356

2009 27,716 28,123 328,875 96,975 39,819 249,887 3,162 11,061 12,447 5,497 17,955 388,414 433,103 29,960 7,110 (12,543) 1,695 4,888 (2,186) 12,198 418,374 25,891 4,069 29,960

2010 31,845 11,489 371,284 123,855 20,774 268,530 4,119 12,284 15,360 5,495 16,965 413,957 468,044 35,975 7,821 (15,430) 984 6,533 (2,682) 15,829 449,932 31,166 4,808 35,975 54

Internship Report on ABL Limited

The Allied Bank

PROFIT AND LOSS STATEMENT

2006 Markup / Rerurn / Interest earned Markup / Rerurn / Interest expensed Net Markup / Interest income Fee, Commission, Brokerage and Exchange income Capital gain & Dividend income Other income Noninterest income Gross income Operating expenses Profit before provisions Donations Provisions Profit before taxation Taxation Profit after taxation 17,216 67,93 10423 1636 540 273 2449 12872 5289 7583 9 (913) 6661 (2264) 4397

2007 21201 10093 11108 2258 1585 77 3920 15029 6174 8855 28 (2874) 4953 (1877) 4076

2008 30571 17273 13298 3266 1571 59 4897 18195 8431 9764 82 (3561) 6121 (1964) 4157

2009 41122 22422 18700 3470 2452 36 4958 24658 9609 15049 97 (4416) 10536 (3414) 7122

2010 44993 22428 22565 2910 25114 251 5672 28237 11529 16708 38 (4326) 12343 (4118) 8225

Department of Management Sciences

55

Internship Report on ABL Limited

The Allied Bank

ANALYSIS OF THE FINANCIAL STATEMENT

There are two types of the statement which I give the name of comparative statement. Comparative Statements 1. Comparative Income Statement 2. Comparative Balance Sheet

TOOLS OF ANALYSIS

There are different tools which are used to analyze the financial statements. There are two major tools which are as under.

HORIZONTAL ANALYSIS (INDEX ANALYSIS)

There are three types of the of horizontal analysis which are as under. i. Absolute increase or decrease in amount. ii. Absolute increase or decrease in % age. iii. Trend % age.

VERTICAL ANALYSIS (Common Size)

Formula= components A X100 Total Asset (Base) And in profit and loss statement I use sales as a base Now we discuss these above tools one by one in detail. Department of Management Sciences 56 (I use this formula for common size analysis)

Internship Report on ABL Limited

The Allied Bank

i.

Absolute increase or decrease in amount: It means to change in absolute amount which is quite different between Base Year and Current Years or Proceeding Years.

Formula: Increase / decrease in amount= Proceeding Year Base year ii. Absolute increase or decrease in % age: This tool is same with the pervious tool. There was increase or decrease in amount but here after calculation the amount change the calculation comes in use the increase or decrease in % age. In the tool we observe that how many percent (%) change will be occurring as compare to Base year. Formula: Increase / decrease in % age = Preceding year Base Year 100 Base Year

OR Increase / decrease in % age = Total Changes 100 Base Year

iii.

Trend % age: The change in financial statement items form a base year to proceeding year or often expressed as Trend % age to show the extent and direction of changes. Two steps are necessary to compute Trend % age. i. First Base year selection.

Department of Management Sciences

57

Internship Report on ABL Limited

The Allied Bank

ii.

The second step is to express each item in financial statement for the Proceeding year as a % age of its Base year amount.

Formula=

Current Year 100 Base Year

(I use this formula for index analysis)

Balance Sheet (Horizontal or Index Analysis)

ASSETS Cash and balances with treasury and other banks Lending to financial institutions Investments- Gross Advances - Gross Operating Fixed assets Other assets Total assets Provisions against non-performing advances Other provisions Total assets - net of provision

2006 100% 100 100 100 100 100 100 100 100 100

2007

2008

2009

2010

122.89% 104.07% 112.00% 128.69% 96.69 178.45 125.99 117.13 105.25 127.13 131.86 94.58 127.01 82.90 179.41 147.42 172.75 170.36 145.95 139.05 963.55 145.58 147.62 205.64 164.71 193.12 166.25 166.64 163.49 1076.84 166.00 60.31 262.65 177.00 238.32 157.08 180.08 201.12 1321.18 178.53

Department of Management Sciences

58

Internship Report on ABL Limited

The Allied Bank

LIABILITIES Customer deposits Inter bank borrowings Bills payable Other liabilities Sub ordinate loans Total Liabilities Net Assets / Liabilities Share capital Share premium Reserves Un - appropriated profit / (loss) Equity - Tier I Surplus on revaluation of assets 100 100 100 100 100 100 100 100 100 100 100 100 100 100 128.12 124.58 153.3 143.23 99.96 128.11 112.38 119.98 79.21 144.85 124.30 113.41 100.82 112.38 144.38 150.79 129.59 266.38 99.92 146.94 126.39 143.99 1 54.24 190.59 152.22 128.19 106.31 126.39 159.62 216.29 138.81 216.07 219.88 165.74 169.38 158.38 39.27 269.01 217.51 159.52 279.08 169.38 180.21 112.84 180.81 239.97 219.8 176.65 203.39 174.23 22.79 359.55 282.26 192.03 329.77 203.39

INTERPETATION Horizontal analysis of balance sheet show that our assets are increases each year. It shows that our assets are increases due to increased in investment and increase in advances. For Investments increase Bank intends to increase investment in order to maintain long term growth, gain market share and improve penetration, simultaneously increasing returns to shareholders. It shows that bank is increases its business. So therefore our assets are increases year by year.

Department of Management Sciences

59

Internship Report on ABL Limited

The Allied Bank

Liabilities of the banks increase from 2006 to 2010 increases in borrowings. During 2006, 2007, 2008, 2009, 2010 number of branches were opened in different areas in order to expand the business and facilitate the customers by reducing the distance from residents to bank, for this purpose bank borrowed money more in these periods. Over all equity of the company also increases due to increase in reserves and share capital. So over all business of the bank increased year by year which is positive sign for the bank.

Profit and Loss (Horizontal or Index Analysis)

2006 Markup / Return / Interest earned Markup / Return / Interest expensed Net Markup / Interest income Fee, Commission, Brokerage and Exchange income Capital gain & Dividend income Other income Noninterest income Gross income Operating expenses Profit before provisions Donations Provisions Profit before taxation Taxation Profit after taxation 100% 100 100 100 100 100 100 100 100 100 100 100 100 100 100 2007 2008 2009 2010

231.14% 177.57% 238.85% 261.34 148.57 106.57 138.0 293.51 28.20 160.06 116.75 116.73 116.77 311.11 314.78 74.35 82.90 92.69 254.28 127.58 199.63 290.93 21.61 199.96 141.35 159.41 128.76 911.11 390.03 91.89 86.75 94.54 330.00 179.41 212.10 454.07 13.18 202.44 191.56 181.67 198.45 1077.77 483.68 158.17 150.79 161.97 330.16 216.49 177.87 465.00 91.94 231.60 219.37 217.98 220.33 422.22 473.82 185.90 181.89 187.06

Department of Management Sciences

60

Internship Report on ABL Limited

The Allied Bank

INTERPETATION Horizontal analysis of income statement shows that interest earned is increased year by year and due to increase in interest earned the expense wills also increased and net income will also increase. The net profit of the bank increased year by year which is minimum in 2006 which is 100% and higher in 2010 which is187.06% which shows good for bank. Total none mark income has also increased in 2010 as compared to previous years Net profit after taxation and profit before taxation is also increased, which motivates the investor, and give confidence to them to invest in ABL shares. Because more the net profit of the organization have more the dividend of the share holders of the organization.

Balance Sheet (Vertical or Common Size Analysis)

ASSETS Cash and balances with treasury and other banks Lending to financial institutions Investments- Gross Advances - Gross Operating Fixed assets Other assets Total assets 2006 10% 8 19 56 3 4 100% 2007 9% 6 26 53 2 4 100% 2008 7% 4 23 58 3 5 100% 2009 7% 7 23 56 3 4 100% 2010 7% 3 27 56 3 4 100%

Department of Management Sciences

61

Internship Report on ABL Limited

The Allied Bank

LIABILITIES Customer deposits Inter bank borrowings Bills payable Other liabilities Sub ordinate loans Total Liabilities Net Assets / Liabilities Share capital Share premium Reserves Un - appropriated profit / (loss) Equity - Tier I Surplus on revaluation of assets 82 7 1 2 1 93 7 2 1.66 2 2 6 1 7 83 7 1 2 1 94 6 2 1.03 2 2 6 0 6 80 8 1 4 1 94 6 2 0.617 2 2 6 0 6 78 10 1 4 1 94 6 2 0.39 2 2 6 0 6 82 5 1 3 1 92 8 2 0.21 2 3 7 1 8

INTERPRETATION:

By vertical analysis the balance sheet of 2006 to 2010 shows that few portions of total assets have been kept for lending to financial institution and investments, this should be increased. Cash balance should also be increased so that it can be utilized to generate more income. Similarly on Liability side we observe that owners equity portion should be increased and bank should acquire fewer funds from outsider. In 2006 cash increased due to more lending to financial institutions and more interested received. Cash was decreased in 2008. Despite of decrease in cash, advances were increased; more branches were opened in different location that increased the operating fixed

Department of Management Sciences

62

Internship Report on ABL Limited

The Allied Bank

assets. Investment continuously decreased from 2007 to 2009 which is 26%, 23%, 23% because bank spent more portion of amount on advances and fixed assets.

Profit and Loss (Vertical or Common Size Analysis)

2006 Markup / Return / Interest earned Markup / Return / Interest expensed Net Markup / Interest income Fee, Commission, Brokerage and Exchange income Capital gain & Dividend income Other income Noninterest income Gross income Operating expenses Profit before provisions Donations Provisions Profit before taxation Taxation Profit after taxation

100% 39.45 60.54 9.50 3.13 1.58 14.22

2007

100% 47.61 52.39 10.65 7.48 0.36 18.48

2008

100% 56.50 43.49 10.68 5.13 0.19 16.01

2009

100% 54.53 45.47 8.44 5.96 0.08 12.06

2010

100% 49.84 50.15 6.46 55.82 0.55 12.60

74.76

30.72 44.04 0.05 (5.30) 38.69 (13.15)

70.89

29.12 41.77 0.13 (13.56) 23.36 (8.85)

59.51

27.57 31.93 0.26 (11.64) 20.02 (5.37)

59.96

23.37 36.59 0.24 (10.73) 25.62 (8.30)

62.75

25.62 37.13 0.08 (9.61) 27.43 (9.15)

25.54

19.22

13.59

17.32

18.28

Department of Management Sciences

63

Internship Report on ABL Limited

The Allied Bank

INTERPETATION By vertically analyzing shows that major portion of income statement expenses are comprised of operating expenses which are 31%, 29%, 28%, 23%, and 26% respectively so bank should make effort to reduce these expenses in order to gain maximum profit. It is observed that over the entire Net markup and EAT or Net income have increased in 2010 as compare to 2008 and 2009. Which show that the overall financial position of the ABL will be strong? due to the more administrative and operating expenses the profit before taxation of the bank decreased from 2006 to 2008 and increased in 2010 which is 18.18%.the taxation rate of the bank in 2006,2009 and in 2010 is higher because to increased in assets and low in 2007 and 2008 which is 8.85%,5.37% that shows that in these two year the assets of the bank not increased.

RATIO ANALYSIS

Ratio analysis is basically a technique of establishing meaningful relationship between significant variables of statements and interpreting the relationship to form judgment regarding the financial affair of the unit.

Department of Management Sciences

64

Internship Report on ABL Limited

The Allied Bank

RETURN ON ASSET:

Formula= Net income / Total Asset X 100 4397/252027 X100=1.74% YEAR 2006 1.74% 2007 1.27% 2008 1.13% 2009 1.70% 2010 1.83%