Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pay Slip

Caricato da

Sushil ShresthaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Pay Slip

Caricato da

Sushil ShresthaCopyright:

Formati disponibili

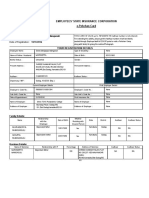

MONTHLY PAY SLIP

NAME: Mr. Lila Bdr Gurung DESIGNATION: Admin Officer Description Level: Grade: 7 2 Amount

MONTHLY PAY SLIP

NAME: Mr. Lila Bdr Gurung DESIGNATION: Admin Officer Description Level: Grade: Amount

Incomes: Monthly Salary Scale Salary Grade Sub total of Salary Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly

Service Gratuity @ Basic salary

Incomes: Monthly Salary Scale 22961 704 23665 Salary Grade Sub total of Salary Monthly Benefits Scal 2,367 1,378 3,745 27,410 Provident Fund 10% Festival Allowance/yearly

Service Gratuity @ Basic salary

22961 704 23665

2,367 1,378 3,745 27,410

Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Social Security Tax

Reserve Fund

Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Salary for the Month Deductions: Total Deduction

4,734 1,266 576 918 7,494 19,916

Provident Fund Deposit CIT Deposit Social Security Tax

Reserve Fund

4,734 1,266 576 918 7,494 19,916

Sub total of Deduction Net Payable/Bank Deposit Amount

Sub total of Deduction Net Payable/Bank Deposit Amount

NOTE: Please verify this pay slip with your bank and PF/CIT deposit statement and contact us if there is any difference. Note: 2 Increment from the Sharwan 2068.

NOTE: Please verify this pay slip with your bank and PF/CIT deposit statement and contact us if there is any difference. Note: 2 Increment from the Sharwan 2068.

Prepared by Lila Bdr Gurung

Received by Mr. Lila Bdr Gurung

Prepared by Lila Bdr Gurung

Received by Mr. Lila Bdr Gurung

Note: 1 Increment from Sharwan 1, 2068.

7 2 Amount

22961 704 23665

2,367 1,378 3,745 27,410

4,734 1,266 576 918 7,494 19,916

CIT deposit statement nce. Note: 2 Increment from the Sharwan 2068.

2068.

eived by Lila Bdr Gurung

Personal Tax Calculation Sheet NAME: Dirga K Lamichhane DESIGNATION: Executive Director Description Incomes: Monthly Salary Scale Salary Grade Sub total of Salary Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

Level: Grade: Months 12 12

11 2 Scal 51,817 799 52,616

Matial Status Married Total Amount 621,804 19,176 640,980

12 12 12 12 12 12 12

5,262 4,385 5,182 3,109

63,139 52,616 62,180 37,308 215,244 856,224

20% 13% 10%

Married 15% 25% Per Month

200,000 100,000 254,316

126,278 159,130 16,500 301,908 554,316 2,000 15,000 63,579 80,579 6,715 80,340 239 30

Total Deposit Monthly

Possible CIT 285,408 67,110 218,298 27,287 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Lila Bdr Gurung Level: Matial Status 7 DESIGNATION: AFO Grade: Married 2 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 22,961 275,532 Grade 12 352 8,448 Sub total of Salary 23,313 283,980 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,331 1,943 2,296 1,378

27,976 23,313 27,553 16,532 95,374 379,354

20% 13% 10%

Married 15% 25% Per Month

200,000 73,006 -

55,951 44,049 6,348 106,348 273,006 2,000 10,951 12,951 1,079 11,283 1,668 208

Deposited Balance Monthly

Possible to Deposit 126,451 18,000 108,451 13,556 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Santosh Paudel Level: Matial Status 4 DESIGNATION: FA Grade: Married 5 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 14,180 170,160 Grade 12 224 13,440 Sub total of Salary 14,404 183,600 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,440 1,200 1,418 1,588 665 -

17,285 14,404 17,016 19,056 7,980 75,741 259,341

20% 13% 10%

Married 15% 25% Per Month

200,000 -

34,570 51,877 86,447 172,894 1,729 1,729 144 495 1,234 154

Deposited Balance Monthly

Possible CIT 86,447 8580 77,867 9,733 Married 200,000 Unmarried 160000

Personal Tax Calculation Sheet NAME: Sumitra Gayak Level: Matial Status 3 DESIGNATION: R/AA Grade: Unmarried 3 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 12,884 154,608 Grade 12 197 7,092 Sub total of Salary 13,081 161,700 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,308 1,090 1,288 -

15,697 13,081 15,461 44,239 205,939

20% 13% 10%

Unmarried 160,000 15% 25% Per Month

31,394 37,252 20,594 89,240 116,699 1,167 1,167 97 399 768 96

Deposited Balance Monthly

Possible CIT 68,646 7624 61,022 7,628 Married 200,000 Unmarried 160000

Personal Tax Calculation Sheet NAME: Gopi Bdr Khatri Level: Matial Status 2 DESIGNATION: OA Grade: Married 8 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 11,428 137,136 Grade 12 176 16,896 Sub total of Salary 11,604 154,032 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,160 967 1,143 3,176 -

13,925 11,604 13,714 38,112 77,354 231,386

20% 13% 10%

Married 15% 25% Per Month

200,000 -

27,850 49,279 77,129 154,258 1,543 1,543 129 480 1,063 133

Deposited Balance monthly

Possible CIT 77,129 7364 69,765 5,814 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Ram Bdr Baniya Level: Matial Status 1 DESIGNATION: Office Guard Grade: Unmarried 2 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 10,200 122,400 Grade 12 158 3,792 Sub total of Salary 10,358 126,192 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,036 863 1,020 3,176 -

12,430 10,358 12,240 38,112 73,140 199,332

20% 13% 10%

Married 15% 25% Per Month

200,000 -

24,859 41,585 66,444 132,888 1,329 1,329 111 411 918 115

Deposited Balance Monthly

Possible Cit 66,444 6008 60,436 7,554 Married 200,000 Unmarried 160000

Personal Tax Calculation Sheet NAME: Tulis Dahal Level: Matial Status 8 DESIGNATION: Training Office Grade: Married 4 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 20,256 Sub total of Salary 28,228 353,928 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,823 2,352 2,781 1,668

33,874 28,228 33,367 20,020 115,489 469,417

20% 13% 10%

Married 15% 25% Per Month

200,000 92,945 -

67,747 88,725 20,000 176,472 292,945 2,000 13,942 15,942 1,328 3,090 12,852 1,606

Deposited Balance monthly

CIT Possible 156,472 36163 120,309 15,039 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Rameshwor Giri Level: Matial Status 8 DESIGNATION: Training Officer Grade: Married 2 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 10,128 Sub total of Salary 28,228 343,800 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,823 2,352 2,781 1,668

33,874 28,228 33,367 20,020 115,489 459,289

20% 13% 10%

Married 15% 25% Per Month

200,000 100,000 6,193

67,747 85,349 153,096 306,193 2,000 15,000 1,548 18,548 1,546 3,321 15,227 1,903

153,096 34990 118,106 14,763 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Chhabi Lal Bhattarai Level: Matial Status 3 DESIGNATION: Training Assistant Grade: Married 1 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 12,884 154,608 Grade 12 197 2,364 Sub total of Salary 13,081 156,972 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,308 1,090 1,288 3,176 773

15,697 13,081 15,461 38,112 9,276 91,627 248,599

20% 13% 10%

Married 15% 25% Per Month

200,000 17,205 -

31,394 31,394 217,205 2,000 2,581 4,581 382 498 4,083 510

Deposited Balance Monthly

Possible CIT 31,394 7338 24,056 3,007 Married 200,000 Unmarried 160000

Personal Tax Calculation Sheet NAME: Bharat Pokherl Level: Matial Status 4 DESIGNATION: Training Assistant Grade: Married 4 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 14,180 170,160 Grade 12 224 10,752 Sub total of Salary 14,404 180,912 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,440 1,200 1,418 851

17,285 14,404 17,016 10,210 58,914 239,826

20% 13% 10%

Married 15% 25% Per Month

200,000 5,257 -

34,570 34,570 205,257 2,000 789 2,789 232 471 2,318 290

Deposited Balance Monthly

Possible CIT 79,942 8536 71,406 8,926 Married 200,000 Unmarried 160000

Personal Tax Calculation Sheet NAME: Bodh Raj Baral Level: Matial Status 9 DESIGNATION: Project Coordinator Grade: Married 0 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 8 32,070 256,560 Grade 8 486 Sub total of Salary 32,556 256,560 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 3 months Monthly TAX for remaining 3 months Sub total of Deduction Net Payable/Bank Deposit Amount

8 8 8 8 8 8 8

3,256 2,713 3,207 1,924

26,045 21,704 25,656 15,394 88,798 345,358

20% 13% 10%

Married 15% 25% Per Month

200,000 18,239 -

52,090 63,030 12,000 127,119 218,239 2,000 2,736 4,736 395 1,190 3,546 1,182

115,119 30476 84,643 10,580 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Khimananda Khanal Level: Matial Status 8 DESIGNATION: Field Coordinator Grade: Unmarried 0 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 Sub total of Salary 28,228 333,672 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,823 2,352 2,781 1,668

33,874 28,228 33,367 20,020 115,489 449,161

20% 13% 10%

Unmarried 15% 25% Per Month

160,000 100,000 39,441

67,747 81,973 149,720 299,441 1,600 15,000 9,860 26,460 2,205 991 25,469 3,184

149,720 30412 119,308 9,942 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Dinesh K Tiwari Level: Matial Status 9 DESIGNATION: Project Coordinator Grade: Married 10 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 32,070 384,840 Grade 12 486 58,320 Sub total of Salary 32,556 443,160 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

3,256 2,713 3,207 1,924

39,067 32,556 38,484 23,090 133,198 576,358

20% 13% 10%

Married 15% 25% Per Month

200,000 100,000 84,238

78,134 113,985 192,119 384,238 2,000 15,000 21,060 38,060 3,172 7,458 30,602 3,825

192,119 44680 147,439 18,430 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Subash Chaudhary Level: Matial Status 8 DESIGNATION: Field Officer Grade: Unmarried 0 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 Sub total of Salary 28,228 333,672 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Poush, 2068 Balance for 6 months Monthly TAX for remaining 6 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,781 2,317 2,781 1,668

33,372 27,806 33,372 20,016 114,566 448,238

20% 13% 10%

Unmarried 15% 25% Per Month

160,000 100,000 20,822

66,744 82,669 18,003 167,416 280,822 1,600 15,000 5,206 21,806 1,817 9,856 11,950 1,992

149,413 34819 114,594 14,324 Married Unmarried 200,000 160000

1350 1350 1350 1350 2228 2228 9856

Personal Tax Calculation Sheet NAME: Lekh Nath Adhikari Level: Matial Status 8 DESIGNATION: Field Coordinator Grade: Unmarried 1 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 5,064 Sub total of Salary 28,228 338,736 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,823 2,352 2,781 3,750 -

33,874 28,228 33,367 45,000 140,469 479,205

20% 13% 10%

Unmarried 15% 25% Per Month

160,000 100,000 39,522

67,747 91,988 19,948 179,683 299,522 1,600 15,000 9,880 26,480 2,207 6,117 20,363 2,545

159,735 36928 122,807 10,234

13,311.24

Married 200,000

Unmarried 160000

Personal Tax Calculation Sheet NAME: Mukesh Nayak Level: Matial Status 8 DESIGNATION: Field Coordinator Grade: Unmarried 1 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 5,064 Sub total of Salary 28,228 338,736 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Poush, 2068 Balance for 6 months Monthly TAX for remaining 6 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,823 2,352 2,781 3,750 -

33,876 28,224 33,372 45,000 140,472 479,208

20% 13% 10%

Unmarried 15% 25% Per Month

160,000 100,000 59,472

67,752 91,984 159,736 319,472 1,600 15,000 14,868 31,468 2,622 12,776 18,692 3,115

159,736 37618 122,118 15,265 Married Unmarried 200,000 160000

6546

3115 3115 12776

Personal Tax Calculation Sheet NAME: Puspendra K Shah Level: Matial Status 8 DESIGNATION: Field Coordinator Grade: Married 0 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 27,806 333,672 Grade 12 422 Sub total of Salary 28,228 333,672 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 6 months Monthly TAX for remaining 6 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

2,781 2,352 2,781 3,176 3,750 -

33,372 27,806 33,372 38,112 45,000 177,662 511,334

20% 13% 10%

Married 15% 25% Per Month

200,000 100,000 24,121

66,744 103,701 16,768 187,213 324,121 2,000 15,000 6,030 23,030 1,919 9,785 13,245 2,208

170,445 40021 130,424 16,303 Married 200,000 Unmarried 160000

4785 2500

2500 9785

Personal Tax Calculation Sheet NAME: Mangal Bdr Tharu Level: Matial Status 5 DESIGNATION: Welfare Facilitator Grade: Unmarried 0 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 16,513 198,156 Grade 12 252 Sub total of Salary 16,765 198,156 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,677 1,397 1,651 3,750 -

20,118 16,765 19,816 45,000 101,699 299,855

20% 13% 10%

Unmarried 15% 25% Per Month

160,000 39,903 -

40,236 59,716 99,952 199,903 1,600 5,985 7,585 632 1,177 6,408 801

99,952 21895 78,057 9,757 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Buddha Laxmi CK Level: Matial Status 6 DESIGNATION: Welfare Facilitator Grade: Unmarried 7 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 18,578 222,936 Grade 12 284 23,856 Sub total of Salary 18,862 246,792 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,886 1,572 1,858 1,115

22,634 18,862 22,294 13,376 77,166 323,958

20% 13% 10%

Unmarried 15% 25% Per Month

160,000 23,576 -

45,269 62,717 32,396 140,382 183,576 1,600 3,536 5,136 428 1,365 3,771 471

107,986 24899 83,087 10,386 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Keshar Bdr Raivat Level: Matial Status 6 DESIGNATION: Welfare Facilitaro Grade: Married 4 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 18,578 222,936 Grade 12 284 13,632 Sub total of Salary 18,862 236,568 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,886 1,572 1,858 3,176 1,115

22,634 18,862 22,294 38,112 13,376 115,278 351,846

20% 13% 10%

Married 15% 25% Per Month

200,000 34,564 -

45,269 72,013 117,282 234,564 2,000 5,185 7,185 599 1,185 6,000 750

117,282 27626 89,656 11,207 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Raman K Misra Level: Matial Status 6 DESIGNATION: Welfare Facilitator Grade: Married 2 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 18,578 222,936 Grade 12 284 6,816 Sub total of Salary 18,862 229,752 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,886 1,572 1,858 3,176 3,750 -

22,634 18,862 22,294 38,112 45,000 146,902 376,654

20% 13% 10%

Married 15% 25% Per Month

200,000 51,103 -

45,269 80,283 125,551 251,103 2,000 7,665 9,665 805 1,902 7,763 970

125,551 29952 95,599 11,950 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Ajaya K Shah Level: Matial Status 5 DESIGNATION: Welfare Facilitator Grade: Married 1 Description Months Scal Total Amount Incomes: Monthly Salary Scale Salary 12 16,513 198,156 Grade 12 252 3,024 Sub total of Salary 16,765 201,180 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,677 1,397 1,651 3,750 -

20,118 16,765 19,816 45,000 101,699 302,879

20% 13% 10%

Married 15% 25% Per Month

200,000 1,919 -

40,236 60,724 100,960 201,919 2,000 288 2,288 191 432 1,856 232

100,960 23678 77,282 9,660 Married Unmarried 200,000 160000

Personal Tax Calculation Sheet NAME: Sukdeo Chaudhary Level: 6 DESIGNATION: Welfare Facilitator Grade: 3 Description Months Scal Incomes: Monthly Salary Scale Salary 12 18,578 Grade 12 284 Sub total of Salary 18,862 Monthly Benefits Scal Provident Fund 10% Festival Allowance/yearly Service Gratuity @ Basic salary Child Allowance/per child Field Allowance/month Cash Allowance/month Project Allowance/month Sub total of Benefits Gross Annual Salary for the Month Deductions: Total Deduction Provident Fund Deposit CIT Deposit Female Rebet - 10% Life Insurance Premium Total Tax deduction TAXABLE Total Taxable Amount Social Security Tax 1% Income TAX 15% Morethan 200,000 Income TAX 25% Morethan 300,000 Total Annual TAX Monthly TAX Deposited - up to Kartik, 2068 Balance for 8 months Monthly TAX for remaining 8 months Sub total of Deduction Net Payable/Bank Deposit Amount

12 12 12 12 12 12 12

1,886 1,572 1,858 1,588 3,750 -

20% 13% 10%

Married 15% 25% Per Month

200,000 40,671 -

Matial Status Married Total Amount 222,936 10,224 233,160

22,634 18,862 22,294 19,056 45,000 127,846 361,006

45,269 75,067 120,335 240,671 2,000 6,101 8,101 675 1,527 6,574 822

120,335 28698 91,637 11,455 Married Unmarried 200,000 160000

Potrebbero piacerti anche

- EPF Provident Fund CalculatorDocumento6 pagineEPF Provident Fund CalculatorUtkal SolankiNessuna valutazione finora

- Labour Law Compliance Due DatesDocumento4 pagineLabour Law Compliance Due DatesAchuthan RamanNessuna valutazione finora

- Whichever Is Lower Is Exempt From Tax. For ExampleDocumento13 pagineWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNessuna valutazione finora

- Provident Fund (PF)Documento13 pagineProvident Fund (PF)chandub6Nessuna valutazione finora

- Artifact 5 - Employee Pension Scheme Form 10 CDocumento4 pagineArtifact 5 - Employee Pension Scheme Form 10 CSiva chowdaryNessuna valutazione finora

- Compliance PDFDocumento20 pagineCompliance PDFSUBHANKAR PALNessuna valutazione finora

- ESIC e-Pehchan Card BenefitsDocumento3 pagineESIC e-Pehchan Card BenefitsGoutam HotaNessuna valutazione finora

- Unit 4 Deductions From Gross Total IncomeDocumento31 pagineUnit 4 Deductions From Gross Total IncomeDisha GuptaNessuna valutazione finora

- Esic Online ChallanDocumento26 pagineEsic Online ChallanahtradaNessuna valutazione finora

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocumento2 pagineSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300Nessuna valutazione finora

- The List of Components Which You Can Use For Salary BreakupDocumento8 pagineThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNessuna valutazione finora

- EPF CalenderDocumento1 paginaEPF CalenderAmitav TalukdarNessuna valutazione finora

- INCOME UNDER SALARIESDocumento44 pagineINCOME UNDER SALARIEShny0910Nessuna valutazione finora

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocumento52 pagineCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGNessuna valutazione finora

- Employees' State Insurance Corporation E-Pehchan CardDocumento3 pagineEmployees' State Insurance Corporation E-Pehchan CardAadil HashmiNessuna valutazione finora

- What Is A Flexible Benefit Plan in A Salary Breakup? - QuoraDocumento8 pagineWhat Is A Flexible Benefit Plan in A Salary Breakup? - QuoraSiNessuna valutazione finora

- Salary StructureDocumento4 pagineSalary StructureniranjanaNessuna valutazione finora

- Annexure II Details of AllowancesDocumento4 pagineAnnexure II Details of AllowancesPravin Balasaheb GunjalNessuna valutazione finora

- Calculate income tax liability under old and new tax regimesDocumento6 pagineCalculate income tax liability under old and new tax regimesJigeesha BhargaviNessuna valutazione finora

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocumento9 pagineTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNessuna valutazione finora

- Omega External Career Portal CareersDocumento5 pagineOmega External Career Portal CareersAdityaNessuna valutazione finora

- Offerletter 369844Documento24 pagineOfferletter 369844Gokul GandhiNessuna valutazione finora

- YTD Statement-1326013854886Documento108 pagineYTD Statement-1326013854886deepson800Nessuna valutazione finora

- Major Spice State Wise Area Production Web 2015 PDFDocumento3 pagineMajor Spice State Wise Area Production Web 2015 PDFbharatheeeyuduNessuna valutazione finora

- Online Registration of Establishment With DSC: User ManualDocumento39 pagineOnline Registration of Establishment With DSC: User ManualroseNessuna valutazione finora

- Higher Pension As Per SC Decision With Calculation - Synopsis1Documento13 pagineHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNessuna valutazione finora

- Esic ChallanDocumento7 pagineEsic Challanrgsr2008Nessuna valutazione finora

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocumento2 pagineEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNessuna valutazione finora

- Insync CTC Breakup PDFDocumento1 paginaInsync CTC Breakup PDFSocialIndostoriesNessuna valutazione finora

- Salary AdministrationDocumento17 pagineSalary AdministrationMae Ann GonzalesNessuna valutazione finora

- YTD Statement 2017 - 2018Documento1 paginaYTD Statement 2017 - 2018HanumanthNessuna valutazione finora

- SL 11058885651 2018 03 05 08 39 43 51562Documento2 pagineSL 11058885651 2018 03 05 08 39 43 51562VikashSinghNessuna valutazione finora

- Payslip MarDocumento1 paginaPayslip Marabhijitj0555Nessuna valutazione finora

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDocumento6 pagineSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwNessuna valutazione finora

- Employee Pension SchemeDocumento6 pagineEmployee Pension SchemeAarthi PadmanabhanNessuna valutazione finora

- RegistrationDocumento15 pagineRegistrationpratikdhond100% (3)

- Annexure - Flexible Benefit PlanDocumento3 pagineAnnexure - Flexible Benefit PlanpvkmanoharNessuna valutazione finora

- SubhashDocumento1 paginaSubhashsubhash221103Nessuna valutazione finora

- Statutory ComplianceDocumento2 pagineStatutory Compliancemax997Nessuna valutazione finora

- Airtel RECRUITMENTDocumento121 pagineAirtel RECRUITMENTDrJyoti AgarwalNessuna valutazione finora

- Organisational Implications of Coaching: Jane StubberfieldDocumento13 pagineOrganisational Implications of Coaching: Jane Stubberfieldarjun.ec633Nessuna valutazione finora

- Joining Forms Guide for BCCL New EmployeesDocumento13 pagineJoining Forms Guide for BCCL New EmployeesgopamaheshwariNessuna valutazione finora

- Form 16: Wipro LimitedDocumento5 pagineForm 16: Wipro LimitedIbrahim MohammadNessuna valutazione finora

- Salary SlipDocumento1 paginaSalary SlipJohn HallNessuna valutazione finora

- June SalaryDocumento1 paginaJune Salaryaruna nadagouniNessuna valutazione finora

- Overtime Allowance Eligibility and RatesDocumento3 pagineOvertime Allowance Eligibility and RatesKumudha Devi100% (1)

- Relevant Dates: 15-Apr QuarterlyDocumento6 pagineRelevant Dates: 15-Apr Quarterlysanyu1208Nessuna valutazione finora

- Benefit Summary IndiaDocumento5 pagineBenefit Summary IndiaMohd Asim AftabNessuna valutazione finora

- Employee Exit ChecklistDocumento9 pagineEmployee Exit ChecklistNoel RozarioNessuna valutazione finora

- National Pension Scheme (NPS) Guidelines FY 2019-20Documento21 pagineNational Pension Scheme (NPS) Guidelines FY 2019-20harrishNessuna valutazione finora

- Income Tax DepartmentDocumento19 pagineIncome Tax DepartmentSharathNessuna valutazione finora

- Salary Slip FinalDocumento1 paginaSalary Slip FinalSarita NayakNessuna valutazione finora

- L&T TransferDocumento2 pagineL&T TransferShashank Kumar DeNessuna valutazione finora

- Statutory Benifits in HCLDocumento63 pagineStatutory Benifits in HCLBhupendra SinghNessuna valutazione finora

- Offer Letter for Unix AdministratorDocumento4 pagineOffer Letter for Unix AdministratorRanjith KumarNessuna valutazione finora

- CompensationDocumento28 pagineCompensationSomalKantNessuna valutazione finora

- IISER Mohali Offer Letter for Dual Degree ProgrammeDocumento3 pagineIISER Mohali Offer Letter for Dual Degree ProgrammeAyush KumarNessuna valutazione finora

- PENSION - Calculation SheetDocumento5 paginePENSION - Calculation SheetsaurabhsriNessuna valutazione finora

- Salary Slip (32114282 October, 2019) PDFDocumento1 paginaSalary Slip (32114282 October, 2019) PDFSafa Saleem ButtNessuna valutazione finora

- AjmalDocumento1 paginaAjmalGHS BALKASSARNessuna valutazione finora

- PrjectDocumento16 paginePrjectSushil ShresthaNessuna valutazione finora

- Bank capital and liability breakdownDocumento2 pagineBank capital and liability breakdownSushil ShresthaNessuna valutazione finora

- Interpretations of Peace in History and Culture: Wolfgang DietrichDocumento1 paginaInterpretations of Peace in History and Culture: Wolfgang DietrichSushil ShresthaNessuna valutazione finora

- TRADERS: Capital 300,000 922,875 25,400 307,625Documento7 pagineTRADERS: Capital 300,000 922,875 25,400 307,625Sushil ShresthaNessuna valutazione finora

- Tax Calculation Sheet, 068-069Documento8 pagineTax Calculation Sheet, 068-069Sushil ShresthaNessuna valutazione finora

- Audit Plan 1st & 2nd Quarter Finance LtdDocumento6 pagineAudit Plan 1st & 2nd Quarter Finance LtdSushil ShresthaNessuna valutazione finora

- Internal Control & Inv MGMTDocumento25 pagineInternal Control & Inv MGMTSushil Shrestha100% (1)

- Discipline and Appeal RulesDocumento13 pagineDiscipline and Appeal Rulesआस्तिक शर्माNessuna valutazione finora

- UWN011 - NRI With GST DeclarationDocumento5 pagineUWN011 - NRI With GST DeclarationSrigandh's WealthNessuna valutazione finora

- Icici Prudential Nitin 8305394430Documento32 pagineIcici Prudential Nitin 8305394430King Nitin AgnihotriNessuna valutazione finora

- Ra 10607Documento27 pagineRa 10607Deneb DoydoraNessuna valutazione finora

- Asc Sept 18Documento48 pagineAsc Sept 18Orhan Mc MillanNessuna valutazione finora

- Assumptions SettingDocumento43 pagineAssumptions SettingphilipoNessuna valutazione finora

- PAA 2M SA TPD 1M ADD LCB 36k ApeDocumento10 paginePAA 2M SA TPD 1M ADD LCB 36k ApeRey Christopher CastilloNessuna valutazione finora

- MGFP BrochureDocumento26 pagineMGFP BrochureAbhinesh KumarNessuna valutazione finora

- Bajaj Allianz Life Pension Guarantee Annuity PlanDocumento8 pagineBajaj Allianz Life Pension Guarantee Annuity PlanRuthvik SharmaNessuna valutazione finora

- A Project Report On Stress Management at Icici-PrudentialDocumento113 pagineA Project Report On Stress Management at Icici-PrudentialBabasab Patil (Karrisatte)0% (2)

- LessDocumento24 pagineLessMANISHANessuna valutazione finora

- Sampoorna Raksha BrochureDocumento7 pagineSampoorna Raksha BrochurePraveen CNessuna valutazione finora

- Build Emergency Fund, Secure Family With Term PlansDocumento15 pagineBuild Emergency Fund, Secure Family With Term PlansVamsi Pavan Kumar SankaNessuna valutazione finora

- Bajaj Allianz Life Insurance Company Mission and Career OpportunitiesDocumento12 pagineBajaj Allianz Life Insurance Company Mission and Career OpportunitiesLakshav KapoorNessuna valutazione finora

- EthicsCanada E112 2016-11-3EDDocumento180 pagineEthicsCanada E112 2016-11-3EDthusi1Nessuna valutazione finora

- Prudential M5 Mock PaperDocumento22 paginePrudential M5 Mock PaperAshNessuna valutazione finora

- 110553i060120221446121909138 EappDocumento11 pagine110553i060120221446121909138 Eapp2hcbqj8kmmNessuna valutazione finora

- Kiplinger x27 S Retirement Report - Volume 28 No 8 August 2021Documento24 pagineKiplinger x27 S Retirement Report - Volume 28 No 8 August 2021Tsups An Tsups100% (1)

- Lalican Vs Insular LifeDocumento1 paginaLalican Vs Insular LifeGian Tristan MadridNessuna valutazione finora

- AFMAN 10-100 - US Air Force - Airman's Manual (01MAR09)Documento266 pagineAFMAN 10-100 - US Air Force - Airman's Manual (01MAR09)Mário Mineiro100% (2)

- COMMERCE 4FP3 at McMaster U, Cheatsheet For FinalDocumento6 pagineCOMMERCE 4FP3 at McMaster U, Cheatsheet For Finalstargaze_night_42Nessuna valutazione finora

- Insurance Claims ProjectDocumento58 pagineInsurance Claims ProjectMukesh ManwaniNessuna valutazione finora

- Online Life & Term Insurance Premium Calculator at SBI Life EShieldDocumento2 pagineOnline Life & Term Insurance Premium Calculator at SBI Life EShieldPrabhu SakinalaNessuna valutazione finora

- Mba Project Report On HDFC BankDocumento78 pagineMba Project Report On HDFC BankRabiaNessuna valutazione finora

- Documents For Supporting InvestmentsDocumento1 paginaDocuments For Supporting InvestmentsPrasad KrrNessuna valutazione finora

- Great Pacific Life Assurance vs. CA, GR Nos. 31845 & 31873, AprilDocumento3 pagineGreat Pacific Life Assurance vs. CA, GR Nos. 31845 & 31873, AprilKimberly SendinNessuna valutazione finora

- Plan for a regular income in retirementDocumento2 paginePlan for a regular income in retirementarunNessuna valutazione finora

- SPWP 61Documento34 pagineSPWP 61Loo Lik HoNessuna valutazione finora

- Chapter 3Documento21 pagineChapter 3Annalyn MolinaNessuna valutazione finora

- Insular Life Assurance Co. v. NLRCDocumento11 pagineInsular Life Assurance Co. v. NLRCPrincess Samantha SarcedaNessuna valutazione finora