Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Econ 121 Syllabus2

Caricato da

Joseph LoyolaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Econ 121 Syllabus2

Caricato da

Joseph LoyolaCopyright:

Formati disponibili

UNIVERSITY OF THE PHILIPPINES VISAYAS TACLOBAN COLLEGE TACLOBAN CITY

Course Syllabus Course number Course title Course credit Class venue, day & time Econ 121 Economics of Money and Banking 3 units AS 22 MTH, 8:30-10 AS Professor Consultation hours Phone Local E-mail Dr. Anita G. Cular MTH 8:30-10 Or by appointment 321-4479 anita_cular@yahoo.com

Course description Course goals At the end of the semester, the students should gain basic understanding on the concepts and theories related to money, banking and the financial system. The students are expected to internalize the relevance of money in the economy, and be able to integrate these concepts in their daily activities as active economic agents. Course objective To know the profile of my students To level off expectations of the students and the teacher To orient the students about the course and its requirements, To present the introductory concepts related to the course GTKY Key Concepts in the Financial System (Financial Markets; Bond Market, Stock Market, Foreign Exchange Markets, financial Chapter 1, Mishkin intermediaries, money and business cycles, money and inflation, money and interest rates, budget deficit and monetary policy The function of financial markets Topic References

Course schedule Week 1

Week 2

The students must be able to

Week 3

draw schematically and explain the over-all financial system correctly Given a lot of examples. The students must be able to differentiate between direct and indirect finance and its involved institutions correctly The students must be able to know how the structure of the financial markets help in the economy The students must be able to appreciate and realize the importance of financial intermediaries compared to the security markets in providing funds to borrowers.

Structure of financial markets Chapter 2, Mishkin Financial market instruments Function of financial intermediaries and its importance Examples of financial intermediaries

week 4

Facts about financial structure Transaction costs: Its influence in the Financial structure; FIs and Transaction costs Asymmetric Information Lemons problems: Stock and Bond Markets How to solve adverse selection problems Moral Hazard:Debt and Equity Contracts The students must be able to How to solve Principal-Agent link the financial crisis and Problem its impact on the economy How to solve moral hazard in Debt contracts Financial Crisis and Its causes and impact on the economy The students must be able to Measuring interest rates know the concept of interest The concept of present value and rates and its role in the Yield to Maturity economy and each individual Bond Price and interest rate in the economy relationship Given various assets, students Current Yield must be able to decide Capital Gains maximally what financial Interest rates vs returns asset to buy or sell using the Real interest vs nominal interest rates as a criterion. Given so much money, the students must be able to decide what portfolio of assets to acquire in order to maximize returns; The students must be able to appreciate the importance of asset diversification Determinants of Asset Demand Portfolio Choice Benefits of Diversification Systematic vs unsystematic risk Asset Return and the Forex Market

Chap.8, Mishkin

Chapter 4, Mishkin

Week 5

Chapter 5, Mishkin Chapter 17, Mishkin

Week 6

Given a lot of factors, the students must be able to identify correctly what factors influence the behavior of interest rates The students must be able to integrate the relationship of the bond and money markets in influencing the behavior of interest rates.

Week 7

The students must be able to trace correctly the history of money perfectly The students must be able characterize money excellently. The students must be able to distinguish the motives for holding money The student must be able to determine how money supply is created Given an economic condition, the students must be able to know how to apply correctly the monetary policy.

Supply and demand in the bond market and its market equilibrium Factors affecting the supply and demand of bonds and its influence in the market equilibrium Supply and demand in the money market Money Market Equilibrium Factors affecting the supply and demand of money and its influence on the behavior of interest rates Evolution of money and the payment system Functions and Characteristics of money Demand of money M1, M2, M3 Supply of money and its determination : Players involved Monetary Base Monetary Equilibrium

Chapter 5, Mishkin

Chapter 3, Mishkin Chap 19, Mishkin

Week 8

Tools of MP The conduct of MP Transmission Mechanisms of MP The BSP, its role and function

Chap 15, 16, Mishkin

Week 9

The students must be able to trace the history of the banking system; The students must be able to outline correctly the evolution of the Phils. Banking system The students must be able to appreciate banking regulation The students must be able to appreciate the role of banks in the economy.

Evolution of the banking system in general Evolution of the Phils. Banking system The decline of traditional banking BSP data Chapter 12, Mishkin

Week 10

The students must be able to analyze correctly the behavior Balance Sheet of the banking system Basic Operation of a bank General principles of bank management How to Manage Credit risk Categories of banking regulation Managing interest rate risk Off balance Sheet activities Financial Innovation

Chapter 9, Mishkin

Week 11 Week 12

The students must be able to trace the relationship between money and inflation The students must be able to know the evolution of the international Financial system

2 views of inflation Keynesian and monetarist Budget deficit and inflation Gold Standard Bretton Woods and the IMF and WB

Chapter 24 Chap 18, Mishkin

Teaching methods & strategies

Lecture-demonstration, group work, presentation, workshop, games. Class requirements Activity 1. Long Exams (3 exams) 50% 2. Class Project ( Symposium, Field Trip 20% 3. Class Participation ( Presentations, Reports, Quizzes, assignments, etc) 30%

4. Passing Mark= 60% Class requirements details Bases for grading a) All reports are to be word- processed using Times font size 12 double space . b) Requirements not submitted on time will be penalized.

Grades will be based on the points earned: 1.0 = 50-49 1.25 = 48-47 1.50 = 46-44 1.75 = 43-41 2.25 = 38-36 2.50 = 35-33 2.75 = 32-31 3.00 = 30

2.00 = 40-39 Reading List

4.00 = below 30

Mishkin, Frederic S. The Economics of Money, Banking and Financial Markets, International ed. Dornbusch, R. and S. Fischer, Macroeconomics (latest edition) McGraw-Hill (DF) Simpson, Thomas, Money and Banking and econ Activity Chandler and Goldfield, Economics of Money and Banking

Class-pals

List below names of at least three classmates. Get the best modes of getting in touch with them in case you have concerns regarding the course. Phone/Fax/Cell Email Address

Name

Potrebbero piacerti anche

- Money & Banking BBA 5thDocumento2 pagineMoney & Banking BBA 5thMehmud Raffæy0% (1)

- University of Gujrat: Faculty of Management and Administrative SciencesDocumento4 pagineUniversity of Gujrat: Faculty of Management and Administrative SciencesTajalli Fatima0% (1)

- ECO 375: Money, Banking, and Financial MarketsDocumento3 pagineECO 375: Money, Banking, and Financial Marketsapi-25939187Nessuna valutazione finora

- Description of Courses UndertakenDocumento13 pagineDescription of Courses UndertakenFelipe ManzorNessuna valutazione finora

- ISC301B Money and BankingDocumento3 pagineISC301B Money and BankingAmosNessuna valutazione finora

- FIN301 Outline FinalDocumento13 pagineFIN301 Outline FinalArsalan AqeeqNessuna valutazione finora

- Financial Markets (Chapter 1)Documento1 paginaFinancial Markets (Chapter 1)Kyla DayawonNessuna valutazione finora

- PRINCIPLES OF BANKING AND FINANCE PrinciDocumento7 paginePRINCIPLES OF BANKING AND FINANCE PrinciEnelyoj TondaNessuna valutazione finora

- ECON 4200n-Winter 2023Documento5 pagineECON 4200n-Winter 2023Tamara KimNessuna valutazione finora

- MGMT 3053 Course OutlineDocumento4 pagineMGMT 3053 Course OutlineStephen M. NeilNessuna valutazione finora

- Syllabus For ECON 1160 Principles of Economics 1Documento4 pagineSyllabus For ECON 1160 Principles of Economics 1Ben MoneyNessuna valutazione finora

- Advanced Financial Instruments and Markets Course Guide BookDocumento6 pagineAdvanced Financial Instruments and Markets Course Guide Bookfinancecottage100% (1)

- BSc3 Financial Intermediation 2020-2021Documento12 pagineBSc3 Financial Intermediation 2020-2021AndrewNessuna valutazione finora

- Villarama, Deserey - CHAPTER 1Documento1 paginaVillarama, Deserey - CHAPTER 1Deserey VillaramaNessuna valutazione finora

- 20220910165230HCTAN008A-PBF Outline Lecturer InfoDocumento3 pagine20220910165230HCTAN008A-PBF Outline Lecturer Infonicholas wijayaNessuna valutazione finora

- Syllabus Finc313-Barnes-Spring2014Documento14 pagineSyllabus Finc313-Barnes-Spring2014Gonzalo CamargoNessuna valutazione finora

- Lahore Garrison University: Course ObjectivesDocumento2 pagineLahore Garrison University: Course ObjectivesMazhar Farid ChishtiNessuna valutazione finora

- Master of Banking and FinanceDocumento12 pagineMaster of Banking and Financevagabondage0511Nessuna valutazione finora

- Course Outline FICMDocumento3 pagineCourse Outline FICMmulutsega yacobNessuna valutazione finora

- Addis Ababa Science and Technology University: School of Business and EconomicsDocumento4 pagineAddis Ababa Science and Technology University: School of Business and EconomicsBirhanu WorkuNessuna valutazione finora

- Money and Banking Mgt-304Documento3 pagineMoney and Banking Mgt-304Anonymous 7nY38BNessuna valutazione finora

- Wealth Global Navigating the International Financial MarketsDa EverandWealth Global Navigating the International Financial MarketsNessuna valutazione finora

- Macroeconomics made simple, investing by interpreting the financial markets: How to read the financial markets in order to invest with greater awarenessDa EverandMacroeconomics made simple, investing by interpreting the financial markets: How to read the financial markets in order to invest with greater awarenessNessuna valutazione finora

- Course Guide 35807 Introductory Economics: Previous Previous KnowledgeDocumento4 pagineCourse Guide 35807 Introductory Economics: Previous Previous KnowledgeamparoNessuna valutazione finora

- 2007 - Fina 101 - Principles of Money, Banking and Credit-3Documento9 pagine2007 - Fina 101 - Principles of Money, Banking and Credit-3adrianrivalNessuna valutazione finora

- BFN 111 Course Compact 2018-2019Documento3 pagineBFN 111 Course Compact 2018-2019CHIDINMA ONUORAH100% (1)

- Unec 1680447941Documento10 pagineUnec 1680447941Elgün AbdullayevNessuna valutazione finora

- Macroeconomics: (Pce, Pcef, Esp, S+E) : Lecturer: Yunus AksoyDocumento3 pagineMacroeconomics: (Pce, Pcef, Esp, S+E) : Lecturer: Yunus AksoyRakesh JangidNessuna valutazione finora

- ISL244E Syllabus 2023 Spring FinalDocumento2 pagineISL244E Syllabus 2023 Spring Finalozcorekcimustafa6Nessuna valutazione finora

- The Wealth Blueprint Unleashing Your Financial PotentialDa EverandThe Wealth Blueprint Unleashing Your Financial PotentialNessuna valutazione finora

- Multi-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading EraDa EverandMulti-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading EraValutazione: 4.5 su 5 stelle4.5/5 (2)

- FINN 341A-Financial Institutions and Markets - Fall 2011Documento8 pagineFINN 341A-Financial Institutions and Markets - Fall 2011BurakNessuna valutazione finora

- ECON201 Macro Fall06Documento5 pagineECON201 Macro Fall06Athena HormachuelosNessuna valutazione finora

- Course Outline FIN401 SPR14Documento2 pagineCourse Outline FIN401 SPR14Shahriar MullickNessuna valutazione finora

- Outline Econ 313 Monetary TheoryDocumento4 pagineOutline Econ 313 Monetary TheoryShayan MujtabaNessuna valutazione finora

- Competences and Skills That Will Be Acquired and Learning ResultsDocumento2 pagineCompetences and Skills That Will Be Acquired and Learning ResultsNguyễn LongNessuna valutazione finora

- BF SyllabusDocumento6 pagineBF Syllabusnghiep tranNessuna valutazione finora

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionDa EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionValutazione: 3 su 5 stelle3/5 (2)

- Cib CoursesDocumento10 pagineCib CoursesEnusah AbdulaiNessuna valutazione finora

- MokzieDocumento2 pagineMokzieMarch LomongoNessuna valutazione finora

- Baf 2203Documento90 pagineBaf 2203geoffrey oodhiambNessuna valutazione finora

- CONCEPT AND ROLE OF BANKING June 22 PDFDocumento210 pagineCONCEPT AND ROLE OF BANKING June 22 PDFgizachewnani2011Nessuna valutazione finora

- EconomicsDocumento4 pagineEconomicss4sabaNessuna valutazione finora

- Learning Outcome On Imf PakistanDocumento2 pagineLearning Outcome On Imf Pakistanshahkrrish43Nessuna valutazione finora

- EC3115 Monetary EconomicsDocumento3 pagineEC3115 Monetary EconomicsIlija NinkovicNessuna valutazione finora

- Economic Analysis 2012Documento5 pagineEconomic Analysis 2012Ali IqbalNessuna valutazione finora

- An Introduction to Stocks, Trading Markets and Corporate Behavior: The Investor's GuideDa EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: The Investor's GuideValutazione: 5 su 5 stelle5/5 (2)

- ECO 203 OutlineDocumento3 pagineECO 203 OutlinekehindeadeniyiNessuna valutazione finora

- International FinanceDocumento87 pagineInternational FinancenawtamsonNessuna valutazione finora

- Business Economics 1Documento57 pagineBusiness Economics 1John ChiwaiNessuna valutazione finora

- Banking and International FinanceDocumento101 pagineBanking and International FinanceHannjack NgNessuna valutazione finora

- FINS3666 Outline 2019Documento6 pagineFINS3666 Outline 2019jake chudnowNessuna valutazione finora

- Grade 9 / Year 10 Economics Course Syllabus 2020-2021 Course OutlineDocumento3 pagineGrade 9 / Year 10 Economics Course Syllabus 2020-2021 Course OutlineCanioNessuna valutazione finora

- Samara University College of Business and Economics Department of Accounting and Finance Course InformationDocumento2 pagineSamara University College of Business and Economics Department of Accounting and Finance Course InformationSeid KassawNessuna valutazione finora

- Betar BSN3Documento6 pagineBetar BSN3Shannie PadillaNessuna valutazione finora

- Eco741b - Ethics & Financial Regulations - Day 1 & 2 1Documento42 pagineEco741b - Ethics & Financial Regulations - Day 1 & 2 1babie naaNessuna valutazione finora

- Forth Sem Syllabus-29805Documento27 pagineForth Sem Syllabus-29805SharmaDeepNessuna valutazione finora

- International Patient Referral - Part 2 - Revised - 29-04-2010 - 2Documento2 pagineInternational Patient Referral - Part 2 - Revised - 29-04-2010 - 2Fatah AssadNessuna valutazione finora

- Catálogo MK 2011/2013Documento243 pagineCatálogo MK 2011/2013Grupo PriluxNessuna valutazione finora

- Lesson Plan SustainabilityDocumento5 pagineLesson Plan Sustainabilityapi-501066857Nessuna valutazione finora

- DIFFERENTIATING PERFORMANCE TASK FOR DIVERSE LEARNERS (Script)Documento2 pagineDIFFERENTIATING PERFORMANCE TASK FOR DIVERSE LEARNERS (Script)Laurice Carmel AgsoyNessuna valutazione finora

- Monitor Stryker 26 PLGDocumento28 pagineMonitor Stryker 26 PLGBrandon MendozaNessuna valutazione finora

- De DusterDocumento6 pagineDe DusterArstNessuna valutazione finora

- 01 - A Note On Introduction To E-Commerce - 9march2011Documento12 pagine01 - A Note On Introduction To E-Commerce - 9march2011engr_amirNessuna valutazione finora

- Daikin FUW Cabinet Fan Coil UnitDocumento29 pagineDaikin FUW Cabinet Fan Coil UnitPaul Mendoza100% (1)

- A - PAGE 1 - MergedDocumento73 pagineA - PAGE 1 - MergedGenalyn DomantayNessuna valutazione finora

- Broiler ProductionDocumento13 pagineBroiler ProductionAlexa Khrystal Eve Gorgod100% (1)

- Using The Monopoly Board GameDocumento6 pagineUsing The Monopoly Board Gamefrieda20093835Nessuna valutazione finora

- Benko Gambit-Jacobs and Kinsman, 1999Documento163 pagineBenko Gambit-Jacobs and Kinsman, 1999johnson Greker100% (3)

- Grade9 January Periodical ExamsDocumento3 pagineGrade9 January Periodical ExamsJose JeramieNessuna valutazione finora

- Timetable - Alton - London Timetable May 2019 PDFDocumento35 pagineTimetable - Alton - London Timetable May 2019 PDFNicholas TuanNessuna valutazione finora

- CL RouterAndSwitches AE Kn1of3 AnswerDocumento19 pagineCL RouterAndSwitches AE Kn1of3 Answereugene ngNessuna valutazione finora

- Particle BoardDocumento1 paginaParticle BoardNamrata RamahNessuna valutazione finora

- Ymrtc LogDocumento26 pagineYmrtc LogVinicius Silveira0% (1)

- MCQs - Chapters 31 - 32Documento9 pagineMCQs - Chapters 31 - 32Lâm Tú HânNessuna valutazione finora

- Cad Data Exchange StandardsDocumento16 pagineCad Data Exchange StandardskannanvikneshNessuna valutazione finora

- 3rd Page 5Documento1 pagina3rd Page 5api-282737728Nessuna valutazione finora

- Process Strategy: Powerpoint Slides by Jeff HeylDocumento13 pagineProcess Strategy: Powerpoint Slides by Jeff HeylMuizzNessuna valutazione finora

- Asus Test ReportDocumento4 pagineAsus Test ReportFerry RiantoNessuna valutazione finora

- Public Access - The GauntletDocumento1 paginaPublic Access - The GauntletTesting0% (2)

- Participant Observation: Qualitative Research Methods: A Data Collector's Field GuideDocumento17 pagineParticipant Observation: Qualitative Research Methods: A Data Collector's Field GuideMarta CabreraNessuna valutazione finora

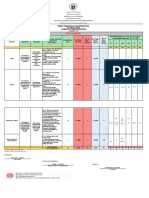

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Documento6 pagineRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNessuna valutazione finora

- Nutrition Great Foods For Getting Vitamins A To K in Your DietDocumento1 paginaNutrition Great Foods For Getting Vitamins A To K in Your DietDhruv DuaNessuna valutazione finora

- Geometry and IntuitionDocumento9 pagineGeometry and IntuitionHollyNessuna valutazione finora

- PH of Soils: Standard Test Method ForDocumento3 paginePH of Soils: Standard Test Method ForYizel CastañedaNessuna valutazione finora

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Documento94 pagineN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESNessuna valutazione finora

- Activity Evaluation Form: "Where Children Come First"Documento1 paginaActivity Evaluation Form: "Where Children Come First"TuTitNessuna valutazione finora