Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Valuation and Capital Budgeting Formulas

Caricato da

Sebastian GorhamDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Valuation and Capital Budgeting Formulas

Caricato da

Sebastian GorhamCopyright:

Formati disponibili

EMBA 807

Corporate Finance

Dr. Rodney Boehme

CHAPTER 17: VALUATION AND CAPITAL BUDGETING FOR THE LEVERED FIRM

Assigned problems are 3, 5, 8a, 14, and 15. Read Appendix 17A.

Chapter 7 covered capital budgeting for an all equity firm. Chapters 10 and 11 introduce asset pricing models that can be applied to determine the appropriate discount rate given the risk of a project. Chapter 17 incorporates the effects of financial leverage into capital budgeting. Using a Modigliani-Miller (Chapter 15) world to simplify the exposition, we cover two complementary valuation approaches: 1. Adjusted present value (APV) approach 2. Flow to equity (FTE) approach 3. Weighted average cost of capital (WACC) approach

I. The Adjusted Present Value Approach

The Adjusted Present Value (APV) for a project with debt financing is:

APV = NPVU + NPVF

APV has the conceptual advantage of separating the value of the unlevered investment from the value that comes from the financing effects (what we see here is an extension of Chapter 15). 1. NPVU is defined as the Net Present Value of the project to an all-equity or unlevered firm:

NPVU = PVUCF Initial investment PVUCF is defined as the PV of Unlevered Cash Flows or UCFs. The discount rate

used is: r0, the Unlevered cost of capital or required return on the Assets, where from Chapter 12: r0 = rF + ASSETS[rM rF]

2. NPVF is the Net Present Value of financial effects, which should include: tax subsidy to debt (the tax shield) costs of issuing new debt and equity securities (flotation costs) costs of financial distress arising from the use of debt subsidies to debt financing You have already seen one of these financing side effects. In Chapter 15, using perpetual debt, the value of a levered firm is: VL = VU + TCB, where TCB is the PV of the tax shield.

An Example of APV and the Tax Subsidy to Debt

The following example takes advantage of the simplicity in the Modigliani-Miller world. Suppose PMM Inc. has an investment with the following characteristics: Initial cost of project or investment is CF0 = $100,000 Page 1

EMBA 807

Corporate Finance

Dr. Rodney Boehme

The assets of this project generate an expected EBIT = $15,000 per year forever (perpetuity). This project or investment can be financed either with $100,000 in equity (assume from internally generated cash flow) or with $40,000 of debt and $60,000 equity. The discount rate on an all equity financed project in this risk class is r0 = 10%. The firm's marginal tax rate is TC = 40%. The cost of any debt is rD = 5% before taxes. We will let the coupon rate and cost of debt be equal, i.e., rD = rB. 1. All equity value (Unlevered NPV): Annual after-tax cash flow to unlevered equity is EBIT(1 TC) = ($15,000)(1 0.40) = $9000 in perpetuity. The Net Present Value of the project if financed with internal equity is therefore: NPVU = PV(UCFs) Initial Investment NPVU = EBIT[1 TC]/r0 initial investment = $9000/0.10 $100,000 = $10,000 Since NPVU = $10,000, the all-equity firm should reject the project since the $100,000 initial investment will create an asset only worth $90,000 2. Financing side effect: (using D=$40,000 and E=$60,000) Note that in the MM world, all cash flows are perpetual and debt does not mature. Interest expense on debt is tax deductible. In this example, the annual coupon interest payment is rBB = (0.05)($40,000) = $2000. The annual tax subsidy (tax savings from the debt) is rBBTC = (0.05)($40,000)(0.40) = $800, and the present value of this financing side effect discounted at the market cost of debt rD = 5%. NPVF = rBBTC/rD; the PV of Tax Shield from Chapter 15 (here, rB = rD = 5%), yielding: NPVF = TCB =(0.40)(40,000) = $16,000 The Adjusted Present Value of the project is then APV = NPVU + NPVF = 10,000 + 16,000 = $6000 After including the value of the tax subsidy or PV(tax shield), stockholders can now expect to gain $6000. The firm should accept this project if it is financed with $40,000 in debt at 5%. Think of this project as a separate firm. The value of the unlevered firm is the value of the original $100,000 investment plus the negative $10,000 NPV, i.e. VU = $100,000 10000 = $90,000. The value of the levered firm is VL = VU + TCB = $90,000 + $16,000. The value of debt is D = $40,000 (the face or par value B, since rB = rD = 5%) and the entire tax shield subsidy is captured by the stockholders; E = VL D = 106,000 40,000 = $66,000. Note that the stockholders originally invested $60,000 of equity.

Page 2

EMBA 807 3. Flotation (Issuance) Costs

Corporate Finance

Dr. Rodney Boehme

When a firm raises funds through external debt or equity, it must incur flotation costs (investment bankers will certainly demand a fee for their services of issuing securities). The cost of issuing debt is going to be around 1 to 4% of the total proceeds that you expect to raise from the bond issue. The firm is allowed to amortize these issuance or flotation costs during future years. I ignore flotation costs in this example, but be aware that these costs exist. Equity flotation costs are the highest, about 7% of the total proceeds of the equity issue! 4. Costs of Financial Distress Firms should continue to exploit tax shields on interest until the benefits are offset by the marginal costs of financial distress. This means that financial distress costs are likely to be non-trivial for an optimally-financed firm. Unfortunately, financial economists are no help here, as there is no easy method to calculate this figure.

II. The Flow To Equity (FTE) Approach

The value of the equity component of a project can be calculated by discounting the projects Levered Cash Flows or LCFs at the projects cost of equity capital. For the sake of continuity, the following example uses the data given in Section I. A project will generate EBIT = $15,000 per year in perpetuity. The project is financed with a Debt to Equity ratio of D/E = 0.6060606 and the amount of debt is D = $40,000. The cost of the debt is rD=5% and the tax rate is TC=40%. The unlevered cost of capital (required return on the assets) is r0=10%. The first step is to calculate the Levered Cash Flows or LCFs to the equity. LCF = [EBIT rBB][1 TC] = [15,000 (0.05)(40,000)][1 0.40] = $7800 Since this example is in the Modigliani-Miller Chapter 15 world, we can use MM Proposition II (with corporate taxes) to estimate the cost of levered equity or rE. The Debt to Equity ratio (to be held constant for the projects life) is D/E = 0.6060606. rE = r0 + (r0 rD)(1 TC)(D/E) rE = 0.10 + (0.10 0.05)(1 0.40)(0.6060606) = 0.11818 or 11.818% The equity value will consist of a perpetuity of LCF=$7800 per year, discounted at rE=0.11818. The value of the equity is E = 7800/rE = 7800/0.11818 = $66,000. Now we find the NPV, still using the data from the example of Section 1 and as continued here. The initial equity invested in the project is $60,000, as $40,000 of the $100,000 initial investment was borrowed as debt. The NPV of the project for the equity providers is thus: NPV = LCF/rE initial eqity investment = 7800/0/11818 60,000 = $6000

Page 3

EMBA 807

Corporate Finance

Dr. Rodney Boehme

III. The Weighted Average Cost Of Capital (WACC) Approach

The value of any firm or project, whether levered or unlevered, can always be calculated by discounting the Unlevered Cash Flows at the weighted average cost of capital. This example uses the data from the example in Section 1. Due to using this data, some of this may appear as circular reasoning, although this is not the intention. Recall that the expected EBIT of the project is $15,000 in perpetuity. If PPM Inc. financed the project with $40,000 debt at 5% interest, the net after-tax cash flows to stockholders is: Cash Flows to Levered Equity = [EBIT rBB][1 TC] = [$15,000 $2000][1 0.40] = $7800 Since this example is in the Modigliani-Miller Chapter 15 world, we can use MM Proposition II (with corporate taxes) to estimate the cost of levered equity: rE = r0 + (r0 rD)(1 TC)(D/E) We need to know the Debt to Equity ratio. From the prior example, D=40,000 and E=66,000. rE = 0.10 + (0.10 0.05)(1 0.40)(40,000/66,000) = 0.11818 or 11.818% The value of the equity is E = 7800/rE = 7800/0.11818 = $66,000 (which we already knew) A firm's overall WACC (originally introduced in Chapter 12) is a market value weighted average of the after-tax cost of debt and cost of equity: rWACC = [D/(D + E)](1 TC)rD + [E/(D + E)]rE The intuition of the WACC approach is simple and appealing. If a project's expected after-tax return (IRR) is higher than the weighted average of the after-tax required returns on debt and equity capital, it is a positive NPV project. Continuing our previous example, the weighted average cost of capital for a levered firm in the MM world is: D = $40,000 E = $66,000 rD = rB = 5% rE = 11.818% TC = 40% rWACC = [40,000/106,000](0.60)(0.05) + [66,000/106,000](0.11818) = 0.084906 or 8.4906% The benefit that is associated with the tax shield of debt is thus already incorporated into the WACC. We always calculate the projects cash flows as if they are Unlevered, (as done in Chapter 7). The present value of the Unlevered after-tax cash flows to the firm discounted at rWACC is:

Page 4

EMBA 807

Corporate Finance

Dr. Rodney Boehme

PVWACC = VL = (Unlevered after-tax cash flows)/rWACC PVWACC = ($15,000)(1 - 0.40)/0.084906 = $106,000 and the NPVWACC = VL Initial Investment = $106,000 - $100,000 = $6000 Of course, this is the same firm value as in the APV approach and the result is identical. This example illustrates that APV and WACC are different but complementary ways of valuing the firm. Each method accounts for the tax benefits of financial leverage differently but the value of the benefits is the same under each approach in the MM world.

When and How to Use the WACC

It is important to remember that a firm's existing WACC is only appropriate as a discount rate for a project when both of the following conditions are met: 1. 2. The project has similar systematic risk (asset beta) as the firm. The project and firm have the same debt capacity.

This WACC approach is often inappropriate for new projects, since a project's systematic risk may be different from that of the existing firm. A project's debt capacity can also be different than the average debt capacity of the firm. If either (1) or (2) above is not met, then the project should be treated as if it were a mini-firm, with its own proportion of debt and equity and its own capital costs. The WACC is typically used to value scale expanding projects. A convenient feature of the WACC approach is that it is often easy to obtain estimates of rE, rD, D and E. For a publicly traded firm, the market values of debt and equity can be obtained from the financial press (e.g. the Wall Street Journal). The next section discusses how to estimate required returns on debt and equity. The cost of debt The easiest way to estimate the cost of debt is to calculate the yield to maturity on a similar-risk bond in the market. Suppose a firm is considering selling 12% coupon bonds ($1000 par) with a 20-year life and annual payments. If similar bonds of the same rating sell for $1,170.30, then the implied Yield to Maturity or YTM is 10%. The cost of equity The asset pricing models introduced in Chapters 10 and 11 are useful for estimating the cost of equity. Using the CAPM model, the cost of equity is: rE = rF + E[rM rF] Many information services publish betas for publicly traded stocks. Chapter 10 provided a discussion on how to estimate variance, covariance, and beta. If you use betas from an external source (such as ValueLine) to estimate rE, you must use the market index used by the information service to estimate beta as rM. Once rD, rE, and the proportions of debt and equity financing are known, the following analysis will estimate the PV of a firm or project.

Page 5

EMBA 807

Corporate Finance

Dr. Rodney Boehme

rWACC = [D/(D + E)](1 TC)rD + [E/(D + E)]rE

PV0 =

t =1

(1 + rwacc )t

UCFt

IV. Perfect Models For An Imperfect World: APV, FTE, and WACC

These three methods for calculating the value of a proposed project should be viewed as complementary. Initial Investment Cash Flows D or D/E held constant Discount Rates PV of financing effects APV All UCF D r0 Yes FTE book E LCF D/E rE No WACC All UCF D/E rWACC No

We suggest the following guideline for choosing between these models:

Use the WACC method if the target debt ratio will be constant throughout the life of the

project.

Use the APV method if the debt level will be constant through out the life of the project.

V. Beta and Leverage

It is never too repetitive to remind students that if the systematic risk of the project differs significantly from the average risk of the firm, the discount rate should reflect the risk of the project. For example, we can use CAPM to estimate the unlevered discount rate: Asset beta ASSET) = Cov(UCF,Market) / Var(Market) and the unlevered discount rate is r0 = rF + ASSET[rM rF]. The Asset Beta and unlevered discount rate do not take into account the effects of financial leverage. If the project generates debt capacity, the following formulas can be used to adjust beta for financial leverage. The No-tax Case: In a world without taxes, the asset beta of a levered firm is simply the weighted average of the betas of debt and equity: ASSET = [D/(D+E)]Debt + [E/(D+E)]Equity If corporate debt is risk-free, i.e., Debt = 0 then: ASSET = [E/(D +E)]Equity Note: this equation is just a rearrangement of equation 17.3 in the text: Equity = (1 + D/E)Asset

Page 6

EMBA 807

Corporate Finance

Dr. Rodney Boehme

The Corporate tax case (yes, the real world example): In a world with corporate taxes and risk-free corporate debt, i.e., Debt = 0, the relationship between levered equity beta and unlevered or asset beta is: Equity = [1 + (1 TC)D/E]ASSET. In this case, since corporate debt is risk-free, the tax shield benefit from debt is also risk-free. The levered equity Beta is always greater than the Asset (unlevered) Beta in all scenarios. If corporate debt is not risk-free, the relationship between the levered equity beta and the unlevered or asset beta becomes: Equity = ASSETS + (1 TC)(ASSETS DEBT)D/E These two formulas combine assumptions of the CAPM and the MM Model. Recall that in the MM world with corporate tax, the optimal capital structure policy is to use 100% debt because the costs of financial distress are assumed to be zero. Consequently, applying the levered beta equations to real world situations that differ markedly from the MM assumptions can be hazardous.

VI. CREATING NPV THROUGH DEBT FINANCING:

This section expands on a topic we first covered in Chapter 15, the PV(tax shield of debt). In Chapter 15, the focus is entirely on the subject of capital structure and we assumed that all cash flows come as perpetuities in order to narrow that focus. Here, we focus solely on the PV created by the Tax Shield of debt and also for a non-perpetual debt. NPVF = Amount received PV(interest payments) PV(par value repayment) 1. Perpetual debt: sell a perpetual bond having a face value of B = $100,000 Par value and coupon rate rB = 10%. The corporate tax rate is TC = 40%. The market requires a return or Yield-To-Maturity or YTM of rD = 10% on this bond. Interest payments = rBB = (0.10)(100,000) = $10,000 per year After-tax cost of interest payments = (1 TC)(rBB) = (1 0.40)(10,000) = $6000 per year PV of after-tax interest payments = 6000/rD = 6000/0.10 = $60,000 PV of repayment of Par value = zero, since the par value is never paid with perpetual debt. NPVF = amount received PV(interest payments) PV(par value repayment) NPVF = 100,000 60,000 0 = $40,000, this is also the PV(tax shield) Short cut method: with a perpetual bond; PV(tax shield) = rBBTC/rD. Here, since rB = rD, we arrive at a PV(tax shield) = NPVF = TCB = $40,000

Page 7

EMBA 807

Corporate Finance

Dr. Rodney Boehme

2. Debt that is not perpetual. A 5-year bond (coupons paid annually) is issued at rB = rD = 10%, and the Par value = $1000. When the Yield-To-Maturity equals rD, the bonds market price will be equal to the Par value. This bond will receive a coupon of rBB = (0.10)(1000) = $100 each year, and the Par value of $1000 will be repaid when the bond matures 5 years from today. Assume that TC = 40%. PV(Par value repayment) = 1000/(1 + 0.10)5 = $620.92, this payment is NOT tax deductible. PV(after-tax interest payments): the $100 coupon paid each year is fully tax deductible. There are five coupon payments. The after-tax cost of each coupon payment is ($100)(1 TC) = $60. These annual $60 payments constitute an annuity of n=5 years. PV(after-tax interest payments) = (1 TC)(coupon)[1/rD 1/(rD(1+rD)n)] PV(after-tax interest payments) = 60[1/0.10 1/(0.10(1+0.10)5)] = $227.45 NPVF = amount received PV(interest payments) PV(par value repayment) NPVF = 1000 227.45 620.92 = $151.63, this is the bonds PV(tax shield) Shortcut method: For this 5-year bond, the annual tax savings is rBBTC = (100)(0.40) = $40. The NPVF will simply be the Present Value of all of the annual $40 tax savings. There will be five of these $40 annual tax savings due to the tax deductibility of interest payments. Treat this as an Annuity of PMT = 40, N = 5, I = 10%, and obtain PV = $151.63, the same result as above.

Page 8

EMBA 807

Corporate Finance

Dr. Rodney Boehme

Chapter 17 Supplemental Problems for practice

Problem 17.1 The Peach Computer Company has $10 million of debt outstanding at book (par) value. The debt is trading in the market at 90% of book (par) value. The yield to maturity at current market prices is 12%. The 1 million shares of Peach stock are selling at $20 per share. The required return on Peach stock is 20%. The tax rate is 34%. Calculate the WACC for Peach Computer. Assume that a Modigliani and Milller world exists and that cash flows are perpetuities. Solution 17.1 D = (0.9)($10 million) = $9 million current market value E = (1 million shares)($20/share) = $20 million rWACC = (9/29)(0.12)(1 0.34) + (20/29)(0.20) = 16.25% Problem 17.2 Use the MM equations to determine EBIT for the above firm. Solution 17.2 Value of the firm = $20 million + $9 million = $29 million From Chapters 15 and 17, we have the equation: VL = EBIT(1 TC)/rWACC

EBIT = VL[rWACC/(1 TC)] = ($29 million)(.l625)/(1 0.34) = $7.14 million per year

Page 9

Potrebbero piacerti anche

- Chapter 18Documento9 pagineChapter 18Kori NofiantiNessuna valutazione finora

- Week 13 SolutionsDocumento4 pagineWeek 13 SolutionsRickyChan100% (2)

- Corporate FinanceDocumento9 pagineCorporate FinancePrince HussainNessuna valutazione finora

- CH19Documento8 pagineCH19Lyana Del Arroyo OliveraNessuna valutazione finora

- Fin322 Week6Documento6 pagineFin322 Week6chi_nguyen_100Nessuna valutazione finora

- Shapiro CHAPTER 6 Altered Probs&Sols 1,2,6Documento5 pagineShapiro CHAPTER 6 Altered Probs&Sols 1,2,6Jasmine NicodemusNessuna valutazione finora

- Wacc NTDocumento41 pagineWacc NTsachin2727Nessuna valutazione finora

- WACC NTDocumento40 pagineWACC NTHamid S. ParwaniNessuna valutazione finora

- 6 Capital StructureDocumento41 pagine6 Capital StructureTrịnh Thu HươngNessuna valutazione finora

- The Basics of Capital Budgeting: Should We Build This Plant?Documento36 pagineThe Basics of Capital Budgeting: Should We Build This Plant?raopandit2001Nessuna valutazione finora

- CS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)Documento11 pagineCS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)manjinderjodhka8903Nessuna valutazione finora

- Problemset5 AnswersDocumento11 pagineProblemset5 AnswersHowo4DieNessuna valutazione finora

- Lecture Set 5Documento23 pagineLecture Set 5api-27554485Nessuna valutazione finora

- ValuationDocumento85 pagineValuationsamNessuna valutazione finora

- L8-Valuations and Capital Budgeting For The LeveredDocumento25 pagineL8-Valuations and Capital Budgeting For The LeveredtyraNessuna valutazione finora

- Introduction To Corporate Finance: Pre-Class MaterialDocumento23 pagineIntroduction To Corporate Finance: Pre-Class Materialnathaniel.chrNessuna valutazione finora

- Capital Structure Decision - Babcock UniversityDocumento23 pagineCapital Structure Decision - Babcock UniversityTAYO AYODEJI AROWOSEGBENessuna valutazione finora

- Capital Structure Decisions: Part I: Answers To End-Of-Chapter QuestionsDocumento8 pagineCapital Structure Decisions: Part I: Answers To End-Of-Chapter Questionssalehin1969Nessuna valutazione finora

- Fin 612 Managerial Finance Week Six Assignment Your Assignment - CompressDocumento3 pagineFin 612 Managerial Finance Week Six Assignment Your Assignment - CompressBala GNessuna valutazione finora

- HW 7Documento3 pagineHW 7Bandar Al-FaisalNessuna valutazione finora

- UTS Menkeu Lanjutan - Michael Krisnaputra Sondakh - 205020200111045Documento16 pagineUTS Menkeu Lanjutan - Michael Krisnaputra Sondakh - 205020200111045Michael SondakhNessuna valutazione finora

- Weighted Average Cost of CapitalDocumento3 pagineWeighted Average Cost of Capital1abhishek1Nessuna valutazione finora

- Main Exam 2015Documento7 pagineMain Exam 2015Diego AguirreNessuna valutazione finora

- Chapter 18: Financing and ValuationDocumento35 pagineChapter 18: Financing and ValuationKoey TseNessuna valutazione finora

- CFA一级培训项目 - 绝密攻坚计划 Corporate finance & DerivativesDocumento43 pagineCFA一级培训项目 - 绝密攻坚计划 Corporate finance & DerivativesBethuel KamauNessuna valutazione finora

- Integrated Case - Cost of CapitalDocumento23 pagineIntegrated Case - Cost of Capitalfaris prasetyoNessuna valutazione finora

- S7 Capital Structure Online VersionDocumento34 pagineS7 Capital Structure Online Versionconstruction omanNessuna valutazione finora

- Chapter 14Documento34 pagineChapter 14Aryan JainNessuna valutazione finora

- Meseleler 100Documento9 pagineMeseleler 100Elgun ElgunNessuna valutazione finora

- APV Vs WACCDocumento8 pagineAPV Vs WACCMario Rtreintaidos100% (2)

- Caluclation of VoidDocumento8 pagineCaluclation of VoidفتىالصحراءفتىالصحراءNessuna valutazione finora

- Capital Structure DecisionsDocumento35 pagineCapital Structure DecisionskiruthekaNessuna valutazione finora

- CF2 - Chapter 3 Capital Budgeting - SVDocumento26 pagineCF2 - Chapter 3 Capital Budgeting - SVleducNessuna valutazione finora

- Chapter 13 SolutionsDocumento5 pagineChapter 13 SolutionsrahidarzooNessuna valutazione finora

- Chapter 6: Alternate Investment Tools I. Payback Period: Original Cost of The ProjectDocumento7 pagineChapter 6: Alternate Investment Tools I. Payback Period: Original Cost of The ProjectmajorkonigNessuna valutazione finora

- Capital Budgeting and Valuation With Leverage: P.V. ViswanathDocumento33 pagineCapital Budgeting and Valuation With Leverage: P.V. ViswanathAnonymous fjgmbzTNessuna valutazione finora

- Solutions Chapter 10 FinanceDocumento10 pagineSolutions Chapter 10 Financebeatrice67% (3)

- Business Finance Module Assignment.Documento14 pagineBusiness Finance Module Assignment.Master's FameNessuna valutazione finora

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocumento7 pagineTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNessuna valutazione finora

- Investment DecDocumento29 pagineInvestment DecSajal BasuNessuna valutazione finora

- 3 Cost of CapitalDocumento31 pagine3 Cost of CapitalWei DengNessuna valutazione finora

- 02 Present Value and The Opportunity Cost of CapitalDocumento10 pagine02 Present Value and The Opportunity Cost of Capitalddrechsler9Nessuna valutazione finora

- Modigliani & Miller + WaccDocumento39 pagineModigliani & Miller + WaccthensureshNessuna valutazione finora

- Solutions Class Examples AFM2015Documento36 pagineSolutions Class Examples AFM2015SherelleJiaxinLiNessuna valutazione finora

- Cost of Equity and Capital Pricing Model: Presented By: Akhilesh Dalal Preeti Yadav Bhushan Pednekar Anuja NaikDocumento25 pagineCost of Equity and Capital Pricing Model: Presented By: Akhilesh Dalal Preeti Yadav Bhushan Pednekar Anuja Naikbhushanmba09Nessuna valutazione finora

- Topic 9 - Advanced Valuation and Capital Budgeting - Practice SolutionsDocumento7 pagineTopic 9 - Advanced Valuation and Capital Budgeting - Practice SolutionsSelina LiNessuna valutazione finora

- EFN406 Module 09 Notes 2022Documento6 pagineEFN406 Module 09 Notes 2022zx zNessuna valutazione finora

- Finance 2midterm 2010 - SolutionsDocumento5 pagineFinance 2midterm 2010 - SolutionsKelvin FuNessuna valutazione finora

- CF - Questions and Practice Problems - Chapter 18Documento4 pagineCF - Questions and Practice Problems - Chapter 18Lê Hoàng Long NguyễnNessuna valutazione finora

- Technical AnalysisDocumento4 pagineTechnical AnalysisSikandar AkramNessuna valutazione finora

- Advanced ValuationDocumento15 pagineAdvanced Valuationgiovanni lazzeriNessuna valutazione finora

- Problem Review Set Cost of Capital With SolutionsDocumento8 pagineProblem Review Set Cost of Capital With SolutionsAnonymous o7bJ7zR100% (2)

- Cap Struc TheoriesjDocumento19 pagineCap Struc TheoriesjPratik AhluwaliaNessuna valutazione finora

- Chap8 Cost of CapitalDocumento75 pagineChap8 Cost of CapitalBaby Khor50% (2)

- Lecture Notes 11: Mcgraw-Hill, IncDocumento6 pagineLecture Notes 11: Mcgraw-Hill, IncHassan ShehadiNessuna valutazione finora

- Capital Budgeting TechniquesDocumento21 pagineCapital Budgeting TechniquesMishelNessuna valutazione finora

- MIN 100 Investment Analysis: University of Stavanger E-MailDocumento52 pagineMIN 100 Investment Analysis: University of Stavanger E-MailSonal Power UnlimitdNessuna valutazione finora

- Lec 13 HandoutDocumento53 pagineLec 13 Handout賴永岫Nessuna valutazione finora

- Applied Corporate Finance. What is a Company worth?Da EverandApplied Corporate Finance. What is a Company worth?Valutazione: 3 su 5 stelle3/5 (2)

- Slides of NPV, Free Cash Flow, Sensitivity Analysis Project DecisionsDocumento57 pagineSlides of NPV, Free Cash Flow, Sensitivity Analysis Project DecisionsSebastian GorhamNessuna valutazione finora

- Investment ExerciseDocumento1 paginaInvestment ExerciseSebastian GorhamNessuna valutazione finora

- CGMDocumento2 pagineCGMSebastian GorhamNessuna valutazione finora

- Portstat 2 y b5Documento1 paginaPortstat 2 y b5Sebastian GorhamNessuna valutazione finora

- Double Object PronounsDocumento7 pagineDouble Object PronounsSebastian GorhamNessuna valutazione finora

- Financial PDFDocumento111 pagineFinancial PDFKarteek Reddy GuntakaNessuna valutazione finora

- Monetary Policy - IndicatorsDocumento4 pagineMonetary Policy - IndicatorsGJ RamNessuna valutazione finora

- Chapter 08 Interest Rates and Bond ValuationDocumento40 pagineChapter 08 Interest Rates and Bond ValuationHuu DuyNessuna valutazione finora

- Stock Audit ReportDocumento8 pagineStock Audit ReportayyazmNessuna valutazione finora

- Feasibility StudyDocumento2 pagineFeasibility StudyMaulik PatelNessuna valutazione finora

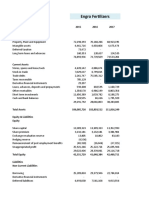

- Engro FertilizerDocumento9 pagineEngro FertilizerAbdullah Sohail100% (1)

- Pay Is inDocumento2 paginePay Is inJo YelleNessuna valutazione finora

- Checklist of Requirements For Issuance of Poea LicenseDocumento4 pagineChecklist of Requirements For Issuance of Poea Licensesbagsic100% (2)

- Hair Salon Business PlanDocumento21 pagineHair Salon Business PlanNdombolo Ya Solo100% (4)

- Himalayan Bank Limited: (Amount in RS.) Capital and Liabilities Schedule Current Year Previous YearDocumento55 pagineHimalayan Bank Limited: (Amount in RS.) Capital and Liabilities Schedule Current Year Previous YearNamrata BhattaraiNessuna valutazione finora

- Mock 2Documento14 pagineMock 2Arslan AlviNessuna valutazione finora

- Case 11-2 SolutionDocumento2 pagineCase 11-2 SolutionArjun PratapNessuna valutazione finora

- United Way Annual Report 2009Documento28 pagineUnited Way Annual Report 2009traci_wickettNessuna valutazione finora

- txnb18 30777Documento49 paginetxnb18 30777Anonymous ANBuh67Nessuna valutazione finora

- Monetary PolicyDocumento5 pagineMonetary PolicyKuthubudeen T MNessuna valutazione finora

- Bar Questions LoanDocumento20 pagineBar Questions LoanCatherine GabroninoNessuna valutazione finora

- Accounting AssignmentDocumento16 pagineAccounting AssignmentMIKASANessuna valutazione finora

- (LC) International TradeDocumento17 pagine(LC) International TradeSumayra RahmanNessuna valutazione finora

- Business Research NotesDocumento41 pagineBusiness Research NotesGorishsharmaNessuna valutazione finora

- Elisco Tool Manufacturing Vs CaDocumento5 pagineElisco Tool Manufacturing Vs CaHasmer Maulana AmalNessuna valutazione finora

- Tocharian Loans in Old ChineseDocumento12 pagineTocharian Loans in Old ChineseMarcelo JolkeskyNessuna valutazione finora

- A Project Report On Credit AppraisalDocumento167 pagineA Project Report On Credit AppraisalParm Sidhu50% (4)

- Real Estate Acronyms Commonly Used in The PhilippinesDocumento2 pagineReal Estate Acronyms Commonly Used in The PhilippineschachiNessuna valutazione finora

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 10Documento24 pagineFinancial Statement Analysis - Concept Questions and Solutions - Chapter 10sakibba80% (5)

- AudProb Test BankDocumento18 pagineAudProb Test BankKarina Barretto AgnesNessuna valutazione finora

- SAMPLE ONLY Topic - Legal Aspect of Sales, Mortgage and LeaseDocumento3 pagineSAMPLE ONLY Topic - Legal Aspect of Sales, Mortgage and LeaseJoshua Armesto100% (2)

- Ca Final Old Law Practice New Questions May 2019Documento30 pagineCa Final Old Law Practice New Questions May 2019Karthik Srinivas NarapalleNessuna valutazione finora

- Modigliani-Miller Theorem - Wikipedia, The Free EncyclopediaDocumento3 pagineModigliani-Miller Theorem - Wikipedia, The Free Encyclopediaapi-3763198100% (1)

- Advanced Accounting 6th Edition Jeter Solutions Manual PDFDocumento24 pagineAdvanced Accounting 6th Edition Jeter Solutions Manual PDFHeni Fernandes FransiskaNessuna valutazione finora

- Revised Joint Trial ExhibitDocumento54 pagineRevised Joint Trial ExhibitTeamMichaelNessuna valutazione finora