Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Review of Literature

Caricato da

Kayam BalajiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Review of Literature

Caricato da

Kayam BalajiCopyright:

Formati disponibili

Chapter2

Review of Literature

Introduction

Financial statement have to major uses in financial analysis first, they one used to present a historical recover of the firms financial development when competed over a number of years a trained analyst can determine important financial factors that have in the ended the growth and Current assets of the firm. Second, they are used to here cast a course of action for the firm.

A performance financial statement is prepared for a future period. It is the financial managers estimate of the firms future performance.

The operation and performance of a business depends on many individuals are collective decisions that are continually made by its management team. Every one of these decisions ultimately causes a financial impact, for better or works on the condition and the periodic results of the business. In essence, the process of managing involves a series of economic choices that activates moments of financial resources connected with the business.

Some of the decisions management makes one major, such as investment in a new facility, raising large amounts of debts or adding a new line of products or services. Most other decisions are part of the day-to-day process in which every functional area of the business is managed. The combine of effect of all decisions can be observed periodically when the performance of the business is judged through various financial statements and special analysis.

These changes have profoundly affected all our lives and it is important for corporate managers, share holders, tenders, customers and suppliers to

investment and the performance of the corporations on which then relay. All who depend on a corporation for products, services, or a job must be med about their companys ability to meet their demands time and in this changing world. The growth and development of the corporate enterprises is reflected in their financial statement.

LIQUIDITY AND PROFITBILITY

Liquidity and profitability are two important demanders in determining the soundness of an enterprise. Liquidity means ability of a firm to meet its current obligations when they become due for payment. It has two aspects quantitative and qualitative. Qualitative aspect implies the quantum of current assets a firm possesses irrespective of making any difference between various types of current assets such as inventories, cash and so on. Qualitative aspect reforms the quality of current in terms of their realization in to cash considering time dimension involved in maturing different components of current assets. Profitability is the capacity of earning profits and due most important measure of performance of affirms. It is generally assumed that there is negative relationship between liquidity and profitability i.e. higher liquidity results in lower profitability and vice-versa. Objectives of the Study To study the growth and development of the company. To study the behavior of liquidity and profitability of the companies. To analyze the factors determining the liquidity and profitability. To comparative study of selected companies on the basis of selected ratios.

Statement of the problem

10

Development of industries depends on several factors such as financial personnel technology, quality of the product and marketing art of these. Financial aspects assume a significant role in determining the growth of industries. All of the companys operations virtually affect its need for cash. Most of these data covering operations areas are however outside the direct responsibility of the financial executives. Values top management appreciates the value of good financial executives to know the profitability and liquidity of the concern. The firm whose present operations are inherently difficult should try to makes its financial analysis to enable its management to stay on top of its working position. In this context the researcher is interested in undertaking on analysis of the financial performance of companies to examine and to understand how management of finance plays a crucial role of the financial performance analysis of selected companies in India has been undertaken.

FINANCIAL ANALYSIS

A basic limitation of the traditional financial statements comprising the balance sheet and the profit and loss account is that they dont give all information related to the financial operations of the firm. Nevertheless, they provide some extremely useful information to the extent that the balance sheet mirrors the financial position on a particular date in terms of the structure of assets, liabilities and owners equity and so on, and the profit and loss account shows the results of operation during a certain period of times in terms of the revenue obtained and the cost incurred during the year. Thus the financial position and operations statement provides a summarized a view of the financial position and operations of the firm. The analysis of financial statement is thus an important aid to financial analysis.

The first task of the financial analyst is to select the information relevant to the decisions under consideration from the total information from the total information contained in the financial statements. The second step is arranged

11

the information in the way to highlight significant relationship. The final step is interpretation and drawing of inferences and conclusions. In the brief financial analysis are the processes of selection, relation and evaluation.

Ratio analysis is a widely used tool of financial analysis. It is defined as the systematic use of ratio to interpret financial statements so that the strength and weakness of a firm as well as its historical performance and current financial conditions can be determined. The term Ratio refers to the numerical or quantitative relationship between two items variables. The relationship can be expressed as Percentages Fractions Proportion of numbers

These alternative methods of expressing items, which are related to each other, are for purposes of financial analysis refer to as Ratio analysis.

BASIS OF COMPARISION

Ratios are relative figures reflecting the relationship between variables. They enable analysis to draw conclusion regarding financial operations. The use of ratios as a tool of financial analysis continuous their comparison, for a single ratio like absolute figure, fails to reveal the true position. Trend ratios Inter firm comparison Comparison of items single years financial statements of a firm. Comparison with standards

Trend ratios involve a comparison of the ratios of a firm overtime is present ratios are compared with past ratios for the same firm. The trend ratios

12

indicate the direction of the change in performance, improvement, deterioration or constancy over the years. The Inter firm comparison including comparison of the ratios of a firm with those of others in the same line of business or the job the industry has a whole reflects the performances in relation to its competitors.

Other types of comparison may relate to comparison of items within a single years financial statement of a firm and comparison with standard. Financial analysis is an important technique of accounting, which makes the financial statements as user oriented, more understandable and meaningful. Here the term analysis which is opposite of synthesis in general breaking/separating a thing into its components, establishing existing relationship, so as to draw meaningful inference.

ADVANTAGES OF FINANCAIL ANALYSIS

1. It provides the full diagnosis of the profitability and financial soundness of the business that is it determines the measure of efficiency of operation and gauze the financial position of the business. 2. It helps the identifying the weakness and strength of the firm. 3. It enables the management to take decision on logical and scientific method in an intelligible way. 4. It helps the other to understand the decision easily that is it makes statement as users oriented. 5. It helps to verify and examine the correctness and accuracy of the decision. 6. It minimizes personal experience and institution in decision-making. 7. It helps in deciding the future prospects of the firm. 8. It investigates the future potentiality of the firm. 9. It considers some useful quantitative aspects also.

13

DISADVANTAGES OF THE FINANCIAL ANALYSIS

Though the financial statement analysis is an important analysis is an important accounting tool and makes the statement simple, it has some disadvantages, which have to be kept in mind while making analysis.

1. The analysis of financial statement requires some specialized knowledge and which involve costs. 2. The analysis is ineffective when the financial statements itself has some limitations. 3. Analysis should be done very carefully, otherwise wrong conclusions may draw. 4. Analysis becomes difficult as the data for more number of years and or for many companies is taken. 5. Analysis will be less effective when the data and accounting methods are not uniform. 6. The influence of the personal judgment, direction, intention, totally may not be eliminated which may result in wrong decision making also.

14

RATIO ANALYSIS

Alexander Wall is considered to be the pioneer of ratio analysis. He presented after a serious a detailed system of ratio analysis in 1990. He explained that the work of interpretation could be made easier by establishing quantitative relationships between the facts given in the financial statements. The focus of financial analysis is on key figures in the financial statements and significance relationships that exist between there. This analysis relationship between component parts of financial statements to obtain a better understanding of the firms position and performance.

MEANING OF RATIO

Generally speaking a ratio is simply one figure expressed in terms of another and thus it is an assessment of one number in relationship must be established on the basis of some scientific and logical methods. Thus a ratio is a mathematical relationship between two items and expressed in quantitative form. When this definition of ratio is explained with reference to the items shown in financial statements, then it called Accounting Ratios. Hence, an accounting ratio is defined as quantitative relationship between two or more items of the financial statements.

Thus ratio analysis is widely is used tool of financial analysis. It is defined as the systematic use of ratio to interpret the financial Statements so that the strengths and weakness of a firm as well as its historical performance and current financial condition can be determined. The term ratio refers to the numerical or quantitative relationship between two item/variable.

15

CLASSIFICATION OF RATIOS TYPES OF RATIOS The ratios can be classified into four types:

LIQUIDITY RATIOS Liquidity ratios measure the firms ability to meet current obligations. I. II. III. IV. V. Current Ratio Quick Ratio Cash Ratio Interval Ratio Net Working Capital Ratio

LEVERAGE RATIOS Leverage ratios show the proportions of debt and equity in financing the firms assets. I. II. III. Debt Equity Ratio Capital Equity Ratio Proprietary Ratio

ACTIVITY RATIOS Activity ratios reflect the firms efficiency in utilizing its assets. I. II. III. IV. V. VI. Inventory Ratio Fixed Assets Turnover Ratio Total Assets Turnover Ratio Current Assets Turnover Ratio Collecting Period of Debtor Ratio Working Capital Turnover Ratio

16

OVERALL PROFITABILITY RATIOS Profitability ratios measure over all performance and effectiveness of the firm. I. II. Return of net worth Working Capital Turnover

LIQUIDITY RATIOS Liquidity ratios measure the ability of the firm to meet the current obligations in the short run, usually one year. Analysis of liquidity needs the preparation of cash budgets, Cash and fund flow statements. A firm should ensure that it does not suffer from lack of liquidity and also it does not suffer from lack of liquidity and also it is not too much highly liquid. Lack of liquidity and also it is not too much highly liquid. Lack of liquidity leads to the failure of the society to meet its obligations, results in also bad credit image, idle assets earns nothing. A very high liquidity is also bad, idle assets earn nothing. Therefore, it is necessary to strike a proper balance between liquidity and lack of liquidity.

LEVERAGE RATIO To judge the long-term financial position of the society leverage ratios are calculated. These ratios indicate mix of funds provided by shareholders and financiers. If the cost of debt is higher than the societys overall rate of return the earnings of shareholders will be reduced. These ratios are used to measure the financial risk and societys ability of using debt for the benefits of shareholders.

17

There are two types of ratios commonly used to analyze financial leverage: Structural Ratios Coverage Ratios

Structural ratios are based on the proportion of debt and equity in the financial structure of the firm. Coverage ratios show the relationship between debt servicing commitments and sources for meeting these.

PROFITABILITY RATIOS

Apart from the creditors both short term and long term also interested in the financial soundness of a firm are the owners and management or the company itself. The management of the firm is naturally eager to measure its operating efficiency similarly the owners invest their funds in the expectation of reasonable returns. The operating efficiency of a firm and its ability to ensure adequate returns to its shareholders depends ultimately on the profit earned by it. The profitability of a firm can be measured by its profitability ratios. In other words, the profitability ratios are designed to provide answers to questions such as Does the profit earned by the firm adequate? What rate of return does it represent? What is a rate of profit for various decisions and segments of the firms? What are the earnings per share? What was amount paid in dividends? What is a rate of return to equity holders?

18

ACTIVITY RATIOS

Funds are invested in various assets to generate sales and profits Activity Ratios are employees to evaluate the efficiency with which the society manges and utilizes in assets. This ratio indicates the speed with which assets are being converted into sales. Thus ratios indicate the relationship between sales and assets. Inventory turnover ratio which identifies the efficiency of the company in selling in producers the ratio is calculated by dividing cost of goods sold by inventory where cost off goods sold includes opening stock plus directs wages plus directs wages plus manufacturing expenses and subtracting closing stock. Fixed assets turnover ratio shows the companys ability in generating sales for each rupee of fixed assets it its calculated by dividing sales by fixed assets. Total assets turnover ratio shows the companys ability in generating sales for each rupee of assets. It is calculated by dividing sales by total assets. Current assets turnover ratio shows the companys ability in generating sales for each rupee of current assets. It is calculated by dividing sales by current assets. Working capital turnover ratio indicates the velocity of the utilization of net working capital.

19

LIQUIDITY RATIOS

It is extremely essential for a firm to be able to meet the obligations as they become due. Liquidity ratios measure the ability of the firm to meet its current obligations (liabilities). Infect, analysis of liquidity needs the preparation of cash budgets and cash and funds flow statements; but liquidity ratios, by establishing a relationship between cash and other current assets to current obligations, provide a quick measure of liquidity. A firm should ensure that it does not suffer from lack of liquidity, and also that it does not have excess liquidity. The failure of a company to meet its obligations due to lack of sufficient liquidity, will result in a poor credit worthiness, loss of credit worthiness, loss of creditors confidence, or even in legal tangles resulting in the closure of the company. A very high degree of liquidity is also bad; idle assets earn nothing. The firms funds will be unnecessarily tied up in current assets. Therefore, it is necessary to strike a proper balance between high liquidity and lack of liquidity. The most common ratios which indicate the extent of liquidity are lack of it, are:

1) Current ratio and 2) Quick ratio.

Other ratios include cash ratio interval measure and networking capital ratio.

20

1. Current Ratio

Current ratio is calculated by dividing current assets by current liabilities.

Current assets Current ratio = ----------------------Current liabilities

Current assets include cash and other assets that can be converted into cash within a year, such as marketable securities, debtors and inventories. Prepaid expenses are also included in the current assets as they represent the payments that will not be made by the firm in the future. All obligations

maturing within a year are included in the current liabilities. Current liabilities include creditors, bills payable. Accrued expenses, short-term bank loan, income tax liability and long-term debt maturing in the current year. The current ratio is a measure of firms short-term solvency. It indicates the availability of current assets in rupees for every one rupee of current liability. A ratio is greater than one means that the firm has more current assets than current claims against them Current liabilities.

2. Quick Ratio

Quick ratio also called Acid Test Ratio, because it is the acid test of concerns financial soundness. It establishes a relationship between quick, or liquid assets and current liabilities. An asset is a liquid if it can be converted into cash immediately or reasonably soon without a loss of value.

Cash is the most liquid asset. Other assets that are considered to be relatively liquid and included in quick assets are debtors and bills receivables and

21

marketable securities (temporary quoted investments). considered to be less liquid.

Inventories are

Inventories normally require some time for

realizing into cash; their value also has a tendency to fluctuate. The quick ratio is found out by dividing quick assets by current liabilities. Current assets Inventory Quick ratio = ----------------------------------Current liabilities

3. Cash Ratio

Since cash is the most liquid asset, it may be examined cash ratio and its equivalent to current liabilities. Trade investment or marketable securities are equivalent of cash; therefore, they may be included in the computation of cash ratio:

Cash + Marketable securities Cash ratios = ------------------------------------Current liabilities

4. Interval Measure Yet another, ratio, which assesses a firms ability to meet its regular cash expenses, is the interval measure. Interval measure relates liquid assets to

average daily operating cash outflows. The daily operating expenses will be equal to cost of goods sold plus selling, administrative and general

expenses less depreciation (and other non cash expenditures divided by number of days in a year (say 360).

22

Current assets Inventory Interval measure = ----------------------------------------Average daily operating expenses

5. Net Working Capital Ratio The different between current assets and current liabilities excluding short-term bank borrowings is called net working capital (NWC) or net current assets (NCA). NWC is sometimes used as a measure of firms liquidity. It is considered that between two firms the one having larger NWC as the greater ability to meet its current obligations. This is not necessarily so; the measure of liquidity is a relationship, rather than the difference between current assets and current liabilities. NWC, however, measures the firms potential reservoir of funds. It can be related to net assets (or capital employed):

Net working capital (NWC) NWC ratio = ------------------------------------(Current liabilities)

6. LEVERAGE RATIO

The short-term creditors, like bankers and suppliers of raw materials, are more concerned with the firms current debt-paying ability. On other hand, longterm creditors like debenture holders, financial institutions etc

are more concerned with the firms long-term financial strength. In fact a firm should have a strong short as well as long-term financial strength. To judge the long-term financial position of the firm, financial leverage, or capital structure ratios are calculated. These ratios indicate mix of funds provided by owners and

23

lenders. As a general rule there should be an appropriate, mix of debt and owners equity in financing the firms assets. Leverage ratios may be calculated from the balance sheet items to determine the proportion of debt in total financing. Many variations of these ratios exist; but all these ratios indicate the same thing the extent to which the firms has relied on debt in financing assets. Leverage ratios are also computed form the profit and loss items by determining the extent to which operating profits are sufficient to cover the fixed charges.

7. DEBT RATIO

Total debt (TD) Total debt (TD) + Net worth (NW)

Total debt (TD) = ----------------------------Capital employed (CE) Debt Ratio

The relationship describing the lenders contribution for each rupee of the owners contribution is called debt-equity (DE) ratio is directly computed by dividing total debt by net worth: Total debt (TD) Debt equity ratio = ----------------------Net worth (NW)

24

8. Capital Employed to Net Worth Ratio

It is another way of expressing the basic relationship between debt and equity. One may want to know: How much funds are being contributed together by lenders and owners for each rupee of owners contribution? Calculating the ratio of capital employed or net assets to net worth can find this out:

Total Debt Debt Equity Ratio = ---------------------Net worth (NW)

8. Activity Ratios

Funds of creditors and owners are interested in various assets to generate sales and profits. The better the management of assets, the larger the amount of sales. Activity ratios are employed to evaluate the efficiency with which the firm manages and utilizes its assets. These ratios are also called turnover ratios because they indicate the speed with which assets are being converted or turned over into sales. Activity ratios, thus, involves a relationship between sales and assets. A proper balance between sales and assets generally reflects that assets are managed well. Several activity ratios are calculated to judge the

effectiveness of asset utilization.

25

9. Inventory Turnover

Inventory turnover indicates the efficiency of the firm in producing and selling its product. It is calculated by dividing the cost of goods sold by the average inventory:

Cost of goods sold Inventory turnover = -------------------------Average inventory

The average inventory is the average of opening and closing balances of inventory. In a manufacturing company inventory of finished goods is used to calculate inventory turnover.

9.Debtors (Accounts Receivable) Turnover

A firm sells goods for cash and credit. Credit is used as a marketing tool by number of companies. When the firm extends credits to its customers, debtors (accounts receivable) are created in the firms accounts. Debtors are convertible into cash over a short period and, therefore, are included in current assets. The liquidity position of the firm depends on the quality of debtors to a great extent. Debtors turnover is found out by dividing credit sales by average debtors:

Credit sales Debtors turnover = ----------------Debtors

26

Debtors turnover indicates the number of times debtors turnover each year generally, the higher the value of debtors turnover, the more efficient is the management of credit.

To outside analyst, information about credit sales and opening and closing balances of debtors may not be available. Therefore, debtors turnover can be calculated by dividing Total sales by the year-end balances of debtors:

Debtors turnover = ------------

10. Total Assets Turnover

Net assets turnover can be computed simply by dividing sales by net sales (NA):

Total Assets Turnover = --------------

It may be recalled that net assets (NA) include net fixed assets (NFA) and net current assets (NCA), that is, current assets (CA) minus current liabilities (CL). Since net assets equal capital employed, net assets turnover may also be called capital employed, net assets turnover may also be called capital employed turnover.

27

11. Current Assets Turnover

A firm may also like to relate current assets (or net working gap) to sales. It may thus complete networking capital turnover by dividing sales by net working capital: Sales Currentasset turnover =------------------------PROFITABILITY RATIOS A company should earn profits to survive and grow over a long period of time. Profits are essential, but it would be wrong to assume that every action initiated by management of a company should be aimed at maximizing profits, irrespective of concerns for customers, employees, suppliers or social consequences. It is unfortunate that the word profit is looked upon as a term of abuse since some firms always want to maximize profits at the cost of employees, customers and society. Except such infrequent cases, it is a fact that sufficient profits must be able to obtain funds from investors for expansion and growth and to contribute towards the social overheads for welfare of the society. Profit is the difference between revenues and expenses over a period of time (usually one year). Profit is the ultimate output of a company, and it will have no future if it fails to make sufficient profits. Therefore, the financial manager should continuously evaluate the efficiency of the company in terms of profit. The profitability ratios are calculated to measure the operating efficiency of the company. Besides management of the company, creditors and owners are also interested in the profitability of the firm. Creditors want to get a required rate of return on their investment. enough profits. This is possible only when the company earns

Generally, two major types of profitability ratios are calculated: Profitability in relation to sales. Profitability in relation to investment.

28

12. Net Profit Margin

Net profit is obtained when operating expenses; interest and taxes are subtracted from the gross profit margin ratio is measured by dividing profit after tax by sales:

N Net Profit Ratio = --------------- X 100

Net profit ratio establishes a relationship between net profit and sales and indicates and managements in manufacturing, administrating and selling the products. This ratio is the overall measure of the firms ability to turn each rupee sales into net profit. If the net margin is inadequate the firm will fail to achieve satisfactory return on shareholders funds.

13. Net Margin Based on NOPAT

The profit after tax (PAT) figure excludes interest on borrowing. Interest is tax deducts able, and therefore, a firm that pays more interest pays less tax. Tax saved on account of payment of interest is called interest tax shield. Thus the conventional measure of net profit margin-PAT to sales ratio is affected by firms financial policy. It can mislead if we compare two firms with different debt ratios. For a true comparison of the operating performance of firms, we must ignore the effect of financial leverage, viz., the measure of profits should ignore interest and its tax effect. Thus net profit margin (for evaluating operating performance) may be computed in the following way:

29

EBIT (1-T) NOPAT Net Profit Margin = ------------------- = ---------------

16. Operating Expense Ratio

The operating expense ratio explains the changes in the profit margin (EBIT to sales) ratio. This is computed by dividing operating expenses viz., cost of goods sold plus selling expense and general and administrative expenses (excluding interest) by sales.

Operating expenses ratio = ----------------------------

17. Return on Investment (ROI)

The term investment may refer to total assets or not assets. The funds employed in net assets are known as capital employed. Net assets equal net fixed assets plus current assets minus current liabilities excluding bank loans. Alternatively, capital employed is equal to net worth plus total debt. The conventional approach of calculating return of investment (ROI) is to divide PAT by investments. Investment represents pool of funds supplied by shareholders and lenders, while PAT represent residue income o shareholders; therefore, it is conceptually unsound to use PAT in the calculation of ROI. Also, as discussed earlier, PAT is affected by capital structure. It is, therefore, more appropriate to use one of the following measures of ROI for comparing the operating efficiency of firms:

30

EBIT (1-T) EBIT (1-T) ROI = ROTA = ----------------- = ---------------Total assets TA

EBIT (1-T) EBIT (1-T) ROI = RONA = ---------------- = --------------Net assets NA

18. Return on Equity (ROE)

Common or ordinary shareholders are entitled to the residual profits. The rate of dividend is not fixed: the earnings may be distributed to shareholders or retained in the business. Nevertheless, the net profits after taxes represent their return. A return on shareholders equity is calculated to see the profitability of owners investment. The shareholders equity or net worth will include paid-up share capital, share premium, and reserves and surplus less accumulated losses. Net worth also be found by subtracting total liabilities from total assets. The return on equity is net profit after taxes divided by shareholders equity, which is given by net worth:

Profit after taxes PAT ROE = ------------------------ = --------Net worth (Equity) NW

ROE indicates how well the firm has used the resources of owners. In fact, this ratio is one of the most important relationships in financial analysis. The earning of a satisfactory return is the most desirable objective of business.

31

The ratio of net profit to owners equity reflects the extent to which this objective has been accomplished. This ratio is, thus, of great interest to the present as well as the prospective.

Shareholders and also of great concern to management, which has the responsibility of maximizing the owners welfare. The return on owners equity of the company should be compared with the ratios of other similar companies and the industry average. This will reveal the relative performance and strength of the company in attracting future investments.

19. Earnings per Share (EPS)

The profitability of the shareholders investments can also be measured in many other ways. One such measure is to calculate the earnings per share. The earnings per share (EPS) are calculated by dividing the profit after taxes by the total number of ordinary shares outstanding.

Profit after tax EPS = ------------------------------------Number of share outstanding

20. Dividends per Share (DPS or DIV)

The net profits after taxes belong to shareholders. But the income, which they will receive, is the amount of earnings distributed as cash dividends.

32

Therefore, a large number of present and potential investors may be interested in DPS, rather than EPS.

DPS is the earnings distributed to ordinary shareholders dividend by the number of ordinary shares outstanding.

Earnings paid to shareholders (dividends) EPS = ---------------------------------------------------Number of ordinary shares outstanding 21. Dividend Payout Ratio The dividend payout Ratio or simply payout ratio is DPS (OR Total equity dividends) divided by the EPS (or profit after tax): Equity dividends Payout Ratio = ----------------------Profit after tax

Dividends per share DPS = --------------------------- = ------Earnings per share EPS

33

ADVANTAGES OF RATIO ANALYSIS Ratio analysis simplifies the comprehension of financial statement. Ratio analysis provides data for inter firm comparison Ratio analysis helps in planning forecasting trends in cost, sales, profit and other related facts are revealed by the past ratios and future events can be forecast on the basis of such trends. Ratio may be used as an instrument of management control particularly in the area of sales cost. A ratio helps in investment decision to make profitable investment. Ratios also facilitate the function of communication. It can be easily conveyed through the ratio as what as happened during the two intervening periods. Ratios may also be used as a measure of efficiency.

LIMITATIONS OF RATIO ANALYSIS

1.The analyst or the user must have comprehensive knowledge and experience about the concern whose statements have been used for calculating these ratios only the dependable conclusions may drawn thus ratios are signified tools only in the hands of experts in the hands of quacks for whom they may prove dangerous tools.

2.Ratios are not an end in themselves but they are a means to achieve a particular end. Hence it totally depends upon user or analyst as what conclusions is drawn on the basis of ratios calculated. 3.A single ratio in itself is not imported or as limited value because trends are more significant in the analysis. 4.Another limitation is that of standard ratio with which the actual ratios may be compared generally there is no such ratio, which may be treated as

34

standard for the purpose of comparison because conditions of one concern differ significantly from those of another concern.

5.The accuracy and correctness of ratios are totally dependent upon the reliability of the data contained in financial statements on the basis of which ratios are calculated. 6.When ratios are used in the comparative study of two concerns there must be uniformity in the accounting plan used both concerns. Similarly there must be consistency in the preparation of financial statements and recording these transaction from year to year with in that concern.

7.analyst must be able to examine the nature of the data carefully.

If

accounting data lack uniformity particularly definitional uniformity, then ratio calculated on the basis of them will be misleading.

8.Ratios become meaningless if detached from the details, which they are deriving and in fact, they should be used as supplementary to, and not substitution of the original absolute figures. 9.The utility of ratios is largely dependent upon the method of presentation also.

[

10. Ratios make the comparatives study complicated and misleading on account of changes in price level.

35

Potrebbero piacerti anche

- Table of Content Title Page NoDocumento26 pagineTable of Content Title Page Nopradeep110Nessuna valutazione finora

- IntroductionDocumento23 pagineIntroductionYASIN CAFENessuna valutazione finora

- Particulars Number CertificateDocumento63 pagineParticulars Number CertificatekeerthiNessuna valutazione finora

- Chapter - 1 Introduction and Design of Study Financial Statement AnaylysisDocumento47 pagineChapter - 1 Introduction and Design of Study Financial Statement Anaylysisaditya dhuparNessuna valutazione finora

- Project Ratio Analysis 3Documento57 pagineProject Ratio Analysis 3anusuyanag2822100% (1)

- RATIODocumento11 pagineRATIOSireeshaNessuna valutazione finora

- Financial Analysis of MRFDocumento69 pagineFinancial Analysis of MRFBALRAJ100% (3)

- Financial Analysis of Reliance Industry LimitedDocumento69 pagineFinancial Analysis of Reliance Industry LimitedWebsoft Tech-Hyd100% (1)

- FM - Lesson 4 - Fin. Analysis - RatiosDocumento8 pagineFM - Lesson 4 - Fin. Analysis - RatiosRena MabinseNessuna valutazione finora

- Ratio AnalysisDocumento47 pagineRatio AnalysisyasarNessuna valutazione finora

- MODULE 1 Lesson 2 and 3Documento22 pagineMODULE 1 Lesson 2 and 3Annabeth BrionNessuna valutazione finora

- Ratio AnalysisDocumento7 pagineRatio AnalysisGuttula GirishNessuna valutazione finora

- Finance ProjectDocumento58 pagineFinance ProjectMuhammed Althaf VK0% (1)

- 05 - Chapter 1 PDFDocumento22 pagine05 - Chapter 1 PDFXirene FelixNessuna valutazione finora

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Documento7 pagineRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08Nessuna valutazione finora

- Main EditeddddDocumento73 pagineMain Editeddddammukhan khanNessuna valutazione finora

- My ProjectDocumento72 pagineMy ProjectPrashob Koodathil0% (1)

- Financial Statement AnalysisDocumento27 pagineFinancial Statement AnalysisJayvee Balino100% (1)

- Chapter - I: Financial Performance Analysis: The ConceptDocumento46 pagineChapter - I: Financial Performance Analysis: The ConceptbalunriitNessuna valutazione finora

- Financial Analysis of Reliance Industries Limited: A Project Report OnDocumento108 pagineFinancial Analysis of Reliance Industries Limited: A Project Report OnVirendra Jha0% (1)

- AccountDocumento108 pagineAccountVirendra JhaNessuna valutazione finora

- Pre Test: Biliran Province State UniversityDocumento6 paginePre Test: Biliran Province State Universitymichi100% (1)

- DevaDocumento15 pagineDevagokulraj0707cmNessuna valutazione finora

- Ratio AnalysisDocumento57 pagineRatio AnalysisShaik Sajid AhmedNessuna valutazione finora

- Finance Project For McomDocumento40 pagineFinance Project For McomSangeeta Rachkonda100% (1)

- F. Understanding The Financial Statement and Its Components Sahid P.ADocumento10 pagineF. Understanding The Financial Statement and Its Components Sahid P.Aantonette.escobia17Nessuna valutazione finora

- Chapter 1Documento53 pagineChapter 1Prashob KoodathilNessuna valutazione finora

- Definition and Explanation of Financial Statement AnalysisDocumento9 pagineDefinition and Explanation of Financial Statement AnalysisadaktanuNessuna valutazione finora

- Project On Ratio AnalysisDocumento69 pagineProject On Ratio AnalysisJitender FansalNessuna valutazione finora

- A Study On Financial Performance Analysis of Sri Karpagam Organic Cotton Industry at Karur General IntroductionDocumento79 pagineA Study On Financial Performance Analysis of Sri Karpagam Organic Cotton Industry at Karur General Introductionk eswariNessuna valutazione finora

- Chapter - 1 Introduction: 1.1 Background of The StudyDocumento78 pagineChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANANessuna valutazione finora

- Ratio Analysis Tirupati Cotton Mills LTDDocumento102 pagineRatio Analysis Tirupati Cotton Mills LTDHarish Babu Gundla PalliNessuna valutazione finora

- Financial Statement AnalysisDocumento110 pagineFinancial Statement AnalysisvidhyabalajiNessuna valutazione finora

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersDa EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNessuna valutazione finora

- Finance Leverage Capital Markets Money Management: Importance-And-Limitations/61727Documento7 pagineFinance Leverage Capital Markets Money Management: Importance-And-Limitations/61727GUDDUNessuna valutazione finora

- Leac 204Documento26 pagineLeac 204Ias Aspirant AbhiNessuna valutazione finora

- ComparativeDocumento91 pagineComparativeSaisanthosh Kumar SharmaNessuna valutazione finora

- 1.1 Industrial BackgroundDocumento62 pagine1.1 Industrial BackgroundSri BhaskararaoNessuna valutazione finora

- Ratio AnalysisDocumento74 pagineRatio AnalysisKarthik NarambatlaNessuna valutazione finora

- Intoducation To LastDocumento20 pagineIntoducation To LastBekar JibonNessuna valutazione finora

- Financial AnalysisDocumento69 pagineFinancial AnalysisOlawale Oluwatoyin Bolaji100% (2)

- Ratio Analysis - Hayleys Fabric PLC: Assignment 01Documento39 pagineRatio Analysis - Hayleys Fabric PLC: Assignment 01shenali kavishaNessuna valutazione finora

- Financial Analysis of Reliance Industries Limited: Arindam BarmanDocumento109 pagineFinancial Analysis of Reliance Industries Limited: Arindam Barmananon_645298319100% (1)

- Ratio AnalysisDocumento80 pagineRatio AnalysisMrutyunjaya YaligarNessuna valutazione finora

- Chapter One GowriDocumento5 pagineChapter One Gowrigowrimahesh2003Nessuna valutazione finora

- SampleDocumento102 pagineSampleDaniel Mathew VibyNessuna valutazione finora

- SampleDocumento102 pagineSampleDaniel Mathew VibyNessuna valutazione finora

- Definition and Explanation of Financial Statement AnalysisDocumento7 pagineDefinition and Explanation of Financial Statement Analysismedbest11Nessuna valutazione finora

- Executive SummaryDocumento97 pagineExecutive Summarybk gautamNessuna valutazione finora

- A Study On Financial PerformanceDocumento73 pagineA Study On Financial PerformanceDr Linda Mary Simon100% (2)

- Financial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaDocumento13 pagineFinancial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaApoorva A NNessuna valutazione finora

- Sample Bcom Project PDFDocumento13 pagineSample Bcom Project PDFRahul KamathNessuna valutazione finora

- Financial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaDocumento13 pagineFinancial Analysis - A Study: Dr. Donthi Ravinder, Muskula Anithawawa1303Nessuna valutazione finora

- FM 1 Chapter 3 Module 3Documento27 pagineFM 1 Chapter 3 Module 3Kitheia Ostrava Reisenchauer100% (1)

- Accounts Project Isc (Mine)Documento12 pagineAccounts Project Isc (Mine)Rahit Mitra100% (2)

- An Introduction of Financial Statement AnlysisDocumento14 pagineAn Introduction of Financial Statement AnlysisUpasana WadhwaniNessuna valutazione finora

- Financial ManagementDocumento50 pagineFinancial Managementsarthak kaushikNessuna valutazione finora

- Sameema ContentsDocumento62 pagineSameema ContentsSAUMYA MNessuna valutazione finora

- The Balanced Scorecard: Turn your data into a roadmap to successDa EverandThe Balanced Scorecard: Turn your data into a roadmap to successValutazione: 3.5 su 5 stelle3.5/5 (4)

- RWJ - FCF11e - Chap - 16-Financial LeverageDocumento50 pagineRWJ - FCF11e - Chap - 16-Financial LeverageCẩm TiênNessuna valutazione finora

- Mutual FundsDocumento68 pagineMutual FundsShivamitra ChiruthaniNessuna valutazione finora

- Analysis of Earnings and Dividend LevelDocumento6 pagineAnalysis of Earnings and Dividend Leveldeveshr25Nessuna valutazione finora

- Margin Trading Short Sales: Chapter 3, Sections 3.6, 3.7Documento38 pagineMargin Trading Short Sales: Chapter 3, Sections 3.6, 3.7isteaq ahamedNessuna valutazione finora

- REXEL SA - Research Report - FinalDocumento6 pagineREXEL SA - Research Report - FinalGlen BorgNessuna valutazione finora

- Non-Current Assets Held For SaleDocumento20 pagineNon-Current Assets Held For Salerj batiyegNessuna valutazione finora

- 9-4b Yield To Call: Price of BondDocumento7 pagine9-4b Yield To Call: Price of BondRina DutonNessuna valutazione finora

- Kolehiyo NG Lungsod NG Lipa Maraouy, Lipa City Bachelor of Science in Business Administration Major in Financial ManagementDocumento6 pagineKolehiyo NG Lungsod NG Lipa Maraouy, Lipa City Bachelor of Science in Business Administration Major in Financial Managementjohn dionelaNessuna valutazione finora

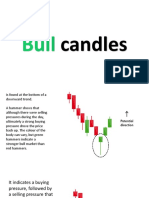

- Candle TypesDocumento19 pagineCandle TypesMarcel ProustNessuna valutazione finora

- Demat Account: Guntur P. Guru Prasad Faculty MemberDocumento20 pagineDemat Account: Guntur P. Guru Prasad Faculty MemberPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- India's Gold Investment Evolution: Indian Gold Coin: An Introduction To Branded Gold CoinsDocumento18 pagineIndia's Gold Investment Evolution: Indian Gold Coin: An Introduction To Branded Gold Coinsmliber000Nessuna valutazione finora

- Problem: 1Documento8 pagineProblem: 1PRIYA SHARMA EPGDIB (On Campus) 2019-20Nessuna valutazione finora

- ChaptersDocumento31 pagineChapterssuhayb_1988Nessuna valutazione finora

- Arouri Et Al. - 2019 - Corporate Social Responsibility and M&A UncertaintDocumento23 pagineArouri Et Al. - 2019 - Corporate Social Responsibility and M&A Uncertaintyiyi liaoNessuna valutazione finora

- Engineering Econ. - ANNUITYDocumento35 pagineEngineering Econ. - ANNUITYNikolai VillegasNessuna valutazione finora

- ACCA F9 June 2015 Suggested AnswersDocumento10 pagineACCA F9 June 2015 Suggested AnswersACFNessuna valutazione finora

- Derivatives As Risk Management Tool For CorporatesDocumento86 pagineDerivatives As Risk Management Tool For CorporatesCharu ModiNessuna valutazione finora

- Sas#10 Acc150Documento4 pagineSas#10 Acc150Mekuh Rouzenne Balisacan PagapongNessuna valutazione finora

- Right IssueDocumento8 pagineRight IssueHeavy Gunner100% (3)

- Lesson 4 Fair Value Gap FVG-1Documento4 pagineLesson 4 Fair Value Gap FVG-1Nguyễn Trường100% (5)

- BUSINESS STUDIES GRADE 11 NOTES CHAPTER 15.editedDocumento9 pagineBUSINESS STUDIES GRADE 11 NOTES CHAPTER 15.editedMatlalagohle SakoNessuna valutazione finora

- Nuziveedu Seeds LTDDocumento5 pagineNuziveedu Seeds LTDIndia Business ReportsNessuna valutazione finora

- Part 6Documento8 paginePart 6Amr YoussefNessuna valutazione finora

- Book Value Per Share PresentationDocumento22 pagineBook Value Per Share PresentationharoonameerNessuna valutazione finora

- Section e - AnswersDocumento7 pagineSection e - AnswersAhmed Raza MirNessuna valutazione finora

- Treasury Department: The Treasury Department Is Responsible For A Company ' S LiquidityDocumento32 pagineTreasury Department: The Treasury Department Is Responsible For A Company ' S LiquidityHanzo vargasNessuna valutazione finora

- Tile - : Private Company ProfileDocumento27 pagineTile - : Private Company ProfileVincent LuiNessuna valutazione finora

- Time Value of MoneyDocumento60 pagineTime Value of MoneyAtta MohammadNessuna valutazione finora

- The CFA Conundrum - Does CFA With MBA in Finance Add Value - Inside IIMDocumento9 pagineThe CFA Conundrum - Does CFA With MBA in Finance Add Value - Inside IIMashokyerasiNessuna valutazione finora