Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Carey Syllabus Fall 2012 - Financial Institutions MGMT

Caricato da

kinderland126Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Carey Syllabus Fall 2012 - Financial Institutions MGMT

Caricato da

kinderland126Copyright:

Formati disponibili

Financial Institutions 2 Credit Hours BU.231.710.81 Saturday August 25th to October 13th 2012.

From 9:00 AM to 12:00 Noon Fall 2012 Baltimore Campus

Instructor: Phone: E-MAIL: Office Hours:

Victor Espitia 443 364 8678 vespitia@jhu.edu After Class and week days via e-mail Financial Institutions Management: A Anthony Saunders, New York University Marcia Millon Cornett, Bentley University

Risk Management Approach, 7/e

ISBN:13: 978-0-07-353075-8 Copyright year: 2011 Publisher: McGraw-Hill Note: If you click on the Financial Management link above, it will take you to the publishers web site. Recommended: Investments by Bodie, Kane, and Marcus, 8th Edition, ISBN-13: 9780077261450. A good review of the basics. Value at Risk by Jorion, 3rd Edition, ISBN -13: 9780071464956. Everything you want to know about Value at Risk. Blackboard Site A Blackboard course site is set up for this course. Each student is expected to check the site throughout the semester as Blackboard will be the primary venue for outside classroom communications between the instructors and the students. Students can access the course site at https://blackboard.jhu.edu. Support for Blackboard is available at 1-866-669-6138. Course Evaluation As a research and learning community, the Carey Business School is committed to continuous improvement. Therefore each student must complete the course evaluation as part of the continuous improvement process. Information on how to complete the evaluation will be provided near the end of the course. Disability Services Johns Hopkins University and the Carey Business School are committed to making all academic programs, support services, and facilities accessible. To determine eligibility for accommodations, please contact the Carey Disability Services Office at time of admission and allow least four weeks prior to the beginning of the first class meeting. Students should contact Rachel Hall in the Disability Services office by phone at 410-234-9243, by fax at 443-529-1552, or email: carey.disability@jhu.edu. Important Academic Policies and Services Honor Code Statement of Diversity and Inclusion

BU.231.710.xx - Financial Institutions Management Instructors Name- Page 2 of 4

Tutoring Carey Writing Center Inclement Weather Policy Students are strongly encouraged to consult the Johns Hopkins Carey Business School Student Handbook and Academic Catalog and the School website http://carey.jhu.edu/syllabus_policies for detailed information regarding the above items. Course Description: (note: the course description in the catalog is for 3-credit course. This is revised to be consistent with the goal of a 2-credit course). The course focuses on quantitative methods to measure and manage the risks faced by financial institutions, especially banks. It covers risk measurement and risk management in the areas of interest rate risk, market risk, liquidity risk, off-balance sheet risk, credit risk and capital requirements. Course Overview: The financial service industry plays a significant role in financial markets and it continues to undergo dramatic changes. Financial institutions (FIs) perform the essential function of channeling funds from investors (or depositors) to the users of funds. The risk management of FIs is crucial not only in maximizing shareholders value, but also in ensuring the stability of the whole financial markets. In this course, we focus on the measurement and management of the risks of banks (depository institutions). For example, banks hold assets that are exposed to default or credit risk and banks tend to mismatch the maturities of their balance sheet assets and liabilities and therefore are exposed to interest rate risk. Furthermore, banks need to manage the uncertainty of the earnings of its trading portfolios caused by extreme market changes, a risk that is known as its market risk. In addition to the risk management of individual financial institutions, we will also introduce systemic risk. Systemic risk in finance refers to the likelihood that a large scale of financial institution failures in a short period of time caused by single event. The measurement and management of systemic risk suggests an important but rather less discussed area of risk management of financial institutions. Student Learning Objectives for This Course All Carey graduates are expected to demonstrate competence on four Learning Goals, operationalized in eight Learning Objectives. These learning goals and objectives are supported by the courses Carey offers. For a complete list of Carey learning goals and objectives, please refer to the website http://carey.jhu.edu/LearningAtCarey/LGO/index.html. The learning objectives for this course are: 1. Understand the essential function of banks in financial markets and how its role has changed. Understand the sources of the risks of a bank (e.g. interest rate risk, market risk, credit risk, off balance sheet risk, and liquidity risk etc). 2. Measure the interest rate risk of a bank from the book value perspective and the market value perspective. 3. Measure the credit risk of a single name and a portfolio. 4. Measure the market risk through the VaR approach. 5. Estimate capital adequacy: a book value perspective and a market value perspective.

Attendance Policy Attendance on-time is proper business etiquette and a minimal requirement for classroom participation. Being regularly late or leaving early or both is unprofessional. Because participation is a part of the grading system of this course, poor attendance is not to your advantage. There will be attendance sheet to be signed in every class. And DO NOT fake signatures for others. In that case, both will get zero credit for attendance for the semester. It is not worth it. Emergencies

BU.231.710.xx - Financial Institutions Management Instructors Name- Page 3 of 4

with proper documentation will be exempted. Please note that business trips do not count as emergency. Attendance accounts for 5% of the final grade. For example: students miss one class will lose 1/15th of the 5%, which is 0.3 point out of 100 points. Assignments Exams: The exams will be structured to include specific problems, some of which will involve both computations and narrative solutions. Use of financial calculators and formulas sheet (formulas as they appear in the textbook will be permitted, no notes about the formulas or the material). The exams will test student's knowledge of course material and reading assignments, as well as ability to apply the material covered to new situations. Students must work independently. Students who have an unavoidable reason to miss any exam should contact me in person well ahead of the exam. I may allow them to take the exam before the scheduled time. No makeup exams will be given after the scheduled time. Students who can't take the midterm exam will take a comprehensive final exam to which the weight for the missed exam will be added. The final exam will be comprehensive. - Mid-term Exam: Most of the exam will be a take home exam; there will be 2 questions/problems to be addressed in class. It covers topics taught before the exam. It consists of multiple choices, and problem solving. No makeup examinations will be given. However, in case of an emergency (illness etc, supported by proper documentation), the points for the midterm shall be based on the final. - Final-term Exam (comprehensive): Most of the exam will be a take home exam; there will be 2 questions/problems to be addressed in class. It will cover all topics taught in the class. In case of an emergency (illness etc, supported by proper documentation), an incomplete grade will be assigned and I will set up an exam for you before the incomplete expires. You can bring a calculator to the exam. - Homework Assignments: There will be several homework assignments due the week after it is assigned. These assignments will be done in groups to promote further discussion of the topic at hand and enhance learning. Homework will not be accepted after the due date. - Quizzes: Several Quizzes (up to six) will be given to students at the end of class each week starting from the second week of the course. The quizzes will be on the topic covered the previous week; reviewing the notes from the previous week, doing the homework, and the problems on the back of each chapter will greatly enhance the students ability to do well on the quizzes. The best four quizzes will be selected for the final grade. No makeup quizzes will be given. Assignment Attendance and participation in class discussion Best 4 quizzes (there could be up to six) Homework Assignments (groups of 4 students) Mid-term Exam Final Exam -Comprehensive Learning Outcome All All All All All Weight 5% 15% 30% 20% 30%

Important notes about grading policy: The grade for good performance in a course will be a B+/B. The grade of A- will only be awarded for excellent performance. The grade of A will be reserved for the select few who demonstrate extraordinarily excellent performance. *The grades of D+, D, and D- are not awarded at the graduate level. Grade appeals will ONLY be considered in the case of a documented clerical error. Tentative Course Calendar* *The instructor reserves the right to alter course content or adjust the pace to accommodate class progress.

BU.231.710.xx - Financial Institutions Management Instructors Name- Page 4 of 4

Week Aug 25th Sep 1st Sep 8th Sep 15th Sep 22nd Sep 29th

Content Introduction of financial service industry and banks in particular Review of the types and the sources of the risks of financial institutions Measuring interest rate risk: Gap analysis and duration analysis -Measuring market risk: Value at Risk -Take home mid-term is given: cover contents taught from week 1 to 3 Measuring credit risk: individual loan risk and portfolio risk Measuring credit risk: portfolio risk Measuring off-balance sheet risk Liquidity risk and liquidity management. -Take home final (comprehensive). -Capital adequacy: a book value perspective and a market value perspective. Swaps

Will cover chapter # Text, Chapter 1 and chapter 2 Text, Chapter 7 Text, Chapter 8 and 9 Text, Chapter 10 Text, Chapter 11 Text, Chapter 12 & 13

Assignment Due

Chapters 1 & 2 Reviewed and Problems Done Chapter 7 Reviewed and Problems done Chapters 8 & 9 Reviewed and Problems Done -Mid-term Exam Due - Chapters 10 Reviewed and Problems Done Chapters 11 Reviewed and Problems Done Chapters 12 & 13 Reviewed and Problems Done -Take home final Due (comprehensive)

Oct 6th Oct 15th

Text, Chapter 17 and 18 Text, Chapter 20. If time permits, Chapter 24

Copyright Statement Unless explicitly allowed by the instructor, course materials, class discussions, and examinations are created for and expected to be used by class participants only. The recording and rebroadcasting of such material, by any means, is forbidden. Violations are subject to sanctions under the Honor Code.

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Analysis of Foreign Reserve in India Since 2001-2018Documento15 pagineAnalysis of Foreign Reserve in India Since 2001-2018simran kaurNessuna valutazione finora

- UntitledDocumento10 pagineUntitledMichael Yang TangNessuna valutazione finora

- Class 12 Business Studies Chapter 10 - Revision NotesDocumento9 pagineClass 12 Business Studies Chapter 10 - Revision NotesAyush ShahNessuna valutazione finora

- Yuvika 1Documento6 pagineYuvika 1Yuvika DhimanNessuna valutazione finora

- Asistensi 8 - PPE (Revaluation Model)Documento3 pagineAsistensi 8 - PPE (Revaluation Model)mirrmirmirNessuna valutazione finora

- Performance Evaluation of Public and Private Sector Mutual Funds Mba ProjectDocumento62 paginePerformance Evaluation of Public and Private Sector Mutual Funds Mba Projectyogeshji_baba_soni18100% (3)

- US Treasury and Repo Markt ExerciseDocumento3 pagineUS Treasury and Repo Markt Exercisechuloh0% (1)

- Handout For Women Who Blockchain Breakout SessionDocumento4 pagineHandout For Women Who Blockchain Breakout SessionRene LubovNessuna valutazione finora

- Index: Foreign Exchange MarketDocumento62 pagineIndex: Foreign Exchange MarketSamNessuna valutazione finora

- The Virgin GroupDocumento25 pagineThe Virgin Grouprohanag25% (4)

- Advanced Financial Theory 2016-2017 Topic 5b. Summary: Dr. Damian S. Damianov Durham UniversityDocumento9 pagineAdvanced Financial Theory 2016-2017 Topic 5b. Summary: Dr. Damian S. Damianov Durham Universitycostas iokaisNessuna valutazione finora

- Financial Management Mid Term Kirti, ShailjaDocumento46 pagineFinancial Management Mid Term Kirti, ShailjaShailja JajodiaNessuna valutazione finora

- A Project Report On Technical Analysis at Share KhanDocumento105 pagineA Project Report On Technical Analysis at Share KhanBabasab Patil (Karrisatte)100% (3)

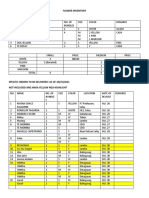

- Flower InventoryDocumento2 pagineFlower InventoryRegine ZulitaNessuna valutazione finora

- Senarai Skim Pelaburan Yang Diharamkan Bank NegaraDocumento2 pagineSenarai Skim Pelaburan Yang Diharamkan Bank NegaraevilsyndicateNessuna valutazione finora

- Market IndicatorsDocumento7 pagineMarket Indicatorssantosh kumar mauryaNessuna valutazione finora

- 09 Chapter 1Documento113 pagine09 Chapter 1Sami ZamaNessuna valutazione finora

- The Wide Angle - Predictions of A Rogue DemographerDocumento16 pagineThe Wide Angle - Predictions of A Rogue DemographersuekoaNessuna valutazione finora

- Hindalco Industries Ltd000Documento19 pagineHindalco Industries Ltd000Parshant Chohan100% (1)

- Sharekhan Pre Market 17th January - TuesdayDocumento27 pagineSharekhan Pre Market 17th January - Tuesdayrajagopal_k@vsnl.netNessuna valutazione finora

- Chapter 9 Capital Budgeting Decision LectureDocumento9 pagineChapter 9 Capital Budgeting Decision LectureAia GarciaNessuna valutazione finora

- Accounting For Plain Vanilla Derivative ContractsDocumento7 pagineAccounting For Plain Vanilla Derivative ContractsShankaran RamanNessuna valutazione finora

- Investors Attitude Towards Primary MarketDocumento62 pagineInvestors Attitude Towards Primary MarketRonak Singhal50% (2)

- Ultimate Charting ManualDocumento114 pagineUltimate Charting ManualChaudaryWaqasIsrar100% (1)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocumento75 pagineInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownAmrit KeyalNessuna valutazione finora

- Idbi ProjectDocumento86 pagineIdbi ProjectGodwin Morris67% (3)

- 1) Lecture 1 Portfolio Management EnvironmentDocumento6 pagine1) Lecture 1 Portfolio Management EnvironmentqwertyuiopNessuna valutazione finora

- Customer Satisfaction IIFLDocumento75 pagineCustomer Satisfaction IIFLDarling RamNessuna valutazione finora

- Li Mengyuan Resume 1Documento1 paginaLi Mengyuan Resume 1api-324828749Nessuna valutazione finora

- Rift Valley University Assela CampusDocumento3 pagineRift Valley University Assela CampusTeshomeNessuna valutazione finora