Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Broadview First Day Decl

Caricato da

Chapter 11 DocketsDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Broadview First Day Decl

Caricato da

Chapter 11 DocketsCopyright:

Formati disponibili

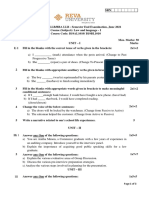

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 1 of 53

Main #0003 Date Pg DocketDocument Filed: 8/22/2012

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------x In re : : 1 Broadview Networks Holdings, Inc., et al., : : Debtors. : ------------------------------------------------------x

Chapter 11 Case No. 12-__________ ( )

(Joint Administration Pending)

DECLARATION OF MICHAEL K. ROBINSON, PRESIDENT AND CHIEF EXECUTIVE OFFICER OF BROADVIEW NETWORKS HOLDINGS, INC., IN SUPPORT OF CHAPTER 11 PETITIONS AND FIRST DAY PLEADINGS I, Michael K. Robinson, declare, pursuant to 28 U.S.C. 1746, under penalty of perjury that: 1. I am the President, Chief Executive Officer, and a Director of Broadview

Networks Holdings, Inc. (BVNH), a corporation incorporated under the laws of Delaware. I have served as an officer of BVNH and the other debtors and debtors in possession in the abovecaptioned cases (collectively with BVNH, the Debtors or the Company) since March 2005, and was appointed to the BVNH board of directors on January 9, 2009. In such capacities, I am familiar with the day-to-day operations, business and financial affairs of the Debtors.

_______________________________

1

The last four digits of the taxpayer identification numbers of the Debtors follow in parentheses: (i) Broadview Networks Holdings, Inc. (0798); (ii) A.R.C. Networks, Inc. (0814); (iii) ARC Networks, Inc. (4934); (iv) ATX Communications, Inc. (2245); (v) ATX Licensing, Inc. (9838); (vi) ATX Telecommunications Services of Virginia, LLC (3888); (vii) BridgeCom Holdings, Inc. (2965); (viii) BridgeCom International, Inc. (3985); (ix) BridgeCom Solutions Group, Inc. (3989); (x) Broadview Networks, Inc. (1082); (xi) Broadview Networks of Massachusetts, Inc. (8054); (xii) Broadview Networks of Virginia, Inc. (6404); (xiii) Broadview NP Acquisition Corp. (2734); (xiv) BV-BC Acquisition Corporation (7846); (xv) CoreComm-ATX, Inc. (0529); (xvi) CoreComm Communications, LLC (2077); (xvii) Digicom, Inc. (0777); (xviii) Eureka Broadband Corporation (6004); (xix) Eureka Holdings, LLC (1318); (xx) Eureka Networks, LLC (1244); (xxi) Eureka Telecom, Inc. (3720); (xxii) Eureka Telecom of VA, Inc. (5508); (xxiii) InfoHighway Communications Corporation (0551); (xxiv) Info-Highway International, Inc. (8543); (xxv) InfoHighway of Virginia, Inc. (1600); (xxvi) nex-i.com, inc. (7035); (xxvii) Open Support Systems LLC (9972); and (xxviii) TruCom Corporation (0714). The Debtors executive headquarters address is 800 Westchester Avenue, Rye Brook, NY 10573.

8rJ ,(6 '( 8824200120822000000000007

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 2 of 53

Main Document

Pg

2.

On the date hereof (the Petition Date), each of the Debtors filed a

voluntary petition for relief under chapter 11 of title 11 of the United States Code (the Bankruptcy Code). The Debtors intend to continue in the possession of their respective properties and the management of their respective businesses as debtors in possession. 3. Prior to the Petition Date, the Debtors solicited votes on the Joint

Prepackaged Plan of Reorganization for Broadview Networks Holdings, Inc. And Its Affiliated Debtors (including all exhibits, schedules, appendices, and supplements thereto, and as amended, modified, or supplemented from time to time, the Prepackaged Plan), through their disclosure statement related to the Prepackaged Plan (the Disclosure Statement). On or around the date that solicitation commenced, holders of over two-thirds of the aggregate principal amount of the Debtors 11 3/8% senior secured notes due 2012 (the Required Consenting Noteholders) and holders of approximately 70% of the preferred equity interests in BVNH (the Consenting Equity Holders) entered into a restructuring support agreement, dated July 13, 2012 (as amended, the Restructuring Support Agreement) whereby such parties agreed to support the Prepackaged Plan. I understand that, after consideration of all votes that were submitted, the Prepackaged Plan was accepted by 80% in dollar amount and 95% in number with respect to all classes entitled to vote. As of the voting deadline (and excluding all late ballots) the Debtors received acceptances from holders of 75% in amount and 95% in number of such holders submitting a ballot. In addition, holders of 99.99% of the Existing Preferred Interests who voted on the Prepackaged Plan voted in favor of the Prepackaged Plan. Only one significant holder of Senior Secured Notes submitted a ballot to reject the Prepackaged Plan. The Debtors have filed concurrently herewith a motion seeking, among other things, to schedule a combined hearing on the confirmation of the Prepackaged Plan and approval of the Disclosure Statement.

-2-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 3 of 53

Main Document

Pg

4.

In order to enable the Debtors to operate effectively postpetition and to

avoid the adverse effects of the chapter 11 filings, the Debtors have requested various types of relief in first day applications and motions (the First Day Motions) filed with the Court, including a motion seeking to have the Debtors chapter 11 cases consolidated for procedural purposes and jointly administered (the Joint Administration Motion). 5. I submit this declaration pursuant to Rule 1007 of the Federal Rules of

Bankruptcy Procedure and Rule 1007-2 of the Local Bankruptcy Rules for the Southern District of New York (the Local Rules): (a) in support of the relief requested in the First Day Motions; (b) to explain to the Court and other interested parties the circumstances that compelled the Debtors to seek relief under the Bankruptcy Code; and (c) to provide certain information that I understand is required by Local Rule 1007-2. Except as otherwise indicated, all facts set forth in this declaration are based upon my personal knowledge and the knowledge I have acquired from those who report to me, consultation with other officers of the Debtors, my review of relevant documents, or my opinion based upon experience, knowledge and information concerning the Debtors operations and financial condition. If called upon to testify, I could and would testify competently to the facts set forth herein. I am duly authorized to submit this declaration. 6. Part I of this declaration provides background with respect to the Debtors

business, capital structure and reorganization efforts. Part II sets forth the relevant facts in support of the Debtors First Day Motions. Part III provides the information that I understand is required by Local Rule 1007-2.

-3-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 4 of 53

Main Document

Pg

I. A. General. 7.

BACKGROUND

The Company is a regulated provider of communications and information

technology solutions to business customers nationwide. Historically, the Company has focused on markets across ten states throughout the Northeast and Mid-Atlantic United States, including the major metropolitan markets of New York, Boston, Philadelphia, Baltimore and Washington, D.C. For the three months ended March 31, 2012, approximately 88% of the Companys total revenue was generated from over 34,000 retail end users in a wide array of industries, including professional services, health care, education, manufacturing, real estate, retail, automotive, nonprofit groups and others. For the same period, approximately 12% of total revenue was generated from wholesale customers, carrier access fees and other market channels. 8. The Company offers a comprehensive product portfolio based on

providing bundled packages that include both network connectivity and telecomm and IT applications, with a focus on addressing the needs of end users operating within complex telecommunications infrastructures. The Company benefits from both a strong traditional network infrastructure and software development expertise and proprietary technology. This allows the Company to offer its customers more than just network access, but additionally a product line that includes advanced, converged communications services, including cloud-based services (as described below), on a cost-effective basis. The Company offers a full suite of voice, data, internet and cloud-based systems and services to customers located within the Companys traditional network infrastructure, which is deployed throughout the Northeast and Mid-Atlantic regional markets. In addition, the Company offers cloud-based systems and services to customers nationwide. That segment represents the greatest growth potential for the Company.

-4-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 5 of 53

Main Document

Pg

9.

To provide comprehensive network connectivity to its nationwide

customers, the Company utilizes its own network of telecommunications switches, data routers, application servers and related equipment located in its switching locations and data centers, and connects to other third parties networks. The Company purchases this connectivity from other carriers for resale to its customers through various resale arrangements and various other commercial agreements. B. Industry Overview. 10. The market for communications services, particularly local voice, has

been historically dominated by the incumbent local exchange carriers (ILECs) in the United States, including Verizon Communications Inc. (Verizon), AT&T Inc. (AT&T), CenturyLink Inc., Frontier Communications Corporation, FairPoint Communications, Inc. (FairPoint) and Windstream Corporation. While the ILECs own substantially all of the local exchange networks providing basic network access in their respective operating regions, competitive communications providers, such as the Company, hold significant market share. In recent years, the number of competitive communications providers in the United States has been reduced due to industry consolidation and the fact that leading cable companies have entered the residential and business communications markets, thereby reducing the market share held by ILECs. 11. Increased complexity in delivering communications and IT services,

together with what has been a challenging economic climate has driven business customers to evaluate alternative approaches, including cloud-based applications and services. As competitive pressures have commoditized more access services, cloud-based services represent growth opportunities for competitive providers who are successful in tailoring cloud-based applications to individual business needs.

-5-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 6 of 53

Main Document

Pg

C.

Products and Services. 12. The Companys array of communications and IT services include cloud-

based services, voice and data communications services and value-added products and services. The Companys products and services are offered with a range of alternatives and customized packages, allowing the Company to meet the specific requirements and objectives of a large number of potential business customers. The Companys sales and marketing initiatives focus on bundling products and services into a single, tailored and competitively priced package for each customer. (1) Cloud Services. 13. Cloud computing is the delivery of voice and data communications,

computing and storage capacity to end users from a remote location. More than just connectivity, cloud-based services allow the actual storage space and software applications to be stored off-site, or in the cloud, and accessed through a network connection. 14. OfficeSuite is the Companys cloud-based voice-over-IP (VoIP)

communications solution, and is one of the Companys fastest-growing product lines. VoIP technology allows for the delivery of voice communications and multimedia sessions over networks such as the Internet. OfficeSuite packages business-grade VoIP with advanced telephone equipment and managed network security into a unified communications package. OfficeSuite features include unlimited local and long distance calls, online updates, secure multi-site data networking and high-speed internet access. Customers can choose from a range of different connectivity options at various price points as a customers access to cloud services is not dependent on such customer being located within the Companys traditional network infrastructure. In 2009, the Debtors acquired the source code and intellectual property underlying the OfficeSuite software.

-6-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 7 of 53

Main Document

Pg

15.

In 2011, the Company introduced OfficeSuite ACD, a full-featured

cloud-based application integrated with OfficeSuite that provides robust call center capabilities for business customers, including advanced call routing, queuing, call recording, easy-to-use reporting and functionality. OfficeSuite ACD delivers to business customers the advanced call center features of other internal telephone connection systems without the need to invest capital in on-site equipment or intensive IT support. It provides a suite of highly flexible capabilities that enable quick and easy prioritization and distribution of incoming business calls, customized hold treatments and advanced call routing options that factor in a number of customer-specified parameters. 16. Along with network connectivity, the Companys cloud-based computing

packages also include bundled packages of subscription-based software and infrastructure services. Thus, by connecting to the cloud, customers are additionally able to remotely access business applications, including Microsoft Office and Microsoft Exchange. By providing these cloud-based software and infrastructure services to its customers, the Company is able to provide greater customer value as compared to solely providing network access, thereby increasing its share of the customers overall communications and IT operational expenditures and at the same time increasing the Companys monthly recurring revenue per customer. (2) Other Value-Added Products and Services. 17. The Company gives its customers the option to outsource necessary

management and maintenance services. Packaged solutions of day-to-day management and ongoing maintenance include managed e-mail security, content filtering and online data backup and recovery.

-7-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 8 of 53

Main Document

Pg

(3)

T-1 Based & Traditional Offerings. 18. The Company also offers integrated voice and data packages. These

integrated offerings result in performance and cost efficiencies compared to purchasing discrete services from separate competing carriers. 19. The Company provides customized voice packages that include features

such as call forwarding, call waiting, call transfer, calling number identification/calling name identification, voicemail and direct inward dialing. The Company uses its own network elements and those procured pursuant to contracts with Verizon, AT&T, FairPoint and other carriers, to service its customers. In addition to the local service portfolio, the Company offers a range of dedicated long-distance services. 20. The Company also offers ancillary long-distance services such as operator

assistance, calling cards and conference calling. In instances where a customer may have locations outside the Companys network footprint, the Company resells the long-distance services of other communications carriers through agreements with those carriers. The Company generally sells or offers its long-distance services as part of a bundle that includes one or more other service offerings. In addition, through arrangements with national IP network providers, the Company offers certain services on a nationwide basis to business customers who have locations outside of the Companys network footprint. D. Service Agreements with Carriers. 21. In order to provide certain services to its customers, the Company

purchases facilities and services from ILECs. Pursuant to Federal Communication Commission (FCC) rules, the Company maintains certain interconnection agreements with ILECs through which it secures access to the unbound network elements it uses to serve its customers. The Company has interconnection agreements in effect with Verizon, FairPoint and AT&T, and is

-8-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 9 of 53

Main Document

Pg

currently negotiating agreements with other ILECs to support its nationwide service offering. The Company also maintains agreements with other, non-ILEC carriers for the provision of network facilities, including fiber routes and high capacity loops and transport, internet service providers, and local voice and data services. Through agreements with a number of different long distance carriers the Company obtains toll services for resale to its customers. Additionally, the Company maintains agreements with various entities for ancillary services such as out-ofband signaling, directory assistance and 9-1-1. E. Real Estate Facilities. 22. The Debtors are headquartered in Rye Brook, New York. The Debtors do

not own any of their facilities, but lease fifteen material facilities in New York, Pennsylvania, New Jersey, Washington D.C./Northern Virginia and Massachusetts consisting of seven offices and eight switch locations. In addition, FCC rules generally require ILECs to permit competitors, such as the Company, to colocate equipment used for interconnection and/or access to the ILECs unbundled network elements. The Debtors maintain approximately 260 of these colocations with Verizon and FairPoint within the Northeast and Mid-Atlantic regions. F. Employees and Channel Partners. 23. As of the Petition Date, the Debtors employed approximately 850

employees, and contracted with hundreds of agent channel partners who market and sell the Companys products. G. Regulation. 24. The Company is subject to federal, state, local and foreign laws,

regulations, and orders affecting the rates, terms, and conditions of certain of its service offerings, operations and relations with other service providers. The FCC has jurisdiction over

-9-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 10 of 53

Main Document

Pg

the Companys facilities and services to the extent they are used in the provision of interstate or international communications services. 25. State regulatory public utility commissions generally have jurisdiction

over the Companys facilities and services to the extent they are used in the provision of intrastate services. In addition, local governments may regulate aspects of the Companys business through zoning requirements, permit or right-of-way procedures, and franchise fees. Foreign laws and regulations apply to communications that originate or terminate in a foreign country. H. Debtors Prepetition Capital Structure. 26. As of the Petition Date, the Debtors had approximately $335 million of

outstanding liabilities under the ABL Facility, Senior Secured Notes (each as defined below) and various capital leases. The Debtors prepetition capital structure is described in more detail below. (1) ABL Facility. 27. Certain of the Debtors are borrowers under a $25 million five-year

revolving credit facility (the ABL Facility) governed by that certain Credit Agreement, dated as of August 23, 2006 and amended as of July 27, 2007, November 23, 2010, December 8, 2011, May 31, 2012 and July 19, 2012 (as further amended and modified, and together with any ancillary documents, the Credit Agreement), by and among the borrowers, and The CIT Group/Business Credit, Inc. (CIT), as administrative agent and lender. 28. Indebtedness under the ABL Facility is guaranteed by substantially all of

BVNHs direct and indirect subsidiaries that are not borrowers thereunder and is secured by a first priority security interest in accounts, inventory, deposit accounts, cash, securities accounts, investment property, lock boxes, capital stock and general intangibles, among other assets, and a

- 10 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 11 of 53

Main Document

Pg

second priority security interest in substantially all of the remainder of the Debtors assets. As of the Petition Date, BVNH has approximately $13.9 million of outstanding borrowings under the ABL Facility. On July 19, 2012, the ABL Facility was amended to extend the term through September 5, 2012. (2) Senior Secured Notes. 29. On August 23, 2006, BVNH completed an offering of $210 million

aggregate principal amount of senior secured notes due 2012 (the 2006 Notes), and on May 14, 2007, BVNH completed an additional offering of $90 million aggregate principal amount of senior secured notes due 2012 (together with the 2006 Notes, the Original Notes) issued pursuant to that certain Indenture for 11 3/8% Senior Secured Notes due 2012, dated as of August 23, 2006, and supplemented as of September 29, 2006, May 14, 2007 and May 31, 2007 among Broadview Networks Holdings, Inc., as Issuer, certain other Debtors, as Guarantors, and The Bank of New York, as Trustee and Collateral Agent. 30. On November 14, 2007, BVNH exchanged $300 million of the Original

Notes, representing 100% of the outstanding aggregate principal amount, for an equal principal amount of a new issue of substantially identical debt securities that were registered under the Securities Act of 1933, as amended (the Senior Secured Notes). Prior to the Petition Date BVNH paid cash interest on the principal amount of the Senior Secured Notes at a rate of 11.375% per annum, which is due semi-annually on March 1 and September 1 of each year. The Senior Secured Notes mature on September 1, 2012. Since the registration of the Senior Secured Notes, the Debtors have filed periodic reports with the Securities Exchange Commission. 31. The obligations under the Senior Secured Notes are guaranteed on a senior

secured basis, jointly and severally, by substantially all of BVNHs existing and future domestic restricted subsidiaries. The Senior Secured Notes are secured by a lien on substantially all of the

- 11 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 12 of 53

Main Document

Pg

Debtors assets; provided, however, that pursuant to the terms of that certain Intercreditor Agreement, dated as of August 23, 2006 and amended as of May 10, 2007, the security interest in the Companys receivables, inventory, deposit accounts, securities accounts and certain other assets that secure the Senior Secured Notes are contractually subordinated to the lien that secures the ABL Facility. (3) Capital Stock. 32. BVNHs outstanding capital stock consists of authorized common stock

and preferred stock. There is no established public trading market for BVNHs outstanding capital stock. As of March 31, 2012, there were: 87,254 outstanding shares of BVNHs Series A Preferred Stock; 100,702 outstanding shares of BVNHs Series A-1 Preferred Stock; 91,187 outstanding shares of BVNHs Series B Preferred Stock; 62,756 outstanding shares of BVNHs Series B-1 Preferred Stock; and 14,402 outstanding shares of BVNHs Series C Preferred Stock (collectively, the Existing Preferred Interests). BVNH also has 9,286,759 outstanding shares of Class A Common Stock and 360,050 shares of Class B Common Stock. I. Events Leading to Chapter 11 Cases. 33. During the last 18 months the Company and its management team

diligently explored potential transactions including mergers and acquisitions, refinancing and restructuring in an effort to have sufficient capital leading up to September 1, 2012, the maturity date for the Companys $300 million in Senior Secured Notes. In October 2010, the Company retained Jefferies & Company, Inc. as its investment banker to evaluate strategic options, and in December 2011, the Company retained Evercore Group, L.L.C. (Evercore) as its financial advisor to assist the Company with respect to a refinancing or restructuring transaction. 34. As part of their engagements, the Debtors financial advisors worked with

the Board of Directors of BVNH and the Companys management to pursue strategic

- 12 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 13 of 53

Main Document

Pg

alternatives, including mergers or acquisitions, an investment in the Company, a sale of all or substantially all of the assets of the Company, or a sale of certain operations or discrete assets of the Company. In connection with such efforts, certain parties expressed preliminary interest in various transactions with respect to the Debtors assets. For a variety of reasons, such transactions did not develop. The Company also explored other strategic options, such as a refinancing, including through a notes offering launched in June 2011 which due to, among other things, the effects of global economic conditions on the debt market, could not be consummated. 35. During this time, the Company also sought to negotiate with its largest

bondholders, and, in the second quarter of 2012, certain of the Debtors largest bondholders retained legal and financial restructuring advisors to work with the Company to pursue a potential balance sheet restructuring, while the Company was simultaneously continuing to explore other opportunities. Due to macro-economic trends and trends specific to the Companys industry, the Company was unable to obtain new financing or to achieve a sale transaction with sufficient value to pay the Senior Secured Notes in full prior to maturity. 36. It became clear that a consensual balance sheet restructuring with holders

of the Senior Secured Notes was the Companys best option to maximize value for the Companys stakeholders. Upon the execution of customary confidentiality agreements, the Debtors provided certain bondholders with information regarding the Debtors operations, projections and business plan to facilitate their ability to negotiate and assess a potential restructuring plan with the Company. After good-faith, arms-length negotiations, the Debtors reached an agreement with the Required Consenting Noteholders and the Consenting Equity Holders, which agreement was memorialized by the Restructuring Support Agreement. Pursuant to the terms of the Restructuring Support Agreement, the Required Consenting Noteholders and

- 13 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 14 of 53

Main Document

Pg

Consenting Equity Holders agreed to support a balance sheet restructuring pursuant to a prepackaged chapter 11 plan in accordance with the terms of a term sheet attached to the Restructuring Support Agreement. 37. Solicitation for votes to accept or reject the Prepackaged Plan was

launched prior to the Petition Date on July 13, 2012. After a 30-day solicitation period, the Debtors received votes in favor of the Prepackaged Plan from 80% of the holders of the Senior Secured Notes and holders of 99.99% of the Existing Preferred Interests that voted. The Company filed these cases on the Petition Date in order to consummate the Prepackaged Plan, which was filed contemporaneously herewith. The Company has contemporaneously filed a motion requesting a hearing date for the confirmation of the Prepackaged Plan, and the approval of the Debtors disclosure statement and prepetition solicitation procedures. If consummated, the restructuring transactions contemplated in the Prepackaged Plan will substantially de-lever the Debtors and provide cost savings and additional needed liquidity for the Company. J. The Prepackaged Plan. 38. In accordance with the terms of the Restructuring Support Agreement,

prior to the Petition Date, the Debtors solicited votes on the Prepackaged Plan through the Disclosure Statement. If consummated, the restructuring transactions contemplated in the Prepackaged Plan will substantially de-lever the Debtors and provide cost savings and additional needed liquidity for the Debtors by, among other things, reducing the amount of the Debtors outstanding debt by half. 39. Generally, the Prepackaged Plan provides that: (a) holders of the Senior Secured Notes shall receive their pro rata share of (i) 97.5% of the common stock (the New Common Stock) of reorganized BVNH subject to dilution by shares of New Common Stock issued pursuant to the management equity plan or

- 14 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 15 of 53

Main Document

Pg

upon exercise of the New Warrants (as defined below), and (ii) $150 million of new 10.5% senior secured notes due 2017; (b) a new exit facility that will provide total borrowing availability upon consummation of the Prepackaged Plan of no less than $25 million; the repayment in full and termination of the Debtors obligations under the Existing ABL Facility if not previously repaid pursuant to the DIP Credit Facility; the issuance of (i) 2.5% of the New Common Stock, subject to dilution by shares of New Common Stock issued pursuant to the management equity plan or upon exercise of the New Warrants, and (ii) two series of 8-year warrants to purchase up to (A) 11% of the New Common Stock, and (B) 4% of the New Common Stock (collectively, the New Warrants), in each case, subject to dilution by the management equity plan to be issued on a pro rata basis to holders of the Debtors outstanding existing preferred equity interests in exchange for the cancellation of such interests; the cancellation of all of the existing equity interests in BVNH; and the retirement of the Senior Secured Notes. SUMMARY OF FIRST DAY MOTIONS2

(c)

(d)

(e) (f) II. 40.

To enable the Debtors to operate effectively and to avoid the adverse

effects of the chapter 11 filings, the Debtors have filed, or will file upon scheduling of a further hearing by this Court, the motions described below. 41. In connection with the preparation for these bankruptcy cases, I have

reviewed each of the First Day Motions referenced below. The First Day Motions were prepared with my input and assistance, or the input and assistance of employees working under my supervision. I believe the information contained in the First Day Motions is accurate and correct. As set forth more fully below, I believe that the entry of orders granting the relief requested in _______________________________

2

Capitalized terms used but not defined in this section have the meanings given them in the relevant First Day Motion. - 15 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 16 of 53

Main Document

Pg

these motions and applications is critical to the Debtors ability to preserve the value of their estates and assist in their reorganization efforts. A. Motions Related to Case Management. (1) Joint Administration Motion. 42. The Debtors seek the joint administration of their chapter 11 cases, 28 in

total, for procedural purposes only. I believe that it would be far more practical and expedient for the administration of these chapter 11 cases if the Court were to authorize their joint administration. Many of the motions, hearings, and other matters involved in these chapter 11 cases will affect all of the Debtors. Hence, joint administration will reduce costs and facilitate the administrative process by avoiding the need for duplicative hearings, notices, applications, and orders. (2) Case Management Motion and Form and Manner of Notice. 43. To ease the administrative burden of these cases on the Debtors estates,

the Debtors request relief regarding creditor lists and the form and manner of the notices in these cases. The Debtors request entry of an order establishing omnibus hearing dates and certain notice, case management, and administrative procedures. The Debtors further request entry of an order: (a) waiving the requirement for filing a list of creditors; (b) authorizing the Debtors to file a consolidated list of creditors; and (c) waiving the initial case conference if the Prepackaged Plan is confirmed on or before sixty (60) calendar days after the Petition Date. I believe that the relief requested will reduce the administrative costs of these cases and is in the best interests of these estates.

- 16 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 17 of 53

Main Document

Pg

(3)

Motion to Grant an Extension of Time to File Schedules and Statement of Financial Affairs and Waiving Same Upon Confirmation. 44. Prior to filing this case, the Debtors were unable to devote the resources

necessary to complete the Schedules due to the substantial time spent preparing for the chapter 11 filing and attending to operations. Furthermore, the Debtors have a significant number of creditors and executory contracts and, thus, will require additional time to review their books and records to accurately reflect their obligations and financial position in the Schedules. Accordingly, the Debtors respectfully request additional time to finalize their Schedules. 45. Moreover, under the circumstances of these chapter 11 cases, I believe

that the purposes of filing the Schedules and Statements generally have been fulfilled by other means and that the completion of the Schedules and Statements cannot be justified given the costs to the Debtors estates. To require the Debtors to file the Schedules and Statements would be unnecessarily burdensome to the Debtors estates. Accordingly, I believe it is in the best interests of the Debtors and their estates for this Court to waive the requirement that the Debtors file their Schedules and Statements upon confirmation of the Prepackaged Plan. (4) Motion to Approve Solicitation Procedures and Schedule Combined Hearing on Disclosure Statement and Confirmation of Prepackaged Plan. 46. In connection with the Prepackaged Plan, the Debtors prepared the

Disclosure Statement describing, among other things, the proposed reorganization and its effects on holders of claims against and interests in the Debtors. On or about July 13, 2012, the Debtors caused a copy of the Disclosure Statement, the Prepackaged Plan and the appropriate ballots to be delivered to each known holder of Senior Secured Notes Claims and Existing Preferred Interests that was entitled to vote on the Prepackaged Plan. The Debtors established August 13, 2012 as the deadline for the receipt of votes to accept or reject the Prepackaged Plan (the

- 17 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 18 of 53

Main Document

Pg

Voting Deadline). As described above, the solicitation of votes on the Prepackaged Plan was an overwhelming success. The Debtors have filed an affidavit of their voting agent certifying the results of the solicitation of votes on the Prepackaged Plan. 47. The Disclosure Statement is extensive and comprehensive. It contains

descriptions and summaries of, among other things: (a) the Prepackaged Plan; (b) certain events preceding the commencement of these chapter 11 cases; (c) claims asserted against the Debtors estates; (d) securities to be issued under the Prepackaged Plan; (e) risk factors affecting the Prepackaged Plan; (f) a liquidation analysis setting forth the estimated return that creditors would receive in a hypothetical chapter 7 case; (g) financial information and valuations that would be relevant to creditors determinations of whether to accept or reject the Prepackaged Plan; and (h) securities law and federal tax law consequences of the Prepackaged Plan. 48. Based on my understanding of the solicitation and notice process

conducted by the Debtors on a prepetition basis, I believe that the Debtors conducted a proper solicitation of votes on the Prepackaged Plan and that no further notice is required. B. Applications and Motions Related to the Retention of Professionals. (1) Application to Employ and Retain Willkie Farr & Gallagher LLP. 49. Concurrently herewith, the Debtors have filed an application to retain

Willkie Farr & Gallagher LLP (WF&G) as counsel with regard to the filing and administration of these chapter 11 cases. Prior to the Petition Date, WF&G was retained by the Debtors as general corporate counsel, and more recently, has provided advice and assistance with regard to financial restructuring, including the solicitation of the Prepackaged Plan and the Disclosure Statement, as well as the preparation and commencement of these cases. The Debtors desire to continue to employ WF&G to provide restructuring advice and services as is necessary

- 18 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 19 of 53

Main Document

Pg

and requested by the Debtors, including, without limitation, bankruptcy, debt restructuring, corporate, litigation and tax services. 50. I understand that WF&Gs attorneys have extensive experience and

knowledge in the fields of debtors and creditors rights, debt restructuring and corporate reorganizations, tax, employee benefits and commercial litigation, among others. In addition, WF&G has become familiar with the Debtors operations and businesses as a result of the services it provided to the Debtors prior to the commencement of these cases. Accordingly, I believe that WF&G is well qualified to represent the Debtors in these chapter 11 cases. (2) Application to Employ and Retain Evercore. 51. The Debtors have filed an application to employ and retain Evercore as

investment banker and financial advisor to the Debtors. On or about December 19, 2011, and after a diligent process by which the Debtors assessed competing advisors, the Debtors retained Evercore to provide advice in connection with the Debtors attempts to complete a strategic restructuring, reorganization, and/or recapitalization and to explore potential sales of assets. I understand that Evercore has extensive experience in the fields of restructuring and providing financial and operational guidance to companies in distressed situations and has provided financial advisory services to debtors and creditors in other chapter 11 cases. I believe that Evercore is well qualified to serve as investment banker and financial advisor to the Debtors by virtue of this experience and its knowledge of the Debtors, their operations and their capital structure that Evercore acquired through its prepetition representation of the Debtors. Accordingly, I submit that the retention of Evercore as investment banker and financial advisor is in the best interests of the Debtors estates, creditors and other parties-in-interest, and should be granted.

- 19 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 20 of 53

Main Document

Pg

(3)

Application to Employ and Retain Kurtzman Carson Consultants. 52. The Debtors filed applications to retain Kurtzman Carson Consultants

LLC (KCC) as this Courts notice and claims agent, and administrative agent, for the Debtors chapter 11 cases. I believe that the retention of KCC is critical because of the large number of creditors identified in these cases. 53. I understand that KCC is a data processing firm with extensive experience

in noticing, claims processing, balloting and other administrative tasks in chapter 11 cases. In accordance with the Protocol for the Employment of Claims Agents, dated November 15, 2011, issued by the Clerk, the Debtors solicited bids from three prominent bankruptcy claims and noticing agents prior to selecting KCC and believe KCCs rates are reasonable given the quality of KCCs services and KCCs prior bankruptcy expertise. Given the need for the services described above and KCCs expertise in providing such services, I believe that retaining KCC will expedite service of notices, streamline the claims administration and balloting processes, and permit the debtors to focus on their reorganization efforts. C. Motions Related to Financing of Operations. (1) Motion to Authorize Continued Use of the Debtors Cash Management System, Bank Accounts and Business Forms. 54. In the ordinary course of their businesses prior to the Petition Date, and as

is typical with business organizations of similar size and scope, the Debtors maintained a centralized cash management system to collect, transfer, and disburse funds generated through their operations efficiently and to record such transactions accurately (the Cash Management System). 55. It is my understanding that the U.S. Trustee has established certain

guidelines which require chapter 11 debtors to, among other things, close all existing bank

- 20 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 21 of 53

Main Document

Pg

accounts and obtain, establish and maintain separate debtor-in-possession accounts, and utilize new checks for all debtor-in-possession accounts, which bear the designation Debtor in Possession and contain certain other information related to the chapter 11 case. The Debtors request a waiver of the requirement that the Debtors open new bank accounts. 56. I believe that the Debtors existing cash management and intercompany

accounting procedures are essential to the orderly operation of the Debtors businesses. A new Cash Management System could cause confusion, disrupt payroll, introduce inefficiency when efficiency is most essential, and strain the Debtors relationships with critical third parties, each of which could diminish the prospects for a successful reorganization. Thus, the Debtors seek authorization to continue the management of their cash receipts and disbursements in the manner in which they were handled immediately prior to the Petition Date. 57. In addition, I understand that section 345(b) of the Bankruptcy Code

contains certain deposit, investment and reporting requirements. The Debtors believe their current Cash Management System meets those requirements. 58. The Debtors also respectfully request that the Court authorize the Debtors

to treat all intercompany claims arising after the Petition Date in the ordinary course of business as superpriority administrative expenses, junior in all respects to the superpriority claims of the Debtors postpetition secured lenders and subject to the adequate protection liens granted to the Debtors prepetition secured lenders. If the Court authorizes the Debtors to treat these Intercompany Claims as administrative expenses, then each entity utilizing funds flowing through the Cash Management System will continue to bear ultimate repayment responsibility for such entitys individual obligations.

- 21 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 22 of 53

Main Document

Pg

59.

I believe that allowing the Debtors to maintain their Cash Management

System would be in the best interests of the Debtors estates, creditors and other parties in interest. (2) Motion to Approve Debtor-in-Possession Financing. 60. The Debtors seek authority to enter into a debtor-in-possession financing

facility, grant senior liens, junior liens and superpriority administrative expense status, use cash collateral, provide adequate protection to prepetition lenders and schedule a final hearing with respect to the relief requested, all as more fully described in the motion. 61. Upon the execution of customary confidentiality agreements, the Debtors

provided CIT with information regarding the Debtors operations, projections and business plan to facilitate their ability to negotiate a potential debtor-in-possession credit facility for the Company. The Debtors intend to enter into a senior secured, superpriority debtor-in-possession revolving credit agreement (the DIP Facility) in the amount of up to $25 million, structured as a revolving credit facility that will be provided by The CIT Group/Business Credit, Inc. While the Company currently projects that it will have sufficient cash to fund its ongoing operations during the course of these cases, the Company, in its business judgment, believes that the DIP Facility is needed in the event that the Debtors chapter 11 cases last longer than anticipated or the Debtors financial results or cash flows are weaker than expected and to provide comfort to third parties, such as the Companys vendors, regarding the adequacy of the Debtors liquidity. 62. The reasons supporting the Debtors request for authority to obtain

postpetition financing under the DIP Facility and to use cash claimed as collateral (Cash Collateral) are compelling. As explained in greater detail in the relevant motion, the DIP Facility will be used to provide liquidity for working capital and other general corporate purposes of the Debtors, subject to the Budget (as defined in the DIP Facility). Cash held by the

- 22 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 23 of 53

Main Document

Pg

Debtors prior to the Petition Date, including some cash that is Cash Collateral, will provide the Debtors with funds necessary for the operation of their business, including meeting their payroll and vendor obligations. Without the immediate use of Cash Collateral, the Debtors may be unable to fund their operations. I believe that access to Cash Collateral and the funds available under the DIP Facility is crucial to the Debtors ability to maintain their businesses and to avoid immediate and irreparable harm to their estates, employees, customers and creditors. 63. I understand that Evercore, the Debtors financial advisors, contacted six

(6) third-party lenders who are active in the debtor-in-possession financing market and each indicated that it would not be willing to extend postpetition financing to the Debtors on an unsecured or junior basis. In addition, on August 6, 2012, the Debtors received a non-binding proposal for potential debtor-in-possession financing. This proposal was accompanied by a term sheet for an alternative plan and was not available to the Debtors as a stand-alone financing alternative. 64. Ultimately, the Debtors determined, given their need for the DIP Facility

and discussions with other potential lending sources, that the financing provided under the DIP Facility was the best financing available on comparable terms. Moreover, pursuant to the terms of their Intercreditor Agreement the Senior Secured Noteholders have consented to the priming of their liens granted under the DIP Facility. D. Motions Related to Employee Matters. (1) Motion for Authorization to Pay Certain Prepetition Claims of Employees. 65. Concurrently herewith, the Debtors have filed a motion seeking authority

to, among other things, satisfy certain of their prepetition obligations to their current employees (the Employees), reimburse Employees for prepetition expenses that were incurred on behalf of the Debtors and pay prepetition payroll-related taxes associated with the Companys employee

- 23 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 24 of 53

Main Document

Pg

wage claims and the employee benefit obligations, and other similar tax obligations. This relief is critical to the Debtors businesses and reorganization efforts. 66. In order to achieve a successful reorganization, it is essential that the

Employees work with the same or greater degree of commitment and diligence as they did prior to the Petition Date. The requested authority to continue to pay the Employees prepetition salaries and wages and to maintain the current employee benefits programs is critical to ensure that: (a) the Debtors can retain personnel knowledgeable about the Debtors businesses; (b) the Debtors Employees continue to provide quality services to the Debtors at a time when they are needed most; and (c) the Debtors remain competitive with comparable employers. 67. If this motion were not granted, I believe that it would result in a

significant deterioration in morale among Employees, which undoubtedly would have a devastating impact on the Debtors, their customers, the value of estate assets and the Debtors ability to reorganize. The total amount to be paid if the relief sought in the motion is granted is modest compared with the size of the Debtors estates and the importance of the Employees to the restructuring effort. I believe authorizing the Debtors to pay these obligations in accordance with the Debtors prepetition business practices is in the best interests of the Debtors, their creditors, and all parties in interest, and will enable the Debtors to continue to operate their businesses without disruption in an economic and efficient manner. 68. For the reasons set forth above, I believe that granting the requested relief

is in the best interests of the Debtors, their creditors, and all parties in interest. (2) Motion for Authorization to Pay Certain Prepetition Claims of Independent Sales Agents. 69. In the ordinary course of their businesses, the Debtors utilize the services

of approximately 300 sales agents, who are engaged as independent contractors (the

- 24 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 25 of 53

Main Document

Pg

Independent Sales Agents). Historically, 25-30% of the Debtors new business is generated by Independent Sales Agents and that percentage is expected to rise. As an integral part of the Debtors sales force, the Independent Sales Agents are essential to the Debtors ability to generate new business and revenue. The services of these parties cannot be replaced at reasonable costs or without substantial hardship to the Debtors. The Debtors have filed a motion seeking authority to, among other things, satisfy their prepetition obligations to their Independent Sales Agents, and for the reasons set forth above, I believe that granting the requested relief is in the best interests of the Debtors, the creditors, and all parties in interest. E. Certain Other Motions. (1) Motion to Provide for Adequate Assurance to Utilities. 70. In connection with the operation of their businesses and management of

their properties, the Debtors obtain water, natural gas, electricity and other similar utility products and services (collectively, the Utility Services) from approximately seven (7) utility companies (collectively, the Utility Companies). The Debtors also have relationships with certain carriers (the Carriers) by which the Debtors purchase facilities and services (the Carrier Services). The Debtors are seeking an order of this Court prohibiting the Utility Companies and Carriers (collectively, the Service Providers) from altering or discontinuing services and deeming the Service Providers adequately assured of future performance by virtue of the Debtors proposed adequate assurance. 71. To provide adequate assurance of payment for future services to the

Utility Companies, the Debtors propose to provide a deposit equal to two (2) weeks of Utility Service, calculated as a historical average over the past twelve (12) months, to any Utility Company who requests such a deposit (the Adequate Assurance Deposit). To provide adequate assurance of payment for future services to the Carriers, the Debtors propose to pay all

- 25 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 26 of 53

Main Document

Pg

undisputed invoices related to prepetition and postpetition Carrier Services in the ordinary course of business (the Carrier Adequate Assurance). 72. I believe that the Debtors Adequate Assurance Deposit and Carrier

Adequate Assurance constitute sufficient adequate assurance to the Utility Companies and Carriers, respectively. However, in light of the severe consequences to the Debtors of any interruption in services by the Service Providers and the recognition that Service Providers have the right to evaluate the proposed adequate assurance on a case-by-case basis, if any Service Provider believes additional assurance is needed, the Debtors have proposed procedures for the Service Providers to request such additional adequate assurance. I believe these procedures, as outlined in the motion, are not only fair and reasonable, but also necessary for the Debtors stability. Furthermore, the Debtors fully intend to timely comply with their postpetition obligations to Service Providers. 73. I believe that without the relief requested in the motion, the Debtors could

be harmed by having to address numerous requests by Service Providers in an unorganized manner at a critical period in their reorganization efforts. (2) Motion to Authorize Payment of Certain Prepetition General Unsecured Claims and Other Unimpaired Claims. 74. In light of the anticipated short duration of these prepackaged chapter 11

cases and the proposed unimpairment and payment in full of general unsecured claims pursuant to the terms of the Prepackaged Plan, the Debtors seek the entry of an order authorizing but not directing the Debtors to pay the undisputed, prepetition unsecured claims that are not otherwise covered by First Day Motions, as they come due in the ordinary course of business (collectively, the Eligible General Unsecured Claims). In exchange, the Debtors may, as appropriate and

- 26 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 27 of 53

Main Document

Pg

necessary, seek agreements from general unsecured creditors to continue to extend prepetition trade credit terms to the Debtors for the duration of these chapter 11 cases. 75. The overall purpose of these chapter 11 cases and the Prepackaged Plan is

to implement a consensual balance sheet restructuring for the Debtors with payment in full to, among others, all of the Debtors trade and other unsecured creditors. If these cases proceed as anticipated, the Debtors will have sufficient liquidity through debtor-in-possession financing and the use of their cash collateral to maintain and enhance their position as a national communications and information technology solutions provider even while the chapter 11 cases are pending. This continuation of business as usual is important to stave off any loss of confidence regarding the Debtors ability to honor their obligations, which would undermine the goals of the Prepackaged Plan and reduce the value of the Debtors estates. Accordingly, it is critical that the Debtors assure the general unsecured creditors that they have sufficient authority to continue to honor their obligations in the ordinary course throughout these cases. 76. The requested relief is not an attempt to prioritize certain claims over

others and is consistent with the terms of the Prepackaged Plan which proposes to unimpair the claims of all general unsecured creditors, including the Eligible General Unsecured Claims. Moreover, payment of the Eligible General Unsecured Claims in the ordinary course of business will ease the administrative burden on the Debtors estates pending confirmation of the Prepackaged Plan by eliminating the need for a bar date and claims procedures. 77. Accordingly, the Debtors request the authority to pay the undisputed

prepetition claims of general unsecured creditors who agree, as applicable, to continue to provide their goods and services on the customary credit terms that existed 120 days prior to the Petition

- 27 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 28 of 53

Main Document

Pg

Date and are not otherwise covered in the First Day Motions (e.g., carriers) as they come due in the ordinary course of business, or on such other mutually agreeable terms and conditions. 78. For the reasons stated above, I believe that the relief sought therein is

necessary for a successful reorganization and is in the best interests of the Debtors and their estates. (3) Motion to Authorize Debtors to Honor Prepetition Customer Programs. 79. Prior to the Petition Date and in the ordinary course of their businesses,

the Debtors sought to develop and sustain a positive reputation in the marketplace through the implementation of certain customer programs (the Customer Programs), including discount contracts, rebates, wholesale customer deposits, a landlord customer program, and upfront maintenance billing. The termination of the Customer Programs would undoubtedly have an adverse effect on the Debtors businesses and their ability to reorganize. Therefore, I believe that the continuation of the Customer Programs is necessary to preserve the Debtors critical customer relationships and is in the best interests of the Debtors and their estates. As of the Petition Date, the Debtors estimate that they have a prepetition cash liability of approximately $800,000 under the Customer Programs. (4) Motion for Authority to Pay Certain Prepetition Sales, Use and Other Taxes and Regulatory Fees. 80. The Debtors seek entry of an order authorizing them to pay various

prepetition sales and use taxes, including a three percent federal excise tax, (collectively, the Trust Fund Taxes), other taxes (the Other Taxes), and certain licensing, permitting and regulatory fees (the Regulatory Fees and together with the Trust Fund Taxes and Other Taxes, the Taxes) to various federal, state and local taxing authorities (the Taxing Authorities). In the ordinary course of their businesses, the Debtors collect the Trust Fund Taxes from customers,

- 28 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 29 of 53

Main Document

Pg

and then send a schedule of the taxes collected to their tax auditor, who calculates the actual amounts owed to each Taxing Authority. Based on these calculations, the Debtors transmit the amounts owed to a third-party accounts payable service provider (the Third-Party Payor) that ultimately transmits the Trust Fund Taxes to the appropriate Taxing Authority. The Debtors estimate that the total amount of prepetition Trust Fund Taxes owing to the Taxing Authorities will not exceed approximately $1.4 million. In addition, the Debtors are required to pay Other Taxes to certain of the Taxing Authorities in order to obtain a license or permit to operate their businesses within the applicable Taxing Authoritys jurisdiction, and Regulatory Fees including FCC fees and fees to various state public utility commissions, many of which the Debtors also pay to the Applicable Authorities through the Third-Party Payor. The Debtors estimate that the total amount of prepetition Regulatory Fees and Other Taxes owing to the Applicable Authorities will not exceed approximately $106,000 and $662,000, respectively. 81. Payment of the prepetition Taxes is critical to the Debtors continued,

uninterrupted operations. The Debtors failure to pay these obligations may cause the Taxing Authorities to take precipitous action, including, but not limited to, seeking to lift the automatic stay, and imposing personal liability on the Debtors officers and directors, which would disrupt the Debtors day-to-day operations and could potentially impose significant costs on the Debtors estates. Further, failure to pay the prepetition Taxes could impact the Debtors applications to receive state and FCC approval for their restructuring. 82. I believe that the authority to pay both the Third-Party Payor and the

Taxing Authorities in accordance with the Debtors prepetition business practices is in the best interest of the Debtors and their estates.

- 29 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 30 of 53

Main Document

Pg

(5)

Motion to Restrict the Purchase or Sale of Certain Claims Against, and Equity Interests In, the Debtors. 83. The Debtors seek entry of an order restricting the purchase and sale of

certain claims against, and equity interests in, the Debtors during the pendency of these cases in order to both aid the required change of control applications (the Regulatory Applications) with the FCC and various state public utility companies (the PUCs) and to preserve the Debtors valuable tax attributes. Prior to the Petition Date, the FCC and various PUCs issued licenses to certain Debtors authorizing them to provide competitive interstate and international telecommunications services. These licenses are essential to the operation of the Debtors businesses. In order to maintain such licenses, the Debtors are required to file the Regulatory Applications with the FCC and applicable PUCs for the approval of any change of control of BVNH. The Regulatory Applications must include, among other information, the identity of significant equityholders of BVNH (the Equityholder Information). 84. As the transactions contemplated by the Prepackaged Plan will cause a

change in control of BVNH, the Debtors have submitted the Regulatory Applications to the applicable PUCs prior to the Petition Date, and intend to submit the Regulatory Application to the FCC in the near term. To ensure that the Debtors are in possession of all Equityholder Information required to be disclosed in the Regulatory Applications, the Debtors request that the Court require certain Senior Secured Noteholders or transferees thereof, other than the Required Consenting Noteholders (whose disclosure requirements are governed by the Restructuring Support Agreement), to provide the Debtors with the Equityholder Information. 85. Further, pending the approval of the Regulatory Applications, certain

changes in both the identity of the significant equityholders and the amount of their ownership interests in BVNH that were previously disclosed in the Regulatory Applications may require the

- 30 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 31 of 53

Main Document

Pg

Debtors to amend the Regulatory Applications, which could delay their approval. Thus, the Debtors request that the Court restrict the purchase or sale of Senior Secured Notes during the pendency of these cases to the extent that such purchase or sale could require the Debtors to amend he Regulatory Applications. 86. In addition, the Debtors estimate that, as of June 30, 2012, they had

consolidated net operating tax loss carryforwards (the NOLs) of at least $213,568,000. As the Debtors NOLs are valuable assets of the estates, the availability of these tax savings may prove beneficial to the financial health and going concern value of the Debtors. In order to protect and preserve their NOLs and other tax assets, the Debtors request that the Court authorize certain notice and hearing procedures governing the transfer or trading in, or any claims of worthlessness with respect to, any class or series of the common stock or the preferred stock of BVNH. 87. I believe that the proposed restrictions upon trading certain claims against,

and equity interests in, the Debtors is in the best interest of the Debtors and all of their constituents, as the restrictions on trading Senior Secured Notes will facilitate the approval of the Regulatory Applications as expeditiously as possible, thus allowing for a timely consummation of the Prepackaged Plan, and the restrictions on trading BVNHs equity securities are necessary to avoid the irreparable harm that could be caused by limitations on the Debtors ability to offset future taxable income. III. 88. INFORMATION REQUIRED BY LOCAL RULE 1007-2 It is my understanding that Local Rule 1007-2 requires certain information

related to the Debtors, which is set forth below. 89. As noted on Exhibit A, an ad hoc committee of holders of Senior Secured

Notes was formed prior to the Petition Date.

- 31 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 32 of 53

Main Document

Pg

90.

Concurrently herewith, the Debtors have filed a motion for authorization

to file a list of the thirty (30) largest unsecured creditors on a consolidated basis. Exhibit B hereto provides the following information with respect to each of the holders of the Debtors thirty (30) largest unsecured claims: (a) each creditors name, address (including the number, street, apartment or suite number, and zip code, if not included in the post office address) and telephone number; (b) the nature and approximate amount of such creditors claim; and (c) an indication of whether the claim is contingent, unliquidated, disputed, or partially secured. 91. Exhibit C hereto provides the following information with respect to the

holders of the five (5) largest secured claims against the Debtors: (a) the creditors name, address (including the number, street, apartment or suite number, and zip code, if not included in the post office address) and telephone number; (b) the amount of the claim; (c) a brief description of such creditors claim; (d) if known, an estimate of the value of the collateral securing the claim; and (e) whether the claim or lien is contingent, unliquidated or disputed. 92. 93. Exhibit D hereto provides a summary of the Debtors assets and liabilities. Exhibit E hereto provides the number and classes of shares of stock,

debentures, and other public securities of the Debtors that are publicly held and the number of holders thereof. 94. Exhibit F hereto sets forth a list of the property of the Debtors in the

possession or custody of a custodian, public officer, mortgagee, pledgee, assignee of rents, or secured creditor, or agent for any such entity. 95. Exhibit G hereto sets forth a list of the owned or leased premises from

which the Debtors operate their businesses.

- 32 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 33 of 53

Main Document

Pg

96.

Exhibit H hereto sets forth the location of the Debtors substantial assets

and the location of their books and records. 97. Exhibit I hereto sets forth the nature and present status of each action or

proceeding, pending or threatened, against the Debtors or their property where a judgment or seizure of their property may be imminent. 98. Exhibit J hereto provides a list of the names of the individuals who

comprise the Debtors existing senior management, their tenure with the Debtors and a brief summary of their relevant responsibilities and experience. 99. Exhibit K hereto sets forth the estimated amount to be paid to:

(a) employees; (b) officers, stockholders and directors; and (c) financial and business consultants retained by the Debtors, for the thirty (30) day period following the Petition Date. 100. Exhibit L hereto sets forth a list of the Debtors estimated cash receipts

and disbursements, net gain or loss, and obligations and receivables expected to accrue that remain unpaid, other than professional fees for the thirty (30) day period following the Petition Date.

- 33 -

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 34 of 53

Main Document

Pg

CONCLUSION In furtherance of their reorganization efforts, the Debtors respectfully request that orders granting the relief requested in the First Day Motions be entered.

Dated: August 22, 2012 Broadview Networks Holdings, Inc., et al., Debtors and Debtors in Possession /s/ Michael K. Robinson_____________________ Michael K. Robinson President and Chief Executive Officer

34

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 35 of 53

Main Document

Pg

SCHEDULE 1

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 36 of 53

Main Document

Pg

EXHIBIT A Committees Organized Prior to the Order for Relief To the best of the Debtors knowledge and pursuant to Local Rule 1007-2(a)(3), the following entities formed the following ad hoc committee prior to the Petition Date:

Names of Committee Members1 Ad Hoc Committee of Holders BlackRock Financial of Senior Secured Notes Management, Inc. Fidelity Management & Research Company MSD Credit Opportunity Master Fund, L.P. Watershed Asset Management, L.L.C.

Type of Committee

Counsel for Committee Dechert LLP 1095 Avenue of the Americas New York, NY 10036 Attn: Michael Sage, Esq.

_______________________________

1

The members of the ad hoc committee are to the best of the Debtors knowledge and are based on information provided to the Debtors by counsel to the ad hoc committee.

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 37 of 53

Main Document

Pg

EXHIBIT B 30 Largest Unsecured Claims1 (on a consolidated basis)

Nature of claim (trade debt, bank loan, government contract, etc.) Indicate if claim is contingent, unliquidated, disputed, or subject to setoff

Name of creditor and complete mailing address, including zip code

Name, telephone number, and fax number of employees, agent or department of creditor familiar with claim who may be contacted Sherry A Walton sherry.walton@verizon.com Ron Chrisner ronald.w.chrisner@verizon.com Tel: (972) 316.3827 476 Conowingo Road Conowingo, MD 21918 Mercy Hendon Tel: (800) 327-8829 x 511 3 Times Square New York, NY 10036 Allen Michael michael2.allen@level3.com Tel: (585) 255-1892 110 East 59th Street New York, NY 10022 Tel: (212) 920-8201 1 Penn Plaza # 4530 New York, NY 10123 Tel: (212) 962-1776

Amount of claim as of 8/8/20122

Verizon Communications Inc. PO Box 37210 Baltimore, MD 21297

Trade Debt

5,178,453

Thomson Reuters Inc. PO Box 6016 Carol Stream, IL

Trade Debt

1,212,888

Global Crossing Telecommunications PO Box 24 Champaign, IL 61824

Trade Debt

475,814

Empirix Inc. 20 Crosby Drive Bedford, MA 01730 Sutherland Global Services 1160 Pittsford-Victor Road Pittsford, NY 14534 UnitedHealthcare Insurance Company of New York 22703 Network Place Chicago, IL 60673 TNS, Inc. PO Box 849985 Dallas, TX 75284

George Bryan Tel: (781) 266-3200 Sento Polito Tel: (585) 705-2390 Melissa Edison Tel: (603) 665-5668 Sharon Osborn billingdept@tsni.com Tel: (866) 421-6984

Trade Debt

432,229

Trade Debt

410,569

Trade Debt

402,970

Trade Debt 4501 Intelco Loop Olympia, Washington 98503

157,525

_______________________________

1

The information herein shall not constitute an admission of liability by, nor is it binding on, any of the Debtors. These claim amounts represent maximum potential liabilities as of 8/8/2012. Any actual amounts owed may be significantly lower.

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 38 of 53

Main Document

Pg

Name of creditor and complete mailing address, including zip code Independence Blue Cross PO Box 70250 Philadelphia, PA 19176

Name, telephone number, and fax number of employees, agent or department of creditor familiar with claim who may be contacted Farah Newcomb Tel: (610) 238-6528 Alt: (215) 241-2000 1901 Market Street Philadelphia, PA 19103 Jan Downie janet.downie@sidera.net Tel: (484) 461-6058 Alt: (215) 872-6212 196 Van Buren Street Herndon, VA 20170

Nature of claim (trade debt, bank loan, government contract, etc.)

Amount of claim as of 8/8/20122

Indicate if claim is contingent, unliquidated, disputed, or subject to setoff

Trade Debt

156,153

Sidera Networks PO Box 644444 Pittsburgh, PA 15264

Trade Debt

116,891

Data Connection Limited 12007 Sunrise Valley Drive Suite 250 Reston, VA 20191 MCI WorldCom PO Box 96022 Charlotte, NC 28296 Lightower Fiber Networks PO Box 30279 New York, NY 10087 EPlus Technology, Inc. 469 Seventh Avenue 5th Floor New York, NY 10018 AT&T PO Box 105068 Atlanta, GA 30348

D.W. Booker Tel: (442) 836-6117 Patty Lunsford patty.lunsford@verizon.com Tel: (918) 590-5511 pwohlander@lightower.com acctsreceivable@lightower.com 80 Central Street Boxborough, MA 01719 Tel: 978-264-6000 Greg Bartolo Tel: (212) 401-5016 Kathy Brennan kb2683@att.com Tel: (800) 251-0103

Trade Debt

109,557

Trade Debt

106,830

Trade Debt

99,413

Trade Debt

95,581

Trade Debt 4513 Western Avenue Lisle, Illinois 60532 Pauline Carter pauline.carter@fairpoint.com 770 Elm Street Manchester, NH 03101 Gladys Brave gbrave@above.net Dendariarena Jose jdendariarena@above.net Tel: (914) 421-6755 William Scheppy, Tax Manager 360 Hamilton Avenue 7th Floor White Plains, NY 10601 Rashmo Mehra neustar.billing@neustar.biz 21575 Ridgetop Circle Sterling, VA 20166 Trade Debt Trade Debt

92,715

FairPoint Communications, Inc PO Box 37210 Baltimore, MD 21297

89,756

AboveNet Communications, Inc. PO Box 785876 Philadelphia, PA 19178

Trade Debt

87,120

Neustar, Inc. PO Box 403034 Atlanta, GA 30348

69,998

-2-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 39 of 53

Main Document

Pg

Name of creditor and complete mailing address, including zip code Sprint Corporation PO Box 873455 Kansas City, MO 64187 Sunesys 202 Titus Avenue Warrington, PA 18976 Community Parents, Inc. 90 Chauncey Street Brooklyn, NY 11233 Windstream Communications PO Box 60549 C/O Bank of America St. Louis, MO 63160 PAETEC Communications, Inc. One PAETEC Plaza 600 Willowbrook Office Park Fairport, NY 14450 VSS Monitoring, Inc. 1850 Gateway Drive Suite 500 San Mateo, CA 94404 World Data Products, Inc. M & I 96 PO Box 1414 Minneapolis, MN 55480 Visual Systems Group, Inc. 7900 Westpark Drive Suite T-610 McLean, VA 22102 IPNETZONE Communications, Inc. 38-31 Crescent Street 2nd Floor Long Island City, NY 11101 Pricewaterhouse Coopers LLP 18 York Street Suite 2600 Ontario, CA M5J 0B2 OneSource Building Technologies, Inc. 8300 Cypress Creek Parkway Suite 100 Houston, TX 77070 Konica Minolta Business Solutions 21146 Network Place Chicago, IL 60673 TeleBill Inc. 6 North Main Street Suite 214B Fairpoint, NY 14450

Name, telephone number, and fax number of employees, agent or department of creditor familiar with claim who may be contacted Janice Harper janice.y.harper@sprint.com Tel: (877) 866-3840 6200 Sprint Parkway Overland Park, KS 66251 Steve Hartman Tel: (267) 927-2000 Fax: (267) 927-2090 Cynthia Cummings Tel: (718) 771-3498 Charles McNew charles.mcnew@windstream.com Tel: (501 )748-6594

Nature of claim (trade debt, bank loan, government contract, etc.)

Amount of claim as of 8/8/20122

Indicate if claim is contingent, unliquidated, disputed, or subject to setoff

Trade Debt

57,252

Trade Debt

37,000

Trade Debt

30,793

Trade Debt 4001 North Rodney Parham Road Little Rock, AR 72212 Suzanne Monahan suzanne.monahan@windstream.com Ricky Chan Tel: (650) 697-8770 Fax: (650) 697-8779 Jon Hautala Tel: (952) 249-3282 Fax: (952) 449-6326 121 Cheshire Lane #100 Minnetonka, MN 55305 Tammy Robeson Tel: (703) 848-8217 Trade Debt

30,285

Trade Debt

29,227

Trade Debt

28,394

27,1740

Trade Debt

25,748

Tina Harbaugh Tel: (646) 254-6800 Fax: (724) 430-6351

Trade Debt

25,542

Kent Smith Tel: (613) 755-8742

Trade Debt

21,409

Derrick Cazares Tel: (832) 782-6161

Trade Debt

20,066

Annette Warner Tel: (800) 896-2590 x 3531 Kelly Hosmer Tel: (585) 388-3360

Trade Debt

19,967

Trade Debt

18,000

-3-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 40 of 53

Main Document

Pg

EXHIBIT C Holders of Five Largest Secured Claims Against the Debtors1

Creditor Mailing Address and Phone Number Counsel2 Approximate Amount of Claim3 Description of Security Interest Contingent, Unliquidated, Disputed (C/U/D)

The Bank of New York in its capacity as Trustee, Collateral Agent and Second Priority Agent for the 11.375% Senior Secured Notes

The Bank of New York 101 Barclay Street, 8W New York, NY 10286 Attn: Latoya S. Elvin (212) 815-5704

Emmet, Marvin & Martin, LLP 120 Broadway, 32nd Floor New York, NY 10271 Attn: Bayard S. Chapin, Esq.

$317.1 million

Second priority security interest in accounts, inventory, deposit accounts and all cash, thereto, lock boxes and capital stock of each subsidiary grantor, among other assets, and a first priority security interest in substantially all of the remainder of the Debtors assets.

_______________________________

1

The Debtors have included all information reasonably available to them. In addition to the secured creditors listed herein, the Debtors are also parties to secured leases. The Debtors have provided information for counsel that are known to the Debtors as of the date hereof to creditors that are known to the Debtors as of the date hereof. These figures are inclusive of principal and accrued interest.

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 41 of 53

Main Document

Pg

The CIT Group/ Business Credit, Inc. in its capacity as Administrative Agent and First Priority Agent for the $25,000,000 Credit Agreement, dated as of August 23, 2006

The CIT Group/ Business Credit, Inc. 11 W. 42nd Street New York, NY 10038 Attn: Evelyn Kusold (212) 461-7725

Stradley Ronon Stevens & Young LLP 2005 Market Street, Suite 2600 Philadelphia, PA 19103 Attn: Gary P. Scharmett, Esq. and Paul A. Patterson, Esq.

$14.0 million

First priority security interest in accounts, inventory, deposit accounts and all cash, thereto, lock boxes and capital stock of each subsidiary grantor, among other assets, and a second priority security interest in substantially all of the remainder of the Debtors assets.

-2-

12-13581

Doc 3

Filed 08/22/12

Entered 08/22/12 17:22:06 42 of 53

Main Document

Pg

EXHIBIT D Summary of Debtors Assets and Liabilities

(unaudited) Mar. 31, 2012 (audited) Dec. 31, 2011