Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

5 Steps To An Effective Online AML Training

Caricato da

Knowledge PlatformDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

5 Steps To An Effective Online AML Training

Caricato da

Knowledge PlatformCopyright:

Formati disponibili

5 STEPS TO AN EFFECTIVE ONLINE AML TRAINING

PUJA ANAND

CEO LEARNING SOLUTIONS, KNOWLEDGE PLATFORM

A KNOWLEDGE PLATFORM WHITEPAPER 2009

What did you learn today?

5 Steps to an Effective Online AML Training

What did you learn today?

Need for AML Training

AML training for employees of financial institutions is mandated by regulations in almost all countries in Asia. Below are excerpts from AML regulations published by regulatory bodies of a few countries, highlighting the requirement of training on AML and related topics Monetary Authority of Singapore (MAS) A bank shall take all appropriate steps to ensure that its staff (whether in Singapore or overseas) are regularly trained on a. AML/CFT laws and regulations, and in particular, CDD measures, detecting and reporting of suspicious transactions b. Prevailing techniques, methods and trends in money laundering and terrorist financing; and c. The banks internal policies, procedures and controls on AML/CFT and the roles and responsibilities of staff in combating money laundering and terrorist financing. FATF Country Report Japan, 17. October 2008 Japan is non-compliant with regards to internal controls, compliance & audit because procedures and policies are not required to be updated, and communicated to the employees, who should be trained on their use. Japan Supervisory Guidelines Has the bank developed manuals on methods for customer due diligence practices, including those for customer identification and suspicious reporting, and made sure to have all officers and employees acquainted therewith? Does the bank provide appropriate and ongoing employee training programmes that enable its employees to follow these methods properly?

Page | 2

Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

5 Steps to an Effective Online AML Training

What did you learn today?

Hong Kong Monetary Authority Institutions should therefore provide proper anti-money laundering training to their local as well as overseas staff. It will also be necessary to make arrangements for refresher training at regular intervals to ensure that staffs do not forget their responsibilities. Peoples Bank of China Financial institutions shall launch anti-money laundering publicity among their customers and provide training for their staff on anti-money laundering so as to familiarize them with laws, administrative rule, and regulations on anti-money laundering and strengthen their competence in combating money laundering activities. RBI, India Banks must have an ongoing employee training programme so that the members of the staff are adequately trained in KYC procedures. Training requirements should have different focuses for frontline staff, compliance staff and staff dealing with new customers. Bank Negara Malaysia The reporting institution must conduct awareness and training programmes on AML/CFT practices and measures for its employees, in particular, 'front-line' staff and officers in-charge-of processing and accepting new customers as well as staff responsible to monitor transactionsThese training and awareness programmes should be conducted regularly and supplemented with refresher courses for employees, with special emphasis for those employees who are exposed to higher risk of potential money laundering and financing of terrorism activities, for example, the 'front-line' employees. Central Bank, UAE The compliance officer in each financial market shall be responsible for a training programme for the staff involved in receiving cash, overseeing accounts and preparing STRs.

Page | 3

Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

5 Steps to an Effective Online AML Training

What did you learn today?

5 Steps to an Effective Online AML Training

Online AML training, in the form of e-learning modules, has become a method of choice for AML training in many financial institutions because of the benefits of extended reach, better record keeping, and long-term savings in time and cost. However, online AML training can often be ineffective, especially when used repeatedly for first-time and ongoing training exercises. Knowledge Platform proposes 5 ways in which Financial Institutions can enhance the AML training experience for their employees.

1. Well-Designed and Targeted Courses

A majority of online AML training courses tend to be mere page turners, with little interactivity and use of strategies for learner engagement. Perhaps the fact that the training is mandatory and has a captive audience has something to do with this. However, for the training to be effective and result in transfer of knowledge and skills, it is important that it engages learners and gives them a positive learning experience. To this end, online AML training must use real case studies to build relevance, visual explanations to enhance retention, and interactive exercises and case studies to engage learners. Another important issue is of tailoring the content to the audience. Different coverage and depth is needed for different audience. One size does not fit all. Here is a sample of how content coverage can be tailored to different job roles.

AML for Managers AML Basics for all employees Provides a basic understanding of money laundering and how it is perpetrated, the basics of KYC and local laws. In addition to the basics, provides details of how to onboard and monitor customers, and recognize suspicious activities. In addition to the basics and customer facing knowledge, provides details on back-end transactions, such as wire transfers, correspondent banking and tools for preventing money laundering. In addition to the basics and customer facing knowledge, provides details on back-end transactions, such as wire transfers, correspondent banking and tools for preventing ML.

AML for Customer Facing Teams

AML for Operational Teams

AML for Managers and Compliance Officers

Page | 4

Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

5 Steps to an Effective Online AML Training

What did you learn today?

2. Incident-based Compliance Seeds

Current events or incidents related to AML provide a powerful learning opportunity. They demonstrate relevance of AML-related procedures. They also provide an opportunity to see the theory in practice, thereby enabling its internalization. As a result, they have the potential of getting immediate attention of the target audience of AML training. Because of the above factors, incidentbased learning is a powerful way to move AML training from its place in the wings to the center stage. Unfortunately, most online AML training programs are structured monoliths that are designed once and updated at most annually. Incidents of AML violations or consequences come and go in the news without affecting the training courses. Incident-based learning can be implemented in the form of what we call compliance seeds. These are short modules containing the incident, its analysis, its application to the financial institution and a short quiz to check understanding. For them to be effective, seeds need to be built quickly, usually within a week of the incident being reported, and distributed seamlessly to target audience. Seeds do more than disseminate relevant information quickly. They help build a culture of compliance that goes far beyond compliance training.

3. Refresher Modules

The need for on-going training and annual refresher training can be met in better ways than having employees undergo the same training modules year after year. With the assumption that the employees have used AML procedures in the past year, refresher training must take them to a higher level of understanding. Complex cases (for example those of trade-based money laundering), which were not in the scope of the original training, can be presented as interactive case studies. These serve dual purpose. First, it encourages employees to apply their existing knowledge in more complex cases and second, it exposes them to recent events and methods used by money launderers.

4. Adaptive Learning / Continuous and Sustainable Learning Path

Adaptive Learning refers to defining a learning path that is adapted based on a learners demonstrated knowledge about the subject matter. In order to determine existing knowledge,

Page | 5 Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

5 Steps to an Effective Online AML Training

What did you learn today?

extensive assessment banks are developed and deployed. Learner response to these questions banks determines the learning path recommended for him/her. This reduces the time required for training. For example, an employee may only need to complete a 30-minute module as compared to a 2-hour complete training. At the heart of a successful Adaptive Learning implementation is a robust question pooling engine that allows tagging of individual questions on multiple parameters, such as topics tested, type of content, and difficulty level. Other drivers for successful implementation of Adaptive Learning are strong reporting and analysis tools. These features, when combined with well-designed questions, can provide financial institutions with several benefits such as better retention of key concepts/skills needed to carry out AML procedures in real life, improved employee interest and motivation in annual retraining exercises, reduction in time taken to retrain all employees and easy monitoring progressive improvement in employee AML knowledge and skills.

5. Reports and Analyses

Online training has a distinct advantage of easy record keeping. If designed and delivered appropriately, online training can provide data for very useful reports and analyses of competence levels and training needs. For example, a report could be generated showing comparison of AML awareness levels across different departments or countries. This would enable training or compliance officers to target corrective training or awareness sessions to employees who need them most. Another report could map out AML competence versus confidence, allowing compliance officers to identify AML-related risks and address them effectively.

Page | 6

Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

5 Steps to an Effective Online AML Training

What did you learn today?

Benefits

Implementation of the 5-step training methodology provides benefits at several levels.

Benefits to the Compliance Officer Access to reports 24/7 Automated & ongoing scheduling of learning content Availability of audit trail Automated content updates Ability to identify weak links

Benefits to Employees Access to training 24/7 Availability of engaging and relevant content Compliance learning can be Fun! Automated content updates

Benefits to the Company Help build compliance culture Deploy a cost-effective and scalable training solution

Page | 7

Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

5 Steps to an Effective Online AML Training

What did you learn today?

About Knowledge Platform

Knowledge Platform is a leading awareness and learning solutions provider for governance, compliance and risk management. With offices in Singapore, Tokyo, Sydney, Delhi and Islamabad, the company has in-depth experience in supporting corporations, financial services institutions and governmental bodies in their drive to achieve excellence in corporate governance, compliance and risk management. Our solutions include (a) designing awareness programs and compliance initiatives, (b) licensing and developing e-learning programs and courseware, (c) delivering e-learning and related technology solutions and (d) providing managed learning services. Knowledge Platforms clients in the area of governance, compliance and risk management include ABN AMRO, AIG, Australian Transaction Reporting and Analysis Centre, Bank of Communications, Bank Hapoalim, Bank Mandiri, Bank Markaz, CEPDR, CIC Bank, Citibank, Cho Hung Bank, Credit Agricole, Dai Nippon, Deutsche Bank, Development Bank of Singapore, Emirates Bank, First Gulf Bank, Habib Bank, Hitachi Zosen, HSBC, Hua Nan Bank, ICICI Bank, Indian Overseas Bank, International Commerce Bank of China, Krung Thai Bank, Millea, NIWS, Nomura Asset Management, Noor Islamic Bank, OCBC, REFCO, Singapore, Societe Generale, Standard Chartered Bank, Straits Lion Asset Management, Toda Kogyo, UniCredito Italiano, United Overseas Bank, Visa Business School, Infocomm Development Authority and Singapore Ministry of Defense. Our clients also include a few additional leading financial institutions in the world, which we may not identify due to confidentiality restrictions.

Page | 8

Copyright 2012 Knowledge Platform - All Rights Reserved | All Rights Reserved | Whitepaper

Potrebbero piacerti anche

- DHR 313 Group 4 AssignmentDocumento19 pagineDHR 313 Group 4 AssignmentsharonNessuna valutazione finora

- EBRD Practical Exercise 1 - Kiev 1Documento2 pagineEBRD Practical Exercise 1 - Kiev 1Vitalii LiakhNessuna valutazione finora

- Comprehensive List of Tools 2014Documento31 pagineComprehensive List of Tools 2014Smart Campaign50% (2)

- Cambodia Financial Report Standard For SMEs-Part 1Documento4 pagineCambodia Financial Report Standard For SMEs-Part 1Jessica HongNessuna valutazione finora

- Hi C RefresherDocumento10 pagineHi C RefresherKnowledge PlatformNessuna valutazione finora

- CA SubjectsDocumento13 pagineCA Subjectsnosbsumpd100% (1)

- BCSVP Lessons Learned 2008Documento12 pagineBCSVP Lessons Learned 2008Amuzweni Lerato NgomaNessuna valutazione finora

- Best Practices Guide For Microfinance Institutions Active in RemittancesDocumento72 pagineBest Practices Guide For Microfinance Institutions Active in RemittancesBelkis RiahiNessuna valutazione finora

- Banking OperationsDocumento7 pagineBanking OperationsManic BashaNessuna valutazione finora

- SCBI Brochure - Run 11Documento2 pagineSCBI Brochure - Run 11Zendy PastoralNessuna valutazione finora

- Certified Risk and Compliance ProfessionalDa EverandCertified Risk and Compliance ProfessionalValutazione: 5 su 5 stelle5/5 (3)

- The Marriott - Training MethodsDocumento15 pagineThe Marriott - Training MethodsHazel-Ann Victoria Solanki100% (7)

- Takoradi Training For Quarter 1Documento2 pagineTakoradi Training For Quarter 1Msta EffNessuna valutazione finora

- Anti-Money Laundering: A Global Financial Services IssueDocumento15 pagineAnti-Money Laundering: A Global Financial Services Issuevkrm14Nessuna valutazione finora

- AML & CFT Program BahrainDocumento2 pagineAML & CFT Program BahrainTariq AliNessuna valutazione finora

- Training 1Documento14 pagineTraining 1Yavuz AyasNessuna valutazione finora

- CRM Mba ProjectDocumento93 pagineCRM Mba Projectravi singhNessuna valutazione finora

- SME Credit Assessment Course OutlineDocumento7 pagineSME Credit Assessment Course OutlineZeeshankhan79Nessuna valutazione finora

- Cost Reduction and Control Best Practices: The Best Ways for a Financial Manager to Save MoneyDa EverandCost Reduction and Control Best Practices: The Best Ways for a Financial Manager to Save MoneyNessuna valutazione finora

- Business Incubation Training ProgramDocumento10 pagineBusiness Incubation Training ProgramJeji HirboraNessuna valutazione finora

- Agent Bank Presentation PilotDocumento111 pagineAgent Bank Presentation Pilotchimdesa TolesaNessuna valutazione finora

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1Da EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1Nessuna valutazione finora

- Auditing Fraud and Revenue Assurance in Telecom Companies Sep12Documento4 pagineAuditing Fraud and Revenue Assurance in Telecom Companies Sep12Syed Raghib AzamNessuna valutazione finora

- Si March BrochureDocumento8 pagineSi March BrochureKazi HasanNessuna valutazione finora

- Modern Methods of Vocational and Industrial TrainingDa EverandModern Methods of Vocational and Industrial TrainingNessuna valutazione finora

- CHK-090 Training Needs AnalysisDocumento5 pagineCHK-090 Training Needs AnalysisReuben EscarlanNessuna valutazione finora

- Audit FoundationDocumento2 pagineAudit FoundationPahladsinghNessuna valutazione finora

- Group6 Summary of Paper 10 Risk Question For Every Mfi BoardDocumento4 pagineGroup6 Summary of Paper 10 Risk Question For Every Mfi BoardgithinthoNessuna valutazione finora

- Training Program Plan Aet 570Documento15 pagineTraining Program Plan Aet 570api-302109003Nessuna valutazione finora

- Financial Accounting CourseworkDocumento7 pagineFinancial Accounting Courseworkafjyadcjesbdwl100% (2)

- Term Paper of Financial ManagementDocumento6 pagineTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- Commercial Credit Risk AssessmentDocumento6 pagineCommercial Credit Risk AssessmentMartin JpNessuna valutazione finora

- Managing Business Process OutsourcingDocumento6 pagineManaging Business Process Outsourcingdhirender testNessuna valutazione finora

- Closing the Gap: A Model for Commercial UnderwritingDa EverandClosing the Gap: A Model for Commercial UnderwritingNessuna valutazione finora

- Revenue Management Dissertation TopicDocumento5 pagineRevenue Management Dissertation TopicBuyPapersForCollegeOnlineArlington100% (1)

- How To Build Your Business Advisory Practice: Practice Management Tips For SmpsDocumento5 pagineHow To Build Your Business Advisory Practice: Practice Management Tips For SmpsKapil GokharuNessuna valutazione finora

- IEB WireframeDocumento7 pagineIEB WireframeVictor PaigeNessuna valutazione finora

- Summer Training Handbo Ok: Lokesh JasraiDocumento32 pagineSummer Training Handbo Ok: Lokesh JasraiJuiÇý ßitëNessuna valutazione finora

- Internship Report Veena - Copy of VeenaDocumento32 pagineInternship Report Veena - Copy of VeenaBhuvan MhNessuna valutazione finora

- Research Paper On Training and Development in BanksDocumento7 pagineResearch Paper On Training and Development in BanksiangetplgNessuna valutazione finora

- Synopsis: Area and Title of Project Work in First SemesterDocumento29 pagineSynopsis: Area and Title of Project Work in First SemesterNikita Chugh RamaniNessuna valutazione finora

- How to Enhance Productivity Under Cost Control, Quality Control as Well as Time, in a Private or Public OrganizationDa EverandHow to Enhance Productivity Under Cost Control, Quality Control as Well as Time, in a Private or Public OrganizationNessuna valutazione finora

- Human ResourceDocumento24 pagineHuman ResourceSean SparksNessuna valutazione finora

- Marriott Manila HotelV2Documento6 pagineMarriott Manila HotelV2johnphilipcabuena024Nessuna valutazione finora

- Walker FinalDocumento12 pagineWalker Finalapi-253950229Nessuna valutazione finora

- TNA Consultancy Skills Course Distance Learning: Department of Personnel and Training Government of IndiaDocumento19 pagineTNA Consultancy Skills Course Distance Learning: Department of Personnel and Training Government of Indiasana nazNessuna valutazione finora

- Entrpr Simple 2Documento14 pagineEntrpr Simple 2iSEED RDFNessuna valutazione finora

- Coursework CiiDocumento8 pagineCoursework Ciif5dgrnzh100% (2)

- Edm 2Documento142 pagineEdm 2IncharaNessuna valutazione finora

- CMA PDF SyllabusDocumento5 pagineCMA PDF Syllabusserrah0% (1)

- LP101 PDFDocumento5 pagineLP101 PDFegy1971Nessuna valutazione finora

- Guide To Practice Management For Small-And Medium-Sized PracticesDocumento52 pagineGuide To Practice Management For Small-And Medium-Sized PracticesMAlek AMARANessuna valutazione finora

- Driving Success: Modern Techniques for CDL Recruiting and Retention: Driving Success, #3Da EverandDriving Success: Modern Techniques for CDL Recruiting and Retention: Driving Success, #3Nessuna valutazione finora

- Overcoming The Limitations of MQCsDocumento12 pagineOvercoming The Limitations of MQCsKnowledge PlatformNessuna valutazione finora

- Localizing E LearningDocumento8 pagineLocalizing E LearningKnowledge PlatformNessuna valutazione finora

- Internet Video - Making An Impact in Training & Corporate CommunicationsDocumento7 pagineInternet Video - Making An Impact in Training & Corporate CommunicationsKnowledge PlatformNessuna valutazione finora

- Direct Instruction WorksDocumento9 pagineDirect Instruction WorksKnowledge PlatformNessuna valutazione finora

- Development and Evaluation of Cross Cultural Distance Learning ProgramDocumento6 pagineDevelopment and Evaluation of Cross Cultural Distance Learning ProgramKnowledge PlatformNessuna valutazione finora

- Corporate Universities and Learning Center - PrimerDocumento15 pagineCorporate Universities and Learning Center - PrimerKnowledge Platform100% (1)

- Learning, Memory, and Product PositioningDocumento36 pagineLearning, Memory, and Product PositioningGwen GennyNessuna valutazione finora

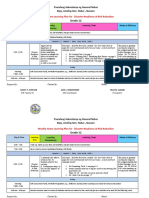

- Grade 12: Weekly Home Learning Plan For Disaster Readiness & Risk ReductionDocumento4 pagineGrade 12: Weekly Home Learning Plan For Disaster Readiness & Risk ReductionNancy AtentarNessuna valutazione finora

- ENVIRONMENTAL ACTIVITIES PP1 & 2 (Ii) PDFDocumento86 pagineENVIRONMENTAL ACTIVITIES PP1 & 2 (Ii) PDFLois100% (1)

- Ipcrf Development PlanDocumento2 pagineIpcrf Development PlanmonalisaNessuna valutazione finora

- Lesson Plan in Mathematics 1: ST ND RD THDocumento3 pagineLesson Plan in Mathematics 1: ST ND RD THhasnifa100% (1)

- Artificial Intelligence (AI) - Definition, Examples, Types, Applications, Companies, & Facts - BritannicaDocumento1 paginaArtificial Intelligence (AI) - Definition, Examples, Types, Applications, Companies, & Facts - Britannicajeremyhove96Nessuna valutazione finora

- GCU Lesson Plan TemplateDocumento7 pagineGCU Lesson Plan TemplateKeyania MurrayNessuna valutazione finora

- Piaget'S Theory of Cognitive DevelopmentDocumento6 paginePiaget'S Theory of Cognitive DevelopmentBES BEBENessuna valutazione finora

- La Météo Unit Plan Jordan Logan OverviewDocumento31 pagineLa Météo Unit Plan Jordan Logan Overviewapi-251768423Nessuna valutazione finora

- Schools Division Office Quezon City: How To Create Quiz On Google FormDocumento31 pagineSchools Division Office Quezon City: How To Create Quiz On Google FormLove ShoreNessuna valutazione finora

- Reeves Multimedia Design ModelDocumento4 pagineReeves Multimedia Design ModelSalah IbrahimNessuna valutazione finora

- DLL MathDocumento5 pagineDLL Mathesang quettNessuna valutazione finora

- Nature and History of LiturgyDocumento8 pagineNature and History of LiturgyJeul AzueloNessuna valutazione finora

- Hbel3203 Teaching of GrammarDocumento25 pagineHbel3203 Teaching of GrammarCristina Johnny FredNessuna valutazione finora

- Ele 160 Remedial Instruction Syllabus AutosavedDocumento6 pagineEle 160 Remedial Instruction Syllabus AutosavedRicky BustosNessuna valutazione finora

- Leslie SDocumento1 paginaLeslie Sapi-554579625Nessuna valutazione finora

- CBAR Lesson Study EditedDocumento11 pagineCBAR Lesson Study EditedCassandra Nichie AgustinNessuna valutazione finora

- Practising Reflective WritingDocumento26 paginePractising Reflective WritingDaren Mansfield100% (1)

- General Letter 129 For ElementaryDocumento2 pagineGeneral Letter 129 For ElementaryReyes C. Ervin100% (1)

- GrandDemo Lesson Plan Probabilities of Simple EventsDocumento3 pagineGrandDemo Lesson Plan Probabilities of Simple EventsGerald PizarroNessuna valutazione finora

- Computational Intelligence Paradigms Inn PDFDocumento280 pagineComputational Intelligence Paradigms Inn PDFMILKII TubeNessuna valutazione finora

- SRFDocumento42 pagineSRFvkumar_345287Nessuna valutazione finora

- Sarah Ann Goodbrand, Ninewells Hospital and Medical School, DundeeDocumento1 paginaSarah Ann Goodbrand, Ninewells Hospital and Medical School, DundeeAh MagdyNessuna valutazione finora

- Equity Diversity Inclusion and Our BiasesDocumento15 pagineEquity Diversity Inclusion and Our Biasesapi-417564374Nessuna valutazione finora

- TEGR 120-Teaching Multigrade ClassesDocumento5 pagineTEGR 120-Teaching Multigrade ClassesMD BadillaNessuna valutazione finora

- Business Enterprise SimulationDocumento2 pagineBusiness Enterprise SimulationROSE MARY OTAZANessuna valutazione finora

- FINAL Arts Award Silver Qualification Specification Sept2020Documento8 pagineFINAL Arts Award Silver Qualification Specification Sept2020Dorothy GraceNessuna valutazione finora

- Models of CurriculumDocumento5 pagineModels of CurriculumMarianne Parohinog100% (1)

- 1 Purposive CommunicationDocumento10 pagine1 Purposive CommunicationDenise100% (1)

- Mentoring Tool - Graduate Teacher Progress Log For Rosie BakerDocumento3 pagineMentoring Tool - Graduate Teacher Progress Log For Rosie Bakerapi-289443430Nessuna valutazione finora